Triple Exhaustion Indicator For ThinkOrSwim

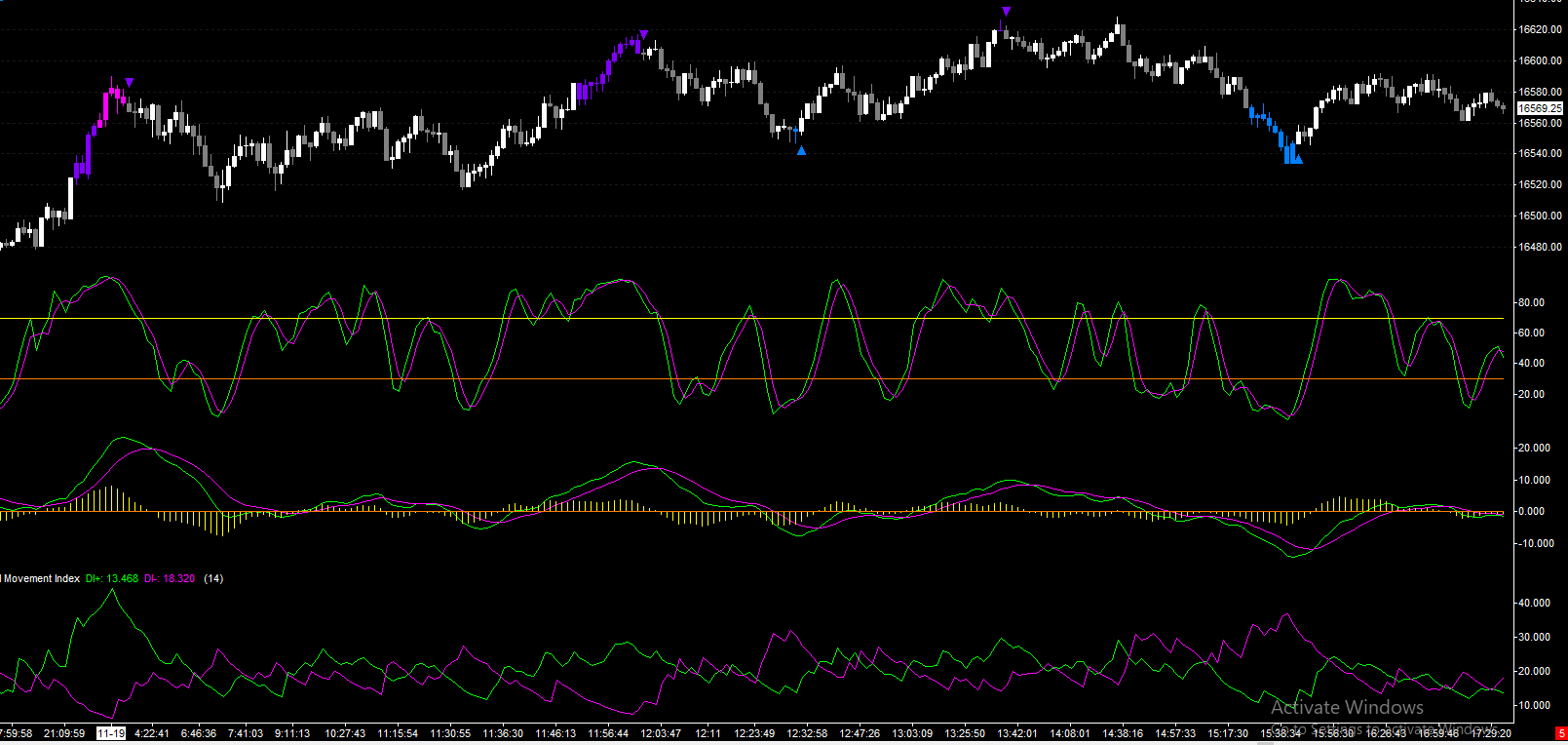

This is a pretty powerful indicator showing buy and sell exhaustion (MACD, Stochastic and DMI all in an extreme condition). When the exhaustion ends, expect a reversal. Thank you @cos251 for the code!

This is a pretty powerful indicator showing buy and sell exhaustion (MACD, Stochastic and DMI all in an extreme condition). When the exhaustion ends, expect a reversal. Thank you @cos251 for the code!

Code:

## Triple Exhaustion Indicator

##

##

## CREDITS

## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/

##

##

## Removing the header Credit credits and description is not permitted, any modification needs to be shared.

##

## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread:

## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/

## V 1.1 : @chence27 - modifcations to better approximate original study

##

##

##

declare upper;

# --- Inputs

input over_bought = 80;

input over_sold = 20;

input KPeriod = 10;

input DPeriod = 10;

input priceH = high;

input priceL = low;

input priceC = close;

input averageType = AverageType.SIMPLE;

input length = 1000;

input paintBars = yes;

input showLabels = yes;

# --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/-

def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK;

def MACD = reference MACD()."Value";

def priceMean = Average(MACD, length);

def MACD_stdev = (MACD - priceMean) / StDev(MACD, length);

def dPlus = reference DMI()."DI+";

def dMinus = reference DMI()."DI-";

# --- End Indicators

# --- Conditions

def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15;

def sellerExtreme = SlowK < 20 and MACD_stdev < -2 and dPlus < 15;

def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15;

def buyerExtreme = SlowK > 80 and MACD_stdev > 2 and dMinus < 15;

# --- End Conditions

# -- Price Color

AssignPriceColor( if paintBars and sellerExtreme then Color.CYAN else if buyerExtreme and paintBars then Color.MAGENTA else if paintBars and sellerRegular then Color.GREEN else if buyerRegular and paintBars then Color.RED else if paintBars then Color.GRAY else Color.Current);

# --- Arrows/Triggers

plot RegularBuy = if sellerRegular[1] and !sellerRegular then low else Double.NaN;

RegularBuy.SetPaintingStrategy(PaintingSTrategy.ARROW_UP);

RegularBuy.SetDefaultColor(Color.GREEN);

plot RegularSell = if buyerRegular[1] and !buyerRegular then high else Double.NaN;

RegularSell.SetPaintingStrategy(PaintingSTrategy.ARROW_Down);

RegularSell.SetDefaultColor(Color.RED);

# --- Labels

AddLabel(showLabels,"SellerRegular",Color.RED);

AddLabel(showLabels,"SellerExtreme",Color.MAGENTA);

AddLabel(showLabels,"BuyerRegular",Color.GREEN);

AddLabel(showLabels,"BuyerExtreme",Color.CYAN);

Last edited by a moderator: