SuperContra

New member

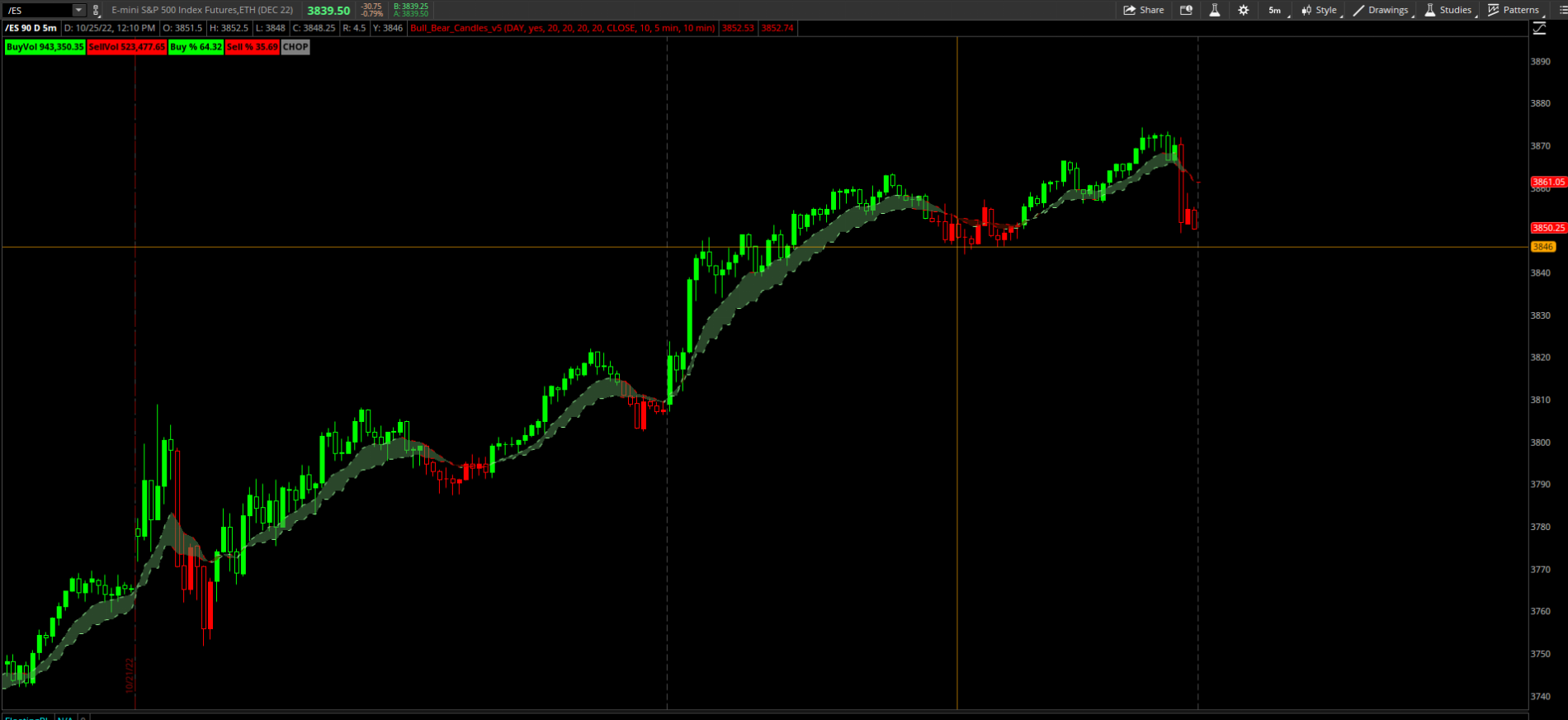

I love this new strat Chris - looks very promising across a variety of instruments on the 5; any changes you would make to the settings for the 1min?

Awesome, I’ll check it out!Hi @HODL-Lay-HE-hoo!

Here's a different combination using my MTF Moving Averages and instead of EMAD_Range. It seems to limit some of the repainting and gives a more consistent read with the volume profile. See what you think https://tos.mx/64t1Tu4. Looking forward to everyone's feedback.

Hi @SuperContra,I love this new strat Chris - looks very promising across a variety of instruments on the 5; any changes you would make to the settings for the 1min?

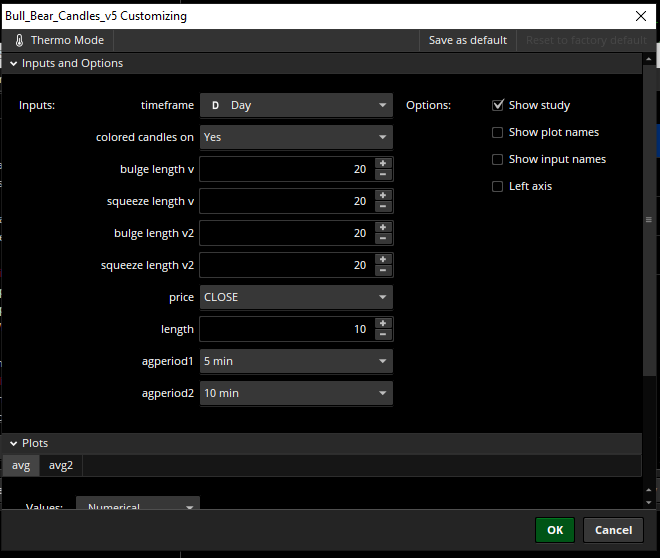

Hey @Christopher84… haven’t been able to look at the code yet - does this one paint the grey candles also?Awesome, I’ll check it out!

Hi @HODL-Lay-HE-hoo!Hey @Christopher84… haven’t been able to look at the code yet - does this one paint the grey candles also?

Ok thanks... I loaded it up... looks really good thank you. I'll keep you posted.Hi @HODL-Lay-HE-hoo!

The candles will paint green and red only. However, the label will go gray and read “Chop” when the averages are not lining up with the current volume profile.

Hello, for future reference when you ask such questions you would need to say what type of trading you are interested in. Day trading, Swing trading, etc.@Christopher84: Hello Chris, for new trader which indicator or strategy would you recommend? (I see there are so many different indicators on this thread)

Hello @latinbori123456 : Can you share what are you doing exactly? I want to paper trade the strategy as well.I have been using these in futures for paper trading to get familiar with /es, /nq.

With all the testing and back testing and overtrading and commissions and losses I did on my paper account for months, ever since I started using the zones for breakouts and stop losses, I was able to make all of the losses back to the point I’m scalping es in a 1 or 5 min chart 2-3 times a day.

My account was down $2k at one point before c3. It is now down $7.80.

This thing saved my life. Those auto generated real time zone painting is a HUGE game changer.

I made some adjustments to it and started adding signal arrows that show up when 7 of the indicstors are all bullish or bearish.

So not only do we get the parabolic sar arrow signals Chris made, but I am now getting conviction arrow indicstors when multiple indicators are on the same direction, the trend is getting stronger, and the volatility is rising.

If it is ok with Christopher, I can put up a version of my enhancement to this.

I didn’t remove any functionality, I just added ease of use and functionality.

I also don’t use pre market or after hours on my 5 min chart. MM manipulate them after hours to the point the charts can blow up on the open.

Hi @Kislayakanan,@Christopher84: Hello Chris, for new trader which indicator or strategy would you recommend? (I see there are so many different indicators on this thread)

Secondly, can you point me to the thread where you have written about bull and bear candle indicator?

Thank you!

Thank you @Christopher84, I will start checking them out. Another question I have is, how do we use EMAD indicator?Hi @Kislayakanan,

