You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Option Flow Sentiment Indicator for ThinkorSwim

- Thread starter MasterSteve

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

astrokjackk1

New member

Hi Steve what platforms are you using to find unusual options activity?

Couple things. I'm running this how I would run about a $5,000 account. Play sizes typically land at about $250-600 each. Smaller plays I'll run a few contracts up to get into that range, and may go more if the play looks better. Some of the more expensive plays happen because of the stock value or me trying to get a different strike to be safer, but I typically play sizes in the $250-600 range. Now, if you're running a bigger account its pretty easy to scale up, keeping everything in a bigger adjusted range.How are you calculating position size?

My original post https://usethinkscript.com/threads/using-flow-data-to-make-profit-strategy-in-testing-update.724/ can answer that question. Lmk if you have any others.Hi Steve what platforms are you using to find unusual options activity?

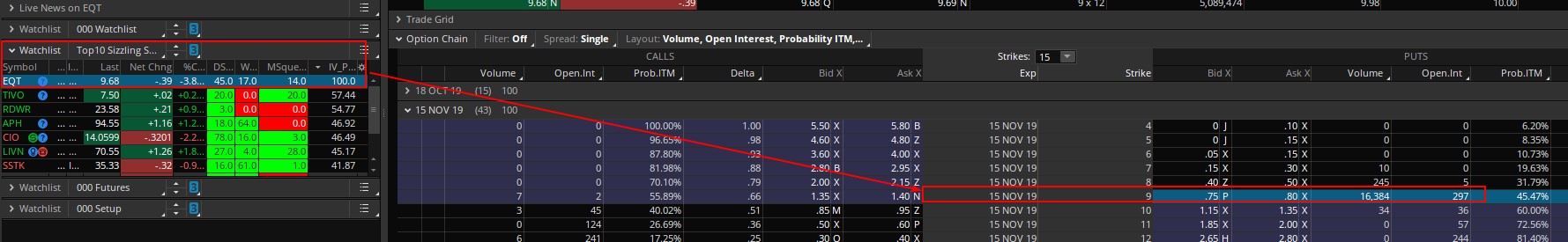

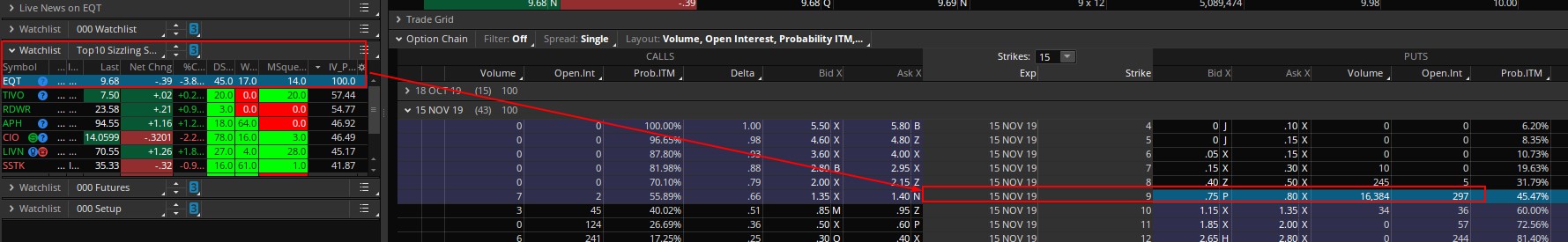

Short answer, similar but not really and much more effective. I'll give you a detailed answer tonight when I get some time.Is this like checking TOS top sizzling stocks.. and look for unusual option volume. eg. EQT with 16434 at 15 NOV 9 PUTS @ $0.80

Attachments

I tried to load TOS top sizzling stocks for unusual option volume and it took surprisingly long to load anything more than the top 10 stocks. Maybe it was just my TOS setup, but there's one difference between our programs. I can scan the entire option flow of the market in like a second.Is this like checking TOS top sizzling stocks.. and look for unusual option volume. eg. EQT with 16434 at 15 NOV 9 PUTS @ $0.80

Second, I don't think just finding a position with a large amount of call or put volume could give you an idea of what future movement could be. It is very common to have an unusual amount of a flow in a position only to find that was a hedge or part of a strangle. Just comparing the ratios won't tell you much. At that point you would check time and sales to see if you could find out what the trader was thinking. Can you see time and sales for previous days?

I can scan through time and sales to filter out the 80% of flow I don't care about so I can just focus on what I think is important. Being able to easily and effectively sort through thousands of data points at any given point with custom scanners that I can tweak makes the expense I pay every month worth it to me.

That's my opinion after messing around with it for a couple hours and seeing what other people do with it. Does that help or should I make a separate post to answer your question with more detail?

Last edited:

Camelotnite

New member

Steve, thank so much for your inputs. There isn't much materials detailed enough to explain exactly how order flow strategy works. From your generous reply, it does help me have better understanding. And I found some interesting youtubes on flowalgo (I tried. to load TOS top sizzling stocks for unusual option volume and it took surprisingly long to load anything more than the top 10 stocks. Maybe it was just my TOS setup, but there's one difference between our programs. I can scan the entire option flow of the market in like a second.

Second, I don't think just finding a position with a large amount of call or put volume could give you an idea of what future movement could be. It is very common to have an unusual amount of a flow in a position only to find that was a hedge or part of a strangle. Just comparing the ratios won't tell you much. At that point you would check time and sales to see if you could find out what the trader was thinking. Can you see time and sales for previous days?

I can scan through time and sales to filter out the 80% of flow I don't care about so I can just focus on what I think is important. Being able to easily and effectively sort through thousands of data points at any given point with custom scanners that I can tweak makes the expense I pay every month worth it to me.

That's my opinion after messing around with it for a couple hours and seeing what other people do with it. Does that help or should I make a separate post to answer your question with more detail?

Steve, thank so much for your inputs. There isn't much materials detailed enough to explain exactly how order flow strategy works. From your generous reply, it does help me have better understanding. And I found some interesting youtubes on flowalgo () and blackbox (). Example of the paid services able to push out alerts on unusual trades is really mind blowing. Conceptually I think now I kinda know how it works. I agree TOS does not provide the edge as compared to the paid services. You mentioned your preference is CBOE, but I cannot find much training videos. I would like to learn more about order flow strategy before choosing the paid services. Especially on how to dive into more details to filter out noise to find stocks that are about to move. Would very much appreciate if you are able to advise where to find more learning resources or starting platform (flowalgo/CBOE/Blackbox) for beginners. Once again, thanks so much for sharing your amazing work.

Blackbox will sometimes offer a 1-2 week free trial for their services. I've seen their trial period announced on the blackbox twitter account, might want to check there or shoot them a message. They also included videos on how to use the blackbox platform.

Also Flowalgo offers a 7-day free trial.

I have been using a service called https://www.blackboxstocks.com/. It is $99.97 p/mo and is the best market scanning software I have seen yet that is available to the retail trader. I mainly use the options flow tool that provides real time flow of unusual options activity. It scans the entire options market in real time. You can see the option flow in the stocks that the Najarian brothers talk about on CNBC before they even come on the show. They also have a discord room that provides many trading ideas. Check out some of their videos on Youtube. It also has dark pool prints which combined with option flow is very helpful.

That question may be better posted in Indicators. I don't have one.Have anyone developed a scan in tos for UOA? Thanks

There aren't any/many training videos on CBOE because they keep everything related to that service pretty locked up. They've got a bunch of training that you can access once you have their program, and anything you have questions about can be answered by one of their support agents. Resources wise, I would recommend you do each trial and try to learn as much as you can about each program. A lot of it is trial and error, and spending time trying to figure out what works and what doesn't. If that's not enough or specific enough for you, I'll be providing more information about these trades as the trial period continues on. I'll be running a $1000 account based solely on this data and will send out weekly trade recaps for interesting positions I think are worth learning about.Steve, thank so much for your inputs. There isn't much materials detailed enough to explain exactly how order flow strategy works. From your generous reply, it does help me have better understanding. And I found some interesting youtubes on flowalgo () and blackbox (). Example of the paid services able to push out alerts on unusual trades is really mind blowing. Conceptually I think now I kinda know how it works. I agree TOS does not provide the edge as compared to the paid services. You mentioned your preference is CBOE, but I cannot find much training videos. I would like to learn more about order flow strategy before choosing the paid services. Especially on how to dive into more details to filter out noise to find stocks that are about to move. Would very much appreciate if you are able to advise where to find more learning resources or starting platform (flowalgo/CBOE/Blackbox) for beginners. Once again, thanks so much for sharing your amazing work.

@John808 and @Mordoor I have been used flowalgo and blackbox stocks in the past, but not using as extensively as the things I am currently doing. I wasn't that impressed with Blackbox stocks. Blackbox does provide a significant amount of unusual options data, but it was hard to pick out what was useful and what wasn't out of the hundreds of alerts. Felt pretty similar about the dark pool prints, they were easy to be misread. Also, I couldn't make custom alerts to what I wanted to search for. However, its been a little while since I've played with blackbox and maybe it has improved since then. Plenty of ways to make money, different things work for different people. How have the alerts helped you trade?I have been using a service called https://www.blackboxstocks.com/. It is $99.97 p/mo and is the best market scanning software I have seen yet that is available to the retail trader. I mainly use the options flow tool that provides real time flow of unusual options activity. It scans the entire options market in real time. You can see the option flow in the stocks that the Najarian brothers talk about on CNBC before they even come on the show. They also have a discord room that provides many trading ideas. Check out some of their videos on Youtube. It also has dark pool prints which combined with option flow is very helpful.

I do keep track of my entries and exits on a spreadsheet for personal use, but I don't track IV and delta nor have any plans to in the near future. I keep very busy tracking and noting the current flow, as well as testing/tweaking for this strategy and some future projects I have.you probably do this on a spreadsheet, but it would be helpful to see the IV and delta when you enter/exit trades

Last edited:

@MasterSteve do you follow the large institution trades exactly (same strike/exp) or do you use a shorter timeframe and close strike? And if so, how do you determine when to use a closer exp

I typically follow the large institution trades and only follow the ones that fit the price I feel comfortable with. For this swing strategy, I rarely if ever take the closer exp. and almost always take the farther exp. This strategy is not a get rich quick strategy. It takes a bunch of smaller plays and using a strict observation to risk management turns it into a steady safer profit. I almost always want more time for the positions to play out and be safer, than risk more for more reward. More info on this in the coming weeks when I switch to a real account.@MasterSteve do you follow the large institution trades exactly (same strike/exp) or do you use a shorter timeframe and close strike? And if so, how do you determine when to use a closer exp

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| T | Option Surface Visualization Project | Playground | 0 | |

| M | Steve's $1000 Option Paper Account | Playground | 15 | |

|

|

$1,000 Option Trading Challenge (Week 2 Update) | Playground | 13 | |

|

|

$1,000 Option Trading Challenge (Week 1 Update + Current Setup) | Playground | 32 | |

| M | Steve's $1,000 Option Trading Challenge (Week 1 Update) | Playground | 15 |

Similar threads

-

-

-

-

$1,000 Option Trading Challenge (Week 1 Update + Current Setup)

- Started by BenTen

- Replies: 32

-

Steve's $1,000 Option Trading Challenge (Week 1 Update)

- Started by MasterSteve

- Replies: 15

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

547

Online

Similar threads

-

-

-

-

$1,000 Option Trading Challenge (Week 1 Update + Current Setup)

- Started by BenTen

- Replies: 32

-

Steve's $1,000 Option Trading Challenge (Week 1 Update)

- Started by MasterSteve

- Replies: 15

Similar threads

-

-

-

-

$1,000 Option Trading Challenge (Week 1 Update + Current Setup)

- Started by BenTen

- Replies: 32

-

Steve's $1,000 Option Trading Challenge (Week 1 Update)

- Started by MasterSteve

- Replies: 15

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.