You should upgrade or use an alternative browser.

Help drawing straight lines automatically For ThinkOrSwim

- Thread starter Learnbot

- Start date

Send me what you haveWeird, my zones are no where close to yours.

But then again, I see you are using a daily chart too.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

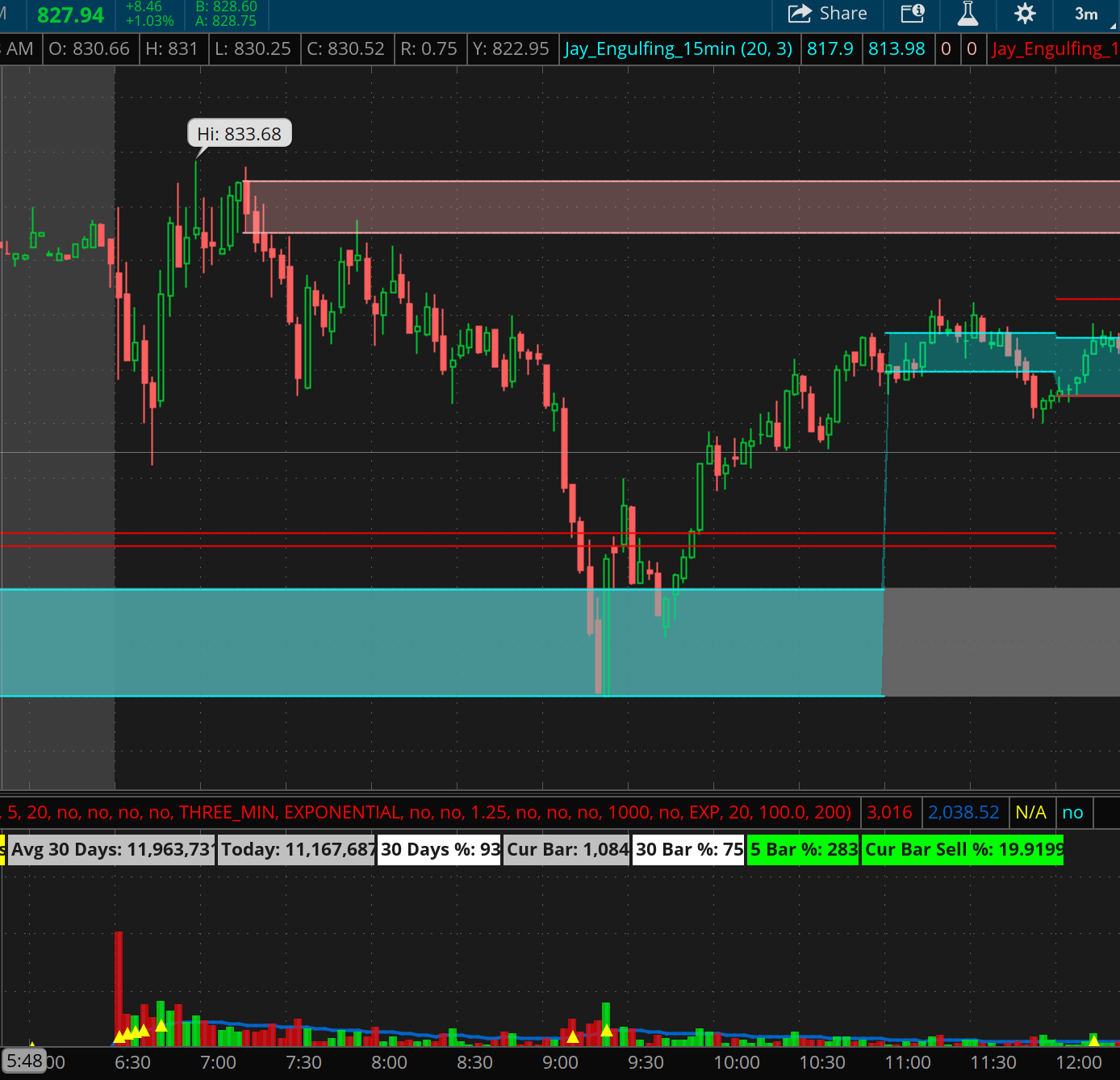

@nitrous So i didn't trade today was little busy at work but here are the zones i had plotted out before the market open:

TSLA:

NVDA:

My plan for TSLA: was to see if buyers step in and defend the zone, TSLA was gapping up 3$ PM so not much movement PM so i wasn't sure if it will move up or down.

NVDA: I actually didn't have plan for this one because there were literally no-zones around the PM areas but i drew the zone at the bottom just in case. I didn't expect the zone i plotted to hit to be completely honest. (Disregard the zones that are showing during the market time)

Always start on higher time chart from weekly down to about 30 min minimum. And within the higher time frames is where you would most likely find smaller zones.Here is what I drew for 15 mins, on a 2 day 1 min chart:

No zones showed up got 1 hour indicator

can you double-check me plz, i think i fixed the issue for the Demand zone (at least i think i did lol) but not 100% sure lolGreat work on this, I also trade Supply & Demand zones this helps me out to draw my zones quicker. For Supply it highlights zones to the tee ( upper wick to lower Body ) . Just need to tweak code for Demand to highlight ( lower wick to upper body)

#Englufing Supply and Demand:

# TD Ameritrade IP Company, Inc. (c) 2011-2020

#

#wizard plots

#wizard text: Inputs: length:

#wizard input: length

#wizard text: trend setup:

#wizard input: trendSetup

input length = 20;

input trendSetup = 3;

def BodyMax = Max(open, close);

def BodyMin = Min(open, close);

def IsEngulfing = BodyMax > BodyMax[1] and

BodyMin < BodyMin[1];

def IsWhite = open < close;

def IsBlack = open > close;

def IsPrevDoji = IsDoji(length)[1];

plot Bearish = IsAscending(close, trendSetup)[1] and

(IsWhite[1] or IsPrevDoji) and

IsBlack and

IsEngulfing;

plot Bullish = IsDescending(close, trendSetup)[1] and

(IsBlack[1] or IsPrevDoji) and

IsWhite and

IsEngulfing;

Bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Bearish.SetDefaultColor(GetColor(2));

Bearish.SetLineWeight(2);

Bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Bullish.SetDefaultColor(GetColor(1));

Bullish.SetLineWeight(2);

def bu_high = if bullish then open[1] else bu_high[1];

def bu_low = if bullish then low[1] else bu_low[1];

def be_high = if bearish then high[1] else be_high[1];

def be_low = if bearish then open[1] else be_low[1];

plot bu_hh = bu_high[-1];

plot bu_ll = bu_low[-1];

plot be_hh = be_high[-1];

plot be_ll = be_low[-1];

bu_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_hh.SetDefaultColor(Color.cyan);

bu_ll.SetDefaultColor(Color.cyan);

be_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_hh.SetDefaultColor(Color.pink);

be_ll.SetDefaultColor(Color.pink);

AddCloud(bu_hh, bu_ll, Color.cyan, Color.cyan);

AddCloud(be_hh,Be_ll, Color.pink, Color.PINK);If you draw a zone and get no bounce and it doesn't consolidate in that zone for a move back higher or lower that zone is invalid. doesn't turn into a support or resistance area thats different from supply & demand. But there could be a support or resistance zone close by but normally on the larger time frame@nitrous also you have to keep in mind these zones are not perfect, meaning when a zone is plotted it doesn't mean the price will bounce off of it all the time. Once the zone is failed (like tesla did today) I use that zone as a resistance (in tesla's case today) rather than support. The PM zone in NVDA's case is a support zone since it bounced off of it but let's say hypothetically if it had broken through and sellers were in control that zone would be invalidated and turned into a resistance zone. Hope i am making sense here lol

Soon as I get to my desktop. Answering on my phone right now.can you double-check me plz, i think i fixed the issue for the Demand zone (at least i think i did lol) but not 100% sure lol

Code:#Englufing Supply and Demand: # TD Ameritrade IP Company, Inc. (c) 2011-2020 # #wizard plots #wizard text: Inputs: length: #wizard input: length #wizard text: trend setup: #wizard input: trendSetup input length = 20; input trendSetup = 3; def BodyMax = Max(open, close); def BodyMin = Min(open, close); def IsEngulfing = BodyMax > BodyMax[1] and BodyMin < BodyMin[1]; def IsWhite = open < close; def IsBlack = open > close; def IsPrevDoji = IsDoji(length)[1]; plot Bearish = IsAscending(close, trendSetup)[1] and (IsWhite[1] or IsPrevDoji) and IsBlack and IsEngulfing; plot Bullish = IsDescending(close, trendSetup)[1] and (IsBlack[1] or IsPrevDoji) and IsWhite and IsEngulfing; Bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); Bearish.SetDefaultColor(GetColor(2)); Bearish.SetLineWeight(2); Bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); Bullish.SetDefaultColor(GetColor(1)); Bullish.SetLineWeight(2); def bu_high = if bullish then open[1] else bu_high[1]; def bu_low = if bullish then low[1] else bu_low[1]; def be_high = if bearish then high[1] else be_high[1]; def be_low = if bearish then open[1] else be_low[1]; plot bu_hh = bu_high[-1]; plot bu_ll = bu_low[-1]; plot be_hh = be_high[-1]; plot be_ll = be_low[-1]; bu_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); bu_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); bu_hh.SetDefaultColor(Color.cyan); bu_ll.SetDefaultColor(Color.cyan); be_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); be_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); be_hh.SetDefaultColor(Color.pink); be_ll.SetDefaultColor(Color.pink); AddCloud(bu_hh, bu_ll, Color.cyan, Color.cyan); AddCloud(be_hh,Be_ll, Color.pink, Color.PINK);

So now it highlights the demand candle but for some reason, it did not find a 15 min candle I had manually drawn out on /ES on 7/01 at 2pm on the 15 min chart which it came back to that zone today 7/6 at 12:15pm for a bounce .25 off from 4305.00. Look at /ES chart I sent I put ovals and red arrows next to those candles hopefully you can figure it out. I dont know jack **** about coding but you are on the right track.Soon as I get to my desktop. Answering on my phone right now.

http://tos.mx/eLGuUWC

Can you define bounce with an example with this indicator?If you draw a zone and get no bounce and it doesn't consolidate in that zone for a move back higher or lower that zone is invalid. doesn't turn into a support or resistance area thats different from supply & demand. But there could be a support or resistance zone close by but normally on the larger time frame

Thanks

you can get faked out alot on a 1 min time frame. 3 min is good for a cleaner entry or exit. 5 min is better to watch along with the 9ema if candles dont close below the 9 ema your still bullish. 9ema acts as a pull back support to enter for most stock trending up or down add the 20 ema on there and watch for 9ema & 2o ema crossing on the 5 min will give you a better direction.with TSLA, 3 min time frame could prove to be a big win or big loss, as it is a very volatile stock. Unless I misunderstood what you are saying.

This is what I call a Bounce had 4305 high lighted as 15 min zone it came to 4305.25 and bounced back up look at it on a 3 min chartCan you define bounce with an example with this indicator?

Thanks

http://tos.mx/I2bdqxz

So this indicator is not perfect, i m the first one to admit this and looking at the candles you pointed out in the pics i think they are not being highlighted because they are technically not an engulfing candle. So i m not that educated in finding exact supply and demand zones, even carmen points out that this could be a subjective thing since there doesn't seem to be exact conditions that get followed each and every time ( i think).So now it highlights the demand candle but for some reason, it did not find a 15 min candle I had manually drawn out on /ES on 7/01 at 2pm on the 15 min chart which it came back to that zone today 7/6 at 12:15pm for a bounce .25 off from 4305.00. Look at /ES chart I sent I put ovals and red arrows next to those candles hopefully you can figure it out. I dont know jack **** about coding but you are on the right track.

http://tos.mx/eLGuUWC

so going to back to your question, yes those candles would be a good zone no doubt abt it however, the indicator did not find it because the low of "Red candle" in both of those arrows are lower than low of the green candle after it hence the green candle "technically" is not an engulfing candle and that's why indicator did not catch it. ( i might be able to tweak this around but i have a feeling if i do that we will get a lot more false zones). I wish carmen or his team would put out an indicator for his strategy that would be so awesome, i would be the first one to buy it lol.

I personally would have gotten in after the bounce off of 15 min demand zone, the small pullback after the giant green candle however, at that point if i had put my stop loss below the demand zone, that is like 5$ stop loss and in options that would result in huge stoploss. so how would you handle this situation? Thank you for ur input

Low of day or 1.00 under my zone which is set 813.13 in chart to give it room to breath. have to under stand a 800.00 stock is not the same as a 40.00 stock if your considering a 5.00 stop loss on stock price that is less than 10% wiggle room in options that's probably within a 1.00 per share on a contract. So risking 1.00 to a reward of possibly gaining more to upside is well worth it. Just manage your size. Just pulled up pricing on the 7/9/ 815 contract that bounce went from 11.32 to 18.90 so at least 7.00 gain to end of day or at least to VWAP to capture profit. Don't know how long your trading buy at least 1 contract to manage risk Look at my chart@Kaydee Quick question for ya, so I buy options for equity. on 3min chart how would you have played NVDA? when would you get in and where would you have your stop loss?

I personally would have gotten in after the bounce off of 15 min demand zone, the small pullback after the giant green candle however, at that point if i had put my stop loss below the demand zone, that is like 5$ stop loss and in options that would result in huge stoploss. so how would you handle this situation? Thank you for ur input

http://tos.mx/Xmf6jXA

Your doing a great Job so far coding it just need to find where to tweak it so it will make it easier for you. Worst case just have to adjust zonesSo this indicator is not perfect, i m the first one to admit this and looking at the candles you pointed out in the pics i think they are not being highlighted because they are technically not an engulfing candle. So i m not that educated in finding exact supply and demand zones, even carmen points out that this could be a subjective thing since there doesn't seem to be exact conditions that get followed each and every time ( i think).

so going to back to your question, yes those candles would be a good zone no doubt abt it however, the indicator did not find it because the low of "Red candle" in both of those arrows are lower than low of the green candle after it hence the green candle "technically" is not an engulfing candle and that's why indicator did not catch it. ( i might be able to tweak this around but i have a feeling if i do that we will get a lot more false zones). I wish carmen or his team would put out an indicator for his strategy that would be so awesome, i would be the first one to buy it lol.

Are we using this new script for both 15 mins and 1 hr now?So this indicator is not perfect, i m the first one to admit this and looking at the candles you pointed out in the pics i think they are not being highlighted because they are technically not an engulfing candle. So i m not that educated in finding exact supply and demand zones, even carmen points out that this could be a subjective thing since there doesn't seem to be exact conditions that get followed each and every time ( i think).

so going to back to your question, yes those candles would be a good zone no doubt abt it however, the indicator did not find it because the low of "Red candle" in both of those arrows are lower than low of the green candle after it hence the green candle "technically" is not an engulfing candle and that's why indicator did not catch it. ( i might be able to tweak this around but i have a feeling if i do that we will get a lot more false zones). I wish carmen or his team would put out an indicator for his strategy that would be so awesome, i would be the first one to buy it lol.

Are we using this new script for both 15 mins and 1 hr now?can you double-check me plz, i think i fixed the issue for the Demand zone (at least i think i did lol) but not 100% sure lol

Code:#Englufing Supply and Demand: # TD Ameritrade IP Company, Inc. (c) 2011-2020 # #wizard plots #wizard text: Inputs: length: #wizard input: length #wizard text: trend setup: #wizard input: trendSetup input length = 20; input trendSetup = 3; def BodyMax = Max(open, close); def BodyMin = Min(open, close); def IsEngulfing = BodyMax > BodyMax[1] and BodyMin < BodyMin[1]; def IsWhite = open < close; def IsBlack = open > close; def IsPrevDoji = IsDoji(length)[1]; plot Bearish = IsAscending(close, trendSetup)[1] and (IsWhite[1] or IsPrevDoji) and IsBlack and IsEngulfing; plot Bullish = IsDescending(close, trendSetup)[1] and (IsBlack[1] or IsPrevDoji) and IsWhite and IsEngulfing; Bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); Bearish.SetDefaultColor(GetColor(2)); Bearish.SetLineWeight(2); Bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); Bullish.SetDefaultColor(GetColor(1)); Bullish.SetLineWeight(2); def bu_high = if bullish then open[1] else bu_high[1]; def bu_low = if bullish then low[1] else bu_low[1]; def be_high = if bearish then high[1] else be_high[1]; def be_low = if bearish then open[1] else be_low[1]; plot bu_hh = bu_high[-1]; plot bu_ll = bu_low[-1]; plot be_hh = be_high[-1]; plot be_ll = be_low[-1]; bu_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); bu_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); bu_hh.SetDefaultColor(Color.cyan); bu_ll.SetDefaultColor(Color.cyan); be_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); be_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); be_hh.SetDefaultColor(Color.pink); be_ll.SetDefaultColor(Color.pink); AddCloud(bu_hh, bu_ll, Color.cyan, Color.cyan); AddCloud(be_hh,Be_ll, Color.pink, Color.PINK);

So here are the updated codes:Are we using this new script for both 15 mins and 1 hr now?

Are we using this new script for both 15 mins and 1 hr now?

General:

#Englufing Supply and Demand:

# TD Ameritrade IP Company, Inc. (c) 2011-2020

#

#wizard plots

#wizard text: Inputs: length:

#wizard input: length

#wizard text: trend setup:

#wizard input: trendSetup

input length = 20;

input trendSetup = 3;

def BodyMax = Max(open, close);

def BodyMin = Min(open, close);

def IsEngulfing = BodyMax > BodyMax[1] and

BodyMin < BodyMin[1];

def IsWhite = open < close;

def IsBlack = open > close;

def IsPrevDoji = IsDoji(length)[1];

plot Bearish = IsAscending(close, trendSetup)[1] and

(IsWhite[1] or IsPrevDoji) and

IsBlack and

IsEngulfing;

plot Bullish = IsDescending(close, trendSetup)[1] and

(IsBlack[1] or IsPrevDoji) and

IsWhite and

IsEngulfing;

Bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Bearish.SetDefaultColor(GetColor(2));

Bearish.SetLineWeight(2);

Bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Bullish.SetDefaultColor(GetColor(1));

Bullish.SetLineWeight(2);

def bu_high = if bullish then open[1] else bu_high[1];

def bu_low = if bullish then low[1] else bu_low[1];

def be_high = if bearish then high[1] else be_high[1];

def be_low = if bearish then open[1] else be_low[1];

plot bu_hh = bu_high[-1];

plot bu_ll = bu_low[-1];

plot be_hh = be_high[-1];

plot be_ll = be_low[-1];

bu_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_hh.SetDefaultColor(Color.cyan);

bu_ll.SetDefaultColor(Color.cyan);

be_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_hh.SetDefaultColor(Color.pink);

be_ll.SetDefaultColor(Color.pink);

AddCloud(bu_hh, bu_ll, Color.cyan, Color.cyan);

AddCloud(be_hh,Be_ll, Color.pink, Color.PINK);15min:

#Engulfing Sup/Dem 15 min

#

# TD Ameritrade IP Company, Inc. (c) 2011-2020

#

#wizard plots

#wizard text: Inputs: length:

#wizard input: length

#wizard text: trend setup:

#wizard input: trendSetup

input length = 20;

input trendSetup = 3;

def agg = aggregationPeriod.FIFTEEN_MIN;

def open = open(period = agg);

def high = high(period = agg);

def low = low(period = agg);

def close = close(period = agg);

def nan = Double.NaN;

def BodyMax = Max(open, close);

def BodyMin = Min(open, close);

def IsEngulfing = BodyMax > BodyMax[1] and

BodyMin < BodyMin[1];

def IsWhite = open < close;

def IsBlack = open > close;

def IsPrevDoji = IsDoji(length)[1];

plot Bearish = IsAscending(close, trendSetup)[1] and

(IsWhite[1] or IsPrevDoji) and

IsBlack and

IsEngulfing;

plot Bullish = IsDescending(close, trendSetup)[1] and

(IsBlack[1] or IsPrevDoji) and

IsWhite and

IsEngulfing;

Bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Bearish.SetDefaultColor(GetColor(1));

Bearish.SetLineWeight(2);

Bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Bullish.SetDefaultColor(GetColor(2));

Bullish.SetLineWeight(2);

def bu_high = if bullish then open[1] else bu_high[1];

def bu_low = if bullish then low[1] else bu_low[1];

def be_high = if bearish then high[1] else be_high[1];

def be_low = if bearish then open[1] else be_low[1];

def buhh = if IsNaN(close()) then buhh[1] else bu_high;

def bull = if IsNaN(close()) then bull[1] else bu_low;

def behh = if IsNaN(close()) then behh[1] else be_high;

def bell = if IsNaN(close()) then bell[1] else be_low;

plot bu_hh = buhh;

plot bu_ll = bull;

plot be_hh = behh;

plot be_ll = bell;

bu_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_hh.SetDefaultColor(Color.cyan);

bu_ll.SetDefaultColor(Color.cyan);

be_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_hh.SetDefaultColor(Color.pink);

be_ll.SetDefaultColor(Color.pink);

AddCloud(bu_hh, bu_ll, Color.cyan, Color.cyan);

AddCloud(be_hh,Be_ll, Color.pink, Color.PINK);3min:

#Engulfing Sup/Dem 3 min

#

# TD Ameritrade IP Company, Inc. (c) 2011-2020

#

#wizard plots

#wizard text: Inputs: length:

#wizard input: length

#wizard text: trend setup:

#wizard input: trendSetup

input length = 20;

input trendSetup = 3;

def agg = aggregationPeriod.three_MIN;

def open = open(period = agg);

def high = high(period = agg);

def low = low(period = agg);

def close = close(period = agg);

def nan = Double.NaN;

def BodyMax = Max(open, close);

def BodyMin = Min(open, close);

def IsEngulfing = BodyMax > BodyMax[1] and

BodyMin < BodyMin[1];

def IsWhite = open < close;

def IsBlack = open > close;

def IsPrevDoji = IsDoji(length)[1];

plot Bearish = IsAscending(close, trendSetup)[1] and

(IsWhite[1] or IsPrevDoji) and

IsBlack and

IsEngulfing;

plot Bullish = IsDescending(close, trendSetup)[1] and

(IsBlack[1] or IsPrevDoji) and

IsWhite and

IsEngulfing;

Bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Bearish.SetDefaultColor(GetColor(1));

Bearish.SetLineWeight(2);

Bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Bullish.SetDefaultColor(GetColor(2));

Bullish.SetLineWeight(2);

def bu_high = if bullish then open[1] else bu_high[1];

def bu_low = if bullish then low[1] else bu_low[1];

def be_high = if bearish then high[1] else be_high[1];

def be_low = if bearish then open[1] else be_low[1];

def buhh = if IsNaN(close()) then buhh[1] else bu_high;

def bull = if IsNaN(close()) then bull[1] else bu_low;

def behh = if IsNaN(close()) then behh[1] else be_high;

def bell = if IsNaN(close()) then bell[1] else be_low;

plot bu_hh = buhh;

plot bu_ll = bull;

plot be_hh = behh;

plot be_ll = bell;

bu_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

bu_hh.SetDefaultColor(Color.yellow);

bu_ll.SetDefaultColor(Color.yellow);

be_hh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_ll.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

be_hh.SetDefaultColor(Color.orange);

be_ll.SetDefaultColor(Color.orange);

AddCloud(bu_hh, bu_ll, Color.cyan, Color.cyan);

AddCloud(be_hh,Be_ll, Color.pink, Color.PINK);I like the script.@nitrous what are your thoughts on this indicator? Any pointers or suggestions?

I am trying to think how to make it better lol

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| D | Help drawing line | Questions | 4 | |

| A | Help Drawing fib level lines | Questions | 7 | |

| Z | Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD | Questions | 3 | |

| J | help with momentum crossover scan ? | Questions | 2 | |

| B | Help with Strategy Builder, 2 moving avg's with ATR | Questions | 1 |

Similar threads

-

-

-

Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD

- Started by Zlotko

- Replies: 3

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD

- Started by Zlotko

- Replies: 3

-

-

Similar threads

-

-

-

Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD

- Started by Zlotko

- Replies: 3

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/