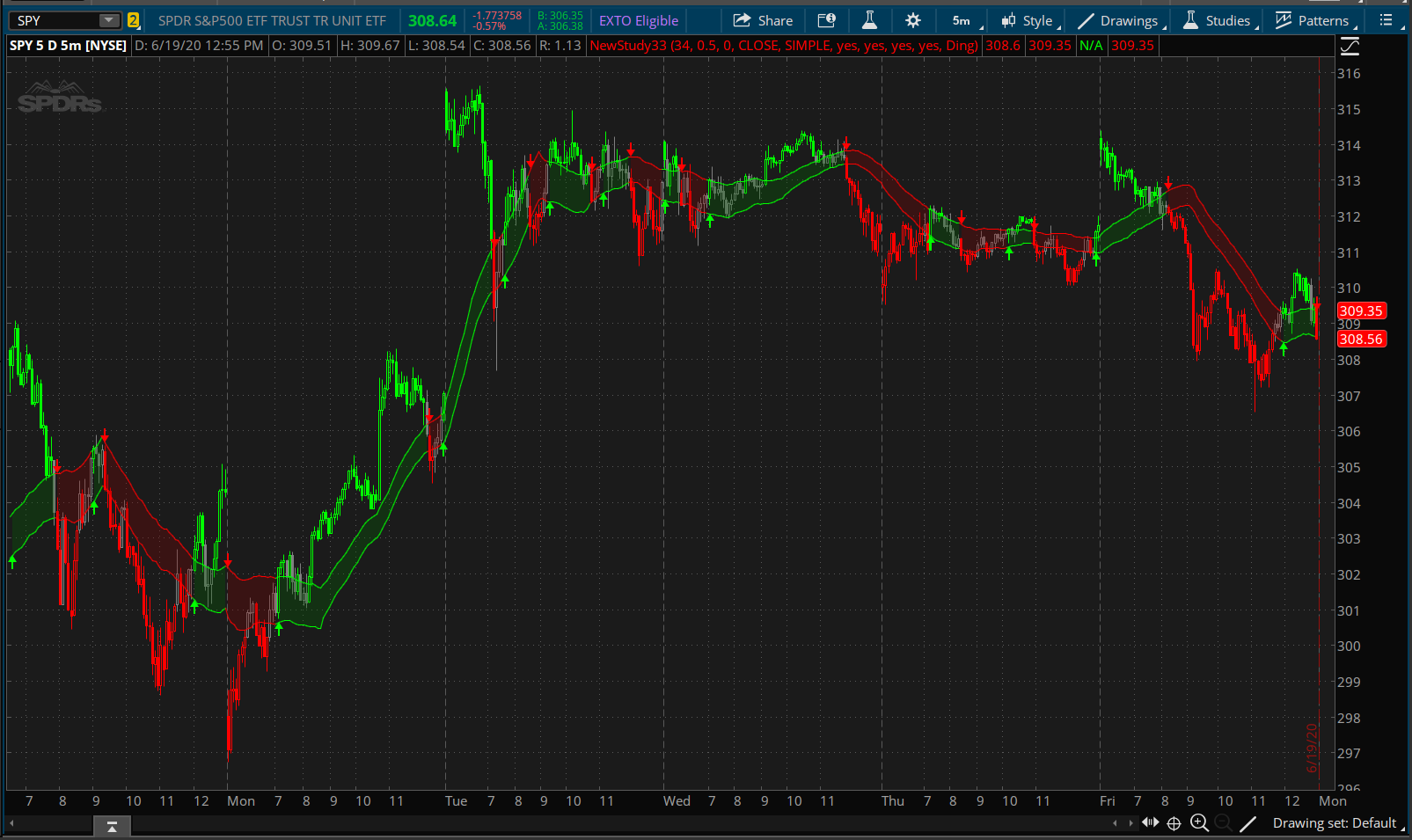

I made this indicator some time ago based on the FW_MOBO code. After doing a few changes recently, I thought I might share it here.  It is similar to Raghee Horner's GRaB indicator, but uses keltner channels instead of offset 34 EMAs. I feel it is best for showing trends in the market.

It is similar to Raghee Horner's GRaB indicator, but uses keltner channels instead of offset 34 EMAs. I feel it is best for showing trends in the market.

Code:

# MomentumKeltnerChannels

# Pensar

# 06/06/2020

# Based on the FW_MOBO code by TOS user davidinc (aka Firstwave, aka David Elliott)

# Modified code to use Keltner Channels, changed code structure.

# Added colored price and user-adjustable global colors.

#Inputs

input length = 34;

input factor = 0.5;

input displace = 0;

input price = close;

input type = AverageType.SIMPLE;

input pricecolor = yes;

input fill = yes;

input arrows = yes;

input alerts = yes;

input sound = {default "Ding", "Bell", "Chimes", "NoSound", "Ring"};

#Variables

def nan = double.nan;

def shift = factor * MovingAverage(type, TrueRange(high, close, low), length);

def avg = MovingAverage(type, price, length);

def line1 = avg[-displace] - shift[-displace];

def line2 = avg[-displace] + shift[-displace];

def Chg = if(close > line2, 1, if(close < line1, -1, 0));

def Hold = CompoundValue(1,if(Hold[1] == Chg or Chg == 0, Hold[1], if(Chg == 1, 1, -1)), 0);

def ArUp = if !arrows or Hold[0] == Hold[1] then nan else if Hold[0] == 1 then line1 else nan;

def ArDn = if !arrows or Hold[0] == Hold[1] then nan else if Hold[0] == -1 then line2 else nan;

def LBUp = if fill and Hold[0] == 1 then line2 else nan;

def UBUp = if fill and Hold[0] == 1 then line1 else nan;

def LBDn = if fill and Hold[0] == -1 then line2 else nan;

def UBDn = if fill and Hold[0] == -1 then line1 else nan;

def AlertUp = alerts and Hold[1] == 1 and (Hold[1] <> Hold[2]);

def AlertDn = alerts and Hold[1] == -1 and (Hold[1] <> Hold[2]);

#Colors

DefineGlobalColor("Cloud Up", color.dark_green);

DefineGlobalColor("Cloud Dn", color.dark_red);

DefineGlobalColor("Channel Up", color.green);

DefineGlobalColor("Channel Down", color.red);

DefineGlobalColor("Price Up", color.green);

DefineGlobalColor("Price Neutral", color.gray);

DefineGlobalColor("Price Down", color.red);

#Plots

plot UB = line1;

UB.SetLineWeight(1);

UB.AssignValueColor(if Hold[0] == 1 then GlobalColor("Channel Up")

else GlobalColor("Channel Down"));

plot LB = line2;

LB.SetLineWeight(1);

LB.AssignValueColor(if Hold[0] == 1 then GlobalColor("Channel Up")

else GlobalColor("Channel Down"));

plot BOA = ArUp;

BOA.SetPaintingStrategy(PaintingStrategy.Arrow_Up);

BOA.SetDefaultColor(color.green);

BOA.SetLineWeight(2);

plot BDA = ArDn;

BDA.SetPaintingStrategy(PaintingStrategy.Arrow_Down);

BDA.SetDefaultColor(color.red);

BDA.SetLineWeight(2);

#Clouds

AddCloud(LBUp, UBUp, GlobalColor("Cloud Up"), GlobalColor("Cloud Dn"));

AddCloud(LBDn, UBDn, GlobalColor("Cloud Dn"), GlobalColor("Cloud Up"));

#Price Color

AssignPriceColor(if pricecolor then if close > line2 then GlobalColor("Price Up")

else if close < line1 then GlobalColor("Price Down")

else GlobalColor("Price Neutral")

else color.current);

#Alerts

Alert(AlertUp, "BREAKOUT!", Alert.Bar, Sound);

Alert(AlertDn, "BREAKDOWN!", Alert.Bar, Sound);

# --- End code ---