You should upgrade or use an alternative browser.

Help drawing straight lines automatically For ThinkOrSwim

- Thread starter Learnbot

- Start date

Sure thing, mind you i m not an expert so plz take it with a grain of salt lol@Learnbot Thanks, this is brilliant.

Mind sharing how you use the clouds, supply/demand, in regards to trading? I.e when do you decide to enter/exit and on what time frames do you relate to, when making decisions.

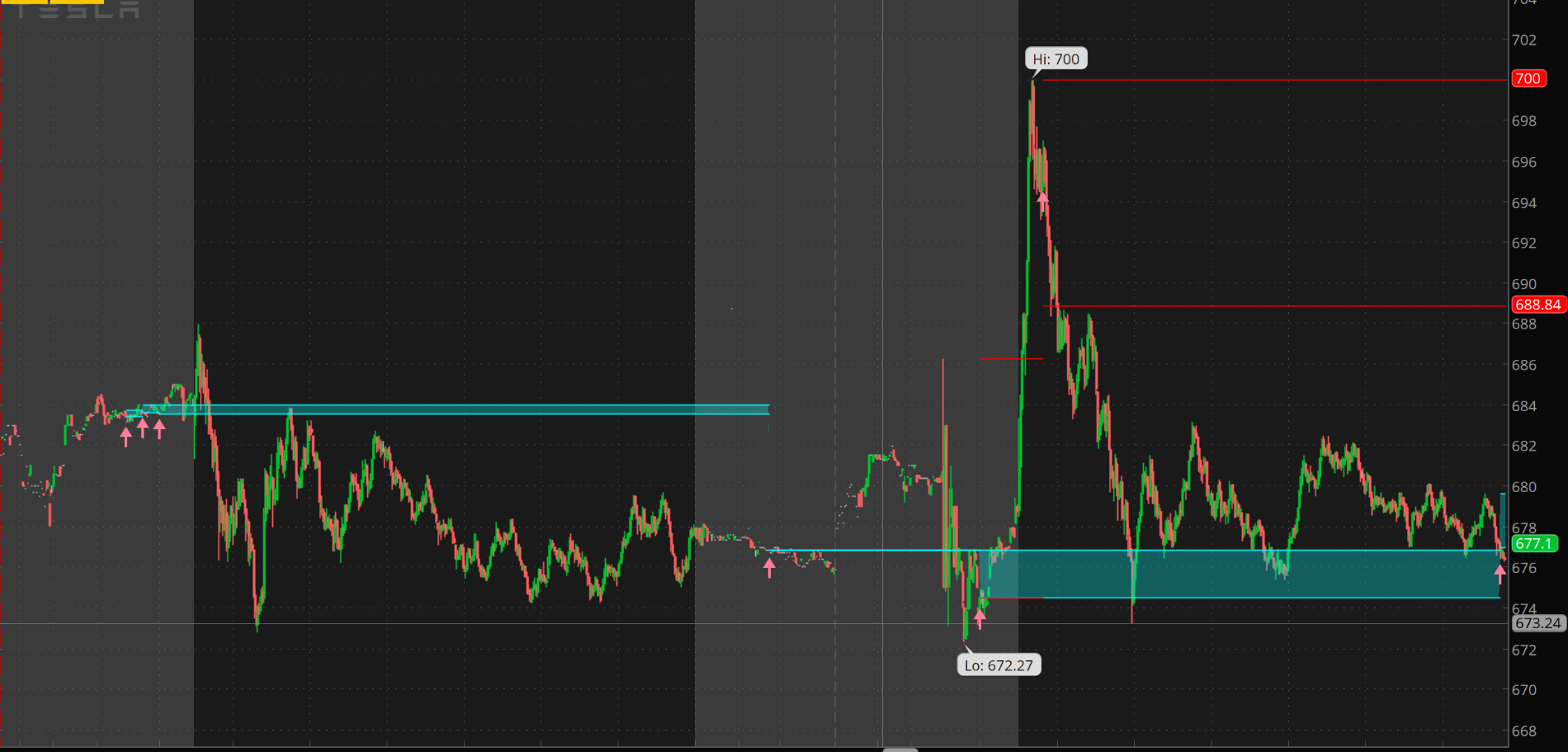

Here are the trades i took this past Thursday and Friday on TSLA:

Ok so little abt my trading style, as i mentioned before i am a day trades and i work full time so i cant be glued to the screen all the time so i wait for my setups.

So I trade on 1 min time frame, in above pic left hand side is the 1 day 1 min chart of TSLA. The teal horizontal bar is a zone that was formed on 15 min chart Premarket, i saw it didn't hold and tesla dumped right at the open breaking the zone so now i treat that zone as a failed zone and now can be a good resistance zone. so I waited till the price tracked back up to the zone, at that point i saw buying power/volume slowing down and then a engulfing red candle formed and that's where i took it short and putting my stop loss above the teal zone bar. So that was a two point short ( i trade options so i had put contracts and i got out quick with two-point drop but could have held it longer for much more gain)

on Friday (right hand chart), again the teal bar is 15 min zone and red lines are 1 hour. I just had premarket red line and teal zone so disregard the other two redlines because they formed during the market. So premarket i was little busy with work so i didnt trade but my plan was if the price breaks above 1 hour zone (PM redline) i was going to go long because of Tesla's news of delivery, if it rejects then short. as you can see the price stalled right at that area and formed Rally Base (basing at the 1 hour line) and Rally so that would have been a massive winner for me especially options but alas didnt get that trade. so i wanted till the price came down to 5 min zone and saw buyers stepping in so i bought calls and got in around 676 area and sold it at 679-680 area and i was done trading. I could have taken same zone trade 4 times that day as u can see because tsla came down and bounced came down and bounce 4 times same exact zone.

Hope this helps, again not a great trader here but this is how i trad and what i saw past two days.

My charts currently has the 15min and the 1 HR loaded, but it looks different to yours.

I also have the pink line, whereas in your screenshot, you only have the teal and the red line.

Mind sharing the link to your chart

Edit: Just to clarify, you use the 3min-15min-1Hour indicator on your 1 min chart?

Also, with the indicators added three times on the 1 min chart, its really hard to see the engulfing lines, how do you get around that.

Here you go:Thanks @Learnbot.

My charts currently has the 15min and the 1 HR loaded, but it looks different to yours.

I also have the pink line, whereas in your screenshot, you only have the teal and the red line.

Mind sharing the link to your chart

Edit: Just to clarify, you use the 3min-15min-1Hour indicator on your 1 min chart?

Also, with the indicators added three times on the 1 min chart, its really hard to see the engulfing lines, how do you get around that.

http://tos.mx/D8lMpOF

So what I do is open 2day 1 min chart every morning with 1hour and 15 min Engulfing indicator. then I use the Rectangle tool to draw the zones that 15 min time frame indicator plots, and use the line tool to draw out the 1 hour lines. Then i take both of those indicators off and change time frame to 2day 3 min and use the general supply and demand indicator (post 39) to fine tune the zones (sometimes). I usually just use 15min and 1 hour timeframe indicators but sometimes what happens is 15 mins plots a large zone so then i go to smaller time frame to further fine-tune aka reduce the zone. But for the most part 15 min and 1hour is my goto.

The Gray area is 15 min zones, light yellow is 3 min zone, and the white dashed line is 1 hour line.

As you most likely know tesla is a volatile stock so zone of 2-3$ i don't mess with. on Friday the zone for 15 min was around 2$ so i didn't mess with it much but i did check 3 min time frame and it was around 1$ and change so i drew that just for the heck of it.

Thanks.Here you go:

http://tos.mx/D8lMpOF

So what I do is open 2day 1 min chart every morning with 1hour and 15 min Engulfing indicator. then I use the Rectangle tool to draw the zones that 15 min time frame indicator plots, and use the line tool to draw out the 1 hour lines. Then i take both of those indicators off and change time frame to 2day 3 min and use the general supply and demand indicator (post 39) to fine tune the zones (sometimes). I usually just use 15min and 1 hour timeframe indicators but sometimes what happens is 15 mins plots a large zone so then i go to smaller time frame to further fine-tune aka reduce the zone. But for the most part 15 min and 1hour is my goto.

My zones still look bit different.

I have on my 2 day 1 min chart:

15 min and 1 hour indicator.

https%3A//i.imgur.com/w4LUY0n.jpg[/img]']

Dude that’s the weirdest thing. I’m not sure whats causing this discrepancy! I‘ll try and look into it when I get homeThanks.

My zones still look bit different.

I have on my 2 day 1 min chart:

15 min and 1 hour indicator.

https%3A//i.imgur.com/w4LUY0n.jpg[/img]']

Ok so i checked and double-checked the 1hour and 15 min codes i provided are the ones I am using and they are the correct/updated codes i cant figure out why your zones look so much different compared to mine. Only thing i can suggest would be try using different time frames to further refine those huge zones i like had mentioned earlier. But it is the weirdest thing for. sorry man i am not that educated in coding to give you a definite answer, my apologies.Thanks.

My zones still look bit different.

I have on my 2 day 1 min chart:

15 min and 1 hour indicator.

https%3A//i.imgur.com/w4LUY0n.jpg[/img]']

Thanks. I think I figured it out, it was some other indicator causing the issue, so I removed all the indicators and started fresh.Ok so i checked and double-checked the 1hour and 15 min codes i provided are the ones I am using and they are the correct/updated codes i cant figure out why your zones look so much different compared to mine. Only thing i can suggest would be try using different time frames to further refine those huge zones i like had mentioned earlier. But it is the weirdest thing for. sorry man i am not that educated in coding to give you a definite answer, my apologies.

Also wanted to ask you, you said that you bought a call option around the 676 mark, do you not wait for the candle to close above/below your drawn zone for a safe entry? 676 was still in the grey zone area.

How do you decide when your entry/exit takes place.

Thats awesome you figured it out because i was stumped for sure lol. Again I m not an expert or very experienced trader so i might have gotten lucky but here is what i saw:Thanks. I think I figured it out, it was some other indicator causing the issue, so I removed all the indicators and started fresh.

Also wanted to ask you, you said that you bought a call option around the 676 mark, do you not wait for the candle to close above/below your drawn zone for a safe entry? 676 was still in the grey zone area.

How do you decide when your entry/exit takes place.

1. On Thursday Tesla bounced twice off of 674-675 area so i figured there is a good support around that area.

2. As you can see in the image above Tsla had a massive volume spike resulting in big downward move but the candles prior to it had next to no volume and one before that one had decent volume.

3. so after the big seller volume canble the next candle was green with almost as much volume as two candles before the big seller volume candle (while line).

4. I got in at the second green volume candle and was expecting a spike in buyer volume but that didn't happen for two candles after it so that's when i sold one of my contract (i had two, i have small account lol) and held the second one.

5. After the spike in buyer volume i had my sell order ready to go because i thought it might come down not a lot in shares value but in opens little drop kills premium quick so i was ready to get out but then i got another spike in buyer volume which was bigger than the previous spike so i held and then the very next candle the volume dipped a little so i sold because i got scared/greedy whatever u want to call it hahahha

hope this helps, again not a pro still learning lol

Here is the link to the volume study i found on this website, i have a lot of bells and whistles turned off that's why mine looks different.

https://usethinkscript.com/threads/advanced-volume-indicator-for-thinkorswim.1665/

Hello,

I am using TOS engulfing candle code to find bullish and bearish engulfing candles (arrow in the image below). What I need help with is the candle right before the engulfing candle (indicated by the circle in the image below). I wanted to figure out a way to draw a horizontal line from the close of the candle to the top wick of the candle. I hope I explained it clearly, I tried using the PaintingStrategy but I am not familiar enough to make it work.

I really appreciate your help,

Thank you,

Code:# # TD Ameritrade IP Company, Inc. (c) 2011-2020 # #wizard plots #wizard text: Inputs: length: #wizard input: length #wizard text: trend setup: #wizard input: trendSetup input length = 20; input trendSetup = 3; def BodyMax = Max(open, close); def BodyMin = Min(open, close); def IsEngulfing = BodyMax > BodyMax[1] and BodyMin < BodyMin[1]; def IsWhite = open < close; def IsBlack = open > close; def IsPrevDoji = IsDoji(length)[1]; plot Bearish = IsAscending(close, trendSetup)[1] and (IsWhite[1] or IsPrevDoji) and IsBlack and IsEngulfing; plot Bullish = IsDescending(close, trendSetup)[1] and (IsBlack[1] or IsPrevDoji) and IsWhite and IsEngulfing; Bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); Bearish.SetDefaultColor(GetColor(1)); Bearish.SetLineWeight(2); Bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); Bullish.SetDefaultColor(GetColor(2)); Bullish.SetLineWeight(2);

Great work on this, I also trade Supply & Demand zones this helps me out to draw my zones quicker. For Supply it highlights zones to the tee ( upper wick to lower Body ) . Just need to tweak code for Demand to highlight ( lower wick to upper body)Sure thing, mind you i m not an expert so plz take it with a grain of salt lol

Here are the trades i took this past Thursday and Friday on TSLA:

Ok so little abt my trading style, as i mentioned before i am a day trades and i work full time so i cant be glued to the screen all the time so i wait for my setups.

So I trade on 1 min time frame, in above pic left hand side is the 1 day 1 min chart of TSLA. The teal horizontal bar is a zone that was formed on 15 min chart Premarket, i saw it didn't hold and tesla dumped right at the open breaking the zone so now i treat that zone as a failed zone and now can be a good resistance zone. so I waited till the price tracked back up to the zone, at that point i saw buying power/volume slowing down and then a engulfing red candle formed and that's where i took it short and putting my stop loss above the teal zone bar. So that was a two point short ( i trade options so i had put contracts and i got out quick with two-point drop but could have held it longer for much more gain)

on Friday (right hand chart), again the teal bar is 15 min zone and red lines are 1 hour. I just had premarket red line and teal zone so disregard the other two redlines because they formed during the market. So premarket i was little busy with work so i didnt trade but my plan was if the price breaks above 1 hour zone (PM redline) i was going to go long because of Tesla's news of delivery, if it rejects then short. as you can see the price stalled right at that area and formed Rally Base (basing at the 1 hour line) and Rally so that would have been a massive winner for me especially options but alas didnt get that trade. so i wanted till the price came down to 5 min zone and saw buyers stepping in so i bought calls and got in around 676 area and sold it at 679-680 area and i was done trading. I could have taken same zone trade 4 times that day as u can see because tsla came down and bounced came down and bounce 4 times same exact zone.

Hope this helps, again not a great trader here but this is how i trad and what i saw past two days.

thanks for the input, yah i did notice that and I'll try and fix it thank you.Great work on this, I also trade Supply & Demand zones this helps me out to draw my zones quicker. For Supply it highlights zones to the tee ( upper wick to lower Body ) . Just need to tweak code for Demand to highlight ( lower wick to upper body)

Any tips/advice you can give on how you use supply and demand zones i would appreciate it since i m not an experienced trader. Thanks again

don't trade lower than a 3 min time frame for entry or exit to get a more clear pic of the zone bounce but mostly on a 5, 15 min charts. Ive learned a lot from Carmine Rosato on you tube and also purchased his course so still learning my selfGreat work on this, I also trade Supply & Demand zones this helps me out to draw my zones quicker. For Supply it highlights zones to the tee ( upper wick to lower Body ) . Just need to tweak code for Demand to highlight ( lower wick to upper body)

Once you fix that, please let us knowthanks for the input, yah i did notice that and I'll try and fix it thank you.

Any tips/advice you can give on how you use supply and demand zones i would appreciate it since i m not an experienced trader. Thanks again

Im learning alot from your indicator

with TSLA, 3 min time frame could prove to be a big win or big loss, as it is a very volatile stock. Unless I misunderstood what you are saying.don't trade lower than a 3 min time frame for entry or exit to get a more clear pic of the zone bounce but mostly on a 5, 15 min charts. Ive learned a lot from Carmine Rosato on you tube and also purchased his course so still learning my self

http://tos.mx/ZX57exs@Learnbot, mind sharing your zones for TSLA today... once again my chart is acting weird I think. Need to confirm with your drawn out zones haha

Weird, my zones are no where close to yours.

But then again, I see you are using a daily chart too.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| D | Help drawing line | Questions | 4 | |

| A | Help Drawing fib level lines | Questions | 7 | |

| T | Help Code Strategy Code SPX ODE profitable System | Questions | 0 | |

| M | pls help me find this script | Questions | 1 | |

| S | scan help for relative volume | Questions | 0 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/