You should upgrade or use an alternative browser.

Triple Exhaustion Indicator For ThinkOrSwim

- Thread starter Chence27

- Start date

I'm pretty sure TMO will always be overbought/oversold when the triple exhaustion signal goes off. Not sure it will eliminate many false signals unless you're using TMO on a higher time frame.Try combining this with the True Momentum Oscillator. Wait for the alignment of the two to minimize the fakeouts.

that seems that is how it is playing out...do you have any other suggestions?I'm pretty sure TMO will always be overbought/oversold when the triple exhaustion signal goes off. Not sure it will eliminate many false signals unless you're using TMO on a higher time frame.

Sure, TMO can be oversold for quite some time without giving a buy signal. You are looking for a buy signal on TMO, not just oversold. I'm a swing trader so I am using these indicators on a daily chart. No idea about the lower time frames, have no interest.I'm pretty sure TMO will always be overbought/oversold when the triple exhaustion signal goes off. Not sure it will eliminate many false signals unless you're using TMO on a higher time frame.

Yes, the key is to wait for the buy signal for both. Just using oversold on TMO is nonsenseI think TMO is a great complement to Triple Exhaustion, at least from my initial backtesting. When both line up on the 10min for example, that´s a strong signal.

Exactly, it´s the signal you want to wait for to line up on both indicators and i even blanked out the OB & OS part of the code on my TMO study and then overlaid only the signal lines on the upper chart which makes the signals even more clear to see. I like it a lot on the 10min timeframe but also the 4/5min works well.Yes, the key is to wait for the buy signal for both. Just using oversold on TMO is nonsense

Gotcha. I've only used a version of TMO on Sierra and there are no entry signals. What are the entry signals for your TMO? MA cross or cross out of overbought/oversold? Although even with the entry signals I'd imagine there'd be a lot of overlap between the studies, perhaps too much to be a meaningful filter.Sure, TMO can be oversold for quite some time without giving a buy signal. You are looking for a buy signal on TMO, not just oversold. I'm a swing trader so I am using these indicators on a daily chart. No idea about the lower time frames, have no interest.

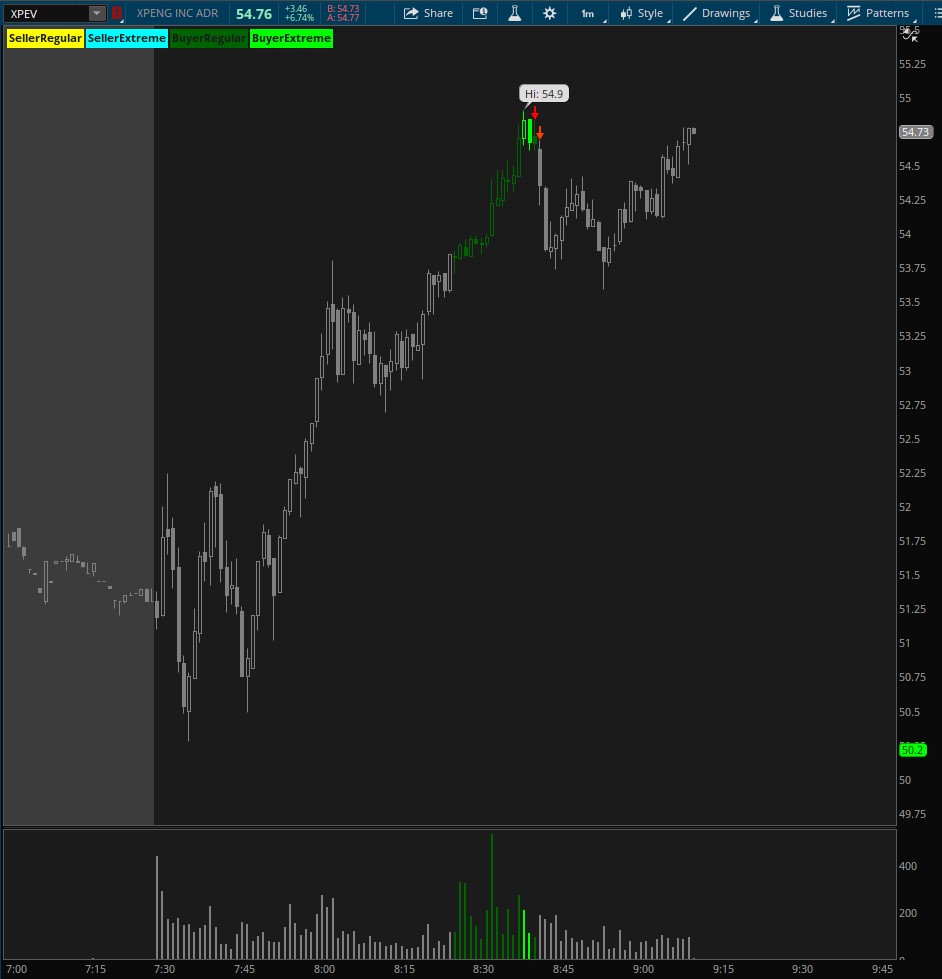

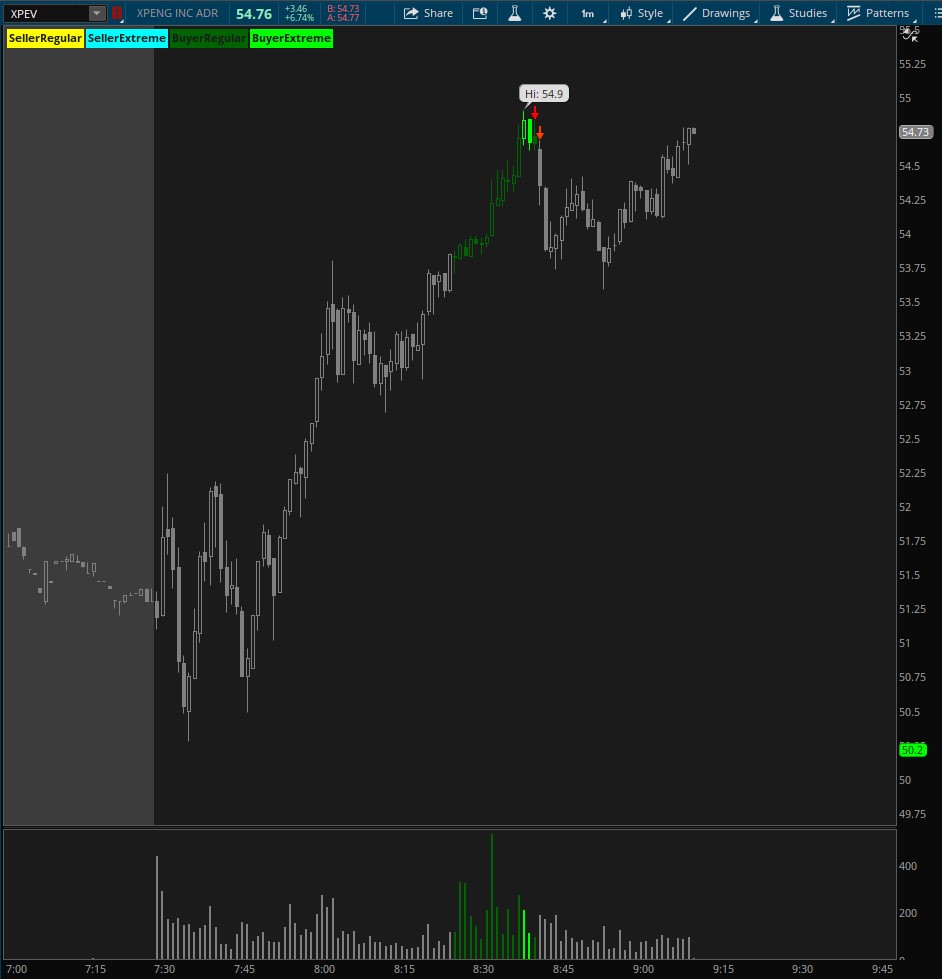

Very nice @zeek! Thanks for sharing. Would you mind posting a shareable setup link? If not, no worries. Thank you.A few examples from today combining Triple Ext & TMO, nice signals

sorry, can't help you with conditional orders I not done coding of these. Am sure if you search"Conditional Order" on this pages there are tutorials and examples.Hello @skaboy et. al,

I am pretty new to this thinkscript thing and wondering if your Smoothed Heikin_Ashi_Moving_Average_S2 ThinkScript could be coded for conditional orders also? If so, please provide the code for using for Conditional Order, or provide suggestions on how it can be done? I like the entries and exits, and if used in conjunction with the SuperTrend Reversals and some other unique strategies here would be so very helpful. Most of these complex coding cannot be used for Conditional Orders, and wondering if your strategy is simple enough to be used for that purpose in addition to displaying on the charts. Thank you.

Boua.

wado729

New member

A few examples from today combining Triple Ext & TMO, nice signals

How did you get those BUY lines going up the chart?

Thanks for asking that question! Was wondering the same thing. Would it be possible to get a setup link? Thank you.How did you get those BUY lines going up the chart?

wado729

New member

Nevermind, figured it out.How did you get those BUY lines going up the chart?

To those interested, use the addverticalLine function.

https://tlc.thinkorswim.com/center/reference/thinkScript/Functions/Look---Feel/AddVerticalLine

addverticalline(BUYsignal,"Buy",color.green,curve.short_dash);

addverticalline(SELLsignal,"Sell",color.red,curve.short_dash);Then if you want to add the lines to upper chart, i also recommend to blank out all the code related to "addcloud" using # in the sourcecode which will remove the OB & OS cloud. Also don´t forget to uncheck all the boxes in the plot section of settings. Then just force the lower study up and you will have the lines there like in my screenshots.

Nevermind, figured it out.

To those interested, use the addverticalLine function.

https://tlc.thinkorswim.com/center/reference/thinkScript/Functions/Look---Feel/AddVerticalLine

Here`s a modified upper study TMO with vertical lines.

# TMO ((T)rue (M)omentum (O)scilator)

# Mobius

# V01.05.2018

# hint: TMO calculates momentum using the delta of price. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price.

declare Upper;

input length = 14;

input calcLength = 5;

input smoothLength = 3;

def o = open;

def c = close;

def data = fold i = 0 to length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def EMA5 = ExpAverage(data, calcLength);

def Main = ExpAverage(EMA5, smoothLength);

def Signal = ExpAverage(Main, smoothLength);

def zero = if isNaN(c) then double.nan else 0;

def ob = if isNaN(c) then double.nan else round(length * .7);

def os = if isNaN(c) then double.nan else -round(length * .7);

#___________________________________________________________________add_on

def BUYsignal =Main < OS and Main crosses above Signal;

def SELLsignal = Main > OB and Main crosses below Signal;

addverticalline(BUYsignal,"Buy",color.green,curve.short_dash);

addverticalline(SELLsignal,"Sell",color.red,curve.short_dash);

# End Code TMO

Hello COS251! Your code for Triple Exhaustion is much appreciated. I've been able to use the SCAN code to find triggers, however it's not working on a day timeframe. Any ideas how I could enable this? Thank you!Check to see if all criteria was coded as you indicated. Hopefully this is what you were looking for.

Triple Exhaustion Indicator

Ruby:## Triple Exhaustion Indicator ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## declare upper; # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def sellerExtreme = SlowK < 20 and MACD_stdev < -2 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; def buyerExtreme = SlowK > 80 and MACD_stdev > 2 and dMinus < 15; # --- End Conditions # -- Price Color AssignPriceColor( if paintBars and sellerExtreme then Color.CYAN else if buyerExtreme and paintBars then Color.GREEN else if paintBars and sellerRegular then Color.YELLOW else if buyerRegular and paintBars then Color.DARK_GREEN else if paintBars then Color.GRAY else Color.Current); # --- Arrows/Triggers plot RegularBuy = if sellerRegular[1] and !sellerRegular then low else Double.NaN; plot ExtremeBuy = if sellerExtreme[1] and !sellerExtreme then low else Double.NaN; RegularBuy.SetPaintingStrategy(PaintingSTrategy.ARROW_UP); ExtremeBuy.SetPaintingSTrategy(paintingSTrategy.Arrow_UP); RegularBuy.SetDefaultColor(Color.LIME); ExtremeBuy.SetDefaultColor(Color.GREEN); plot RegularSell = if buyerRegular[1] and !buyerRegular then high else Double.NaN; plot ExtremeSell = if buyerExtreme[1] and !buyerExtreme then high else Double.NaN; RegularSell.SetPaintingStrategy(PaintingSTrategy.ARROW_Down); ExtremeSell.SetPaintingSTrategy(paintingSTrategy.Arrow_DOWN); RegularSell.SetDefaultColor(Color.Light_RED); ExtremeSell.SetDefaultColor(Color.RED); # --- Labels AddLabel(showLabels,"SellerRegular",Color.YELLOW); AddLabel(showLabels,"SellerExtreme",Color.CYAN); AddLabel(showLabels,"BuyerRegular",Color.DARK_GREEN); AddLabel(showLabels,"BuyerExtreme",Color.GREEN);

Triple Exhaustion Indicator SCAN (Scanner)

Ruby:## Triple Exhaustion Indicator SCAN ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## SCAN requested by @Trader_Andrew ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## : SCAN version requested by @Trader_Andrew ## ## ## # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; # --- End Conditions # --- Arrows/Triggers plot RegularBuyArrow = if sellerRegular[1] and !sellerRegular then 1 else Double.NaN; plot RegularSellArrow = if buyerRegular[1] and !buyerRegular then 1 else Double.NaN; plot RegularBuyTrendExists = if sellerRegular then 1 else Double.NaN; plot RegularSellTrendExists = if buyerRegular then 1 else Double.NaN;

curranjohn46

New member

Nice indicator. I am very interested in the scan here. I tried adding this custom scan to thinkorswim but the OK button is greyed out. Are you able to add it the same way I am? See https://snipboard.io/4ozJIE.jpg. Thx.Check to see if all criteria was coded as you indicated. Hopefully this is what you were looking for.

