Hi Ben, Thanks for all your hard work with regards to the Thinkscript indicators etc. I was just wondering if there’s a way to get an alert when the up or down arrows are painted on a chart? I have been looking at the arrows for intraday trading, it looks like a 10 or 15 minute chart is what would be best for what I’m looking for. Thanks again!!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

Repaints

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

CashPrince

New member

Been messing with this one for the last week. One of THE BEST customs I've ever worked with. Amazing work (note: I only do swing and long term)

What time frame do you use for your swings?

Year/day is what I'm on 80% of the time (which is where this indicator works best) but I look for confirmations on 1 and 5 min, hourly, and weekly typicallyWhat time frame do you use for your swings?

Ben indicated earlier that for some reason alerts doesn't work with this indicator@BenTen

This is a great indicator and find it far more reliable with the change you made by using the VWAP as a trend. Please could you make a change to the code and add a sound when an arrow is painted on the chart? Sorry, I am new and hope that makes sense?

Thank you

KevinSammy

Member

My bad, copied from the wrong study.

This will do it for you:

Be careful with backtests as this repaints, so it will give the impression of working 100% of the time.

This will do it for you:

Code:

######

# Alerts

######

input AudibleAlerts = yes;

Alert(AudibleAlerts and bEngulf, GetSymbol(), Alert.BAR, Sound.Bell);

Alert(AudibleAlerts and sEngulf, GetSymbol(), Alert.BAR, Sound.Bell);

Alert(AudibleAlerts and bVWAP, GetSymbol(), Alert.BAR, Sound.Bell);

Alert(AudibleAlerts and sVWAP, GetSymbol(), Alert.BAR, Sound.Bell);

# End CodeBe careful with backtests as this repaints, so it will give the impression of working 100% of the time.

Newbie_789456

New member

Hi Ben, great work and thanks for sharing! Have you had a chance to compare the efficacity of this version vs. the original one? As there is no way to systematically backtest, i was hoping you might have already some idea on this before I embark on a long and tedious manual backtesting of both.. Also, do you still recommend using 15m aggregation period? Thanks!Here is the Enhanced version of the popular Trend Reversal indicator available here for ThinkorSwim.

Before we jump into what's new, I just want to clarify that the new version will continue to repaint. Repainting was the problem with the original Trend Reversal. Though there is no way to fix that issue, we continue to find ways to improve it.

One way to increase the reliability of the signals is to implement additional trend reversal patterns. Included in the Enhanced version are:

- Bullish and Bearish Engulfing candles

- VWAP

- Advanced Market Moves (will not be included in the public release due to obvious reason)

Here’s How it Works:

From now on, the Trend Reversal Signals will only appear on your chart if it fits the following requirement:

The reversal candle (pulled from the original version) must either be an Engulfing candle, below/above VWAP, or matches with the signal given by the Advanced Market Moves.

We assume that if any of the three conditions match up in a single candle, most likely there would be a point of reversal in trend. Of course, since this indicator repaint, it’s impossible to backtest. Hopefully, this Enhanced version will work better since additional conditions have been added.

