Its a neat indicator..thank youEdit: code Updated 6-27-23

Edit for name change.

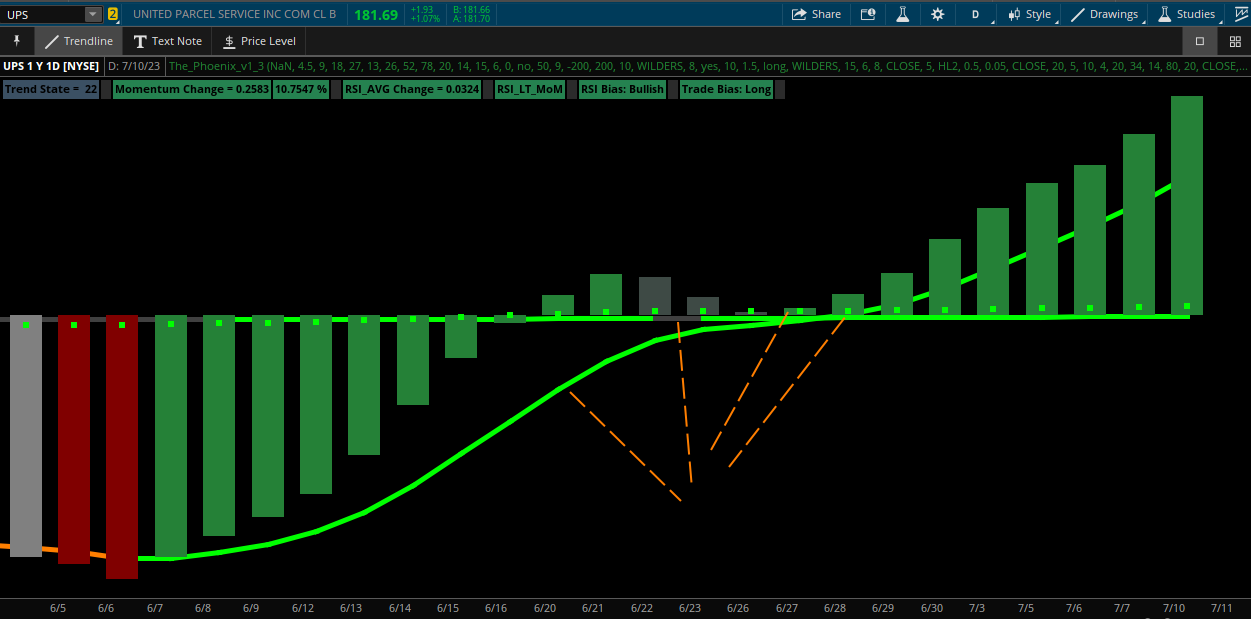

"The Phoenix" was partially born from @Christopher84 and his Study, Confirmation candles.

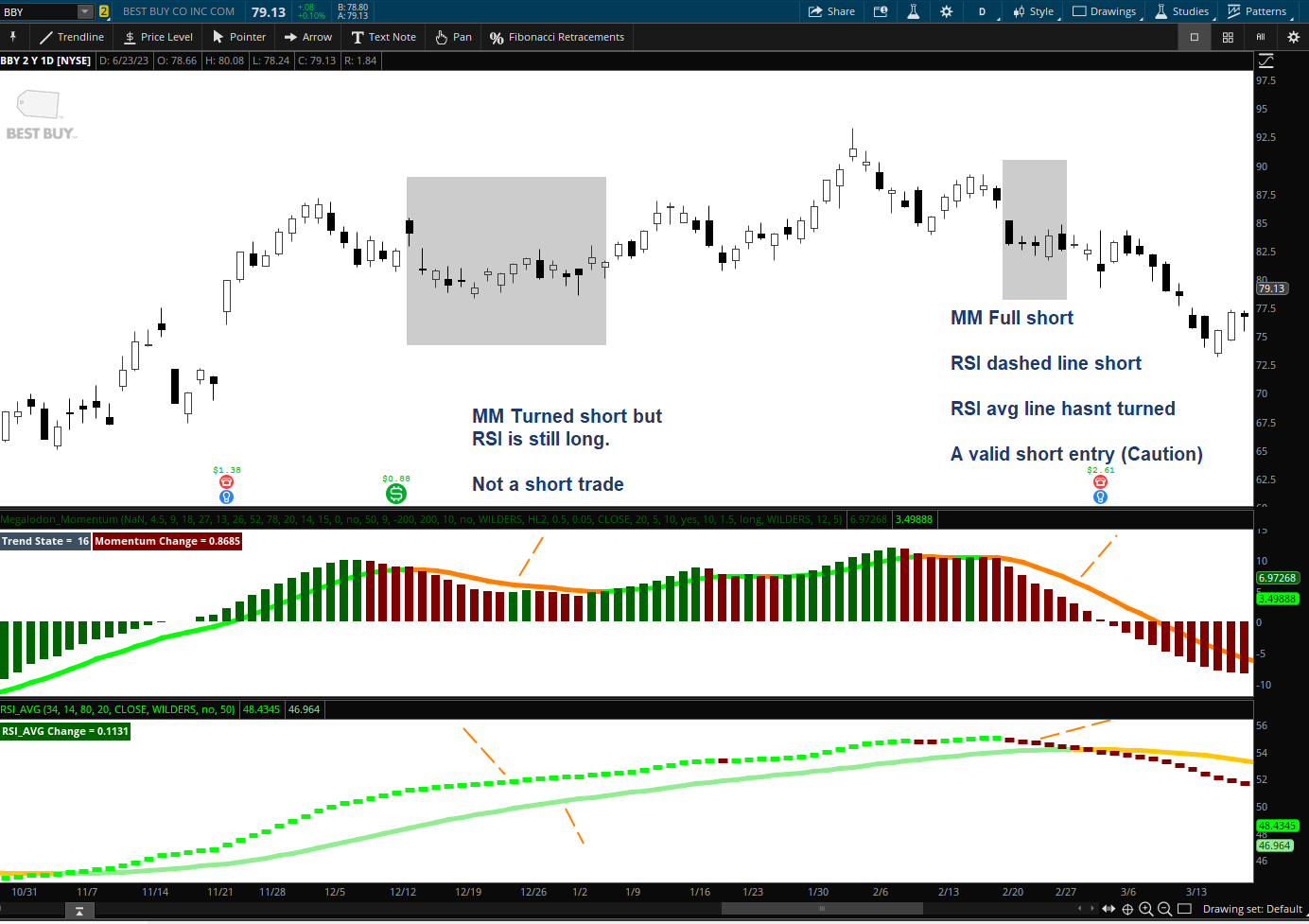

This uses some other study's than CC and is measuring the Average of Momentum (Consensus) Whereas "Consensus" can be quite low but a valid long entry may setup

This is by no means finished, though I am satisfied in it's current state.

WL columns are needed.

Let me know what you think - I'm open to any suggestions

Enjoy

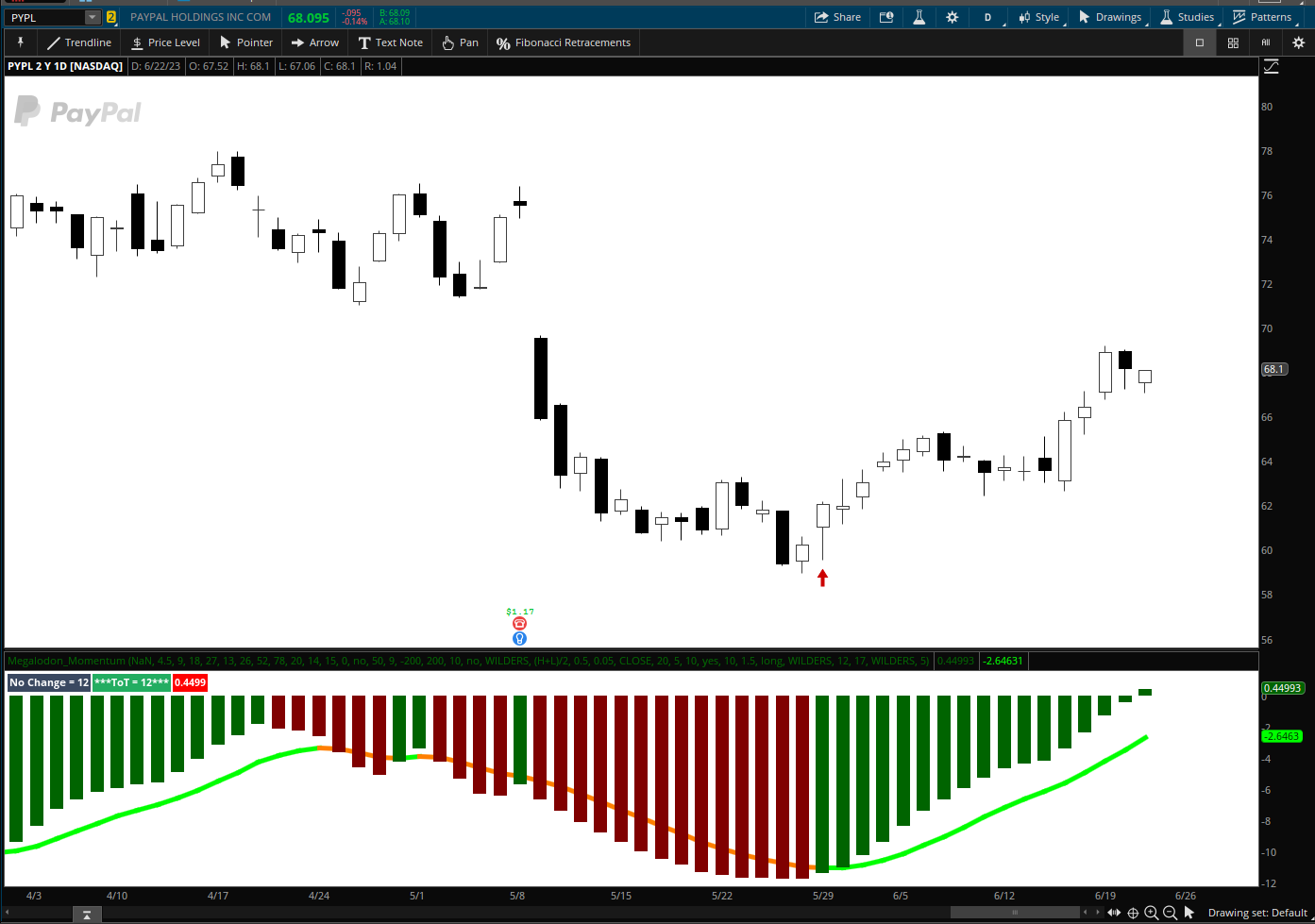

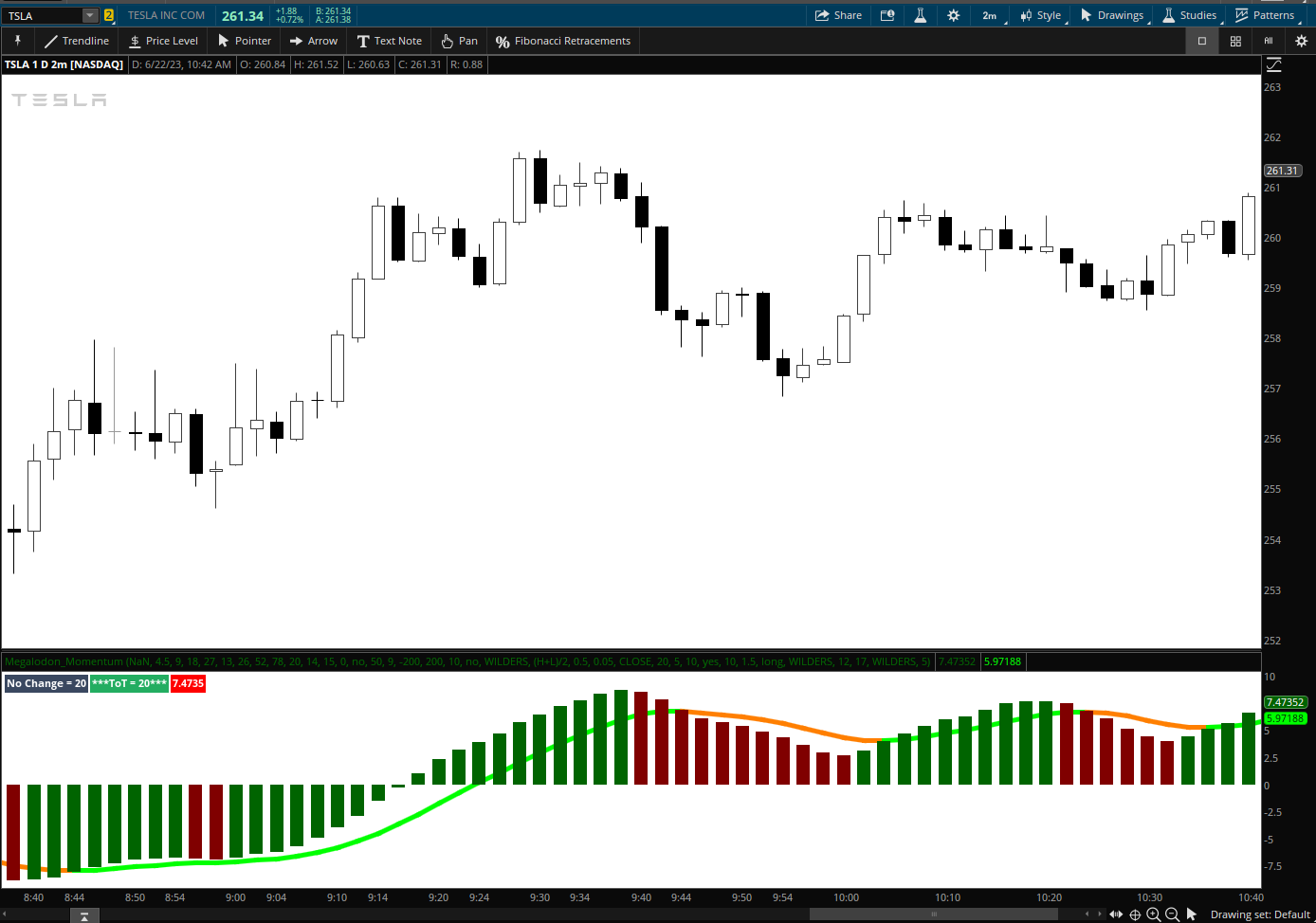

TSLA 2 Min

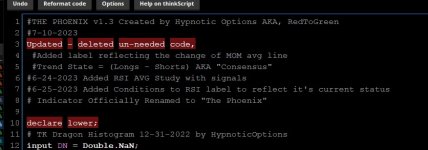

Code:#THE PHOENIX v1.3 Created by Hypnotic Options AKA, RedToGreen #7-10-2023 Updated - deleted un-needed code, #Added label reflecting the change of MOM avg line #Trend State = (Longs - Shorts) AKA "Consensus" #6-24-2023 Added RSI AVG Study with signals #6-25-2023 Added Conditions to RSI label to reflect it's current status # Indicator Officially Renamed to "The Phoenix" declare lower; # TK Dragon Histogram 12-31-2022 by HypnoticOptions input DN = Double.NaN; input T4 = 4.5; input T9 = 9; input T18 = 18; input T27 = 27; input K13 = 13; input K26 = 26; input K52 = 52; input K78 = 78; ######################################################## # Tenkan_Kijun # ################################################## def Tenkan4 = (Highest(high, T4) + Lowest(low, T4)) / 2 ; def Kijun13 = (Highest(high, K13) + Lowest(low, K13)) / 2; def A2 = (Tenkan4[K13] + Kijun13[K13]) / 2; def B2 = (Highest(high[K13], 2 * K13) + Lowest(low[K13], 2 * K13)) / 2; #plot Chikou = close[-K13]; def Tenkan9 = (Highest(high, T9) + Lowest(low, T9)) / 2 ; def Kijun26 = (Highest(high, K26) + Lowest(low, K26)) / 2; def A3 = (Tenkan9[K26] + Kijun26[K26]) / 2; def B3 = (Highest(high[K26], 2 * K26) + Lowest(low[K26], 2 * K26)) / 2; def Tenkan18 = (Highest(high, T18) + Lowest(low, T18)) / 2; def Kijun52 = (Highest(high, K52) + Lowest(low, K52)) / 2; def A4 = (Tenkan18[K52] + Kijun52[K52]) / 2; def B4 = (Highest(high[K52], 2 * K52) + Lowest(low[K52], 2 * K52)) / 2; def Tenkan27 = (Highest(high, T27) + Lowest(low, T27)) / 2; def Kijun78 = (Highest(high, K78) + Lowest(low, K78)) / 2; def A5 = (Tenkan27[K78] + Kijun78[K78]) / 2; def B5 = (Highest(high[K78], 2 * K78) + Lowest(low[K78], 2 * K78)) / 2; ##################################################### # CHIKOU # ####################################################### def Chikou13 = close[-K13] ; def Chikou26 = close[-K26] ; def Chikou52 = close[-K52] ; def Chikou78 = close[-K78] ; #def Lagg2 = Chikou26[26] - Chikou13[26]; #def Lagg3 = Chikou52[52] - Chikou26[52]; #def Lagg4 = Chikou78[78] - Chikou52[78]; ######################################################## # Longs # ################################################## def TKL4_13 = Tenkan4 > Kijun13; #*** def TKL4_52 = Tenkan4 > Kijun52; def FutureBullishCloudB = A2[-13] > B2[-13]; def FutureBullishCloudC = A3[-26] > B3[-26]; def FutureBullishCloudD = A4[-52] > B4[-52]; def FutureBullishCloudE = A5[-78] > B5[-78]; def Lag2L = Chikou26[26] > Chikou13[26]; def Lag3L = Chikou52[52] > Chikou26[52]; def Lag4L = Chikou78[78] > Chikou52[78]; ######################################################## # Shorts # ################################################## def TKS4_13 = Tenkan4 < Kijun13; #*** def TKS4_52 = Tenkan4 < Kijun52; def FutureBearishCloudB = A2[-13] < B2[-13]; def FutureBearishCloudC = A3[-26] < B3[-26]; def FutureBearishCloudD = A4[-52] < B4[-52]; def FutureBearishCloudE = A5[-78] < B5[-78]; def Lag2S = Chikou26[26] < Chikou13[26]; def Lag3S = Chikou52[52] < Chikou26[52]; def Lag4S = Chikou78[78] < Chikou52[78]; ################################################# #RGMB VOLUME by Hypnotic_Options AKA - Me input LengthV5 = 20; input lengthV = 14; input length_mom = 15; input lengthVolAVG = 6; input displace = 0; input showBreakoutSignals = no; #input ShowChartLabels = yes; def ZeroLine = 0; def O = open; def H = high; def C = close; def L = low; def V = volume; def buying = V * (C - L) / (H - L); def selling = V * (H - C) / (H - L); #Buy/sell difference================================ def buy1 = buying + buying[1]; def buy2 = buying + buying[1] + buying[2]; def buy3 = buying + buying[1] + buying[2] + buying[3]; def buy4 = buying + buying[1] + buying[2] + buying[3] + buying[4]; def buy5 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5]; def buy6 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6]; def buy7 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7]; def buy8 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7] + buying[8]; def buy9 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7] + buying[8] + buying[9]; def buy10 = buying + buying[1] + buying[2] + buying[3] + buying[4] + buying[5] + buying[6] + buying[7] + buying[8] + buying[9] + buying[10]; def curbuyVolume5 = (buy1 + buy2 + buy3 + buy4 + buy5) / 5; def curbuyvol10 = (buy1 + buy2 + buy3 + buy4 + buy5 + buy6 + buy7 + buy8 + buy9 + buy10) / 10; def sell1 = selling + selling[1]; def sell2 = selling + selling[1] + selling[2]; def sell3 = selling + selling[1] + selling[2] + selling[3]; def sell4 = selling + selling[1] + selling[2] + selling[3] + selling[4]; def sell5 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5]; def sell6 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6]; def sell7 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7]; def sell8 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7] + selling[8]; def sell9 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7] + selling[8] + selling[9]; def sell10 = selling + selling[1] + selling[2] + selling[3] + selling[4] + selling[5] + selling[6] + selling[7] + selling[8] + selling[9] + selling[10]; def cursellVolume5 = (sell1 + sell2 + sell3 + sell4 + sell5) / 5; def cursellvol10 = (sell1 + sell2 + sell3 + sell4 + sell5 + sell6 + sell7 + sell8 + sell9 + sell10) / 10; def Sellbuydiff5 = (curbuyVolume5 - cursellVolume5); def Sellbuydiff10 = (curbuyvol10 - cursellvol10); def v5Avg = WildersAverage(curbuyVolume5, LengthV5) ; def Buyline = WildersAverage(curbuyvol10[-displace], lengthV); def Sellline = WildersAverage(cursellvol10[-displace], lengthV); def Buylineavg = wildersAverage(buyline[-displace], lengthVolAVG) ; def Selllineavg = wildersAverage(sellline[-displace], lengthVolAVG) ; #def BuyLineAVG_Change = (Buylineavg - Buylineavg[1]); ########################### # CCI AVERAGE # ########################### input cciLength = 50; input cciAvgLength = 9; input over_sold = -200; input over_bought = 200; ### def pricecci = close + low + high; def linDev = LinDev(pricecci, cciLength); def CCI = if linDev == 0 then 0 else (pricecci - Average(pricecci, cciLength)) / linDev / 0.015; ### def CCIAvg = Average(CCI, cciAvgLength); def OverBought = over_bought; def OverSold = over_sold; def CCI_X_Up = CCI crosses above ZeroLine within 3 bars; def CCI_X_Down = CCI crosses below ZeroLine within 3 bars; #AddLabel(yes, " " + ccicountG + " ", color.DARK_GREEN); #AddLabel(yes, " " + ccicountR + " ", color.DARK_RED); #addlabel(yes, " ", color.DARK_GRAY); ################### # DMI OSC # ################### input lengthdmi = 10; input averageTypedmi = AverageType.WILDERS; input DMI_L = 8; def diPlus = DMI(lengthdmi, averageTypedmi)."DI+"; def diMinus = DMI(lengthdmi, averageTypedmi)."DI-"; def Osc = diPlus - diMinus; def DMI_A = wildersAverage(osc, DMI_L); ######################### # VOLATILITY STOP ######################### ## Volatility Trailing Stop ## Version 1.1 ## By Steve Coombs ## This ATR Trailing Stop is calculated using the Highest Close in an uptrend or ## the Lowest Close in a downtrend, rather than just the Close that is used ## in the standard TOS ATRTrailing Stop #input StopLabel = yes; #ATRStop Label is Stop value from yesterdays ATR calculation input ShowStop = yes; input ATRPeriod = 10; input ATRFactor = 1.5; input firstTrade = {default long, short}; input averageType = AverageType.WILDERS; Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor); def trueRange = TrueRange(high, close, low); def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod); def state = {default init, long, short}; def trail; def mclose; switch (state[1]) { case init: if (!IsNaN(loss)) { switch (firstTrade) { case long: state = state.long; mclose = close; trail = close - loss; case short: state = state.short; mclose = close; trail = close + loss; } } else { state = state.init; trail = Double.NaN; mclose = Double.NaN; } case long: if (close > trail[1]) { state = state.long; mclose = Max(mclose[1], close); trail = Max (trail[1], mclose - loss); } else { state = state.short; mclose = close; trail = mclose + loss; } case short: if (close < trail[1]) { state = state.short; mclose = Min(mclose[1], close); trail = Min(trail[1], mclose + loss); } else { state = state.long; mclose = close + 0; trail = mclose - loss; } } ################################################### #### CMF ###### input CMFL = 15; input CMFL_Avg = 6; def tmp_var = if high == low then volume else (close - low - (high - close)) / (high - low) * volume ; def sum_close = Sum(tmp_var, CMFL); def total = Sum(volume, CMFL); def CMF = if total == 0 then 0 else sum_close / total ; def CMF_P = WildersAverage(CMF, CMFL); def CMF_P_AVG = WildersAverage(cmf_P, CMFL_Avg) ; ######### ROC ########################## # # TD Ameritrade IP Company, Inc. (c) 2008-2023 # input lengthOBV = 8; def OBV = TotalSum(Sign(close - close[1]) * volume); def OBV_AVG = wildersAverage(obv,lengthOBV); ################## ####### MONEYFlow ###################### # # TD Ameritrade IP Company, Inc. (c) 2008-2023 # input priceM = close; input flowL = 5; def MF = TotalSum(if pricem < pricem[1] then -pricem * volume else if pricem > pricem[1] then pricem * volume else 0); def Flow = wildersAverage(MF, flowL); def MFlow_Up = flow > flow[1]; def MFlow_Dwn = flow < flow[1]; ############################## # filename: _MAMA_MDI_Combo_Lower_ # Here is Ehler's MAMA: # hint: <b>Ehler's Mesa Adaptive Moving Average</b> using Ray's clean version # of the homodyne discriminator. # # MIT License # Copyright (c) <2010> <Radford Juang> # #Permission is hereby granted, free of charge, to any person obtaining a copy #of this software and associated documentation files (the "Software"), to deal #in the Software without restriction, including without limitation the rights #to use, copy, modify, merge, publish, distribute, sublicense, and/or sell #copies of the Software, and to permit persons to whom the Software is #furnished to do so, subject to the following conditions: # #The above copyright notice and this permission notice shall be included in #all copies or substantial portions of the Software. # #THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR #IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, #FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE #AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER #LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM, #OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN #THE SOFTWARE. # script WMA_Smooth { input price = hl2; plot smooth = (4 * price + 3 * price[1] + 2 * price[2] + price[3]) / 10; } script Phase_Accumulation { # This is Ehler's Phase Accumulation code. It has a full cycle delay. # However, it computes the correction factor to a very high degree. # input price = hl2; rec Smooth; rec Detrender; rec Period; rec Q1; rec I1; rec I1p; rec Q1p; rec Phase1; rec Phase; rec DeltaPhase; rec DeltaPhase1; rec InstPeriod1; rec InstPeriod; def CorrectionFactor; if BarNumber() <= 5 then { Period = 0; Smooth = 0; Detrender = 0; CorrectionFactor = 0; Q1 = 0; I1 = 0; Q1p = 0; I1p = 0; Phase = 0; Phase1 = 0; DeltaPhase1 = 0; DeltaPhase = 0; InstPeriod = 0; InstPeriod1 = 0; } else { CorrectionFactor = 0.075 * Period[1] + 0.54; # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; # Compute Quadrature and Phase of Detrended signal: Q1p = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1p = Detrender[3]; # Smooth out Quadrature and Phase: I1 = 0.15 * I1p + 0.85 * I1p[1]; Q1 = 0.15 * Q1p + 0.85 * Q1p[1]; # Determine Phase if I1 != 0 then { # Normally, ATAN gives results from -pi/2 to pi/2. # We need to map this to circular coordinates 0 to 2pi if Q1 >= 0 and I1 > 0 then { # Quarant 1 Phase1 = ATan(AbsValue(Q1 / I1)); } else if Q1 >= 0 and I1 < 0 then { # Quadrant 2 Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1)); } else if Q1 < 0 and I1 < 0 then { # Quadrant 3 Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1)); } else { # Quadrant 4 Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1)); } } else if Q1 > 0 then { # I1 == 0, Q1 is positive Phase1 = Double.Pi / 2; } else if Q1 < 0 then { # I1 == 0, Q1 is negative Phase1 = 3 * Double.Pi / 2; } else { # I1 and Q1 == 0 Phase1 = 0; } # Convert phase to degrees Phase = Phase1 * 180 / Double.Pi; if Phase[1] < 90 and Phase > 270 then { # This occurs when there is a big jump from 360-0 DeltaPhase1 = 360 + Phase[1] - Phase; } else { DeltaPhase1 = Phase[1] - Phase; } # Limit our delta phases between 7 and 60 if DeltaPhase1 < 7 then { DeltaPhase = 7; } else if DeltaPhase1 > 60 then { DeltaPhase = 60; } else { DeltaPhase = DeltaPhase1; } # Determine Instantaneous period: InstPeriod1 = -1 * (fold i = 0 to 40 with v=0 do if v < 0 then v else if v > 360 then -i else v + GetValue(DeltaPhase, i, 41) ); if InstPeriod1 <= 0 then { InstPeriod = InstPeriod[1]; } else { InstPeriod = InstPeriod1; } Period = 0.25 * InstPeriod + 0.75 * Period[1]; } plot DC = Period; } script Ehler_MAMA { input price = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; rec Period; rec Period_raw; rec Period_cap; rec Period_lim; rec Smooth; rec Detrender; rec I1; rec Q1; rec jI; rec jQ; rec I2; rec Q2; rec I2_raw; rec Q2_raw; rec Phase; rec DeltaPhase; rec DeltaPhase_raw; rec alpha; rec alpha_raw; rec Re; rec Im; rec Re_raw; rec Im_raw; rec SmoothPeriod; rec vmama; rec vfama; def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor; if BarNumber() <= 5 then { Smooth = 0; Detrender = 0; Period = 0; Period_raw = 0; Period_cap = 0; Period_lim = 0; I1 = 0; Q1 = 0; I2 = 0; Q2 = 0; jI = 0; jQ = 0; I2_raw = 0; Q2_raw = 0; Re = 0; Im = 0; Re_raw = 0; Im_raw = 0; SmoothPeriod = 0; Phase = 0; DeltaPhase = 0; DeltaPhase_raw = 0; alpha = 0; alpha_raw = 0; vmama = 0; vfama = 0; } else { # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; Q1 = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1 = Detrender[3]; jI = ( 0.0962 * I1 + 0.5769 * I1[2] - 0.5769 * I1[4] - 0.0962 * I1[6] ) * CorrectionFactor; jQ = ( 0.0962 * Q1 + 0.5769 * Q1[2] - 0.5769 * Q1[4] - 0.0962 * Q1[6] ) * CorrectionFactor; # This is the complex conjugate I2_raw = I1 - jQ; Q2_raw = Q1 + jI; I2 = 0.2 * I2_raw + 0.8 * I2_raw[1]; Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1]; Re_raw = I2 * I2[1] + Q2 * Q2[1]; Im_raw = I2 * Q2[1] - Q2 * I2[1]; Re = 0.2 * Re_raw + 0.8 * Re_raw[1]; Im = 0.2 * Im_raw + 0.8 * Im_raw[1]; # Compute the phase if Re != 0 and Im != 0 then { Period_raw = 2 * Double.Pi / ATan(Im / Re); } else { Period_raw = 0; } if Period_raw > 1.5 * Period_raw[1] then { Period_cap = 1.5 * Period_raw[1]; } else if Period_raw < 0.67 * Period_raw[1] { Period_cap = 0.67 * Period_raw[1]; } else { Period_cap = Period_raw; } if Period_cap < 6 then { Period_lim = 6; } else if Period_cap > 50 then { Period_lim = 50; } else { Period_lim = Period_cap; } Period = 0.2 * Period_lim + 0.8 * Period_lim[1]; SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1]; if I1 != 0 then { Phase = ATan(Q1 / I1); } else if Q1 > 0 then { # Quadrant 1: Phase = Double.Pi / 2; } else if Q1 < 0 then { # Quadrant 4: Phase = -Double.Pi / 2; } else { # Both numerator and denominator are 0. Phase = 0; } DeltaPhase_raw = Phase[1] - Phase; if DeltaPhase_raw < 1 then { DeltaPhase = 1; } else { DeltaPhase = DeltaPhase_raw; } alpha_raw = FastLimit / DeltaPhase; if alpha_raw < SlowLimit then { alpha = SlowLimit; } else { alpha = alpha_raw; } vmama = alpha * price + (1 - alpha) * vmama[1]; vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1]; } plot MAMA = vmama; plot FAMA = vfama; } #declare upper; input price = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; #AddLabel(yes, Concat("MAMA: ", Concat("", #if MAMA > FAMA then "Bull" else "Bear")), #if MAMA > FAMA then Color.GREEN else Color.RED); # McGinley Dynamic Indicator # Mobius # V02.11.2011 # D = D1 + ((I - D1) / ( N * (I/D1)^4)) # where D1= yesterday's Dynamic, I = today's price, N = smoothing factor. input valueMcD = close; input length = 20; input Slength = 5; def A1 = ExpAverage(valueMcD, length)[1]; def MDI = A1 + ((valueMcD - A1) / Sqr(valueMcD / A1)); input periods = 10; rec _md = CompoundValue( 1, _md[1] + (( close - _md[1] ) / ( periods * Power( close / _md[1], 4 ) ) ), close ); def MD = _md; def FAMA = Ehler_MAMA(price, FastLimit, SlowLimit).FAMA; def MAMA = Ehler_MAMA(price, FastLimit, SlowLimit).MAMA; ########################################################################### ################### SIGNALS ############ def BuyLine5Up = v5Avg > v5Avg[1]; def BuylineUp = Buyline > Buyline[1] ; def Long5vol = curbuyVolume5 > cursellVolume5; def Long10Vol = curbuyvol10 > cursellvol10; def Buy_AVG_UP = Buylineavg > Buylineavg[1]; def CMF_Long = CMF_P > CMF_P[1]; def CMF_Short = CMF_P < CMF_P[1]; def CMF_P_AVG_UP = CMF_P_AVG > CMF_P_AVG[1]; def CMF_P_AVG_Down = CMF_P_AVG < CMF_P_AVG[1]; def CCI_AVG_Long = CCIAvg > CCIAvg[1]; def CCI_AVG_Short = CCIAvg < CCIAvg[1]; def DMILong = Osc > ZeroLine; def DMIShort = Osc < ZeroLine; def DMIUP = DMI_A > DMI_A[1]; def DMIDown = DMI_A < DMI_A[1]; def MAMA_FAMA_L = MAMA > FAMA; def MAMA_FAMA_S = MAMA < FAMA; def MAMA_McG_L = MAMA > MD; def MAMA_McG_S = MAMA < MD; def Trail_L = state == state.long; def Trail_S = state == state.short; def ROC_UP = OBV_AVG > OBV_AVG[1]; def ROC_Down = OBV_AVG < OBV_AVG[1]; def BuylineDown = Buyline < Buyline[1] ; def SelllineUp = Sellline > Sellline[1] ; def SelllineDown = Sellline < Sellline[1] ; def Short5vol = curbuyVolume5 < cursellVolume5; def Short10Vol = curbuyvol10 < cursellvol10; def BuyLine5Down = v5Avg < v5Avg[1]; def Buy_AVG_Down = Buylineavg < Buylineavg[1]; def Sell_AVG_Down = Selllineavg < Selllineavg[1]; def Sell_AVG_UP = Selllineavg > Selllineavg[1]; ######## AGREEMENT LEVELS ############# ###### Confirmation, derived from Christopher84's Confirmation candles def AgreeTotalL = CCI_AVG_Long + DMILong + DMIUP + MAMA_FAMA_L + MAMA_McG_L + Trail_L + Long5vol + Long10Vol + CMF_Long + TKL4_13 + TKL4_52 + FutureBullishCloudB + FutureBullishCloudC + FutureBullishCloudD + Lag2L + Lag3L + Lag4L + cmf_P_AVG_UP + BuyLineUp + SellLineDown + Buy_AVG_UP + Sell_AVG_Down + Mflow_Up + ROC_UP; def AgreeTotalS = CCI_AVG_Short + DMIShort + DMIDown + MAMA_FAMA_S + MAMA_McG_S + Trail_S + Short5vol + Short10Vol + CMF_Short + TKS4_13 + TKS4_52 + FutureBearishCloudB + FutureBearishCloudC + FutureBearishCloudD + Lag2S + Lag3S + Lag4S + cmf_P_AVG_Down + SellLineUp + BuyLineDown + Buy_AVG_Down + Sell_AVG_UP + Mflow_Dwn + ROC_Down; def ConTotal = AgreeTotalL - AgreeTotalS; def MomTotalUp = ConTotal[1] < ConTotal; def MomTotalDown = Contotal[1] > ConTotal; ########################### AddLabel(yes, "Trend State = " + Round(ConTotal, 1), CreateColor(59, 80, 99)); AddLabel(yes, " ", CreateColor(43, 43, 43)); ##### input MOMAVG = 4; plot MOMline = WildersAverage(ConTotal[-displace], length_mom); plot MOMlineAVGp = wildersAverage(MOMline, MOMAVG) ; MOMline.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); MOMline.AssignValueColor(if MOMlineAVGp < MOMlineAVGp[1] and MOMline > MOMline[1] then color.GRAY else if MOMline > MOMline[1] then createcolor(37,129,55) else if MOMlineAVGp > MOMlineAVGp[1] and MOMline < MOMline[1] then createColor(62,74,69) else if MOMline < MOMline[1] then color.DARK_RED else color.BLACK); MOMline.SetLineWeight(5); #def MOMline = wildersAverage(cursellvol10[-displace], length12) ; #def MOMLINEAVG = (Momline / 10); MOMlineAVGp.SetPaintingStrategy(PaintingStrategy.LINE); MOMlineAVGp.SetLineWeight(5); MOMlineAVGp.AssignValueColor(if MOMlineAVGp > MOMlineAVGp[1] then Color.GREEN else if MOMlineAVGp < MOMlineAVGp[1] then Color.DARK_ORANGE else Color.DARK_GRAY); def MomlineDiff = (MOMlineAVGp - MOMlineAVGp[1]); ############### Momentum Change #def MoMDir1 = if MOMlineAVGp > MOMlineAVGp[1] then 1 else if MOMlineAVGp < MOMlineAVGp[1] then 2 else 0; #def MoMDirUp = if MoMDir1[1] == 0 and MoMDir1 == 1 then 1 else if MoMDir1 == 1 then MoMDirUp[1] + 1 else 0; #def MomCntUp = MoMDirUp; #def MoMDirDwn = if MoMDir1[1] == 0 and MoMDir1 == 2 then 2 else if MoMDir1 == 2 then MoMDirDwn[1] + 1 else 0; #def MoMCntdwn = MoMDirDwn; ########### MOM_AVG ################### #def MomLUp = MomlineDiff > MomlineDiff[1]; #def MomLDwn = MomlineDiff < MomlineDiff[1]; input ML = 20; plot MoMLabelLine = wildersAverage(momlineDiff, ml); MoMLabelLine.setpaintingStrategy(paintingStrategy.SQUARES); MoMLabelLine.setlineWeight(3); MoMLabelLine.assignValueColor(if MoMLabelLine > MoMLabelLine[1] then color.GREEN else if MoMLabelLine < MoMLabelLine[1] then color.DARK_ORANGE else color.GRAY); ############ AddLabel(yes, "Momentum Change = " + MoMLabelLine , if MoMLabelLine > MoMLabelLine[1] then CreateColor(37,130,80) else if MoMLabelLine < MoMLabelLine[1] then CreateColor(168,12,22) else Color.DARK_GRAY); def MoM_PercentChange = (MoMLabelLine - MoMLabelLine[1]) / MoMLabelLine * (100) ; AddLabel(yes, MoM_PercentChange + " %", if MoMLabelLine > MoMLabelLine[1] then CreateColor(37, 130, 80) else if MoMLabelLine < MoMLabelLine[1] then CreateColor(168, 12, 22) else Color.DARK_GRAY); ########################### RSI AVG ############################## #RSI AVG BY Hypnotic_Options input lengthRSI = 34; input lengthrsiAVG = 14; input over_BoughtRSI = 80; input over_SoldRSI = 20; input priceRSI = close; input averageTypeRSI = AverageType.WILDERS; input mid = 50; def NetChgAvg = MovingAverage(averageTypeRSI, priceRSI - priceRSI[1], lengthRSI); def TotChgAvg = MovingAverage(averageTypeRSI, AbsValue(priceRSI - priceRSI[1]), lengthRSI); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def RSI_A = WildersAverage(RSI, lengthRSI) ; #RSI_A.setpaintingStrategy(paintingStrategy.DASHES); #RSI_A.assignValueColor(if RSI_A > RSI_A[1] then color.GREEN else if RSI_A < RSI_A[1] then color.DARK_RED else color.DARK_GRAY); #RSI_A.setlineWeight(5); def rsiavg = WildersAverage(RSI_A, lengthrsiAVG); #rsiavg.SetLineWeight(5); #rsiavg.SetPaintingStrategy(PaintingStrategy.LINE); #rsiavg.AssignValueColor(if rsiavg > rsiavg[1] then Color.LIGHT_GREEN else if rsiavg < rsiavg[1] then Color.ORANGE else Color.DARK_GRAY); ####### RSI SIGNALS ############# def RSIavg_Change = (rsiavg - rsiavg[1]); def RSI_L = RSI_A > RSI_A[1]; def RSI_S = RSI_A < RSI_A[1]; def RSIavg_L = rsiavg > rsiavg[1]; def RSIavg_S = rsiavg < rsiavg[1]; ####### RSI TRADE BIAS, LABELS NOT INCLUDED #def RSI_ST_Long = rsi_l and RSIavg_S and RSIavg_Change > RSIavg_Change[1]; #def RSI_Long = RSI_L and RSIavg_L; #def RSI_ST_Short = rsi_S and RSIavg_L and RSIavg_Change < RSIavg_Change[1]; #def RSI_Short = RSI_S and RSIavg_S; ########### TRADE BIAS WITH LABELS ############ def RSI_ST_Long = RSI_L and RSIavg_S and RSIavg_Change > RSIavg_Change[1]; def RSI_Long = RSI_L and RSIavg_L and RSIavg_Change > RSIavg_Change[1]; def RSI_ST_Short = RSI_S and RSIavg_L and RSIavg_Change < RSIavg_Change[1]; def RSI_Short = RSI_S and RSIavg_S and RSIavg_Change < RSIavg_Change[1]; ######################### def RSI_LineStatus_L = RSI_A > rsiavg; def RSI_LineStatus_S = RSI_A < rsiavg; def RSI_CT_L = RSI_L and RSIavg_S; def RSI_CT_S = RSI_S and RSIavg_L; AddLabel(yes, " ", CreateColor(43, 43, 43)); ##### Long Term ########## AddLabel(yes, "RSI_AVG Change = " + RSIavg_Change, if RSIavg_Change > RSIavg_Change[1] then CreateColor(37, 130, 80) else if RSIavg_Change < RSIavg_Change[1] then CreateColor(168, 12, 22) else Color.DARK_GRAY); #AddLabel(yes, " ", CreateColor(43, 43, 43)); ########## RSI COUNTER ################################## #def RSIDir1 = if rsiavg > rsiavg[1] then 1 else if rsiavg < rsiavg[1] then 2 else 0; #def RSIDirUp = if RSIDir1[1] == 0 and RSIDir1 == 1 then 1 else if RSIDir1 == 1 then RSIDir1[1] + 1 else 0; #def RSICntUp = MoMDirUp; #def RSIDirDwn = if RSIDir1[1] == 0 and RSIDir1 == 2 then 2 else if RSIDir1 == 2 then RSIDirDwn[1] + 1 else 0; #def RSICntdwn = RSIDirDwn; ######## RSI Momentum Line ################## input t = 10; input u = 2; plot RSI_ST_MoM = wildersAverage(RSIavg_Change, t); def RSI_AVGUp = RSIavg_Change > RSIavg_Change[1]; def RSI_AVGDwn = RSIavg_Change < RSIavg_Change[1]; def RSI_ST_MoMUp = RSI_ST_MoM > RSI_ST_MoM[1]; def RSI_ST_MoMDwn = RSI_ST_MoM < RSI_ST_MoM[1]; #def RSI_ST_MoMUP_Rising = RSI_ST_MoMUp and RSI_AVGUp; #def RSI_ST_MoMUP_Falling = RSI_ST_MoMUp and RSI_AVGDwn ; #def RSI_ST_MoMDwn_Rising = RSI_ST_MoMDwn and RSI_AVGUp; #def RSI_ST_MoMDwn_Falling = RSI_ST_MoMDwn and RSI_AVGDwn ; #AddLabel(yes, "RSI_ST_MoM = " + if RSI_ST_MoMUP_Rising then CreateColor(37, 130, 80) else if RSI_ST_MoMUP_Falling then CreateColor(168, 12, 22) else Color.DARK_GRAY); AddLabel(yes, " ", CreateColor(43, 43, 43)); RSI_ST_MoM.setstyle(curve.FIRM); RSI_ST_MoM.setlineWeight(5); RSI_ST_MoM.assignValueColor(if RSI_AVGUp and RSI_ST_MoMUp then color.GREEN else if RSI_AVGDwn and RSI_ST_MoMDwn then color.YELLOW else color.DARK_GRAY); def rsilabelavg = WildersAverage(RSI_ST_MoM, u); #rsilabelavg.SetLineWeight(5) #rsilabelavg.Setstyle(curve.FIRM); addlabel(yes, if rsilabelavg > rsilabelavg[1] then "RSI_LT_MoM" else if rsilabelavg < rsilabelavg[1] then "RSI_LT_MoM" else "", if rsilabelavg > rsilabelavg[1] then CreateColor(37,130,80) else if rsilabelavg < rsilabelavg[1] then CreateColor(168,12,22) else Color.DARK_GRAY); AddLabel(yes, " ", CreateColor(43, 43, 43)); #addlabel(yes, "Momentum Change = " + momlineDiff + if MomlineDiff > MomlineDiff[1] then " (" + MomCntUp + ")" else if MomlineDiff < MomlineDiff[1] then " (" + MoMCntdwn + ")" else "", if MomlineDiff > MomlineDiff[1] then CreateColor(37, 130, 80) else if MomlineDiff < MomlineDiff[1] then CreateColor(168,12,22) else color.DARK_GRAY); ############## ########################################################## ####### MM SIGNALS (W/O LABELS ############ #def MM_L = momline > momline[1] and momlineavGp > momlineavGp[1]; #def MM_S = momline < momline[1] and momlineavGp < momlineavGp[1]; ######### WITH LABELS def MM_L = MOMline > MOMline[1] and MOMlineAVGp > MOMlineAVGp[1] and MomlineDiff > MomlineDiff[1]; def MM_S = MOMline < MOMline[1] and MOMlineAVGp < MOMlineAVGp[1] and MomlineDiff < MomlineDiff[1]; ############## COMBINED SIGNALS ############################ def MM_Long_Caution = MM_L and RSI_ST_Long; def MM_Long = MM_L and RSI_Long; def MM_Short_Caution = MM_S and RSI_ST_Short; def MM_Short = MM_S and RSI_Short; #addlabel(yes, "RSI Bias: " + if RSI_ST_Long then "UP (Caution) " else if RSI_Long then "UP" else if RSI_ST_Short then "Down (Caution) " else if RSI_Short then "Down " else " ", if RSI_ST_Long or RSI_Long then CreateColor(37,130,80) else if RSI_ST_Short or RSI_Short then CreateColor(168,12,22) else color.DARK_GRAY); AddLabel(yes, "RSI Bias: " + if RSI_CT_L then "Bullish: Countertrend" else if RSI_CT_S then "Bearish: Countertrend " else if RSI_LineStatus_L then "Bullish" else if RSI_LineStatus_S then "Bearish" else " ", if RSI_CT_L then CreateColor(37, 130, 80) else if RSI_CT_S then CreateColor(168, 12, 22) else if RSI_LineStatus_L then CreateColor(37, 130, 80) else if RSI_LineStatus_S then CreateColor(168, 12, 22) else Color.DARK_GRAY); AddLabel(yes, " ", CreateColor(43, 43, 43)); #def MoMLine_L = momline > momline[1]; #def MomAvg_L = momlineavGp > momlineavGp[1]; #def MomDiff_L = MomlineDiff > MomlineDiff[1]; #def LBias = momLine_L + momavg_L + RSI_L + RSIavg_L + momDiff_L; #def MoMLine_S = momline < momline[1]; #def MomAvg_S = momlineavGp < momlineavGp[1]; #def MomDiff_S = MomlineDiff < MomlineDiff[1]; #def SBias = momLine_S + momavg_S + RSI_S + RSIavg_S + momDiff_S; #def Trade_bias = LBias - SBias; #def Trade_Bias_L = Trade_bias > Trade_bias; #def Trade_Bias_S = Trade_bias < Trade_bias; #def TradeBiasUp = Trade_bias[1] < Trade_bias; #def TradeBiasDwn = Trade_bias[1] > Trade_bias; AddLabel(yes, "Trade Bias: " + if MM_Long_Caution then "*** Long (Caution) ***" else if MM_Long then "Long" else if MM_Short_Caution then "*** Short (Caution) ***" else if MM_Short then "*** Short ***" else " ", if MM_Long_Caution or MM_Long then CreateColor(37, 130, 80) else if MM_Short_Caution or MM_Short then CreateColor(168, 12, 22) else Color.DARK_GRAY); AddLabel(yes, " ", CreateColor(43, 43, 43)); #addlabel(yes, Round(Trade_bias, 1)); #plot MomlineDiffC = (MOMlineAVGp - MOMlineAVGp[1]); #momlineDiffC.setlineWeight(5); #momlineDiff.assignValueColor(if MomlineDiff > MomlineDiff[1] then color.GREEN else if MomlineDiff < #MomlineDiff[1] then color.YELLOW else color.DARK_GRAY); #def MomLUp = MomlineDiff > MomlineDiff[1]; #def MomLDwn = MomlineDiff < MomlineDiff[1]; #AddCloud(if momlUp then momlUp else Double.NaN, momlineDiff, color.GREEN, color.BLUE); #AddCloud(if momlDwn then momlDwn else Double.NaN, momlineDiff, color.YELLOW, Color.CURRENT); #plot MoMLabelLine = momlineDiff; #MoMLabelLine.setpaintingStrategy(paintingStrategy.SQUARES); #MoMLabelLine.setlineWeight(4); #MoMLabelLine.assignValueColor(if momlUp then color.GREEN else if momlDwn then color.DARK_ORANGE else color.GRAY);

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Megalodon Momentum For ThinkOrSwim

- Thread starter RedToGreen

- Start date

RedToGreen

Active member

Great, hope it helpsIf this does not re paint then it looks like this could of saved me a lot of money when comparing to other indicators I use. Great confirmation tool at the least.

It does not re-paint.

@Christopher84 has sired many children on this forum (the studies... not the users...)

ovalenzuelab

New member

Any chances to have a can scan for this study?

RedToGreen

Active member

Unfortunately, noAny chances to have a can scan for this study?

Can anyone help me to put alert on this signal @MerryDay @samer800 .. Thank you

Code:#RSI AVG BY Hypnotic_Options declare lower; input lengthRSI = 34; input lengthrsiAVG = 14; input over_Bought = 80; input over_Sold = 20; input price = close; input averageType = AverageType.WILDERS; input showBreakoutSignals = no; input mid = 50; def NetChgAvg = MovingAverage(averageType, price - price[1], lengthRSI); def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), lengthRSI); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); plot RSI_A = WildersAverage(RSI, lengthRSI) ; RSI_A.setpaintingStrategy(paintingStrategy.DASHES); RSI_A.assignValueColor(if RSI_A > RSI_A[1] then color.GREEN else if RSI_A < RSI_A[1] then color.DARK_RED else color.DARK_GRAY); RSI_A.setlineWeight(5); plot rsiavg = WildersAverage(RSI_A, lengthrsiAVG); rsiavg.SetLineWeight(5); rsiavg.SetPaintingStrategy(PaintingStrategy.LINE); rsiavg.AssignValueColor(if rsiavg > rsiavg[1] then Color.LIGHT_GREEN else if rsiavg < rsiavg[1] then Color.ORANGE else Color.DARK_GRAY); def RSI_L = RSI_A > RSI_A[1]; def RSI_S = RSI_A < RSI_A[1]; def RSIavg_L = rsiavg > rsiavg[1]; def RSIavg_S = rsiavg < rsiavg[1]; def RSI_ST_Long = rsi_l and RSIavg_S; def RSI_Long = RSI_L and RSIavg_L; def RSIavg_Change = (rsiavg - rsiavg[1]); addlabel(yes, "RSI_AVG Change = " + RSIavg_Change, if RSIavg_Change > RSIavg_Change[1] then CreateColor(37,130,80) else if RSIavg_Change < RSIavg_Change[1] then CreateColor(168,12,22) else color.DARK_GRAY); #addlabel(yes, " ", createColor(43,43,43));

Kislayakanan

Member

@RedToGreen : Thank you for sharing the indicator. Can you please explain the various part of indicators? For example what does orange/green dot means at bottom of the bar?

What does the grey bar mean?

How to best use this indicator?

What does the grey bar mean?

How to best use this indicator?

Last edited:

Code:

#RSI AVG BY Hypnotic_Options

declare lower;

input lengthRSI = 34;

input lengthrsiAVG = 14;

input over_Bought = 80;

input over_Sold = 20;

input price = close;

input averageType = AverageType.WILDERS;

input showBreakoutSignals = no;

input mid = 50;

input UseAlerts = yes;

def NetChgAvg = MovingAverage(averageType, price - price[1], lengthRSI);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), lengthRSI);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

plot RSI_A = WildersAverage(RSI, lengthRSI) ;

RSI_A.setpaintingStrategy(paintingStrategy.DASHES);

RSI_A.assignValueColor(if RSI_A > RSI_A[1] then color.GREEN else if RSI_A < RSI_A[1] then color.DARK_RED else color.DARK_GRAY);

RSI_A.setlineWeight(5);

plot rsiavg = WildersAverage(RSI_A, lengthrsiAVG);

rsiavg.SetLineWeight(5);

rsiavg.SetPaintingStrategy(PaintingStrategy.LINE);

rsiavg.AssignValueColor(if rsiavg > rsiavg[1] then Color.LIGHT_GREEN else if rsiavg < rsiavg[1] then Color.ORANGE else Color.DARK_GRAY);

def RSI_L = RSI_A > RSI_A[1];

def RSI_S = RSI_A < RSI_A[1];

Alert(RSI_L and UseAlerts, "RSI: Long", Alert.BAR, Sound.Ding);

Alert(RSI_S and UseAlerts, "RSI: Short", Alert.BAR, Sound.Ding);

def RSIavg_L = rsiavg > rsiavg[1];

def RSIavg_S = rsiavg < rsiavg[1];

Alert(RSIavg_L and UseAlerts, "RSI AVG: Long", Alert.BAR, Sound.Ding);

Alert(RSIavg_S and UseAlerts, "RSI AVG: Short", Alert.BAR, Sound.Ding);

def RSI_ST_Long = rsi_l and RSIavg_S;

def RSI_Long = RSI_L and RSIavg_L;

Alert(RSI_ST_Long and UseAlerts, "RSI: Long Stop", Alert.BAR, Sound.Ding);

Alert(RSI_Long and UseAlerts, "RSI: Long", Alert.BAR, Sound.Ding);

def RSIavg_Change = (rsiavg - rsiavg[1]);

addlabel(yes, "RSI_AVG Change = " + RSIavg_Change, if RSIavg_Change > RSIavg_Change[1] then CreateColor(37,130,80) else if RSIavg_Change < RSIavg_Change[1] then CreateColor(168,12,22) else color.DARK_GRAY);

#addlabel(yes, " ", createColor(43,43,43));I would love to get an alert when the dash green and dash red appears.. right now it is giving me alert every single candle. Not sure whyCode:#RSI AVG BY Hypnotic_Options declare lower; input lengthRSI = 34; input lengthrsiAVG = 14; input over_Bought = 80; input over_Sold = 20; input price = close; input averageType = AverageType.WILDERS; input showBreakoutSignals = no; input mid = 50; input UseAlerts = yes; def NetChgAvg = MovingAverage(averageType, price - price[1], lengthRSI); def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), lengthRSI); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); plot RSI_A = WildersAverage(RSI, lengthRSI) ; RSI_A.setpaintingStrategy(paintingStrategy.DASHES); RSI_A.assignValueColor(if RSI_A > RSI_A[1] then color.GREEN else if RSI_A < RSI_A[1] then color.DARK_RED else color.DARK_GRAY); RSI_A.setlineWeight(5); plot rsiavg = WildersAverage(RSI_A, lengthrsiAVG); rsiavg.SetLineWeight(5); rsiavg.SetPaintingStrategy(PaintingStrategy.LINE); rsiavg.AssignValueColor(if rsiavg > rsiavg[1] then Color.LIGHT_GREEN else if rsiavg < rsiavg[1] then Color.ORANGE else Color.DARK_GRAY); def RSI_L = RSI_A > RSI_A[1]; def RSI_S = RSI_A < RSI_A[1]; Alert(RSI_L and UseAlerts, "RSI: Long", Alert.BAR, Sound.Ding); Alert(RSI_S and UseAlerts, "RSI: Short", Alert.BAR, Sound.Ding); def RSIavg_L = rsiavg > rsiavg[1]; def RSIavg_S = rsiavg < rsiavg[1]; Alert(RSIavg_L and UseAlerts, "RSI AVG: Long", Alert.BAR, Sound.Ding); Alert(RSIavg_S and UseAlerts, "RSI AVG: Short", Alert.BAR, Sound.Ding); def RSI_ST_Long = rsi_l and RSIavg_S; def RSI_Long = RSI_L and RSIavg_L; Alert(RSI_ST_Long and UseAlerts, "RSI: Long Stop", Alert.BAR, Sound.Ding); Alert(RSI_Long and UseAlerts, "RSI: Long", Alert.BAR, Sound.Ding); def RSIavg_Change = (rsiavg - rsiavg[1]); addlabel(yes, "RSI_AVG Change = " + RSIavg_Change, if RSIavg_Change > RSIavg_Change[1] then CreateColor(37,130,80) else if RSIavg_Change < RSIavg_Change[1] then CreateColor(168,12,22) else color.DARK_GRAY); #addlabel(yes, " ", createColor(43,43,43));

I would love to get an alert when the dash green and dash red appears.. right now it is giving me alert every single candle. Not sure why

try this

Code:

#RSI AVG BY Hypnotic_Options

declare lower;

input lengthRSI = 34;

input lengthrsiAVG = 14;

input over_Bought = 80;

input over_Sold = 20;

input price = close;

input averageType = AverageType.WILDERS;

input showBreakoutSignals = no;

input mid = 50;

input UseAlerts = yes;

def NetChgAvg = MovingAverage(averageType, price - price[1], lengthRSI);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), lengthRSI);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

plot RSI_A = WildersAverage(RSI, lengthRSI) ;

RSI_A.setpaintingStrategy(paintingStrategy.DASHES);

RSI_A.assignValueColor(if RSI_A > RSI_A[1] then color.GREEN else if RSI_A < RSI_A[1] then color.DARK_RED else color.DARK_GRAY);

RSI_A.setlineWeight(5);

plot rsiavg = WildersAverage(RSI_A, lengthrsiAVG);

rsiavg.SetLineWeight(5);

rsiavg.SetPaintingStrategy(PaintingStrategy.LINE);

rsiavg.AssignValueColor(if rsiavg > rsiavg[1] then Color.LIGHT_GREEN else if rsiavg < rsiavg[1] then Color.ORANGE else Color.DARK_GRAY);

def RSI_L = RSI_A > RSI_A[1];

def RSI_S = RSI_A < RSI_A[1];

Alert(RSI_L and UseAlerts, "RSI: Long", Alert.BAR, Sound.Ding);

Alert(RSI_S and UseAlerts, "RSI: Short", Alert.BAR, Sound.Ding);

def RSIavg_L = rsiavg > rsiavg[1];

def RSIavg_S = rsiavg < rsiavg[1];

#Alert(RSIavg_L and UseAlerts, "RSI AVG: Long", Alert.BAR, Sound.Ding);

#Alert(RSIavg_S and UseAlerts, "RSI AVG: Short", Alert.BAR, Sound.Ding);

def RSI_ST_Long = rsi_l and RSIavg_S;

def RSI_Long = RSI_L and RSIavg_L;

#Alert(RSI_ST_Long and UseAlerts, "RSI: Long Stop", Alert.BAR, Sound.Ding);

#Alert(RSI_Long and UseAlerts, "RSI: Long", Alert.BAR, Sound.Ding);

def RSIavg_Change = (rsiavg - rsiavg[1]);

addlabel(yes, "RSI_AVG Change = " + RSIavg_Change, if RSIavg_Change > RSIavg_Change[1] then CreateColor(37,130,80) else if RSIavg_Change < RSIavg_Change[1] then CreateColor(168,12,22) else color.DARK_GRAY);

#addlabel(yes, " ", createColor(43,43,43));red_man_1111

New member

Changes are coming...Actually they are here..Updates when I have time...In the meantime, code has been updated.

I'll explain when I have a moment.

Hello Red2Green, the megalodon indicator looks awesome, thanks for sharing! I really want to try it but I'm getting error, no code experience, sorry, not sure what im doing wrong, if yoy dont mind to give me a hand Thanks!

Attachments

Hello Red2Green, the megalodon indicator looks awesome, thanks for sharing! I really want to try it but I'm getting error, no code experience, sorry, not sure what im doing wrong, if yoy dont mind to give me a hand Thanks!

Code has been fixed in this thread:

https://usethinkscript.com/threads/megalodon-momentum-for-thinkorswim.15875/#post-127115

You need to put a hashtag in front of the word: Updated

Last edited by a moderator:

gsvector24

New member

Hi, Great to see this. can you please help me with this ?

1. did you make any enhancements/fine tuning recently ?

2. Do you have simple steps how to use and make long and short decisions using these lines?

Thank you

1. did you make any enhancements/fine tuning recently ?

2. Do you have simple steps how to use and make long and short decisions using these lines?

Thank you

rlohmeyer

Active member

@RedToGreen

I find this indicator fascinating. I am using only the Histogram with no labels and no other indicators on a 1 minute time frame of the Spy setup so I can clearly see the high, low, and close of the 5 Minute bars and the 15 minute Volume Profile info with POCs. I have certain S/R lines on the chart as targets and supports, such as todays open, yesterdays close, yesterdays high and low, as well as the VWAP and the 30Minute Opening Range which also acts as both Target and Resistance/Support.

This morning the indicator gave a great reversal signal after the 30 minute opening range period, which I never trade. The signal is indicated by the arrow on chart which shows the approximate entry, and the 2 targets that were reached. The indicator is complex enough that I did not fool with any of the inputs except MOMAVG which I set to 5 to correspond to a five minute bar, which will often times correspond to a push. The chart is below. Kudos on this indicator. I have not found any other oscillator as useful as this to indicate a possible change in direction supported by price action.

Regards,

Bob

PS..You can also clearly see the indicator gave other good signals of a turn.

I find this indicator fascinating. I am using only the Histogram with no labels and no other indicators on a 1 minute time frame of the Spy setup so I can clearly see the high, low, and close of the 5 Minute bars and the 15 minute Volume Profile info with POCs. I have certain S/R lines on the chart as targets and supports, such as todays open, yesterdays close, yesterdays high and low, as well as the VWAP and the 30Minute Opening Range which also acts as both Target and Resistance/Support.

This morning the indicator gave a great reversal signal after the 30 minute opening range period, which I never trade. The signal is indicated by the arrow on chart which shows the approximate entry, and the 2 targets that were reached. The indicator is complex enough that I did not fool with any of the inputs except MOMAVG which I set to 5 to correspond to a five minute bar, which will often times correspond to a push. The chart is below. Kudos on this indicator. I have not found any other oscillator as useful as this to indicate a possible change in direction supported by price action.

Regards,

Bob

PS..You can also clearly see the indicator gave other good signals of a turn.

Last edited:

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Momentum-based-ZigZag-incl-QQE-NON-REPAINTING for ThinkOrSwim

- Started by samer800

- Replies: 7

-

-

Free Warrior Trading Momentum Scanner for ThinkorSwim

- Started by GetRichOrDieTrying

- Replies: 17

-

A Serving of Trend and Momentum Indicators for ThinkorSwim

- Started by merryDay

- Replies: 3

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

883

Online

Similar threads

-

Momentum-based-ZigZag-incl-QQE-NON-REPAINTING for ThinkOrSwim

- Started by samer800

- Replies: 7

-

-

Free Warrior Trading Momentum Scanner for ThinkorSwim

- Started by GetRichOrDieTrying

- Replies: 17

-

A Serving of Trend and Momentum Indicators for ThinkorSwim

- Started by merryDay

- Replies: 3

-

Similar threads

-

Momentum-based-ZigZag-incl-QQE-NON-REPAINTING for ThinkOrSwim

- Started by samer800

- Replies: 7

-

-

Free Warrior Trading Momentum Scanner for ThinkorSwim

- Started by GetRichOrDieTrying

- Replies: 17

-

A Serving of Trend and Momentum Indicators for ThinkorSwim

- Started by merryDay

- Replies: 3

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.