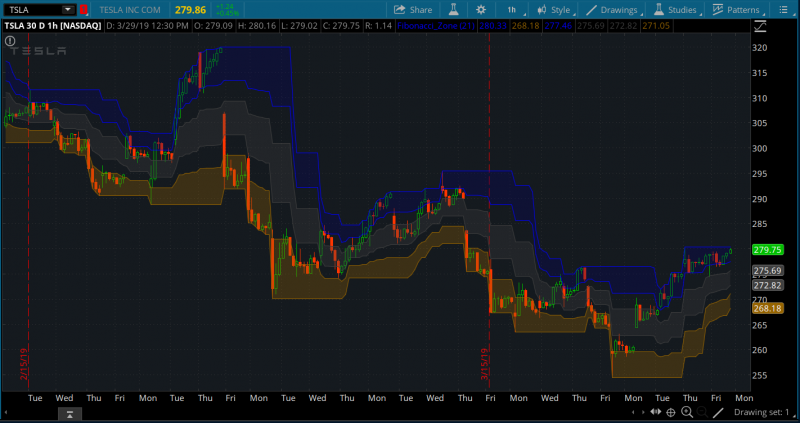

Here is the converted version of Fibonacci Zone on TradingView to ThinkorSwim. According to the developer, it was a Donchian Channel but instead of using the median line he added four Fibonacci lines.

How to read the Fibonacci Zone:

Thanks to WalkingBallista for converting the script.

How to read the Fibonacci Zone:

- Blue area is the uptrend zone

- Grey area is the ranging zone

- Orange area is the downtrend zone

- Outside of the mentioned zones is in-betweens

thinkScript Code

Rich (BB code):

# WalkingBallista

# Converted from: https://www.tradingview.com/script/FDTcR7e9-Fibonacci-Zone/

input length = 21;

plot hl = highest(high, length);

plot ll = lowest(low, length);

def range = hl-ll;

plot hf = hl-range*0.236;

plot cfh = hl-range*0.382;

plot cfl = hl-range*0.618;

plot lf = hl-range*0.764;

DefineGlobalColor("Dark_Blue", createColor(0,0,100));

DefineGlobalColor("Dark_Orange", createColor(150,100,0));

DefineGlobalColor("Dark_Gray", Color.Dark_Gray);

AddCloud(cfh,cfl,GlobalColor("Dark_Gray"));

AddCloud(hl,hf, GlobalColor("Dark_Blue"), GlobalColor("Dark_Blue"));

AddCloud(ll, lf, GlobalColor("Dark_Orange"), GlobalColor("Dark_Orange"));

cfh.setDefaultColor(Color.Dark_Gray);

cfh.setLineWeight(2);

cfl.setDefaultColor(Color.Dark_Gray);

cfl.setLineWeight(2);

hl.setDefaultColor(Color.Blue);

hl.setLineWeight(2);

hf.setDefaultColor(Color.Blue);

hf.setLineWeight(2);

ll.setDefaultColor(GlobalColor("Dark_Orange"));

ll.setLineWeight(2);

lf.setdefaultColor(GlobalColor("Dark_Orange"));

lf.setLineWeight(2);Shareable Link

https://tos.mx/apRWcvThanks to WalkingBallista for converting the script.

Last edited: