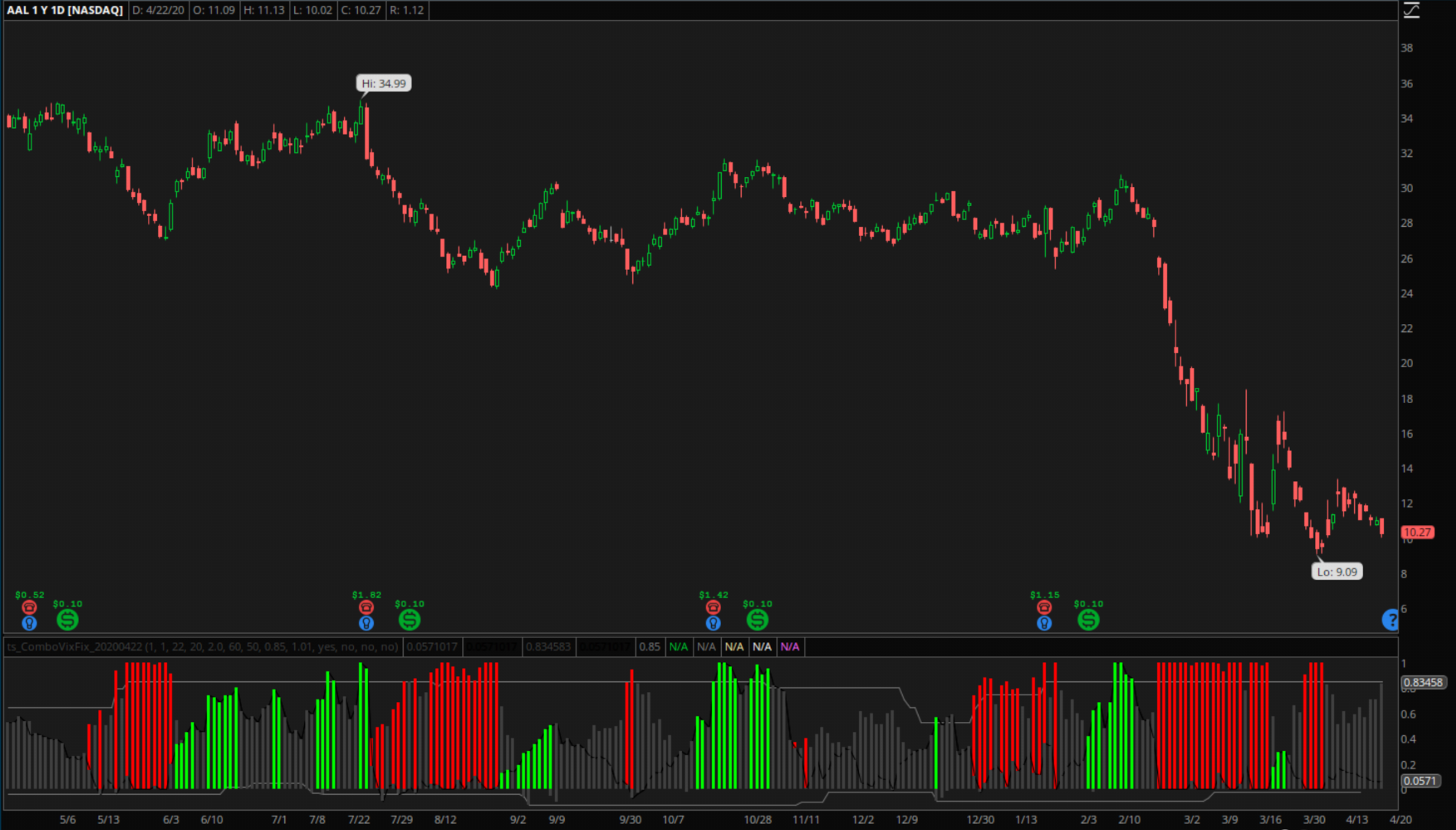

Here is the initial port of Combo Williams Vix Fix (Twin version) to ToS, as per requested by @Ken_Adams.

Share your test results and pairings.

Happy Trading.

Ruby:

#Combo Williams Vix Fix (Twin version) to ToS

#

#CREDITS

# capissimo

#

#CHANGELOG

# 2020.04.22 1.0 @diazlaz - Initial Port/interpretation

#

#LINKS

# https://www.tradingview.com/script/tVtxISLu-combo-williams-vix-fix-twin-version/

#

#DESCRIPTION

#This is a very powerful Williams' Vix Fix indicator.

#My implementation of this wonderful indicator features both up and down movements.

