Mr_Wheeler

Active member

https://tos.mx/WKPQpFhDo you mind sharing me your setup as I am having a hard time trying to match it base on your screenshot. Love to test what you have. Thanks.

https://tos.mx/WKPQpFhDo you mind sharing me your setup as I am having a hard time trying to match it base on your screenshot. Love to test what you have. Thanks.

When I open your shared workspace, I do not see your custom indicators. All I see was a simple VWAP and AwesomeOscillator. Nothing else.

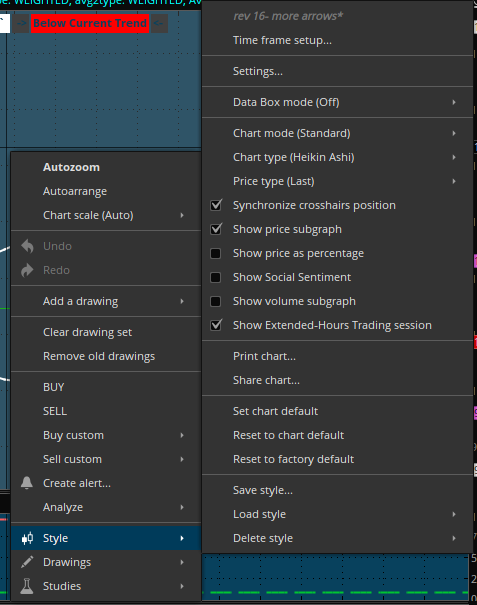

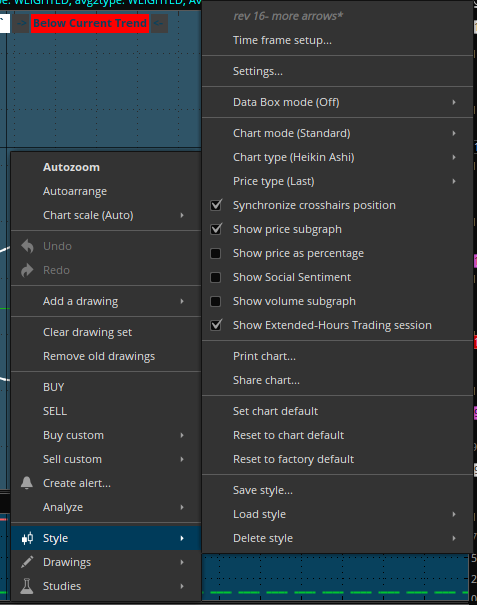

How about the styles?When I open your shared workspace, I do not see your custom indicators. All I see was a simple VWAP and AwesomeOscillator. Nothing else.

I'll share everything. I'll just share every last study and post a screen shot of the configs for each study. Give me a bit of time.This is all I see.

Would you be willing to copy the codes and share it here? Am I close to match your bottom indicators?

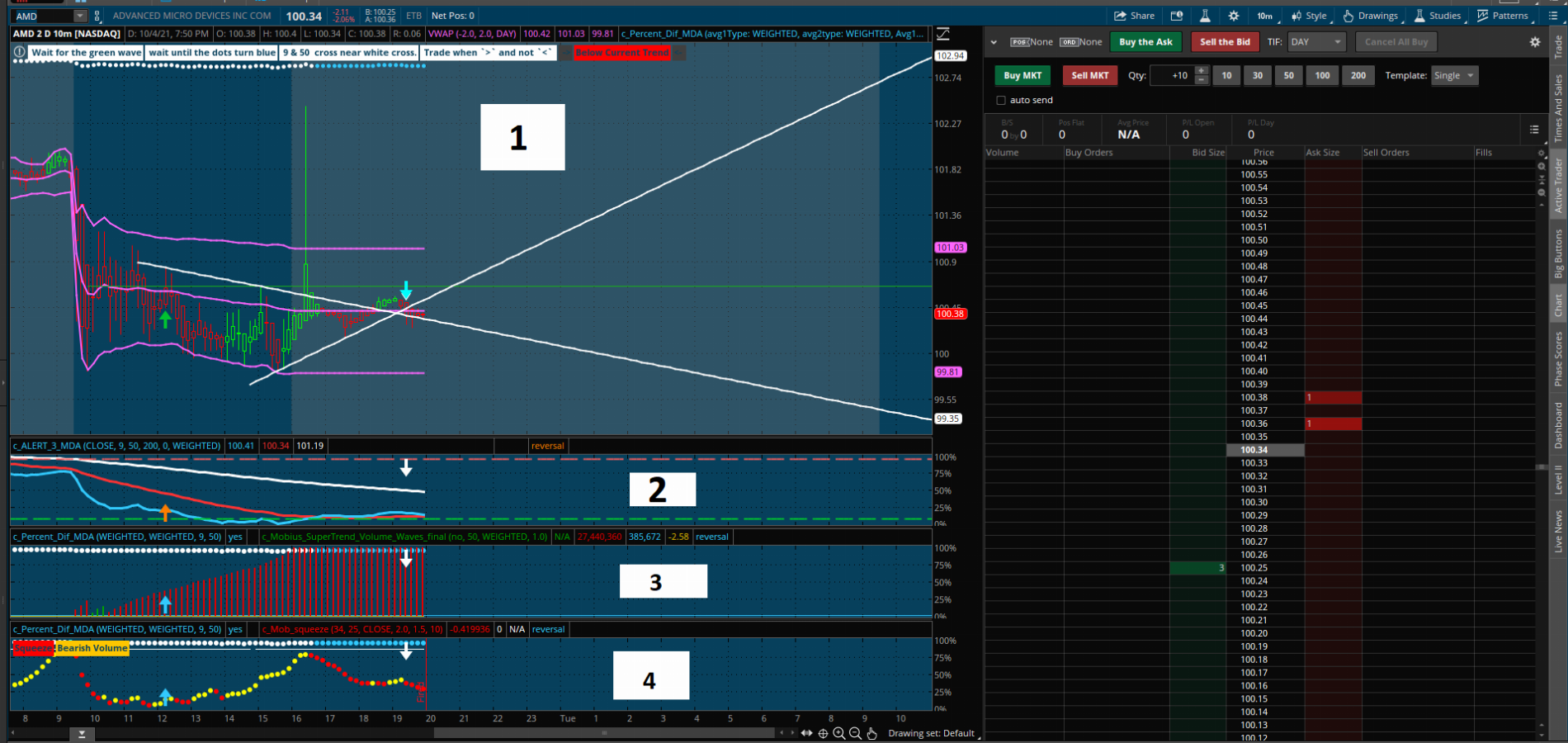

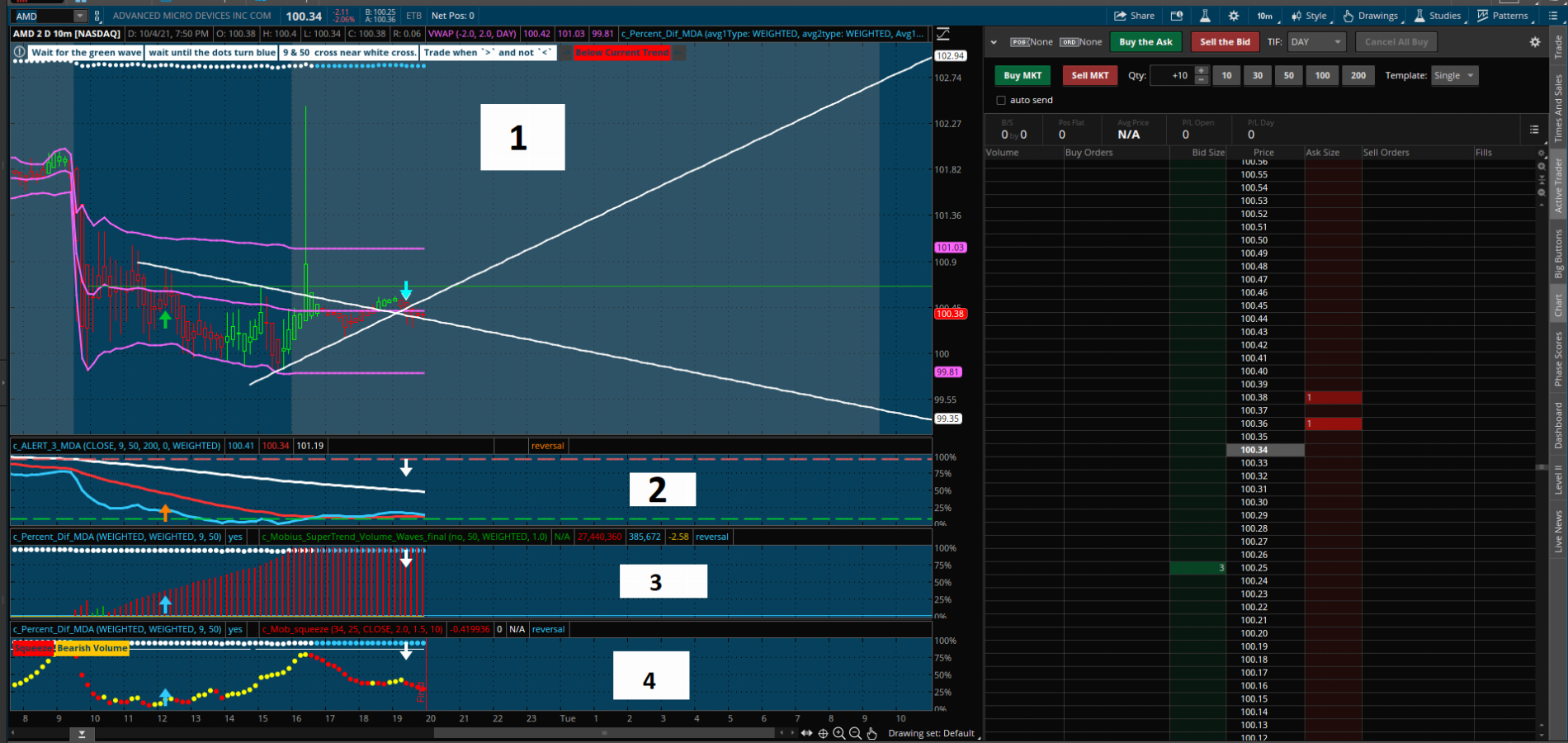

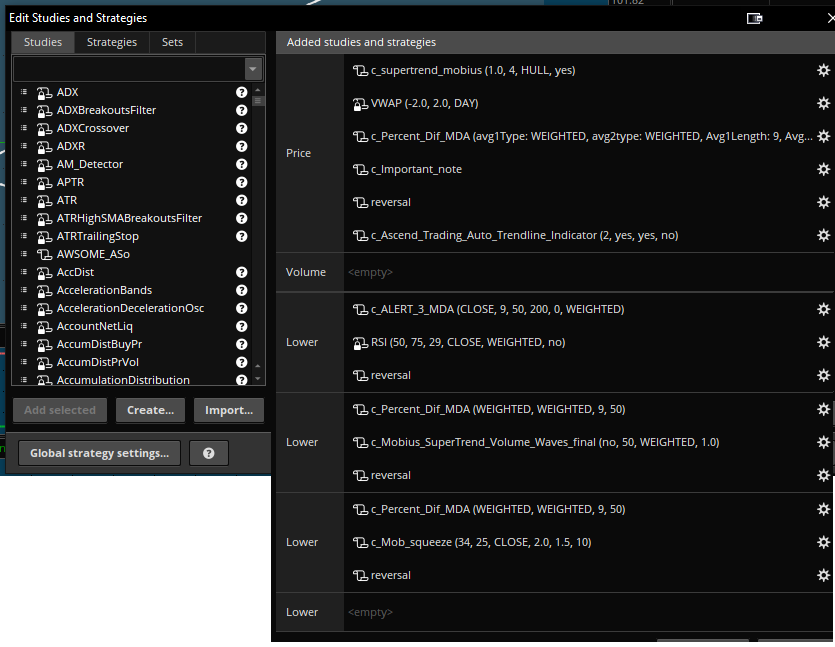

- I labeled the chart areas with numbers to help people keep track.

- Just in case.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

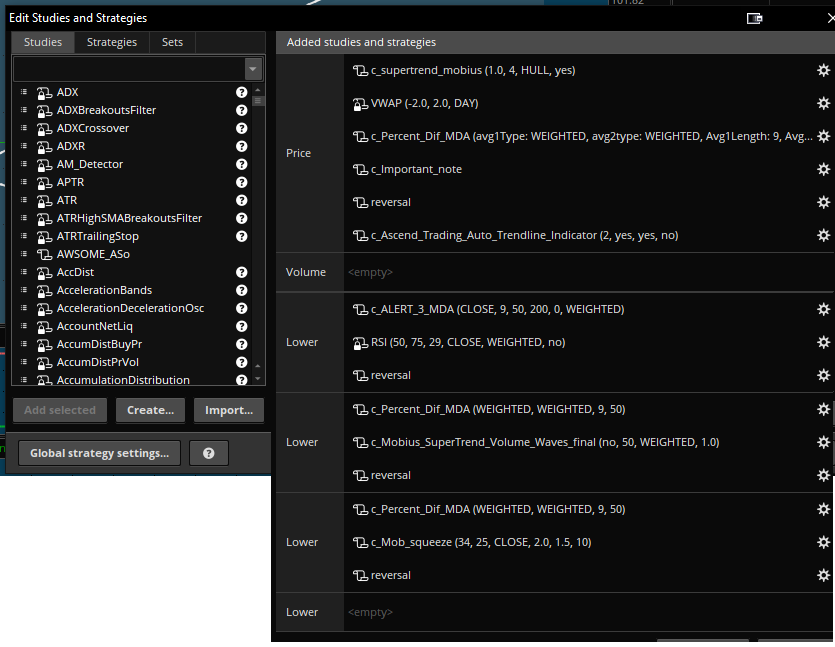

First group

1 - c_supertrend_mobius - https://tos.mx/eGwb7vP

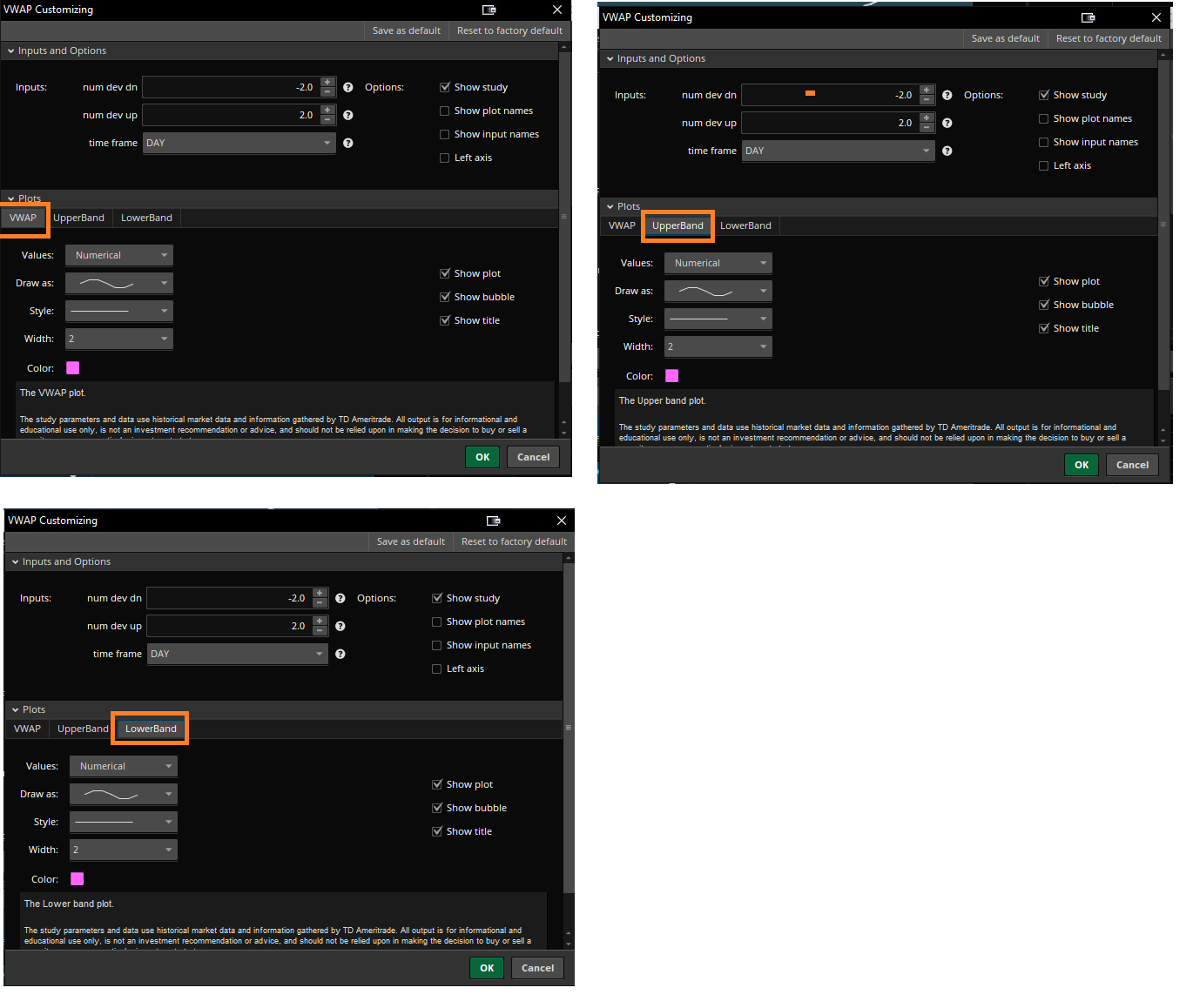

2 - VWAP

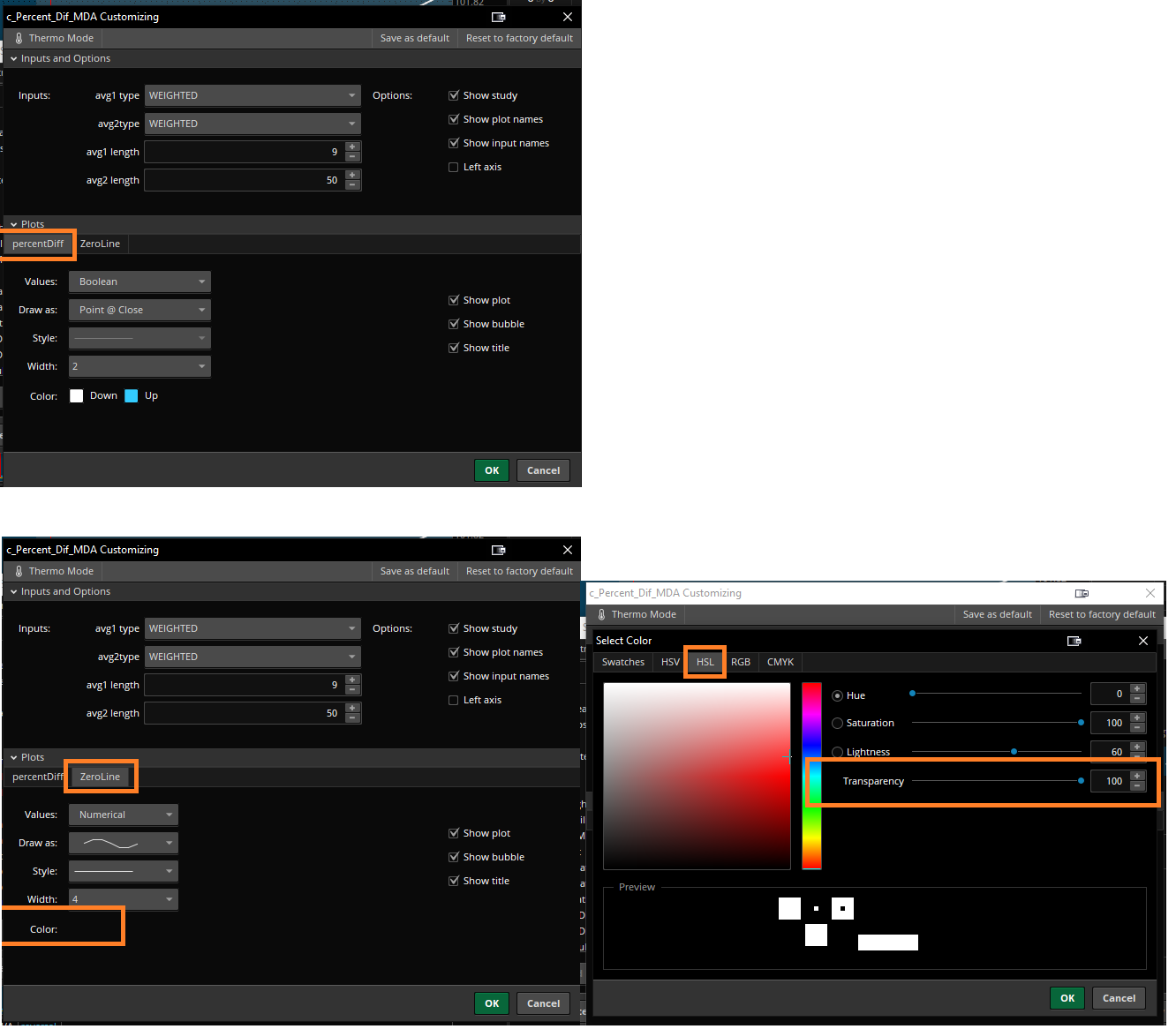

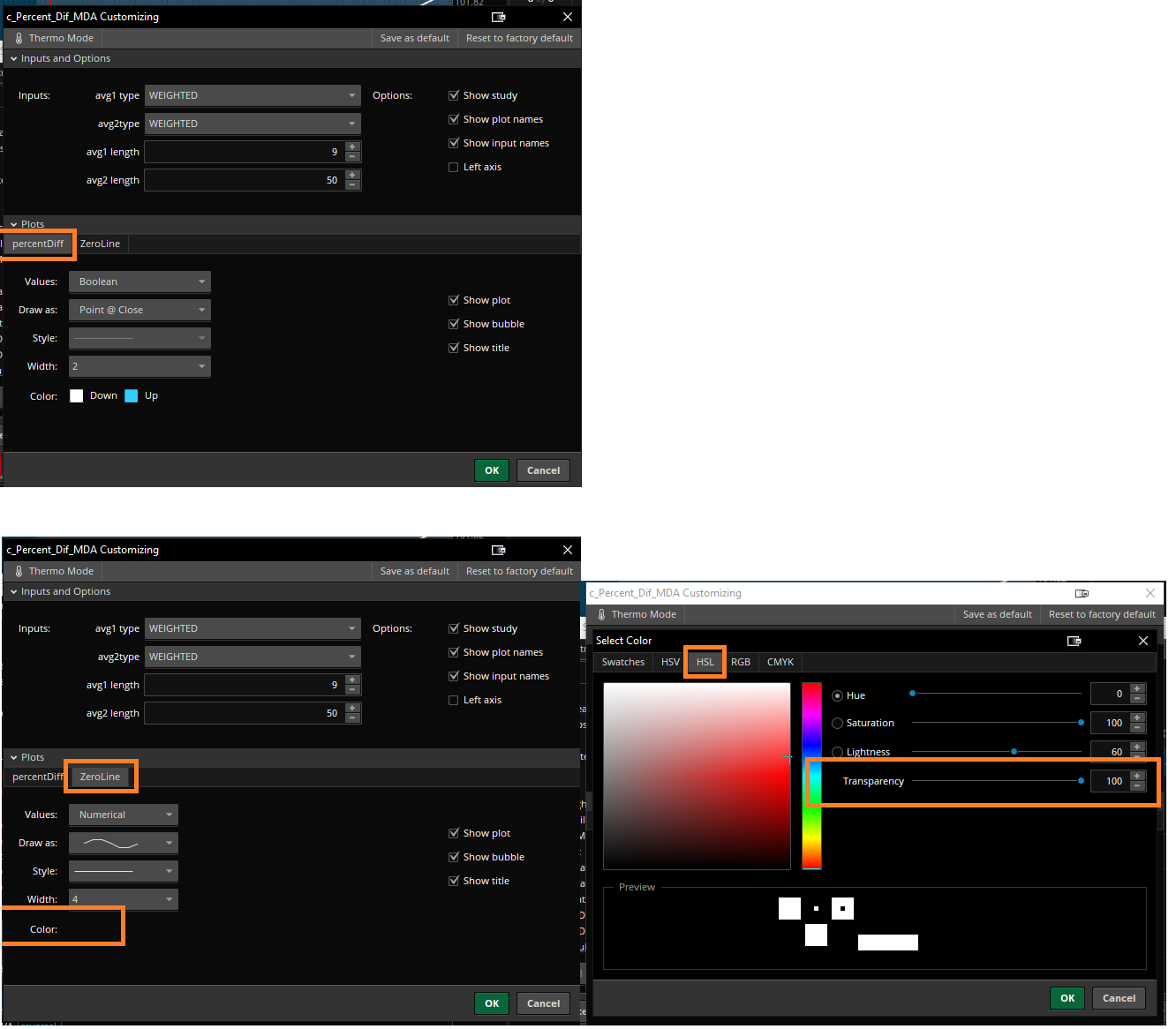

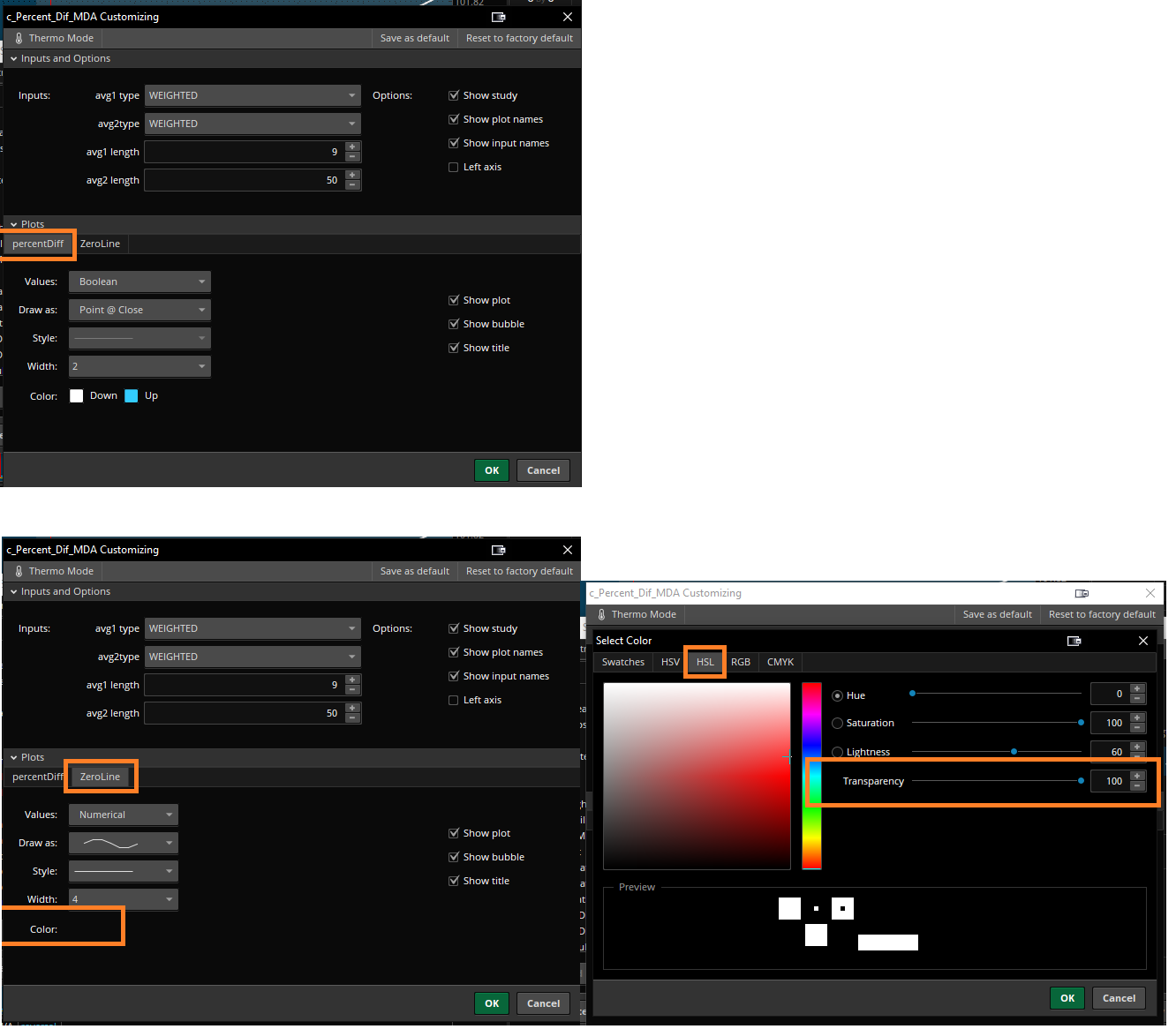

3 - c_Percent_Dif_MDA - https://tos.mx/q2A5p35

4 - c_Important_note - https://tos.mx/xTInacu

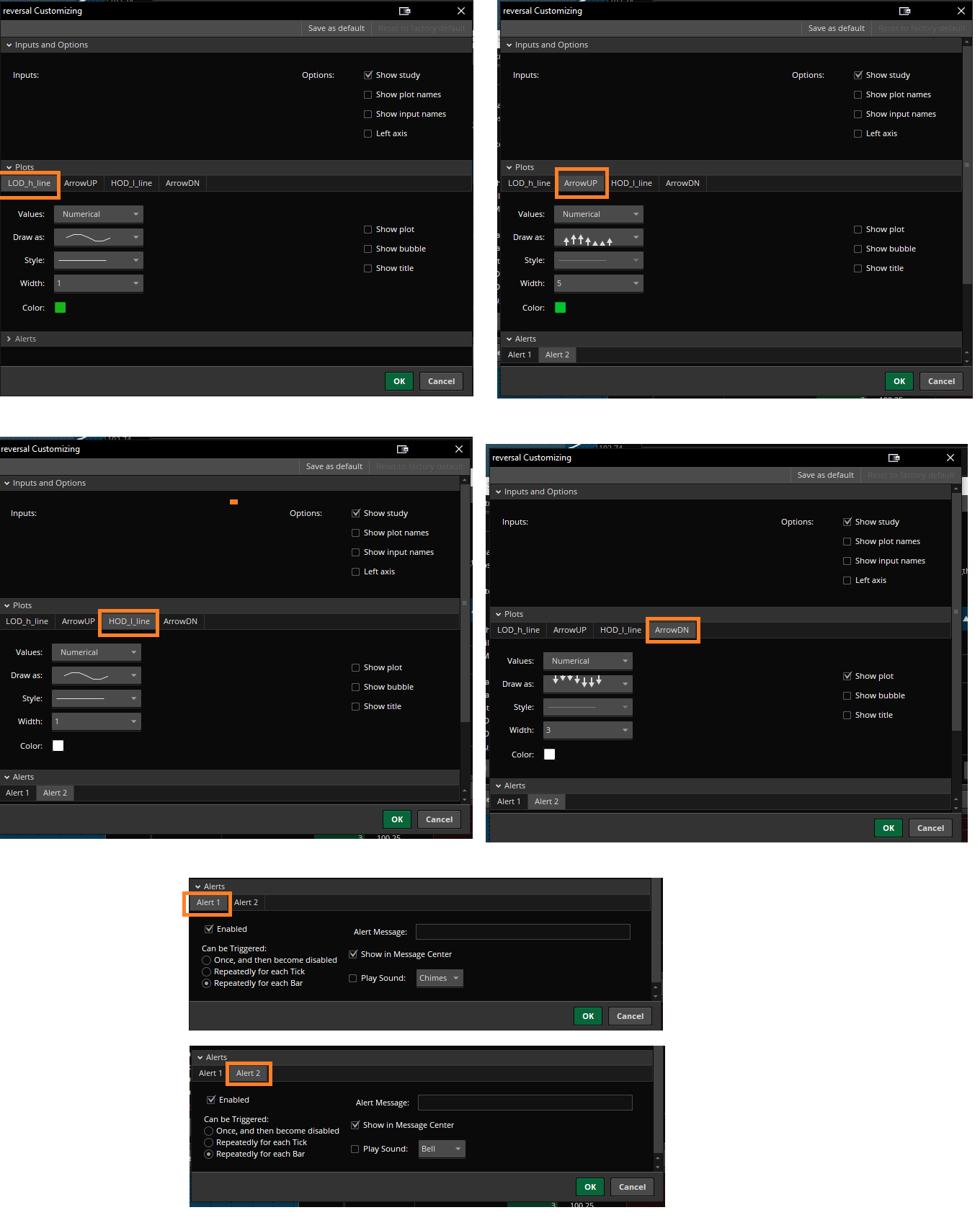

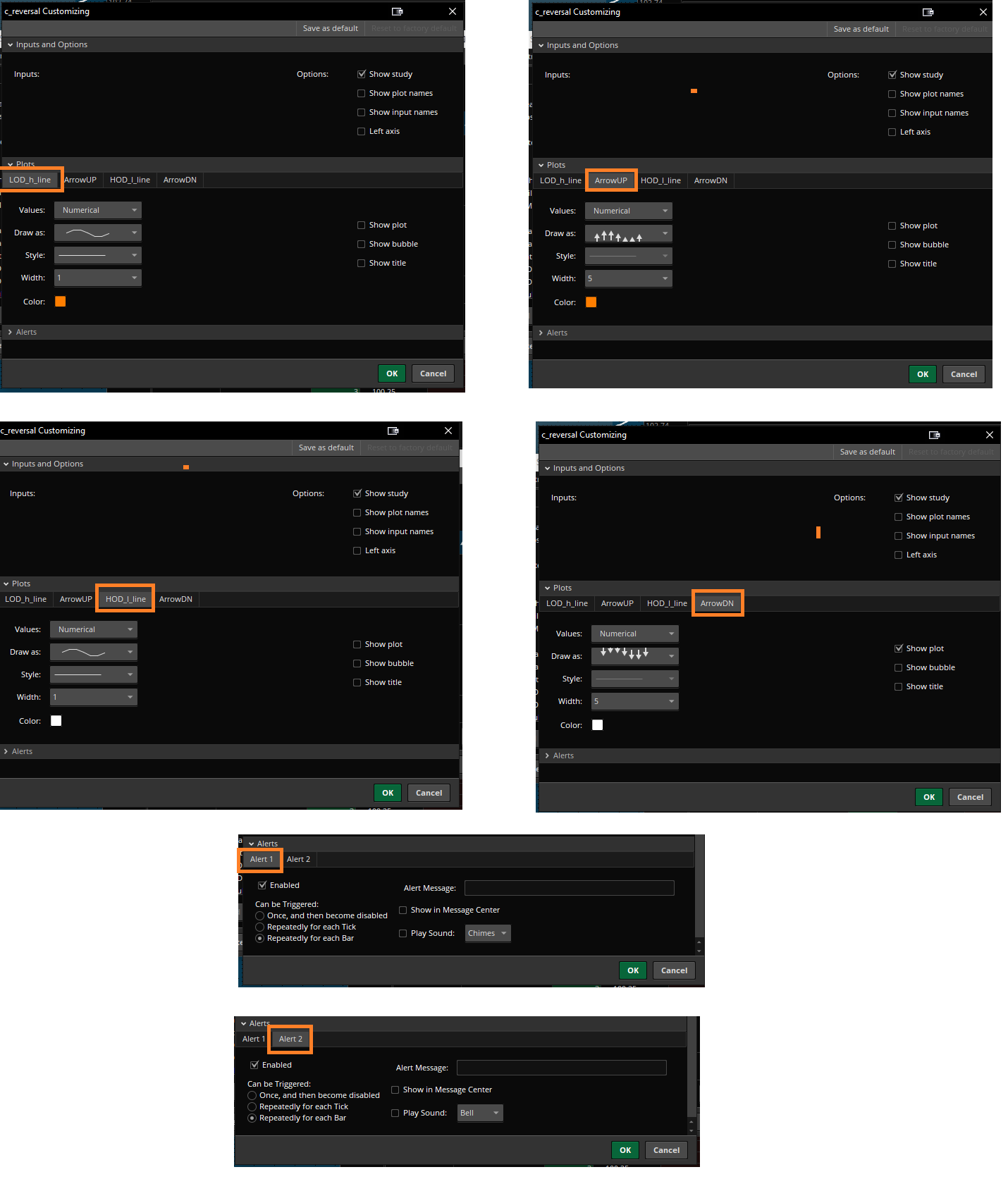

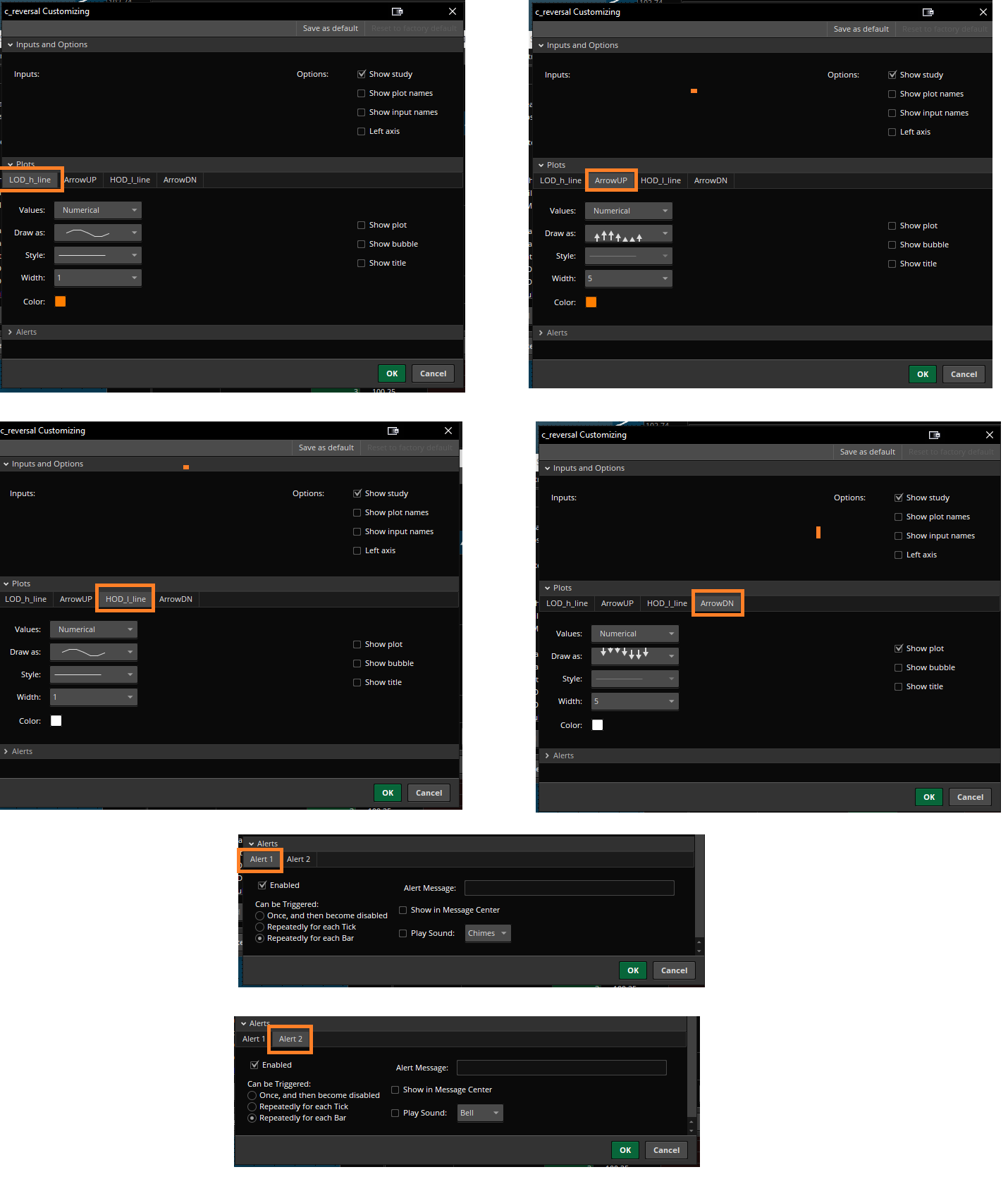

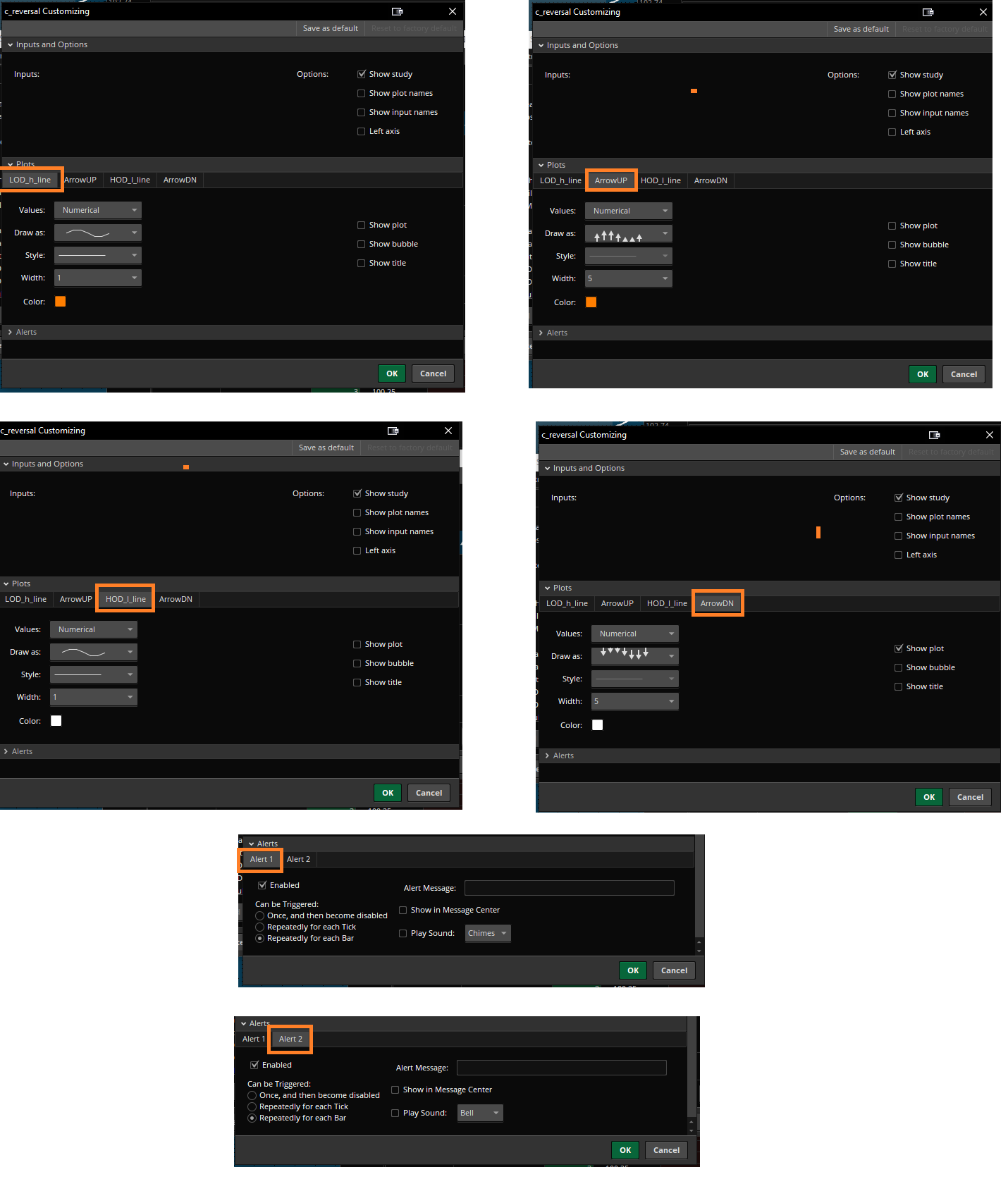

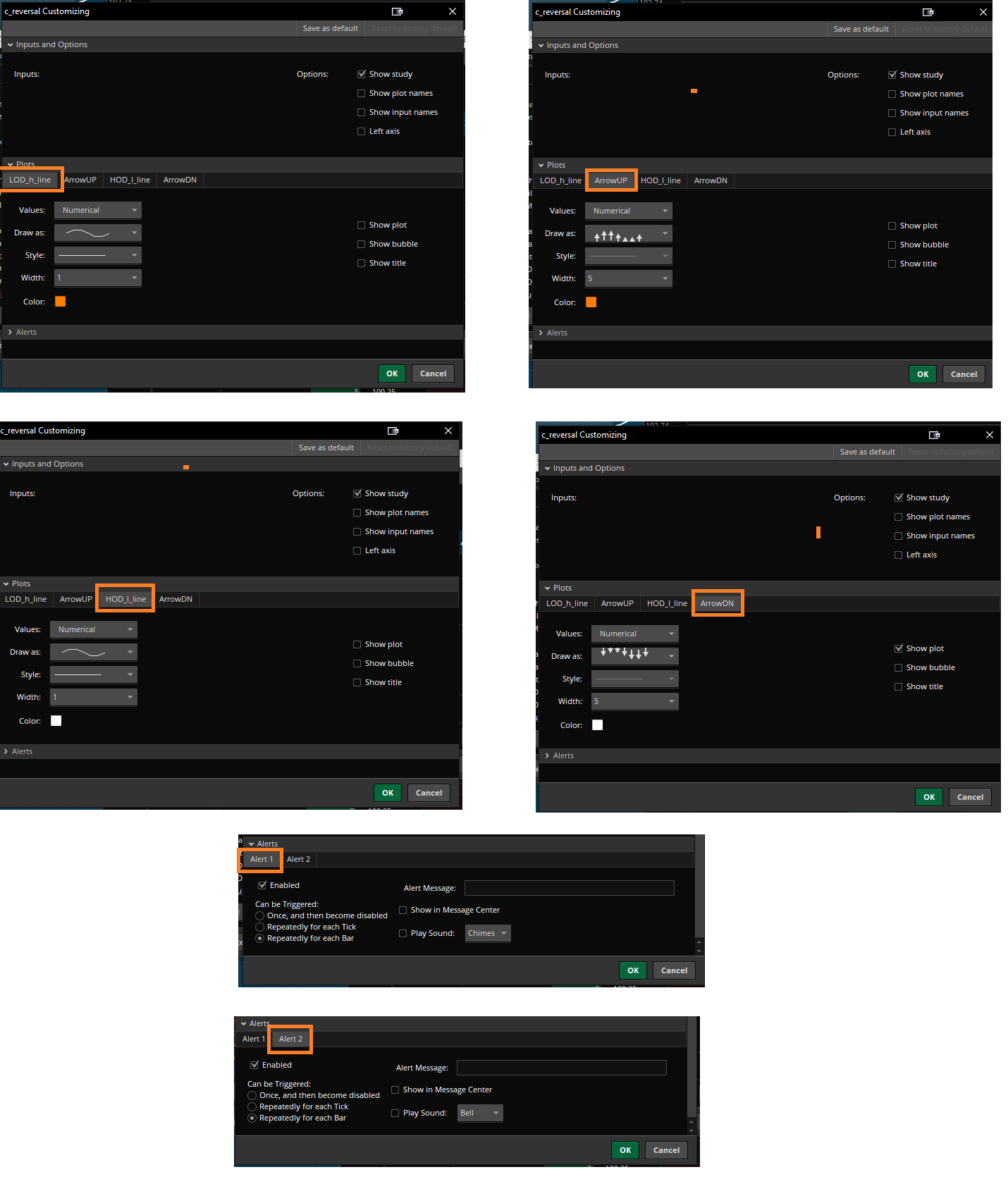

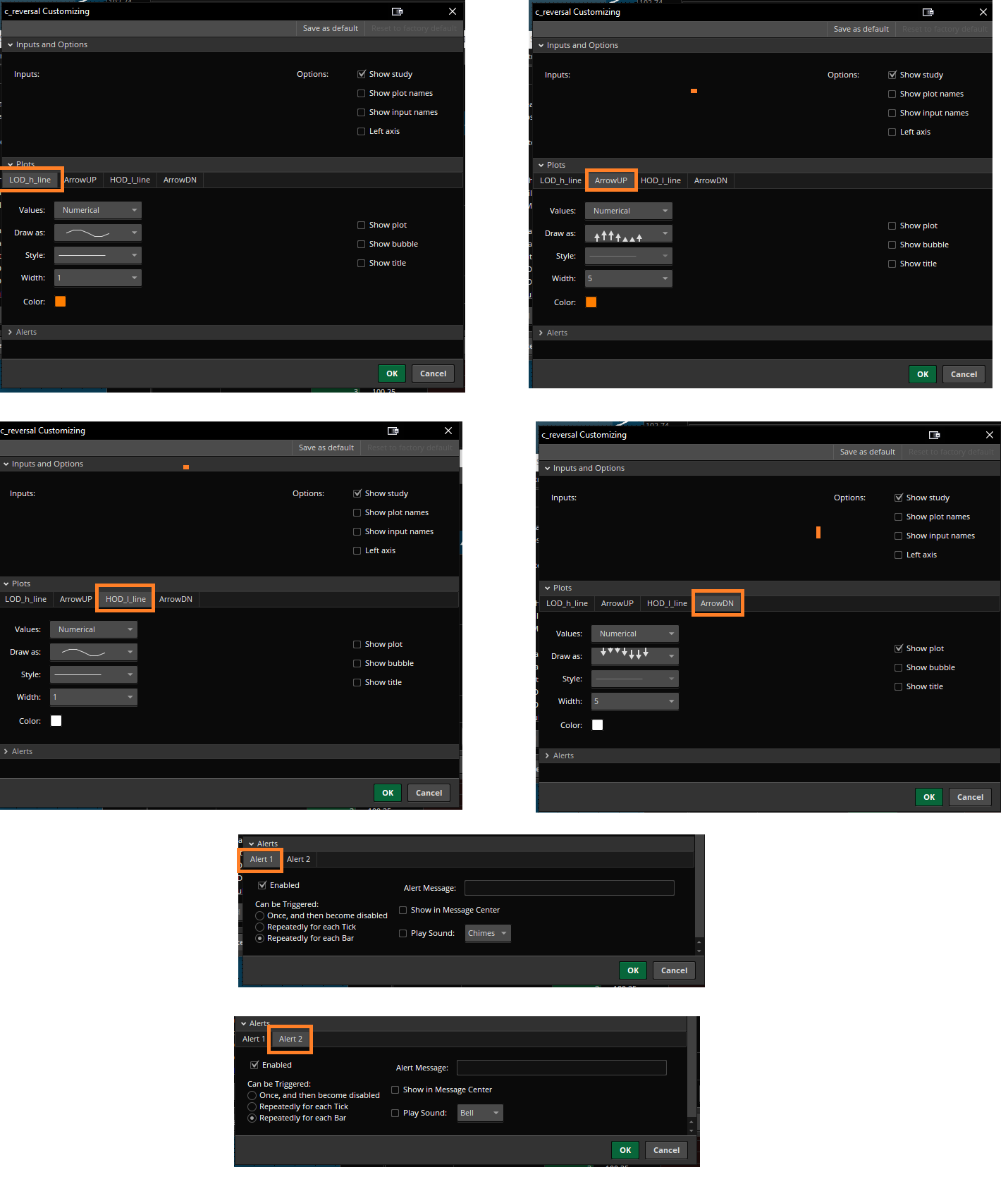

5 - c_reversal - https://tos.mx/3Y4SzHA

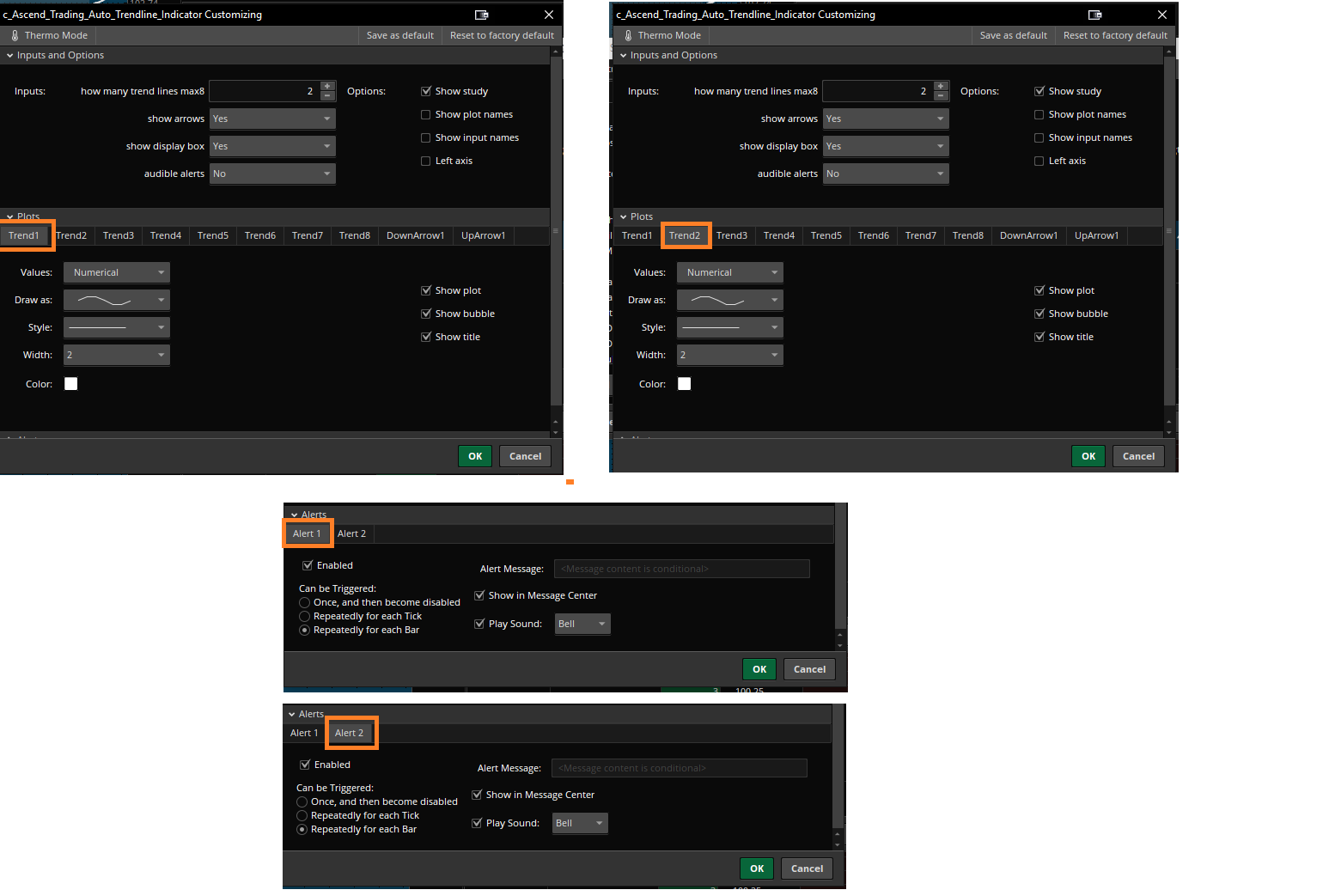

6 - c_Ascend_Trading_Auto_Trendline_Indicator - https://tos.mx/lU9ScxX

------------------------------------------------------------------

Second Group

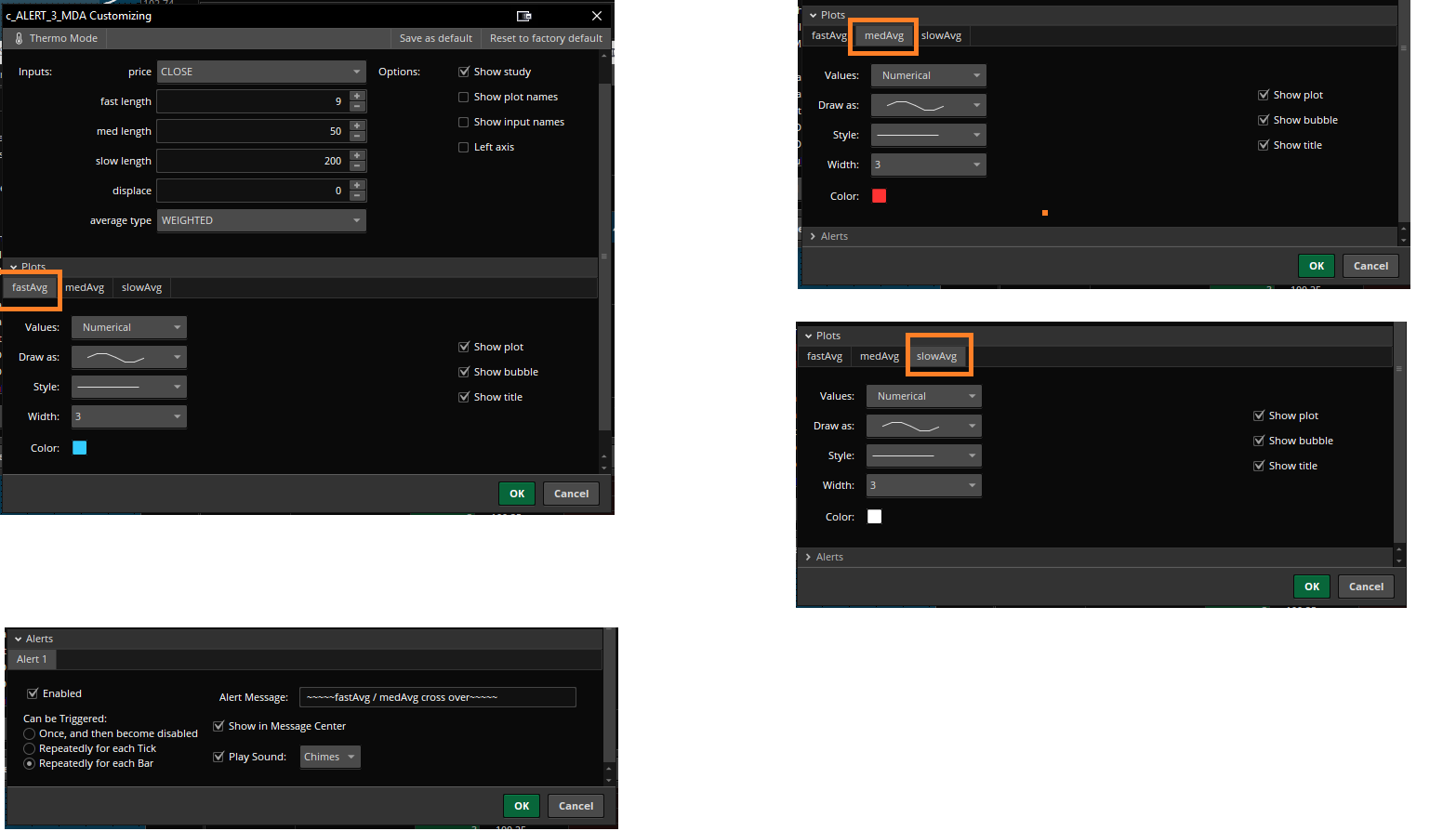

1 - c_ALERT_3_MDA - http://tos.mx/CvUS2FC

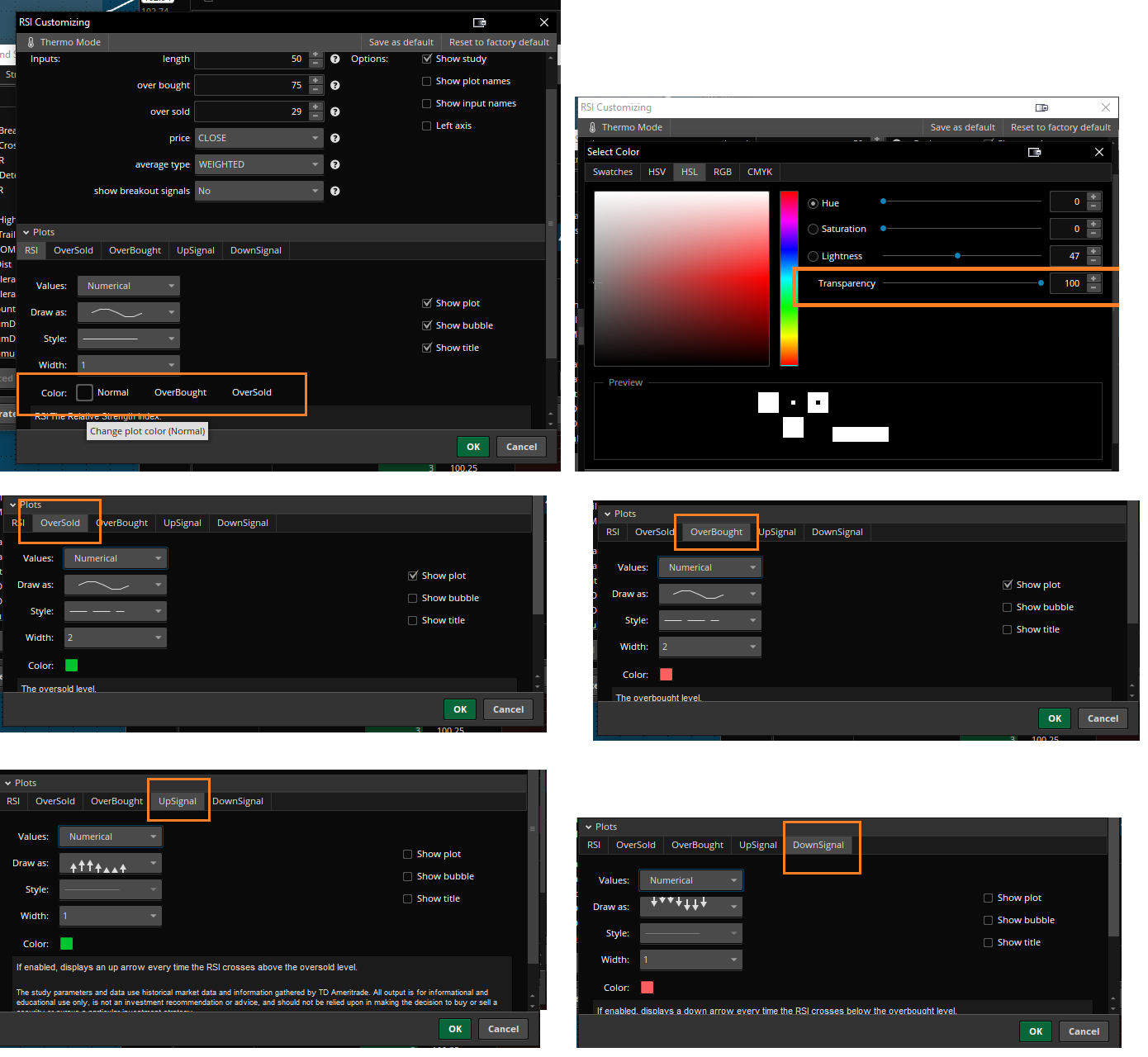

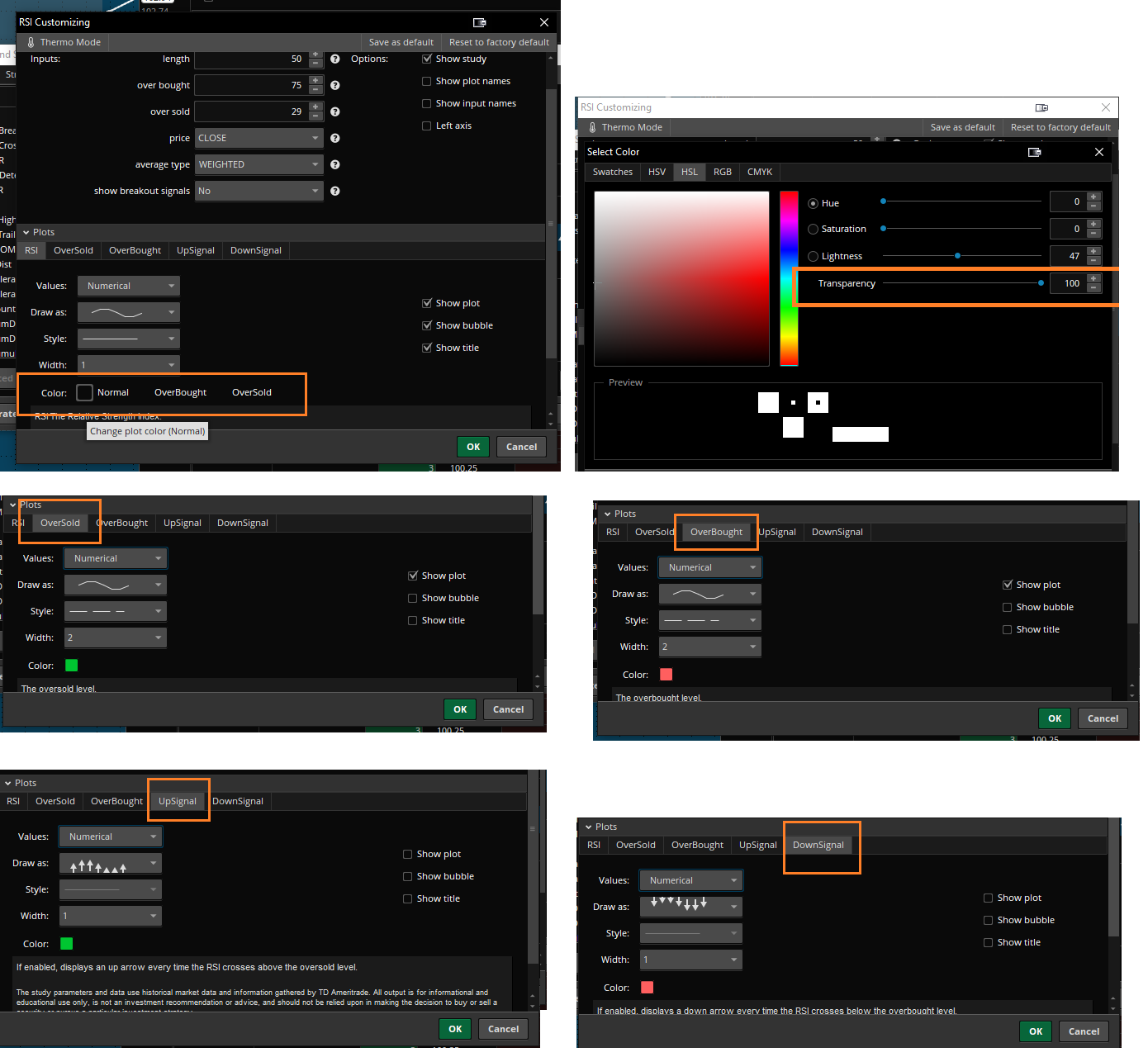

2 - RSI

3 - c_reversal - https://tos.mx/3Y4SzHA

---------------------------------------------------

Third Group

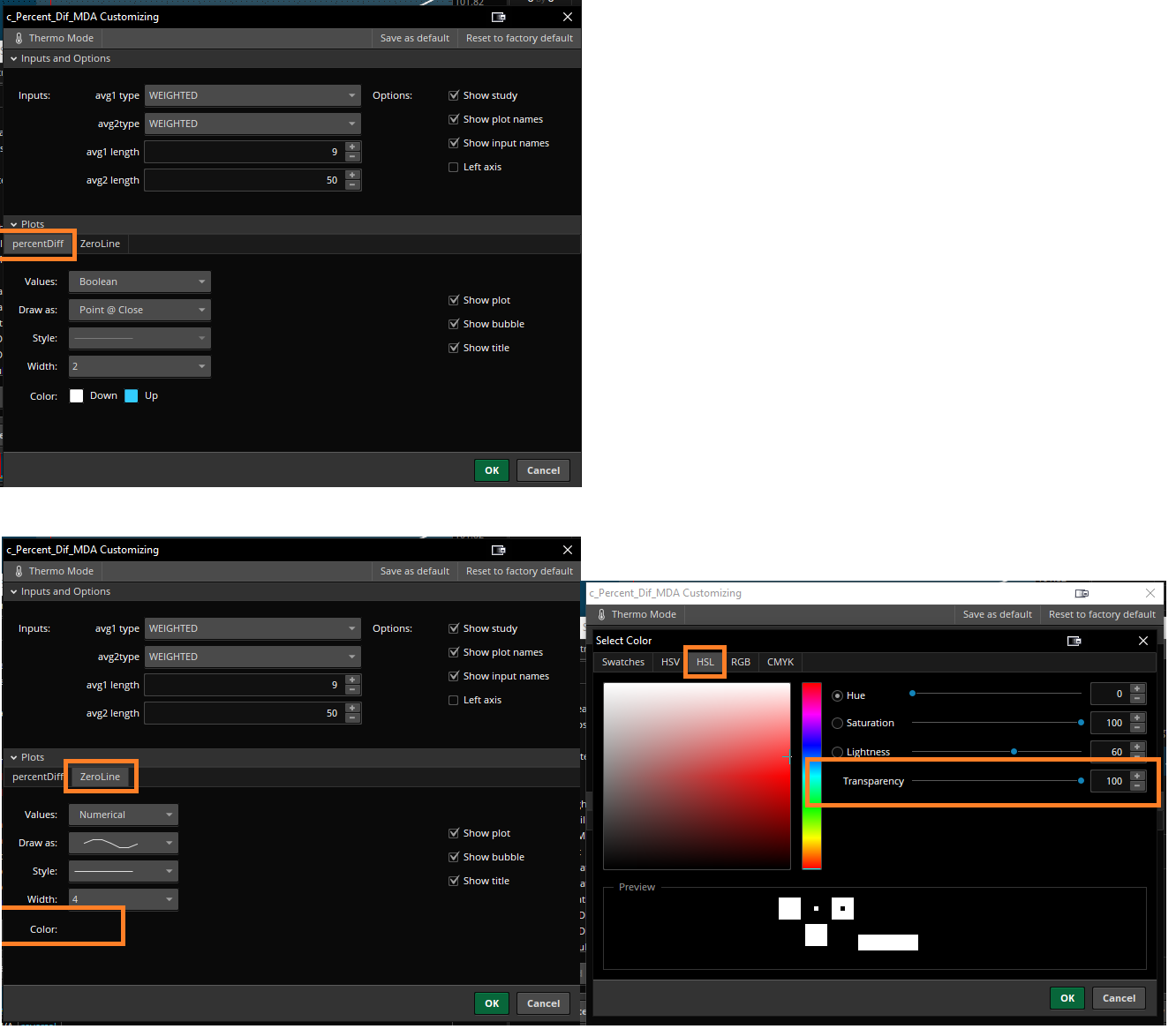

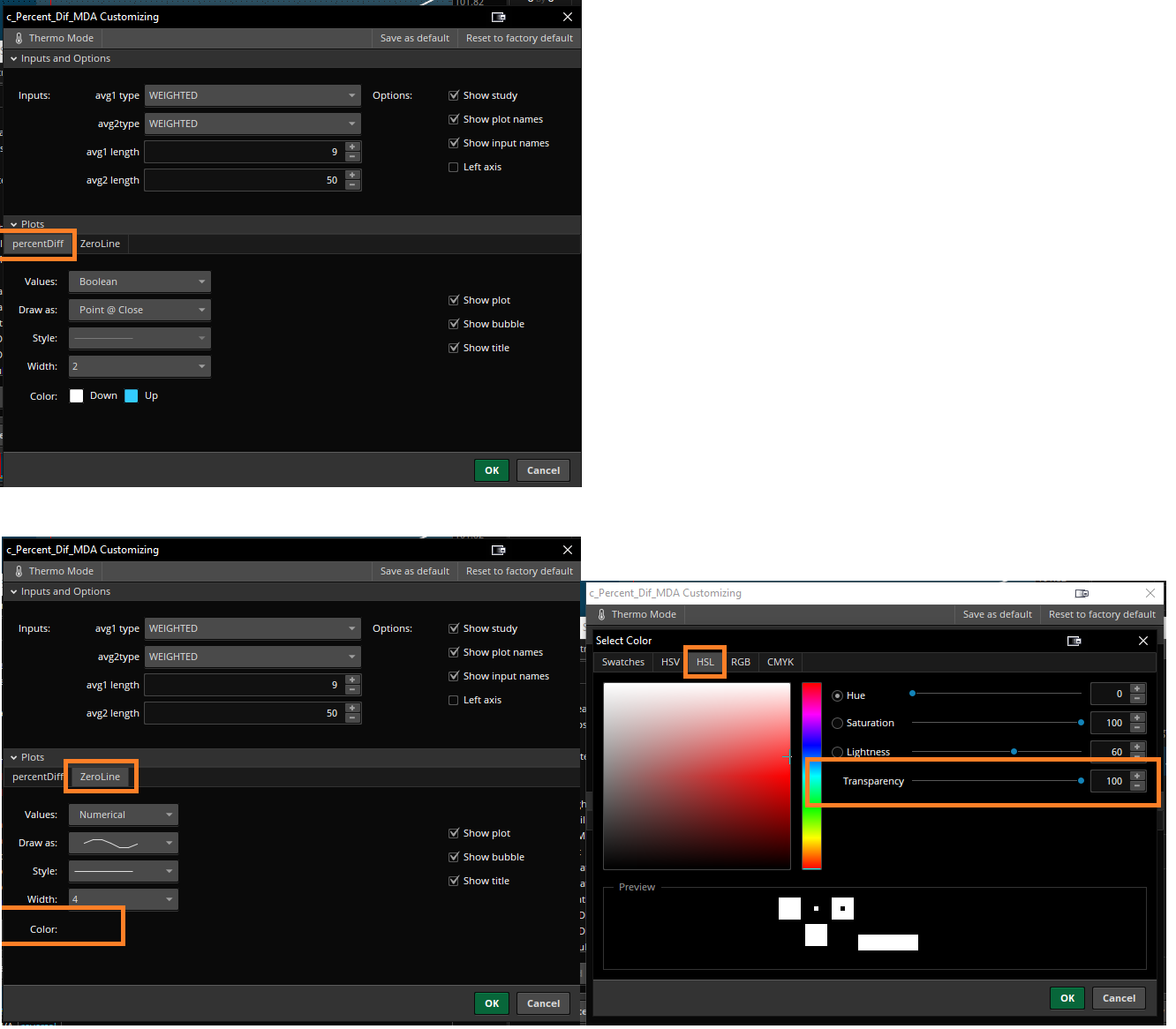

1 - c_Percent_Dif_MDA - https://tos.mx/q2A5p35

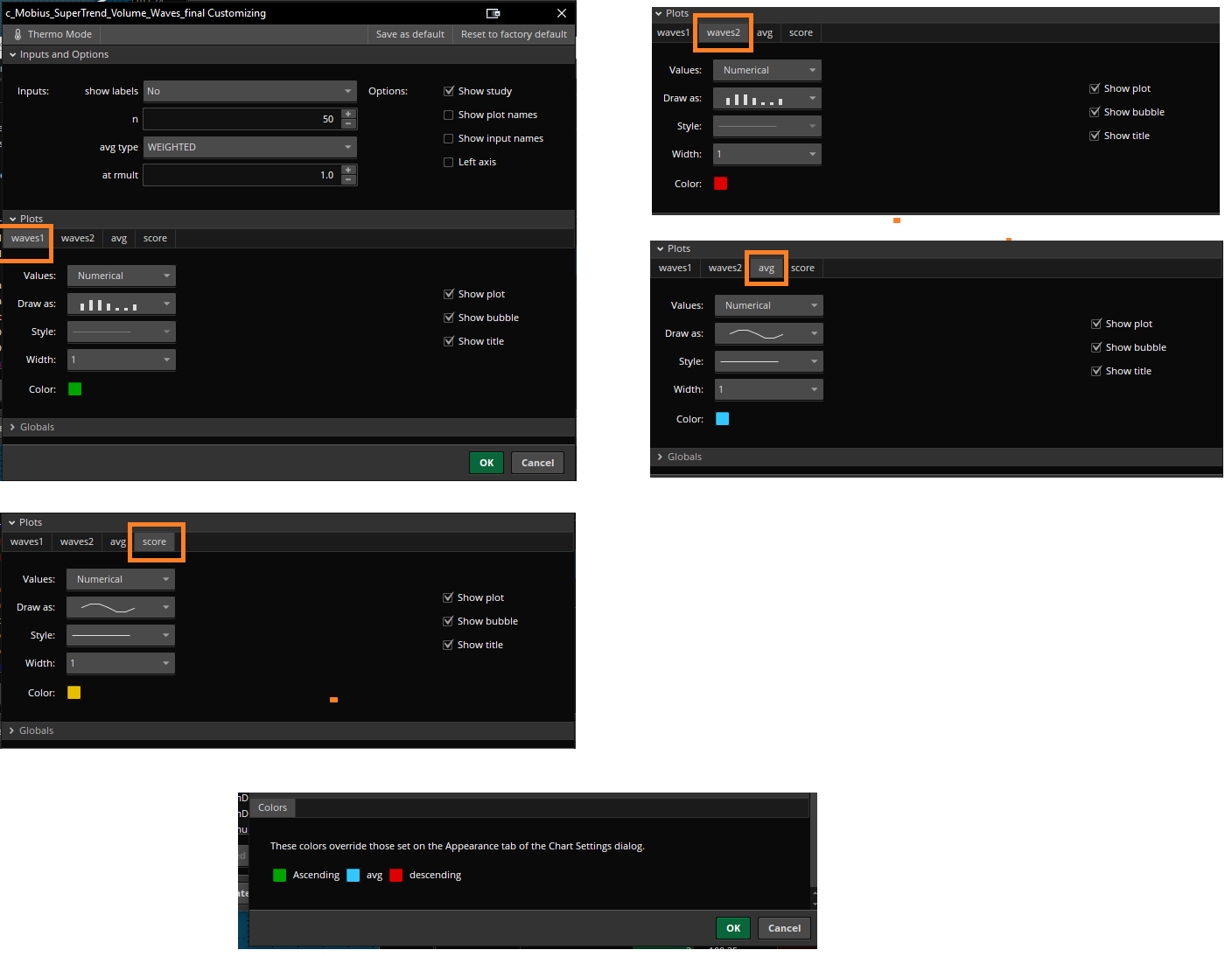

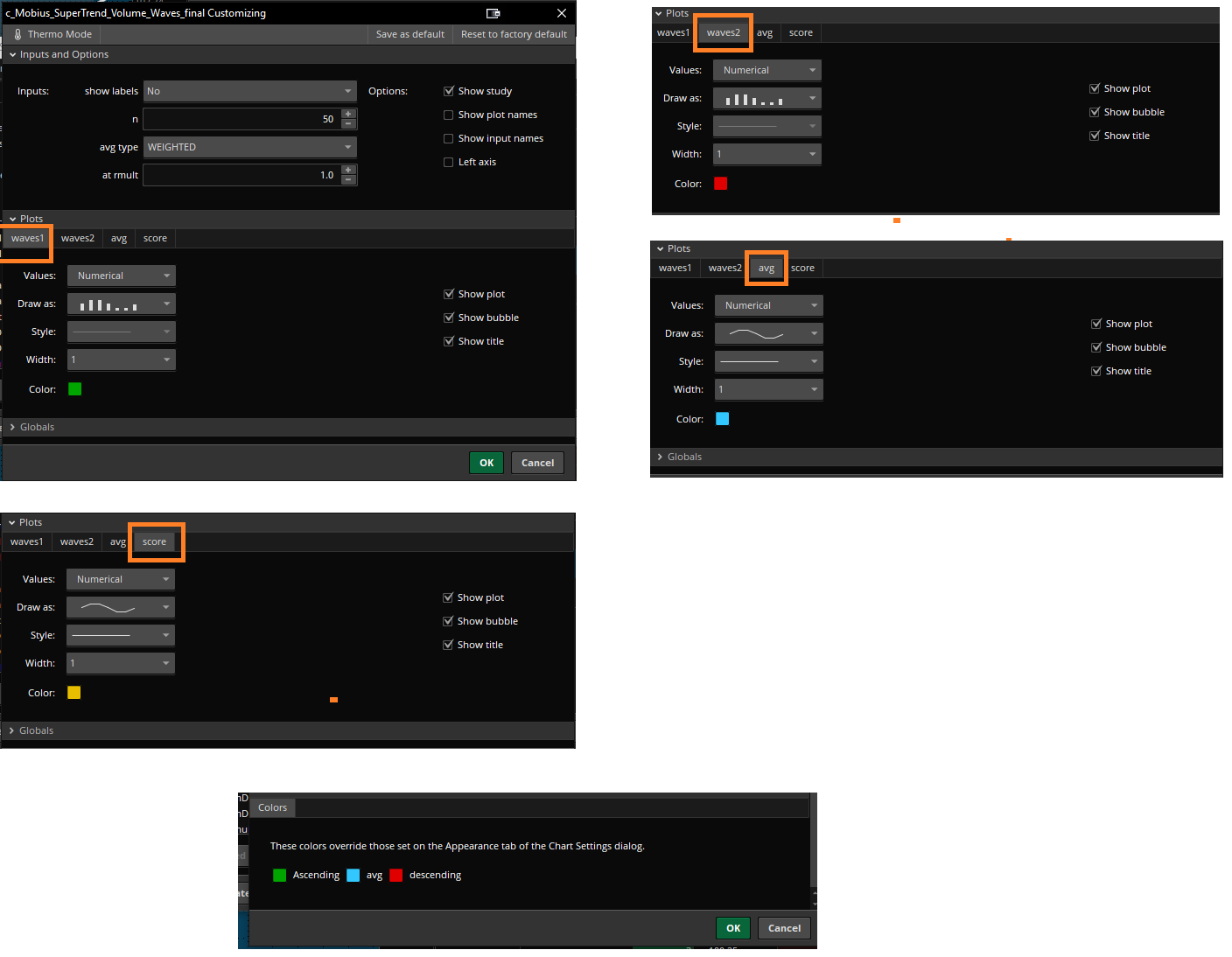

2 - c_Mobius_SuperTrend_Volume_Waves_final - https://tos.mx/9NHrd0z

3 - c_reversal - https://tos.mx/3Y4SzHA

---------------------------------------

Fourth Group

1 - c_Percent_Dif_MDA - https://tos.mx/q2A5p35

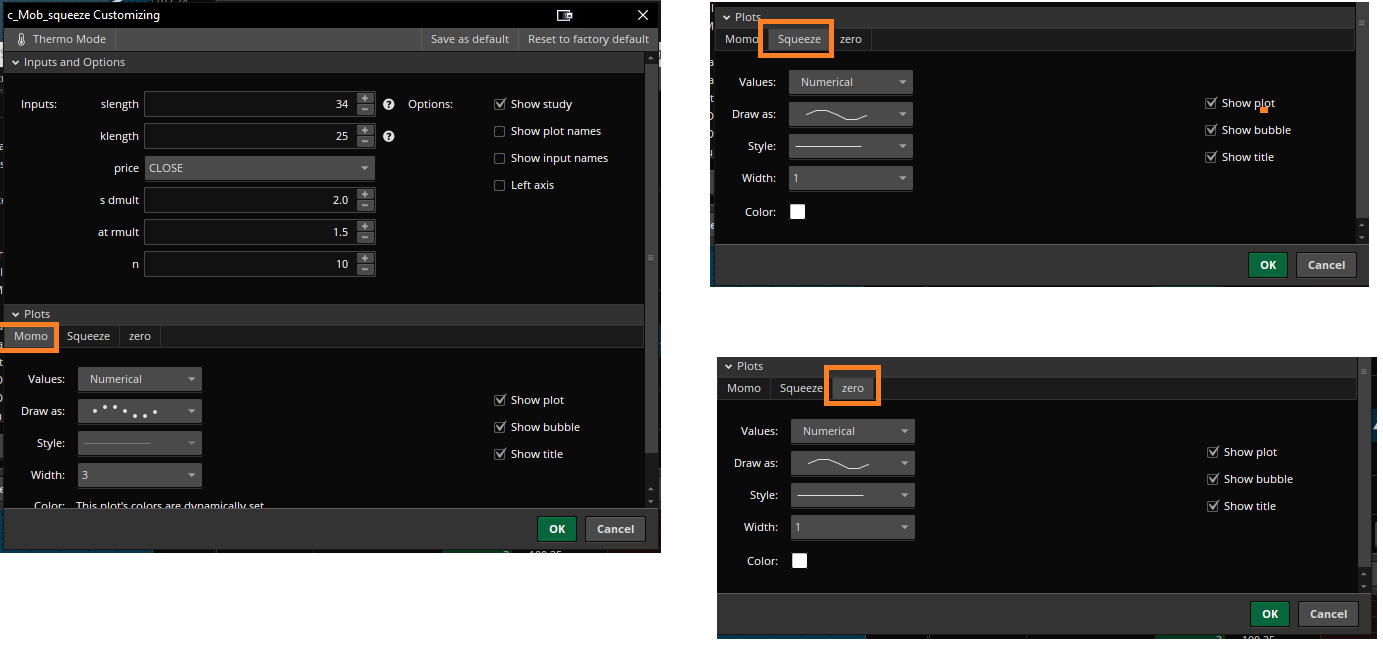

2 - c_Mob_squeeze - https://tos.mx/zMPLFHD

3 - c_reversal - https://tos.mx/3Y4SzHA

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Group 1 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

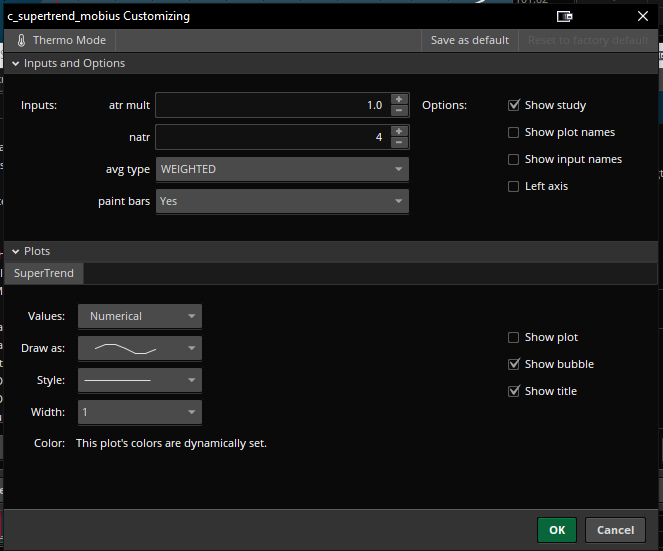

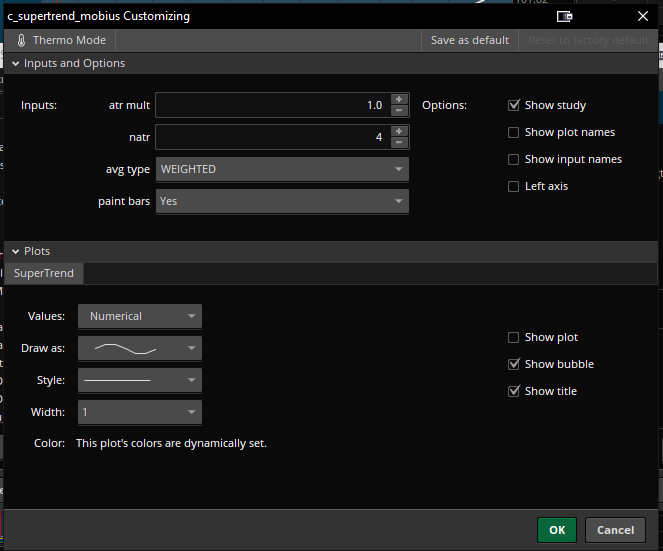

1 - c_supertrend_mobius

2 - VWAP

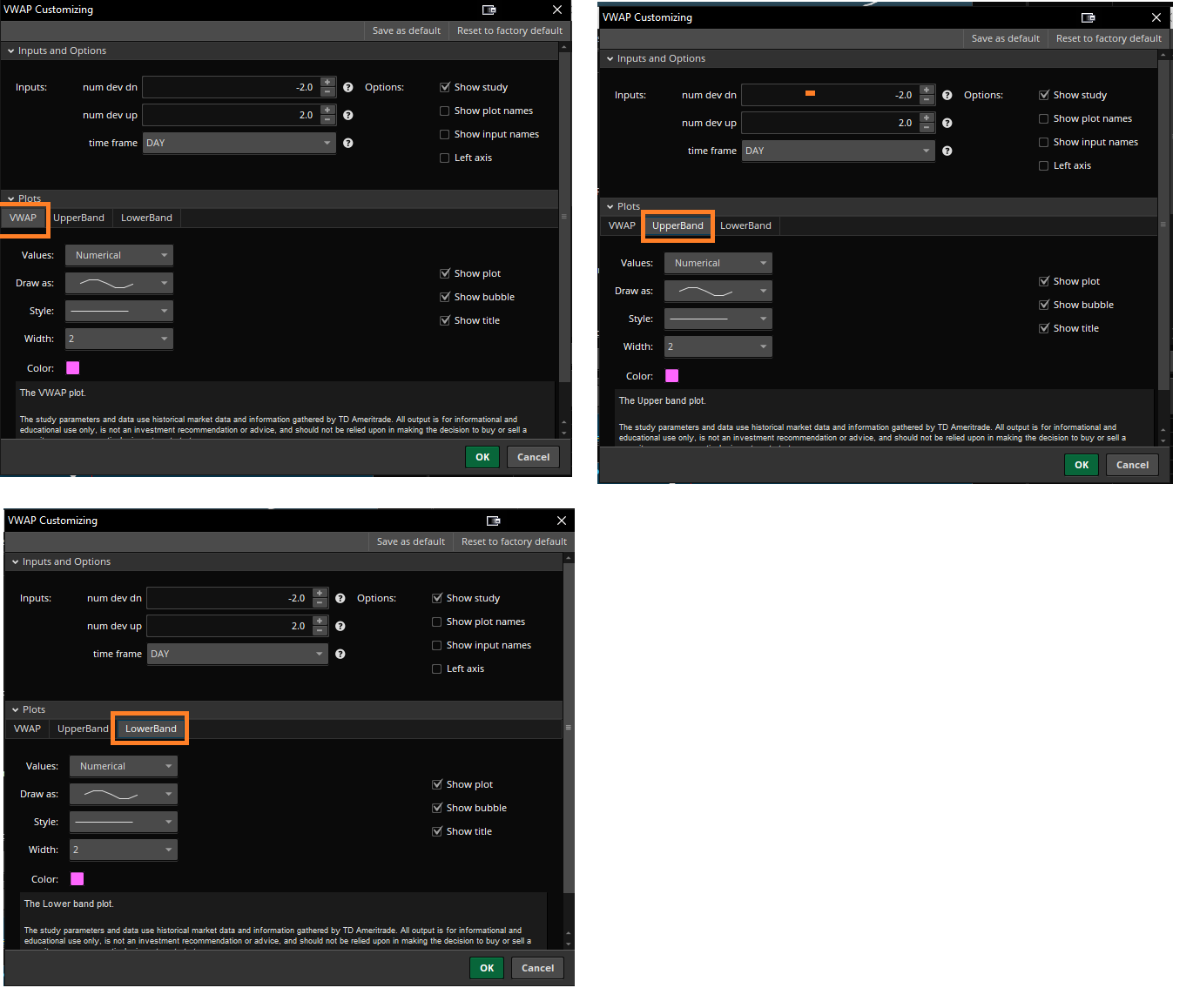

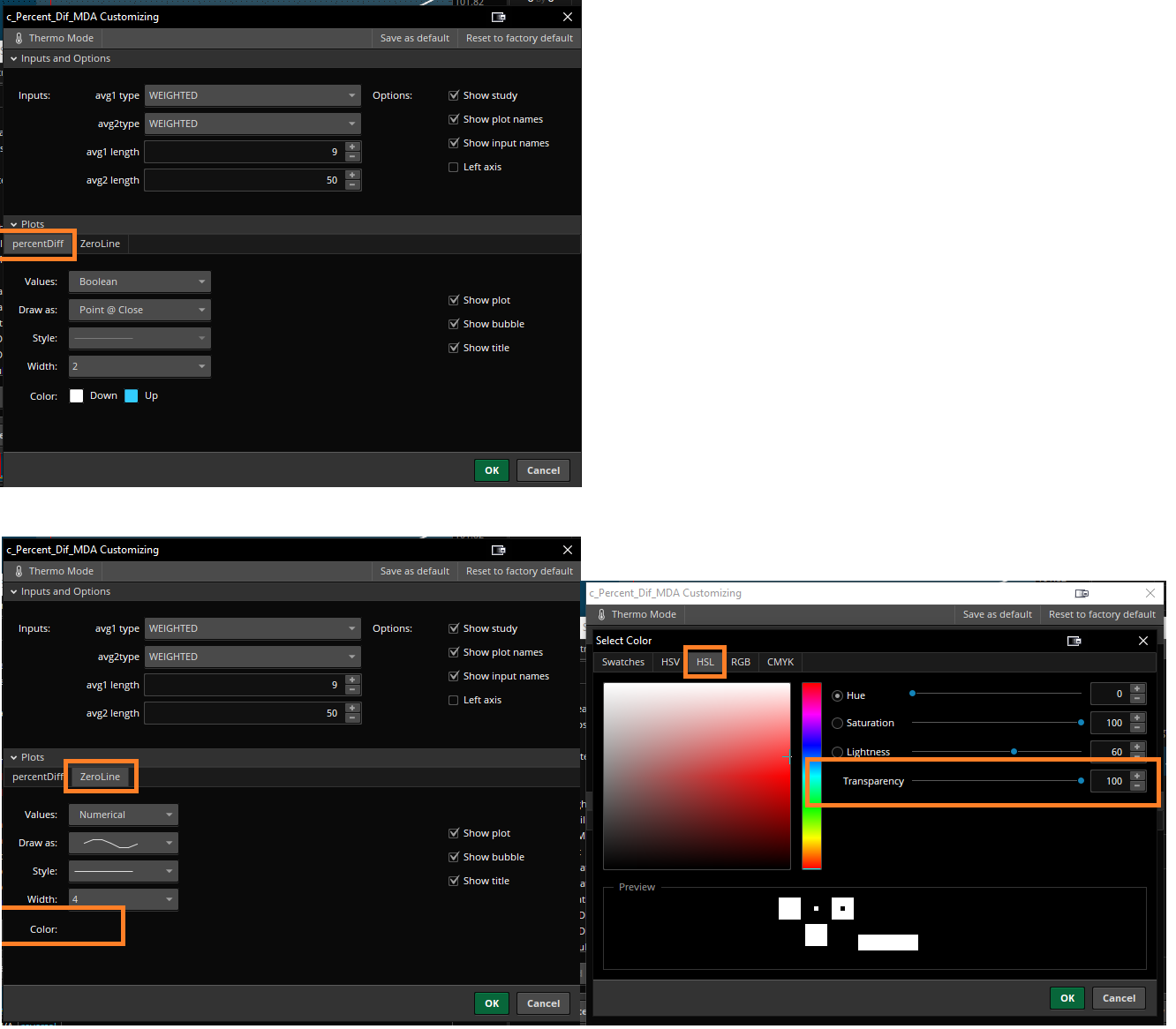

3 - c_Percent_Dif_MDA

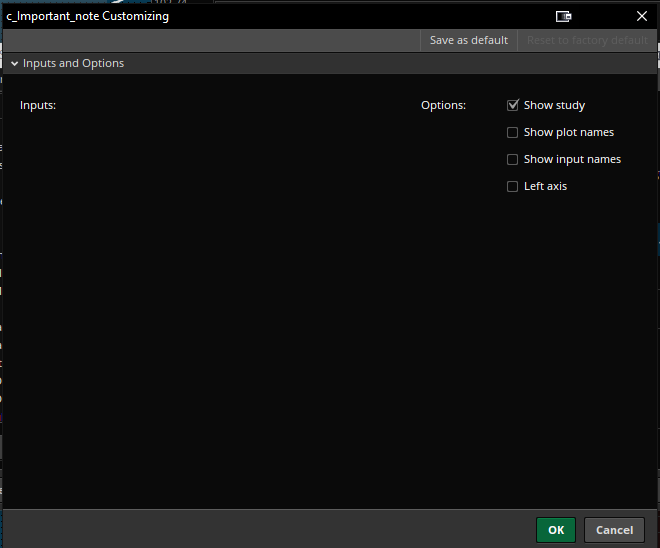

4 - c_important_note

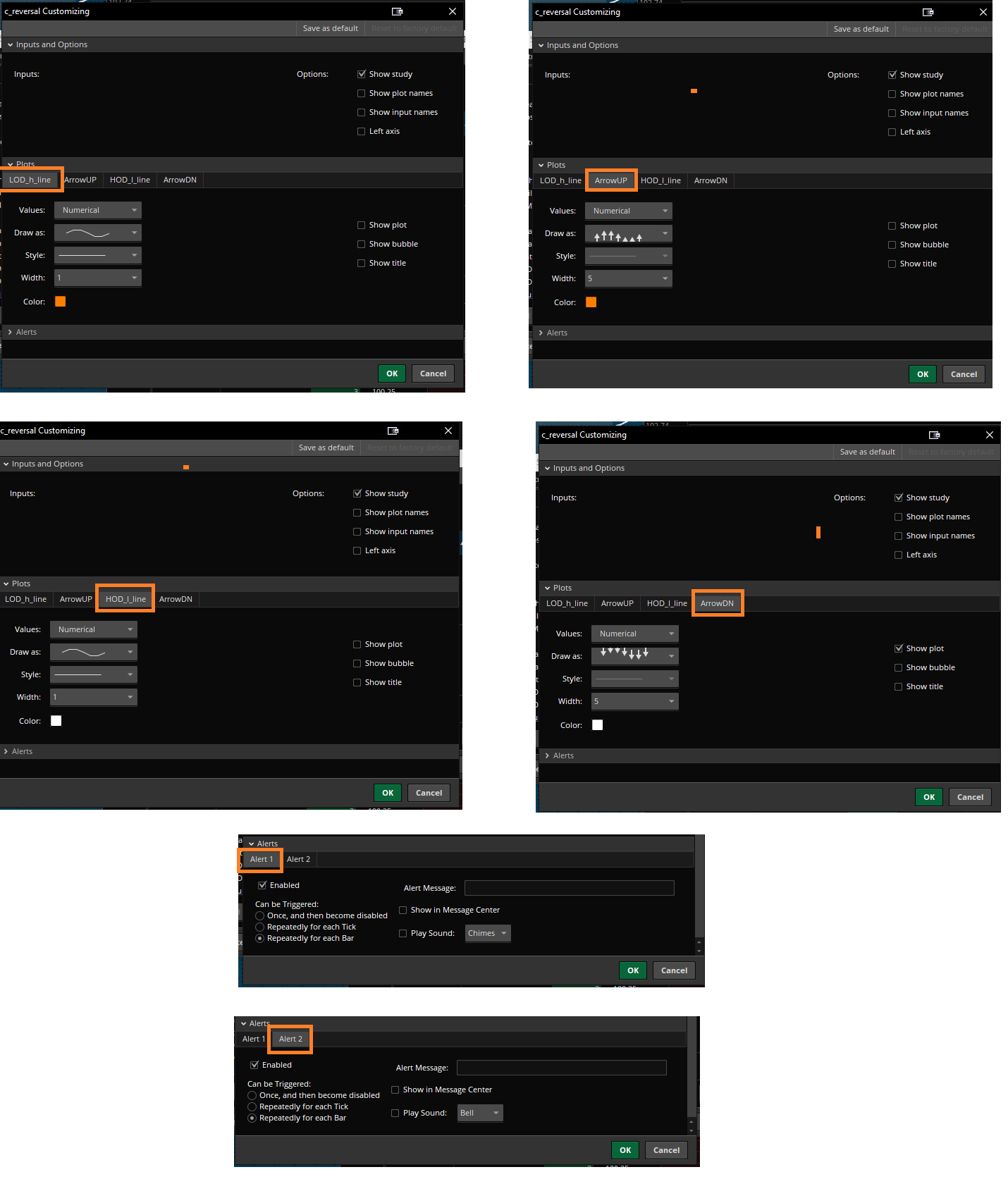

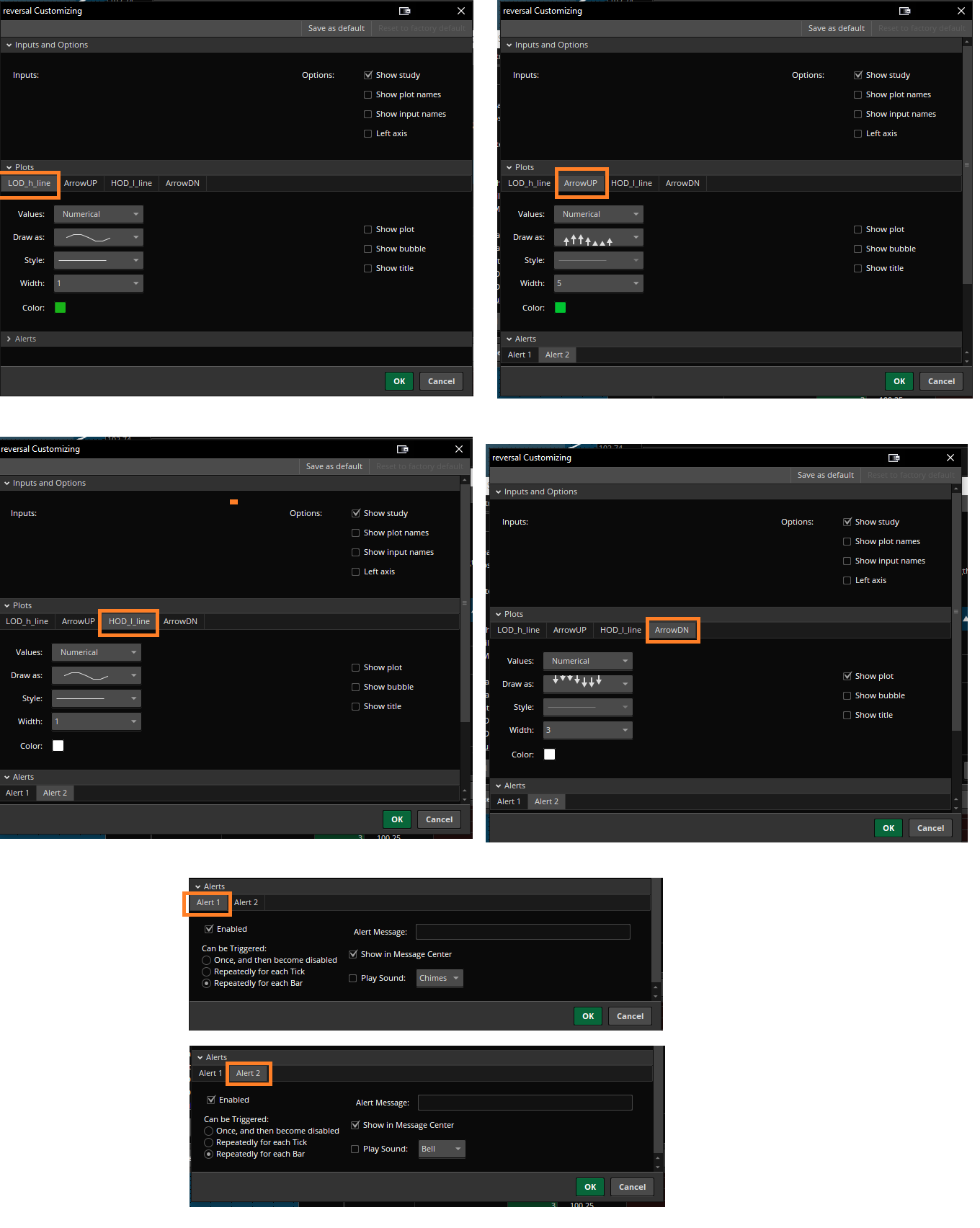

5 - reversal

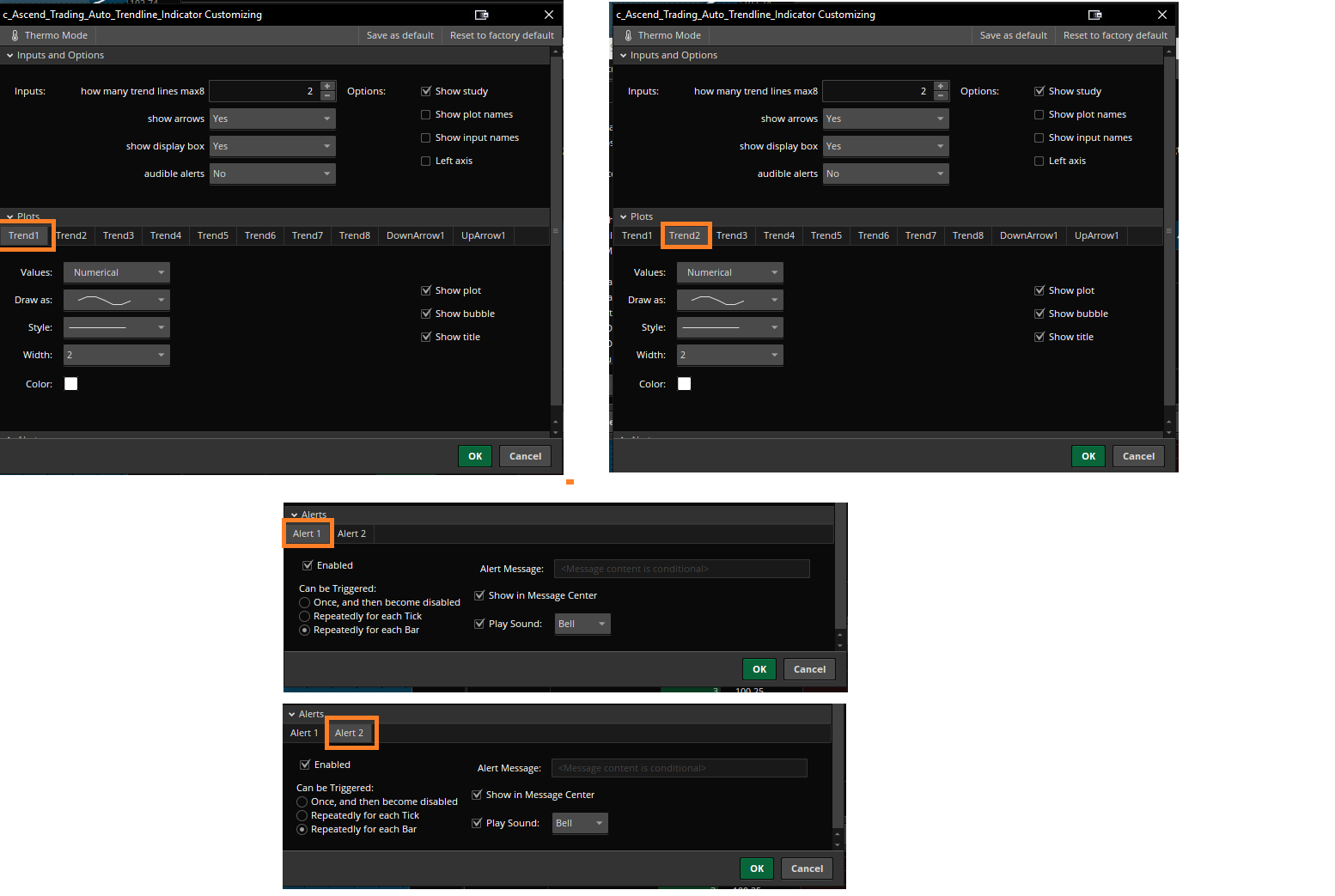

6 - c_ascend_trading_auto_trendline_indicator

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Group 2 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

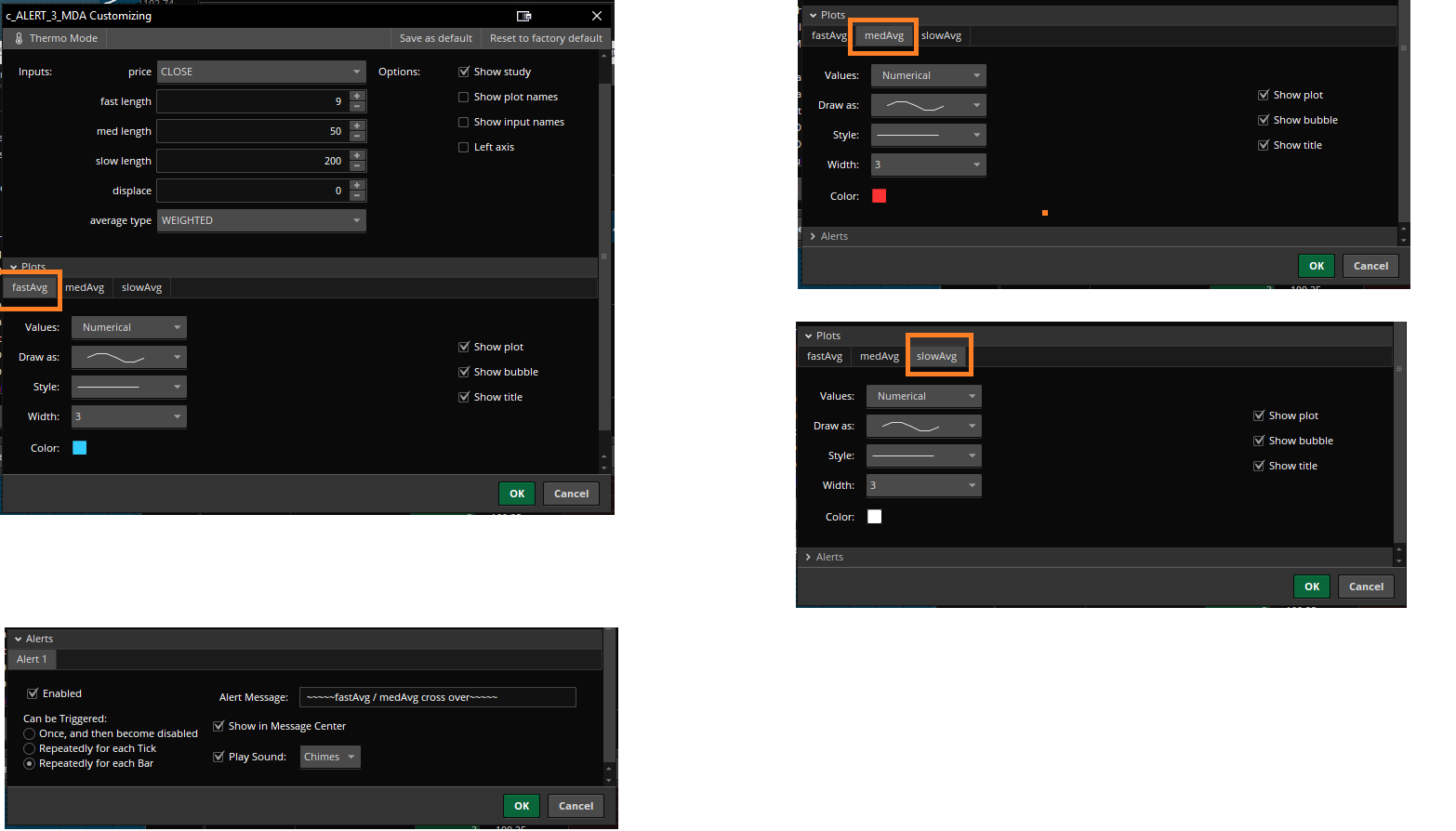

1 - c_ALERT_3_MDA

2 - RSI

3 - c_reversal

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Group 3 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

1 - c_Percent_Dif_MDA

2 - c_mobius_supertrend_volume_waves_final

3 - c_reversal

----------------------------------------------------------------------------------------------------------------------------------------------------------------

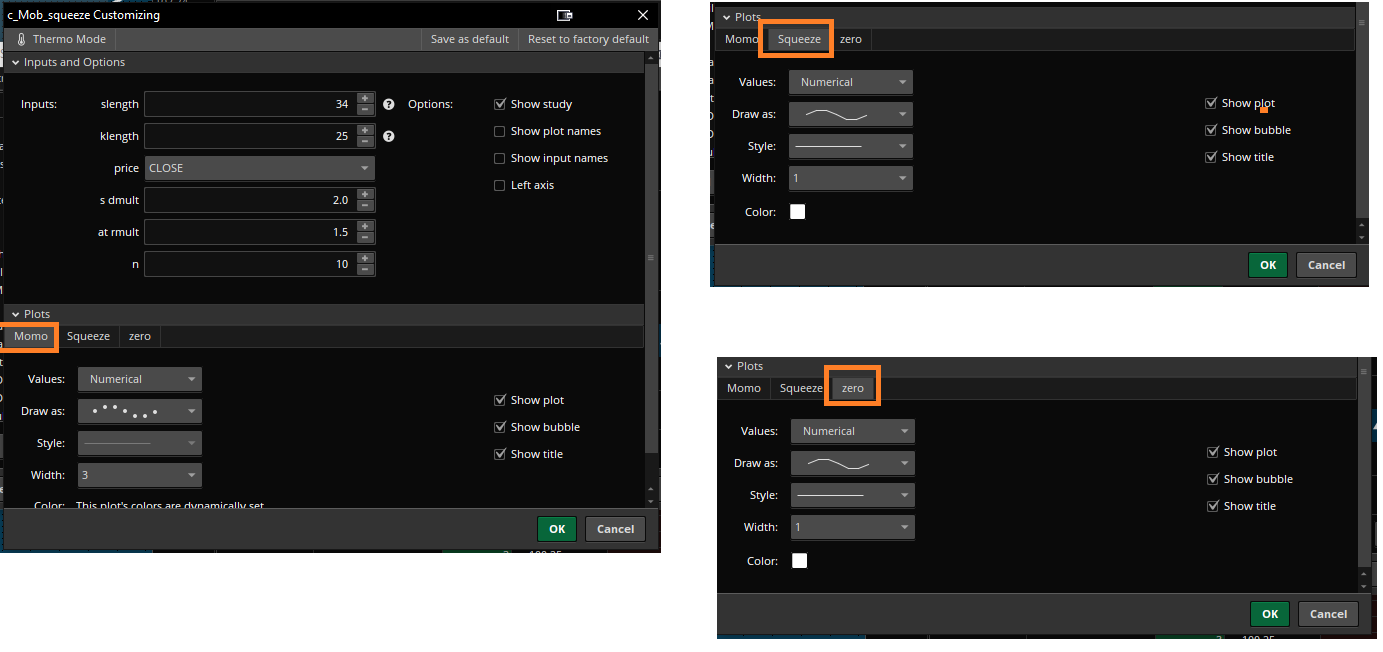

Group 4 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

1 - c_Percent_Dif_MDA

2 - c_mob_squeeze

3 - c_reversal

- I labeled the chart areas with numbers to help people keep track.

- Just in case.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

First group

1 - c_supertrend_mobius - https://tos.mx/eGwb7vP

2 - VWAP

3 - c_Percent_Dif_MDA - https://tos.mx/q2A5p35

4 - c_Important_note - https://tos.mx/xTInacu

5 - c_reversal - https://tos.mx/3Y4SzHA

6 - c_Ascend_Trading_Auto_Trendline_Indicator - https://tos.mx/lU9ScxX

------------------------------------------------------------------

Second Group

1 - c_ALERT_3_MDA - http://tos.mx/CvUS2FC

2 - RSI

3 - c_reversal - https://tos.mx/3Y4SzHA

---------------------------------------------------

Third Group

1 - c_Percent_Dif_MDA - https://tos.mx/q2A5p35

2 - c_Mob_squeeze - https://tos.mx/OPZGsuu

3 - c_reversal - https://tos.mx/3Y4SzHA

---------------------------------------

Fourth Group

1 - c_Percent_Dif_MDA - https://tos.mx/q2A5p35

2 - c_Mob_squeeze - https://tos.mx/zMPLFHD

3 - c_reversal - https://tos.mx/3Y4SzHA

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Group 1 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

1 - c_supertrend_mobius

2 - VWAP

3 - c_Percent_Dif_MDA

4 - c_important_note

5 - reversal

6 - c_ascend_trading_auto_trendline_indicator

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Group 2 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

1 - c_ALERT_3_MDA

2 - RSI

3 - c_reversal

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Group 3 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

1 - c_Percent_Dif_MDA

2 - c_mobius_supertrend_volume_waves_final

3 - c_reversal

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Group 4 - Screen shots in one whole group -listed by the order they're on my study set -

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Screenshots of individual studies - listed by the order they're in my study set.

1 - c_Percent_Dif_MDA

2 - c_mob_squeeze

3 - c_reversal

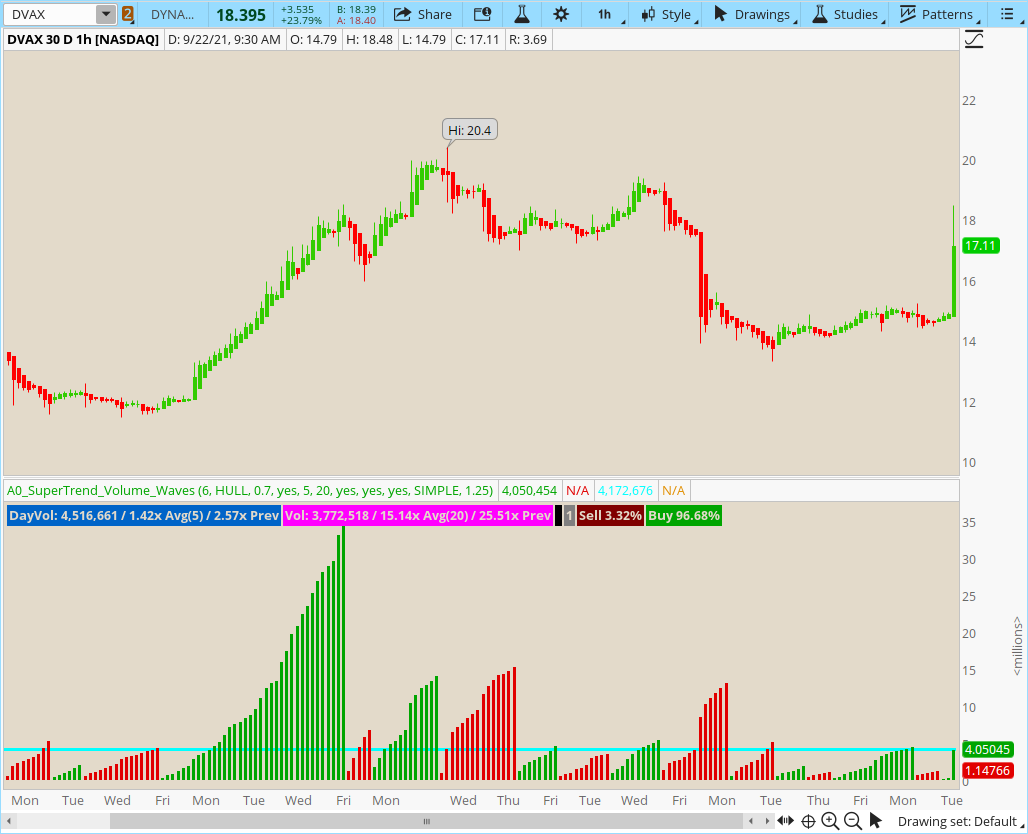

Wow. Much appreciate you sharing your setup. What is your bottom settings for the Mobius SuperTrend Volume Waves? Do you have any custom codes in that indcator?

Wow. Much appreciate you sharing your setup. What is your bottom settings for the Mobius SuperTrend Volume Waves? Do you have any custom codes in that indcator?

Does anyone know how to interpret the volume waves? I am not able to figure out what they are showing and how to interpret the waves? Thanks in advance.

indeed, it would be very helpful if we could set an alert to sound off once each time the histogram changes color (either from green to red or vice versa).@MerryDay thanks for your help.

Does anyone have any idea how to add an alert whenever the wave changes color in either direction? Thanks.

Alert(w1 and w2[1], “Buy Alert”, Alert.BAR, Sound.Ring);

Alert(w2 and w1[1], “Sell Alert”, Alert.BAR, Sound.Ring);Hi, can you explain the blue line thru the volumes in the indicator, is it 50% of the last 20 days?Mobius Supertrend Volume Waves PLUS Welkin Volume Labels

Volume Waves present a simple visual picture. But I find I still want my volume statistics. So I added Welkin's Volume Statistics

Ruby:# Mobius Supertrend Volume Waves PLUS Welkin Volume Labels # V01.2020 # Plots Volume Waves based on trend. declare lower; input n = 6; input AvgType = AverageType.HULL; input ATRmult = .7; def h = high; def l = low; def c = close; def v = volume; DefineGlobalColor("Ascending", CreateColor(0, 165, 0)); DefineGlobalColor("descending", CreateColor(225, 0, 0)); DefineGlobalColor("avg", Color.CYAN); def ATR = MovingAverage(AvgType, TrueRange(h, c, l), n); def DN = HL2 + (AtrMult * ATR); def UP = HL2 + (-AtrMult * ATR); def cond = if c < cond[1] then DN else UP; def accumulation = cond == UP; def distribution = cond == DN; def w1 = if accumulation and !accumulation[1] then v else if accumulation then w1[1] + v else Double.NaN; def w2 = if distribution and !distribution[1] then v else if distribution then w2[1] + v else Double.NaN; plot waves1 = w1; waves1.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); waves1.SetDefaultColor(GlobalColor("Ascending")); waves1.SetLineWeight(5); plot waves2 = w2; waves2.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); waves2.SetDefaultColor(GlobalColor("Descending")); waves2.SetLineWeight(5); def SD = StDevAll(v); plot avg = (HighestAll(w1/2)+highestAll(w2/2))/n ; avg.SetDefaultColor(GlobalColor("avg")); avg.SetLineWeight(3); # End Code #Advanced Volume Study #[email protected] #v5.22.2020 input AvgDayVolLength = 5; input AvgVolLength = 20; input ShowDayVolLabel = yes; input ShowBarVolLabel = yes; input ShowBuySellStrength = yes; input VolAverageType = AverageType.SIMPLE; input RelativetoPrevVolTolerance = 1.25; #if volume is 1.25x greater than previous bar it will paint even if it is still below the average/sigma2/sigma3 def NA = Double.NaN; def PriceRange = high - low; def TopShadowRange = if open >= close then high - open else high - close; def BottomShadowRange = if open <= close then open - low else close - low; def BodyRange = PriceRange - (TopShadowRange + BottomShadowRange); def VolumeTopShadowValue = (1 - (TopShadowRange / PriceRange)) * volume; def VolumeBottomShadowValue = ((BottomShadowRange / PriceRange) * volume); def BodyRangeVolValue = ((BodyRange + BottomShadowRange) / PriceRange) * volume; def DayVolAgg = if GetAggregationPeriod() < AggregationPeriod.DAY then AggregationPeriod.DAY else GetAggregationPeriod(); def DayVol = volume("period" = DayVolAgg); def AvgDayVol = Average(DayVol, AvgDayVolLength); def Start = 0930; def End = 1600; def conf = SecondsFromTime(Start) >= 0 and SecondsFromTime(End) <= 0; plot VolColor = NA; VolColor.DefineColor("Bullish", Color.GREEN); VolColor.DefineColor("Bearish", Color.RED); VolColor.DefineColor("VolAvg", CreateColor(0, 100, 200)); VolColor.DefineColor("VolSigma2", Color.DARK_ORANGE); VolColor.DefineColor("VolSigma3", Color.MAGENTA); VolColor.DefineColor("Relative to Prev", Color.YELLOW); VolColor.DefineColor("Below Average", Color.GRAY); #Current Candle Buy and Sell Strength def BuyStr = ((close - low) / PriceRange) * 100; def SellStr = ((high - close) / PriceRange) * 100; def BuyVol = (BuyStr / 100) * volume; def SellVol = (SellStr / 100) * volume; def Vol = volume; def VolAvg = MovingAverage(VolAverageType, volume, AvgVolLength); #2Sigma and 3Sigma Vol Filter def Num_Dev1 = 2.0; def Num_Dev2 = 3.0; def averageType = AverageType.SIMPLE; def sDev = StDev(data = Vol, length = AvgVolLength); def VolSigma2 = VolAvg + Num_Dev1 * sDev; def VolSigma3 = VolAvg + Num_Dev2 * sDev; def RelDayVol = DayVol / AvgDayVol[1]; def RelPrevDayVol = DayVol / volume("period" = DayVolAgg)[1]; #Daily aggregation volume labels AddLabel(if GetAggregationPeriod() >= AggregationPeriod.DAY then 0 else if ShowDayVolLabel then 1 else 0, "DayVol: " + DayVol + " / " + Round(RelDayVol, 2) + "x Avg(" + AvgDayVolLength + ") / " + Round(RelPrevDayVol, 2) + "x Prev", if DayVol > AvgDayVol then VolColor.Color("VolAvg") else VolColor.Color("Below Average")); def RelVol = Vol / VolAvg[1]; def RelPrevVol = volume / volume[1]; #Triangle Vol Signal def VolSignal = if Vol > VolSigma3 then volume else if Vol > VolSigma2 then volume else if Vol > VolAvg then volume else if RelPrevVol >= RelativetoPrevVolTolerance then volume else NA; #current aggregation's volume labels AddLabel(ShowBarVolLabel, "Vol: " + volume + " / " + Round(RelVol, 2) + "x Avg(" + AvgVolLength + ") / " + Round(RelPrevVol, 2) + "x Prev", if Vol > VolSigma3 then VolColor.Color("VolSigma3") else if Vol > VolSigma2 then VolColor.Color("VolSigma2") else if Vol > VolAvg then VolColor.Color("VolAvg") else VolColor.Color("Below Average")); DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; #current candle Buy/Sell strength labels AddLabel(if ShowBuySellStrength then 1 else 0, " ", Color.BLACK); AddLabel(if ShowBuySellStrength then 1 else 0, "1", Color.GRAY); AddLabel(if ShowBuySellStrength then 1 else 0, "Sell " + Round(SellStr, 2) + "%", if SellStr > BuyStr then Color.RED else Color.DARK_RED); AddLabel(if ShowBuySellStrength then 1 else 0, "Buy " + Round(BuyStr, 2) + "%", if BuyStr > SellStr then GlobalColor("LabelGreen") else Color.DARK_GREEN);

He plots: the average of the HighestAll buying pressure plus the highestAll selling pressure divided by 2 over n periods to provide a visual representation of those spikes which are higher than average.Hi, can you explain the blue line thru the volumes in the indicator, is it 50% of the last 20 days?

plot avg = (HighestAll(w1/2)+highestAll(w2/2))/n ;Did you ever get a scanner? Or a work-around?Interesting study! Thanks! The Supertrend version I guess is to be used with the Supertrend indicator. Is it possible to scan for changes in the Volume Waves, when red changes to green and vice versa?

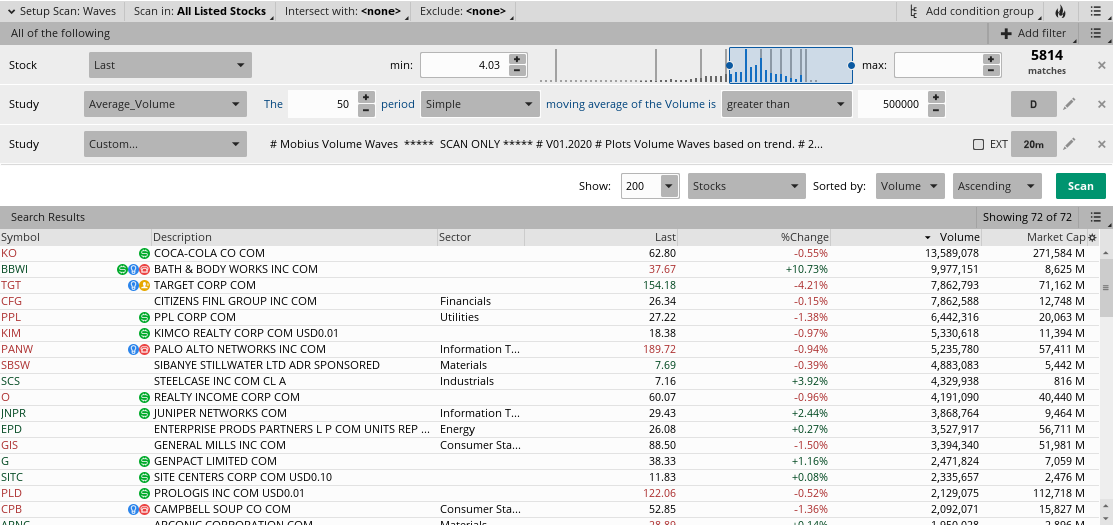

# Mobius Volume Waves ***** SCAN ONLY *****

# V01.2020

# Plots Volume Waves based on trend.

# 2.2022 modified into a scan script @merryday

input n = 6;

input AvgType = AverageType.HULL;

input ATRmult = .7;

def h = high;

def l = low;

def c = close;

def v = volume;

def ATR = MovingAverage(AvgType, TrueRange(h, c, l), n);

def DN = HL2 + (ATRmult * ATR);

def UP = HL2 + (-ATRmult * ATR);

def cond = if c < cond[1]

then DN

else UP;

def accumulation = cond == UP;

def distribution = cond == DN;

def w1 = if accumulation and !accumulation[1]

then v

else if accumulation

then w1[1] + v

else Double.NaN;

def w2 = if distribution and !distribution[1]

then v

else if distribution

then w2[1] + v

else Double.NaN;

def waves1 = w1;

def waves2 = w2;

plot Begin = IsNaN(waves2) and !IsNaN(waves2[1]) ;

plot End = isnan(waves1) and !isnan(waves1[1]) ;

# Alert

Alert(Begin, "Bull Begin", Alert.BAR, Sound.Chimes);

Alert(End, "Bear Begin", Alert.BAR, Sound.Ding);Scanner Code for Mobius Volume Waves

@Tradervic @DB01 @evilsurgeon

Here is the scanner code. I DO NOT RECOMMEND USING A SCANNER WITH THIS INDICATOR!

Due to the way the code is written all scans will be delayed a minimum of at least one bar.

Also, this uses a huge amount of resources and you will be in danger of execution time-outs.

The use of any of the dozens of buy/sell pressure scans (for example: https://usethinkscript.com/threads/...essure-indicator-labels-for-thinkorswim.8466/) would be more timely and more efficient.

With the above caveats, here is the scanner code for Mobius Volume Waves:

Ruby:# Mobius Volume Waves ***** SCAN ONLY ***** # V01.2020 # Plots Volume Waves based on trend. # 2.2022 modified into a scan script @merryday input n = 6; input AvgType = AverageType.HULL; input ATRmult = .7; def h = high; def l = low; def c = close; def v = volume; def ATR = MovingAverage(AvgType, TrueRange(h, c, l), n); def DN = HL2 + (ATRmult * ATR); def UP = HL2 + (-ATRmult * ATR); def cond = if c < cond[1] then DN else UP; def accumulation = cond == UP; def distribution = cond == DN; def w1 = if accumulation and !accumulation[1] then v else if accumulation then w1[1] + v else Double.NaN; def w2 = if distribution and !distribution[1] then v else if distribution then w2[1] + v else Double.NaN; def waves1 = w1; def waves2 = w2; plot Begin = IsNaN(waves2) and !IsNaN(waves2[1]) ; plot End = isnan(waves1) and !isnan(waves1[1]) ; # Alert Alert(Begin, "Bull Begin", Alert.BAR, Sound.Chimes); Alert(End, "Bear Begin", Alert.BAR, Sound.Ding);

Shared Scan Link: http://tos.mx/25VFtfa Click here for --> Easiest way to load shared linksDid anyone get this scan to work? If I put this study on the chart it works however if I put it in the scan it returns no symbols found. Any help would be much appreciated. I have tried to get it to work for a few hours today with no luck.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.