Triple Exhaustion Indicator

Ruby:## Triple Exhaustion Indicator ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## declare upper; # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def sellerExtreme = SlowK < 20 and MACD_stdev < -2 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; def buyerExtreme = SlowK > 80 and MACD_stdev > 2 and dMinus < 15; # --- End Conditions # -- Price Color AssignPriceColor( if paintBars and sellerExtreme then Color.CYAN else if buyerExtreme and paintBars then Color.GREEN else if paintBars and sellerRegular then Color.YELLOW else if buyerRegular and paintBars then Color.DARK_GREEN else if paintBars then Color.GRAY else Color.Current); # --- Arrows/Triggers plot RegularBuy = if sellerRegular[1] and !sellerRegular then low else Double.NaN; plot ExtremeBuy = if sellerExtreme[1] and !sellerExtreme then low else Double.NaN; RegularBuy.SetPaintingStrategy(PaintingSTrategy.ARROW_UP); ExtremeBuy.SetPaintingSTrategy(paintingSTrategy.Arrow_UP); RegularBuy.SetDefaultColor(Color.LIME); ExtremeBuy.SetDefaultColor(Color.GREEN); plot RegularSell = if buyerRegular[1] and !buyerRegular then high else Double.NaN; plot ExtremeSell = if buyerExtreme[1] and !buyerExtreme then high else Double.NaN; RegularSell.SetPaintingStrategy(PaintingSTrategy.ARROW_Down); ExtremeSell.SetPaintingSTrategy(paintingSTrategy.Arrow_DOWN); RegularSell.SetDefaultColor(Color.Light_RED); ExtremeSell.SetDefaultColor(Color.RED); # --- Labels AddLabel(showLabels,"SellerRegular",Color.YELLOW); AddLabel(showLabels,"SellerExtreme",Color.CYAN); AddLabel(showLabels,"BuyerRegular",Color.DARK_GREEN); AddLabel(showLabels,"BuyerExtreme",Color.GREEN);

Triple Exhaustion Indicator SCAN (Scanner)

Ruby:## Triple Exhaustion Indicator SCAN ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## SCAN requested by @Trader_Andrew ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## : SCAN version requested by @Trader_Andrew ## ## ## # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; # --- End Conditions # --- Arrows/Triggers plot RegularBuyArrow = if sellerRegular[1] and !sellerRegular then 1 else Double.NaN; plot RegularSellArrow = if buyerRegular[1] and !buyerRegular then 1 else Double.NaN; plot RegularBuyTrendExists = if sellerRegular then 1 else Double.NaN; plot RegularSellTrendExists = if buyerRegular then 1 else Double.NaN;

curranjohn46

New member

Are you all able to to add this scan in TOS? My OK button is greyed out when I try.## Triple Exhaustion Indicator SCAN ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## SCAN requested by @Trader_Andrew ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## : SCAN version requested by @Trader_Andrew ## ## ## # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; # --- End Conditions # --- Arrows/Triggers plot RegularBuyArrow = if sellerRegular[1] and !sellerRegular then 1 else Double.NaN; plot RegularSellArrow = if buyerRegular[1] and !buyerRegular then 1 else Double.NaN; plot RegularBuyTrendExists = if sellerRegular then 1 else Double.NaN; plot RegularSellTrendExists = if buyerRegular then 1 else Double.NaN;

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| H | Triple TSI For ThinkOrSwim | Indicators | 12 | |

|

|

Triple 3 Inside Bars Indicator and Scanner for ThinkorSwim | Indicators | 94 | |

|

|

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion | Indicators | 6 | |

|

|

Leledc Exhaustion Indicator for ThinkorSwim | Indicators | 46 | |

|

|

Trend Exhaustion Indicator for ThinkorSwim | Indicators | 28 |

Similar threads

-

-

-

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion

- Started by autoloader

- Replies: 6

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion

- Started by autoloader

- Replies: 6

-

-

Similar threads

-

-

-

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion

- Started by autoloader

- Replies: 6

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/