You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ultimate MACD Indicator for ThinkorSwim

- Thread starter horserider

- Start date

-

- Tags

- oscillator unanswered

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

webdementia

New member

I like this script. Do you have a link back to the original post. I would like to see the thought process behind how it works exactly, Thanks!!

freedom Traders

New member

@webdementia Just found it from a post BenTen: https://usethinkscript.com/threads/macd-with-bollinger-bands-bb-indicator-for-thinkorswim.287/

Last edited:

Hi horserider,

I would like to use both your Ultimate MACD and Ultimate RSI together on the same chart to help confirm each other for long and short signals. I see you have a standard, short-term and long-term Ultimate MACD and a short-term and long-term Ultimate RSI.

I will be using these to swing trade index ETFs such as SPY on the daily chart. With that said:

Would you suggest using the short-term or the long-term versions of these studies for my intended purpose? Again, I'm not a day trader, I'm a swing trader using the daily chart for signals.

If using both the Ultimate MACD and Ultimate RSI on the same chart to help confirm each other for long and short signals, would you suggest pairing like time frame versions i.e. the long-term Ultimate MACD with the long-term Ultimate RSI or the short-term Ultimate MACD with the short-term Ultimate RSI? Not sure where the standard Ultimate MACD would fit in with the long-term or short-term Ultimate RSI?

Thanks very much horserider for your insights!

I would like to use both your Ultimate MACD and Ultimate RSI together on the same chart to help confirm each other for long and short signals. I see you have a standard, short-term and long-term Ultimate MACD and a short-term and long-term Ultimate RSI.

I will be using these to swing trade index ETFs such as SPY on the daily chart. With that said:

Would you suggest using the short-term or the long-term versions of these studies for my intended purpose? Again, I'm not a day trader, I'm a swing trader using the daily chart for signals.

If using both the Ultimate MACD and Ultimate RSI on the same chart to help confirm each other for long and short signals, would you suggest pairing like time frame versions i.e. the long-term Ultimate MACD with the long-term Ultimate RSI or the short-term Ultimate MACD with the short-term Ultimate RSI? Not sure where the standard Ultimate MACD would fit in with the long-term or short-term Ultimate RSI?

Thanks very much horserider for your insights!

@David45 Pairing short to short or long to long should give confirming signals. This is logical as both are momentum type indicators. So both are giving you the same information. If it works to make money for you then that is all that matters.

Maybe think of combining Long MACD to show bigger trend and the short RSI to pick entry/exit points.

Maybe think of combining Long MACD to show bigger trend and the short RSI to pick entry/exit points.

Thank you so much horserider for your thoughts on this. I also really like the idea of using the long-term MACD for the overall trend with the short-term RSI for entry/exit points. Much appreciated!@David45 Pairing short to short or long to long should give confirming signals. This is logical as both are momentum type indicators. So both are giving you the same information. If it works to make money for you then that is all that matters.

Maybe think of combining Long MACD to show bigger trend and the short RSI to pick entry/exit points.

@horserider do you have a watchlist based on Ultimate MACD Indicator ?

@bspratt22 It looks like @crawford5002 posted more than what he needed to (probably a mistake). But yes, the following section was not needed otherwise it will show an error in ToS.

Code:

lower;

input fastLength = 5;

input slowLength = 20;

input MACDLength = 30;

input averageType = AverageType.EXPONENTIAL;

input showBreakoutSignals = no;

plot Value = MovingAverage(averageType, close, fastLength) - MovingAverage(averageType, close, slowLength);

plot Avg = MovingAverage(averageType, Value, MACDLength);

def higherFast = Value > Value[1];

def lowerFast = Value < Value[1];

def higherSlow = Avg > Avg[1];

def lowerSlow = Avg < Avg[1];

plot ZeroLine = 0;

Avg.SetDefaultColor(GetColor(8));@horserider if there a way to make this study an upper study? I don't need the MACD portion as upper but the Bollinger band portion as upper study. i Tried doing it my self but no luck, I tried using TD's bolinger band study but the squeeze seems more pronounced in your study than in TD's Bollinger band. Thank you

Can someone help me with a scanner that will find tickers that have a color change in the macd line from red to green? I don't need it to be crossing the sma line either. I can't seem to figure out what drives that condition. Thanks in advance.

Any luck with this scan technique? I haven't been able to get anything to work that meets the red to green color change criteria on any timeframe.@rcjh88 - Did you get a scanner to work? I tried "macd_line, pick greater than or less than and pick the study again and macd_line again. " I got no results.

Last edited by a moderator:

germanburrito

Active member

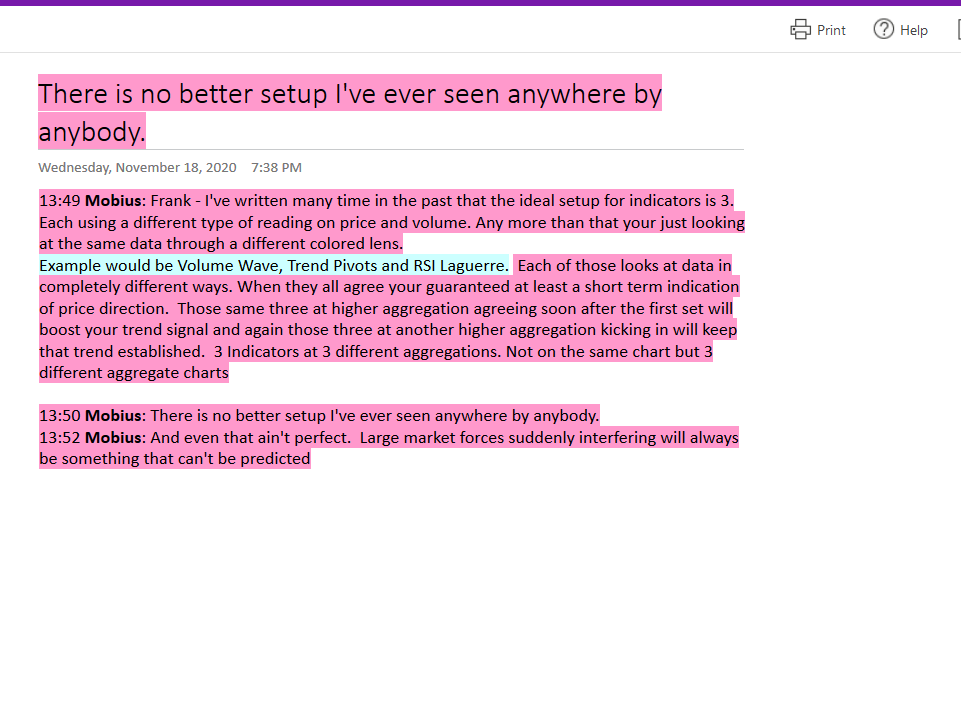

Honestly macd is a great, so are bollingers, but its even greater to understand what bolingers are actually doing, they are taking the standard deviation, meaning the average extreme moves of the last (usually can be changed) 21 bars, look into what standard deviations are, all indicators do is show you a different way that price is moving, like it simplifies the idea that price is going up or down, the most simple form of this that i have come across is THE STRAT, this will allow you to visualize price action, trading without understand what the indicators are actually doing is only seeing the result, trading "indicators" are not the way to trade, but they do help you visualise what price is doing, one may argue that if everyone is looking at the same indicator than it becomes a self-fulfilling prophecy, meaning if everyone is looking at macd to across over to green than to buy than it works, or if everyone is looking at Fibonacci than it might work, i once saw a post by this creator of indicators name mobious, and he stated that more than three indicators is too much. read this

Last edited by a moderator:

pyeatienza

New member

@pyeatienza Try to follow the tutorial here https://usethinkscript.com/threads/ultimate-macd-indicator-for-thinkorswim.558/post-23204

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| P | Ultimate MACD For ThinkOrSwim | Indicators | 16 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 | |

|

|

Ultimate RSI [LuxAlgo] for ThinkOrSwim | Indicators | 20 | |

|

|

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading | Indicators | 26 | |

|

|

YungTrader's Ultimate Indicator | Indicators | 685 |

Similar threads

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1492

Online

Similar threads

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

-

Similar threads

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.