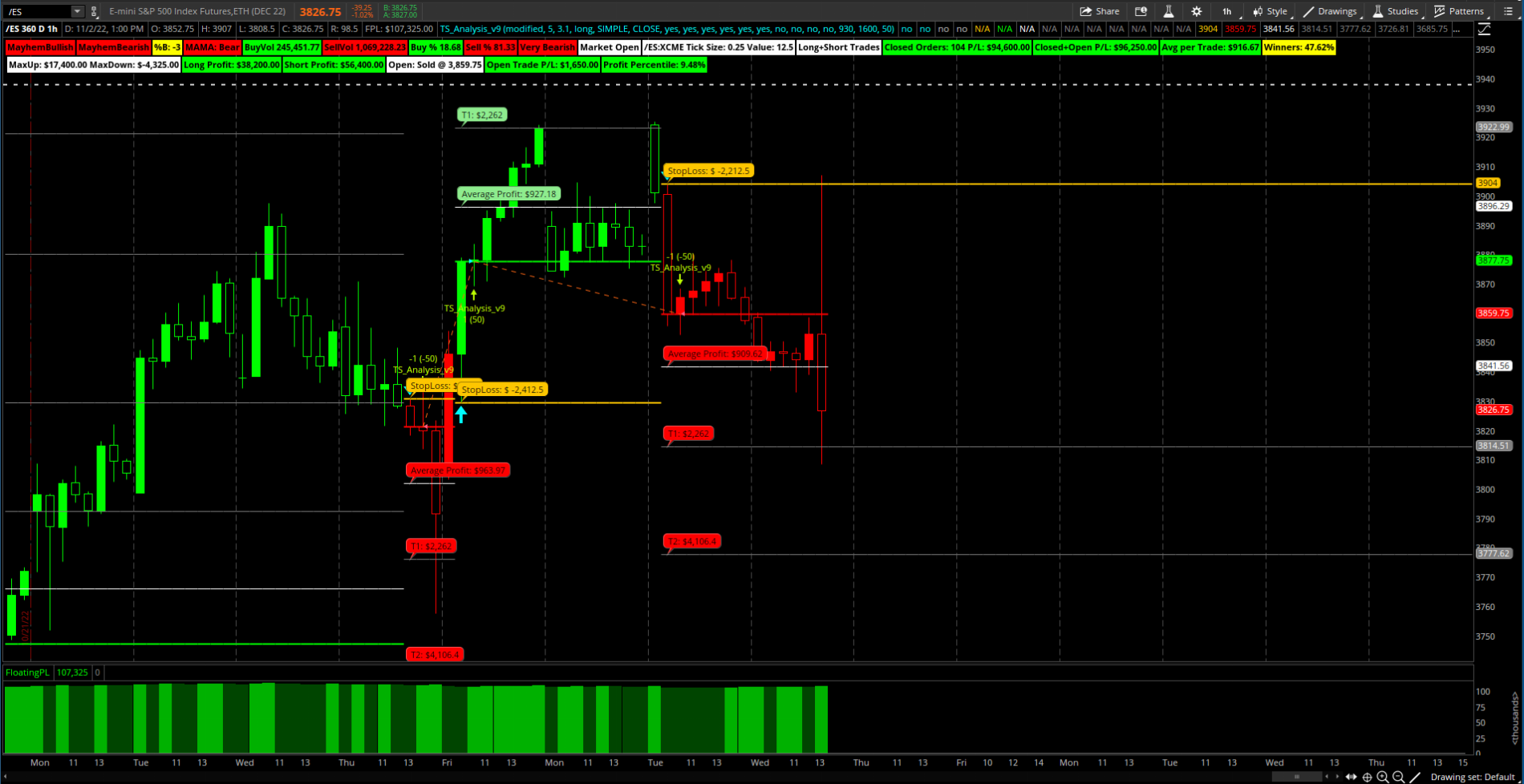

Here is a sharelink to the Bull Bear Candles (code will be posted on pg.1 of the thread soon). A brief description is on pg.94 of this thread. This particular code is still "in the works". There are several strategies on pg.1 of the thread that can be utilized successfully across a multitude of assets and timeframes. There has been a lot of positive feedback on TS_v9 as well as PLD Bands and Ehler's Distant Coefficient Filter Strategy. The real key is to make sure the strategy you are intending to use lines up with the higher timeframe trend (I like the month chart using C3_Max's Consensus Level for swing trades making entries on the 1 hour chart with TS_v9, or for scalping using the trend indication on TS_v9 on the 1 hour chart and making entries that are in line with the 1 hour chart on the 3-5 min chart using PLD Bands or TS_v9). These strategies are adjustable, so dial them in to the asset you are trading. I hope this helps!

Hi @Kislayakanan,Thank you @Christopher84, I will start checking them out. Another question I have is, how do we use EMAD indicator?

1. Does green color means bullish?

2. What is significance of zero line?

3. What is significance of mid band?

Got it thank you, how do you understand where previous pullback occurred? Can you share any example please?Hi @Kislayakanan,

This is from pg.1 of the thread “Here is the code for EMAD_Range. This indicator helps to trader see the trend (below 0 bearish, above 0 bullish). It also helps to see where potential pullbacks may occur by looking at where previous pullbacks have occured.” I would also add that price moves that push the range up or down tend to have much stronger momentum. I hope this helps!

He was saying that the EMAD lower indicator is coded in such a way that takes into account previous pullbacks to predict future pullback levels. (A pullback would be for example when the hourly chart is showing an up trend and the 15min chart is trending down - if it is actually a pullback it will bounce off support and continue on the up trend whereas reversal would result in a change in direction on a higher timeframe.)Got it thank you, how do you understand where previous pullback occurred? Can you share any example please?

Thank you, I have been reading through it from last couple of days and it has been very helping. I am just trying to learn from other expert trader experience with this indicator. In that past I have used to many indicators and "strategies" which has led me no where and hence I want to go deep in one of the strategy and keep practicing until I get the desired result.He was saying that the EMAD lower indicator is coded in such a way that takes into account previous pullbacks to predict future pullback levels. (A pullback would be for example when the hourly chart is showing an up trend and the 15min chart is trending down - if it is actually a pullback it will bounce off support and continue on the up trend whereas reversal would result in a change in direction on a higher timeframe.)

I will try to get something together to show you how I use it however I day trade options for the most part but the same concept applies. In the meantime, there are 95 pages of gold in this thread. I would suggest you scour the comments - you will find others explaining how they use the indicators.

At the end of the day you have to find what works best for YOU. Uncle Sam wants YOU to trade stonks! (that was a joke)

Can you share a screenshot of what SPY looks like for you on the 1 hour?The TS_v9 Strategy continues to perform well on the 1 hour chart. Strong levels being called out. Volatility continues to ramp up.

Hi @lolreconlol,Can you share a screenshot of what SPY looks like for you on the 1 hour?

Hi @Christopher84 ,

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.