Stochastic Oscillator

The stochastic oscillator is a popular technical analysis tool used to assess momentum and overbought or oversold conditions.

It compares the current closing price to its price range over a specific period, typically 14 periods.

This comparison helps identify potential trend reversals or continuation points.

When the oscillator indicates overbought, it suggests that the price may soon decline.

When it indicates oversold conditions, it suggests that the price may soon rise.

Basic Stochastic Chart with Arrows, Alerts, Labels

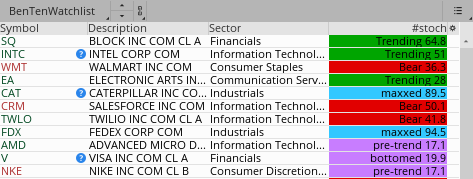

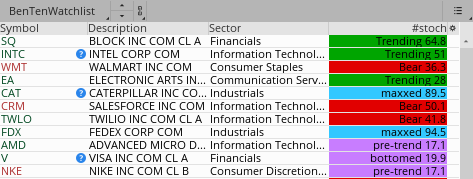

Basic Stochastic Watchlist

Lower Chart Script:

Upper Chart Code:

Watchlist column script code:

The stochastic oscillator is a popular technical analysis tool used to assess momentum and overbought or oversold conditions.

It compares the current closing price to its price range over a specific period, typically 14 periods.

This comparison helps identify potential trend reversals or continuation points.

When the oscillator indicates overbought, it suggests that the price may soon decline.

When it indicates oversold conditions, it suggests that the price may soon rise.

Basic Stochastic Chart with Arrows, Alerts, Labels

Basic Stochastic Watchlist

Lower Chart Script:

Ruby:

# ########################################

# TOS Stochastic Lower Chart

input show_label = yes ;

input OB = 80 ;

input OS = 20 ;

input fast = 3;

input slow = 14 ;

def stoch = reference StochasticFull(OB, OS, slow, fast, high, low, close, fast, AverageType.SIMPLE);

# ########################################

# Charting & Formatting

declare lower;

declare real_size;

DefineGlobalColor("maxxed", CreateColor(50, 200, 255)) ;

DefineGlobalColor("rising", CreateColor(0, 165, 0)) ;

DefineGlobalColor("bear", CreateColor(225, 0, 0)) ;

DefineGlobalColor("pretrend", CreateColor (200, 125, 255)) ;

plot overbought = OB ;

plot oversold = OS ;

plot pStoch = stoch ;

pStoch .AssignValueColor(

if Stoch > OB then GlobalColor("maxxed") else

if Stoch < OS then GlobalColor("pretrend") else

if Stoch > Stoch [1] then GlobalColor("rising")

else GlobalColor("bear"));

pStoch .SetLineWeight(3);

plot UpArrow = if stoch crosses above OS then OS else double.NaN ;

UpArrow.SetPaintingStrategy(PaintingStrategy.ARROW_up);

UpArrow.SetLineWeight(1);

UpArrow.SetDefaultColor(color.lime) ;

plot DownArrow = if stoch crosses below OB then OB else double.NaN ;

DownArrow.SetPaintingStrategy(PaintingStrategy.ARROW_down);

DownArrow.SetLineWeight(1);

DownArrow.SetDefaultColor(color.light_orange) ;

AddCloud(if Stoch >= OB then Stoch else Double.NaN, OB,GlobalColor("maxxed"),GlobalColor("maxxed"));

AddCloud(if Stoch <= OS then Stoch else Double.NaN, OS,GlobalColor("pretrend"),GlobalColor("pretrend"));

# ########################################################

# The same logic that was used in coloring the plot can be used in labels

AddLabel(show_label,

if Stoch > OB then "stochastic maxxed " +round(Stoch ,1) else

if Stoch < OS and Stoch >Stoch [1] then "stochastic pre-trend " +round(Stoch ,1) else

if Stoch < OS and Stoch <=Stoch [1] then "stochastic bottomed " +round(Stoch ,1) else

if Stoch > Stoch [1] then "stochastic Trending " +round(Stoch ,1)

else "stochastic Bear " +round(Stoch ,1),

if Stoch > OB then GlobalColor("maxxed") else

if Stoch < OS then GlobalColor("pretrend") else

if Stoch > Stoch [1] then GlobalColor("rising")

else GlobalColor("bear"));

Alert(stoch crosses OB, "stoch crosses OB", Alert.Bar, Sound.Bell);

Alert(stoch crosses OS, "stoch crosses OS", Alert.Bar, Sound.Bell);Upper Chart Code:

Ruby:

# ########################################

# TOS Stochastic Upper Chart Arrows

input show_label = yes ;

input OB = 80 ;

input OS = 20 ;

input fast = 3;

input slow = 14 ;

def stoch = reference StochasticFull(OB, OS, slow, fast, high, low, close, fast, AverageType.SIMPLE);

# ########################################

# Charting & Formatting

plot UpArrow = stoch crosses above OS ;

UpArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

UpArrow.SetLineWeight(1);

UpArrow.SetDefaultColor(color.lime) ;

plot DownArrow = stoch crosses below OB;

DownArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

DownArrow.SetLineWeight(1);

DownArrow.SetDefaultColor(color.light_orange) ;

Alert(stoch crosses ob, "stoch crosses ob", Alert.Bar, Sound.Bell);

Alert(stoch crosses os, "stoch crosses os", Alert.Bar, Sound.Bell);Watchlist column script code:

Ruby:

# ########################################

# TOS Stochastic Watchlist

input OB = 80 ;

input OS = 20 ;

input fast = 3;

input slow = 14 ;

def stoch = reference StochasticFull(OB, OS, slow, fast, high, low, close, fast, AverageType.SIMPLE);

AddLabel(yes,

if Stoch > OB then "maxxed " +round(Stoch ,1) else

if Stoch < OS and Stoch >Stoch [1] then "pre-trend " +round(Stoch ,1) else

if Stoch < OS and Stoch <=Stoch [1] then "bottomed " +round(Stoch ,1) else

if Stoch > Stoch [1] then "Trending " +round(Stoch ,1)

else "Bear " +round(Stoch ,1));

AssignBackgroundColor(

if Stoch > OB then CreateColor(50, 200, 255) else

if Stoch < OS then CreateColor (200, 125, 255) else

if Stoch > Stoch [1] then CreateColor(0, 165, 0)

else CreateColor(225, 0, 0));

Last edited: