It still repaints, more on shorter timeframes than longer...When I checked this indicator last it used to repaint. Has the repainting been overcome by now? the topic has become 55 pages now so would save lots of time if quick answer is available.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

scott69

Active member

Hello all, I've been experimenting with this one for about two weeks now, so not a typical "clinical trial" time, but enough to see how it would work on the /NQ. I actually started out on a 1 minute chart. After trying to make my way through the 55 pages of discussion here, several coder/traders said not to use it under 5 minutes. So I have been running it on a 1 minute and 5 minute chart as an experiment. First may I say that lately the NQ has not been "typical," moving 100s of points in minutes, and 300-400 points in a day. At $20 per emini contract, we're talking serious money made or lost. Anyway, my results have been that the 1 minute chart signals have been surprisingly accurate. The 5 minute has also been accurate, but the 1 minute signals had an earlier trigger, and would be excellent in a market that had "clean" turns, i.e. no congestion a range. When the market entered a period of chop as I identified by the ADX on a 5 minute chart, the 1 minute reversal indicator did give many whipsaw signals, but I ignored them because of the 5 min ADX. Now the 5 minute use of the indicator did give accurate signals, but they were quite a bit later than the 1. When they were in agreement about direction and signal, the 5 minute was, in recent NQ market, 30 - 50 points behind, which as you know, 50 points in the NQ is $1000s of dollars. So, in summary, I am still experimenting with this indicator on the 1 min chart as a heads up to watch my own analysis and indicators, and the 5 min chart for confirmation of my own entry (from my own personally designed indicators). A hat tip to the designers of this, though, as it is a remarkable piece of coding. Thanks again.

Last edited:

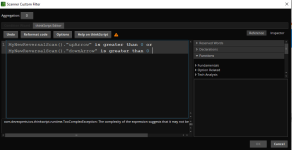

@BenTen, this is an interesting study. I am going to give it a try. I want to know how the scan works. I tried

MyNewReversalScan()."upArrow" is greater than 0 within 5 bars or MyNewReversalScan()."downArrow" is greater than 0 within 5 bars.

TOS says this is too complex to give results. Do I have to do two separate scans for bullish and bearish?

MyNewReversalScan()."upArrow" is greater than 0 within 5 bars or MyNewReversalScan()."downArrow" is greater than 0 within 5 bars.

TOS says this is too complex to give results. Do I have to do two separate scans for bullish and bearish?

add volume limit to scan@BenTen, this is an interesting study. I am going to give it a try. I want to know how the scan works. I tried

MyNewReversalScan()."upArrow" is greater than 0 within 5 bars or MyNewReversalScan()."downArrow" is greater than 0 within 5 bars.

TOS says this is too complex to give results. Do I have to do two separate scans for bullish and bearish?

@BTExpress

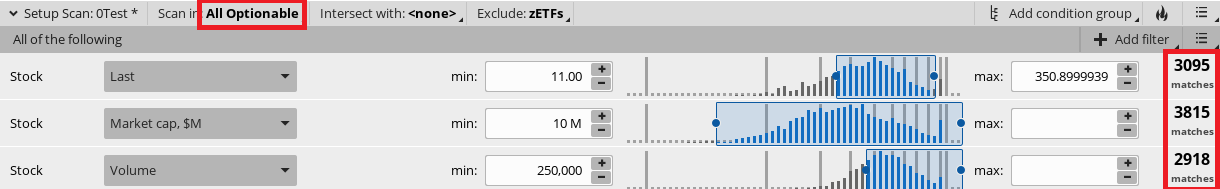

I am not sure that all of this will fix your problem but you have to fix these parts so we can find out what your problem is. Here is an example of some ways to commonly filter. See how it reduces the number of stocks that need to be scanned?

These filters are ONLY an example. They may not fit your strategy at all. You should define filters that fit your strategy AND brings the number of stocks you are attempting to scan down to a reasonable amount.

- YES! You have to have separate scans for bullish and bearish.

- AND 'within 5 bars' requires a lot of resources. Perhaps start with 1 bar and once you have that working, you can attempt to go back further and see if it blows up on you.

- AND as @dmillz said, it is common to get an execution error if you are trying to scan the whole universe of stocks.

I am not sure that all of this will fix your problem but you have to fix these parts so we can find out what your problem is. Here is an example of some ways to commonly filter. See how it reduces the number of stocks that need to be scanned?

These filters are ONLY an example. They may not fit your strategy at all. You should define filters that fit your strategy AND brings the number of stocks you are attempting to scan down to a reasonable amount.

@firestick55 The code can be found right on the first page of this thread. If you don't know how to add it to ToS, check out this tutorial.

Bobbydigital83

Member

The scanner link on page 1 does not work. Its just an study instead of a scan. Any updated link?

@Bobbydigital83 Yes, it's supposed to be a study so you can load it up when creating your scanner. Take a look at this comment.

@BTExpress @MisterSK

@BTExpress @MisterSK

don't worry about this request, found this:In the lower part of the code under #Fibonacci Extensions, if you change showFibExtLines = no to yes, a bunch of bubbles plot showing the fib extensions based on the reversal. What would we change in the code to have it plot lines instead of the bubbles?

https://usethinkscript.com/threads/zigzag-high-low-with-supply-demand-zones-for-thinkorswim.172/

it is the same code except it will plot the fib extensions and all of the code works.

Last edited:

@Iceburgh We already posted the alternative version with arrows. Even if you load it to your mobile it probably not going to work due to the ZigZagHighLow function.

Ben

Where can i find a version with alerts built-in?

WolfgangFX

New member

How did you set it up? Did you copy the code into the ThinkScript? or added the study all together? I'm getting an error message that says "Trying to self-assign a non-initialized rec: state. Not sure how to go about this.@BenTen This is the scanner that I was able to successfully setup : https://tos.mx/ace3eC

Give this a shot, I'll be trying this out tomorrow

Last edited:

humpydumpylol

New member

I have a question about reversals based, for example, on Bollinger bands, I tried to write on thinscript that when current high is above the upper band then the shares change for the negative sign shares, for short reversal, and when the current low is below the lower band the sign changes to positive shares for bullish reversal. It should be a simple few lines of codes, but I couldn't achieved other than only positive sign shares. Thanks in advance

- Status

- Not open for further replies.

Volatility Trading Range

VTR is a momentum indicator that shows if a stock is overbought or oversold based on its Weekly and Monthly average volatility trading range.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim | Indicators | 125 | |

|

|

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim | Indicators | 10 | |

| C | AGAIG Trend Vertical Line For ThinkOrSwim | Indicators | 11 | |

| D | Trend Trader Buy/Sell Signals For ThinkOrSwim | Indicators | 9 | |

|

|

LNL Trend System for ThinkOrSwim | Indicators | 27 |

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

782

Online

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.