# ADX_DMI indicator

# cabe1332

# 20210814

# ADX code start

declare lower;

# You can modify ADX setting below to you liking

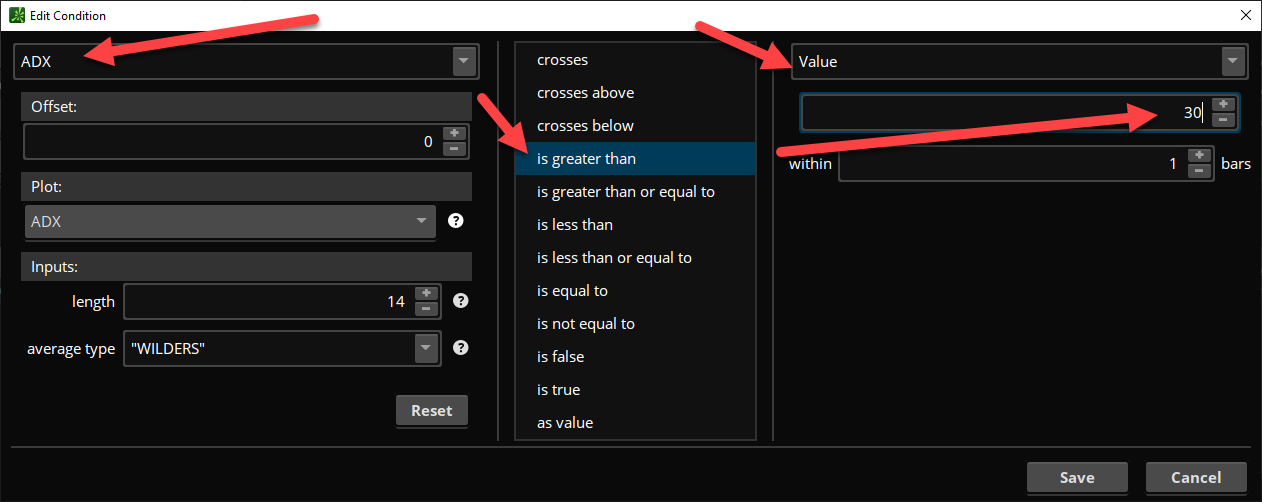

input ADXCutoff = 25;

input DMILength = 6;

input MaFastLength=9;

input DIRangeFilter=10;

#DMI, ADX plots

def averageType = AverageType.WILDERS;

def hiDiff = high - high[1];

def loDiff = low[1] - low;

def plusDM = if hiDiff > loDiff and hiDiff > 0 then hiDiff else 0;

def minusDM = if loDiff > hiDiff and loDiff > 0 then loDiff else 0;

def ATR = MovingAverage(averageType, TrueRange(high, close, low), DMILength);

def "DI+" = 100 * MovingAverage(averageType, plusDM, DMILength) / ATR;

def "DI-" = 100 * MovingAverage(averageType, minusDM, DMILength) / ATR;

def DX = if ("DI+" + "DI-" > 0) then 100 * AbsValue("DI+" - "DI-") / ("DI+" + "DI-") else 0;

plot ADX = MovingAverage(averageType, DX, DMILength);

#DIline - small diff = sideways

def DIrange = AbsValue(AbsValue("DI+")-AbsValue("DI-"));

#dirange.setPaintingStrategy(paintingStrategy.HISTOGRAM);

def DIok=DIRange>DIRangeFilter;

#adx filters

plot adxavg = MovingAverage(AverageType.SIMPLE, ADX, DMILength);

def ADXOk = ADX > ADXCutoff;# and adx>adxavg;

def DMICutBull = ("DI-" < ADXCutoff and "DI+" > ADXCutoff) or ("DI+" > ADX and "DI-" < ADX) ;

def DMICutBear = ("DI+" < ADXCutoff and "DI-" > ADXCutoff) or ("DI+" < ADX and "DI-" > ADX);

def dxcrossBull = if IsNaN(dxcrossBull[1]) then "DI+" > "DI-" #for init -what it is on first bar

else if "DI+" crosses above "DI-" then 1

else if dxcrossBull[1] > 0 and "DI+" > "DI-" then 1

else 0;

#plot dxXBull=dxCrossBull;

def dxcrossBear = if IsNaN(dxcrossBear[1]) then "DI-" > "DI+"

else if "DI+" crosses below "DI-" then 1

else if dxcrossBear[1] > 0 and "DI+" < "DI-" then 1

else 0 ;

#plot dxXBear=dxCrossBear;

#==========Pivots

def pivotprice=close;

#pivots per sami. changed logic for watchlist so there is no [-1]

def engbull= close>high[1] and low<=low[1];

def engbear= close<low[1] and high>=high[1];

def pivotHigh=(low[2] >low[1] and low>low[1] and close>pivotprice[1]) or engbull ;

def pivotLow=(high[2] <high[1] and high<high[1] and close<pivotprice[1]) or engbear;

def lastPH= if isnan(close[1]) then low else if PivotHigh then low[1] else LastPH[1];

def lastPL= if isnan(close[1]) then high else if PivotLow then high[1] else LastPL[1];

def breakout=if close> lastPL and close[1]<= lastPL then 1 else 0 ;

def breakdown= if close< lastPH and close[1]>= lastPH then 1 else 0;

#=============================

def signalbull = if dxcrossBull and ADXOk and DIOk then 1 else 0;

def signalbear = if dxcrossBear and ADXOk and DIOk then 1 else 0;

# ignore the signal if prevsignal was same direction and had higher DI

def signal = if signalbull then 1 else if signalbear then -1 else 0;

def prevSignal = if IsNaN(prevSignal[1]) then signal[1]

else if (signal[1] <> signal) then signal[1]

else prevSignal[1];

def DAPEntry = if signalbull and !signalbull[1] and prevSignal <= 0 then 1

else if signalbear and !signalbear[1] and prevSignal >= 0 then -1

else 0;

# Entry based on mas

input ATRMult = 0.3;

def MAFast = ExpAverage(close, MaFastLength);

#vwap

def vwp = reference VWAP("time frame" = "DAY");

def ATRMod = ATRMult * ATR;

def uptrend = signalbull;

def downtrend = signalbear ;

def PivotEntry = if uptrend and pivothigh then 1

else if downtrend and pivotlow then -1

else 0 ;

def VWPPB = if uptrend and low <= vwp + ATRMod and close > vwp then 1

else if downtrend and high >= vwp - ATRMod and close < vwp then -1

else 0 ;

#significant cross

def sigcross = if MAFast crosses above vwp and uptrend then 1.5

else if MAFast crosses below vwp and downtrend then -1.5

else 0;

#=== combined entry signal

def entry =

if sigcross <> 0 then sigcross

else

if VWPPB > 0 and pivotEntry>0 then 2

else if VWPPB < 0 and pivotEntry<0 then- 2

else if pivotEntry>0 then 1

else if pivotEntry<0 then -1

else 0

;

#======study display

plot pDIPlus = "DI+";

plot pDIminus = "DI-";

pDIPlus.SetDefaultColor(Color.GREEN);

pDIminus.SetDefaultColor(Color.RED);

AddCloud(pDIPlus, pDIminus, Color.UPTICK);

#plot padxcutoff = ADXCutoff;

plot padxcutoff = if !isnan(close) then ADXCutoff else double.nan;

padxcutoff.assignValueColor(if (adx < adxCutoff) or (pDiminus > adxcutoff) or (pDiplus < adxCutoff) then color.light_red else Color.green);

padxcutoff.SetLineWeight(1);

padxcutoff.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

#adx cross plots

#pivots

def prange=2; #pivot range

def adxbull = ADX > lowest(ADX,prange)[1];

def adxbear = ADX < highest(ADX,prange)[1];

ADX.AssignValueColor(if adxbull then Color.cyan else if adxbear then Color.orange else Color.GRAY);

def ptrend=adx;

def adxPH= if isnan(ptrend[-1]) then 0 else lowest(ptrend,prange)[1] > ptrend and lowest(ptrend,prange)[-prange]> ptrend ;

def adxPL= if isnan(ptrend[-1]) then 0 else highest(ptrend,prange)[1] < ptrend and highest(ptrend,prange)[-prange]< ptrend ;

# Trend Direction

def dmisprd = pdiPlus - pdiMinus;

AddLabel(yes, if DMICutBull then "Trend Status: UP | D+: " + round(pdiPlus,2) + " D-: " + round(pdiMinus,2) + " Spread: " + round(dmisprd,2) else "Trend Status: DOWN | D-: " + round(pdiMinus,2) + " D+: " + round(pdiPlus,2) + " Spread: " + round(dmisprd,2), if DMICutBull then color.green else color.red);

# ADX Dynamic Label

# Adds ADX value and context

input ADXLength = 6;

input ADXLower = 25;

input ADXMid = 40;

input ADXHigh = 75;

#input MALength = 10;

input MALength = 9;

def ADXlabel = reference ADX(ADXLength).ADX;

def MA = reference movAvgExponential(close,MALength);

# ADX Label

AddLabel(yes, if ADXlabel < ADXLower then " Strenght: " + Round(ADXlabel,2) + " SETTING UP - Watch/Wait " else if ADXlabel < ADXMid then " Strenght: " + Round(ADXlabel,2) + " CHOPPY - Watch/Wait " else if ADXlabel < ADXlabel[1] then " Strenght: " + Round(ADXlabel,2) + " TREND WEAKENING " else if ADXlabel > ADXlabel[1] and MA > MA[1] and ADXlabel < ADXHigh then " Strenght: " + Round(ADXlabel,2) + " UPTRENDING " else if ADXlabel > ADXlabel[1] and MA < MA[1] then " Strenght: " + Round(ADXlabel,2) + " DOWNTRENDING " else if ADXlabel > ADXHigh then " Strenght: " + Round(ADXlabel,2) + " HIGH/WAIT TO COOL OFF " else " ", if ADXlabel < ADXLower then Color.CYAN else if ADXlabel < ADXMid then Color.RED else if (ADXlabel < ADXlabel[1]) then Color.YELLOW else if ADXlabel > ADXlabel[1] and MA > MA[1] and ADXlabel < ADXHigh then Color.GREEN else if ADXlabel > ADXlabel[1] and MA < MA[1] then Color.RED else if ADXlabel > ADXHigh then Color.MAGENTA else Color.light_gray);

# end of ADX