Hey, Thank you MarryDay. I am trying to run this scan after hours but sometimes it doesn't work, any idea, please? Thank you for your help

Thanks

Try removing volume. 5 mil after market will not yield anything.

Hey, Thank you MarryDay. I am trying to run this scan after hours but sometimes it doesn't work, any idea, please? Thank you for your help

Thanks

When I enter "plot scan = close >= (open*1.04)" it says invalid statement: syntax error: double ==Here is a new revision of the code which now captures price of 0.5 to 15:

Last: 0.5 to 15

% Change: 10% to No Max

Volume: 100,000 to No Max

Shares: 1 to 70,000,000

and

Custom Study Filter with Aggregation set to D (day) using this code:

plot scan = close >= (open*1.04);

and

Study Filter - (under Volume) Unusual Volume, Current bar's Volume increased at least 40% from its typical average over 60 periods and Aggregation set to D (day)

With these new settings, stocks like VRNA will show up on here. VRNA had a great setup. It was an AM gapper (from premarket scan). It would show up on this momentum scan as well. It also had the highest RV1 of all stocks on Friday. Plus it had bullish stock patterns like rounding bottom, double bottom, VWAP break, and bull flag pattern before it had the big spikes. When a stock has the highest RV1 and has bullish stock patterns, it has a good chance to do big VWAP bounces like VRNA did.

Any chance you remember the RV1 it was at when it popped up on your scanner?Got alerted for TAOP when it was $4.59, went to put an order in and boom it took off. Mad at myself for overthinking this one.

I believe it was somewhere around 3Any chance you remember the RV1 it was at when it popped up on your scanner?

You need to add the “;” after each line for the script to registerWhen I enter "plot scan = close >= (open*1.04)" it says invalid statement: syntax error: double ==

Please advise. Thank you.

wow only 3? Ran up to over 300 todayI believe it was somewhere around 3

wow only 3? Ran up to over 300 today

Sonny, now I know the secret sauce I've been missing!@CDJay Actually, this is more for looking back on RV and volume to see the values. The best live values will be the RV column code in my other thread and my volume chart label.

The best premarket relative volume estimate is my chart label and the latest version is page 4 of Useful Intraday Chart Labels.

I realize this is off topic but I have certain songs that motivate me to do well in trading: (artist, title)

Pet Shop Boys, Opportunities

ABC, Millionaire song

Warrant, DRFSR

Twisted Sister, We're Gonna Make It

Motley Crue, Keep your eye on the money

Twisted Sister, I Wanna Rock

Warrant, Big Talk

Lita Ford, Larger Than Life

Check them out on Youtube if you get a chance and let me know what you think.

Thank you!You need to add the “;” after each line for the script to register

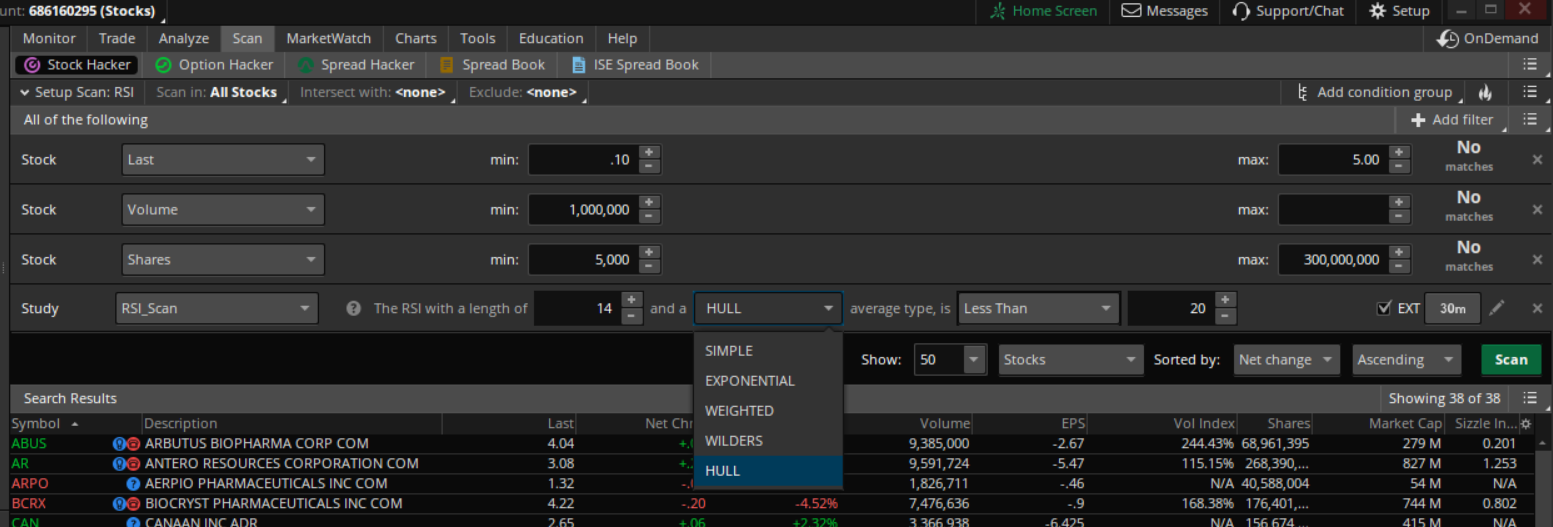

Is this your tweak the RSI cuz I dont see that even posted as an initial scan critera that he posted.Question, for this scan, which RSI should I pick? Thank you

#Relative Volume High;

def x = Average(volume, 60)[1];

def v = volume;

def r = Round((v/x),1);

def rvi = r >= 2;

plot scan = rvi;#Relative Volume Low;

def x = Average(volume, 60)[1];

def v = volume;

def r = Round((v/x),1);

def rvi = r < 2;

plot scan = rvi;

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.