Cool and the indicator is not recommended for below 5min chart what time chart do you have this on?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Supertrend Indicator by Mobius for ThinkorSwim

- Thread starter BenTen

- Start date

-

- Tags

- trend unanswered

Thanks could I see your chart?@Zlotko I use a 30 min bar.

Here is how @Svanoy has the 30min chart setup:Thanks could I see your chart?

https://usethinkscript.com/threads/...by-mobius-for-thinkorswim.7/page-3#post-94832

How would I add a ding sound (Sound.DING) when either the "Sell @" or "Buy @" chart bubbles are added?

AddChartBubble(close[n] crosses below ST[n], low[n+1] + TickSize() * n, "Sell @ " + low[n1], color.Cyan, yes); AddChartBubble(close[n] crosses above ST[n], high[n+1] - TickSize() * n, "Buy @ " + high[n1], color.Yellow, no);

Thank you,

AddChartBubble(close[n] crosses below ST[n], low[n+1] + TickSize() * n, "Sell @ " + low[n1], color.Cyan, yes); AddChartBubble(close[n] crosses above ST[n], high[n+1] - TickSize() * n, "Buy @ " + high[n1], color.Yellow, no);

Thank you,

How would I add a ding sound (Sound.DING) when either the "Sell @" or "Buy @" chart bubbles are added?

AddChartBubble(close[n] crosses below ST[n], low[n+1] + TickSize() * n, "Sell @ " + low[n1], color.Cyan, yes); AddChartBubble(close[n] crosses above ST[n], high[n+1] - TickSize() * n, "Buy @ " + high[n1], color.Yellow, no);

Thank you,

This should help

Code:input alerts = yes; Alert(alerts and close[n] crosses below ST[n], "SELL", Alert.BAR, Sound.Ding); Alert(alerts and close[n] crosses above ST[n], "BUY", Alert.BAR, Sound.Ding);

Would like to see this tooIs it possible to change the chart bubbles to arrows instead?

Is it possible to change the chart bubbles to arrows instead?

https://usethinkscript.com/threads/supertrend-indicator-by-mobius-for-thinkorswim.7/#post-54027Would like to see this too

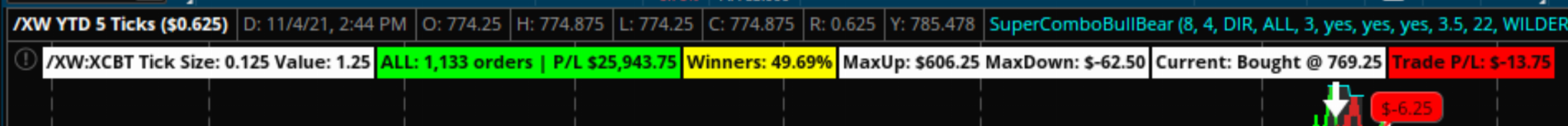

the above code produce the following error:You can try this template I use for my studies, pieced it together and modified it from here and there, most from linus' SuperCombo. Basically, just plug in what triggers your buy and sell signals (and stops if you use them) and it will put a bar on top with your overall p/l for the given timeframe. This isn't a strategy so a report isn't given, but it does give a quick p/l so you can change settings and instantly see the effect. Note, this won't account for any fees or commissions, so if doing futures, have to take off the fees per order.

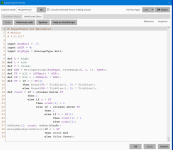

Code:input showSignals = yes; input showLabels = yes; input showBubbles = yes; input useStops = no; ############################################ ## Create Signals - FILL IN THIS SECTION ############################################ def BuySignal ; # insert condition to create long position def SellSignal ; # insert condition to create short position def BuyStop = if !useStops then 0 else 0 ; # insert condition to stop in place of the 0 after else def SellStop = if !useStops then 0 else 0 ; # insert condition to stop in place of the 0 after else ####################################### ## Maintain the position of trades ####################################### def CurrentPosition; # holds whether flat = 0 long = 1 short = -1 if (BarNumber()==1) OR isNaN(CurrentPosition[1]) { CurrentPosition = 0; }else{ if CurrentPosition[1] == 0 { # FLAT if (BuySignal) { CurrentPosition = 1; } else if (SellSignal){ CurrentPosition = -1; } else { CurrentPosition = CurrentPosition[1]; } } else if CurrentPosition[1] == 1 { # LONG if (SellSignal){ CurrentPosition = -1; } else if (BuyStop){ CurrentPosition = 0; } else { CurrentPosition = CurrentPosition[1]; } } else if CurrentPosition[1] == -1 { # SHORT if (BuySignal){ CurrentPosition = 1; } else if (SellStop){ CurrentPosition = 0; } else { CurrentPosition = CurrentPosition[1]; } } else { CurrentPosition = CurrentPosition[1]; } } def isLong = if CurrentPosition == 1 then 1 else 0; def isShort = if CurrentPosition == -1 then 1 else 0; def isFlat = if CurrentPosition == 0 then 1 else 0; ####################################### ## Plot the Signals ####################################### Plot BuySig = if (!isLong[1] and BuySignal and showSignals) then 1 else 0; BuySig.AssignValueColor(color.yellow); BuySig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); BuySig.SetLineWeight(3); Plot SellSig = if (!isShort[1] and SellSignal and showSignals) then 1 else 0; SellSig.AssignValueColor(color.white); SellSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); SellSig.SetLineWeight(3); Plot BuyStpSig = if (BuyStop and isLong[1] and showSignals) then 1 else 0; BuyStpSig.AssignValueColor(color.gray); BuyStpSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); BuyStpSig.SetLineWeight(3); Plot SellStpSig = if (SellStop and isShort[1] and showSignals) then 1 else 0; SellStpSig.AssignValueColor(color.gray); SellStpSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); SellStpSig.SetLineWeight(3); ####################################### ## Orders ####################################### def isOrder = if CurrentPosition == CurrentPosition[1] then 0 else 1; # Status changed so it's a new order def orderPrice = if (isOrder and (BuySignal or SellSignal)) then open[-1] else orderPrice[1]; ####################################### ## Price and Profit ####################################### def profitLoss; if (!isOrder){ profitLoss = 0; } else if ((isOrder and isLong[1]) and (SellSig or BuyStpSig)){ profitLoss = close - orderPrice[1]; } else if ((isOrder and isShort[1]) and (BuySig or SellStpSig)) { profitLoss = orderPrice[1] - close; } else { profitLoss = 0; } def profitLossSum = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder then profitLossSum[1] + profitLoss else profitLossSum[1], 0); def profitWinners = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder and profitLoss > 0 then profitWinners[1] + 1 else profitWinners[1], 0); def profitLosers = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder and profitLoss < 0 then profitLosers[1] + 1 else profitLosers[1], 0); def profitPush = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder and profitLoss == 0 then profitPush[1] + 1 else profitPush[1], 0); def TradePL = If isLong then Round(((close - orderprice)/TickSize())*TickValue()) else if isShort then Round(((orderPrice - close)/TickSize())*TickValue()) else 0; # current trade p/l def dollarProfitLoss = round((profitLoss/Ticksize())*Tickvalue()); # per trade for chart bubbles def biggestWin = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder and (dollarProfitLoss > 0) and (dollarProfitLoss > biggestWin[1]) then dollarProfitLoss else biggestWin[1], 0); def biggestLoss = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder and (dollarProfitLoss < 0) and (dollarProfitLoss < biggestLoss[1]) then dollarProfitLoss else biggestLoss[1], 0); def orderCount = (profitWinners+profitLosers+profitPush); def PCTWin = round((profitWinners/orderCount)*100,2); ####################################### ## Create Labels ####################################### AddLabel(yes, GetSymbol()+" Tick Size: "+TickSize()+" Value: "+TickValue(), color.white); AddLabel(showSignals and showLabels, "Orders: " + orderCount + " P/L: " + AsDollars(profitLossSum), if profitLossSum > 0 then Color.GREEN else if profitLossSum < 0 then Color.RED else Color.GRAY); AddLabel(yes, "Winners: "+ PCTWin +"%",if PCTWin > 50 then color.green else if PCTWin > 40 then color.yellow else color.gray); AddLabel(yes, "MaxUp: "+ AsDollars(biggestWin) +" MaxDown: "+AsDollars(biggestLoss), color.white); AddLabel(if !IsNan(CurrentPosition) then 1 else 0, "Current: "+ (If isLong then "Bought" else "Sold") + " @ "+orderPrice, color.white); AddLabel(if !IsNan(orderPrice) then 1 else 0, "Trade P/L: "+ AsDollars(TradePL), if (TradePL > 0) then color.green else if (TradePl < 0) then color.red else color.gray); ####################################### ## Chart Bubbles for Profit/Loss ####################################### AddChartBubble(showSignals and showBubbles and isOrder and isLong[1], low, "$"+dollarProfitLoss, if dollarProfitLoss == 0 then Color.LIGHT_GRAY else if dollarProfitLoss > 0 then Color.GREEN else color.Red, 1); AddChartBubble(showSignals and showBubbles and isOrder and isShort[1], high, "$"+dollarProfitLoss, if dollarProfitLoss == 0 then Color.LIGHT_GRAY else if dollarProfitLoss > 0 then Color.GREEN else color.Red, 0);

