@K_O_Trader I updated the above code with the count.That works great, is it possible to get the label with the number in it too?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Momentum Keltner Channels for ThinkorSwim

- Thread starter Pensar

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

K_O_Trader

Member

its still not giving me a count@K_O_Trader I updated the above code with the count.

K_O_Trader

Member

@K_O_Trader Thank you, got it, copying the wrong one

Thanks for the response. So I was thinking daily. I see the number displayed. Like DG is currently 99. The High is the channel is 194.52 and the low is 191.03. It would be nice to see how close it is to the channel values. Or is there another way I can pull the channel values maybe using the EMA? I take the values on the scan and often export to excel.

@PhinsUp Since this indicator is based on FW_Mobo, I think this will give you some insight into it:

MOBO (Momentum Breakout Bands) study suggests that all markets and stock prices have a period where they chop or have a noise level that is trendless.

Using settings on adjusted standard deviation bands (Bollinger Bands®), the study has momentum breakouts above the bands for positive moves and momentum breakdowns for price breaks below the bands. This works for all time periods and tick charts.

sivakumar777

New member

for the watchlist code, I added from dropdown>custom quotes>custom1 (double click) added code in the editor and set to D .. I am getting "error secondry period can not be first" .. BTW I added this column to one of my existing watchlist

@sivakumar777 The chart label code is not compatible with the watchlist column since it has a hard-coded aggregation. Take the second code from this post instead.for the watchlist code, I added from dropdown>custom quotes>custom1 (double click) added code in the editor and set to D .. I am getting "error secondry period can not be first" .. BTW I added this column to one of my existing watchlist

profitmaya

Member

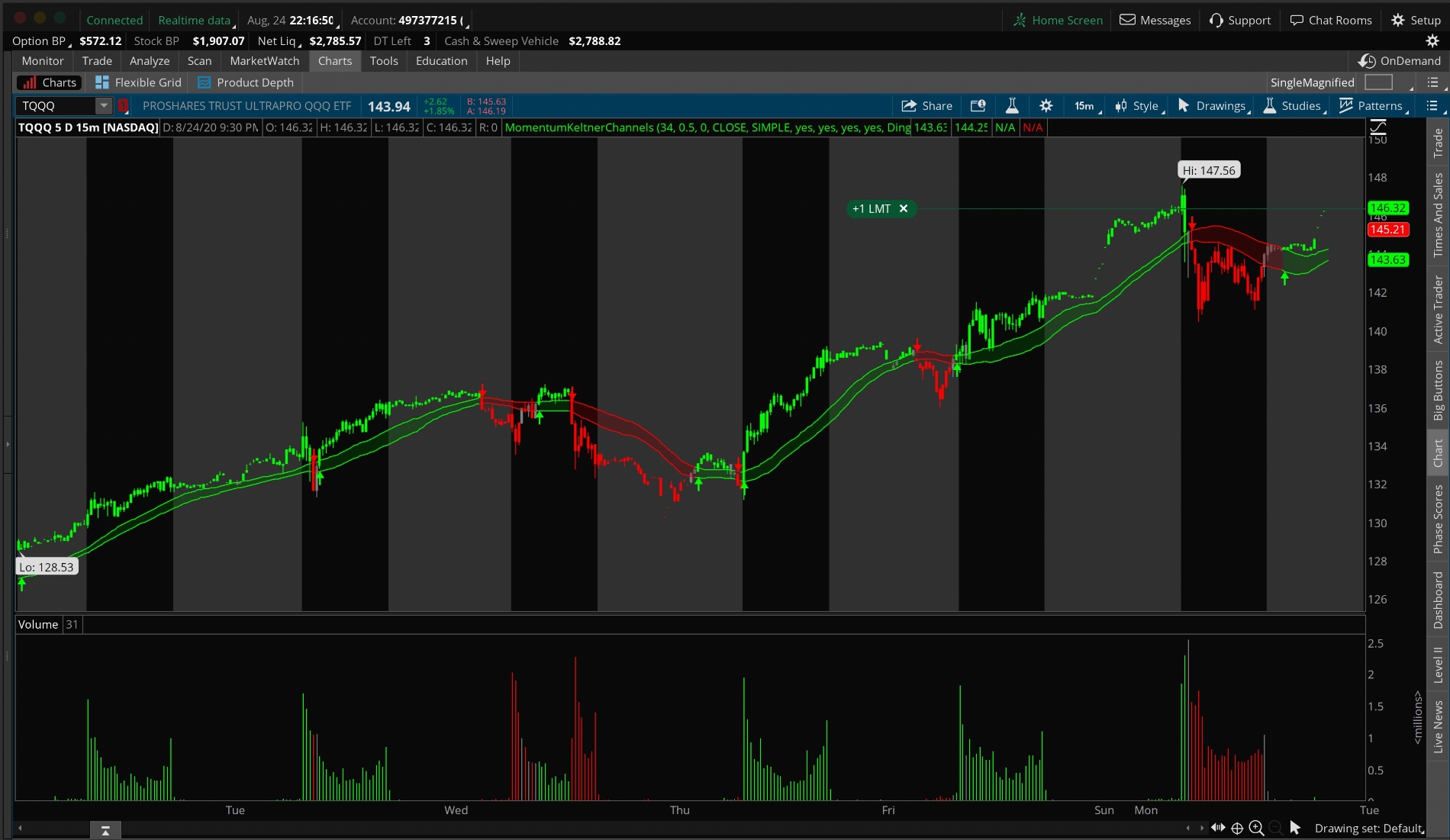

I'm not getting how to make use of this indicator. I was looking at TQQQ with this indicator as shown below, TQQQ for today is up by 1.84% and this indicator shows Red, does it mean to short or buy the put options? How this needs to be used for day trading? Can this be used for option trading?

Also, where should I put the watchlist code, can you

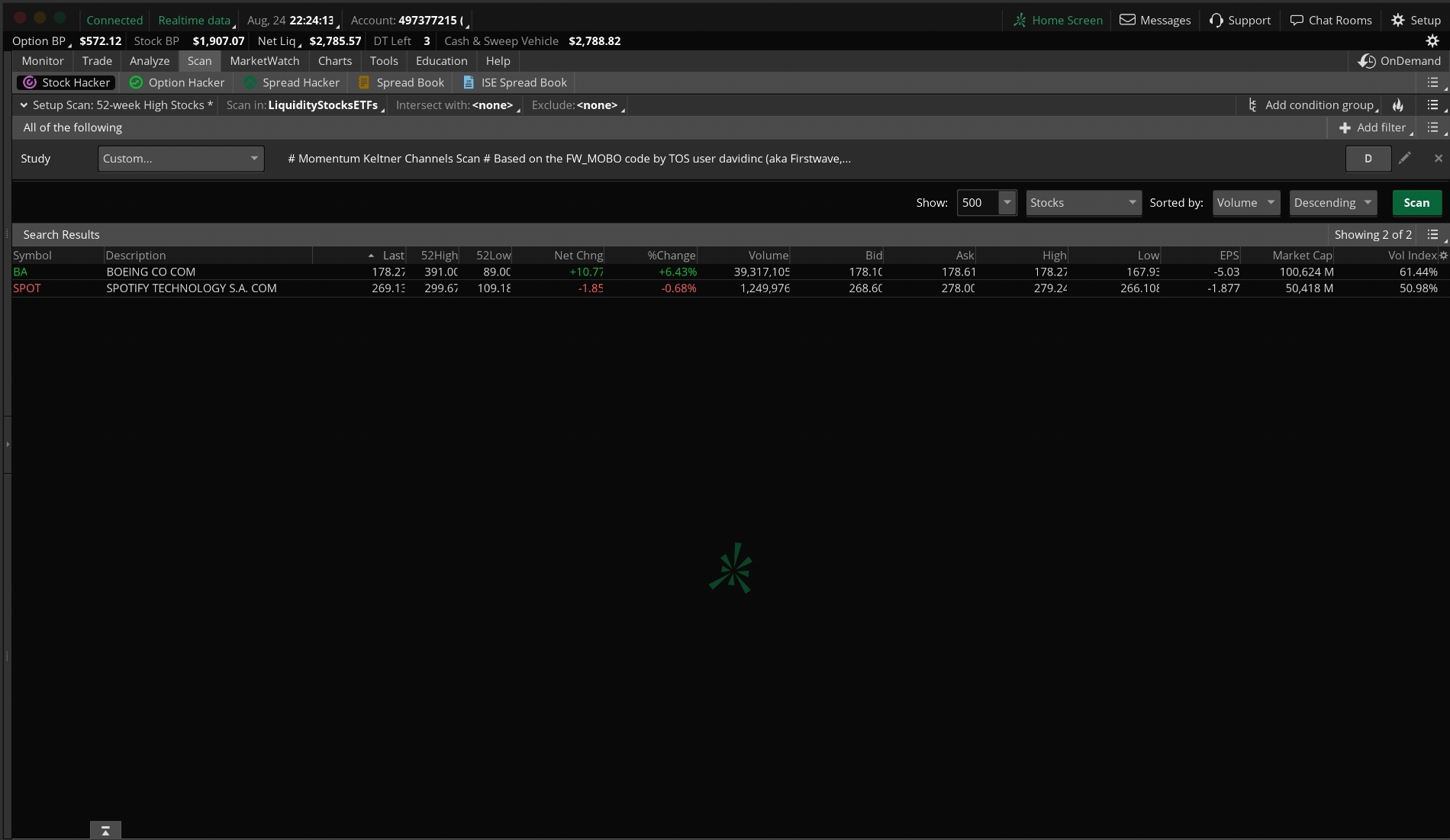

I was able to copy the scanned and got 2 stocks under my stock list but not getting why they were listed or whether to short or long on them?

It would be great if you can let me know the instructions on what do with the watchlist code or where to paste it in ToS

Also, where should I put the watchlist code, can you

I was able to copy the scanned and got 2 stocks under my stock list but not getting why they were listed or whether to short or long on them?

It would be great if you can let me know the instructions on what do with the watchlist code or where to paste it in ToS

@profitmaya The watchlist code can be found in post# 5. A tutorial for creating watchlists can be found here:

https://intercom.help/simpler-tradi...ow-to-create-a-custom-watchlist-column-in-tos

As to what to do from the results of your scan: No one indicator makes successful trades. You need to look and see if this complements your overall stock strategy.

https://intercom.help/simpler-tradi...ow-to-create-a-custom-watchlist-column-in-tos

As to what to do from the results of your scan: No one indicator makes successful trades. You need to look and see if this complements your overall stock strategy.

This study tracks like moving average crossovers however I feel it smoothes out the edges and therefore shows the overall trend somewhat better. Like @rad14733 said it is used to indicate trends so can be used successfully with any trending strategy.

Successful trending strategies look at price action along w/ support and resistance and volume and then one of the hundreds of oscillators like RSI, TMO or Stoch's to time entry and exits. One also needs to look at the overall Market Trend as it doesn't pay to buck the trend. Searching some of the other threads concerning trend indicators will elucidate how others are using them.

Search for SuperTrend, Half-Trend, Trend Magic, Trend Painter, Blue Magic to name a few.

I am a swing trader, not a scalper so trending strategies work great for longer intraday and daily aggregations.

Trend is difficult to establish in the very short aggregations but I suppose it could be used to keep you out of downtrends if you are going long and vice-a-versa.

I love this study! Thank you @Pensar for sharing it.

This is a study is not a strategy. If you search this site there are almost 700 results for moving average /trending strategies. One for everyone.

Successful trending strategies look at price action along w/ support and resistance and volume and then one of the hundreds of oscillators like RSI, TMO or Stoch's to time entry and exits. One also needs to look at the overall Market Trend as it doesn't pay to buck the trend. Searching some of the other threads concerning trend indicators will elucidate how others are using them.

Search for SuperTrend, Half-Trend, Trend Magic, Trend Painter, Blue Magic to name a few.

I am a swing trader, not a scalper so trending strategies work great for longer intraday and daily aggregations.

Trend is difficult to establish in the very short aggregations but I suppose it could be used to keep you out of downtrends if you are going long and vice-a-versa.

I love this study! Thank you @Pensar for sharing it.

This is a study is not a strategy. If you search this site there are almost 700 results for moving average /trending strategies. One for everyone.

Last edited:

@Pensar When i add it in watch list column even for breakdown state it showing as number X, but is there anyway we can define it as "-x" for breakdown & breakout "+x" value. x=number of candles or what ever your formula.

i see code with colours but for me in watch list column colour is not showing anything, did i miss any settings?

plot n = if n1 then count1 else if n2 then count2 else double.nan;

n.setdefaultcolor(color.black);

assignbackgroundcolor(if n1 and count1 then color.green else color.red);

#End of cod

For MRNA its -20 candles but its showing as 20, any fix for that?

i see code with colours but for me in watch list column colour is not showing anything, did i miss any settings?

plot n = if n1 then count1 else if n2 then count2 else double.nan;

n.setdefaultcolor(color.black);

assignbackgroundcolor(if n1 and count1 then color.green else color.red);

#End of cod

For MRNA its -20 candles but its showing as 20, any fix for that?

Last edited:

Similar threads

-

-

Momentum-based-ZigZag-incl-QQE-NON-REPAINTING for ThinkOrSwim

- Started by samer800

- Replies: 7

-

-

Free Warrior Trading Momentum Scanner for ThinkorSwim

- Started by GetRichOrDieTrying

- Replies: 17

-

A Serving of Trend and Momentum Indicators for ThinkorSwim

- Started by merryDay

- Replies: 3

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1536

Online

Similar threads

-

-

Momentum-based-ZigZag-incl-QQE-NON-REPAINTING for ThinkOrSwim

- Started by samer800

- Replies: 7

-

-

Free Warrior Trading Momentum Scanner for ThinkorSwim

- Started by GetRichOrDieTrying

- Replies: 17

-

A Serving of Trend and Momentum Indicators for ThinkorSwim

- Started by merryDay

- Replies: 3

Similar threads

-

-

Momentum-based-ZigZag-incl-QQE-NON-REPAINTING for ThinkOrSwim

- Started by samer800

- Replies: 7

-

-

Free Warrior Trading Momentum Scanner for ThinkorSwim

- Started by GetRichOrDieTrying

- Replies: 17

-

A Serving of Trend and Momentum Indicators for ThinkorSwim

- Started by merryDay

- Replies: 3

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.