You should upgrade or use an alternative browser.

Supertrend Indicator by Mobius for ThinkorSwim

- Thread starter BenTen

- Start date

-

- Tags

- trend unanswered

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

https://usethinkscript.com/threads/supertrend-indicator-by-mobius-for-thinkorswim.7/page-4#post-4925how to setup alerts in TOS using this indicator?

do you have a script for that watchlist scan?@danl

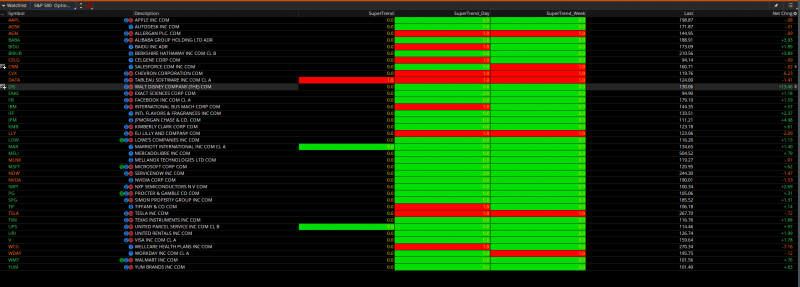

Example of how I use in a watchlist scan.

https://usethinkscript.com/threads/...y-mobius-for-thinkorswim.7/page-17#post-87548do you have a script for that watchlist scan?

JP782

Active member

Is there a MTF for this?@Talochka @BenTen I have adjusted the bubbles, fixed the coloring and added a buy/sell description on the bubble

Note that the bubbles can be further moved to your preference by changing the value of the variable "n"

You can do this either in the code directly or via the input selector in the user interface

Hope this would be aesthetically better visually.

EDIT: I have based my modifications based on @BenTen post #1 in this thread

Code:# SuperTrend # Mobius # Chat Room Request # 11.20.2019 tomsk Enhanced and adjusted bubbles with coloring and description tag input AtrMult = 1.0; input nATR = 4; input AvgType = AverageType.HULL; input PaintBars = yes; input n = 0; def n1 = n + 1; def ATR = MovingAverage(AvgType, TrueRange(high, close, low), nATR); def UP = HL2 + (AtrMult * ATR); def DN = HL2 + (-AtrMult * ATR); def ST = if close < ST[1] then UP else DN; plot SuperTrend = ST; SuperTrend.AssignValueColor(if close < ST then Color.RED else Color.GREEN); AssignPriceColor(if PaintBars and close < ST then Color.RED else if PaintBars and close > ST then Color.GREEN else Color.CURRENT); AddChartBubble(close[n] crosses below ST[n], low[n+1] + TickSize() * n, "Sell @ " + low[n1], color.Cyan, yes); AddChartBubble(close[n] crosses above ST[n], high[n+1] - TickSize() * n, "Buy @ " + high[n1], color.Yellow, no); # End Code SuperTrend

You can combine 3 supertrends, long boring job but not difficult:Wondering if anyone can help. I have 3 supertrends on my charts (10/1, 11/2, and 12/3) - i'd like to have a buy signal appear when all 3 trend lines turn green (on a 1 hr chart) or a sell signal when all 3 trend lines turn red.

https://usethinkscript.com/threads/combine-studies-indicators-in-thinkorswim.8766/

Be aware that such a complex combo indicator will not work in the scan hacker.

The workaround would be to scan for when all 3 trend lines turn red or green. You might have to scan in parts as this script has a tendency to have execution-time-out errors. Scan Supertrend1 and save to a watchlist, scan for supertrend2 against that watchlist, save as watchlist2. scan for supertrend3 against watchlist2 and save as watchlist3. Watchlist3 will now contain all stocks that happen to have a buy signals at the exact same point (this will have few if any results).

Screenshot with settings: period 10, multiplier 3

# Mobius

# SuperTrend

# Chat Room Request

input AtrMult = 1.0;

input nATR = 4;

input AvgType = AverageType.HULL;

input PaintBars = yes;

def ATR = MovingAverage(AvgType, TrueRange(high, close, low), nATR);

def UP = HL2 + (AtrMult * ATR);

def DN = HL2 + (-AtrMult * ATR);

def ST = if close < ST[1] then UP else DN;

def UpperBand;

def LowerBand;

if close[1] > UpperBand[1]{

LowerBand = DN;

UpperBand = Double.NaN;

} else if Crosses(close[1], LowerBand[1], CrossingDirection.BELOW) {

LowerBand = Double.NaN;

UpperBand = UP;

} else if close[1] > LowerBand[1] and DN <= DN[1] {

LowerBand = LowerBand[1];

UpperBand = Double.NaN;

} else if close[1] > LowerBand[1] and DN >= LowerBand[1] {

LowerBand = DN;

UpperBand = Double.NaN;

} else if close[1] > LowerBand[1] and DN < LowerBand[1] {

LowerBand = LowerBand[1];

UpperBand = Double.NaN;

} else if close[1] < LowerBand[1] {

LowerBand = Double.NaN;

UpperBand = UP;

} else if Crosses(close[1], UpperBand[1], CrossingDirection.ABOVE) {

LowerBand = DN;

UpperBand = Double.NaN;

} else if close[1] < UpperBand[1] and UP >= UP[1] {

LowerBand = Double.NaN;

UpperBand = UpperBand[1];

} else if close[1] < UpperBand[1] and UP <= UpperBand[1] {

LowerBand = Double.NaN;

UpperBand = UP;

} else if close[1] < UpperBand[1] and UP > UpperBand[1] {

LowerBand = Double.NaN;

UpperBand = UpperBand[1];

} else {

LowerBand = LowerBand[1];

UpperBand = UpperBand[1];

}

plot UpperBandPlot = UpperBand;

UpperBandPlot.SetDefaultColor(GetColor(9));

UpperBandPlot.SetPaintingStrategy(PaintingStrategy.LINE);

UpperBandPlot.AssignValueColor(Color.RED);#

plot LowerBandPlot = LowerBand;

LowerBandPlot.SetDefaultColor(GetColor(9));

LowerBandPlot.SetPaintingStrategy(PaintingStrategy.LINE);

LowerBandPlot.AssignValueColor(Color.GREEN);

AssignPriceColor(if PaintBars and !IsNaN(UpperBand) then Color.RED else if PaintBars and !IsNaN(LowerBand) then Color.GREEN else Color.CURRENT);

#AddChartBubble(close crosses below UpperBand, low[1], low[1], color.Dark_Gray);

#AddChartBubble(close crosses above LowerBand, high[1], high[1], color.Dark_Gray, no);

# End Code SuperTrendThis makes it easier to filter out false signals.

Screenshot with 2 Supertrend indicators, one with settings: period 10, multiplier 3; 2nd with settings: period 20, multiplier 5.

Thanks for your quick reply and clear reply

I see in the settings 1.0, is this the same as 10?

Thanks much, I was able to add a watchlist column with this exact study and I do see the count populated with green/red.@dougn As you requested, here is the very last version of the SuperTrend Watchlist that Mobius posted

Code:# SuperTrend for WatchList # Mobius # 8.8.2017 input AtrMult = .7; input nATR = 4; input AvgType = AverageType.Hull; def h = high; def l = low; def c = close; def ATR = MovingAverage(AvgType, TrueRange(h, c, l), nATR); def UP = hl2 + (ATRmult * ATR); def DN = hl2 + (-ATRmult * ATR); def ST = if c < ST[1] then Round(UP / TickSize(), 0) * TickSize() else Round(DN / TickSize(), 0) * TickSize(); def count = if c crosses below ST then 1 else if c < ST then count[1] + 1 else if c crosses above ST then 1 else if c > ST[1] then count[1] + 1 else count[1]; AddLabel(1, count, color.black); AssignBackgroundColor(if c < ST then Color.Red else Color.Green);

I'd like to setup an alert(pop-up with beep) that'll trigger on trend change(red to green & vice-versa) on any of the stocks on the watchlist.Right now, I get an alert only when the stock is loaded up on the chart actively and trend changes.