Value never assigned to BuySignal at 13:5

Value never assigned to SellSignal at 20:5

The directions state:the above code produce the following error:

Value never assigned to BuySignal at 13:5

Value never assigned to SellSignal at 20:5

- You can try this template

- Just plug in what triggers your buy and sell signals

Without seeing how you coded your plugs, it is not possible to provide any further assistance.

Last edited:

Last edited by a moderator:

Uberloading

New member

Hi I'm trying to apply a condition for the scanner where the supertrend Up line is above the 200sma but I can't figure it out for the life of me.

So what I've done in the past is use a simple script in custom study such as: SimpleMovingAvg(length = 100) is greater than SimpleMovingAvg(length = 200)from 1 bars ago

I tried using: Supertrend(1) is greater than SimpleMovingAvg(length = 200)from 1 bars ago but it didn't work.

I think I need to add a few line of codes into the original Mobius supertrend scanner script itself but have no clue what to add, does anyone have any ideas?

So what I've done in the past is use a simple script in custom study such as: SimpleMovingAvg(length = 100) is greater than SimpleMovingAvg(length = 200)from 1 bars ago

I tried using: Supertrend(1) is greater than SimpleMovingAvg(length = 200)from 1 bars ago but it didn't work.

I think I need to add a few line of codes into the original Mobius supertrend scanner script itself but have no clue what to add, does anyone have any ideas?

I have this supertrend indicator long time ago and it worked very well for me, I got it from here and I think it was posted by Mobius. It has the pivots, resistance and support lines and it can work for any time frame.http://tos.mx/wf3aXRa here you go

#Public Indicator

#Special Thanks to Mobius who created original super trend indicator. This is a spin off of his work. All credits go to him. This software is free.

#CREATED 09/12/2020

input AtrMult = 0.7;

input nATR = 4;

input AvgType = AverageType.HULL;

input PaintBars = yes;

def ATR = MovingAverage(AvgType, TrueRange(high, close, low), nATR);

def UP = HL2 + (AtrMult * ATR);

def DN = HL2 + (-AtrMult * ATR);

def ST = if close < ST[1] then UP else DN;

plot SuperTrend = ST;

SuperTrend.AssignValueColor(if close < ST then Color.GREEN else color.RED);

AssignPriceColor(if PaintBars and close < ST

then Color.RED

else if PaintBars and close > ST

then Color.GREEN

else Color.CURRENT);

#AddChartBubble(close crosses below ST, low[1], low[1], #color.Dark_Gray);

#AddChartBubble(close crosses above ST, high[1], high[1], #color.Dark_Gray, no);

# End Code SuperTrend# Mobius

# SuperTrend

# Chat Room Request

plot SuperTrendUp = close crosses above ST;

plot SuperTrendDown = close crosses below ST;

SuperTrend.AssignValueColor(if close < ST then Color.RED else Color.GREEN);

SuperTrendUp.SetDefaultColor(Color.YELLOW);

SuperTrendUp.setPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SuperTrendDown.SetDefaultColor(Color.PINK);

SuperTrendDown.setPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

def bullish = close crosses below ST;

def bearish = close crosses above ST;

# Alerts

Alert(bullish, " ", Alert.Bar, Sound.Chimes);

Alert(bearish, " ", Alert.Bar, Sound.Bell);

#ProjectionPivots_v03_JQ

#03.04.2019

#Original Code and Concept by Mobius:

# V01.08.2012 Projection Pivots

# mobius

# Notes:

# 03.04.2019 added linits on extensions

# 03.05.2019 adjusted limits on extensions by adding user input upper and lower extenion percent limits

#declare Once_Per_Bar;

#Inputs

input n = 21;

input showLines = yes;

input showValues = no;

input showBarNumbers = no;

input ExtensionLengthBars = 20; # added to control length of Entension

input UpperExtensionPercentLimit = 5;

input LowerExtensionPercentLimit = 5;

input DisplayLabel = yes; #JQ 7.8.2018 added

addlabel (DisplayLabel, "Projection Pivots n:" + n + " " , color.WHITE); #JQ 7.8.2018 added

# Universal Header _v030429019 _JQ

# code from various sources including Mobius, NoLongerNube and others

# Comment out unnecessary portions to preserve tos memory and enhance speed

# Universal Definitions using Padawan variable naming convention (JQ) v03.04.2019

# iData Definitions

def vHigh = high; # creates the variable vHigh. Use of the variable reduce data calls to tos iData server

# def initHigh = CompoundValue(1, high, high); # creates and initialized variable for High

def vLow = low;

# def initLow = CompoundValue(1, low, low);

def vOpen = open;

# def initOpen = CompoundValue(1, open, open);

def vClose = close;

# def initClose = CompoundValue(1, close, close);

def vVolume = volume;

# def initVolume = CompoundValue(1, volume, volume);

def nan = Double.NaN;

# Bar Time & Date

def bn = BarNumber();

def currentBar = HighestAll(if !IsNaN(vHigh) then bn else nan);

# def Today = GetDay() ==GetLastDay();

# def time = GetTime();

# def GlobeX = GetTime() < RegularTradingStart(GetYYYYMMDD());

# def globeX_v2 = if time crosses below RegularTradingEnd(GetYYYYMMDD()) then bn else GlobeX[1];

# def RTS = RegularTradingStart(GetYYYYMMDD());

# def RTE = RegularTradingEnd(GetYYYYMMDD());

# def RTH = GetTime() > RegularTradingStart(GetYYYYMMDD());

# def RTH_v2 = if time crosses above RegularTradingStart(GetYYYYMMDD()) then bn else RTH[1];

# bars that start and end the sessions #(borrowed from nube)

# def rthStartBar = CompoundValue(1,

# if !IsNaN(vClose)

# && time crosses above RegularTradingStart(GetYYYYMMDD())

# then bn

# else rthStartBar[1], 0);

# def rthEndBar = CompoundValue(1,

# if !IsNaN(vClose)

# && time crosses above RegularTradingEnd(GetYYYYMMDD())

# then bn

# else rthEndBar[1], 1);

# def globexStartBar = CompoundValue(1,

# if !IsNaN(vClose)

# && time crosses below RegularTradingEnd(GetYYYYMMDD())

# then bn

# else globexStartBar[1], 1);

# def rthSession = if bn crosses above rthStartBar #+ barsExtendedBeyondSession

# then 1

# else if bn crosses above rthEndBar #+ barsExtendedBeyondSession

# then 0

# else rthSession[1];

# Bubble Locations

def x_AxisLastExpansionBar = BarNumber() == HighestAll(BarNumber()); #corrected 11.12.2018 (JQ)

# syntax: addChartBubble(x_AxisLastExpansionBar, y-axis coordinate," text", Color.LIME); #verified 12.25.2018 (JQ)

def PH;

def PL;

def hh = fold i = 1 to n + 1

with p = 1

while p

do vHigh > getValue(vHigh, -i);

PH = if (bn > n and

vHigh == highest(vHigh, n) and

hh)

then vHigh

else double.NaN;

def ll = fold j = 1 to n + 1

with q = 1

while q

do vLow < getValue(low, -j);

PL = if (bn > n and

vLow == lowest(vLow, n) and

ll)

then vLow

else double.NaN;

def PHBar = if !isNaN(PH)

then bn

else PHBar[1];

def PLBar = if !isNaN(PL)

then bn

else PLBar[1];

def PHL = if !isNaN(PH)

then PH

else PHL[1];

def priorPHBar = if PHL != PHL[1]

then PHBar[1]

else priorPHBar[1];

def PLL = if !isNaN(PL)

then PL

else PLL[1];

def priorPLBar = if PLL != PLL[1]

then PLBar[1]

else priorPLBar[1];

def HighPivots = bn >= highestAll(priorPHBar);

def LowPivots = bn >= highestAll(priorPLBar);

def FirstRpoint = if HighPivots

then bn - PHBar

else 0;

def PriorRpoint = if HighPivots

then bn - PriorPHBar

else 0;

def RSlope = (getvalue(PH, FirstRpoint) - getvalue(PH, PriorRpoint))

/ (PHBar - PriorPHBar);

def FirstSpoint = if LowPivots

then bn - PLBar

else 0;

def PriorSpoint = if LowPivots

then bn - PriorPLBar

else 0;

def SSlope = (getvalue(PL, FirstSpoint) - getvalue(PL, PriorSpoint))

/ (PLBar - PriorPLBar);

def RExtend = if bn == highestall(PHBar)

then 1

else RExtend[1];

def SExtend = if bn == highestall(PLBar)

then 1

else SExtend[1];

plot pivotHigh = if HighPivots

then PH

else double.NaN;

pivotHigh.SetDefaultColor(GetColor(1));

pivotHigh.setPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

pivotHigh.setHiding(!showValues);

plot pivotHighLine = if PHL > 0 and

HighPivots

then PHL

else double.NaN;

pivotHighLine.SetPaintingStrategy(PaintingStrategy.DASHES); # Mobius original was DASHES

pivotHighLine.setDefaultColor(color.uptick); #JQ 7.8.2018 added

pivotHighLine.setHiding(!showLines);

plot RLine = pivotHigh;

RLine.enableApproximation();

RLine.SetDefaultColor(Color.LIGHT_GRAY);

RLine.SetStyle(Curve.Short_DASH);

# Added code to limit resistance estension line (JQ 03.04.2019)

def calc_ResistanceExtension = if RExtend

then (bn - PHBar) * RSlope + PHL

else double.NaN;

plot line_ResistanceExtension = if bn <= (Currentbar + ExtensionLengthBars)

and calc_ResistanceExtension[1] >= (lowestall(vLow) * (1-(lowerExtensionPercentLimit/100)))

and calc_ResistanceExtension[1] <= (Highestall(vHigh) * (1 + (upperExtensionPercentLimit/100)))

then calc_ResistanceExtension else double.nan;

line_ResistanceExtension.SetStyle(Curve.Short_DASH);

line_ResistanceExtension.SetDefaultColor(color.LIGHT_GRAY); #was 7

line_ResistanceExtension.setLineWeight(1);

# Low Plots

plot pivotLow = if LowPivots

then PL

else double.NaN;

pivotLow.setDefaultColor(GetColor(4));

pivotLow.setPaintingStrategy(PaintingStrategy.VALUES_BELOW);

pivotLow.setHiding(!showValues);

plot pivotLowLine = if PLL > 0 and

LowPivots

then PLL

else double.NaN;

pivotLowLine.SetPaintingStrategy(PaintingStrategy.DASHES); # Mobius original was DASHES

pivotLowLine.setDefaultColor(color.DOWNTICK);# # JQ 7.8.2018 added

pivotLowLine.setHiding(!showLines);

plot SupportLine = pivotLow;

SupportLine.enableApproximation();

SupportLine.SetDefaultColor(color.LIGHT_GRAY);

SUpportLine.SetStyle(Curve.Short_DASH);

# Added code to limit support estension line (JQ 03.04.2019)

def calc_SupportExtension = if SExtend

then (bn - PLBar) * SSlope + PLL

else double.NaN;

plot line_SupportExtension = if bn <= (Currentbar + ExtensionLengthBars)

and calc_SupportExtension[1] >= (lowestall(vLow) * (1-(lowerExtensionPercentLimit/100)))

and calc_SupportExtension[1] <= (Highestall(vHigh) * (1 + (upperExtensionPercentLimit/100)))

then calc_supportExtension else double.nan;

line_SupportExtension.SetDefaultColor(color.LIGHT_GRAY); #was 7

line_SupportExtension.SetStyle(Curve.Short_DASH);

line_SupportExtension.setLineWeight(1);

plot BarNumbersBelow = bn;

BarNumbersBelow.SetDefaultColor(GetColor(0));

BarNumbersBelow.setHiding(!showBarNumbers);

BarNumbersBelow.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

plot PivotDot = if !isNaN(pivotHigh)

then pivotHigh

else if !isNaN(pivotLow)

then pivotLow

else double.NaN;

pivotDot.SetDefaultColor(GetColor(7));

pivotDot.SetPaintingStrategy(PaintingStrategy.POINTS);

pivotDot.SetLineWeight(3);

##

# End Code

Can anybody teach me how to use this Super Trend WatchList? I thought it is for scan. But it cannot be saved because there is no plot. I cannot find a way to make a watchList based on above code.

I tried to add the script but can't figure it out... I want it to just show new signals green color for UP or BUY, and red color for DOWN or sell.. could you modified the script please? I'm going to use it for my watchlist column...

I am not showing any errors:

make sure you are using this script:

https://usethinkscript.com/threads/supertrend-indicator-by-mobius-for-thinkorswim.7/#post-13098

read more:

https://usethinkscript.com/threads/...hlist-column-a-tutorial-for-thinkorswim.9709/

Attachments

Last edited:

Thanks so much for this indicator. Can I change the code to remove the color lines following along the bars or change the color of these lines.?

hello everyone, a quick question, can someone here can add a buy and sell orders strategy to back test this system? just a basic buy order and sell order with the signal. thank you in advanceVersion 3. http://tos.mx/i5TMVJb

meaning for the mobius super trend V3hello everyone, a quick question, can someone here can add a buy and sell orders strategy to back test this system? just a basic buy order and sell order with the signal. thank you in advance

Last edited by a moderator:

https://usethinkscript.com/threads/supertrend-indicator-by-mobius-for-thinkorswim.7/#post-4647hello everyone, a quick question, can someone here can add a buy and sell orders strategy to back test this system? just a basic buy order and sell order with the signal. thank you in advance

meaning for the mobius super trend V3

JOSHTHEBANKER

Member

can you share a link to this scanner?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Archived: Supertrend Indicator by Mobius for ThinkorSwim | Indicators | 312 | |

|

|

SuperTrend and RSI Laguerre Indicator for ThinkorSwim | Indicators | 35 | |

|

|

Q-Trend, QQE, SuperTrend strategy for ThinkOrSwim | Indicators | 24 | |

|

|

Smart Supertrend For ThinkOrSwim | Indicators | 13 | |

| M | SuperTrend Oscillator [LUX] For ThinkOrSwim | Indicators | 6 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

810

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.