thinkorswim does have a "WilliamsAD" study but it is missing the simple moving average and does not show crossovers.

- https://www.investopedia.com/terms/a/accumulationdistribution.asp

- https://www.tradingview.com/script/budDCi5L-CM-Williams-AD-SMA-V1-Public/

Code:

declare lower;

input length = 20;

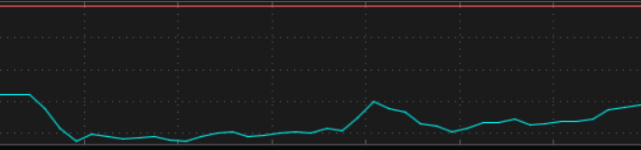

plot ad = AccumDistBuyPr();

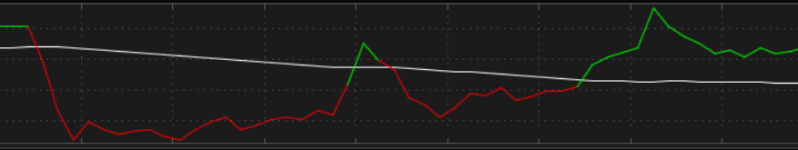

plot smoothed = SimpleMovingAvg(ad, length=length);

smoothed.AssignValueColor(Color.WHITE);

ad.DefineColor("Up", Color.GREEN);

ad.DefineColor("Down", Color.RED);

ad.AssignValueColor(if ad > smoothed then ad.color("Up") else ad.color("Down"));