Found something very cool

It is a lower indicator with Price Bar Coloring options are as follows:

SOURCE* https://indexswingtrader.blogspot.com/2013/01/guestpost-by-lar-kcpercentk.html

It is a lower indicator with Price Bar Coloring options are as follows:

| - Bright_Green | : Both Short term and Long term trends are Up, |

| - Bright_Green | : Both Short term and Long term trends are Up, |

| - Bright_Red | : Both Short term and Long term trends are Down, |

| - Light_Red | : Short term trend is Down and Long term trend is Up, |

| - Yellow | : If ChopColor is selected yes, then all Price Bars occurring during Choppiness periods per the Trend Strength Label (discussed below) will be colored. |

thinkScript Code

Code:

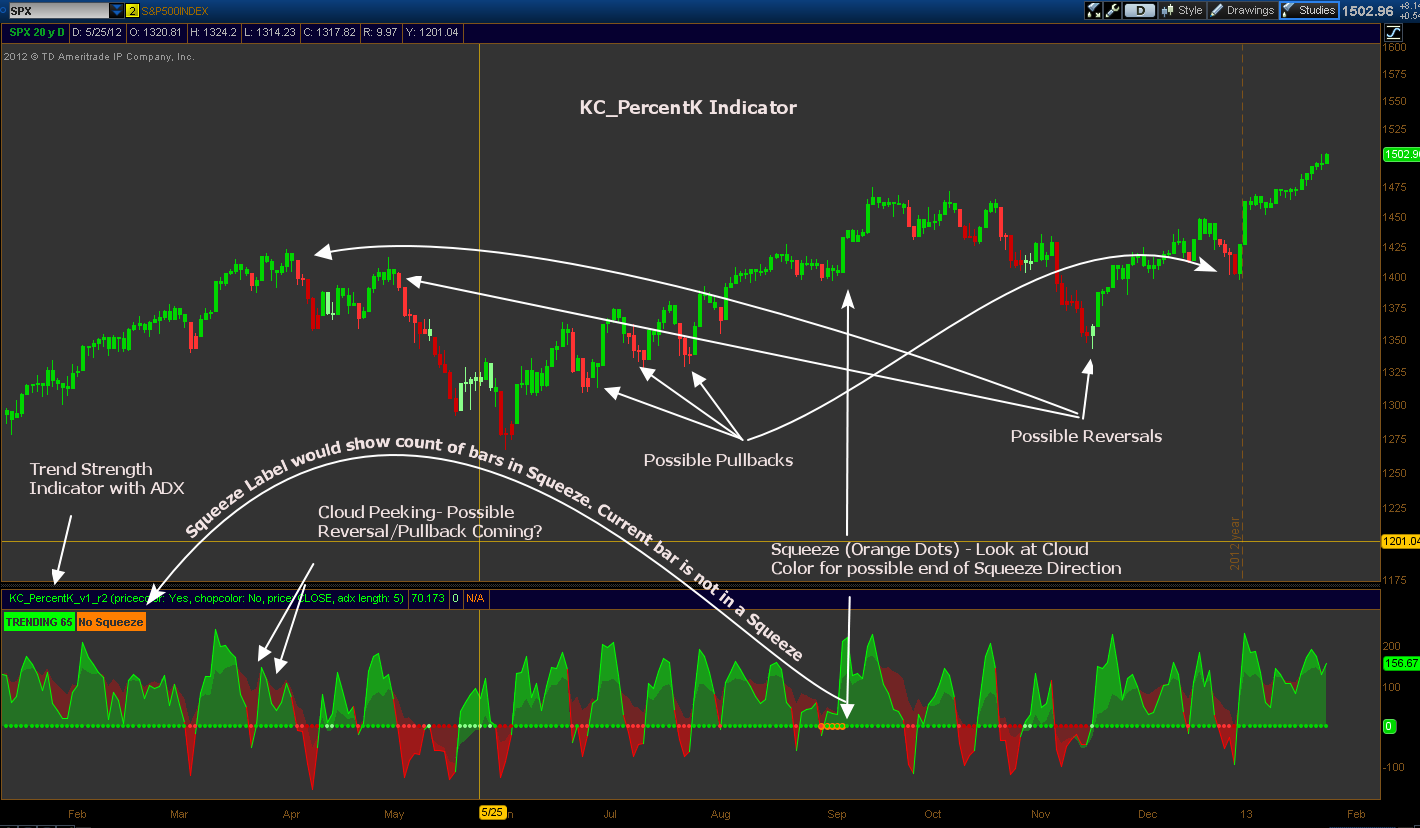

# KC_PercentK V1_R2

# KeltnerChannels set to similar BB PercentB

# Developed by Lar with assistance from TrendXplorer

# Trending and Squeeze Indicators provided by Mobius @My Trade

# Orange dots indicate squeeze.

# Orange Label indicates Squeeze status and number of consecutive bars being squeezed.

# The longer the squeeze is lasting may indicate a larger move when it ends.

#

# Green dots on zero line indicate trend direction is up.

# Red dots on zero line indicate trend is down.

#

# Cloud colors indicate short term price action green/red and long term

# dark_green/dark_red.

#

# Trend Strength label is worded Trending and color coded to be light_green (weak)

# and green (strong) for uptrends and light_red (weak) and red (strong) for downtrends.

# It is worded Choppy and color coded light_green/light_red for Choppiness.

#

# Coloring of Price bars can be selected:

# - Bright Green = Both Short term and Long term trends are Up,

# - Light Green = Short term trend is Up and Long term trends is Down,

# - Bright Red = Both Short term and Long term trends are Down,

# - Light Red = Short term trend is Down and Long term trend is Up.

# During uptrends, light red colors may indicate a pullback if light red cloud is

# shrinking or above -100 and then Green dots continue. Otherwise, a possible trend

# reversal is indicated. The opposite applies for downtrends.

#

# Coloring of Price bars for Choppiness can be selected. Yellow = Bars in Chop.

declare lower;

input pricecolor = yes;

input chopcolor = no; #Hint chopcolor: Choose yes to have Price bars colored Yellow while the trend is CHOPPY.

def price = close;

def displace = 0;

def h = high;

def l = low;

def c = close;

# Keltner Channel set similar to BollingerBands PercentB by Lar (Longer Term Trend)

def factorKCLT = 1.500;

def lengthKCLT = 20.000;

def shiftKCLT = factorKCLT * AvgTrueRange(h, c, l, lengthKCLT);

def averageKCLT = SimpleMovingAvg(price, lengthKCLT);

def AvgKCLT = averageKCLT[-displace];

def Upper_BandKCLT = averageKCLT[-displace] + shiftKCLT[-displace];

def Lower_BandKCLT = averageKCLT[-displace] - shiftKCLT[-displace];

plot PercentkLT = (price - Lower_BandKCLT) / (Upper_BandKCLT - Lower_BandKCLT) * 100;

PercentkLT.AssignValueColor(if PercentkLT > 0 then Color.GREEN else Color.RED);

PercentkLT.SetLineWeight(1);

PercentkLT.Hide();

# Keltner Channel set similar to BollingerBands PercentB by Lar (Shorter Term Trend)

def factorKCST = .500;

def lengthKCST = 6.000;

def shiftKCST = factorKCST * AvgTrueRange(h, c, l, lengthKCST);

def averageKCST = SimpleMovingAvg(price, lengthKCST);

def AvgKCST = averageKCST[-displace];

def Upper_BandKCST = averageKCST[-displace] + shiftKCST[-displace];

def Lower_BandKCST = averageKCST[-displace] - shiftKCST[-displace];

plot PercentkST = (price - Lower_BandKCST) / (Upper_BandKCST - Lower_BandKCST) * 100;

PercentkST.AssignValueColor(if PercentkST > 0 then Color.GREEN else Color.RED);

PercentkST.SetLineWeight(1);

PercentkST.HideBubble();

# Trends Defined

# Long Term Trend

rec Uptrend = if Uptrend[1] == 0 and PercentkLT >= 0 then 1 else if Uptrend[1] == 1 and PercentkLT >= 0 then 1 else 0;

rec Downtrend = if Uptrend == 0 then 1 else 0;

# Short Term Trend

rec uptrendsmall = if uptrendsmall[1] == 0 and PercentkST >= 0 then 1 else if uptrendsmall[1] == 1 and PercentkST >= 0 then 1 else 0;

rec downtrendsmall = if uptrendsmall == 0 then 1 else 0;

# Line Definitions

def ZeroLine = if !IsNaN(price) then 0 else Double.NaN;

def HalfLine = if !IsNaN(price) then 50 else Double.NaN;

def UnitLine = if !IsNaN(price) then 100 else Double.NaN;

# Clouds

AddCloud(PercentkST, ZeroLine, Color.GREEN, Color.RED);

AddCloud(PercentkST, PercentkLT, Color.GREEN, Color.RED);

# Choppiness Indicator from Mobius @My Trade with color changes by Lar

# Set ADX & SMA to how you trade

# Indicates Trending or Chop along with current ADX level

def ADXLength = 5; # TOS default 10

def SMALength = 8; # TOS default 8

def Lengthchop = 8;

def Signal = 3;

def Choppy = 61.8;

def MidLine = 50;

def Trending = 38.2;

def ADX = Round(reference ADX(length = ADXLength), 0);

def SMA = Average(price, SMALength);

def CIB = ((Log(Sum(TrueRange(h, c, l), Lengthchop) /

(Highest(if h >= c[1] then h else

c[1], Lengthchop) -

Lowest( if l <= c[1] then l else c[1], Lengthchop)))

/ Log(10)) / (Log(Lengthchop) / Log(10))) * 100;

def CI = CIB;

def Mid = MidLine;

def Trend1 = Trending;

def TrendLine = 0;

# Plot of Trends

plot trend = if uptrendsmall == 1 or downtrendsmall == 1 then TrendLine else Double.NaN;

trend.SetPaintingStrategy(PaintingStrategy.POINTS);

trend.AssignValueColor(if Uptrend == 1 and uptrendsmall == 1 then createcolor(0,214,0) else if uptrendsmall == 1 and Uptrend == 0 then createcolor(138,255,138) else if Downtrend == 1 and downtrendsmall == 1 then createcolor(204,0,0) else if downtrendsmall == 1 and Downtrend == 0 then createcolor(255,51,51) else Color.YELLOW);

trend.SetLineWeight(1);

trend.HideBubble();

# Choppiness Indicator Label

AddLabel(yes, if CI > MidLine then "CHOPPY " + ADX else "TRENDING " + ADX, if CI < Trend1 then (if uptrendsmall == 1 then Color.GREEN else Color.RED) else if CI > Trend1 and CI < MidLine then (if uptrendsmall == 1 then Color.LIGHT_GREEN else Color.LIGHT_RED) else if CI > MidLine and uptrendsmall == 1 then Color.LIGHT_GREEN else Color.LIGHT_RED);

# Squeeze by Mobius @ My Trade with color mod by Lar

# Look at Cloud Color as a possible indication of direction once squeeze ends

def nK = 1.5;

def nBB = 2.0;

def lengthsqueeze = 20;

def BBHalfWidth = StDev(price, lengthsqueeze);

def KCHalfWidth = nK * AvgTrueRange(h, c, l, lengthsqueeze);

def isSqueezed = nBB * BBHalfWidth / KCHalfWidth < 1;

# Squeeze for Longer Term Trend Indicator

plot BBS_Ind = if isSqueezed then TrendLine else Double.NaN;

BBS_Ind.SetDefaultColor(Color.DARK_ORANGE);

BBS_Ind.SetPaintingStrategy(PaintingStrategy.POINTS);

BBS_Ind.SetLineWeight(4);

BBS_Ind.HideBubble();

# Count of Periods in consecutive squeeze

rec count = if isSqueezed then count[1] + 1 else 0;

AddLabel(yes, if isSqueezed then Concat("Squeeze ", count) else "No Squeeze", Color.DARK_ORANGE);

# Paint Price Bars

assignPriceColor(if pricecolor==yes then if uptrendsmall==1 and CI > MidLine and chopcolor==yes then Color.yellow else if uptrendsmall==1 and uptrend==1 then createcolor(0,214,0) else if Uptrend==0 and Uptrendsmall==1 then createcolor(138,255,138) else if Downtrendsmall==1 and CI > MidLine and chopcolor==yes then Color.yellow else if Downtrend==1 and downtrendsmall==1 then createcolor(204,0,0) else if downtrend==0 and downtrendsmall==1 then createcolor(255,51,51) else color.current else color.current);SOURCE* https://indexswingtrader.blogspot.com/2013/01/guestpost-by-lar-kcpercentk.html

Last edited by a moderator: