UpTwoBucks

Active member

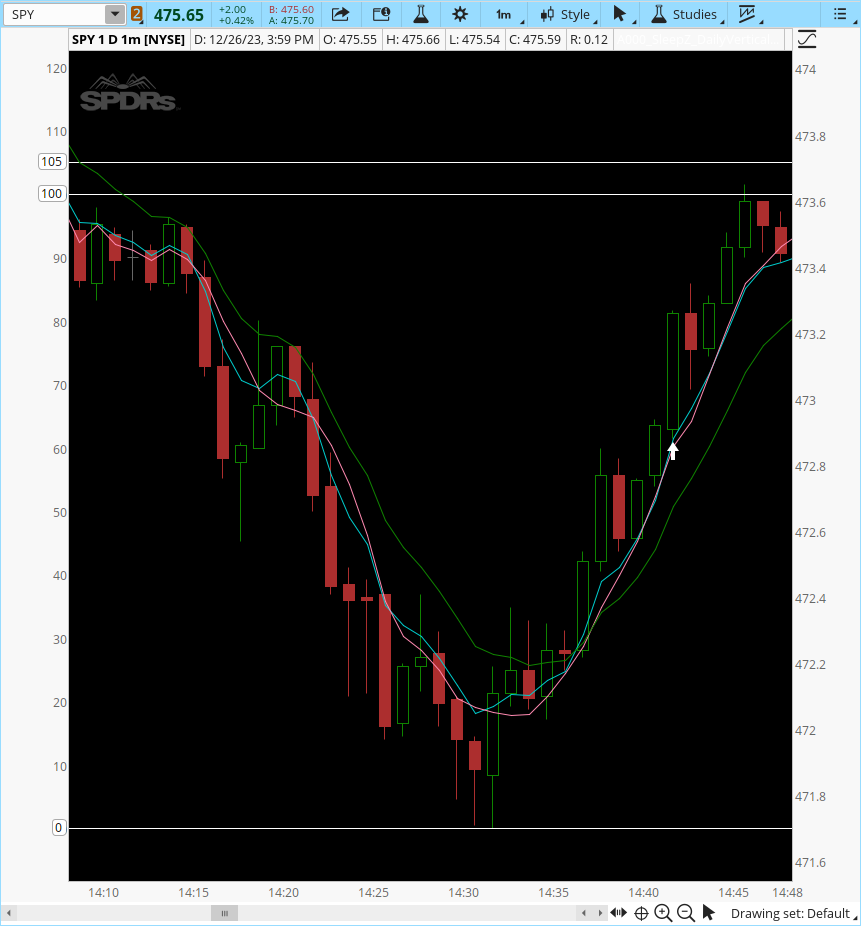

Welcome to our ThinkScript tutorial where we explore the critical importance of creating custom buy and sell indicators based on your own unique trading strategy. In this video, we delve into the world of ThinkScript, a powerful scripting language used within ThinkorSwim, and discover how you can leverage its capabilities to gain a competitive edge in the financial markets.

Code:

# Created by Ricky_Gaspard 7-16-2023

#Buying and Selling Indicator Arrows for Scalping

# Buying Conditions

def buycondition1 = SimpleMovingAvg("length" = 5)."SMA" is greater than MovAvgExponential("length" = 10)."AvgExp" and MovAvgExponential("length" = 5)."AvgExp" is greater than MovAvgExponential("length" = 10)."AvgExp" and MovAvgExponential("length" = 5)."AvgExp" crosses above SimpleMovingAvg("length" = 5)."SMA";

#def buycondition2 =

#Selling Conditions

def sellcondition1 = MovAvgExponential("length" = 5)."AvgExp" crosses below MovAvgExponential("length" = 10)."AvgExp";

#def sellcondition2 =

#Determies Conditions of an UP Arrow

plot bullish = if buycondition1 then 1 else 0;

#Determies Conditions of a Down Arrow

plot bearish = if sellcondition1 then 1 else 0;

#Paints Up Arrow On Chart

bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#Sets Default UP Arrow Color

bullish.SetDefaultColor(Color.white);

#Paints Down Arrow On Chart

bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#Sets Default Down Arrow Color

bearish.SetDefaultColor(Color.WHITE);

#Sets Thickness of Arrows

bullish.SetLineWeight(3);

bearish.SetLineWeight(3);Current DeskTop: http://tos.mx/61uIJpH