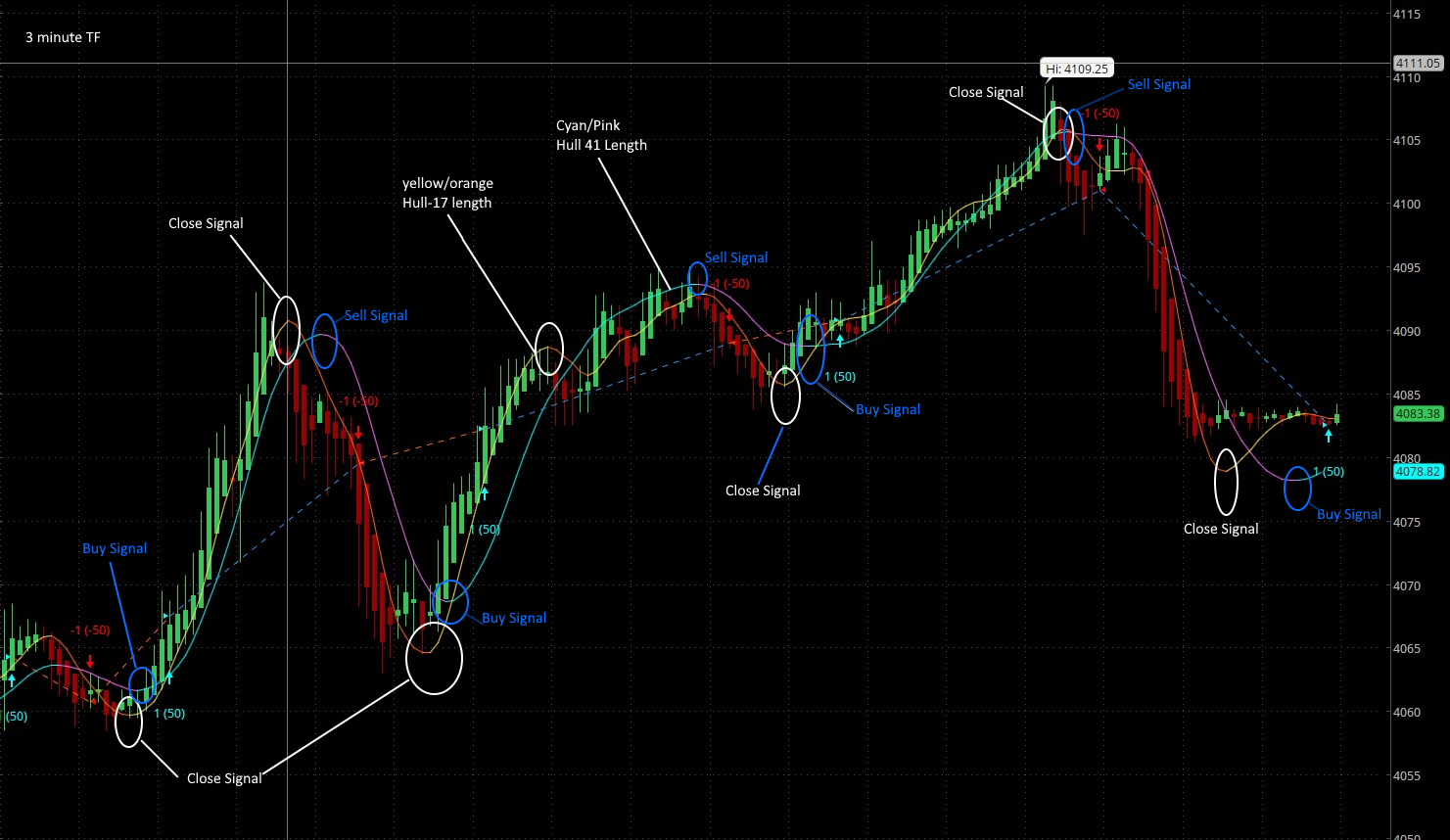

If you move the hma length to 4, and the hma displace to 4, you get a P/L that is more than double. with the HMA length and HMA displayed set at 2 for /ES 5D 5M I got a P/L of 1687, When they were both changed to 4, I got a P/L of 5462. With less signals. (Fewer trades). try this Grid 4AnyHnUAwesome. Thanks. Only issue I get is that the close signal isn't working. I assume we need a close at displace and the a new buy/sell signal to fire on the next candle. There must be a way to trigger the close but then also take advantage of the next move. Maybe adding another Hull average that can be used as a close trigger. I tested this using two different Hull MAs. Looks Like it may be doable. Would be nice to have the option to change both the "Hull to Close" and the "Hull to buy/sell" Lengths so we can use on different TFs etc. What are your thoughts?

Also, Can the time to trade just be removed or at least disabled. Not sure how important this is.

Last edited: