#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © allanster on TradingView

# https://www.tradingview.com/v/S7HGang6/

# 'concept. Whenever this setting is enabled the indicator should be regarded as operating in an experimental mode.'

#// Original concept by David Bostian, with variations featured in "Bollinger on Bollinger Bands".

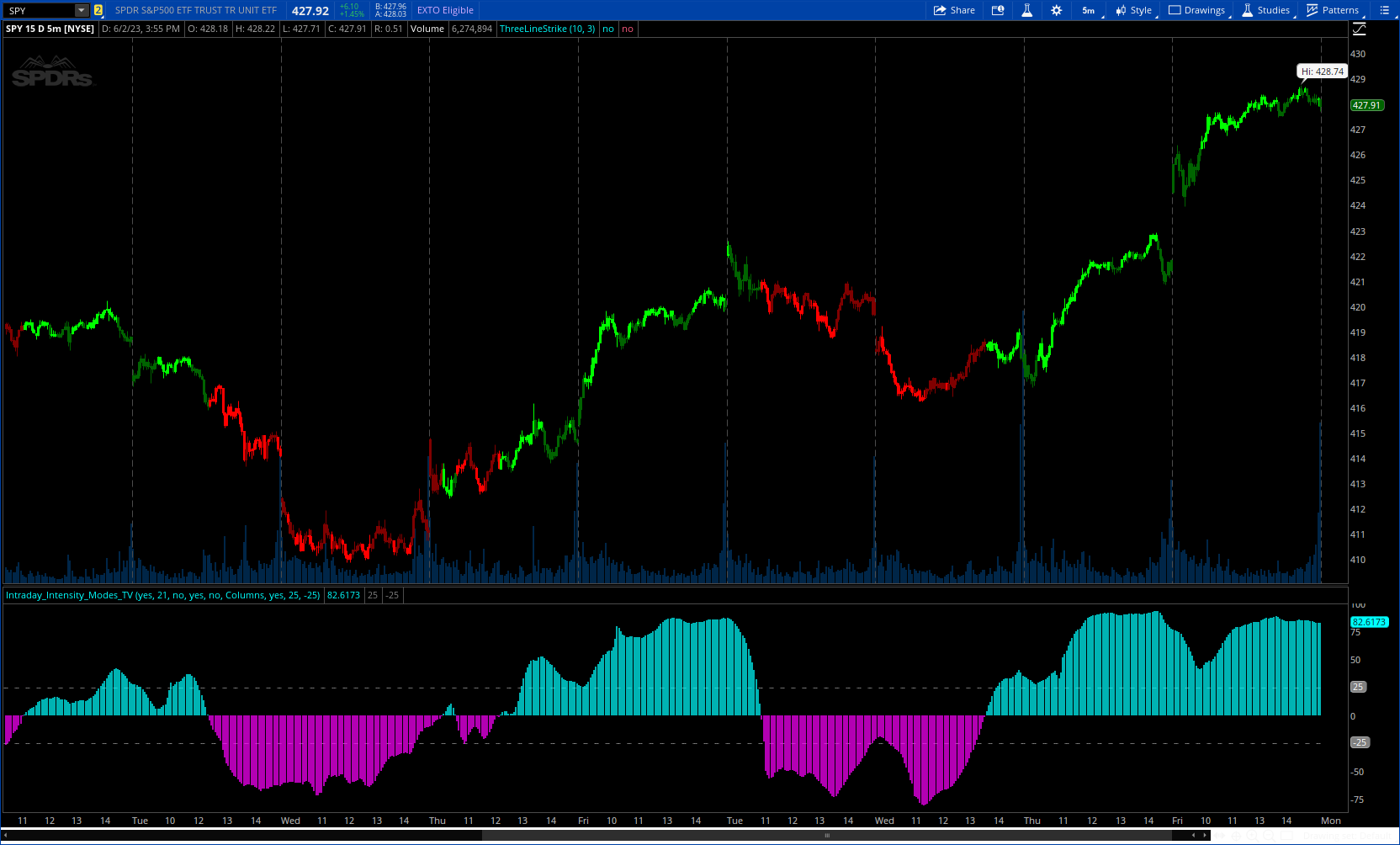

#indicator("Intraday Intensity Modes", 'Intensity')

# converted by Sam4Cok@Samer - 06/2023

declare lower;

input ColorBars = yes;

input OscLength = 21; # 'Osc Length'

input Cumulative = no; # 'Cumulative'

input Normalized = yes; # 'Normalized'

input Intrabar = no; # 'Intrabar'

input chartStyle = {default Columns, Histogram, Line}; # 'Style & Width'

input ShowLevels = yes;

input ShowLevelAbove = 25; # 'Show Levels Above'

input ShowLevelBelow = -25; # 'Below'

def na = Double.NaN;

def last = isNaN(Close);

def i_length = OscLength;

def Columns = chartStyle==chartStyle.Columns;

def Histogram = chartStyle==chartStyle.Histogram;

#id_cum(source) => // perform cumulative sum once per day when using realtime intraday source values

script id_cum {

input source = close;

def current = GetAggregationPeriod();

def isintraday = current < AggregationPeriod.DAY;

def startDay = GetYYYYMMDD() - GetYYYYMMDD()[1];

def carrySum;

def dailySum;

if isintraday {

dailySum = CompoundValue(1, if startDay then carrySum[1] else dailySum[1], source[1]);

carrySum = dailySum + source;

} else {

dailySum = Double.NaN;

carrySum = CompoundValue(1,carrySum[1] + source, source);

}

plot out = if carrySum==0 then Double.NaN else carrySum;

}

#altSum(source, length)

script altSum {

input source = close;

input length = 21;

def normal = Sum(if(isNaN(source),0,source), length);# // treat na as 0 and return sum

plot out = normal;

}

def startDay = GetYYYYMMDD() - GetYYYYMMDD()[1];

def current = GetAggregationPeriod();

def isintraday = current < AggregationPeriod.DAY;

def idRangeH;def idRangeL;def idVolume;

def idH = if idRangeH[1]==0 then high[1] else idRangeH[1];

idRangeH = if (!isintraday or startDay) then high else

if high > idH then high else idH;# // intraday high

def idL = if idRangeL[1]==0 then low[1] else idRangeL[1];

idRangeL = if (!isintraday or startDay) then low else

if low < idL then low else idL;# // intraday low

def idVol = if idVolume[1]==0 then volume else idVolume[1];

idVolume = if (!isintraday or startDay) then volume else idVol + volume;

def iiValue = ((2 * close - idRangeH - idRangeL) / (idRangeH - idRangeL)) * idVolume; # // intraday intensity

def iiiValue = if isNaN(iiValue) then 0 else iiValue;

def iii = ((2 * close - high - low) / (high - low)) * volume;

def TotVol = CompoundValue(1, TotVol[1] + volume, volume);

def TotSumiii = (CompoundValue(1, TotSumiii[1] + iii, iii));

def cumiii = id_cum(iiiValue);

def cumVol = id_cum(idVolume);

def Sumii1 = if Cumulative then if Intrabar then TotSumiii else cumiii else if Intrabar then iii else iiiValue;

def Sumii2 = if Cumulative then if Intrabar then TotVol else cumVol else

if Intrabar then volume else idVolume;

def usePrcnt = if Normalized then 100 else 1;

def iiSource = usePrcnt * altSum(Sumii1, i_length) / (if Normalized then altSum(Sumii2, i_length) else 1);

def colrSign = altSum(if Intrabar then iii else iiiValue, i_length) /

(if Normalized then if Intrabar then volume else altSum(idVolume, i_length) else 1);

def upCandle = sign(colrSign) != -1;

plot Intensity = if last then na else iiSource;

Intensity.SetLineWeight(2);

Intensity.SetPaintingStrategy(if Histogram then PaintingStrategy.HISTOGRAM else

if Columns then PaintingStrategy.SQUARED_HISTOGRAM else PaintingStrategy.LINE);

Intensity.AssignValueColor(if upCandle then Color.CYAN else Color.MAGENTA);

plot hline = if last or !ShowLevels then na else ShowLevelAbove;

plot lline = if last or !ShowLevels then na else

if Cumulative then 0 else ShowLevelBelow;

hline.SetDefaultColor(Color.GRAY);

lline.SetDefaultColor(Color.GRAY);

hline.SetStyle(Curve.SHORT_DASH);

lline.SetStyle(Curve.SHORT_DASH);

AssignPriceColor(if !ColorBars then Color.CURRENT else if upCandle then

if iiSource>iiSource[1] then Color.GREEN else Color.DARK_GREEN else

if iiSource<iiSource[1] then Color.RED else Color.DARK_RED);

#// Reference Equations Used

#// III = ((2 * close) - high - low) / ((high - low) * volume)

#--- END of CODE