# 3&4 Bar Play v1.6 by Len20

# based on Live Traders video https://www.youtube.com/watch?v=xEjUd82NVVg

# v1.1 fixed small mistake

# v1.2 individual lookback customization, ignitor bar height now includes wicks, can now customize pause bars minimum low (was ignitor midpoint),

# non-uptrend and no resistance requirements can be disabled, better uptrend detection, inputs more consistent, tweaks, fixes, more comments

# v1.3 trigger bar need not be green = more potential pattern matches

# v1.4 "Show Potential" now includes possible pattern setups during middle ("pause") bars, bug fix, trigger bar min low can now be same as pause bars min low ("Relaxed"), instead of pause bars actual low (official)

# v1.5 "Show potential" now includes ignitor bar. Can now color bars. Background color change on signals. Pattern will signal when forming live, disappears if it fails. Uptrend detection lookback now won't overlap pre-market, reg hours, or afterhours time zones. Recoded some logic. Other fixes, tweaks.

# v1.6 Now includes bullish & bearish indicators (selectable). Scanner has 3 modes. Bugfixes

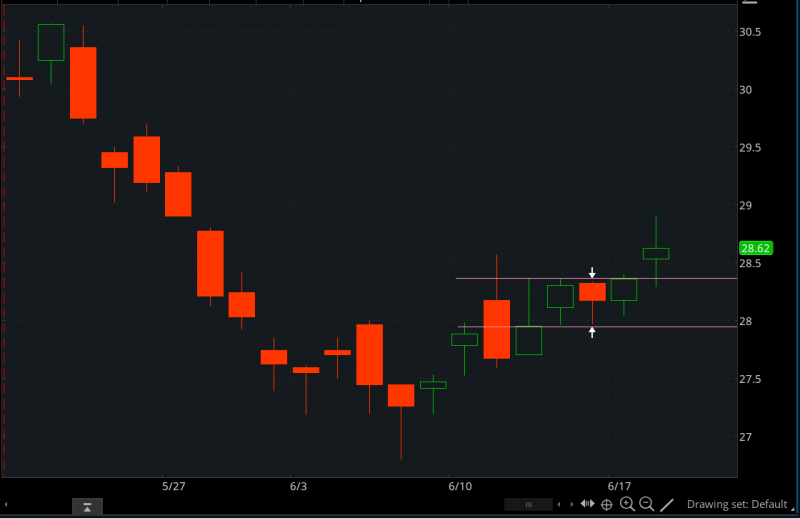

# Magenta arrow = potential pattern forming

# White arrow = confirmed (trigger bar high broke the high of ignitor and pause bars)

# Official Criteria:

# 1st bar ("ignitor") spike in price, range, maybe volume & 1st or 2nd bar of a move

# 1st bar not in middle of an uptrend

# 1st bar should be above resistance (closes above recent high)

# middle bar/bars ("pause") low is above midpoint of 1st bar

# middle bar/bars high is near 1st bar high

# middle bar/bars can be green or red

# trigger bar (potential) low is greater than low of middle bar/bars

# trigger bar (confirmed) high is above the high of the ingnitor and middle bars

# Inputs are asked for bullish mode, and will be reversed automatically for bearish

input Mode = {default "Both", "Bullish", "Bearish"};

input Show_Arrows_Potential = yes; # ignitor and pause bars match pattern, trigger has potential

input Show_Arrows_Confirmed = yes; # trigger bar successfully crossed previous bars high

input Color_Bars_Potential = yes; # ignitor and pause bars match pattern, trigger has potential

input Color_Bars_Confirmed = yes; # trigger bar successfully crossed previous bars high

input Flash_Background_Start = {default "Off", "Ignitor", "Pause Bars", "Trigger"}; # BG color change starting with selected bar match

input trigger_Bar_Low_Min = {default "Official", "Relaxed"}; # Trigger bar low min based on pause bars low (official), or pause bars minimum

input Show_During_Trend = yes; # Strict pattern not supposed to be in middle of uptrend

input trend_Limit_Perc_Chg = 1.0; # Only used if Show_During_Trend = no (Still signal if uptrend is below % entered)

