I put this code in the scanner and it showed no results on the 5 min......Is the code valid to scan?

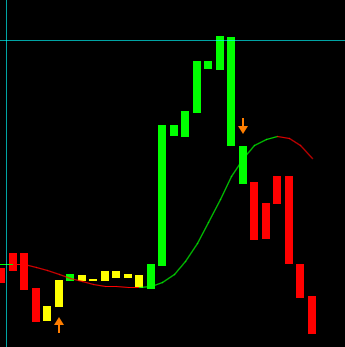

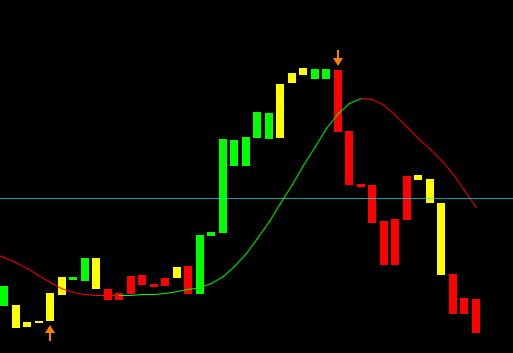

## Triple Exhaustion Indicator

##

##

## CREDITS

## Requested by

@Chence27 from criteria listed here

https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/

##

##

## Removing the header Credit credits and description is not permitted, any modification needs to be shared.

##

## V 1.0 :

@cos251 - Initial release per request from

www.usethinkscript.com forum thread:

## :

https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/

##

##

##

declare upper;

# --- Inputs

input over_bought = 80;

input over_sold = 20;

input KPeriod = 10;

input DPeriod = 10;

input priceH = high;

input priceL = low;

input priceC = close;

input averageType = AverageType.SIMPLE;

input length = 1000;

input paintBars = yes;

input showLabels = yes;

# --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/-

def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK;

def MACD = reference MACD()."Value";

def priceMean = Average(MACD, length);

def MACD_stdev = (MACD - priceMean) / StDev(MACD, length);

def dPlus = reference DMI()."DI+";

def dMinus = reference DMI()."DI-";

# --- End Indicators

# --- Conditions

def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15;

def sellerExtreme = SlowK < 20 and MACD_stdev < -2 and dPlus < 15;

def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15;

def buyerExtreme = SlowK > 80 and MACD_stdev > 2 and dMinus < 15;

# --- End Conditions

# -- Price Color

# --- Arrows/Triggers

plot RegularBuy = if sellerRegular[1] and !sellerRegular then low else Double.NaN;