"After Hours", another expression for "Extended Hours"...would it be Axis Hours?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SPX Trading Strategy for ThinkorSwim

- Thread starter Hypoluxa

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Hypoluxa

Well-known member

Never a dumb question when you’re learning this stuff - AH is after hours trading. You’ll also see people use PM for pre-market trading.I'm pretty sure this is a dumb question, but I will ask anyway......what are AH's

Anyone have luck finding earlier entries into this strategy? Lots of good setups are just missed waiting for the MACD_BB dots to cross above zero...

Hypoluxa

Well-known member

For SPX only - There is one thing I'm noticing with all the double and triple backtesting, as well as live:Anyone have luck finding earlier entries into this strategy? Lots of good setups are just missed waiting for the MACD_BB dots to cross above zero...

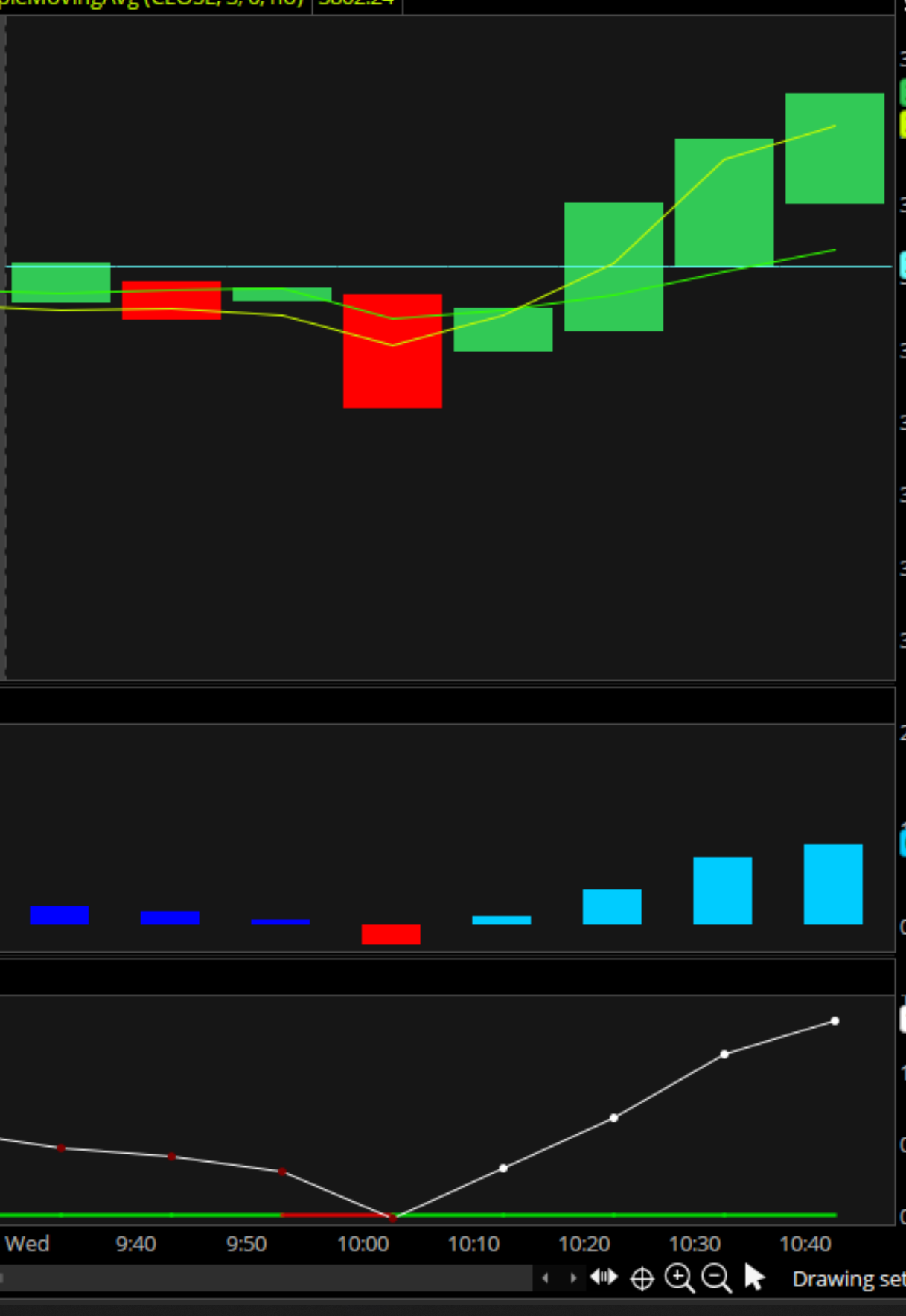

If the red dots come down (above the zero line coming down to the zero line) and actually touch the zero line...but doesn't cross (basically "bounces" off of it) a call opportunity has shown itself, as it always has a tendency to reverse. The same applies for a put...if the white dots are coming up to the zero line (coming from bottom to top) and it bounces off the bottom of the zero line....a put opportunity is there. Take a look at this screenshot I have attached for an example from this morning...SPX went up $6 once that white dot appeared. I've seen a lot of these same type scenarios. Backtest it to feel good about it tho.

Last edited:

VJET

New member

can we get the code ?For SPX only - There is one thing I'm noticing with all the double and triple backtesting, as well as live:

If the red dots come down (above the zero line coming down to the zero line) and actually touch the zero line...but doesn't cross (basically "bounces" off of it) a call opportunity has shown itself, as it always has a tendency to reverse. The same applies for a put...if the white dots are coming up to the zero line (coming from bottom to top) and it bounces off the bottom of the zero line....a put opportunity is there. Take a look at this screenshot I have attached for an example from this morning...SPX went up $6 once that white dot appeared. I've seen a lot of these same type scenarios. Backtest it to feel good about it tho.

Hypoluxa

Well-known member

I tweak the MACD bollinger band settings for each stock symbol. For mine - AMZN is slightly different than SPX. What I look for the most, are trying to adjust it to NOT have only one or two dots cross the zero line. Once I fill comfortable with one day that I pick to adjust to...I’ll go back 30-90 days to see how many times it’s successful....but most importantly, counting the minimal (hopefully minimal) times it’s a short run. You’ll never find perfection...but you will find minimal short crossings.@Hypoluxa What were you adjusting to fine-tune your settings on SPX? I'm attempting to use this on MES and I am noticing when the MAs cross, it'll tale 5-6 dots for before it goes above or below the zero line. On SPX, it appears to be within a couple of dots after the MAs cross.

Hypoluxa

Well-known member

@malone1020 to be completely honest with you...I have no idea what 36 is suppose to change. I've changed it from 1 to 100 and nothing changes from what I can tell.

@mdtn that's correct.

@mdtn that's correct.

you're welcome. And I only tweak the "mac dfast length" and mac dslow length" until I'm comfortable. I move them either up or down 2 points at the time.Thank @Hypoluxa If I could one ask more question: On the MACD settings, are you tweaking all the settings are just one or two?

Thanks again. Are you using a backtesting code, if possible can you share? Other than that, I like the strat. I can't mess with SPX till I grow my account

Hypoluxa

Well-known member

I'm not sure what you mean by a back backtesting code, but I use TOS and go back 30-90 days to look at the charts and indicators. I also use the "OnDemand" feature in TOS to test the profit and loss once I get the indicator dialed in and then adjust as needed.Thanks again. Are you using a backtesting code, if possible can you share? Other than that, I like the strat. I can't mess with SPX till I grow my account

Last edited:

@Hypoluxa Thanks.  Another question, you said you have tested 90 days. Would you mind sharing how to test? What do I have to do? I would like to test other stock such as TSLA.

Another question, you said you have tested 90 days. Would you mind sharing how to test? What do I have to do? I would like to test other stock such as TSLA.

You answered the same question to @securedabag23. Some people do backtesting tool and able to export result to Excel spreadsheet, I believe. Not sure how, that's why I ask. Thanks again

You answered the same question to @securedabag23. Some people do backtesting tool and able to export result to Excel spreadsheet, I believe. Not sure how, that's why I ask. Thanks again

Thank you!AHHHH...ok that makes better sense. There is a hyperlink in the post that takes you to what BenTen built. But here it is again:

https://usethinkscript.com/threads/macd-with-bollinger-bands-bb-indicator-for-thinkorswim.287/

- Status

- Not open for further replies.

Ben's Swing Trading Strategy + Indicator

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

594

Online

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.