#Both up & down flavors have two versions (fields tp and tp2, each having two values).

#

declare lower;

#INPUTS

input tp = 1; #VixFix UP [1,2]

input tp2 = 1; #VixFix DN [1,2]

input pd = 22; #LookBack Period Standard Deviation High/Low

input bbl = 20; #Bolinger Band Length

input mult = 2.0; #Bollinger Band Standard Deviation Up/Dn

input p = 60; #LookBack

input lb = 50; #Look Back Period Percentile High/Low

input ph = 0.85; #Highest Percentile

input pl = 1.01; #Lowest Percentile

input hp = yes; #Show High Range - Based on Percentile and LookBack Period

input sd = no; #Show Standard Deviation Line

input hp2 = no; #Show Low Range - Based on Percentile and LookBack Period

input sd2 = no; #Show Standard Deviation Line

script scaleMinimax {

input x = close;

input p = 5;

input Min = .01;

input Max = 1;

def hh = Highest(x, p);

def ll = Lowest(x, p);

plot data = (((Max - Min) * (x - ll)) / (hh - ll)) + Min;

}

#CORE

def prix = scaleMinimax(close, p, 0, 1);

def prixn = 1 - prix;

def neg = 1 - scaleMinimax(high, p, 0, 1);

def hi = scaleMinimax(high, p, 0, 1);

def lo = scaleMinimax(low, p, 0, 1);

def up1 = (Highest(prix, pd) - lo) / Highest(prix, pd);

def up2 = (Highest(prix, pd) - hi) / Highest(prix, pd);

def dn1 = (Highest(prixn, pd) - neg) / Highest(prixn, pd);

def dn2 = scaleMinimax((high - Lowest(close, pd)) / Lowest(close, pd), p, 0, 1);

def wvf = If(tp == 1, up1, up2);

def wvfr = If(tp2 == 1, dn1, dn2);

def sDev = mult * StDev(wvf, bbl);

def midLine = Average(wvf, bbl);

def lowerBand = midLine - sDev;

def upperBand = midLine + sDev;

def rangeHigh = (Highest(wvf, lb)) * ph;

def rangeLow = (Lowest(wvf, lb)) * pl;

def col = If (wvf >= upperBand or wvf >= rangeHigh, -100, 0);

def sDev2 = mult * StDev(wvfr, bbl);

def midLine2 = Average(wvfr, bbl);

def lowerBand2 = midLine2 - sDev2;

def upperBand2 = midLine2 + sDev2;

def rangeHigh2 = (Highest(wvfr, lb)) * ph;

def rangeLow2 = (Lowest(wvfr, lb)) * pl;

def col2 = If(wvfr >= upperBand2 or wvfr >= rangeHigh2, 100, 0);

#PLOTS

plot pwvfr1 = wvfr;

pwvfr1.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

pwvfr1.AssignValueColor(if wvfr >= upperBand2 or wvfr >= rangeHigh2 then Color.GREEN else Color.DARK_GRAY);

pwvfr1.SetLineWeight(4);

plot pwvfr2 = wvfr;

pwvfr2.SetLineWeight(1);

pwvfr2.SetDefaultColor(Color.BLACK);

plot pwvf1 = wvf;

pwvf1.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

pwvf1.AssignValueColor(if wvf >= upperBand or wvf >= rangeHigh then Color.RED else Color.DARK_GRAY);

pwvf1.SetLineWeight(4);

plot pwvf2 = wvfr;

pwvf2.SetLineWeight(1);

pwvf2.SetDefaultColor(Color.BLACK);

plot pRPH = if hp and rangeHigh then rangeHigh else Double.NaN; #Range High Percentile

pRPH.AssignValueColor(GetColor(7));

plot pRPL = if hp and rangeLow then rangeLow else Double.NaN; #Range Low Percentile

pRPL.AssignValueColor(GetColor(7));

plot pUpperBand = if sd and upperBand then upperBand else Double.NaN; #Upper Band

pUpperBand.AssignValueColor(GetColor(5));

plot pRPH2 = if hp2 and rangeHigh2 then rangeHigh2 else Double.NaN; #Range High Percentile

pRPH2.AssignValueColor(GetColor(5));

plot pRPL2 = if hp2 and rangeLow2 then rangeLow2 else Double.NaN; #Range Low Percentile

pRPL2.AssignValueColor(GetColor(5));

plot pUpperBand2 = if sd2 and upperBand2 then upperBand2 else Double.NaN; #Upper Band

pUpperBand2.AssignValueColor(GetColor(7));

#END of Combo Williams Vix Fix (Twin version) to ToSShare your test results and pairings.

Happy Trading.