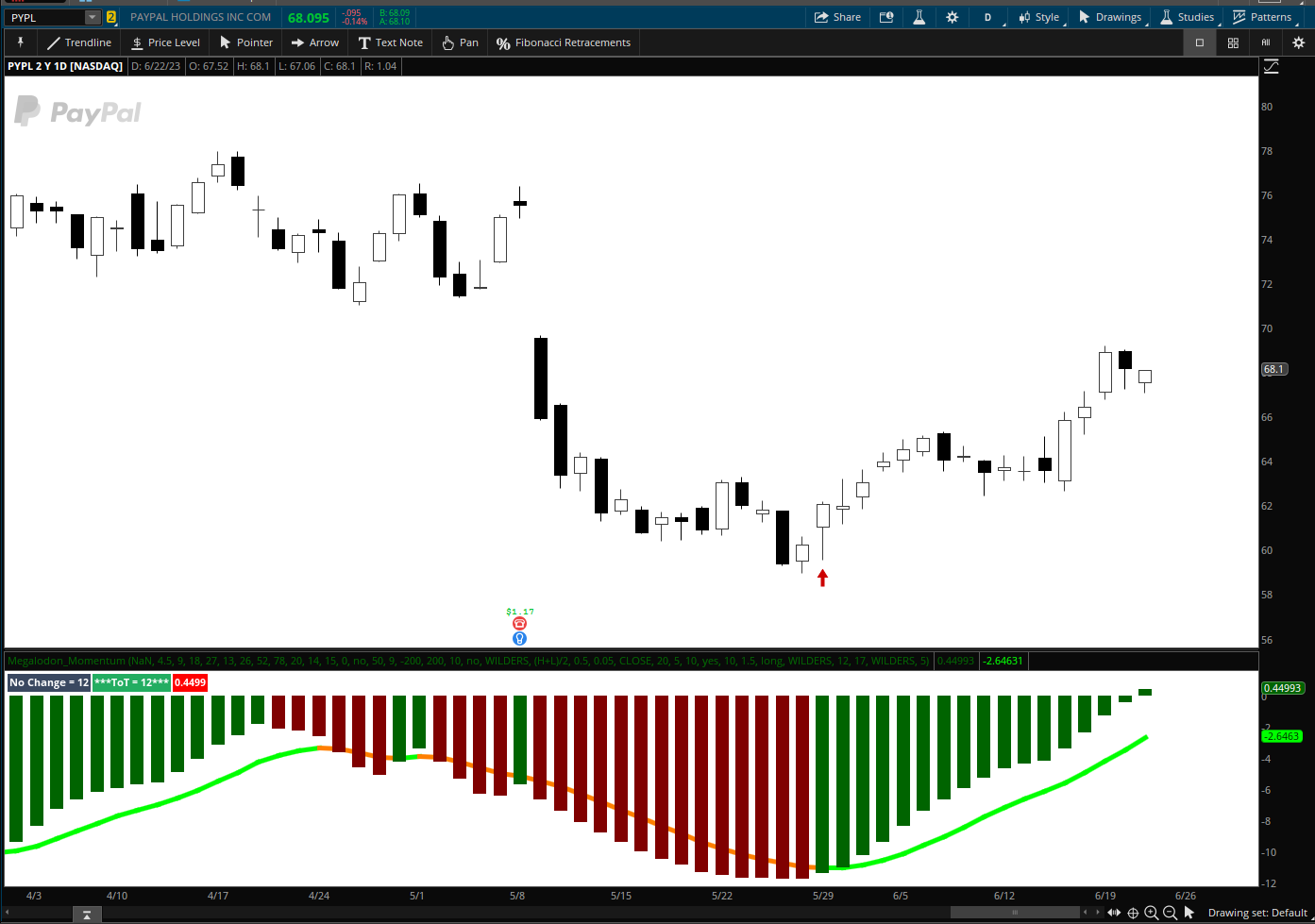

RedToGreen

Active member

Edit: code Updated 6-27-23

Edit for name change.

"The Phoenix" was partially born from @Christopher84 and his Study, Confirmation candles.

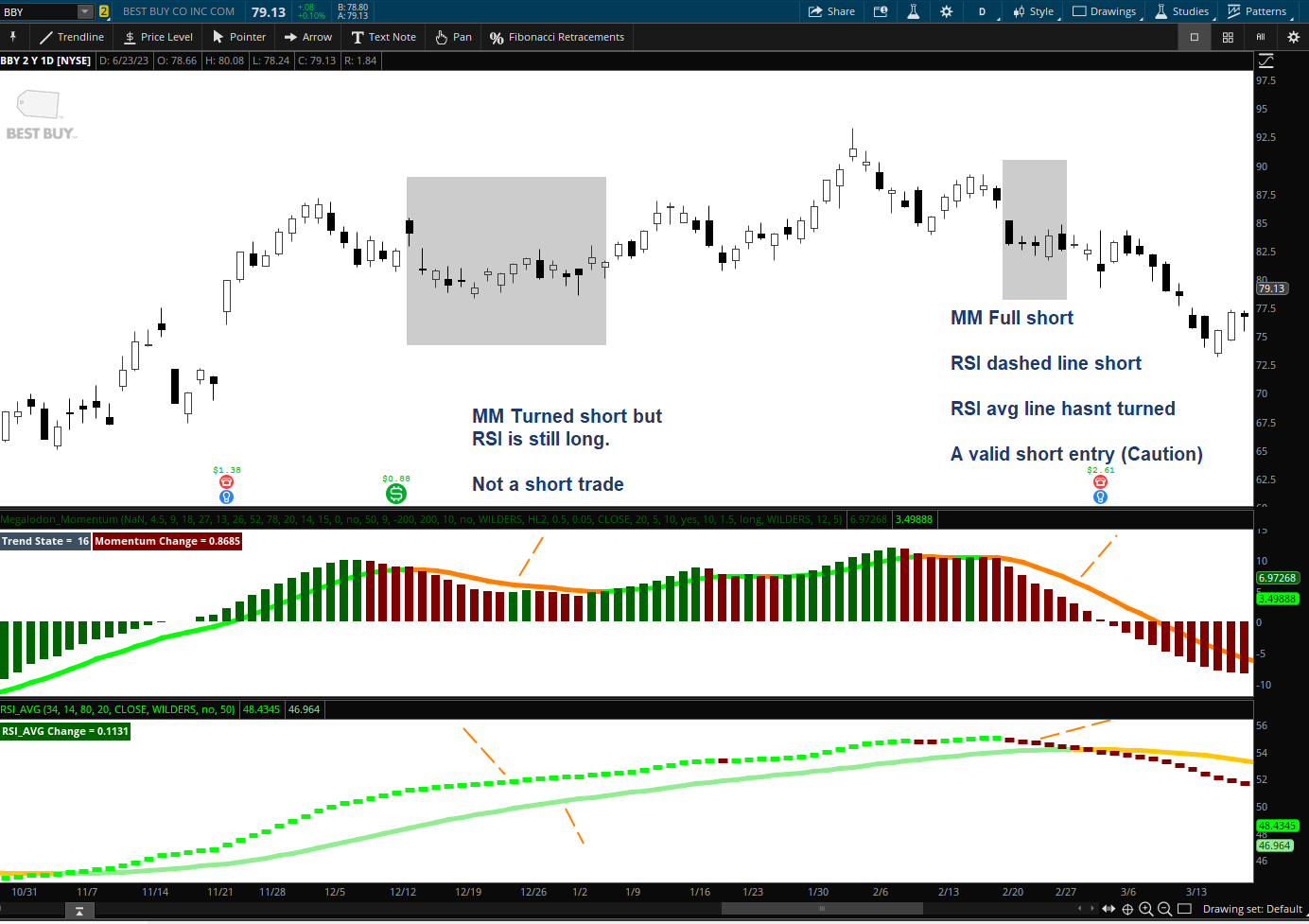

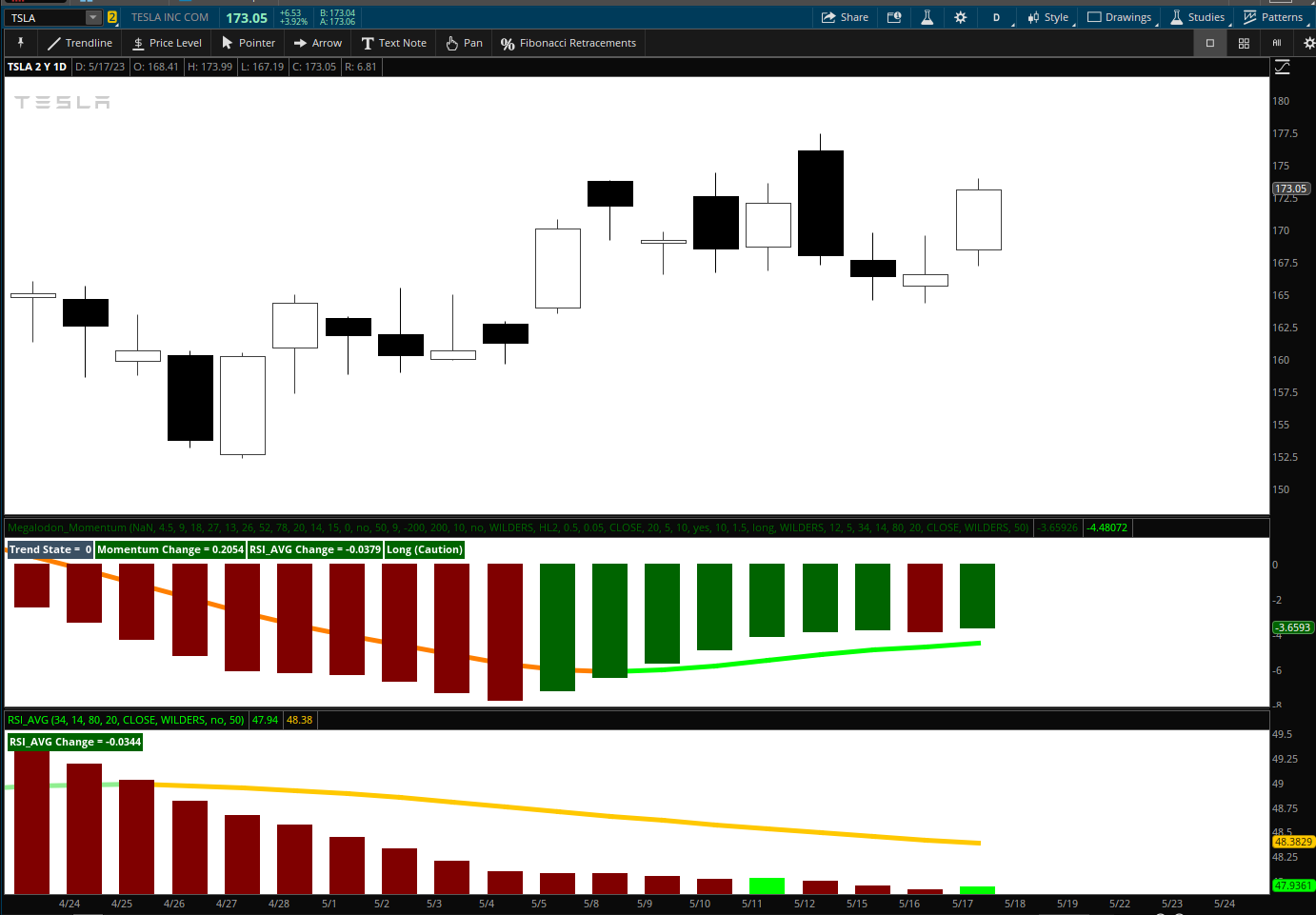

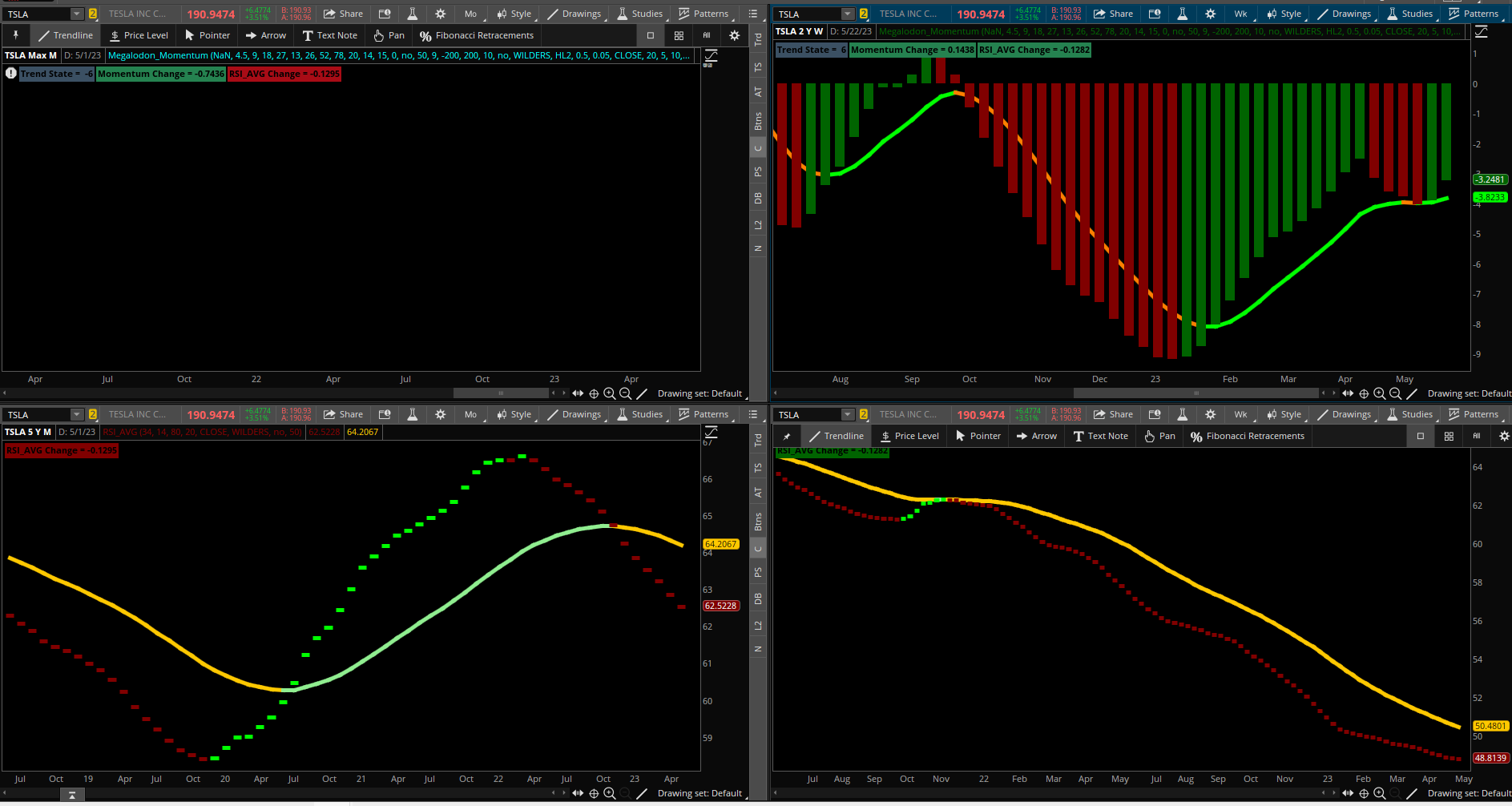

This uses some other study's than CC and is measuring the Average of Momentum (Consensus) Whereas "Consensus" can be quite low but a valid long entry may setup

This is by no means finished, though I am satisfied in it's current state.

WL columns are needed.

Let me know what you think - I'm open to any suggestions

Enjoy

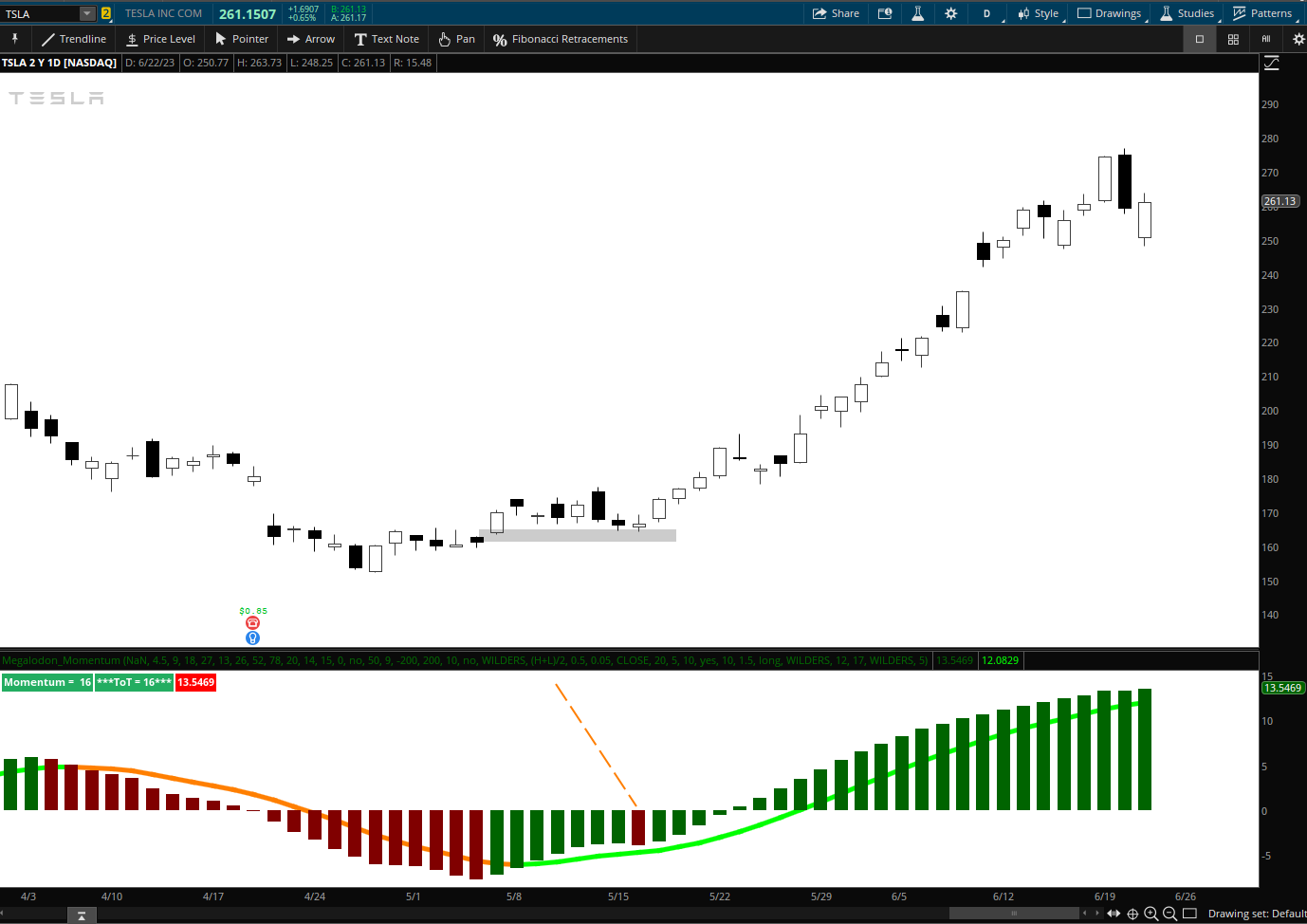

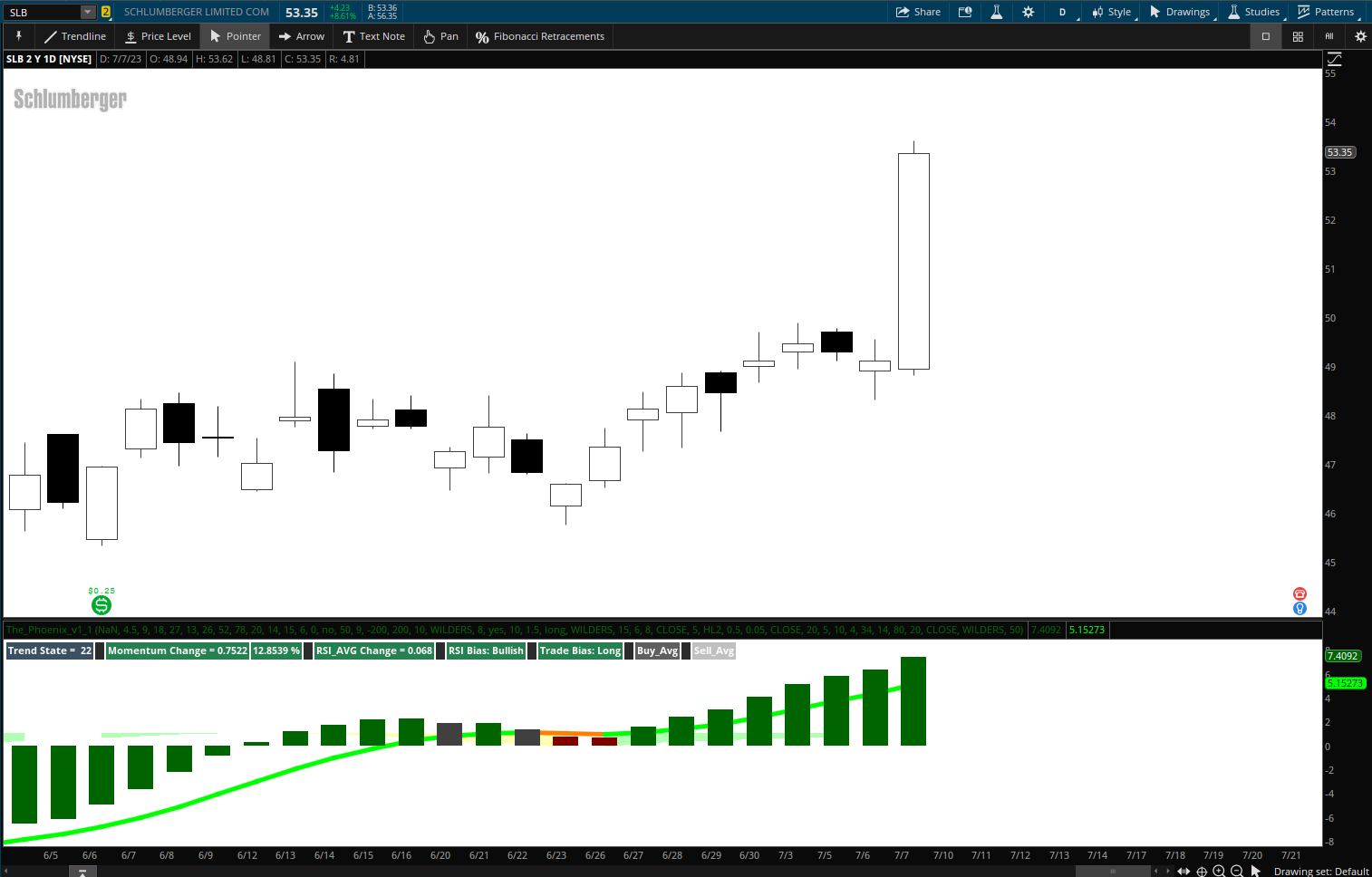

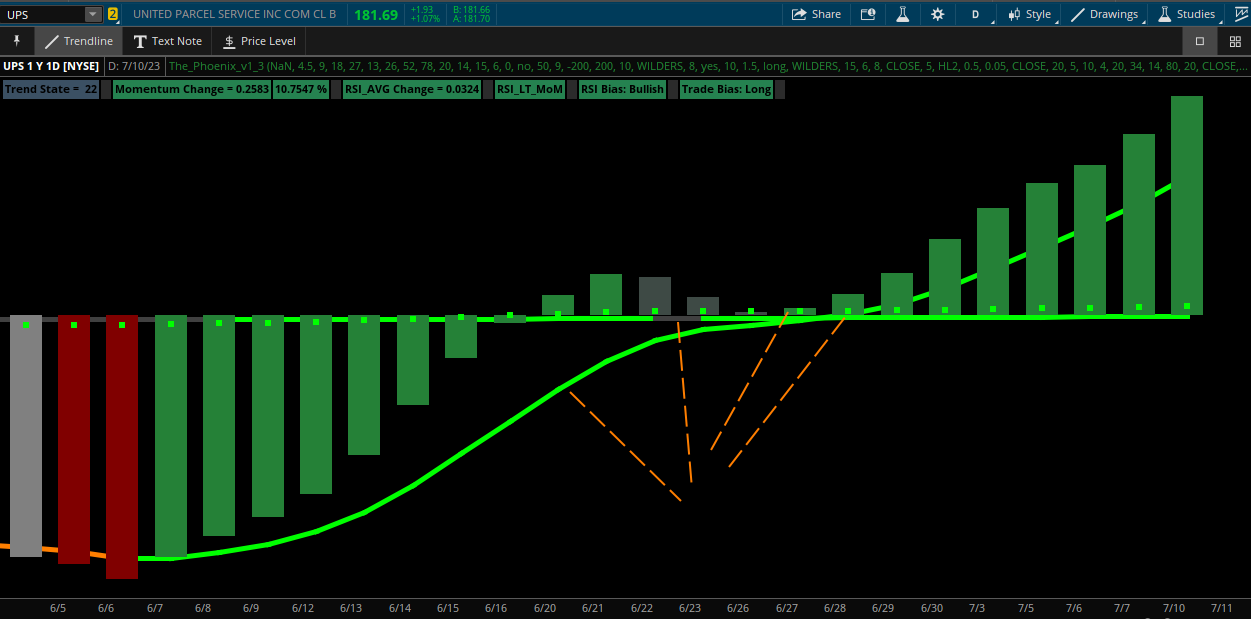

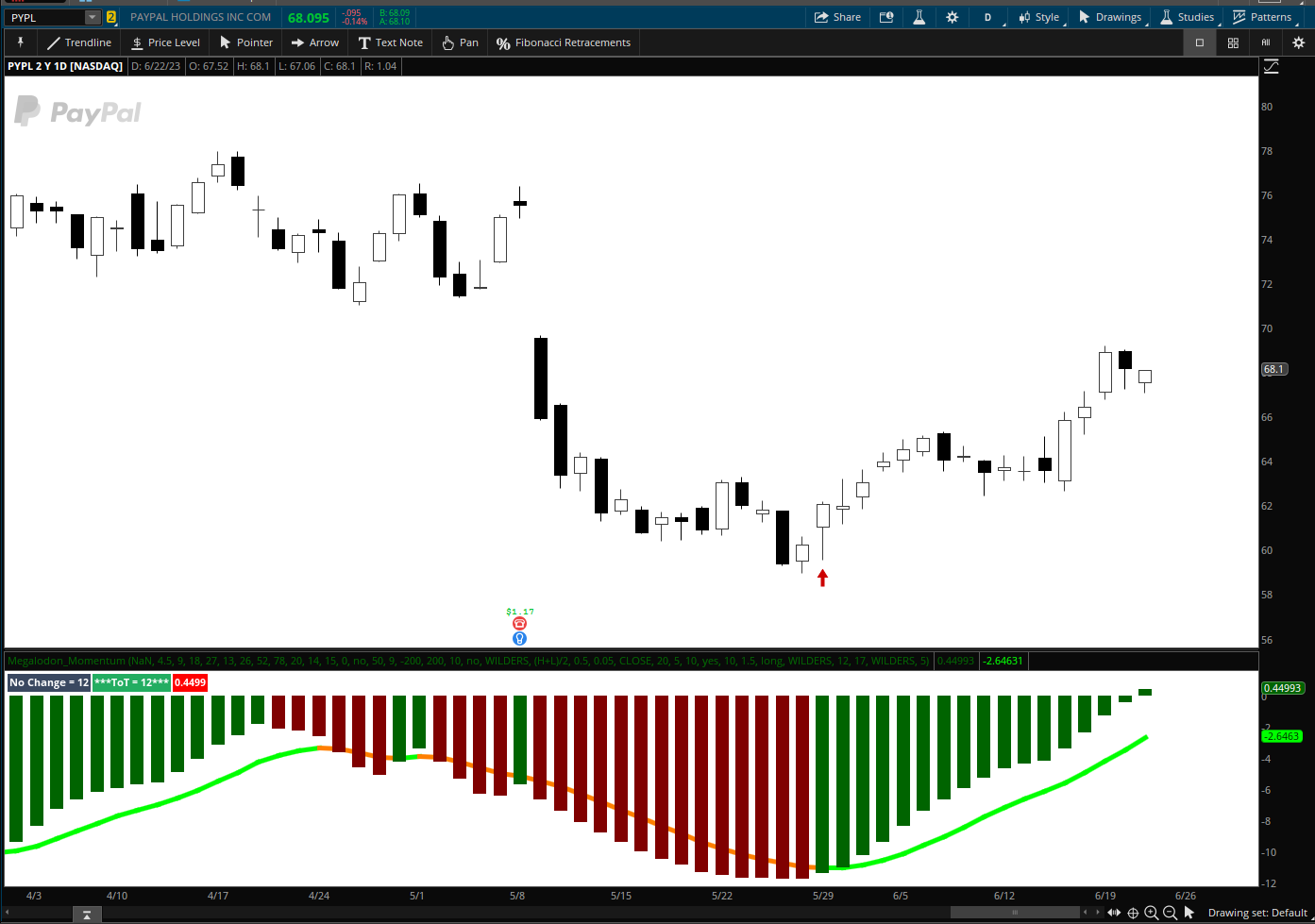

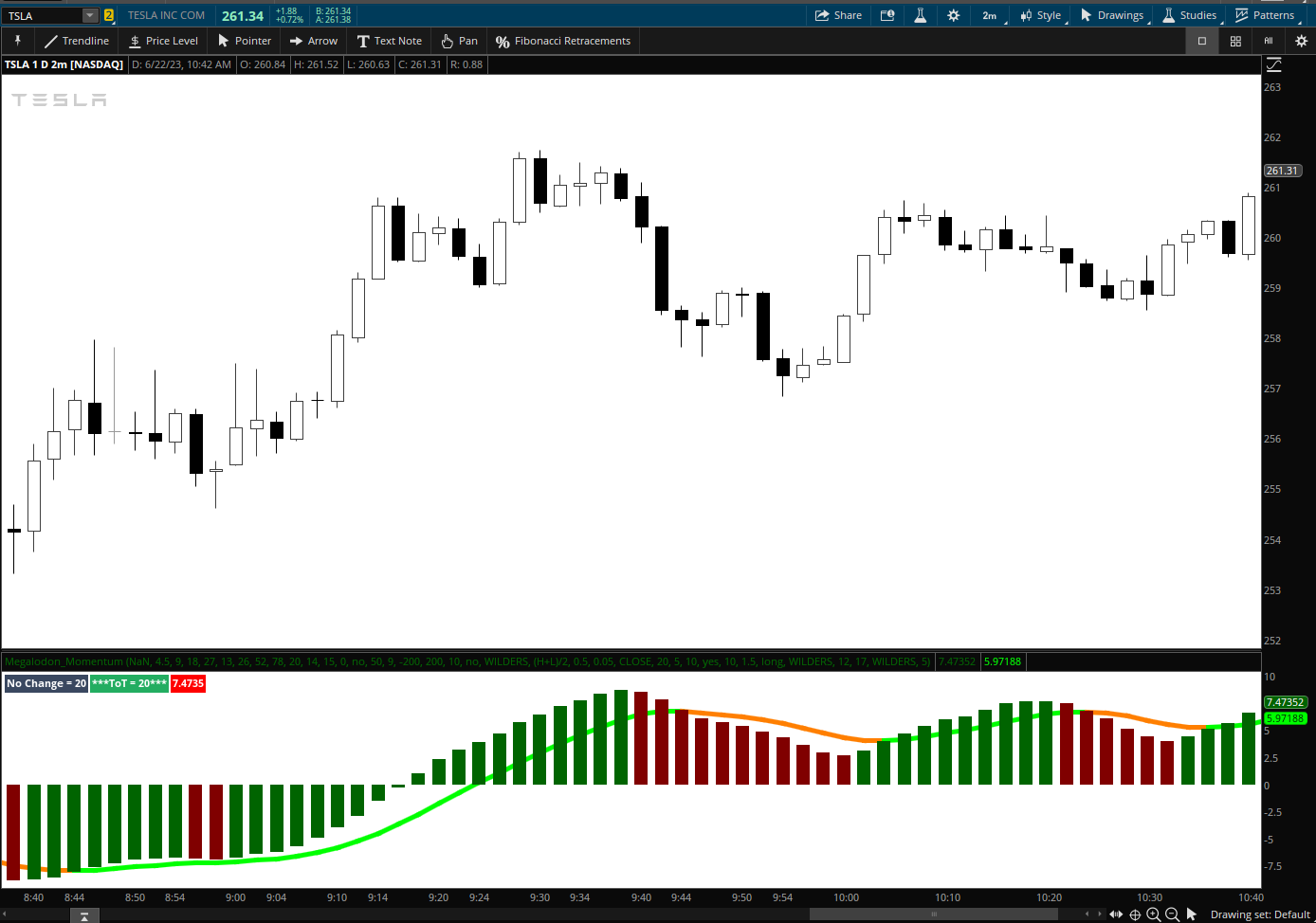

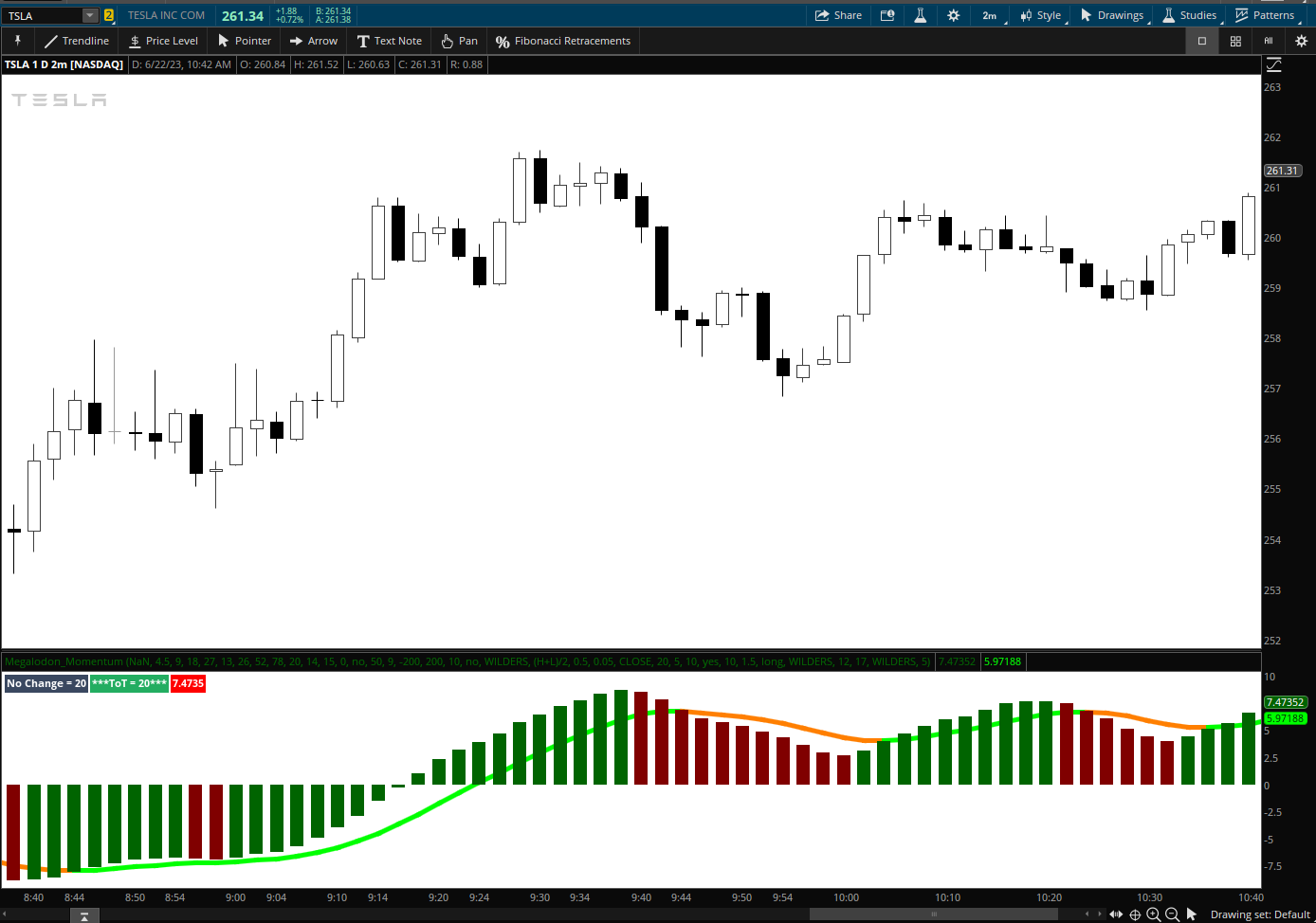

TSLA 2 Min

Edit for name change.

"The Phoenix" was partially born from @Christopher84 and his Study, Confirmation candles.

This uses some other study's than CC and is measuring the Average of Momentum (Consensus) Whereas "Consensus" can be quite low but a valid long entry may setup

This is by no means finished, though I am satisfied in it's current state.

WL columns are needed.

Let me know what you think - I'm open to any suggestions

Enjoy

TSLA 2 Min

Code:

#THE PHOENIX v1.3 Created by Hypnotic Options AKA, RedToGreen

#7-10-2023

# Updated - deleted un-needed code,

#Added label reflecting the change of MOM avg line

#Trend State = (Longs - Shorts) AKA "Consensus"

#6-24-2023 Added RSI AVG Study with signals

#6-25-2023 Added Conditions to RSI label to reflect it's current status

# Indicator Officially Renamed to "The Phoenix"

declare lower;

# TK Dragon Histogram 12-31-2022 by HypnoticOptions

input DN = Double.NaN;

input T4 = 4.5;

input T9 = 9;

input T18 = 18;

input T27 = 27;

input K13 = 13;

input K26 = 26;

input K52 = 52;

input K78 = 78;

########################################################

# Tenkan_Kijun #

##################################################

def Tenkan4 = (Highest(high, T4) + Lowest(low, T4)) / 2 ;

def Kijun13 = (Highest(high, K13) + Lowest(low, K13)) / 2;

def A2 = (Tenkan4[K13] + Kijun13[K13]) / 2;

def B2 = (Highest(high[K13], 2 * K13) + Lowest(low[K13], 2 * K13)) / 2;

#plot Chikou = close[-K13];

def Tenkan9 = (Highest(high, T9) + Lowest(low, T9)) / 2 ;

def Kijun26 = (Highest(high, K26) + Lowest(low, K26)) / 2;

def A3 = (Tenkan9[K26] + Kijun26[K26]) / 2;

def B3 = (Highest(high[K26], 2 * K26) + Lowest(low[K26], 2 * K26)) / 2;

def Tenkan18 = (Highest(high, T18) + Lowest(low, T18)) / 2;

def Kijun52 = (Highest(high, K52) + Lowest(low, K52)) / 2;

def A4 = (Tenkan18[K52] + Kijun52[K52]) / 2;

def B4 = (Highest(high[K52], 2 * K52) + Lowest(low[K52], 2 * K52)) / 2;

def Tenkan27 = (Highest(high, T27) + Lowest(low, T27)) / 2;

def Kijun78 = (Highest(high, K78) + Lowest(low, K78)) / 2;

def A5 = (Tenkan27[K78] + Kijun78[K78]) / 2;

def B5 = (Highest(high[K78], 2 * K78) + Lowest(low[K78], 2 * K78)) / 2;

#####################################################

# CHIKOU #

#######################################################

def Chikou13 = close[-K13] ;

def Chikou26 = close[-K26] ;

def Chikou52 = close[-K52] ;

def Chikou78 = close[-K78] ;

#def Lagg2 = Chikou26[26] - Chikou13[26];

#def Lagg3 = Chikou52[52] - Chikou26[52];

#def Lagg4 = Chikou78[78] - Chikou52[78];

########################################################

# Longs #

##################################################

def TKL4_13 = Tenkan4 > Kijun13; #***

def TKL4_52 = Tenkan4 > Kijun52;

def FutureBullishCloudB = A2[-13] > B2[-13];

def FutureBullishCloudC = A3[-26] > B3[-26];

def FutureBullishCloudD = A4[-52] > B4[-52];

def FutureBullishCloudE = A5[-78] > B5[-78];

def Lag2L = Chikou26[26] > Chikou13[26];

def Lag3L = Chikou52[52] > Chikou26[52];

def Lag4L = Chikou78[78] > Chikou52[78];

########################################################

# Shorts #

##################################################

def TKS4_13 = Tenkan4 < Kijun13; #***

def TKS4_52 = Tenkan4 < Kijun52;

def FutureBearishCloudB = A2[-13] < B2[-13];

def FutureBearishCloudC = A3[-26] < B3[-26];

def FutureBearishCloudD = A4[-52] < B4[-52];

def FutureBearishCloudE = A5[-78] < B5[-78];

def Lag2S = Chikou26[26] < Chikou13[26];

def Lag3S = Chikou52[52] < Chikou26[52];

def Lag4S = Chikou78[78] < Chikou52[78];

#################################################

#RGMB VOLUME by Hypnotic_Options AKA - Me

input LengthV5 = 20;

input lengthV = 14;

input length_mom = 15;

input lengthVolAVG = 6;

input displace = 0;

input showBreakoutSignals = no;

#input ShowChartLabels = yes;

def ZeroLine = 0;

def O = open;

def H = high;

def C = close;

def L = low;

def V = volume;

def buying = V * (C - L) / (H - L);

def selling = V * (H - C) / (H - L);

#Buy/sell difference================================

def buy1 = buying + buying[1];

def buy2 = buying + buying[1] + buying[2];

def buy3 = buying + buying[1] + buying[2] + buying[3];

def buy4 = buying + buying[1] + buying[2] + buying[3] + buying[4];

def buy5 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5];

def buy6 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6];

def buy7 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7];

def buy8 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7] + buying[8];

def buy9 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7] + buying[8] + buying[9];

def buy10 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7] + buying[8] + buying[9] + buying[10];

def curbuyVolume5 = (buy1 + buy2 + buy3 + buy4 + buy5) / 5;

def curbuyvol10 = (buy1 + buy2 + buy3 + buy4 + buy5 + buy6 + buy7 + buy8 + buy9 + buy10) / 10;

def sell1 = selling + selling[1];

def sell2 = selling + selling[1] + selling[2];

def sell3 = selling + selling[1] + selling[2] + selling[3];

def sell4 = selling + selling[1] + selling[2] + selling[3] + selling[4];

def sell5 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5];

def sell6 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6];

def sell7 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7];

def sell8 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7] + selling[8];

def sell9 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7] + selling[8] + selling[9];

def sell10 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7] + selling[8] + selling[9] + selling[10];

def cursellVolume5 = (sell1 + sell2 + sell3 + sell4 + sell5) / 5;

def cursellvol10 = (sell1 + sell2 + sell3 + sell4 + sell5 + sell6 + sell7 + sell8 + sell9 + sell10) / 10;

def Sellbuydiff5 = (curbuyVolume5 - cursellVolume5);

def Sellbuydiff10 = (curbuyvol10 - cursellvol10);

def v5Avg = WildersAverage(curbuyVolume5, LengthV5) ;

def Buyline = WildersAverage(curbuyvol10[-displace], lengthV);

def Sellline = WildersAverage(cursellvol10[-displace], lengthV);

def Buylineavg = wildersAverage(buyline[-displace], lengthVolAVG) ;

def Selllineavg = wildersAverage(sellline[-displace], lengthVolAVG) ;

#def BuyLineAVG_Change = (Buylineavg - Buylineavg[1]);

###########################

# CCI AVERAGE #

###########################

input cciLength = 50;

input cciAvgLength = 9;

input over_sold = -200;

input over_bought = 200;

###

def pricecci = close + low + high;

def linDev = LinDev(pricecci, cciLength);

def CCI = if linDev == 0 then 0 else (pricecci - Average(pricecci, cciLength)) / linDev / 0.015;

###

def CCIAvg = Average(CCI, cciAvgLength);

def OverBought = over_bought;

def OverSold = over_sold;

def CCI_X_Up = CCI crosses above ZeroLine within 3 bars;

def CCI_X_Down = CCI crosses below ZeroLine within 3 bars;

#AddLabel(yes, " " + ccicountG + " ", color.DARK_GREEN);

#AddLabel(yes, " " + ccicountR + " ", color.DARK_RED);

#addlabel(yes, " ", color.DARK_GRAY);

###################

# DMI OSC #

###################

input lengthdmi = 10;

input averageTypedmi = AverageType.WILDERS;

input DMI_L = 8;

def diPlus = DMI(lengthdmi, averageTypedmi)."DI+";

def diMinus = DMI(lengthdmi, averageTypedmi)."DI-";

def Osc = diPlus - diMinus;

def DMI_A = wildersAverage(osc, DMI_L);

#########################

# VOLATILITY STOP

#########################

## Volatility Trailing Stop

## Version 1.1

## By Steve Coombs

## This ATR Trailing Stop is calculated using the Highest Close in an uptrend or

## the Lowest Close in a downtrend, rather than just the Close that is used

## in the standard TOS ATRTrailing Stop

#input StopLabel = yes; #ATRStop Label is Stop value from yesterdays ATR calculation

input ShowStop = yes;

input ATRPeriod = 10;

input ATRFactor = 1.5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def trueRange = TrueRange(high, close, low);

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

def mclose;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

mclose = close;

trail = close - loss;

case short:

state = state.short;

mclose = close;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

mclose = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

mclose = Max(mclose[1], close);

trail = Max (trail[1], mclose - loss);

} else {

state = state.short;

mclose = close;

trail = mclose + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

mclose = Min(mclose[1], close);

trail = Min(trail[1], mclose + loss);

} else {

state = state.long;

mclose = close + 0;

trail = mclose - loss;

}

}

###################################################

#### CMF ######

input CMFL = 15;

input CMFL_Avg = 6;

def tmp_var =

if high == low then

volume

else

(close - low - (high - close)) / (high - low) * volume

;

def sum_close = Sum(tmp_var, CMFL);

def total = Sum(volume, CMFL);

def CMF =

if total == 0 then

0

else

sum_close / total

;

def CMF_P = WildersAverage(CMF, CMFL);

def CMF_P_AVG = WildersAverage(cmf_P, CMFL_Avg) ;

######### ROC ##########################

#

# TD Ameritrade IP Company, Inc. (c) 2008-2023

#

input lengthOBV = 8;

def OBV = TotalSum(Sign(close - close[1]) * volume);

def OBV_AVG = wildersAverage(obv,lengthOBV);

##################

####### MONEYFlow ######################

#

# TD Ameritrade IP Company, Inc. (c) 2008-2023

#

input priceM = close;

input flowL = 5;

def MF = TotalSum(if pricem < pricem[1] then -pricem * volume else if pricem > pricem[1] then pricem * volume else 0);

def Flow = wildersAverage(MF, flowL);

def MFlow_Up = flow > flow[1];

def MFlow_Dwn = flow < flow[1];

##############################

# filename: _MAMA_MDI_Combo_Lower_

# Here is Ehler's MAMA:

# hint: <b>Ehler's Mesa Adaptive Moving Average</b> using Ray's clean version

# of the homodyne discriminator.

#

# MIT License

# Copyright (c) <2010> <Radford Juang>

#

#Permission is hereby granted, free of charge, to any person obtaining a copy

#of this software and associated documentation files (the "Software"), to deal

#in the Software without restriction, including without limitation the rights

#to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

#copies of the Software, and to permit persons to whom the Software is

#furnished to do so, subject to the following conditions:

#

#The above copyright notice and this permission notice shall be included in

#all copies or substantial portions of the Software.

#

#THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

#IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

#FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

#AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

#LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

#OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN

#THE SOFTWARE.

#

script WMA_Smooth {

input price = hl2;

plot smooth = (4 * price

+ 3 * price[1]

+ 2 * price[2]

+ price[3]) / 10;

}

script Phase_Accumulation {

# This is Ehler's Phase Accumulation code. It has a full cycle delay.

# However, it computes the correction factor to a very high degree.

#

input price = hl2;

rec Smooth;

rec Detrender;

rec Period;

rec Q1;

rec I1;

rec I1p;

rec Q1p;

rec Phase1;

rec Phase;

rec DeltaPhase;

rec DeltaPhase1;

rec InstPeriod1;

rec InstPeriod;

def CorrectionFactor;

if BarNumber() <= 5

then {

Period = 0;

Smooth = 0;

Detrender = 0;

CorrectionFactor = 0;

Q1 = 0;

I1 = 0;

Q1p = 0;

I1p = 0;

Phase = 0;

Phase1 = 0;

DeltaPhase1 = 0;

DeltaPhase = 0;

InstPeriod = 0;

InstPeriod1 = 0;

} else {

CorrectionFactor = 0.075 * Period[1] + 0.54;

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

# Compute Quadrature and Phase of Detrended signal:

Q1p = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1p = Detrender[3];

# Smooth out Quadrature and Phase:

I1 = 0.15 * I1p + 0.85 * I1p[1];

Q1 = 0.15 * Q1p + 0.85 * Q1p[1];

# Determine Phase

if I1 != 0

then {

# Normally, ATAN gives results from -pi/2 to pi/2.

# We need to map this to circular coordinates 0 to 2pi

if Q1 >= 0 and I1 > 0

then { # Quarant 1

Phase1 = ATan(AbsValue(Q1 / I1));

} else if Q1 >= 0 and I1 < 0

then { # Quadrant 2

Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1));

} else if Q1 < 0 and I1 < 0

then { # Quadrant 3

Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1));

} else { # Quadrant 4

Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1));

}

} else if Q1 > 0

then { # I1 == 0, Q1 is positive

Phase1 = Double.Pi / 2;

} else if Q1 < 0

then { # I1 == 0, Q1 is negative

Phase1 = 3 * Double.Pi / 2;

} else { # I1 and Q1 == 0

Phase1 = 0;

}

# Convert phase to degrees

Phase = Phase1 * 180 / Double.Pi;

if Phase[1] < 90 and Phase > 270

then {

# This occurs when there is a big jump from 360-0

DeltaPhase1 = 360 + Phase[1] - Phase;

} else {

DeltaPhase1 = Phase[1] - Phase;

}

# Limit our delta phases between 7 and 60

if DeltaPhase1 < 7

then {

DeltaPhase = 7;

} else if DeltaPhase1 > 60

then {

DeltaPhase = 60;

} else {

DeltaPhase = DeltaPhase1;

}

# Determine Instantaneous period:

InstPeriod1 =

-1 * (fold i = 0 to 40 with v=0 do

if v < 0 then

v

else if v > 360 then

-i

else

v + GetValue(DeltaPhase, i, 41)

);

if InstPeriod1 <= 0

then {

InstPeriod = InstPeriod[1];

} else {

InstPeriod = InstPeriod1;

}

Period = 0.25 * InstPeriod + 0.75 * Period[1];

}

plot DC = Period;

}

script Ehler_MAMA {

input price = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

rec Period;

rec Period_raw;

rec Period_cap;

rec Period_lim;

rec Smooth;

rec Detrender;

rec I1;

rec Q1;

rec jI;

rec jQ;

rec I2;

rec Q2;

rec I2_raw;

rec Q2_raw;

rec Phase;

rec DeltaPhase;

rec DeltaPhase_raw;

rec alpha;

rec alpha_raw;

rec Re;

rec Im;

rec Re_raw;

rec Im_raw;

rec SmoothPeriod;

rec vmama;

rec vfama;

def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor;

if BarNumber() <= 5

then {

Smooth = 0;

Detrender = 0;

Period = 0;

Period_raw = 0;

Period_cap = 0;

Period_lim = 0;

I1 = 0;

Q1 = 0;

I2 = 0;

Q2 = 0;

jI = 0;

jQ = 0;

I2_raw = 0;

Q2_raw = 0;

Re = 0;

Im = 0;

Re_raw = 0;

Im_raw = 0;

SmoothPeriod = 0;

Phase = 0;

DeltaPhase = 0;

DeltaPhase_raw = 0;

alpha = 0;

alpha_raw = 0;

vmama = 0;

vfama = 0;

} else {

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

Q1 = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1 = Detrender[3];

jI = ( 0.0962 * I1

+ 0.5769 * I1[2]

- 0.5769 * I1[4]

- 0.0962 * I1[6] ) * CorrectionFactor;

jQ = ( 0.0962 * Q1

+ 0.5769 * Q1[2]

- 0.5769 * Q1[4]

- 0.0962 * Q1[6] ) * CorrectionFactor;

# This is the complex conjugate

I2_raw = I1 - jQ;

Q2_raw = Q1 + jI;

I2 = 0.2 * I2_raw + 0.8 * I2_raw[1];

Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1];

Re_raw = I2 * I2[1] + Q2 * Q2[1];

Im_raw = I2 * Q2[1] - Q2 * I2[1];

Re = 0.2 * Re_raw + 0.8 * Re_raw[1];

Im = 0.2 * Im_raw + 0.8 * Im_raw[1];

# Compute the phase

if Re != 0 and Im != 0

then {

Period_raw = 2 * Double.Pi / ATan(Im / Re);

} else {

Period_raw = 0;

}

if Period_raw > 1.5 * Period_raw[1]

then {

Period_cap = 1.5 * Period_raw[1];

} else if Period_raw < 0.67 * Period_raw[1] {

Period_cap = 0.67 * Period_raw[1];

} else {

Period_cap = Period_raw;

}

if Period_cap < 6

then {

Period_lim = 6;

} else if Period_cap > 50

then {

Period_lim = 50;

} else {

Period_lim = Period_cap;

}

Period = 0.2 * Period_lim + 0.8 * Period_lim[1];

SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1];

if I1 != 0

then {

Phase = ATan(Q1 / I1);

} else if Q1 > 0

then { # Quadrant 1:

Phase = Double.Pi / 2;

} else if Q1 < 0

then { # Quadrant 4:

Phase = -Double.Pi / 2;

} else { # Both numerator and denominator are 0.

Phase = 0;

}

DeltaPhase_raw = Phase[1] - Phase;

if DeltaPhase_raw < 1

then {

DeltaPhase = 1;

} else {

DeltaPhase = DeltaPhase_raw;

}

alpha_raw = FastLimit / DeltaPhase;

if alpha_raw < SlowLimit

then {

alpha = SlowLimit;

} else {

alpha = alpha_raw;

}

vmama = alpha * price + (1 - alpha) * vmama[1];

vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1];

}

plot MAMA = vmama;

plot FAMA = vfama;

}

#declare upper;

input price = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

#AddLabel(yes, Concat("MAMA: ", Concat("",

#if MAMA > FAMA then "Bull" else "Bear")),

#if MAMA > FAMA then Color.GREEN else Color.RED);

# McGinley Dynamic Indicator

# Mobius

# V02.11.2011

# D = D1 + ((I - D1) / ( N * (I/D1)^4))

# where D1= yesterday's Dynamic, I = today's price, N = smoothing factor.

input valueMcD = close;

input length = 20;

input Slength = 5;

def A1 = ExpAverage(valueMcD, length)[1];

def MDI = A1 + ((valueMcD - A1) / Sqr(valueMcD / A1));

input periods = 10;

rec _md = CompoundValue( 1, _md[1] + (( close - _md[1] ) / ( periods *

Power( close / _md[1], 4 ) ) ), close );

def MD = _md;

def FAMA = Ehler_MAMA(price, FastLimit, SlowLimit).FAMA;

def MAMA = Ehler_MAMA(price, FastLimit, SlowLimit).MAMA;

###########################################################################

################### SIGNALS ############

def BuyLine5Up = v5Avg > v5Avg[1];

def BuylineUp = Buyline > Buyline[1] ;

def Long5vol = curbuyVolume5 > cursellVolume5;

def Long10Vol = curbuyvol10 > cursellvol10;

def Buy_AVG_UP = Buylineavg > Buylineavg[1];

def CMF_Long = CMF_P > CMF_P[1];

def CMF_Short = CMF_P < CMF_P[1];

def CMF_P_AVG_UP = CMF_P_AVG > CMF_P_AVG[1];

def CMF_P_AVG_Down = CMF_P_AVG < CMF_P_AVG[1];

def CCI_AVG_Long = CCIAvg > CCIAvg[1];

def CCI_AVG_Short = CCIAvg < CCIAvg[1];

def DMILong = Osc > ZeroLine;

def DMIShort = Osc < ZeroLine;

def DMIUP = DMI_A > DMI_A[1];

def DMIDown = DMI_A < DMI_A[1];

def MAMA_FAMA_L = MAMA > FAMA;

def MAMA_FAMA_S = MAMA < FAMA;

def MAMA_McG_L = MAMA > MD;

def MAMA_McG_S = MAMA < MD;

def Trail_L = state == state.long;

def Trail_S = state == state.short;

def ROC_UP = OBV_AVG > OBV_AVG[1];

def ROC_Down = OBV_AVG < OBV_AVG[1];

def BuylineDown = Buyline < Buyline[1] ;

def SelllineUp = Sellline > Sellline[1] ;

def SelllineDown = Sellline < Sellline[1] ;

def Short5vol = curbuyVolume5 < cursellVolume5;

def Short10Vol = curbuyvol10 < cursellvol10;

def BuyLine5Down = v5Avg < v5Avg[1];

def Buy_AVG_Down = Buylineavg < Buylineavg[1];

def Sell_AVG_Down = Selllineavg < Selllineavg[1];

def Sell_AVG_UP = Selllineavg > Selllineavg[1];

######## AGREEMENT LEVELS #############

###### Confirmation, derived from Christopher84's Confirmation candles

def AgreeTotalL = CCI_AVG_Long + DMILong + DMIUP + MAMA_FAMA_L + MAMA_McG_L + Trail_L + Long5vol + Long10Vol + CMF_Long + TKL4_13 + TKL4_52 + FutureBullishCloudB + FutureBullishCloudC + FutureBullishCloudD + Lag2L + Lag3L + Lag4L + cmf_P_AVG_UP + BuyLineUp + SellLineDown + Buy_AVG_UP + Sell_AVG_Down + Mflow_Up + ROC_UP;

def AgreeTotalS = CCI_AVG_Short + DMIShort + DMIDown + MAMA_FAMA_S + MAMA_McG_S + Trail_S + Short5vol + Short10Vol + CMF_Short + TKS4_13 + TKS4_52 + FutureBearishCloudB + FutureBearishCloudC + FutureBearishCloudD + Lag2S + Lag3S + Lag4S + cmf_P_AVG_Down + SellLineUp + BuyLineDown + Buy_AVG_Down + Sell_AVG_UP + Mflow_Dwn + ROC_Down;

def ConTotal = AgreeTotalL - AgreeTotalS;

def MomTotalUp = ConTotal[1] < ConTotal;

def MomTotalDown = Contotal[1] > ConTotal;

###########################

AddLabel(yes, "Trend State = " + Round(ConTotal, 1), CreateColor(59, 80, 99));

AddLabel(yes, " ", CreateColor(43, 43, 43));

#####

input MOMAVG = 4;

plot MOMline = WildersAverage(ConTotal[-displace], length_mom);

plot MOMlineAVGp = wildersAverage(MOMline, MOMAVG) ;

MOMline.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

MOMline.AssignValueColor(if MOMlineAVGp < MOMlineAVGp[1] and MOMline > MOMline[1] then color.GRAY else if MOMline > MOMline[1] then createcolor(37,129,55) else if MOMlineAVGp > MOMlineAVGp[1] and MOMline < MOMline[1] then createColor(62,74,69) else if MOMline < MOMline[1] then color.DARK_RED else color.BLACK);

MOMline.SetLineWeight(5);

#def MOMline = wildersAverage(cursellvol10[-displace], length12) ;

#def MOMLINEAVG = (Momline / 10);

MOMlineAVGp.SetPaintingStrategy(PaintingStrategy.LINE);

MOMlineAVGp.SetLineWeight(5);

MOMlineAVGp.AssignValueColor(if MOMlineAVGp > MOMlineAVGp[1] then Color.GREEN else if MOMlineAVGp < MOMlineAVGp[1] then Color.DARK_ORANGE else Color.DARK_GRAY);

def MomlineDiff = (MOMlineAVGp - MOMlineAVGp[1]);

############### Momentum Change

#def MoMDir1 = if MOMlineAVGp > MOMlineAVGp[1] then 1 else if MOMlineAVGp < MOMlineAVGp[1] then 2 else 0;

#def MoMDirUp = if MoMDir1[1] == 0 and MoMDir1 == 1 then 1 else if MoMDir1 == 1 then MoMDirUp[1] + 1 else 0;

#def MomCntUp = MoMDirUp;

#def MoMDirDwn = if MoMDir1[1] == 0 and MoMDir1 == 2 then 2 else if MoMDir1 == 2 then MoMDirDwn[1] + 1 else 0;

#def MoMCntdwn = MoMDirDwn;

########### MOM_AVG ###################

#def MomLUp = MomlineDiff > MomlineDiff[1];

#def MomLDwn = MomlineDiff < MomlineDiff[1];

input ML = 20;

plot MoMLabelLine = wildersAverage(momlineDiff, ml);

MoMLabelLine.setpaintingStrategy(paintingStrategy.SQUARES);

MoMLabelLine.setlineWeight(3);

MoMLabelLine.assignValueColor(if MoMLabelLine > MoMLabelLine[1] then color.GREEN else if MoMLabelLine < MoMLabelLine[1] then color.DARK_ORANGE else color.GRAY);

############

AddLabel(yes, "Momentum Change = " + MoMLabelLine , if MoMLabelLine > MoMLabelLine[1] then CreateColor(37,130,80) else if MoMLabelLine < MoMLabelLine[1] then CreateColor(168,12,22) else Color.DARK_GRAY);

def MoM_PercentChange = (MoMLabelLine - MoMLabelLine[1]) / MoMLabelLine * (100) ;

AddLabel(yes, MoM_PercentChange + " %", if MoMLabelLine > MoMLabelLine[1] then CreateColor(37, 130, 80) else if MoMLabelLine < MoMLabelLine[1] then CreateColor(168, 12, 22) else Color.DARK_GRAY);

########################### RSI AVG ##############################

#RSI AVG BY Hypnotic_Options

input lengthRSI = 34;

input lengthrsiAVG = 14;

input over_BoughtRSI = 80;

input over_SoldRSI = 20;

input priceRSI = close;

input averageTypeRSI = AverageType.WILDERS;

input mid = 50;

def NetChgAvg = MovingAverage(averageTypeRSI, priceRSI - priceRSI[1], lengthRSI);

def TotChgAvg = MovingAverage(averageTypeRSI, AbsValue(priceRSI - priceRSI[1]), lengthRSI);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def RSI_A = WildersAverage(RSI, lengthRSI) ;

#RSI_A.setpaintingStrategy(paintingStrategy.DASHES);

#RSI_A.assignValueColor(if RSI_A > RSI_A[1] then color.GREEN else if RSI_A < RSI_A[1] then color.DARK_RED else color.DARK_GRAY);

#RSI_A.setlineWeight(5);

def rsiavg = WildersAverage(RSI_A, lengthrsiAVG);

#rsiavg.SetLineWeight(5);

#rsiavg.SetPaintingStrategy(PaintingStrategy.LINE);

#rsiavg.AssignValueColor(if rsiavg > rsiavg[1] then Color.LIGHT_GREEN else if rsiavg < rsiavg[1] then Color.ORANGE else Color.DARK_GRAY);

####### RSI SIGNALS #############

def RSIavg_Change = (rsiavg - rsiavg[1]);

def RSI_L = RSI_A > RSI_A[1];

def RSI_S = RSI_A < RSI_A[1];

def RSIavg_L = rsiavg > rsiavg[1];

def RSIavg_S = rsiavg < rsiavg[1];

####### RSI TRADE BIAS, LABELS NOT INCLUDED

#def RSI_ST_Long = rsi_l and RSIavg_S and RSIavg_Change > RSIavg_Change[1];

#def RSI_Long = RSI_L and RSIavg_L;

#def RSI_ST_Short = rsi_S and RSIavg_L and RSIavg_Change < RSIavg_Change[1];

#def RSI_Short = RSI_S and RSIavg_S;

########### TRADE BIAS WITH LABELS ############

def RSI_ST_Long = RSI_L and RSIavg_S and RSIavg_Change > RSIavg_Change[1];

def RSI_Long = RSI_L and RSIavg_L and RSIavg_Change > RSIavg_Change[1];

def RSI_ST_Short = RSI_S and RSIavg_L and RSIavg_Change < RSIavg_Change[1];

def RSI_Short = RSI_S and RSIavg_S and RSIavg_Change < RSIavg_Change[1];

#########################

def RSI_LineStatus_L = RSI_A > rsiavg;

def RSI_LineStatus_S = RSI_A < rsiavg;

def RSI_CT_L = RSI_L and RSIavg_S;

def RSI_CT_S = RSI_S and RSIavg_L;

AddLabel(yes, " ", CreateColor(43, 43, 43));

##### Long Term ##########

AddLabel(yes, "RSI_AVG Change = " + RSIavg_Change, if RSIavg_Change > RSIavg_Change[1] then CreateColor(37, 130, 80) else if RSIavg_Change < RSIavg_Change[1] then CreateColor(168, 12, 22) else Color.DARK_GRAY);

#AddLabel(yes, " ", CreateColor(43, 43, 43));

########## RSI COUNTER ##################################

#def RSIDir1 = if rsiavg > rsiavg[1] then 1 else if rsiavg < rsiavg[1] then 2 else 0;

#def RSIDirUp = if RSIDir1[1] == 0 and RSIDir1 == 1 then 1 else if RSIDir1 == 1 then RSIDir1[1] + 1 else 0;

#def RSICntUp = MoMDirUp;

#def RSIDirDwn = if RSIDir1[1] == 0 and RSIDir1 == 2 then 2 else if RSIDir1 == 2 then RSIDirDwn[1] + 1 else 0;

#def RSICntdwn = RSIDirDwn;

######## RSI Momentum Line ##################

input t = 10;

input u = 2;

plot RSI_ST_MoM = wildersAverage(RSIavg_Change, t);

def RSI_AVGUp = RSIavg_Change > RSIavg_Change[1];

def RSI_AVGDwn = RSIavg_Change < RSIavg_Change[1];

def RSI_ST_MoMUp = RSI_ST_MoM > RSI_ST_MoM[1];

def RSI_ST_MoMDwn = RSI_ST_MoM < RSI_ST_MoM[1];

#def RSI_ST_MoMUP_Rising = RSI_ST_MoMUp and RSI_AVGUp;

#def RSI_ST_MoMUP_Falling = RSI_ST_MoMUp and RSI_AVGDwn ;

#def RSI_ST_MoMDwn_Rising = RSI_ST_MoMDwn and RSI_AVGUp;

#def RSI_ST_MoMDwn_Falling = RSI_ST_MoMDwn and RSI_AVGDwn ;

#AddLabel(yes, "RSI_ST_MoM = " + if RSI_ST_MoMUP_Rising then CreateColor(37, 130, 80) else if RSI_ST_MoMUP_Falling then CreateColor(168, 12, 22) else Color.DARK_GRAY);

AddLabel(yes, " ", CreateColor(43, 43, 43));

RSI_ST_MoM.setstyle(curve.FIRM);

RSI_ST_MoM.setlineWeight(5);

RSI_ST_MoM.assignValueColor(if RSI_AVGUp and RSI_ST_MoMUp then color.GREEN else if RSI_AVGDwn and RSI_ST_MoMDwn then color.YELLOW else color.DARK_GRAY);

def rsilabelavg = WildersAverage(RSI_ST_MoM, u);

#rsilabelavg.SetLineWeight(5)

#rsilabelavg.Setstyle(curve.FIRM);

addlabel(yes, if rsilabelavg > rsilabelavg[1] then "RSI_LT_MoM" else if rsilabelavg < rsilabelavg[1] then "RSI_LT_MoM" else "", if rsilabelavg > rsilabelavg[1] then CreateColor(37,130,80) else if rsilabelavg < rsilabelavg[1] then CreateColor(168,12,22) else Color.DARK_GRAY);

AddLabel(yes, " ", CreateColor(43, 43, 43));

#addlabel(yes, "Momentum Change = " + momlineDiff + if MomlineDiff > MomlineDiff[1] then " (" + MomCntUp + ")" else if MomlineDiff < MomlineDiff[1] then " (" + MoMCntdwn + ")" else "", if MomlineDiff > MomlineDiff[1] then CreateColor(37, 130, 80) else if MomlineDiff < MomlineDiff[1] then CreateColor(168,12,22) else color.DARK_GRAY);

##############

##########################################################

####### MM SIGNALS (W/O LABELS ############

#def MM_L = momline > momline[1] and momlineavGp > momlineavGp[1];

#def MM_S = momline < momline[1] and momlineavGp < momlineavGp[1];

######### WITH LABELS

def MM_L = MOMline > MOMline[1] and MOMlineAVGp > MOMlineAVGp[1] and MomlineDiff > MomlineDiff[1];

def MM_S = MOMline < MOMline[1] and MOMlineAVGp < MOMlineAVGp[1] and MomlineDiff < MomlineDiff[1];

############## COMBINED SIGNALS ############################

def MM_Long_Caution = MM_L and RSI_ST_Long;

def MM_Long = MM_L and RSI_Long;

def MM_Short_Caution = MM_S and RSI_ST_Short;

def MM_Short = MM_S and RSI_Short;

#addlabel(yes, "RSI Bias: " + if RSI_ST_Long then "UP (Caution) " else if RSI_Long then "UP" else if RSI_ST_Short then "Down (Caution) " else if RSI_Short then "Down " else " ", if RSI_ST_Long or RSI_Long then CreateColor(37,130,80) else if RSI_ST_Short or RSI_Short then CreateColor(168,12,22) else color.DARK_GRAY);

AddLabel(yes, "RSI Bias: " + if RSI_CT_L then "Bullish: Countertrend" else if RSI_CT_S then "Bearish: Countertrend " else if RSI_LineStatus_L then "Bullish" else if RSI_LineStatus_S then "Bearish" else " ", if RSI_CT_L then CreateColor(37, 130, 80) else if RSI_CT_S then CreateColor(168, 12, 22) else if RSI_LineStatus_L then CreateColor(37, 130, 80) else if RSI_LineStatus_S then CreateColor(168, 12, 22) else Color.DARK_GRAY);

AddLabel(yes, " ", CreateColor(43, 43, 43));

#def MoMLine_L = momline > momline[1];

#def MomAvg_L = momlineavGp > momlineavGp[1];

#def MomDiff_L = MomlineDiff > MomlineDiff[1];

#def LBias = momLine_L + momavg_L + RSI_L + RSIavg_L + momDiff_L;

#def MoMLine_S = momline < momline[1];

#def MomAvg_S = momlineavGp < momlineavGp[1];

#def MomDiff_S = MomlineDiff < MomlineDiff[1];

#def SBias = momLine_S + momavg_S + RSI_S + RSIavg_S + momDiff_S;

#def Trade_bias = LBias - SBias;

#def Trade_Bias_L = Trade_bias > Trade_bias;

#def Trade_Bias_S = Trade_bias < Trade_bias;

#def TradeBiasUp = Trade_bias[1] < Trade_bias;

#def TradeBiasDwn = Trade_bias[1] > Trade_bias;

AddLabel(yes, "Trade Bias: " + if MM_Long_Caution then "*** Long (Caution) ***" else if MM_Long then "Long" else if MM_Short_Caution then "*** Short (Caution) ***" else if MM_Short then "*** Short ***" else " ", if MM_Long_Caution or MM_Long then CreateColor(37, 130, 80) else if MM_Short_Caution or MM_Short then CreateColor(168, 12, 22) else Color.DARK_GRAY);

AddLabel(yes, " ", CreateColor(43, 43, 43));

#addlabel(yes, Round(Trade_bias, 1));

#plot MomlineDiffC = (MOMlineAVGp - MOMlineAVGp[1]);

#momlineDiffC.setlineWeight(5);

#momlineDiff.assignValueColor(if MomlineDiff > MomlineDiff[1] then color.GREEN else if MomlineDiff < #MomlineDiff[1] then color.YELLOW else color.DARK_GRAY);

#def MomLUp = MomlineDiff > MomlineDiff[1];

#def MomLDwn = MomlineDiff < MomlineDiff[1];

#AddCloud(if momlUp then momlUp else Double.NaN, momlineDiff, color.GREEN, color.BLUE);

#AddCloud(if momlDwn then momlDwn else Double.NaN, momlineDiff, color.YELLOW, Color.CURRENT);

#plot MoMLabelLine = momlineDiff;

#MoMLabelLine.setpaintingStrategy(paintingStrategy.SQUARES);

#MoMLabelLine.setlineWeight(4);

#MoMLabelLine.assignValueColor(if momlUp then color.GREEN else if momlDwn then color.DARK_ORANGE else color.GRAY);

Last edited by a moderator: