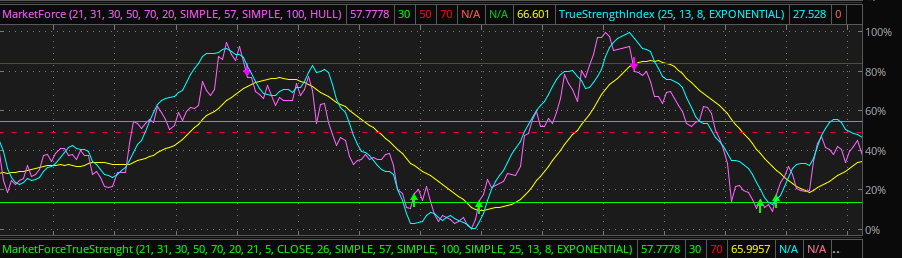

Another indicator that shows when a stock is overbought or oversold. Not sure why the original source code is no longer available. But I was able to obtain part of the description from an old copy.

This is the best indicator that measures the strength of the market and //predicts its movement.

thinkScript Code

Code:

# Market Force

# Assembled by BenTen at useThinkScript.com

# Converted from https://www.tradingview.com/script/SmMnX3ZK-forcemarket/

declare lower;

input D = 21;

input D1 = 31;

input L1 = 30;

input L2 = 50;

input L3 = 70;

def X = if (close>close[1]) then absValue(close-close[1]) else 0;

def Y = if (close<close[1]) then absValue(close-close[1]) else 0;

def X1 = highest(X, D);

def Y1 = highest(Y, D);

def W = 100 * X1 / (X1 + Y1);

def W1 = 100 * simpleMovingAvg(X, D1) / (simpleMovingAvg(X, D1) + simpleMovingAvg(Y, D1));

plot mf = W1;

plot oversold = L1;

plot middle = L2;

plot overbought = L3;

oversold.setDefaultColor(color.green);

middle.setDefaultColor(color.gray);

overbought.setDefaultColor(color.red);