input trend_LookBack = 10; # Only used if Show_During_Trend = no

input prev_High_LookBack = 5; # Ignitor bar must break previous period high

input avg_Vol_LookBack = 10; # for qualifying ignitor bar

input avg_Range_LookBack = 10; # for qualifying ignitor bar

input ignitor_Range_Spike_Perc = 200; # Minimum ignitor range % relative to avg range (200% = 2x avg range)

input ignitor_Vol_Spike_Perc = 100; # Minimum volume % relative to avg volume

input pause_Low_Min_Perc_Bull = 45; # Pause bars low min % of ignitor bar range (50% = middle of ingitor bar, lower is looser)

input pause_High_Min_Perc_Bull = 80; # Pause bars high min % of ignitor bar range (90% recommended, lower is looser)

input pause_High_max_Perc_Bull = 110; # Pause bars high max % of ignitor bar range (110% recommended, higher is looser)

Assert(prev_High_LookBack >= 1, "prev_High_Low_LookBack must be greater than zero");

Assert(trend_LookBack >= 1, "trend_LookBack must be greater than zero");

Assert(avg_Vol_LookBack >= 1, "avg_Vol_LookBack must be greater than zero");

Assert(avg_Range_LookBack >= 1, "avg_Range_LookBack must be greater than zero");

Assert(ignitor_Range_Spike_Perc >= 110, "ignitor_Range_Spike_Perc must be greater than 110%");

Assert(pause_Low_Min_Perc_Bull >= 0, "pause_Low_Min_Perc_Bull must be greater than zero");

Assert(pause_High_Min_Perc_Bull >= pause_Low_Min_Perc_Bull, "pause_High_Min_Perc_Bull must be greater than pause_Low_Min_Perc_Bull");

Assert(pause_High_max_Perc_Bull >= 100, "pause_High_max_Perc_Bull must be greater than or equal to 100%");

def indMode;

switch (Mode) {

case "Both": indMode = 1;

case "Bullish": indMode = 2;

case "Bearish": indMode = 3; }

def showBull = indMode == 1 or indMode == 2;

def showBear = indMode == 1 or indMode == 3;

def triggerMode;

switch (trigger_Bar_Low_Min) {

case "Official": triggerMode = 1;

case "Relaxed": triggerMode = 2; }

def flashBGMode;

switch (Flash_Background_Start) {

case "Off": flashBGMode = 1;

case "Ignitor": flashBGMode = 2;

case "Pause Bars": flashBGMode = 3;

case "Trigger": flashBGMode = 4; }

def start = 0930;

def end = 1600;

def pre = secondsTillTime(start) > 0;

def regHrs = secondsfromtime(start) >= 0 and secondsTillTime(end) > 0;

def AH = secondsfromtime(end) >= 0;

def tLookback = max(1, rounddown(trend_LookBack / 2, 0));

def tLookbackRecent = max(1, rounddown(trend_LookBack / 4, 0));

def trendLimMult = 1 + (trend_Limit_Perc_Chg * .01);

def h = high;

def l = low;

def o = open;

def c = close;

def v = volume;

def liveBar = isNaN(c[-1]);

def upBar = o < c;

def downBar = o > c;

def range = h - l;

def avgRange = ATR(avg_Range_LookBack);

def avgVol = Average(v, avg_Vol_LookBack);

def hh = Highest(h, prev_High_LookBack);

def ll = Lowest(l, prev_High_LookBack);

def movAvg = MovingAverage(AverageType.SIMPLE, c, tLookback);

def movAvgRecent = MovingAverage(AverageType.SIMPLE, c, tLookbackRecent);

def diffTimeZone1 = (pre and !pre[tLookback * 2]) or (regHrs and !regHrs[tLookback * 2]) or (AH and !AH[tLookback * 2]);

def diffTimeZone2 = (pre and !pre[tLookbackRecent * 2]) or (regHrs and !regHrs[tLookbackRecent * 2]) or (AH and !AH[tLookbackRecent * 2]);

def notUptrend1 = diffTimeZone1 or (movAvg <= movAvg[tLookback] * trendLimMult);

def notUptrend2 = diffTimeZone2 or (movAvgRecent <= movAvgRecent[tLookbackRecent] * trendLimMult);

def notUptrend = Show_During_Trend or (notUptrend1 and notUptrend2);

def notDntrend1 = diffTimeZone1 or (movAvg >= movAvg[tLookback] * trendLimMult);

def notDntrend2 = diffTimeZone2 or (movAvgRecent >= movAvgRecent[tLookbackRecent] * trendLimMult);

def notDntrend = Show_During_Trend or (notDntrend1 and notDntrend2);

def bullIgnitorMinHigh = max(hh[1] , h[1] + (range[1] * (ignitor_Range_Spike_Perc - 100) * .01 * .7));

def bull_ignitor_bar = upBar and notUptrend[1] and h >= bullIgnitorMinHigh and range > range[1] and range >= avgRange[1] * ignitor_Range_Spike_Perc * .01 and v >= avgVol[1] * ignitor_Vol_Spike_Perc *.01;

def bearIgnitorLowMax = min(ll[1] , l[1] - (range[1] * (ignitor_Range_Spike_Perc - 100) * .01 * .7));

def bear_ignitor_bar = downBar and notDntrend[1] and l <= bearIgnitorLowMax and range > range[1] and range >= avgRange[1] * ignitor_Range_Spike_Perc * .01 and v >= avgVol[1] * ignitor_Vol_Spike_Perc *.01;

def bullPauseLowMin = l + (range * pause_Low_Min_Perc_Bull * .01);

def bullPauseHighMin = l + (range * pause_High_Min_Perc_Bull * .01);

def bullPauseHighMax = l + (range * pause_High_max_Perc_Bull * .01);

def bull_pause_bar1 = bull_ignitor_bar[1] and l >= bullPauseLowMin[1] and h <= bullPauseHighMax[1] and h >= bullPauseHighMin[1];

def bull_pause_bar2 = bull_pause_bar1[1] and l >= bullPauseLowMin[2] and h <= bullPauseHighMax[2] and h >= bullPauseHighMin[2];

def bearPauseHighMax = h - (range * pause_Low_Min_Perc_Bull * .01);

def bearPauseLowMax = h - (range * pause_High_Min_Perc_Bull * .01);

def bearPauseLowMin = h - (range * pause_High_max_Perc_Bull * .01);

def bear_pause_bar1 = bear_ignitor_bar[1] and h <= bearPauseHighMax[1] and l >= bearPauseLowMin[1] and l <= bearPauseLowMax[1];

def bear_pause_bar2 = bear_pause_bar1[1] and h <= bearPauseHighMax[2] and l >= bearPauseLowMin[2] and l <= bearPauseLowMax[2];

def bull_potential_3BP = bull_pause_bar1[1] and range > 0 and if triggerMode == 1 then l >= l[1] else l >= bullPauseLowMin[2];

def bull_confirmed_3BP = bull_potential_3BP and h > Max(h[1], h[2]);

def bull_potential_4BP = bull_pause_bar2[1] and range > 0 and if triggerMode == 1 then l >= min(l[1], l[2]) else l >= bullPauseLowMin[3];

def bull_confirmed_4BP = bull_potential_4BP and h > Max(Max(h[1], h[2]), h[3]);

def bear_potential_3BP = bear_pause_bar1[1] and range > 0 and if triggerMode == 1 then h <= h[1] else h <= bearPauseHighMax[2];

def bear_confirmed_3BP = bear_potential_3BP and l < min(l[1], l[2]);

def bear_potential_4BP = bear_pause_bar2[1] and range > 0 and if triggerMode == 1 then h <= max(h[1], h[2]) else h <= bearPauseHighMax[3];

def bear_confirmed_4BP = bear_potential_4BP and l < min(min(l[1], l[2]), l[3]);

# The 3rd bar can be both pause_bar2 and 3BP trigger bar at same time

def bull_show_confirmed = bull_confirmed_3BP or bull_confirmed_4BP;

def bull_show_potential = (bull_potential_3BP or bull_potential_4BP) and liveBar;

def bull_show_pause2 = bull_pause_bar2 and (if liveBar then 1 else (bull_potential_4BP[-1] and liveBar[-1]) or bull_confirmed_4BP[-1]);

def bull_show_pause1 = bull_pause_bar1 and (if liveBar then 1 else bull_show_pause2[-1] or (bull_potential_3BP[-1] and liveBar[-1]) or bull_confirmed_3BP[-1]);

def bull_show_ignitor = bull_ignitor_bar and (if liveBar then 1 else bull_show_pause1[-1]);

def bear_show_confirmed = bear_confirmed_3BP or bear_confirmed_4BP;

def bear_show_potential = (bear_potential_3BP or bear_potential_4BP) and liveBar;

def bear_show_pause2 = bear_pause_bar2 and (if liveBar then 1 else (bear_potential_4BP[-1] and liveBar[-1]) or bear_confirmed_4BP[-1]);

def bear_show_pause1 = bear_pause_bar1 and (if liveBar then 1 else bear_show_pause2[-1] or (bear_potential_3BP[-1] and liveBar[-1]) or bear_confirmed_3BP[-1]);

def bear_show_ignitor = bear_ignitor_bar and (if liveBar then 1 else bear_show_pause1[-1]);

plot confirmed_arrows_bull = showBull and Show_Arrows_Confirmed and bull_show_confirmed;

plot potential_arrows_bull = showBull and Show_Arrows_Potential and (bull_show_ignitor or bull_show_pause1 or bull_show_pause2 or bull_show_potential);

plot confirmed_arrows_bear = showBear and Show_Arrows_Confirmed and bear_show_confirmed;

plot potential_arrows_bear = showBear and Show_Arrows_Potential and (bear_show_ignitor or bear_show_pause1 or bear_show_pause2 or bear_show_potential);

def paintPotentialBull = showBull and Color_Bars_Potential and (bull_show_ignitor or bull_show_pause1 or bull_show_pause2 or bull_show_potential);

def paintConfirmedBull = showBull and Color_Bars_Confirmed and bull_show_confirmed;

def paintPotentialBear = showBear and Color_Bars_Potential and (bear_show_ignitor or bear_show_pause1 or bear_show_pause2 or bear_show_potential);

def paintConfirmedBear = showBear and Color_Bars_Confirmed and bear_show_confirmed;

def flashBGbull = showBull and

if flashBGMode == 2 then (bull_show_ignitor or bull_show_pause1 or bull_show_pause2 or bull_show_potential or bull_show_confirmed) else

if flashBGMode == 3 then (bull_show_pause1 or bull_show_pause2 or bull_show_potential or bull_show_confirmed) else

if flashBGMode == 4 then (bull_show_potential or bull_show_confirmed) else 0;

def flashBGbear = showBear and

if flashBGMode == 2 then (bear_show_ignitor or bear_show_pause1 or bear_show_pause2 or bear_show_potential or bear_show_confirmed) else

if flashBGMode == 3 then (bear_show_pause1 or bear_show_pause2 or bear_show_potential or bear_show_confirmed) else

if flashBGMode == 4 then (bear_show_potential or bear_show_confirmed) else 0;

##### COLORS AND STYLE #####

confirmed_arrows_bull.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

confirmed_arrows_bull.SetDefaultColor(Color.WHITE);

confirmed_arrows_bull.SetLineWeight(3);

potential_arrows_bull.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

potential_arrows_bull.SetDefaultColor(Color.MAGENTA);

potential_arrows_bull.SetLineWeight(3);

confirmed_arrows_bear.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

confirmed_arrows_bear.SetDefaultColor(Color.WHITE);

confirmed_arrows_bear.SetLineWeight(3);

potential_arrows_bear.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

potential_arrows_bear.SetDefaultColor(Color.MAGENTA);

potential_arrows_bear.SetLineWeight(3);

assignPriceColor(if paintPotentialBull then if c < o then Color.MAGENTA else createColor(200,255,20) else color.CURRENT);

assignPriceColor(if paintConfirmedBull then if c < o then Color.MAGENTA else createColor(200,255,20) else color.CURRENT);

assignPriceColor(if paintPotentialBear then if c <= o then Color.MAGENTA else createColor(200,255,20) else color.CURRENT);

assignPriceColor(if paintConfirmedBear then if c <= o then Color.MAGENTA else createColor(200,255,20) else color.CURRENT);

assignBackgroundColor(if flashBGbull then color.LIGHT_GRAY else color.current);

assignBackgroundColor(if flashBGbear then color.LIGHT_GRAY else color.current);