Are you looking for reversals? The Elastic Stochastic may be a good fit for your trading strategy. This is a twist on the StochasticFull indicator. This does not repaint. This is an elastic indicator because it acts like a rubber band that gets stretched and snaps back. There is a stretching and then a pull back. Typically the longer the stretch goes, the stronger the pull back. This indicator provides both weak and strong signals. The white arrows are weak signals and the magenta arrows are strong signals for reversals. The yellow wedges are indicators that the stock is currently going through a stretch. When you see yellow wedges, expect to see it end with a magenta arrow followed by the snap back. Yellow wedge signals are caution signs. It's letting you know to be prepared for a pull back or correction coming. Be cautious because it can stretch for many candles before you finally get the magenta snap back arrow. This works on any timeframe, but I would suggest you trade longer than the one minute.

The magenta snap back arrows and yellow caution wedges can be adjusted in the settings. So I highly suggest you look at this on many time frames and adjust the sensitivity based on your own preferences. By default, both are set at 80 overbought and 20 oversold. The higher you make the overbought, the less signals you will see. The lower you make the oversold, the less signals you will see. So adjust it to your own preferences.

In the settings, you can also turn off the yellow caution wedges and weak white arrow signals by selecting "No".

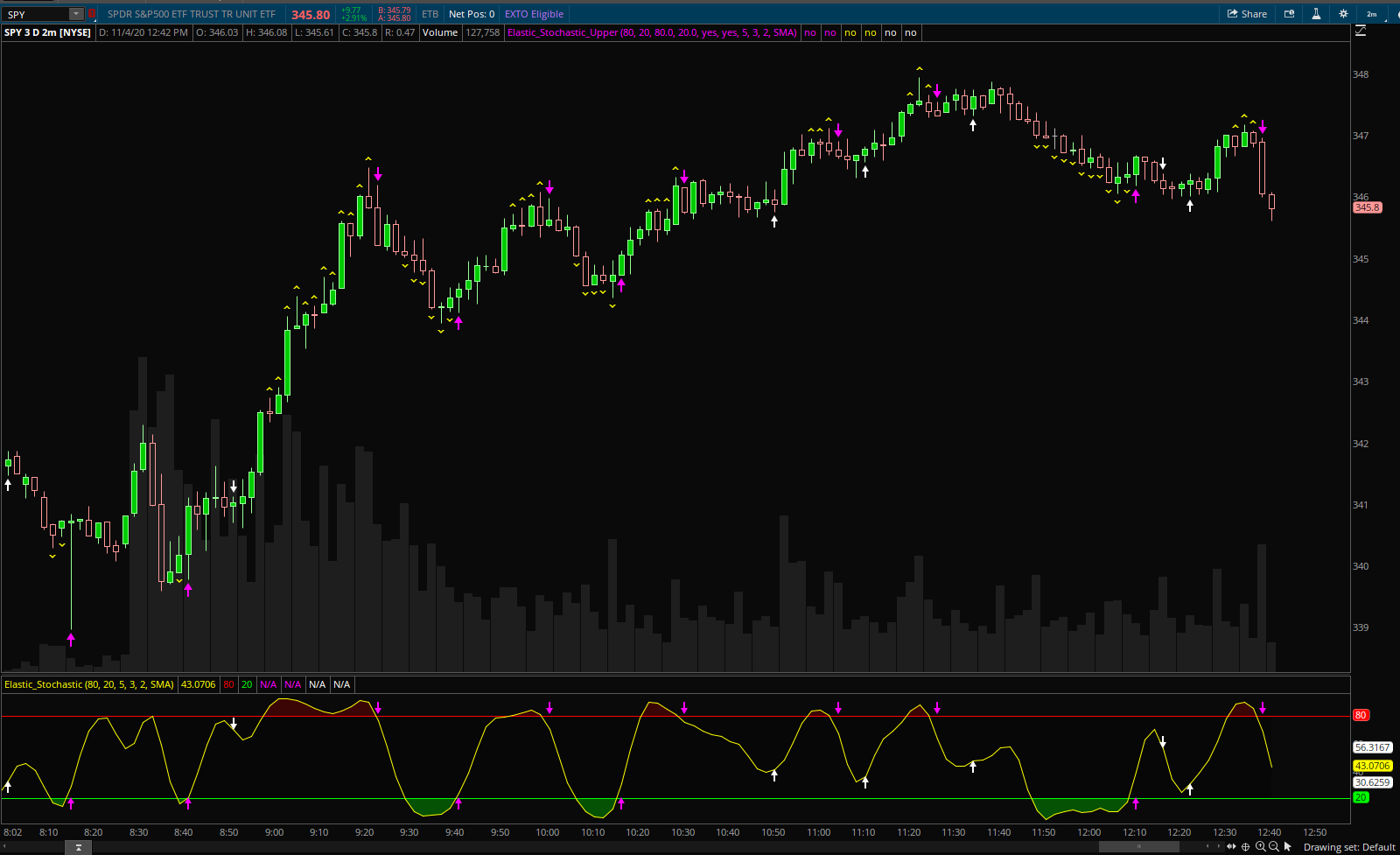

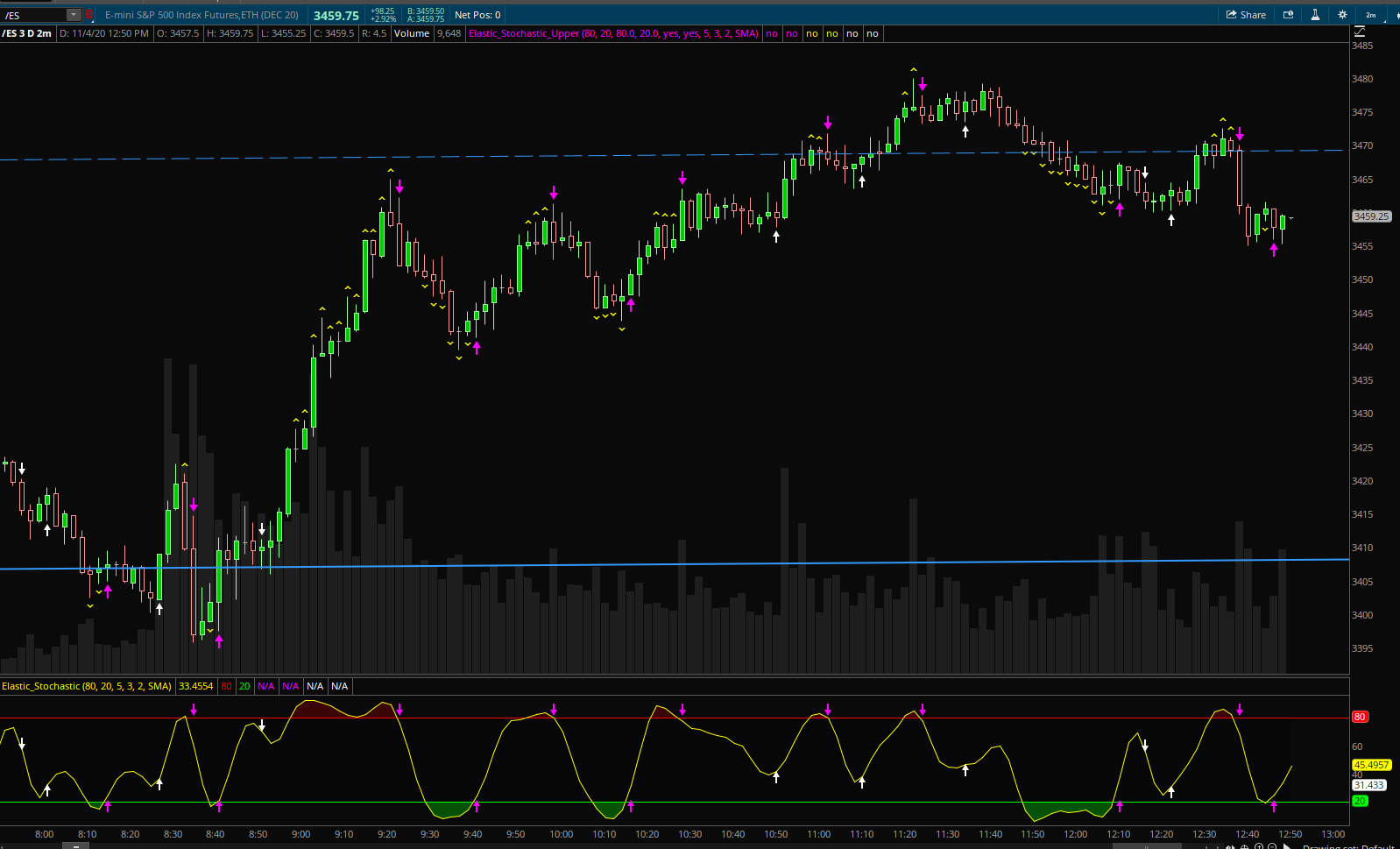

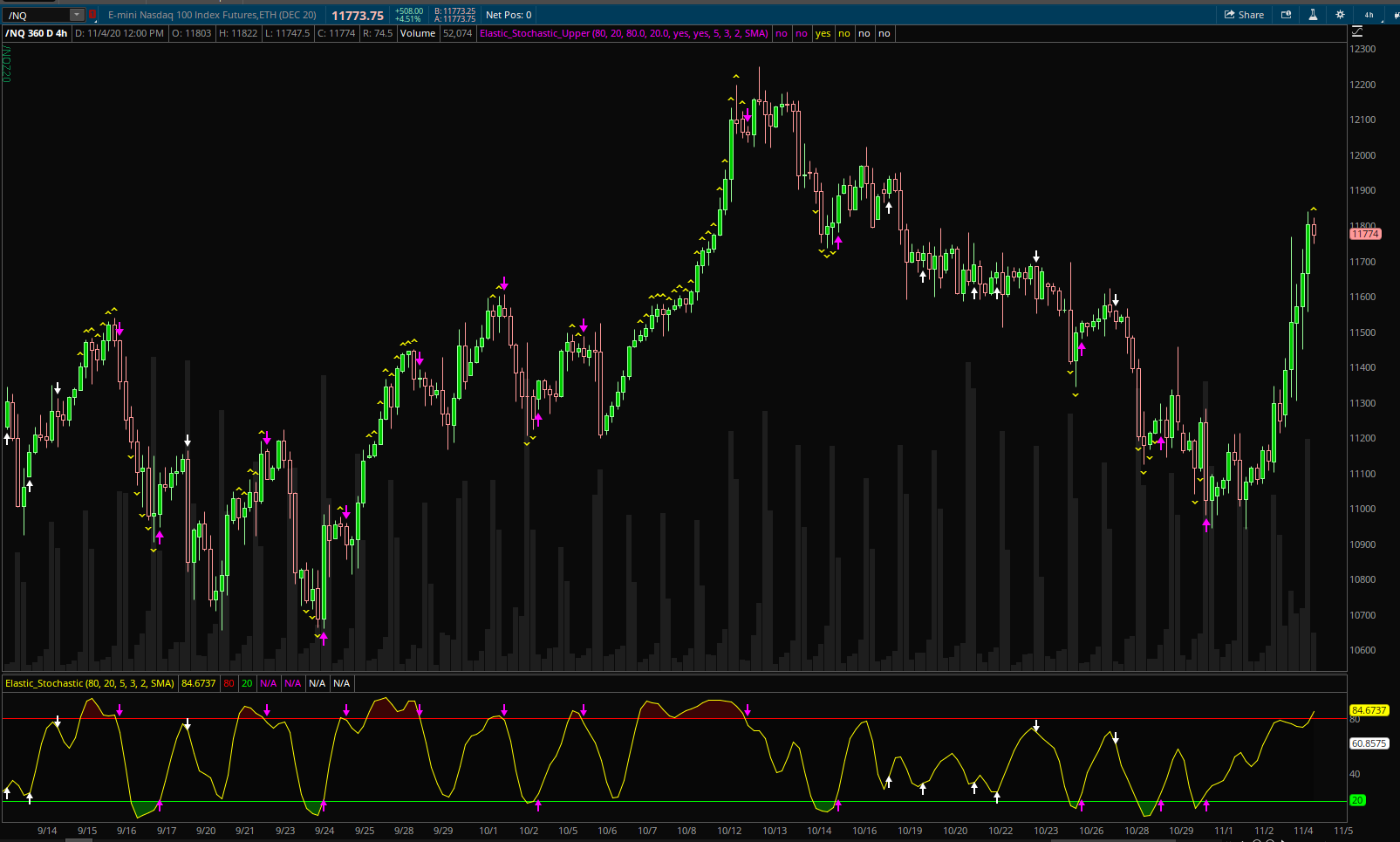

Here are some examples followed by a watchlist column. You can use this indicator to create your own scan.

Example of SPY on the 2 min chart. Yellow wedges are stretching and magenta arrow is the snap back. The white arrows are weak reversals.

Example of /ES on the 2 min chart.

Example of /NQ on the 4 hour chart.

Here is the Watchlist Column. When there is a yellow wedge up, you see the word "Up" in yellow. A wedge down, you'll see "Down". When there is a magenta up arrow, you'll see "BUY" in magenta, and a down arrow is a magenta "SELL". Weak buy and sell white arrows will say "WBUY" or "WSELL" in white lettering. Below is an example.

WATCHLIST COLUMN:

http://tos.mx/s6P8ipm

UPPER INDICATOR:

http://tos.mx/sg3pepL

LOWER INDICATOR:

http://tos.mx/REZmVJ8

STRATEGY LINK:

It actually triggers on the candle after the magenta signal. http://tos.mx/LGQBZmk

Enjoy!

The magenta snap back arrows and yellow caution wedges can be adjusted in the settings. So I highly suggest you look at this on many time frames and adjust the sensitivity based on your own preferences. By default, both are set at 80 overbought and 20 oversold. The higher you make the overbought, the less signals you will see. The lower you make the oversold, the less signals you will see. So adjust it to your own preferences.

In the settings, you can also turn off the yellow caution wedges and weak white arrow signals by selecting "No".

Here are some examples followed by a watchlist column. You can use this indicator to create your own scan.

Example of SPY on the 2 min chart. Yellow wedges are stretching and magenta arrow is the snap back. The white arrows are weak reversals.

Example of /ES on the 2 min chart.

Example of /NQ on the 4 hour chart.

Here is the Watchlist Column. When there is a yellow wedge up, you see the word "Up" in yellow. A wedge down, you'll see "Down". When there is a magenta up arrow, you'll see "BUY" in magenta, and a down arrow is a magenta "SELL". Weak buy and sell white arrows will say "WBUY" or "WSELL" in white lettering. Below is an example.

WATCHLIST COLUMN:

http://tos.mx/s6P8ipm

Code:

#Elastic Stochastic Watchlist Column

#Assembled by Chewie on usethinkscript.com

input over_bought = 80;

input over_sold = 20;

input caution_high = 80.0;

input caution_low = 20.0;

input caution = yes;

input KPeriod = 5;

input DPeriod = 3;

input slowing_period = 2;

input smoothingType = {default SMA, EMA};

def priceH = high;

def priceL = low;

def priceC = close;

def lowest_k = Lowest(priceL, KPeriod);

def c1 = priceC - lowest_k;

def c2 = Highest(priceH, KPeriod) - lowest_k;

def FastK = if c2 != 0 then c1 / c2 * 100 else 0;

def fullk;

def FullD;

switch (smoothingType) {

case SMA:

fullk = Average(FastK, slowing_period);

FullD = Average(fullk, DPeriod);

case EMA:

fullk = ExpAverage(FastK, slowing_period);

FullD = ExpAverage(fullk, DPeriod);

}

def OverBought = over_bought;

def OverSold = over_sold;

def crossedb = Crosses(FullD, overbought, CrossingDirection.BELOW);

def crossbelow = if crossedb is true then 1 else 0;

def crosseda = Crosses(FullD, oversold, CrossingDirection.above);

def crossabove = if crosseda is true then 1 else 0;

def Caution_UP = FullD > caution_high;

def CautionUP = if caution and Caution_UP is true then 1 else 0;

def Caution_DOWN = FullD < caution_low;

def CautionDOWN = if caution and Caution_DOWN is true then 1 else 0;

def Weak1 = if FullD < 48 and FullD > 25 and FullD[1] < 48 and FullD[1] < FullD[2] and FullD[2] < 48 and FullD[2] > 25 and FullD > FullD[1] then FullD else Double.NaN;

plot WeakBUY = if Weak1 is true then 1 else 0;

def Weak2 = if FullD > 52 and FullD < 75 and FullD[1] > 52 and FullD[1] > FullD[2] and FullD[2] > 52 and FullD[2] <75 and FullD < FullD[1] then FullD else Double.NaN;

plot WeakSELL = if Weak2 is true then 1 else 0;

def Trending = caution_UP or caution_Down;

def Signal = crosseda or crossedb;

addlabel(yes,

if crossabove then ("BUY")

else if crossedb then ("SELL")

else if WeakBUY then ("WBUY")

else if WeakSELL then ("WSELL")

else if caution_UP then("Up")

else if caution_Down then("Down")

else " ",

if Signal then color.magenta else if WeakBUY and WeakSELL then color.white else if Trending then color.yellow else color.current);UPPER INDICATOR:

http://tos.mx/sg3pepL

Code:

#Elastic Stochastic Upper with signals

#Assembled by Chewie on usethinkscript.com https://usethinkscript.com/threads/elastic-stochastic-for-thinkorswim-upper-and-lower-indicator.4360/

declare upper;

input snap_high = 80;

input snap_low = 20;

input caution_high = 80.0;

input caution_low = 20.0;

input caution = yes;

input weak = yes;

input KPeriod = 5;

input DPeriod = 3;

input slowing_period = 2;

input smoothingType = {default SMA, EMA};

def priceH = high;

def priceL = low;

def priceC = close;

def lowest_k = Lowest(priceL, KPeriod);

def c1 = priceC - lowest_k;

def c2 = Highest(priceH, KPeriod) - lowest_k;

def FastK = if c2 != 0 then c1 / c2 * 100 else 0;

def fullk;

def FullD;

switch (smoothingType) {

case SMA:

fullk = Average(FastK, slowing_period);

FullD = Average(fullk, DPeriod);

case EMA:

fullk = ExpAverage(FastK, slowing_period);

FullD = ExpAverage(fullk, DPeriod);

}

def OverBought = snap_high;

def OverSold = snap_low;

def crossedb = Crosses(FullD, overbought, CrossingDirection.BELOW);

plot crossbelow = if crossedb is true then 1 else 0;

crossbelow.SetDefaultColor(Color.magenta);

crossbelow.SetPaintingStrategy(PaintingStrategy.Boolean_arrow_down);

def crosseda = Crosses(FullD, oversold, CrossingDirection.above);

plot crossabove = if crosseda is true then 1 else 0;

crossabove.SetDefaultColor(Color.magenta);

crossabove.SetPaintingStrategy(PaintingStrategy.Boolean_arrow_up);

def Caution_UP = FullD > caution_high;

plot CautionUP = if caution and Caution_UP is true then 1 else 0;

CautionUP.setDefaultColor(Color.yellow);

CautionUP.SetPaintingStrategy(PaintingStrategy.Boolean_wedge_up);

def Caution_DOWN = FullD < caution_low;

plot CautionDOWN = if caution and Caution_DOWN is true then 1 else 0;

CautionDOWN.setDefaultColor(Color.yellow);

CautionDOWN.SetPaintingStrategy(PaintingStrategy.Boolean_wedge_DOWN);

def Weak1 = if FullD < 48 and FullD > 25 and FullD[1] < 48 and FullD[1] < FullD[2] and FullD[2] < 48 and FullD[2] > 25 and FullD > FullD[1] then FullD else Double.NaN;

plot WeakBUY = if weak and Weak1 is true then 1 else 0;

WeakBUY.SetDefaultColor(Color.white);

WeakBUY.SetPaintingStrategy(PaintingStrategy.Boolean_arrow_up);

def Weak2 = if FullD > 52 and FullD < 75 and FullD[1] > 52 and FullD[1] > FullD[2] and FullD[2] > 52 and FullD[2] <75 and FullD < FullD[1] then FullD else Double.NaN;

plot WeakSELL = if weak and Weak2 is true then 1 else 0;

WeakSELL.SetDefaultColor(Color.white);

WeakSELL.SetPaintingStrategy(PaintingStrategy.Boolean_arrow_DOWN);LOWER INDICATOR:

http://tos.mx/REZmVJ8

Code:

#Elastic_Stochastic with signals

#Assembled by Chewie on usethinkscript.com https://usethinkscript.com/threads/elastic-stochastic-for-thinkorswim-upper-and-lower-indicator.4360/

declare lower;

input over_bought = 80;

input over_sold = 20;

input KPeriod = 5;

input DPeriod = 3;

input slowing_period = 2;

input smoothingType = {default SMA, EMA};

def priceH = high;

def priceL = low;

def priceC = close;

def lowest_k = Lowest(priceL, KPeriod);

def c1 = priceC - lowest_k;

def c2 = Highest(priceH, KPeriod) - lowest_k;

def FastK = if c2 != 0 then c1 / c2 * 100 else 0;

def fullk;

plot FullD;

FullD.SetDefaultColor(color.yellow);

switch (smoothingType) {

case SMA:

fullk = Average(FastK, slowing_period);

FullD = Average(fullk, DPeriod);

case EMA:

fullk = ExpAverage(FastK, slowing_period);

FullD = ExpAverage(fullk, DPeriod);

}

plot OverBought = over_bought;

plot OverSold = over_sold;

OverBought.SetDefaultColor(Color.red);

OverSold.SetDefaultColor(Color.green);

AddCloud(FULLD, OverBought, Color.RED, Color.CURRENT);

AddCloud(OverSold, FULLD, Color.GREEN, Color.CURRENT);

def crossedb = Crosses(FullD, overbought, CrossingDirection.BELOW);

plot crossbelow = if crossedb then crossedb + overbought else Double.NaN;

crossbelow.SetDefaultColor(Color.magenta);

crossbelow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

def crossedu = Crosses(FullD, oversold, CrossingDirection.ABOVE);

plot crossabove = if crossedu then crossedu + oversold else Double.NaN;

crossabove.SetDefaultColor(Color.magenta);

crossabove.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

def Weak1 = if FullD < 48 and FullD > 25 and FullD[1] < 48 and FullD[1] < FullD[2] and FullD[2] < 48 and FullD[2] > 25 and FullD > FullD[1] then FullD else Double.NaN;

plot WeakBUY = Weak1;

WeakBUY.SetDefaultColor(Color.white);

WeakBUY.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

def Weak2 = if FullD > 52 and FullD < 75 and FullD[1] > 52 and FullD[1] > FullD[2] and FullD[2] > 52 and FullD[2] <75 and FullD < FullD[1] then FullD else Double.NaN;

plot WeakSELL = Weak2;

WeakSELL.SetDefaultColor(Color.white);

WeakSELL.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);STRATEGY LINK:

It actually triggers on the candle after the magenta signal. http://tos.mx/LGQBZmk

Enjoy!

Last edited: