Spoiler: It's not the "holy grail". In trading, there is no such thing. This strategy was written by Linda Bradford Raschke and Larry Connors. We kept the name because it sounds cool.

Bullish Direction

I learned about this strategy from here, you should read up on it before using the indicator.

Bullish Direction

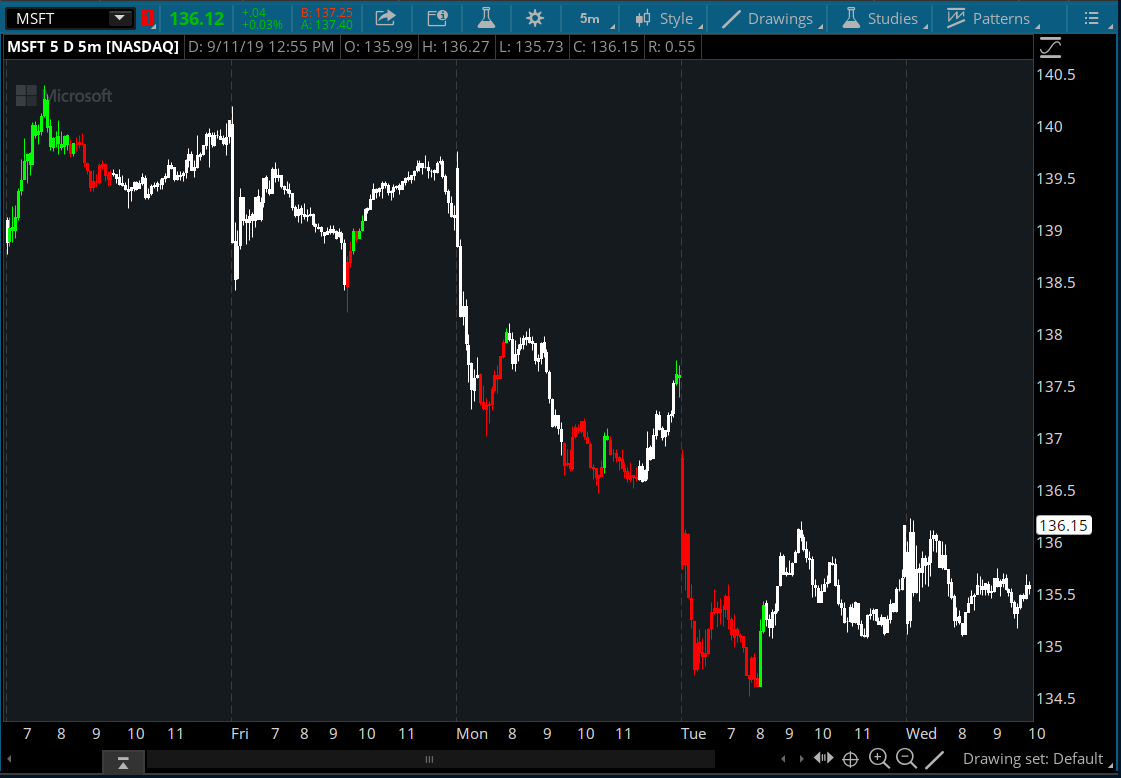

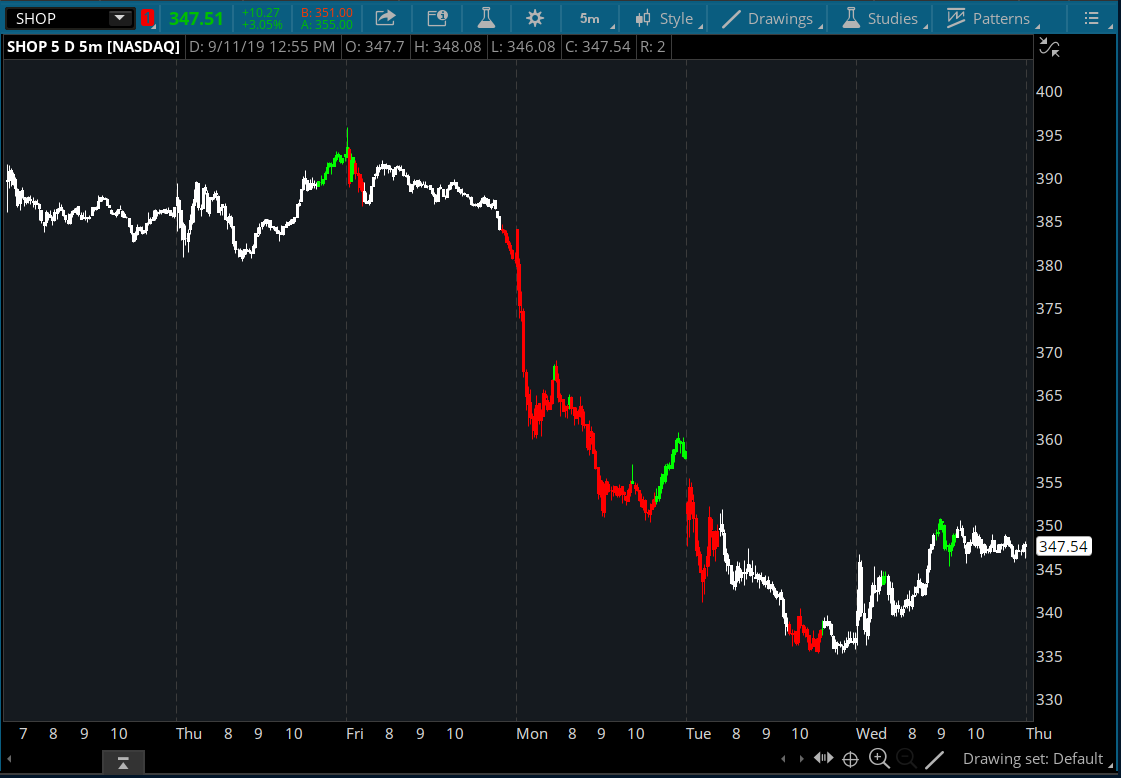

- 14-period ADX is above 30 and rising

- Retracement down to 20-period SMA

- Your entry would be at the high of the bar that touches 20-period simple moving average

- 14-period ADX is above 30 and rising

- Retracement up to 20-period SMA

- Your short entry would be at the low of the bar that touches 20-period simple moving average

thinkScript Code

Code:

# The Holy Grail ADX Trading Setup

# Assembled by BenTen at useThinkScript.com

# This is NOT the Holy Grail! It was named that way by Linda Bradford Raschke and Larry Connors for its simplicity.

# You are free to use this code for personal use, and make derivative works from it.

# You are NOT GRANTED permission to use this code (or derivative works) for commercial

# purposes which includes and is not limited to selling, reselling, or packaging with

# other commercial indicators. Headers and attribution in this code should remain as provided,

# and any derivative works should extend the existing headers.

# Start SMA

input price = close;

input length = 20;

input displace = 0;

def SMA = Average(price[-displace], length);

def SMAbull = price > SMA;

def SMAbear = price < SMA;

# Start ADX

input ADXlength = 14;

input ADXaverageType = AverageType.WILDERS;

def ADX = DMI(ADXlength, ADXaverageType).ADX;

def ADXpower = ADX > 30;

def bullish = SMAbull and ADXpower;

def bearish = SMAbear and ADXpower;

AssignPriceColor(if bullish then Color.GREEN else if bearish then Color.RED else Color.WHITE);I learned about this strategy from here, you should read up on it before using the indicator.