thinkScript Code

Code:# Enhanced Trend Reversal Indicator with Signals # Added VWAP and Engulfing Candles # Assembled by BenTen at useThinkScript.com # Original developer: Bayside of Enhanced Investor # Original version: https://usethinkscript.com/threads/trend-reversal-indicator-with-signals-for-thinkorswim.183/ # Version 1.0 (read changelog in forum) def price = close; def superfast_length = 9; def fast_length = 14; def slow_length = 21; def displace = 0; def mov_avg9 = ExpAverage(price[-displace], superfast_length); def mov_avg14 = ExpAverage(price[-displace], fast_length); def mov_avg21 = ExpAverage(price[-displace], slow_length); # MAs part of Trend Reversal def Superfast = mov_avg9; def Fast = mov_avg14; def Slow = mov_avg21; def buy = mov_avg9 > mov_avg14 and mov_avg14 > mov_avg21 and low > mov_avg9; def stopbuy = mov_avg9 <= mov_avg14; def buynow = !buy[1] and buy; def buysignal = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal[1] == 1 and stopbuy then 0 else buysignal[1], 0); def Buy_Signal = buysignal[1] == 0 and buysignal == 1; def Momentum_Down = buysignal[1] == 1 and buysignal == 0; def sell = mov_avg9 < mov_avg14 and mov_avg14 < mov_avg21 and high < mov_avg9; def stopsell = mov_avg9 >= mov_avg14; def sellnow = !sell[1] and sell; def sellsignal = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal[1] == 1 and stopsell then 0 else sellsignal[1], 0); def Sell_Signal = sellsignal[1] == 0 and sellsignal; input method = {default average, high_low}; def bubbleoffset = .0005; def percentamount = .01; def revAmount = .05; def atrreversal = 2.0; def atrlength = 5; def pricehigh = high; def pricelow = low; def averagelength = 5; def averagetype = AverageType.EXPONENTIAL; def mah = MovingAverage(averagetype, pricehigh, averagelength); def mal = MovingAverage(averagetype, pricelow, averagelength); def priceh = if method == method.high_low then pricehigh else mah; def pricel = if method == method.high_low then pricelow else mal; def EI = ZigZagHighLow("price h" = priceh, "price l" = pricel, "percentage reversal" = percentamount, "absolute reversal" = revAmount, "atr length" = atrlength, "atr reversal" = atrreversal); rec EISave = if !IsNaN(EI) then EI else GetValue(EISave, 1); def chg = (if EISave == priceh then priceh else pricel) - GetValue(EISave, 1); def isUp = chg >= 0; def EIL = if !IsNaN(EI) and !isUp then pricel else GetValue(EIL, 1); def EIH = if !IsNaN(EI) and isUp then priceh else GetValue(EIH, 1); def dir = CompoundValue(1, if EIL != EIL[1] or pricel == EIL[1] and pricel == EISave then 1 else if EIH != EIH[1] or priceh == EIH[1] and priceh == EISave then -1 else dir[1], 0); def signal = CompoundValue(1, if dir > 0 and pricel > EIL then if signal[1] <= 0 then 1 else signal[1] else if dir < 0 and priceh < EIH then if signal[1] >= 0 then -1 else signal[1] else signal[1], 0); # Define original signals def bullish2 = signal > 0 and signal[1] <= 0; def bearish2 = signal < 0 and signal[1] >= 0; # VWAP input numDevDn = -2.0; input numDevUp = 2.0; input timeFrame = {default DAY, WEEK, MONTH}; def cap = GetAggregationPeriod(); def errorInAggregation = timeFrame == timeFrame.DAY and cap >= AggregationPeriod.WEEK or timeFrame == timeFrame.WEEK and cap >= AggregationPeriod.MONTH; Assert(!errorInAggregation, "timeFrame should be not less than current chart aggregation period"); def yyyyMmDd = GetYYYYMMDD(); def periodIndx; switch (timeFrame) { case DAY: periodIndx = yyyyMmDd; case WEEK: periodIndx = Floor((DaysFromDate(First(yyyyMmDd)) + GetDayOfWeek(First(yyyyMmDd))) / 7); case MONTH: periodIndx = RoundDown(yyyyMmDd / 100, 0); } def isPeriodRolled = CompoundValue(1, periodIndx != periodIndx[1], yes); def volumeSum; def volumeVwapSum; def volumeVwap2Sum; if (isPeriodRolled) { volumeSum = volume; volumeVwapSum = volume * vwap; volumeVwap2Sum = volume * Sqr(vwap); } else { volumeSum = CompoundValue(1, volumeSum[1] + volume, volume); volumeVwapSum = CompoundValue(1, volumeVwapSum[1] + volume * vwap, volume * vwap); volumeVwap2Sum = CompoundValue(1, volumeVwap2Sum[1] + volume * Sqr(vwap), volume * Sqr(vwap)); } def priceVWAP = volumeVwapSum / volumeSum; def deviation = Sqrt(Max(volumeVwap2Sum / volumeSum - Sqr(priceVWAP), 0)); def VWAP = priceVWAP; #plot UpperBand = priceVWAP + numDevUp * deviation; #plot LowerBand = priceVWAP + numDevDn * deviation; def UpVWAP = price > VWAP; def DownVWAP = price < VWAP; # Engulfing Candles. Snippets from @ConfluenceCptl def BodyMax = Max(open, close); def BodyMin = Min(open, close); def IsEngulfing = BodyMax > BodyMax[1] and BodyMin < BodyMin[1]; # Define Signals with VWAP def bullish_vwap = UpVWAP and bullish2; def bearish_vwap = DownVWAP and bearish2; # Plot Signals with VWAP plot bull_vwap = bullish_vwap; bull_vwap.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); bull_vwap.SetDefaultColor(Color.CYAN); bull_vwap.SetLineWeight(2); plot bear_vwap = bearish_vwap; bear_vwap.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); bear_vwap.SetDefaultColor(Color.CYAN); bear_vwap.SetLineWeight(2); # Define Signals with Engulfing Candles def bullish_engulf = bullish2 and Isengulfing and close > open; def bearish_engulf = bearish2 and Isengulfing and close < open; # Plot Signals with Engulfing Candles plot bull_engulf = bullish_engulf; bull_engulf.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); bull_engulf.SetDefaultColor(Color.WHITE); bull_engulf.SetLineWeight(2); plot bear_engulf = bearish_engulf; bear_engulf.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); bear_engulf.SetDefaultColor(Color.WHITE); bear_engulf.SetLineWeight(2); AddLabel(yes,"Signals w/ VWAP",color.CYAN); AddLabel(yes,"Signals w/ Engulfing",color.WHITE); # Configurations input bEngulf = yes; input sEngulf = yes; input bVWAP = yes; input sVWAP = yes; bull_engulf.SetHiding(!bEngulf); bear_engulf.SetHiding(!sEngulf); bull_vwap.SetHiding(!bVWAP); bear_vwap.SetHiding(!sVWAP);

Shareable Link: https://tos.mx/1we0QW

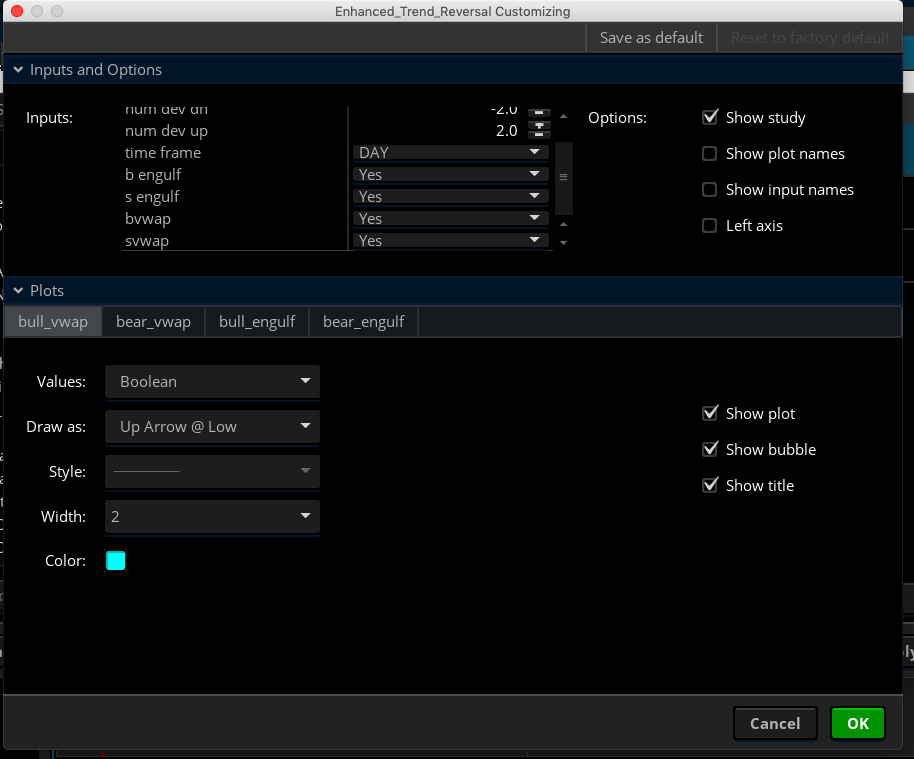

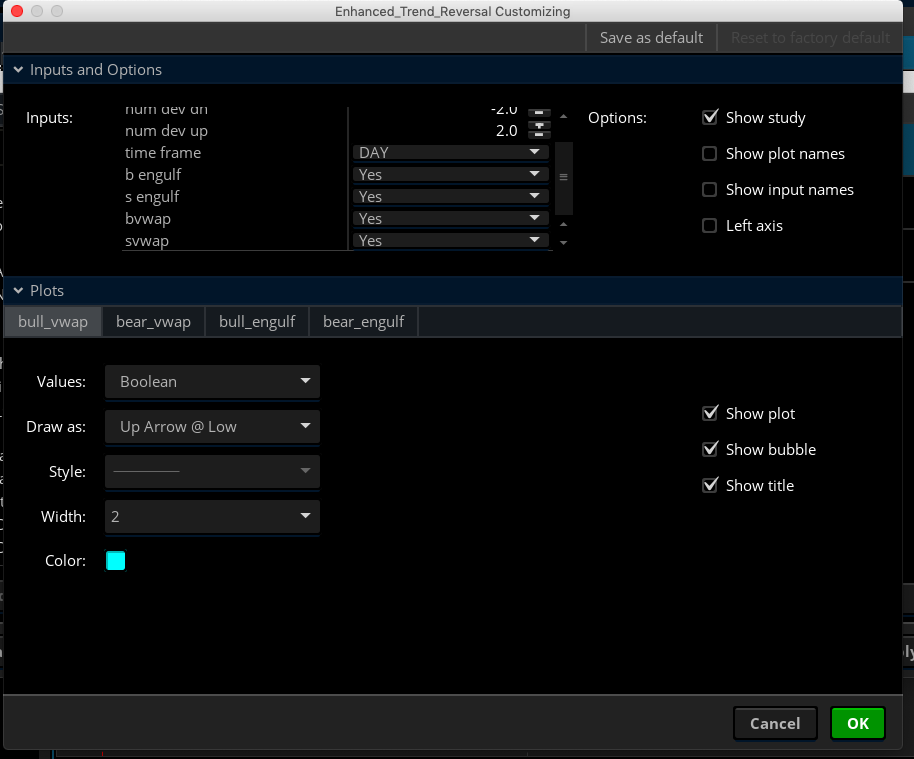

Configurations

There will be a lot of signals on your chart, however, I have color-coded them. You can also disable any type of arrows right from the indicator’s settings page. You don’t have to edit anything in the source code.

Changelog

Feel free to test it out and let me know. I heard a lot of positive feedback from members using the original version.

Video Tutorial

@Newbie_789456 I actually don't recommend this indicator or the original one at all. It's a repainting indicator so trading it in real-time would be risky.

binhvesting

Member

Hi @BenTen is it possible to incorporate the three bar indicator you developed in this awesome imdicator? Also, just read your comment in the beginning of the thread, so the Advanced Market Movers has all the features that this one has?Here is the Enhanced version of the popular Trend Reversal indicator available here for ThinkorSwim.

Before we jump into what's new, I just want to clarify that the new version will continue to repaint. Repainting was the problem with the original Trend Reversal. Though there is no way to fix that issue, we continue to find ways to improve it.

One way to increase the reliability of the signals is to implement additional trend reversal patterns. Included in the Enhanced version are:

- Bullish and Bearish Engulfing candles

- VWAP

- Advanced Market Moves (will not be included in the public release due to obvious reason)

Here’s How it Works:

From now on, the Trend Reversal Signals will only appear on your chart if it fits the following requirement:

The reversal candle (pulled from the original version) must either be an Engulfing candle, below/above VWAP, or matches with the signal given by the Advanced Market Moves.

We assume that if any of the three conditions match up in a single candle, most likely there would be a point of reversal in trend. Of course, since this indicator repaint, it’s impossible to backtest. Hopefully, this Enhanced version will work better since additional conditions have been added.

thinkScript Code

Code:# Enhanced Trend Reversal Indicator with Signals # Added VWAP and Engulfing Candles # Assembled by BenTen at useThinkScript.com # Original developer: Bayside of Enhanced Investor # Original version: https://usethinkscript.com/threads/trend-reversal-indicator-with-signals-for-thinkorswim.183/ # Version 1.0 (read changelog in forum) def price = close; def superfast_length = 9; def fast_length = 14; def slow_length = 21; def displace = 0; def mov_avg9 = ExpAverage(price[-displace], superfast_length); def mov_avg14 = ExpAverage(price[-displace], fast_length); def mov_avg21 = ExpAverage(price[-displace], slow_length); # MAs part of Trend Reversal def Superfast = mov_avg9; def Fast = mov_avg14; def Slow = mov_avg21; def buy = mov_avg9 > mov_avg14 and mov_avg14 > mov_avg21 and low > mov_avg9; def stopbuy = mov_avg9 <= mov_avg14; def buynow = !buy[1] and buy; def buysignal = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal[1] == 1 and stopbuy then 0 else buysignal[1], 0); def Buy_Signal = buysignal[1] == 0 and buysignal == 1; def Momentum_Down = buysignal[1] == 1 and buysignal == 0; def sell = mov_avg9 < mov_avg14 and mov_avg14 < mov_avg21 and high < mov_avg9; def stopsell = mov_avg9 >= mov_avg14; def sellnow = !sell[1] and sell; def sellsignal = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal[1] == 1 and stopsell then 0 else sellsignal[1], 0); def Sell_Signal = sellsignal[1] == 0 and sellsignal; input method = {default average, high_low}; def bubbleoffset = .0005; def percentamount = .01; def revAmount = .05; def atrreversal = 2.0; def atrlength = 5; def pricehigh = high; def pricelow = low; def averagelength = 5; def averagetype = AverageType.EXPONENTIAL; def mah = MovingAverage(averagetype, pricehigh, averagelength); def mal = MovingAverage(averagetype, pricelow, averagelength); def priceh = if method == method.high_low then pricehigh else mah; def pricel = if method == method.high_low then pricelow else mal; def EI = ZigZagHighLow("price h" = priceh, "price l" = pricel, "percentage reversal" = percentamount, "absolute reversal" = revAmount, "atr length" = atrlength, "atr reversal" = atrreversal); rec EISave = if !IsNaN(EI) then EI else GetValue(EISave, 1); def chg = (if EISave == priceh then priceh else pricel) - GetValue(EISave, 1); def isUp = chg >= 0; def EIL = if !IsNaN(EI) and !isUp then pricel else GetValue(EIL, 1); def EIH = if !IsNaN(EI) and isUp then priceh else GetValue(EIH, 1); def dir = CompoundValue(1, if EIL != EIL[1] or pricel == EIL[1] and pricel == EISave then 1 else if EIH != EIH[1] or priceh == EIH[1] and priceh == EISave then -1 else dir[1], 0); def signal = CompoundValue(1, if dir > 0 and pricel > EIL then if signal[1] <= 0 then 1 else signal[1] else if dir < 0 and priceh < EIH then if signal[1] >= 0 then -1 else signal[1] else signal[1], 0); # Define original signals def bullish2 = signal > 0 and signal[1] <= 0; def bearish2 = signal < 0 and signal[1] >= 0; # VWAP input numDevDn = -2.0; input numDevUp = 2.0; input timeFrame = {default DAY, WEEK, MONTH}; def cap = GetAggregationPeriod(); def errorInAggregation = timeFrame == timeFrame.DAY and cap >= AggregationPeriod.WEEK or timeFrame == timeFrame.WEEK and cap >= AggregationPeriod.MONTH; Assert(!errorInAggregation, "timeFrame should be not less than current chart aggregation period"); def yyyyMmDd = GetYYYYMMDD(); def periodIndx; switch (timeFrame) { case DAY: periodIndx = yyyyMmDd; case WEEK: periodIndx = Floor((DaysFromDate(First(yyyyMmDd)) + GetDayOfWeek(First(yyyyMmDd))) / 7); case MONTH: periodIndx = RoundDown(yyyyMmDd / 100, 0); } def isPeriodRolled = CompoundValue(1, periodIndx != periodIndx[1], yes); def volumeSum; def volumeVwapSum; def volumeVwap2Sum; if (isPeriodRolled) { volumeSum = volume; volumeVwapSum = volume * vwap; volumeVwap2Sum = volume * Sqr(vwap); } else { volumeSum = CompoundValue(1, volumeSum[1] + volume, volume); volumeVwapSum = CompoundValue(1, volumeVwapSum[1] + volume * vwap, volume * vwap); volumeVwap2Sum = CompoundValue(1, volumeVwap2Sum[1] + volume * Sqr(vwap), volume * Sqr(vwap)); } def priceVWAP = volumeVwapSum / volumeSum; def deviation = Sqrt(Max(volumeVwap2Sum / volumeSum - Sqr(priceVWAP), 0)); def VWAP = priceVWAP; #plot UpperBand = priceVWAP + numDevUp * deviation; #plot LowerBand = priceVWAP + numDevDn * deviation; def UpVWAP = price > VWAP; def DownVWAP = price < VWAP; # Engulfing Candles. Snippets from @ConfluenceCptl def BodyMax = Max(open, close); def BodyMin = Min(open, close); def IsEngulfing = BodyMax > BodyMax[1] and BodyMin < BodyMin[1]; # Define Signals with VWAP def bullish_vwap = UpVWAP and bullish2; def bearish_vwap = DownVWAP and bearish2; # Plot Signals with VWAP plot bull_vwap = bullish_vwap; bull_vwap.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); bull_vwap.SetDefaultColor(Color.CYAN); bull_vwap.SetLineWeight(2); plot bear_vwap = bearish_vwap; bear_vwap.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); bear_vwap.SetDefaultColor(Color.CYAN); bear_vwap.SetLineWeight(2); # Define Signals with Engulfing Candles def bullish_engulf = bullish2 and Isengulfing and close > open; def bearish_engulf = bearish2 and Isengulfing and close < open; # Plot Signals with Engulfing Candles plot bull_engulf = bullish_engulf; bull_engulf.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); bull_engulf.SetDefaultColor(Color.WHITE); bull_engulf.SetLineWeight(2); plot bear_engulf = bearish_engulf; bear_engulf.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); bear_engulf.SetDefaultColor(Color.WHITE); bear_engulf.SetLineWeight(2); AddLabel(yes,"Signals w/ VWAP",color.CYAN); AddLabel(yes,"Signals w/ Engulfing",color.WHITE); # Configurations input bEngulf = yes; input sEngulf = yes; input bVWAP = yes; input sVWAP = yes; bull_engulf.SetHiding(!bEngulf); bear_engulf.SetHiding(!sEngulf); bull_vwap.SetHiding(!bVWAP); bear_vwap.SetHiding(!sVWAP);

Shareable Link: https://tos.mx/1we0QW

Configurations

There will be a lot of signals on your chart, however, I have color-coded them. You can also disable any type of arrows right from the indicator’s settings page. You don’t have to edit anything in the source code.

Changelog

Feel free to test it out and let me know. I heard a lot of positive feedback from members using the original version.

Video Tutorial

Thanks for the great work as always.

@binhvesting First of all, I just want to let you know that this indicator combines with VWAP, Engulfing candles, and Trend Reversal indicator into one. Because it includes the trend reversal indicator, the signals will repaint. I don't think anyone should be using repainting indicators unless they know what they are doing.

Last edited:

Haha maybe.

So if the reversal code is edited out, its literally just VWAP and Engulfing? Thats too bad. I havent seen the indicator live yet, but looking back on my charts, it looks pretty great for scalping. Im just not sure how the repainting works live.... maybe it makes this indicator useless if it doesnt pop up until its several candles too late.

What exactly is the VWAP indicator (blue one) looking for? Id love the code for just that, specifically...

So if the reversal code is edited out, its literally just VWAP and Engulfing? Thats too bad. I havent seen the indicator live yet, but looking back on my charts, it looks pretty great for scalping. Im just not sure how the repainting works live.... maybe it makes this indicator useless if it doesnt pop up until its several candles too late.

What exactly is the VWAP indicator (blue one) looking for? Id love the code for just that, specifically...

@KennyN Correct, the conditions are pretty straight-forward if you dissect the code. Basically, taking the up and down arrows from the trend reversal indicator and then pairing them with Engulfing candlestick patterns and VWAP.

For example, up arrow = when there is a bullish signal (from the trend reversal indicator) and the price is above the VWAP line.

For example, up arrow = when there is a bullish signal (from the trend reversal indicator) and the price is above the VWAP line.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Repaints Super Trend MTF Enhanced For ThinkOrSwim | Indicators | 31 | |

|

|

Enhanced Zero Lag MACD Indicator for ThinkorSwim | Indicators | 4 | |

|

|

Enhanced VWAP Indicator for ThinkorSwim | Indicators | 12 | |

|

|

Standard Deviation Bands Enhanced for ThinkorSwim | Indicators | 28 | |

| C | AGAIG Trend Vertical Line For ThinkOrSwim | Indicators | 11 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

905

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.