I have a static watchlist with few stocks and not interested so much in scanning.

can you pls advise, how I can do that? Thanks!

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-58010Thanks much, I was able to add a watchlist column with this exact study and I do see the count populated with green/red.

I'd like to setup an alert(pop-up with beep) that'll trigger on trend change(red to green & vice-versa) on any of the stocks on the watchlist.Right now, I get an alert only when the stock is loaded up on the chart actively and trend changes.

I have a static watchlist with few stocks and not interested so much in scanning.

can you pls advise, how I can do that? Thanks!

Thanks much for posting this. Hoping you can help with an issue I'm running into with this upper indicator.

Have noticed this issue multiple times on different tickers.. It plots RED on uptrend sometimes misleading. Attached screenshot from today on $BABA on 5 min chart.

Another example from $AMD on 2 min chart from today

======================

Any ideas how we fix that?

Thanks!

No, you don't want to "fix that".@BenTen

Thanks much for posting this. Hoping you can help with an issue I'm running into with this upper indicator.

Have noticed this issue multiple times on different tickers.. It plots RED on uptrend sometimes misleading. Attached screenshot from today on $BABA on 5 min chart.

Any ideas how we fix that?

Thanks!

What you see as an 'uptrend' has no defined supertrend trend or momentum. It is NOT a defined uptrend and therefore plots a 'red line'.

FYI, the SuperTrend as well as many other indicators are not recommended for below the 5min chart.

Read more here: https://usethinkscript.com/threads/...y-mobius-for-thinkorswim.7/page-16#post-98964

@MerryDay I see..,that explains it! When I relook at the charts with this interpretation, it works great, almost predicting the next move! ..,so an a small uptrend with red plot, I can see an upcoming consolidation or a pullback. The same works when I see a green plot on a downward move...I get a consolidation or a pullback on the downward move.. Are you sure this doesnt repaint ;-)!?No, you don't want to "fix that".

What you see as an 'uptrend' has no defined supertrend trend or momentum. It is NOT a defined uptrend and therefore plots a 'red line'.

FYI, the SuperTrend as well as many other indicators are not recommended for below the 5min chart.

Read more here: https://usethinkscript.com/threads/...y-mobius-for-thinkorswim.7/page-16#post-98964

When I do a bar-by-bar replay, with the supertrend plotted, it gets scary accurate in estimating the upcoming move

I was really impressed on how it showed the waning momentum on both sides rather very accurately.

Yes repainting while the candle is still formed is expected..it should! The candle bar itself repaints while its still active until is closed..,thats the nature of price action. Was just complementing

Thanks!

I'm getting these error messages: Expected Double at the column position for 'crosses,' and No Such Variable : ST for both lines. I can't figure out where to go from here.[Ruby:###------------------------------------------------------------------------------------------ input showSignals = yes; input showLabels = yes; input showBubbles = yes; input useStops = no; input useAlerts = no; ###------------------------------------------------------------------------------------------ ############################################ ## Create Signals - ## FILL IN THIS SECTION IF NOT DEFINED ABOVE ## ############################################ def BuySignal = close crosses above ST; # insert condition to create long position def SellSignal = close crosses below ST; # insert condition to create short position

Here's the whole thing (with the ST code from the original post, so if there have been mods, you'll have to add those) along with an updated P/L

# Mobius

# SuperTrend

# Chat Room Request

input AtrMult = 1.0;

input nATR = 4;

input AvgType = AverageType.HULL;

input PaintBars = yes;

def ATR = MovingAverage(AvgType, TrueRange(high, close, low), nATR);

def UP = HL2 + (AtrMult * ATR);

def DN = HL2 + (-AtrMult * ATR);

def ST = if close < ST[1] then UP else DN;

plot SuperTrend = ST;

SuperTrend.AssignValueColor(if close < ST then Color.RED else Color.GREEN);

AssignPriceColor(if PaintBars and close < ST

then Color.RED

else if PaintBars and close > ST

then Color.GREEN

else Color.CURRENT);

AddChartBubble(close crosses below ST, low[1], low[1], color.Dark_Gray);

AddChartBubble(close crosses above ST, high[1], high[1], color.Dark_Gray, no);

# End Code SuperTrend

###------------------------------------------------------------------------------------------

# Profit and Loss Labels

#

# Fill in the 0>0 in the Create Signals section below to match your buy and sell signal conditions

#

# When using large amounts of hisorical data, P/L may take time to calculate

###------------------------------------------------------------------------------------------

input showSignals = yes; #hint showSignals: show buy and sell arrows

input LongTrades = yes; #hint LongTrades: perform long trades

input ShortTrades = yes; #hint ShortTrades: perform short trades

input showLabels = yes; #hint showLabels: show PL labels at top

input showBubbles = yes; #hint showBubbles: show PL bubbles at close of trade

input useStops = no; #hint useStops: use stop orders

input useAlerts = no; #hint useAlerts: use alerts on signals

input tradeDaytimeOnly = no; #hint tradeDaytimeOnly: (IntraDay Only) Only perform trades during hours stated

input OpenTime = 0930; #hint OpenTime: Opening time of market

input CloseTime = 1600; #hint CloseTime: Closing time of market

def Begin = secondsfromTime(OpenTime);

def End = secondsTillTime(closetime);

# Only use market hours when using intraday timeframe

def isIntraDay = if getaggregationperiod() > 14400000 or getaggregationperiod()==0 then 0 else 1;

def MarketOpen = if !tradeDaytimeOnly or !isIntraDay then 1 else if tradeDaytimeOnly and isIntraDay and Begin > 0 and End > 0 then 1 else 0;

###------------------------------------------------------------------------------------------

######################################################

## Create Signals -

## FILL IN THIS SECTION

## replace 0>0 with your conditions for signals

######################################################

def PLBuySignal = if MarketOpen AND (close crosses above ST) then 1 else 0 ; # insert condition to create long position in place of the 0>0

def PLSellSignal = if MarketOpen AND (close crosses below ST) then 1 else 0; # insert condition to create short position in place of the 0>0

def PLBuyStop = if !useStops then 0 else if (0>0) then 1 else 0 ; # insert condition to stop in place of the 0<0

def PLSellStop = if !useStops then 0 else if (0>0) then 1 else 0 ; # insert condition to stop in place of the 0>0

def PLMktStop = if MarketOpen[-1] == 0 then 1 else 0; # If tradeDaytimeOnly is set, then stop at end of day

#######################################

## Maintain the position of trades

#######################################

def CurrentPosition; # holds whether flat = 0 long = 1 short = -1

if (BarNumber()==1) OR isNaN(CurrentPosition[1]) {

CurrentPosition = 0;

}else{

if CurrentPosition[1] == 0 { # FLAT

if (PLBuySignal AND LongTrades) {

CurrentPosition = 1;

} else if (PLSellSignal AND ShortTrades){

CurrentPosition = -1;

} else {

CurrentPosition = CurrentPosition[1];

}

} else if CurrentPosition[1] == 1 { # LONG

if (PLSellSignal AND ShortTrades){

CurrentPosition = -1;

} else if ((PLBuyStop and useStops) or PLMktStop or (PLSellSignal AND ShortTrades==0)){

CurrentPosition = 0;

} else {

CurrentPosition = CurrentPosition[1];

}

} else if CurrentPosition[1] == -1 { # SHORT

if (PLBuySignal AND LongTrades){

CurrentPosition = 1;

} else if ((PLSellStop and useStops) or PLMktStop or (PlBuySignal and LongTrades==0)){

CurrentPosition = 0;

} else {

CurrentPosition = CurrentPosition[1];

}

} else {

CurrentPosition = CurrentPosition[1];

}

}

def isLong = if CurrentPosition == 1 then 1 else 0;

def isShort = if CurrentPosition == -1 then 1 else 0;

def isFlat = if CurrentPosition == 0 then 1 else 0;

# If not already long and get a PLBuySignal

#Plot BuySig = if (!isLong[1] and PLBuySignal and showSignals and LongTrades) then 1 else 0;

Plot BuySig = if (((isShort[1] and LongTrades) or (isFlat[1] and LongTrades)) and PLBuySignal and showSignals) then 1 else 0;

BuySig.AssignValueColor(color.cyan);

BuySig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

BuySig.SetLineWeight(5);

Alert(BuySig and useAlerts, "Buy Signal",Alert.bar,sound.Ding);

Alert(BuySig and useAlerts, "Buy Signal",Alert.bar,sound.Ding);

# If not already short and get a PLSellSignal

Plot SellSig = if (((isLong[1] and ShortTrades) or (isFlat[1] and ShortTrades)) and PLSellSignal and showSignals) then 1 else 0;

SellSig.AssignValueColor(color.cyan);

SellSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SellSig.SetLineWeight(5);

Alert(SellSig and useAlerts, "Sell Signal",Alert.bar,sound.Ding);

Alert(SellSig and useAlerts, "Sell Signal",Alert.bar,sound.Ding);

# If long and get a PLBuyStop

Plot BuyStpSig = if (PLBuyStop and isLong[1] and showSignals and useStops) or (isLong[1] and PLMktStop) or (isLong[1] and PLSellSignal and !ShortTrades) then 1 else 0;

BuyStpSig.AssignValueColor(color.light_gray);

BuyStpSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

BuyStpSig.SetLineWeight(3);

Alert(BuyStpSig and useAlerts, "Buy Stop Signal",Alert.bar,sound.Ding);

Alert(BuyStpSig and useAlerts, "Buy Stop Signal",Alert.bar,sound.Ding);

# If short and get a PLSellStop

Plot SellStpSig = if (PLSellStop and isShort[1] and showSignals and useStops) or (isShort[1] and PLMktStop) or (isShort[1] and PLBuySignal and !LongTrades) then 1 else 0;

SellStpSig.AssignValueColor(color.light_gray);

SellStpSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SellStpSig.SetLineWeight(3);

Alert(SellStpSig and useAlerts, "Sell Stop Signal",Alert.bar,sound.Ding);

Alert(SellStpSig and useAlerts, "Sell Stop Signal",Alert.bar,sound.Ding);

#######################################

## Orders

#######################################

def isOrder = if ((isFlat[1] and (BuySig and LongTrades) or (SellSig and ShortTrades)) or (isLong[1] and BuyStpSig or (SellSig and ShortTrades)) or (isShort[1] and SellStpSig or (BuySig and LongTrades))) then 1 else 0 ;

def orderPrice = if (isOrder and ((BuySig and LongTrades) or (SellSig and ShortTrades))) then (if isNan(open[-1]) then close else open[-1]) else orderPrice[1];

plot OPL = if !isFlat and isLong then orderPrice else double.Nan;

OPL.AssignValueColor(color.green);

OPL.SetPaintingStrategy(PaintingStrategy.lINE);

OPL.SetStyle(Curve.SHORT_DASH);

OPL.SetLineWeight(1);

plot OPS = if !isFlat and isShort then orderPrice else double.Nan;

OPS.AssignValueColor(color.red);

OPS.SetPaintingStrategy(PaintingStrategy.lINE);

OPS.SetStyle(Curve.SHORT_DASH);

OPS.SetLineWeight(1);

def orderCount = compoundValue(1,if isNan(isOrder) or barnumber()==1 then 0 else if (BuySig or SellSig) then orderCount[1]+1 else orderCount[1],0);

#######################################

## Price and Profit

#######################################

def profitLoss;

if (!isOrder or orderPRice[1]==0){

profitLoss = 0;

} else if ((isOrder and isLong[1]) and (SellSig or BuyStpSig)){

profitLoss = (if isNan(open[-1]) then close else open[-1]) - orderPrice[1];

} else if ((isOrder and isShort[1]) and (BuySig or SellStpSig)) {

profitLoss = orderPrice[1] - (if isNan(open[-1]) then close else open[-1]);

} else {

profitLoss = 0;

}

# Total Profit or Loss

def profitLossSum = compoundValue(1, if isNaN(isOrder) or barnumber()==1 then 0 else if isOrder then profitLossSum[1] + profitLoss else profitLossSum[1], 0);

# How many trades won or lost

def profitWinners = compoundValue(1, if isNaN(profitWinners[1]) or barnumber()==1 then 0 else if isOrder and profitLoss > 0 then profitWinners[1] + 1 else profitWinners[1], 0);

def profitLosers = compoundValue(1, if isNaN(profitLosers[1]) or barnumber()==1 then 0 else if isOrder and profitLoss < 0 then profitLosers[1] + 1 else profitLosers[1], 0);

def profitPush = compoundValue(1, if isNaN(profitPush[1]) or barnumber()==1 then 0 else if isOrder and profitLoss == 0 then profitPush[1] + 1 else profitPush[1], 0);

# Current Open Trade Profit or Loss

def TradePL = If isLong then Round(((close - orderprice)/TickSize())*TickValue()) else if isShort then Round(((orderPrice - close)/TickSize())*TickValue()) else 0;

# Convert to actual dollars based on Tick Value for bubbles

def dollarProfitLoss = if orderPRice[1]==0 or isNaN(orderPrice[1]) then 0 else round((profitLoss/Ticksize())*Tickvalue());

# Closed Orders dollar P/L

def dollarPLSum = round((profitLossSum/Ticksize())*Tickvalue());

# Split profits or losses by long and short trades

def profitLong = compoundValue(1, if isNan(profitLong[1]) or barnumber()==1 then 0 else if isOrder and isLong[1] then profitLong[1]+dollarProfitLoss else profitLong[1],0);

def profitShort = compoundValue(1, if isNan(profitShort[1]) or barnumber()==1 then 0 else if isOrder and isShort[1] then profitShort[1]+dollarProfitLoss else profitShort[1],0);

def countLong = compoundValue(1, if isNaN(countLong[1]) or barnumber()==1 then 0 else if isOrder and isLong[1] then countLong[1]+1 else countLong[1],0);

def countShort = compoundValue(1, if isNaN(countShort[1]) or barnumber()==1 then 0 else if isOrder and isShort[1] then countShort[1]+1 else countShort[1],0);

# What was the biggest winning and losing trade

def biggestWin = compoundValue(1, if isNaN(biggestWin[1]) or barnumber()==1 then 0 else if isOrder and (dollarProfitLoss > 0) and (dollarProfitLoss > biggestWin[1]) then dollarProfitLoss else biggestWin[1], 0);

def biggestLoss = compoundValue(1, if isNaN(biggestLoss[1]) or barnumber()==1 then 0 else if isOrder and (dollarProfitLoss < 0) and (dollarProfitLoss < biggestLoss[1]) then dollarProfitLoss else biggestLoss[1], 0);

def ClosedTradeCount = if (isLong or isShort) then orderCount-1 else orderCount;

def OpenTrades = if (isLong or isShort) then 1 else 0;

# What percent were winners

def PCTWin = if (OpenTrades and (TradePL < 0)) then round((profitWinners/(ClosedTradeCount+1))*100,2)

else if (OpenTrades and (TradePL > 0)) then round(((profitWinners+1)/(ClosedTradeCount+1))*100,2) else round(((profitWinners)/(ClosedTradeCount))*100,2) ;

# Average trade

def avgTrade = if (OpenTrades and (TradePL < 0)) then round(((dollarPLSum - TradePL)/(ClosedTradeCount+1)),2)

else if (OpenTrades and (TradePL > 0)) then round(((dollarPLSum + TradePL)/(ClosedTradeCount+1)),2) else round(((dollarPLSum)/(ClosedTradeCount)),2) ;

#######################################

## Create Labels

#######################################

AddLabel(showLabels and isIntraDay, if MarketOpen then "Market Open" else "Market Closed", color.white);

AddLabel(showLabels, GetSymbol()+" Tick Size: "+TickSize()+" Value: "+TickValue(), color.white);

AddLabel(showLabels and (LongTrades and ShortTrades), "Long+Short Trades", color.white);

AddLabel(showLabels and (LongTrades and !ShortTrades),"Long Trades Only", color.white);

AddLabel(showLabels and (!LongTrades and ShortTrades),"Short Trades Only", color.white);

AddLabel(showLabels and (tradeDaytimeOnly),"Daytime Only", color.white);

AddLabel(showLabels, "Closed Orders: " + ClosedTradeCount + " P/L: " + AsDollars(dollarPLSum), if dollarPLSum > 0 then Color.GREEN else if dollarPLSum< 0 then Color.RED else Color.GRAY);

AddLabel(if !IsNan(orderPrice) and showLabels then 1 else 0, "Closed+Open P/L: "+ AsDollars(TradePL+dollarPLSum), if ((TradePL+dollarPLSum) > 0) then color.green else if ((TradePL+dollarPLSum) < 0) then color.red else color.gray);

AddLabel(showLabels, "Avg per Trade: "+ AsDollars(avgTrade), if avgTrade > 0 then Color.Green else if avgTrade < 0 then Color.RED else Color.GRAY);

AddLabel(showLabels, "Winners: "+ PCTWin +"%",if PCTWin > 50 then color.green else if PCTWin > 40 then color.yellow else color.gray);

AddLabel(showLabels, "MaxUp: "+ AsDollars(biggestWin) +" MaxDown: "+AsDollars(biggestLoss), color.white);

AddLabel(showLabels, "Long Profit: " +AsDollars(profitLong), if profitLong > 0 then color.green else if profitLong < 0 then color.red else color.gray);

AddLabel(showLabels, "Short Profit: " +AsDollars(profitShort), if profitShort > 0 then color.green else if profitShort < 0 then color.red else color.gray);

AddLabel(if !IsNan(CurrentPosition) and showLabels and OpenTrades then 1 else 0, "Open: "+ (If isLong then "Bought" else "Sold") + " @ "+orderPrice, color.white);

AddLabel(if !IsNan(orderPrice) and showLabels and OpenTrades then 1 else 0, "Open Trade P/L: "+ AsDollars(TradePL), if (TradePL > 0) then color.green else if (TradePl < 0) then color.red else color.gray);

#######################################

## Chart Bubbles for Profit/Loss

#######################################

AddChartBubble(showSignals and showBubbles and isOrder and isLong[1], low, "$"+dollarProfitLoss, if dollarProfitLoss == 0 then Color.LIGHT_GRAY else if dollarProfitLoss > 0 then Color.GREEN else color.Red, 0);

AddChartBubble(showSignals and showBubbles and isOrder and isShort[1], high, "$"+dollarProfitLoss, if dollarProfitLoss == 0 then Color.LIGHT_GRAY else if dollarProfitLoss > 0 then Color.GREEN else color.Red, 1);

#AssignPriceColor(if CurrentPosition == 1 then color.green else if CurrentPosition == -1 then color.red else color.gray);Try that.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Archived: Supertrend Indicator by Mobius for ThinkorSwim | Indicators | 312 | |

|

|

SuperTrend and RSI Laguerre Indicator for ThinkorSwim | Indicators | 35 | |

|

|

Q-Trend, QQE, SuperTrend strategy for ThinkOrSwim | Indicators | 24 | |

|

|

Smart Supertrend For ThinkOrSwim | Indicators | 13 | |

| M | SuperTrend Oscillator [LUX] For ThinkOrSwim | Indicators | 6 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/