Please Code

30 MIN ORB on SPX

Entry is 30 in ORB that is a pulse Bars.

Pattern Set-ups between 9:30-11:30 EST.

Exit at >80% max profit or expiration at end of day

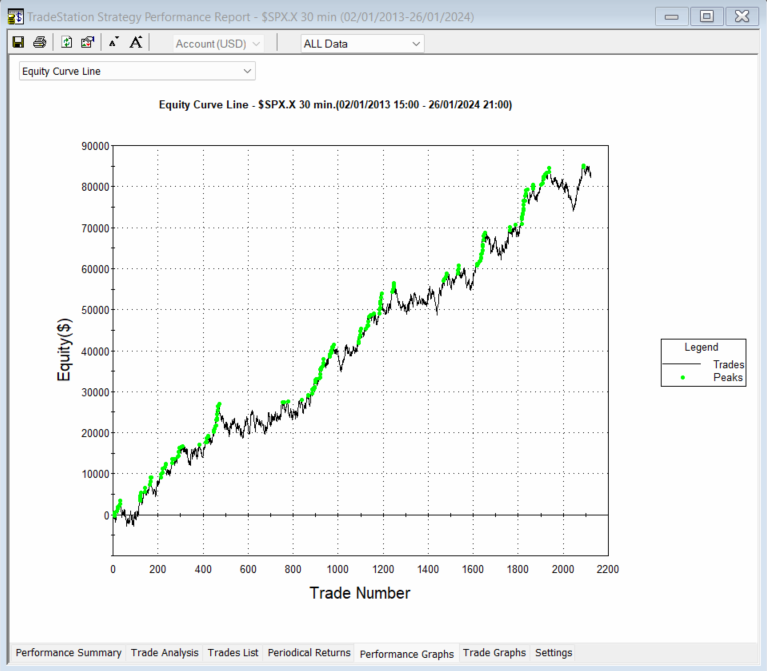

This image is for SPX and illustrates the theoretical performance of the charting setup used for the SPX Income System.

1:1 r:r is used to emulate what we do with options and uses zero discretion.

The data used is 10 years of SPX 30-min charts. From Jan 2013 to Jan 2024

30 MIN ORB on SPX

Entry is 30 in ORB that is a pulse Bars.

Pattern Set-ups between 9:30-11:30 EST.

The Pattern Setup - Pulse Bars

- This is a 1 bar price pattern setup and is 100% mechanical.

- Looking for a bar that closes AT or NEAR the high/low of the 30-min bar.

- Typically a close in the top/bottom 10% of the bars high/low range.

-

Bullish Setup

- Entry on the break of setup bar high

- Use an at the money put credit spread

- Planned exits

- Stop loss - the risk of the option spread

- At expiration (end of day)

- Target choice 1 - >80% of max profit (credit received)

- Target choice 2 - 1.5-2 x ATR of stocks price (approximately)

- This assumes there is a directional move.

- Stop loss - the risk of the option spread

Exit at >80% max profit or expiration at end of day

This image is for SPX and illustrates the theoretical performance of the charting setup used for the SPX Income System.

1:1 r:r is used to emulate what we do with options and uses zero discretion.

The data used is 10 years of SPX 30-min charts. From Jan 2013 to Jan 2024

Last edited by a moderator: