I recently talked to a friend who sent me a thread on an SMA cross strategy dubbed "The System", by TraderBJones on twitter. There is a pdf written about it:

https://docs.google.com/presentatio...h2hMEFe7cFIU/edit#slide=id.g118a2787cc5_0_152

though the general strategies follow any typical moving average cross strategies you've seen.

The thread:

https://t.co/GmFVnoqPP9

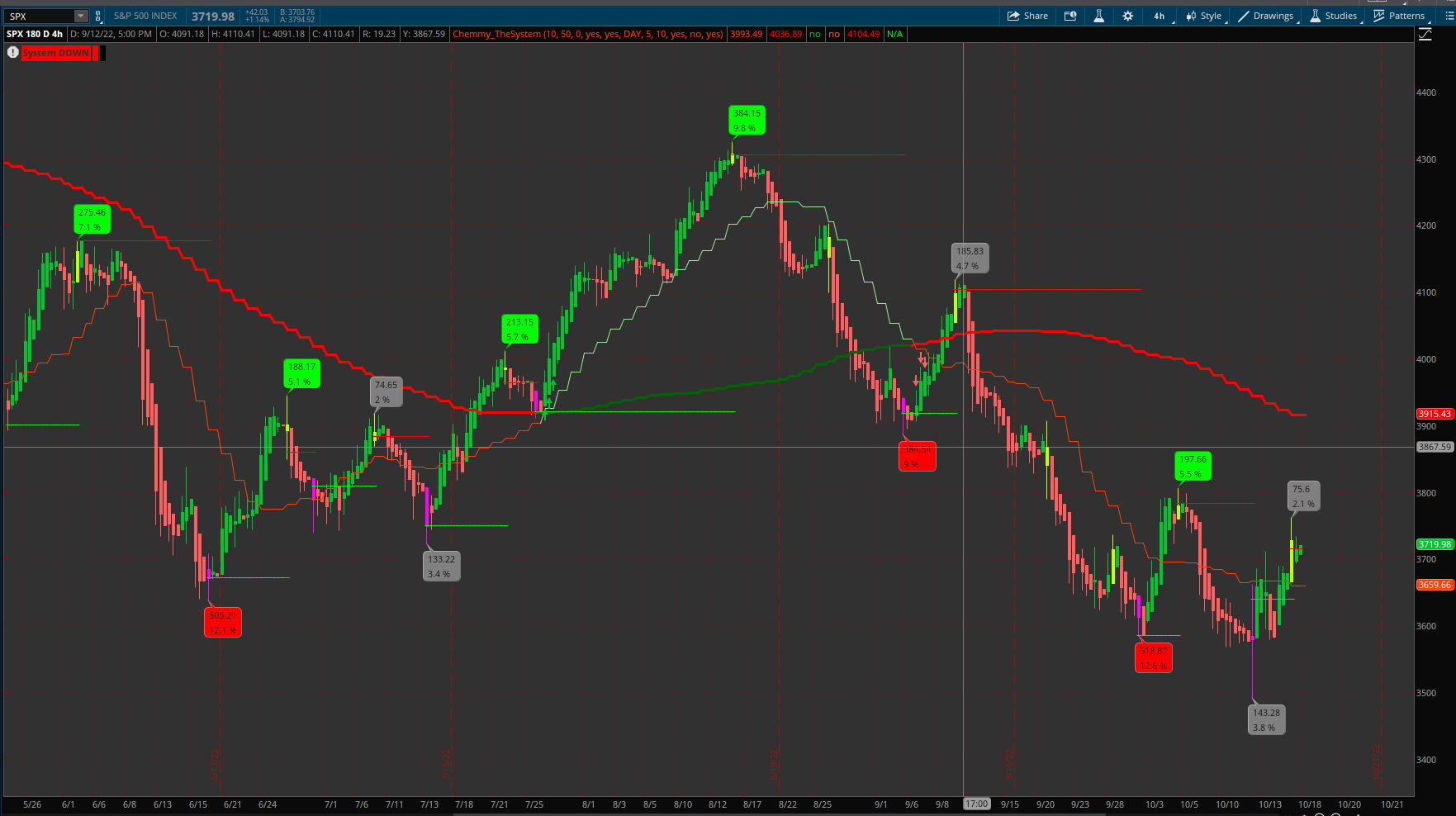

I wanted to test this quick script, which plots the two SMAs -- according to the documentation, it should either be used on a 30-minute aggregation for intraday trading or daily for swings, so I allowed for MTF aggregation since we both trade on lower time frames. As an idea, I wanted to see if better entries or adding opportunities could be found by combining this with peaks and valleys, particularly those that qualified as market pullbacks (5% or more):

In general, this should be used to follow the rules of "The System" as it's written, but the identification of strong peaks during a bearish trend or strong valleys during a bullish trend within the system should allow for optimal entries in the direction of the System's trend, while the trend is still strong.

This is just a test script, so if anyone sees any promise in this you're welcome to improve it. Thanks to @halcyonguy for their incredible market pullback study: https://usethinkscript.com/threads/identifying-market-pullback-i-e-5.12744/#post-108853

https://docs.google.com/presentatio...h2hMEFe7cFIU/edit#slide=id.g118a2787cc5_0_152

though the general strategies follow any typical moving average cross strategies you've seen.

The thread:

https://t.co/GmFVnoqPP9

I wanted to test this quick script, which plots the two SMAs -- according to the documentation, it should either be used on a 30-minute aggregation for intraday trading or daily for swings, so I allowed for MTF aggregation since we both trade on lower time frames. As an idea, I wanted to see if better entries or adding opportunities could be found by combining this with peaks and valleys, particularly those that qualified as market pullbacks (5% or more):

In general, this should be used to follow the rules of "The System" as it's written, but the identification of strong peaks during a bearish trend or strong valleys during a bullish trend within the system should allow for optimal entries in the direction of the System's trend, while the trend is still strong.

This is just a test script, so if anyone sees any promise in this you're welcome to improve it. Thanks to @halcyonguy for their incredible market pullback study: https://usethinkscript.com/threads/identifying-market-pullback-i-e-5.12744/#post-108853

Code:

# The System

# By @TraderBJones on twitter

# Coded by Chemmy for useThinkScript.com

# corrections_peak_to_valley_00 portion credits

#https://usethinkscript.com/threads/identifying-market-pullback-i-e-5.12744/

#Identifying Market Pullback (i.e. 5%+)

# Thread starterscottsamesame Start dateToday at 9:01 AM

#.........................................

# ref: peak/valley code , robert post#10

# https://usethinkscript.com/threads/zigzag-high-low-with-supply-demand-zones-for-thinkorswim.172/#post-7048

#.........................................

# Inputs

input fast = 10;

input slow = 50;

input displace = 0;

input showBreakoutSignals = no;

input addlabels = yes;

input agg = aggregationPeriod.THIRTY_MIN;

def price1 = close(period=agg);

def price2 = close(period=agg);

## SMA plots

plot SMAFast = Average(price1[-displace], fast);

plot SMASlow = Average(price2[-displace], slow);

# Signals plots

plot UpSignal = SMAFast crosses above SMASlow;

plot DownSignal = SMAFast crosses below SMASlow;

UpSignal.SetHiding(!showBreakoutSignals);

DownSignal.SetHiding(!showBreakoutSignals);

## Look and feel settings

SMAFast.SetDefaultColor(GetColor(1));

SMASlow.SetDefaultColor(GetColor(3));

UpSignal.SetDefaultColor(Color.UPTICK);

UpSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

DownSignal.SetDefaultColor(Color.DOWNTICK);

DownSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SMAFast.AssignValueColor(if SMAFast >= SMASlow then color.Light_Green else color.Light_Red);

SMASlow.AssignValueColor(if SMAFast >= SMASlow then color.Dark_Green else color.Red);

SMASlow.SetLineWeight(3);

AddLabel(addlabels, if SMAFast >= SMASlow then "System UP" else "System DOWN", if SMAFast >= SMASlow then color.green else color.red);

### Peak and Valley code

input min_percent_change = 5;

input length = 10;

def na = double.nan;

def bn = BarNumber();

def lastBar = HighestAll(if IsNaN(close) then 0 else bn);

def offset = Min(length - 1, lastBar - bn);

def peak = high > highest(high[1], length - 1) and high == GetValue(highest(high, length), -offset);

def valley = low < Lowest(low[1], length - 1) and low == GetValue(Lowest(low, length), -offset);

# set to 0 if peak and valley happen on same bar

def pv = if bn == 1 then 0

else if peak and valley then 0

else if peak then 1

else if valley then -1

else pv[1];

def peak2 = if bn == 1 then 0

else if peak and pv[1] != -1 then 0

else peak;

def valley2 = if bn == 1 then 0

else if valley and pv[1] != 1 then 0

else valley;

input color_peak_valley_bars = yes;

input color_remaining_bars = yes;

AssignPriceColor(

if (peak and color_peak_valley_bars) then Color.LIME

else if (valley and color_peak_valley_bars) then Color.magenta

else if (peak and !color_peak_valley_bars) then Color.current

else if (valley and !color_peak_valley_bars) then Color.current

else if color_remaining_bars then Color.DARK_GRAY

else color.current);

def peak_line = if bn == 1 then 0

else if peak2 then close

else if valley2[1] then 0

else peak_line[1];

def valley_line = if bn == 1 then 0

else if valley2 then close

else if peak2[1] then 0

else valley_line[1];

plot zp = if peak_line > 0 then peak_line else na;

zp.setdefaultcolor(color.red);

zp.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

plot zv = if valley_line > 0 then valley_line else na;

zv.setdefaultcolor(color.green);

zv.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#----------------------------

input gain_drop_stats = yes;

def gain = if pv[1] == 0 then 0

else if peak2 then round(close - valley_line, 2)

else 0;

def gain_per = if pv[1] == 0 then 0 else round( 100 * gain/valley_line, 1);

def is_gain_big = (gain_per >= min_percent_change);

addchartbubble((gain_drop_stats and peak2 and valley_line > 0 and gain_per > 1.30), high,

gain + "\n" +

gain_per + " %"

, ( if is_gain_big then color.green else color.gray), yes);

#----------------------------

def drop = if pv[1] == 0 then 0

else if valley2 then round(peak_line - close, 2)

else 0;

def drop_per = if pv[1] == 0 then 0 else round( 100 * drop/peak_line, 1);

def is_drop_big = (drop_per >= min_percent_change);

addchartbubble((gain_drop_stats and valley2 and peak_line > 0 and drop_per > 1.30), low,

drop + "\n" +

drop_per + " %"

, ( if is_drop_big then color.red else color.gray), no);

#

AddLabel(yes, if (SMAFast >= SMASlow and zp < SMASlow) then "Poss. Entry on Pullback" else " ", if (SMAFast >= SMASlow and zp < SMASlow) then color.green else color.red);

AddLabel(yes, if (SMAFast < SMASlow and zv > SMASlow) then "Poss. Entry on Pullback" else " ", if (SMAFast < SMASlow and zv > SMASlow) then color.red else color.green);

#Alerts

Alert(UpSignal, "System Up!", Alert.Bar, sound.Ding);

Alert(DownSignal, "System Down!", Alert.Bar, sound.Ding);

# End Code

Last edited by a moderator: