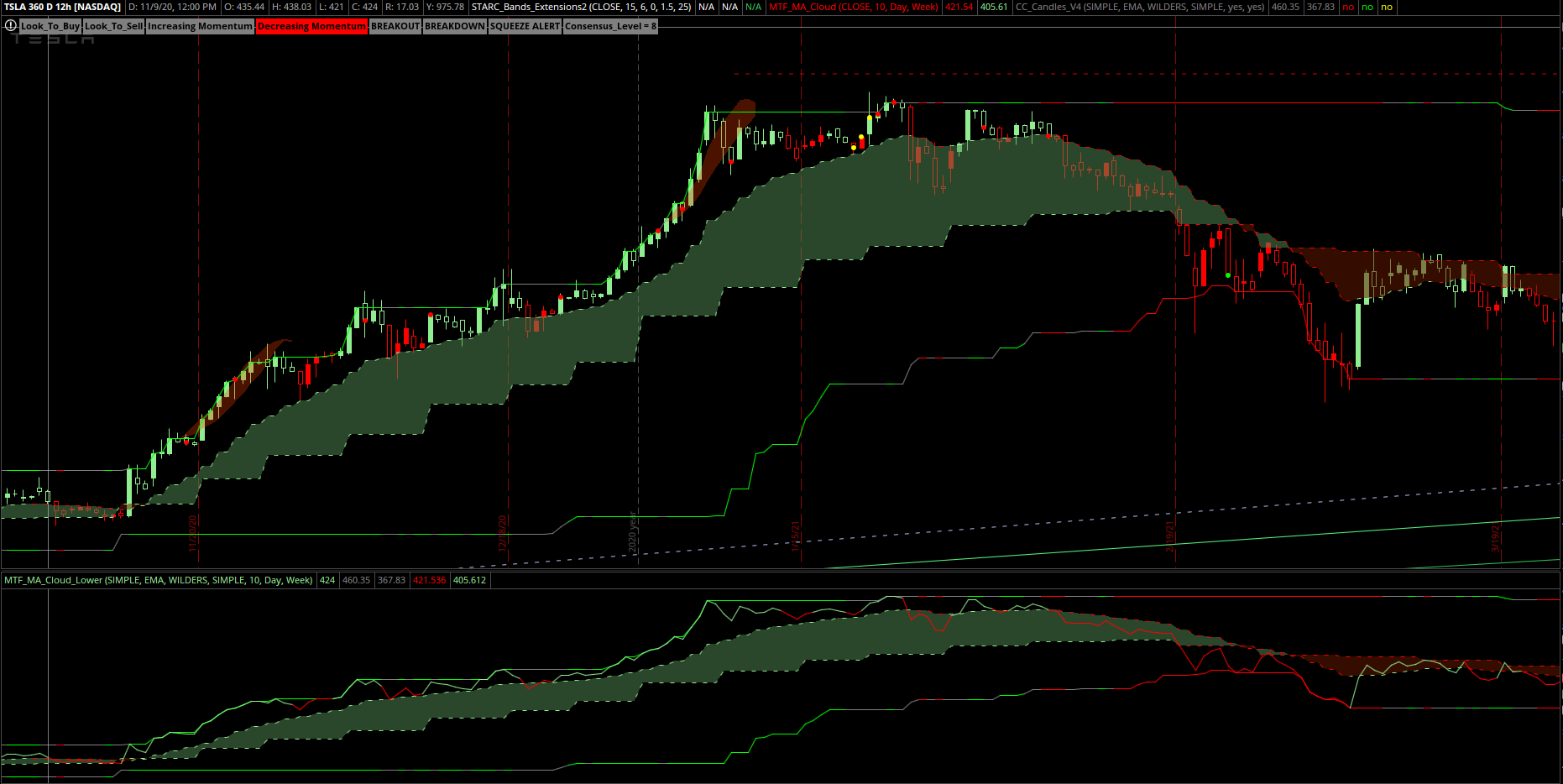

I just posted my MTF Cloud upper and lower studies on page 1, of this thread, for those of you that are interested.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Hi @skkar,Hi ,

Where can I get the Script of MTF studies -- Upper and Lower.

Thanks,

Swapan Kar

The MTF MA upper and lower are available on pg.1 of this thread.

Thank you!You can check page 1, posts 16 & 17 and page 5, post 100 for more information related to your question. Hope this help.

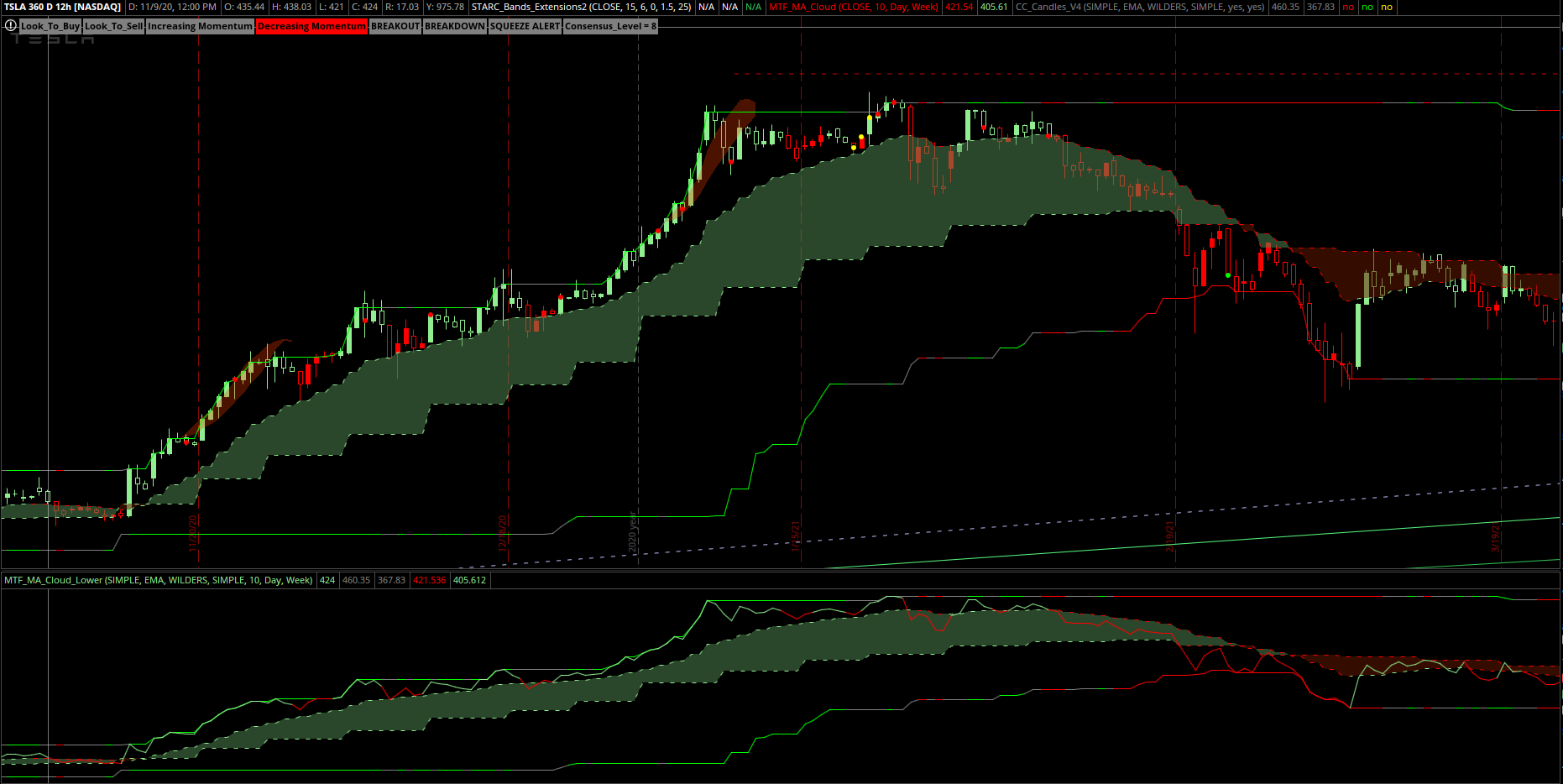

Hi @Christopher84 can you share your chart.Sometimes it is easier to see the price action without the distractions of the bright colors.

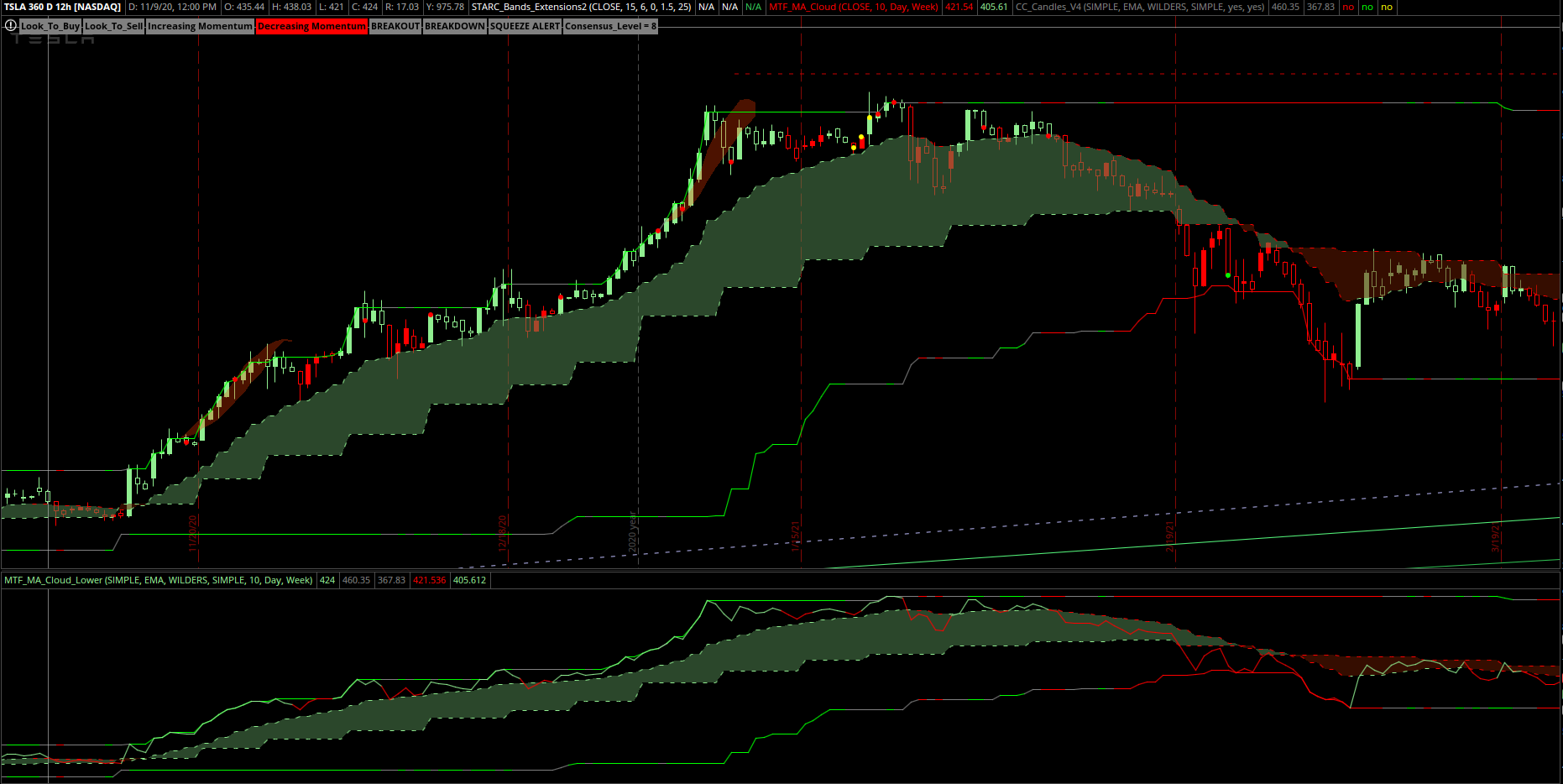

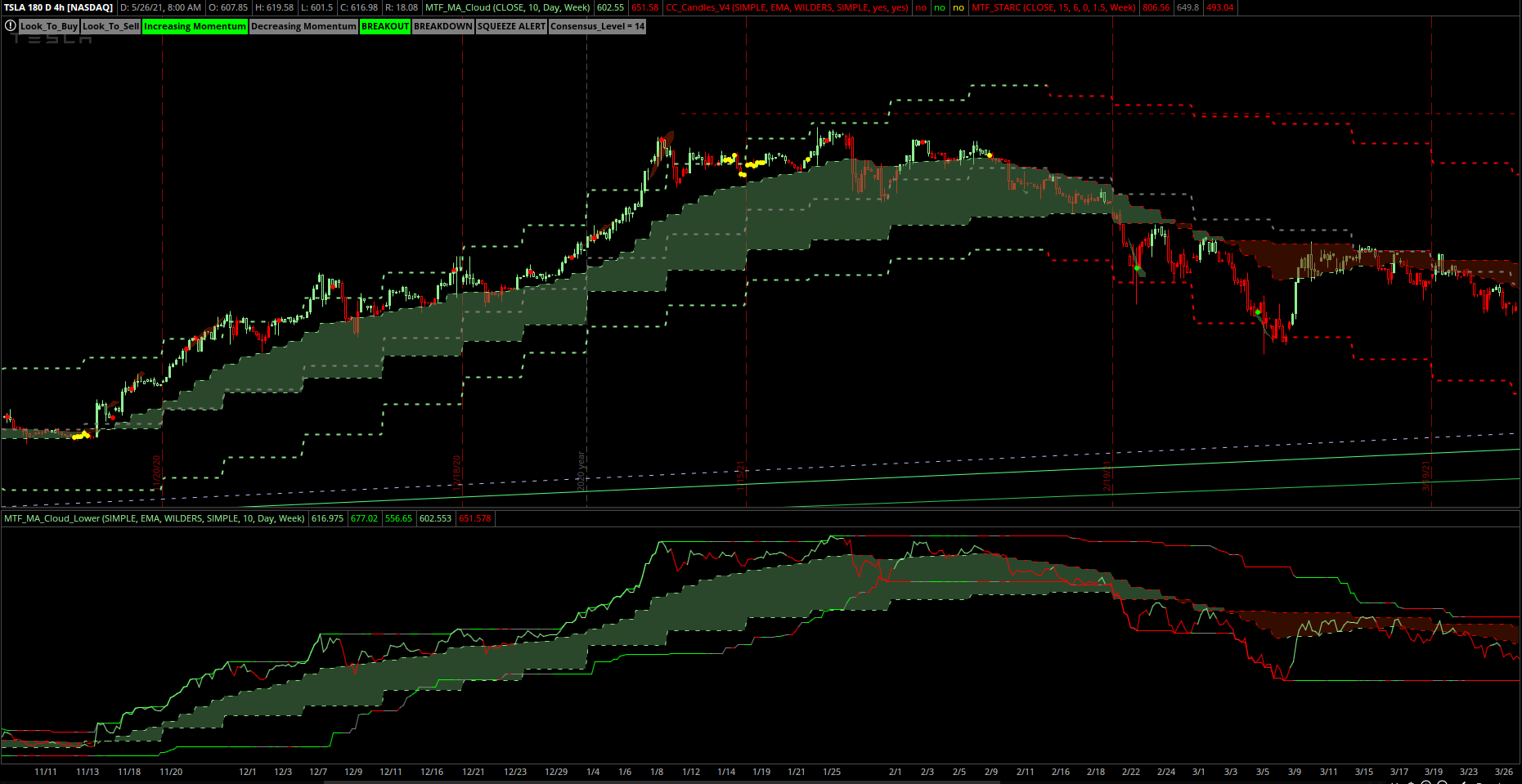

@Christopher84 The indicators are amazing. I been using the (daily) mtf starc bands on the 4hr chart for swing trading and found that you get faster entries (red candles green channels), just following the trend of the higher timeframe in this case the daily mtf starc bands. is that a good way to use them?

thanks

thanks

murtaza1234

New member

Hello @Christopher84, I am very new to day trading and I came across this thread. This is such a long and popular thread  and it has so many scripts for charts and lower studies, that its confusing which one is the most update version for both the indicators and the lower OB/OS study that I can backtest/use for day trading?

and it has so many scripts for charts and lower studies, that its confusing which one is the most update version for both the indicators and the lower OB/OS study that I can backtest/use for day trading?

Thank you in advance for creating such a helpful tool.

Thank you in advance for creating such a helpful tool.

As a quick start,Hello @Christopher84, I am very new to day trading and I came across this thread. This is such a long and popular threadand it has so many scripts for charts and lower studies, that its confusing which one is the most update version for both the indicators and the lower OB/OS study that I can backtest/use for day trading?

Thank you in advance for creating such a helpful tool.

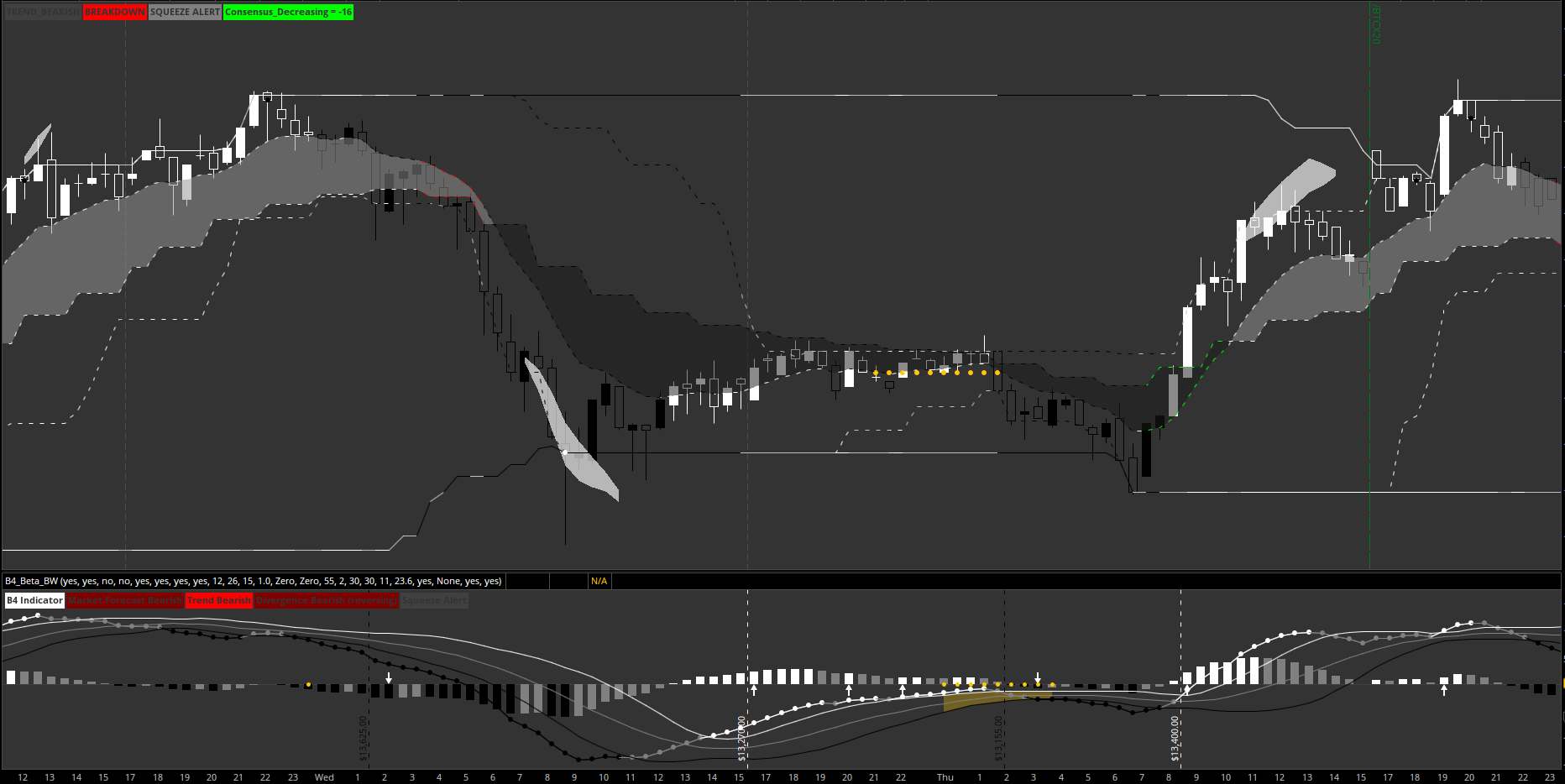

I suggest installing

1. C3 indicator (upper study from the 1st page)

and

2. B4 indicator (lower study; search for it in the forums)

Also, read this thread ...I know it will take some time, but it is totally worth it

murtaza1234

New member

DeepThinker, Thanks. So far I foundAs a quick start,

I suggest installing

1. C3 indicator (upper study from the 1st page)

and

2. B4 indicator (lower study; search for it in the forums)

Also, read this thread ...I know it will take some time, but it is totally worth it

1. In this https://usethinkscript.com/threads/confirmation-candles-indicator-for-thinkorswim.6316/ -- C3 V10 and V6

2. B4: https://tos.mx/0aqdRea

However, I am trying to add

#Confirmation Level Watchlist and #Super_OB_OS_Lower but I cant seem to make this work. Is there a doc/video that I can follow to add this custom watchlist?Thanks.

murtaza1234

New member

Nevermind, I found out, thanks toDeepThinker, Thanks. So far I found

1. In this https://usethinkscript.com/threads/confirmation-candles-indicator-for-thinkorswim.6316/ -- C3 V10 and V6

2. B4: https://tos.mx/0aqdRea

However, I am trying to add#Confirmation Level Watchlistand#Super_OB_OS_Lowerbut I cant seem to make this work. Is there a doc/video that I can follow to add this custom watchlist?

Thanks.

Can you please share the MCD with the squeeze that you show on your video. ThanksHi Everyone!

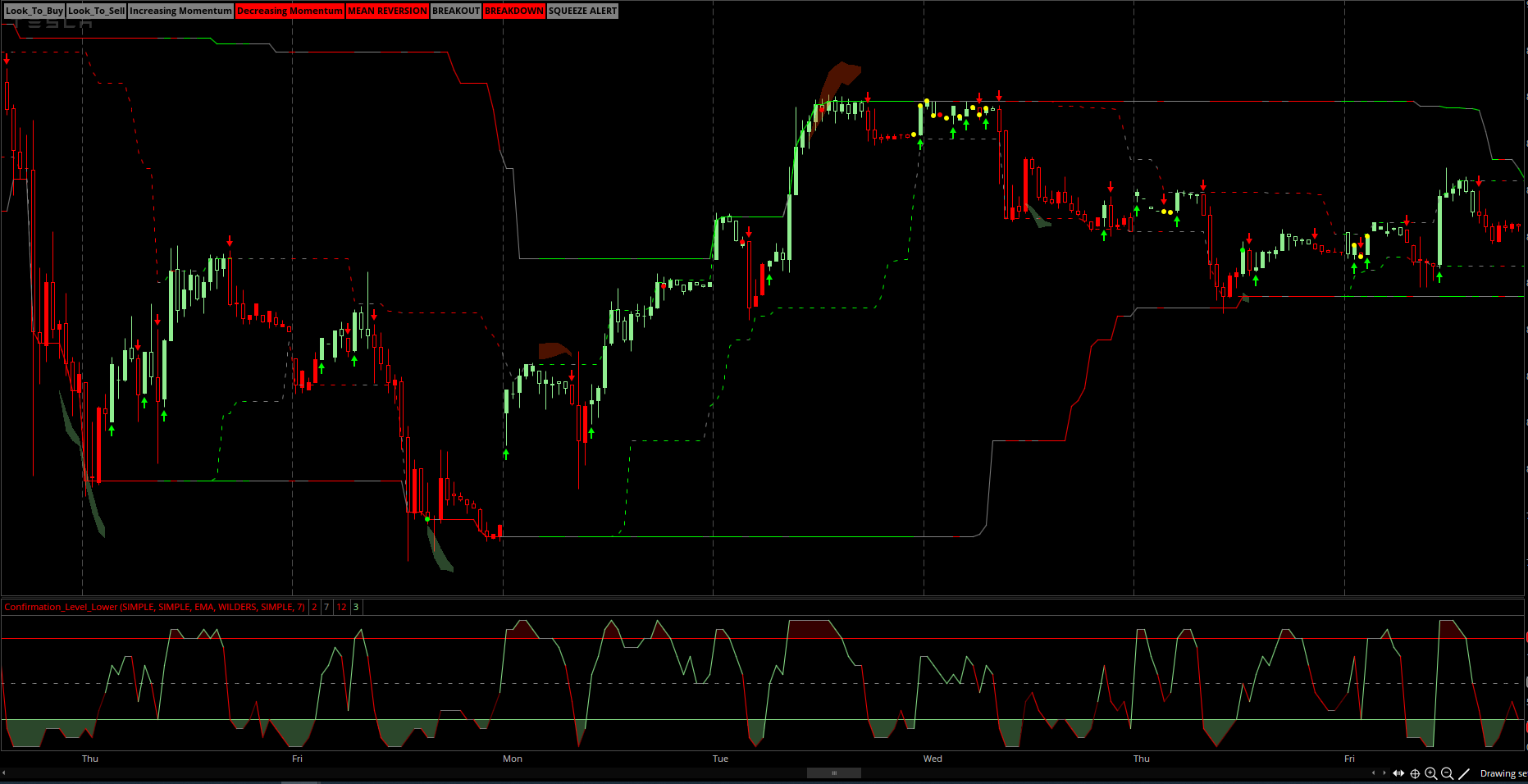

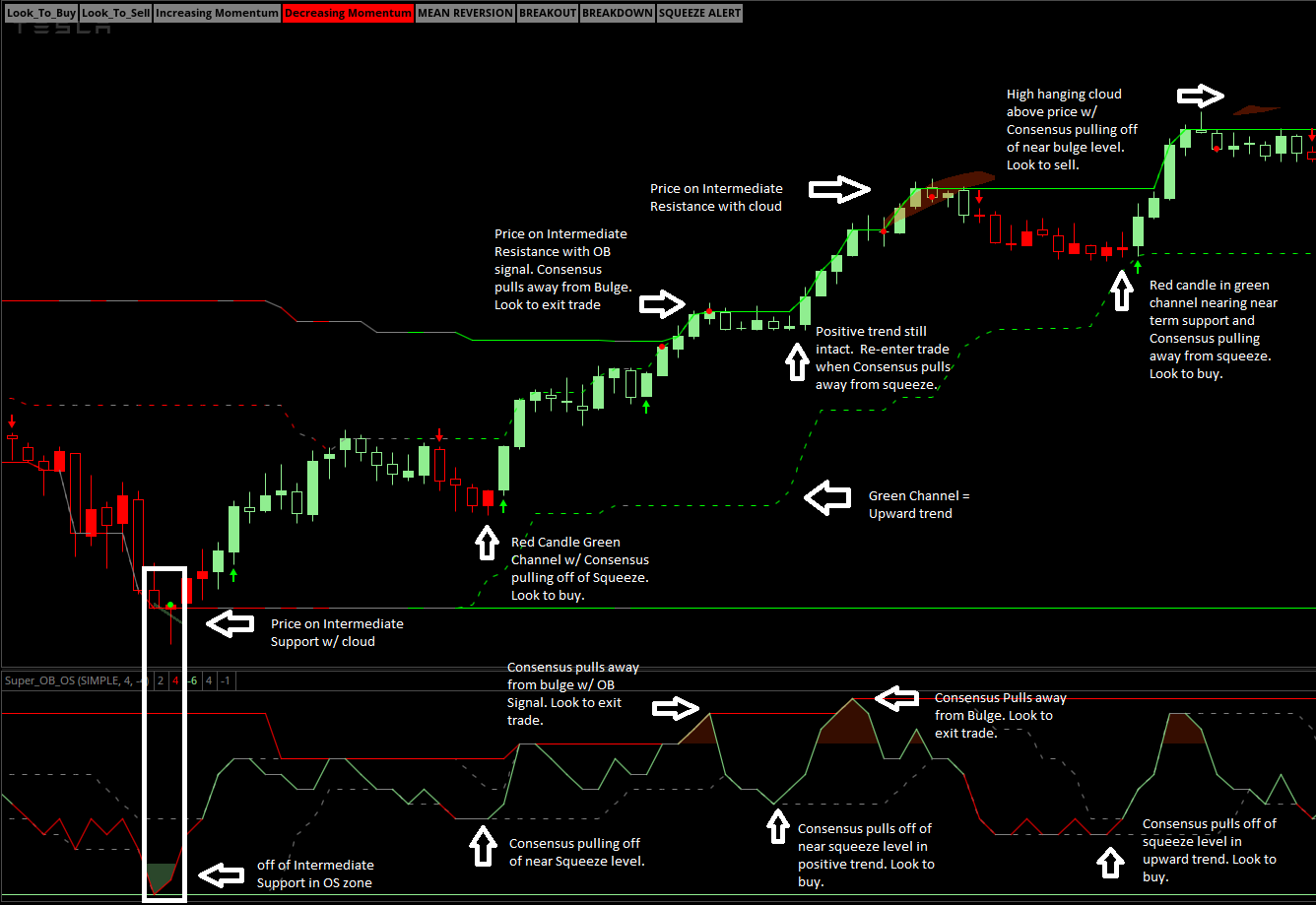

I have been working on an Idea I am calling confirmation candles. I often times find myself trying to find agreement among the numerous indicators that I use to help guide my decisions. Unfortunately, a lot of the time this creates indicator overload and analysis paralysis. So I have included 15 indicators of trend within this indicator. You can choose how many of the 15 indicators have to be in agreement in order to confirm the trend. I may have gone a bit overboard here, however it makes it adaptable to individual risk tolerance and trading style.

***Please note that I will always post the newest version of these indicators on page 1 of this thread. I am always happy to answer questions for those who are trying to utilize these indicators. However, I ask that you review my post below explaining the various aspects of the indicators. I'll do my best to continue to elaborate to help everyone.

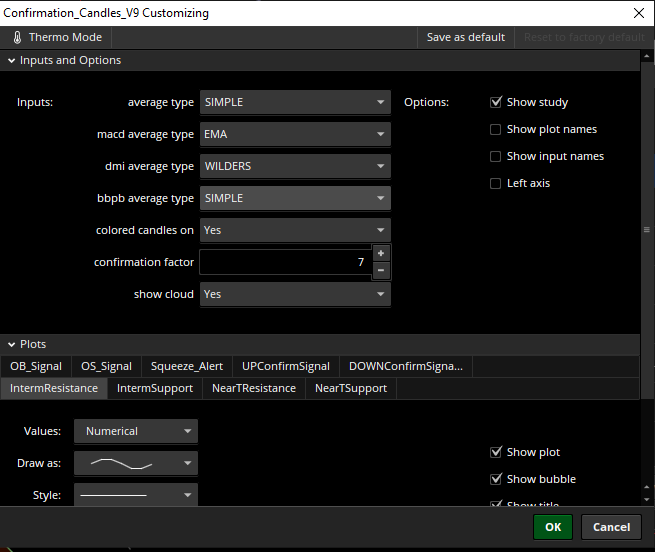

Code:# #Confirmation Candles V.10 #Created 04/15/2021 by Christopher84 #Select the level of agreement among the 15 indicators included. #Changed 04/19/2021 to V.3 - Removed ChaikinOsc and replaced with STARCBands. Added squeeze alert. #Changed 04/20/2021 to V.4 - Added Keltner Channel, Labels, and Buy and Sell Zones. Mean Reversion and Breakout Labels added. Reversal_Alert points added. #Changed 4/22/2021 to V.5 - Removed Buy/Sell clouds. Created new reversal alert buy(gray points) and take profit (red points). Increase factorK. #Changed 4/23/2021 to V.6 - Refined reversal signals. Fully integrated Super_OB_OS indicator. Fixed candles going yellow if colored_candles is off. #Changed 4/26/2021 to V.7 - Refined reversal signals and included Keltner Bandwidth. Adjusted Keltner Channel levels. #Changed 4/27/2021 to V.8 - Improved reversal signals and included support and resistance zones. #Changed 05/12/2021 to V.9 - dialed in studies to give stronger signals. Removed reversal buy and sell signals with OB/OS signals. Included OB/OS clouds to indicate favorable zones to buy or take profit. Clouds can also indicate nearterm reversals. Cleaned up code. #Changed 05/20/2021 to V.10 - Removed Pivot Study and replaced with CIP. Reworked Labels to reflect mean reversion Look to Buy/Look to Sell conditions. Removed Mean Reversion Label. Added new label to show the Confirmation_Level and color coded it to show OB/OS conditions. #Keltner Channel declare upper; def displace = 0; def factorK = 2.0; def lengthK = 20; def price = close; input averageType = AverageType.SIMPLE; def trueRangeAverageType = AverageType.SIMPLE; def BulgeLengthK = 150; def SqueezeLengthK = 150; def BulgeLengthK2 = 40; def SqueezeLengthK2 = 40; def BulgeLengthPrice = 75; def SqueezeLengthPrice = 75; def BulgeLengthPrice2 = 20; def SqueezeLengthPrice2 = 20; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionK1 = price >= Upper_BandK; def conditionK2 = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK); def conditionK2L = (Upper_BandK[2] < Upper_BandK[1]) and (Lower_BandK[2] < Lower_BandK[1]); def conditionK3L = (Upper_BandK[3] < Upper_BandK[2]) and (Lower_BandK[3] < Lower_BandK[2]); def conditionK3 = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK); def BandwidthK = (Upper_BandK - Lower_BandK) / AvgK * 100; def condition_BWKUP = BandwidthK[1] < BandwidthK; def condition_BWKDOWN = BandwidthK[1] > BandwidthK; def BulgeK = Highest(BandwidthK, BulgeLengthK); def SqueezeK = Lowest(BandwidthK, SqueezeLengthK); def BulgeK2 = Highest(BandwidthK, BulgeLengthK2); def SqueezeK2 = Lowest(BandwidthK, SqueezeLengthK2); plot IntermResistance = Highest(price, BulgeLengthPrice); IntermResistance.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); plot IntermSupport = Lowest(price, SqueezeLengthPrice); IntermSupport.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); plot NearTResistance = Highest(price, BulgeLengthPrice2); NearTResistance.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); NearTResistance.SetStyle(Curve.SHORT_DASH); plot NearTSupport = Lowest(price, SqueezeLengthPrice2); NearTSupport.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); NearTSupport.SetStyle(Curve.SHORT_DASH); #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength); } def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def conditionOB1 = RSI > RSI_OB; def conditionOS1 = RSI < RSI_OS; #MFI def MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; def conditionOB2 = MoneyFlowIndex > MFIover_Bought; def conditionOS2 = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); def conditionOB3 = Intermed > FOB; def conditionOS3 = Intermed < FOS; def conditionOB4 = NearT > FOB; def conditionOS4 = NearT < FOS; #Change in Price def lengthCIP = 5; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def condition5 = CIP_UP; #EMA_1 def EMA_length = 12; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp2); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= ZeroLine; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def conditionOB5 = PFE > UpperLevel; def conditionOS5 = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.SIMPLE; def BBPB_length = 20;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def conditionOB6 = PercentB > BBPB_OB; def conditionOS6 = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); #Klinger Histogram def Klinger_Length = 13; def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; def KVOH = KVOsc - Average(KVOsc, Klinger_Length); def condition13 = (KVOH > 0); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = (PROSC > 50);# or ((PROSC[1] < PROSC) and PROSC > 40); def conditionOB7 = PROSC > PROSC_OB; def conditionOS7 = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = yes; input Confirmation_Factor = 7; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 12; def Agreement_LevelOS = 3; def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionK1 + conditionK2; def conditionChannel1 = Upper_BandK > price; def conditionChannel2 = Lower_BandK < price; def UP = Agreement_Level >= Confirmation_Factor; def DOWN = Agreement_Level < Confirmation_Factor; AssignPriceColor(if coloredCandlesOn and UP then Color.LIGHT_GREEN else if coloredCandlesOn and DOWN then Color.RED else Color.CURRENT); #Additional Signals #Keltner #2 input showCloud = yes; def factorK2 = 3.25; def lengthK2 = 20; def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2); def averageK2 = MovingAverage(averageType, price, lengthK2); def AvgK2 = averageK2[-displace]; def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace]; def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace]; def condition_BandRevDn = (Upper_BandS > Upper_BandK2); def condition_BandRevUp = (Lower_BandS < Lower_BandK2); AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, color.CURRENT); AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_Red, Color.CURRENT); #Super_OB/OS Signal def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7; def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7; def Consensus_Line = OB_Level - OS_Level; def Zero_Line = 0; def Super_OB = 4; def Super_OS = -3; def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB); def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS); def OS_Buy = UP_OS; def OB_Sell = DOWN_OB; def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS; #AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH); #AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH); #AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH); def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED); def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED); plot OB_Signal = Upper_BandS crosses above IntermResistance; OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OB_Signal.SetLineWeight(3); OB_Signal.SetDefaultColor(Color.RED); plot OS_Signal = (condition_BandRevUP) and (Lower_BandS crosses below IntermSupport); OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OS_Signal.SetLineWeight(3); OS_Signal.SetDefaultColor(Color.GREEN); #Squeeze Alert def length = 20; def BulgeLength = 150; def SqueezeLength = 150; def upperBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).UpperBand; def lowerBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).LowerBand; def midLineBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).MidLine; def Bandwidth = (upperBandBB - lowerBandBB) / midLineBB * 100; def Bulge = Highest(Bandwidth, BulgeLength); def Squeeze = Lowest(Bandwidth, SqueezeLength); plot Squeeze_Alert = Bandwidth <= Squeeze; Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); Squeeze_Alert.SetLineWeight(3); Squeeze_Alert.SetDefaultColor(Color.YELLOW); #Trend Signals #Bollinger_Bands2 def lengthBB = 10; def Num_Dev_DnBB = -0.8; def Num_Dev_upBB = 0.8; def price1 = open; def sDev = StDev(data = price[-displace], length = lengthBB); def MidLineBB2 = MovingAverage(averageType, data = price[-displace], length = lengthBB); def LowerBandBB2 = MidLineBB2 + Num_Dev_DnBB * sDev; def UpperBandBB2 = MidLineBB2 + Num_Dev_upBB * sDev; plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor; UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); UPConfirmSignal.SetLineWeight(1); UPConfirmSignal.SetDefaultColor(Color.GREEN); plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor; DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); DOWNConfirmSignal.SetLineWeight(1); DOWNConfirmSignal.SetDefaultColor(Color.RED); #Labels def Buy = UP_OS; def Sell = DOWN_OB; AddLabel(yes, "Look_To_Buy", if (ConditionK2 and (Agreement_Level < Confirmation_Factor)) then Color.GREEN else Color.GRAY); AddLabel(yes, "Look_To_Sell", if (ConditionK3 and (Agreement_Level > Confirmation_Factor)) then Color.RED else Color.GRAY); def MomentumUP = Agreement_Level[1] < Agreement_Level; def MomentumDOWN = Agreement_Level[1] > Agreement_Level; AddLabel(yes, "Increasing Momentum", if MomentumUP then Color.GREEN else Color.GRAY); AddLabel(yes, "Decreasing Momentum", if MomentumDOWN then Color.RED else Color.GRAY); def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK)); AddLabel(yes, "BREAKOUT", if conditionBO then Color.GREEN else Color.GRAY); def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK)); AddLabel(yes, "BREAKDOWN", if conditionBD then Color.RED else Color.GRAY); def Squeeze_Signal = Squeeze_Alert; AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY); AddLabel(yes, "Confirmation_Level = " + round(Agreement_Level,1), if ((Agreement_Level >= 12) and (Consensus_Line >= 4)) then Color.RED else if ((Agreement_Level <= 3) and (Consensus_Line <= -3)) then Color.Green else color.Gray);

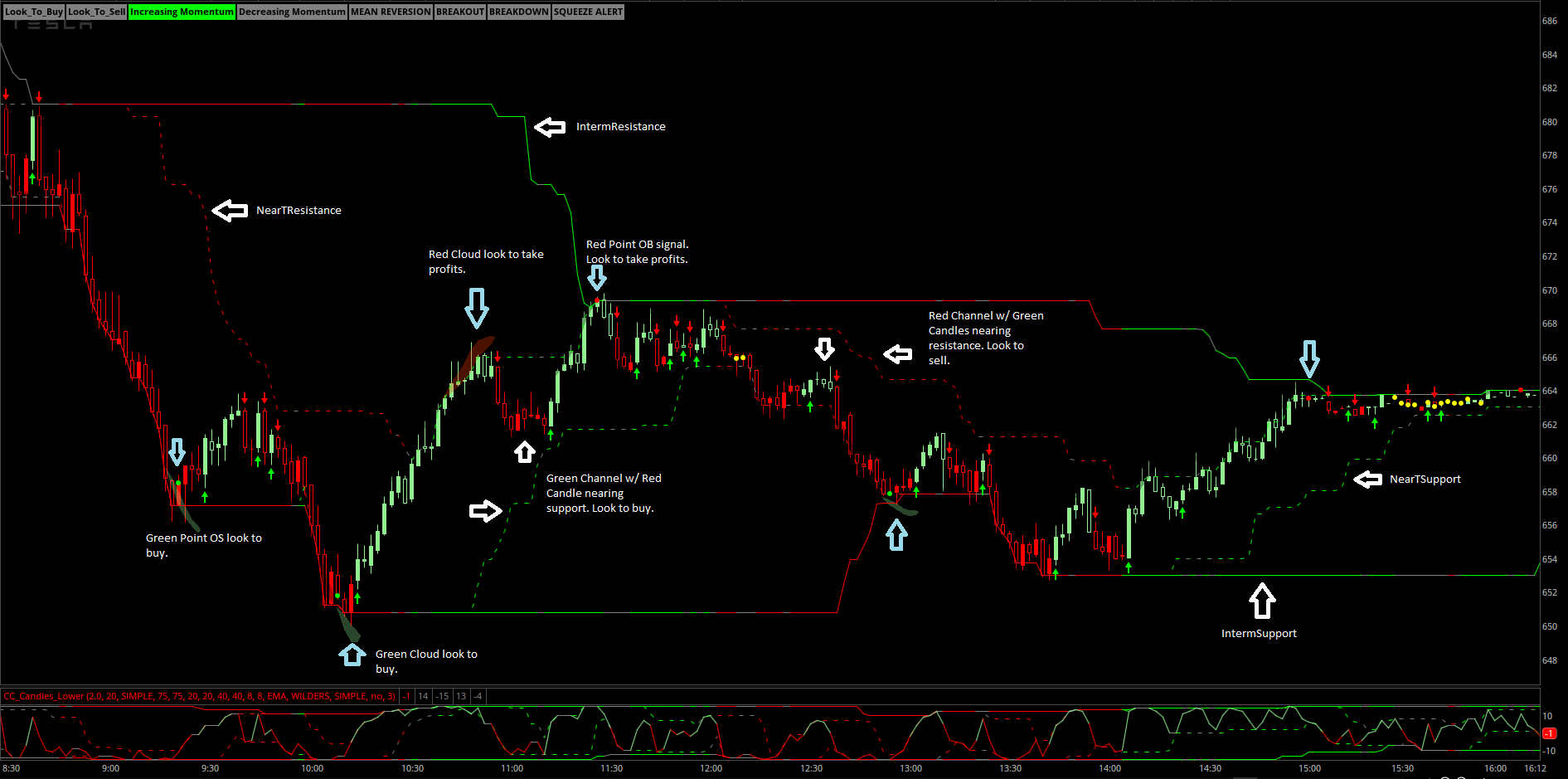

Here is the Confirmation Candles lower study.

Code:#Confirmation Candles Lower V.10 #Created 04/15/2021 by Christopher84 #Select the level of agreement among the 14 indicators included. #Last changed 04/20/2021 to V.3 - Removed ChaikinOsc and replaced with STARCBands. Adjusted levels to match upper study. Added OB/OS levels. #Changed 05/12/2021 to V.9 - dialed in studies to give stronger signals. #Changed 05/20/2021 to V.10 - Removed Pivot Study and replaced with CIP. #Keltner Channel declare lower; def displace = 0; def factorK = 2.0; def lengthK = 20; def price = close; input averageType = AverageType.SIMPLE; input trueRangeAverageType = AverageType.SIMPLE; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionKup = price >= Upper_BandK; def conditionKdown = price <= Lower_BandK; #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength);} def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def conditionRSI_OB = RSI > RSI_OB; def conditionRSI_OS = RSI < RSI_OS; #MFI def MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; def conditionMFI_OB = MoneyFlowIndex > MFIover_Bought; def conditionMFI_OS = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); def conditionFOB = Intermed > FOB; def conditionFOS = Intermed < FOS; #Change in Price def lengthCIP = 5; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def CIP_DOWN = AvgCIP < AvgCIP[1]; def condition5 = CIP_UP; #EMA_1 def EMA_length = 12; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp2); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= zeroline; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def conditionPFE_OB = PFE > UpperLevel; def conditionPFE_OS = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.Simple; def BBPB_length = 20;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def conditionBBPB_OB = PercentB > BBPB_OB; def conditionBBPB_OS = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); #Klinger Histogram def Klinger_Length = 13; def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; def KVOH = KVOsc - Average(KVOsc, Klinger_Length); def condition13 = (KVOH > 0); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def conditionPROSC_OB = PROSC > PROSC_OB; def conditionPROSC_OS = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input Confirmation_Factor = 7; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; plot Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionKup; Agreement_Level.AssignValueColor( if Agreement_Level > Agreement_Level[1] and Agreement_Level >= Confirmation_Factor then Color.LIGHT_GREEN else if Agreement_Level < Agreement_Level[1] and Agreement_Level >= Confirmation_Factor then Color.LIGHT_GREEN else if Agreement_Level < Agreement_Level[1] and Agreement_Level < Confirmation_Factor then Color.RED else if Agreement_Level > Agreement_Level[1] and Agreement_Level < Confirmation_Factor then Color.DARK_RED else Color.GRAY); plot Factor_Line = Confirmation_Factor; Factor_Line.SetStyle(Curve.SHORT_DASH); Factor_Line.SetLineWeight(1); Factor_Line.SetDefaultColor(Color.Gray); plot OB_Level = 12; OB_Level.SetPaintingStrategy(PaintingStrategy.LINE); OB_Level.SetLineWeight(1); OB_Level.SetDefaultColor(Color.RED); plot OS_Level = 3; OS_Level.SetPaintingStrategy(PaintingStrategy.LINE); OS_Level.SetLineWeight(1); OS_Level.SetDefaultColor(Color.LIGHT_GREEN); AddCloud(Agreement_Level, OB_Level, Color.RED, Color.CURRENT); AddCloud(Agreement_Level, OS_Level, Color.CURRENT, Color.LIGHT_GREEN);

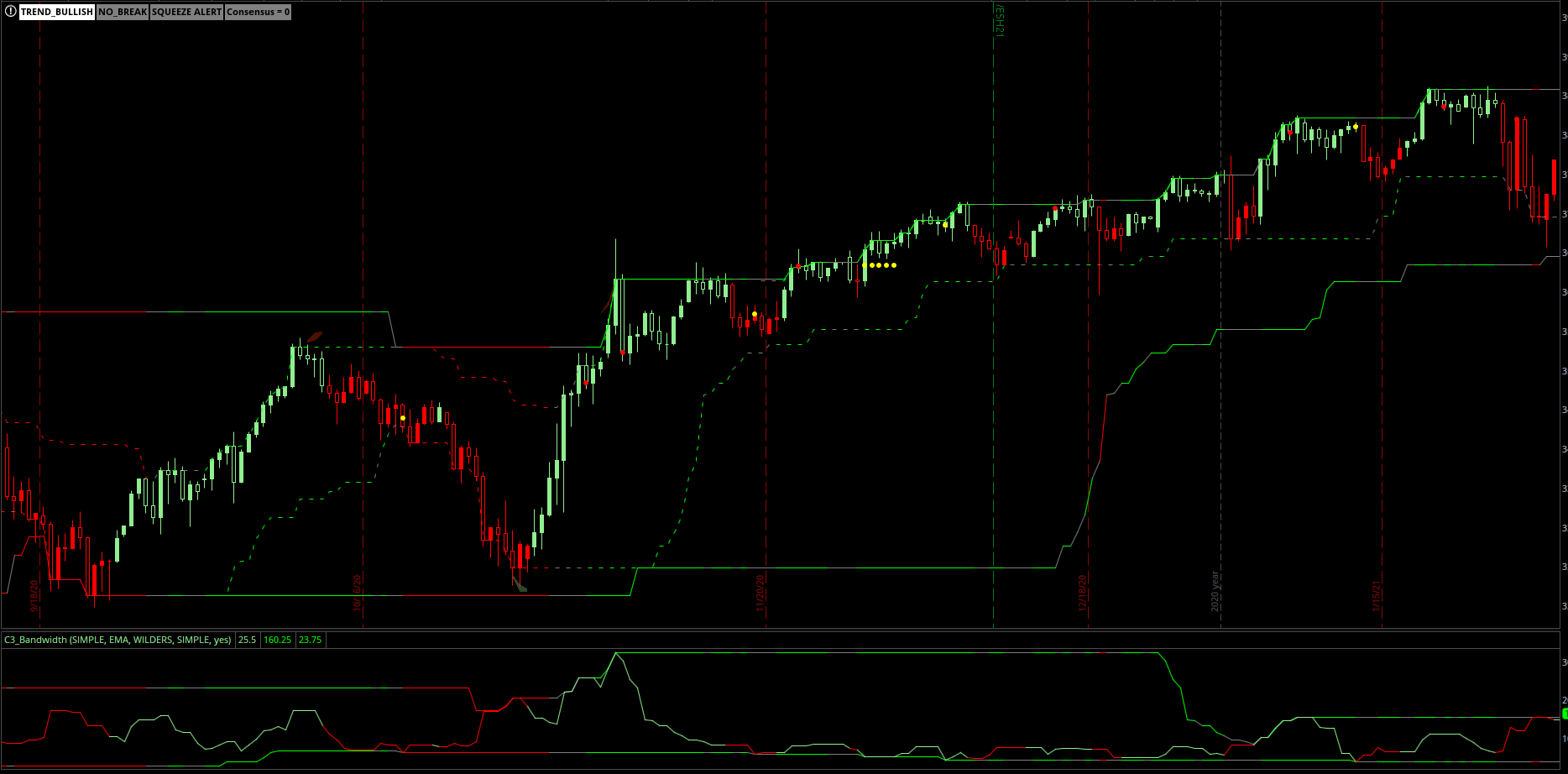

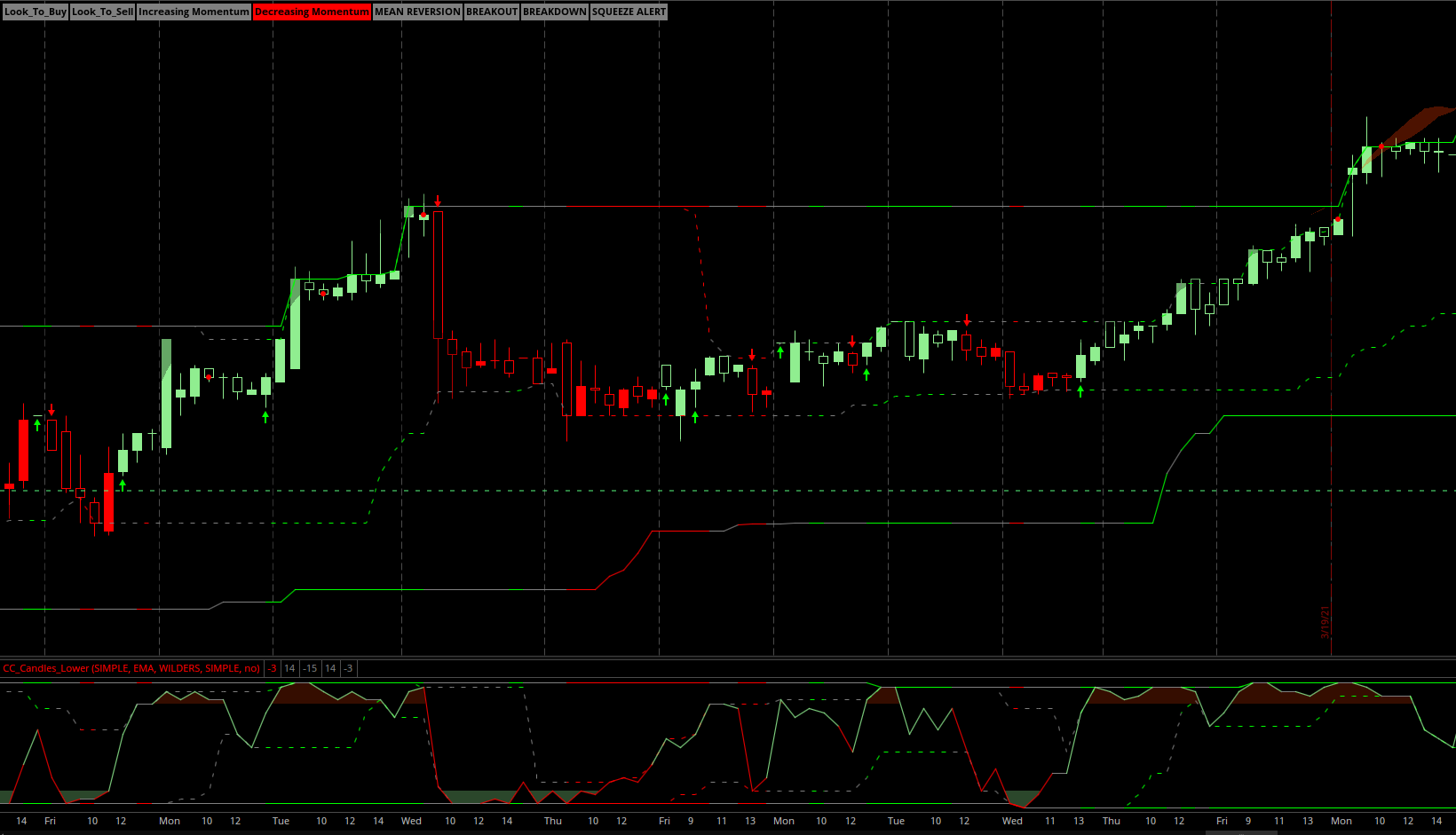

(Confirmation Consensus Candles) C3 v5

This is a new candle painting indicator C3, that I have adapted from the original Confirmation Candles. The main difference between the two indicators is that Confirmation Candles confirms only positive factors for upward price movement, and C3 utilizes both positive and negative factors of price movement and weighs them against each other to derive the Consensus Level. There is a histagram style lower study that goes with it. Check it out! Big thanks to everyone trying out my work and giving feedback.

Code:# (Consensus Confirmation Candles) C3 v6 # # Created 04/28/2021 by Christopher84 # Based off of the Confirmation Candles Study. Main difference is that CC Candles weigh factors of positive # and negative price movement to create the Consensus_Level. The Consensus_Level is considered positive if # above zero and negative if below zero. # # v2 - 05/11/2021 - dialed in studies to give stronger signals. Removed reversal buy and sell signals with # OB/OS signals. Included OB/OS clouds to indicate favorable zones to buy or take profit. # Clouds can also indicate nearterm reversals. Cleaned up code. # v3 - 05/20/2021 - Removed Pivot Study and replaced with CIP. Reworked Labels to reflect mean reversion Look # to Buy/Look to Sell conditions. Removed Mean Reversion Label. Added new label to show the # Confirmation_Level and color coded it to show OB/OS conditions. # BETA - 05/21/2021 - (barbaros) Consensus Level filter set to above 4 and below -4 # v4 - 05/24/2021 - Consensus Level filter changed to above 6 and below -6 # BETA - 05/29/2021 - (barbaros) Bug fixes # v5 - 06/01/2021 - Consolidated labels. Added new squeeze condition based on NearTSupport and NearTResistance. # v5 - 06/04/2021 - Included Ichimoku cloud. # v6 - 06/09/2021 - Added Arrows using Confirmation_Factor #Keltner Channel declare upper; def displace = 0; def factorK = 2.0; def lengthK = 20; def price = close; input averageType = AverageType.SIMPLE; def trueRangeAverageType = AverageType.SIMPLE; def BulgeLengthPrice = 75; def SqueezeLengthPrice = 75; def BulgeLengthPrice2 = 20; def SqueezeLengthPrice2 = 20; def BulgeLengthPrice3 = 12; def SqueezeLengthPrice3 = 12; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionK1UP = price >= Upper_BandK; def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK); def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK); def conditionK4DN = price < Lower_BandK; def BandwidthK = (Upper_BandK - Lower_BandK) / AvgK * 100; plot IntermResistance = Highest(price, BulgeLengthPrice); IntermResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); plot IntermSupport = Lowest(price, SqueezeLengthPrice); IntermSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); plot NearTResistance = Highest(price, BulgeLengthPrice2); NearTResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); NearTResistance.SetStyle(Curve.SHORT_DASH); plot NearTSupport = Lowest(price, SqueezeLengthPrice2); NearTSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); NearTSupport.SetStyle(Curve.SHORT_DASH); def NearTResistance1 = Highest(price, BulgeLengthPrice3); def NearTSupport1 = Lowest(price, SqueezeLengthPrice3); #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength); } def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; def condition1D = Value[1] > Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true; def conditionOB1 = RSI > RSI_OB; def conditionOS1 = RSI < RSI_OS; #MFI def MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true; def conditionOB2 = MoneyFlowIndex > MFIover_Bought; def conditionOS2 = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine); def conditionOB3 = Intermed > FOB; def conditionOS3 = Intermed < FOS; def conditionOB4 = NearT > FOB; def conditionOS4 = NearT < FOS; #Change in Price def lengthCIP = 5; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def CIP_DOWN = AvgCIP < AvgCIP[1]; def condition5 = CIP_UP; def condition5D = CIP_DOWN; #EMA_1 def EMA_length = 8; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp); def condition7D = (price < AvgExp2) and (AvgExp2[2] > AvgExp); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= ZeroLine; def condition8D = Osc < ZeroLine; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; def condition9D = Periods < 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def condition10D = PFE < 0; def conditionOB5 = PFE > UpperLevel; def conditionOS5 = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.SIMPLE; def BBPB_length = 20;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def condition11D = PercentB < HalfLine; def conditionOB6 = PercentB > BBPB_OB; def conditionOS6 = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS); #Klinger Histogram def Klinger_Length = 13; def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; def KVOH = KVOsc - Average(KVOsc, Klinger_Length); def condition13 = (KVOH > 0); def condition13D = (KVOH < 0); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def condition14D = PROSC < 50; def conditionOB7 = PROSC > PROSC_OB; def conditionOS7 = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = yes; input Confirmation_Factor = 7; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 10; def Agreement_LevelOS = -10; def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionK1UP + conditionK2UP; def Agreement_LevelD = (condition1D + condition2D + condition3D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition13D + condition14D + conditionK3DN + conditionK4DN); def Consensus_Level = Agreement_Level - Agreement_LevelD; def UP = Consensus_Level >= 6; def DOWN = Consensus_Level < -6; def priceColor = if UP then 1 else if DOWN then -1 else priceColor[1]; AssignPriceColor(if coloredCandlesOn and priceColor == 1 then Color.LIGHT_GREEN else if coloredCandlesOn and priceColor == -1 then Color.RED else Color.CURRENT); #Additional Signals #Keltner #2 input showCloud = yes; def factorK2 = 3.25; def lengthK2 = 20; def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2); def averageK2 = MovingAverage(averageType, price, lengthK2); def AvgK2 = averageK2[-displace]; def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace]; def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace]; def condition_BandRevDn = (Upper_BandS > Upper_BandK2); def condition_BandRevUp = (Lower_BandS < Lower_BandK2); AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT); AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT); #Super_OB/OS Signal def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7; def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7; def Consensus_Line = OB_Level - OS_Level; def Zero_Line = 0; def Super_OB = 4; def Super_OS = -4; def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB); def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS); def OS_Buy = UP_OS; def OB_Sell = DOWN_OB; def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS; #AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH); #AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH); #AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH); def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED); def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED); plot OB_Signal = Upper_BandS crosses above IntermResistance; OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OB_Signal.SetLineWeight(3); OB_Signal.SetDefaultColor(Color.RED); plot OS_Signal = (condition_BandRevUp) and (Lower_BandS crosses below IntermSupport); OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OS_Signal.SetLineWeight(3); OS_Signal.SetDefaultColor(Color.GREEN); #Squeeze Alert def BandwidthC3 = (NearTResistance1 - NearTSupport1); def IntermResistance2 = Highest(BandwidthC3,BulgeLengthPrice); def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice); def sqzTrigger = BandwidthC3 <= IntermSupport2; def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2 else if !sqzTrigger then Double.NaN else sqzLevel[1]; plot Squeeze_Alert = sqzLevel; Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS); Squeeze_Alert.SetLineWeight(3); Squeeze_Alert.SetDefaultColor(Color.YELLOW); #Trend Signals plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor; UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); UPConfirmSignal.SetLineWeight(1); UPConfirmSignal.SetDefaultColor(Color.GREEN); plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor; DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); DOWNConfirmSignal.SetLineWeight(1); DOWNConfirmSignal.SetDefaultColor(Color.RED); #Bollinger_Bands2 def lengthBB = 10; def Num_Dev_DnBB = -0.8; def Num_Dev_upBB = 0.8; def price1 = open; def sDev = StDev(data = price[-displace], length = lengthBB); def MidLineBB2 = MovingAverage(averageType, data = price[-displace], length = lengthBB); def LowerBandBB2 = MidLineBB2 + Num_Dev_DnBB * sDev; def UpperBandBB2 = MidLineBB2 + Num_Dev_upBB * sDev; input tenkan_period = 9; input kijun_period = 26; input show_Ichimoku_Cloud = yes; def Tenkan = (Highest(high, tenkan_period) + Lowest(low, tenkan_period)) / 2; def Kijun = (Highest(high, kijun_period) + Lowest(low, kijun_period)) / 2; def "Span A" = (Tenkan[kijun_period] + Kijun[kijun_period]) / 2; def "Span B" = (Highest(high[kijun_period], 2 * kijun_period) + Lowest(low[kijun_period], 2 * kijun_period)) / 2; def Chikou = close[-kijun_period]; AddCloud(if show_Ichimoku_Cloud and "Span A" then "Span A" else Double.NaN, "Span B", Color.WHITE, Color.GRAY); #AddCloud("Span A", "Span B", color.WHITE, color.GRAY); #Labels def Buy = UP_OS; def Sell = DOWN_OB; def conditionLTB = (ConditionK2UP and (Consensus_Level < 0)); def conditionLTS = (ConditionK3DN and (Consensus_Level > 0)); def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK)); def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK)); def MomentumUP = Consensus_Level[1] < Consensus_Level; def MomentumDOWN = Consensus_Level[1] > Consensus_Level; def Squeeze_Signal = !isNaN(Squeeze_Alert); def conditionOB = (Consensus_Level >= 12) and (Consensus_Line >= 4); def conditionOS = (Consensus_Level <= -12) and (Consensus_Line <= -3); AddLabel(yes, if conditionLTB then "BULLISH_LOOK_To_BUY" else if conditionLTS then "BEARISH_LOOK_TO_SELL" else if conditionK2UP then "TREND_BULLISH" else if conditionK3DN then "TREND_BEARISH" else "TREND_CONSOLIDATION", if conditionLTB then Color.GREEN else if conditionLTS then Color.Red else if conditionK2UP then Color.WHITE else if conditionK3DN then Color.DARK_GRAY else Color.GRAY); AddLabel(yes, if conditionBD then "BREAKDOWN" else if conditionBO then "BREAKOUT" else "NO_BREAK", if conditionBD then Color.RED else if conditionBO then Color.Green else Color.Gray); AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY); AddLabel(yes, if MomentumUP then "Consensus_Increasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOB then "Consensus_OVERBOUGHT = " + round(Consensus_Level,1) else if MomentumDOWN then "Consensus_Decreasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOS then "Consensus_OVERSOLD = " + round(Consensus_Level,1)else "Consensus = " + round(Consensus_Level,1), if conditionOB then Color.RED else if conditionOS then Color.Green else color.GRAY);

For those of you that trade FOREX or the SPX, here is a modified version that will function on those instruments.

Here's the lower study.Code:# (Consensus Confirmation Candles) C3 v5 FOREX & SPX Compatible # # Created 04/28/2021 by Christopher84 # Based off of the Confirmation Candles Study. Main difference is that CC Candles weigh factors of positive # and negative price movement to create the Consensus_Level. The Consensus_Level is considered positive if # above zero and negative if below zero. # # v2 - 05/11/2021 - dialed in studies to give stronger signals. Removed reversal buy and sell signals with # OB/OS signals. Included OB/OS clouds to indicate favorable zones to buy or take profit. # Clouds can also indicate nearterm reversals. Cleaned up code. # v3 - 05/20/2021 - Removed Pivot Study and replaced with CIP. Reworked Labels to reflect mean reversion Look # to Buy/Look to Sell conditions. Removed Mean Reversion Label. Added new label to show the # Confirmation_Level and color coded it to show OB/OS conditions. # BETA - 05/21/2021 - (barbaros) Consensus Level filter set to above 4 and below -4 # v4 - 05/24/2021 - Consensus Level filter changed to above 6 and below -6 # BETA - 05/29/2021 - (barbaros) Bug fixes # v5 - 06/01/2021 - Consolidated labels. Added new squeeze condition based on NearTSupport and NearTResistance. # BETA - 06/02/2021 - Modified study set to be compatable with FOREX and SPX. # v6 - 06/09/2021 - Modified to include Confirmation Arrows #Keltner Channel declare upper; def displace = 0; def factorK = 2.0; def lengthK = 20; def price = close; input averageType = AverageType.SIMPLE; def trueRangeAverageType = AverageType.SIMPLE; def BulgeLengthK = 250; def SqueezeLengthK = 250; def BulgeLengthK2 = 150; def SqueezeLengthK2 = 150; def BulgeLengthPrice = 75; def SqueezeLengthPrice = 75; def BulgeLengthPrice2 = 20; def SqueezeLengthPrice2 = 20; def BulgeLengthPrice3 = 12; def SqueezeLengthPrice3 = 12; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionK1UP = price >= Upper_BandK; def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK); def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK); def conditionK4DN = price < Lower_BandK; def BandwidthK = (Upper_BandK - Lower_BandK) / AvgK * 100; def BandwidthKS = (Bandwidthk[2]+ Bandwidthk[1] + BandwidthK) / 3; def BulgeK = Highest(BandwidthKS, BulgeLengthK); def SqueezeK = Lowest(BandwidthKS, SqueezeLengthK); def BulgeK2 = Highest(BandwidthKS, BulgeLengthK2); def SqueezeK2 = Lowest(BandwidthKS, SqueezeLengthK2); def condition_Keltner_Squeeze = BandwidthKS <= SqueezeK; plot IntermResistance = Highest(price, BulgeLengthPrice); IntermResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); plot IntermSupport = Lowest(price, SqueezeLengthPrice); IntermSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); plot NearTResistance = Highest(price, BulgeLengthPrice2); NearTResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); NearTResistance.SetStyle(Curve.SHORT_DASH); plot NearTSupport = Lowest(price, SqueezeLengthPrice2); NearTSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); NearTSupport.SetStyle(Curve.SHORT_DASH); def NearTResistance1 = Highest(price, BulgeLengthPrice3); def NearTSupport1 = Lowest(price, SqueezeLengthPrice3); #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength); } def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; def condition1D = Value[1] > Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true; def conditionOB1 = RSI > RSI_OB; def conditionOS1 = RSI < RSI_OS; #MFI #def MFI_Length = 14; #def MFIover_Sold = 20; #def MFIover_Bought = 80; #def movingAvgLength = 1; #def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength); #def MFIOverBought = MFIover_Bought; #def MFIOverSold = MFIover_Sold; #def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; #def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true; #def conditionOB2 = MoneyFlowIndex > MFIover_Bought; #def conditionOS2 = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine); def conditionOB3 = Intermed > FOB; def conditionOS3 = Intermed < FOS; def conditionOB4 = NearT > FOB; def conditionOS4 = NearT < FOS; #Change in Price def lengthCIP = 5; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def CIP_DOWN = AvgCIP < AvgCIP[1]; def condition5 = CIP_UP; def condition5D = CIP_DOWN; #EMA_1 def EMA_length = 8; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp); def condition7D = (price < AvgExp2) and (AvgExp2[2] > AvgExp); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= ZeroLine; def condition8D = Osc < ZeroLine; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; def condition9D = Periods < 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def condition10D = PFE < 0; def conditionOB5 = PFE > UpperLevel; def conditionOS5 = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.SIMPLE; def BBPB_length = 20;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def condition11D = PercentB < HalfLine; def conditionOB6 = PercentB > BBPB_OB; def conditionOS6 = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS); #Klinger Histogram #def Klinger_Length = 13; #def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; #def KVOH = KVOsc - Average(KVOsc, Klinger_Length); #def condition13 = (KVOH > 0); #def condition13D = (KVOH < 0); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def condition14D = PROSC < 50; def conditionOB7 = PROSC > PROSC_OB; def conditionOS7 = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = yes; input Confirmation_Factor = 7; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 10; def Agreement_LevelOS = -10; def Agreement_Level = condition1 + condition2 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition14 + conditionK1UP + conditionK2UP; def Agreement_LevelD = condition1D + condition2D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition14D + conditionK3DN + conditionK4DN; def Consensus_Level = Agreement_Level - Agreement_LevelD; def UP = Consensus_Level >= 4; def DOWN = Consensus_Level < -4; def priceColor = if UP then 1 else if DOWN then -1 else priceColor[1]; AssignPriceColor(if coloredCandlesOn and priceColor == 1 then Color.LIGHT_GREEN else if coloredCandlesOn and priceColor == -1 then Color.RED else Color.CURRENT); #Additional Signals #Keltner #2 input showCloud = yes; def factorK2 = 3.25; def lengthK2 = 20; def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2); def averageK2 = MovingAverage(averageType, price, lengthK2); def AvgK2 = averageK2[-displace]; def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace]; def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace]; def condition_BandRevDn = (Upper_BandS > Upper_BandK2); def condition_BandRevUp = (Lower_BandS < Lower_BandK2); AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT); AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT); #Super_OB/OS Signal def OB_Level = conditionOB1 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7; def OS_Level = conditionOS1 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7; def Consensus_Line = OB_Level - OS_Level; def Zero_Line = 0; def Super_OB = 4; def Super_OS = -4; def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB); def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS); def OS_Buy = UP_OS; def OB_Sell = DOWN_OB; def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS; #AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH); #AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH); #AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH); def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED); def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED); plot OB_Signal = Upper_BandS crosses above IntermResistance; OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OB_Signal.SetLineWeight(3); OB_Signal.SetDefaultColor(Color.RED); plot OS_Signal = (condition_BandRevUp) and (Lower_BandS crosses below IntermSupport); OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OS_Signal.SetLineWeight(3); OS_Signal.SetDefaultColor(Color.GREEN); #Squeeze Alert def length = 20; def BulgeLength = 150; def SqueezeLength = 150; def upperBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).UpperBand; def lowerBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).LowerBand; def midLineBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).MidLine; def Bandwidth = (upperBandBB - lowerBandBB) / midLineBB * 100; def Bulge = Highest(Bandwidth, BulgeLength); def Squeeze = Lowest(Bandwidth, SqueezeLength); def BandwidthC3 = (NearTResistance1 - NearTSupport1); def IntermResistance2 = Highest(BandwidthC3,BulgeLengthPrice); def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice); #def NearTResistance2 = Highest(BandwidthC3, BulgeLengthPrice2); #def NearTSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice2); def sqzTrigger = BandwidthC3 <= IntermSupport2; def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2 else if !sqzTrigger then Double.NaN else sqzLevel[1]; plot Squeeze_Alert = sqzLevel; Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS); Squeeze_Alert.SetLineWeight(3); Squeeze_Alert.SetDefaultColor(Color.YELLOW); #Trend Signals plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor; UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); UPConfirmSignal.SetLineWeight(1); UPConfirmSignal.SetDefaultColor(Color.GREEN); plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor; DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); DOWNConfirmSignal.SetLineWeight(1); DOWNConfirmSignal.SetDefaultColor(Color.RED); #Bollinger_Bands2 def lengthBB = 10; def Num_Dev_DnBB = -0.8; def Num_Dev_upBB = 0.8; def price1 = open; def sDev = StDev(data = price[-displace], length = lengthBB); def MidLineBB2 = MovingAverage(averageType, data = price[-displace], length = lengthBB); def LowerBandBB2 = MidLineBB2 + Num_Dev_DnBB * sDev; def UpperBandBB2 = MidLineBB2 + Num_Dev_upBB * sDev; #Labels def Buy = UP_OS; def Sell = DOWN_OB; def conditionLTB = (ConditionK2UP and (Consensus_Level < 0)); def conditionLTS = (ConditionK3DN and (Consensus_Level > 0)); def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK)); def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK)); def MomentumUP = Consensus_Level[1] < Consensus_Level; def MomentumDOWN = Consensus_Level[1] > Consensus_Level; def Squeeze_Signal = !isNaN(Squeeze_Alert); def conditionOB = (Consensus_Level >= 12) and (Consensus_Line >= 4); def conditionOS = (Consensus_Level <= -12) and (Consensus_Line <= -3); AddLabel(yes, if conditionLTB then "BULLISH_LOOK_To_BUY" else if conditionLTS then "BEARISH_LOOK_TO_SELL" else if conditionK2UP then "TREND_BULLISH" else if conditionK3DN then "TREND_BEARISH" else "TREND_CONSOLIDATION", if conditionLTB then Color.GREEN else if conditionLTS then Color.Red else if conditionK2UP then Color.WHITE else if conditionK3DN then Color.DARK_GRAY else Color.GRAY); AddLabel(yes, if conditionBD then "BREAKDOWN" else if conditionBO then "BREAKOUT" else "NO_BREAK", if conditionBD then Color.RED else if conditionBO then Color.Green else Color.Gray); AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY); AddLabel(yes, if MomentumUP then "Consensus_Increasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOB then "Consensus_OVERBOUGHT = " + round(Consensus_Level,1) else if MomentumDOWN then "Consensus_Decreasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOS then "Consensus_OVERSOLD = " + round(Consensus_Level,1)else "Consensus = " + round(Consensus_Level,1), if conditionOB then Color.RED else if conditionOS then Color.Green else color.GRAY);

Code:#CC Candles Lower V.2 #Created 04/28/2021 by Christopher84 #Modified to V.2 05/11/2021 - dialed in studies to give stronger signals. Included OB/OS Clouds and cleaned up code. #Changed 05/20/2021 to V.3 - Removed Pivot Study and replaced with CIP. #Keltner Channel declare lower; def displace = 0; def factorK = 2.0; def lengthK = 20; def price = close; input averageType = AverageType.SIMPLE; def trueRangeAverageType = AverageType.SIMPLE; def BulgeLengthK = 150; def SqueezeLengthK = 150; def BulgeLengthK2 = 40; def SqueezeLengthK2 = 40; def BulgeLengthPrice = 75; def SqueezeLengthPrice = 75; def BulgeLengthPrice2 = 20; def SqueezeLengthPrice2 = 20; def BulgeLengthCC = 40; def SqueezeLengthCC = 40; def BulgeLengthCC2 = 8; def SqueezeLengthCC2 = 8; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionK1 = price >= Upper_BandK; def conditionK2 = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK); def conditionK3D = price < Lower_BandK; def conditionK4D = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK); def conditionK2L = (Upper_BandK[2] < Upper_BandK[1]) and (Lower_BandK[2] < Lower_BandK[1]); def conditionK3L = (Upper_BandK[3] < Upper_BandK[2]) and (Lower_BandK[3] < Lower_BandK[2]); def conditionK3 = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK); def BandwidthK = (Upper_BandK - Lower_BandK) / AvgK * 100; def condition_BWKUP = BandwidthK[1] < BandwidthK; def condition_BWKDOWN = BandwidthK[1] > BandwidthK; def BulgeK = Highest(BandwidthK, BulgeLengthK); def SqueezeK = Lowest(BandwidthK, SqueezeLengthK); def BulgeK2 = Highest(BandwidthK, BulgeLengthK2); def SqueezeK2 = Lowest(BandwidthK, SqueezeLengthK2); #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength); } def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; def condition1D = Value[1] > Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true; def conditionOB1 = RSI > RSI_OB; def conditionOS1 = RSI < RSI_OS; #MFI def MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true; def conditionOB2 = MoneyFlowIndex > MFIover_Bought; def conditionOS2 = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine); def conditionOB3 = Intermed > FOB; def conditionOS3 = Intermed < FOS; def conditionOB4 = NearT > FOB; def conditionOS4 = NearT < FOS; #Change in Price def lengthCIP = 5; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def CIP_DOWN = AvgCIP < AvgCIP[1]; def condition5 = CIP_UP; def condition5D = CIP_DOWN; #EMA_1 def EMA_length = 12; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp[2] <= AvgExp); def condition7D = (price < AvgExp2) and (AvgExp[2] > AvgExp); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= ZeroLine; def condition8D = Osc < ZeroLine; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; def condition9D = Periods < 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def condition10D = PFE < 0; def conditionOB5 = PFE > UpperLevel; def conditionOS5 = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.SIMPLE; def BBPB_length = 20;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def condition11D = PercentB < HalfLine; def conditionOB6 = PercentB > BBPB_OB; def conditionOS6 = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS); #Klinger Histogram def Klinger_Length = 13; def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; def KVOH = KVOsc - Average(KVOsc, Klinger_Length); def condition13 = (KVOH > 0); def condition13D = (KVOH < 0); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def condition14D = PROSC < 50; def conditionOB7 = PROSC > PROSC_OB; def conditionOS7 = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = no; def Confirmation_Factor = 0; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 10; def Agreement_LevelOS = -10; def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionK1 + conditionK2; def Agreement_LevelD = (condition1D + condition2D + condition3D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition13D + condition14D + conditionK3D + conditionK4D); plot Consensus_Level = Agreement_Level - Agreement_LevelD; def conditionChannel1 = Upper_BandK > price; def conditionChannel2 = Lower_BandK < price; def UP = Consensus_Level >= 0; def DOWN = Consensus_Level < 0; Consensus_Level.AssignValueColor( if Consensus_Level > Consensus_Level[1] and Consensus_Level >= 0 then Color.LIGHT_GREEN else if Consensus_Level < Consensus_Level[1] and Consensus_Level >= 0 then Color.LIGHT_GREEN else if Consensus_Level < Consensus_Level[1] and Consensus_Level < 0 then Color.RED else if Consensus_Level > Consensus_Level[1] and Consensus_Level < 0 then Color.RED else Color.GRAY); def Zero_Line = 0; AddCloud(Consensus_Level, Agreement_LevelOB, Color.LIGHT_RED, Color.CURRENT); AddCloud(Consensus_Level, Agreement_LevelOS, Color.CURRENT, Color.LIGHT_GREEN); plot BulgeCC = Highest(Consensus_Level, BulgeLengthCC); BulgeCC.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); plot SqueezeCC = Lowest(Consensus_Level, SqueezeLengthCC); SqueezeCC.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); plot BulgeCC2 = Highest(Consensus_Level, BulgeLengthCC2); BulgeCC2.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); BulgeCC2.SetStyle(Curve.SHORT_DASH); plot SqueezeCC2 = Lowest(Consensus_Level, SqueezeLengthCC2); SqueezeCC2.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY); SqueezeCC2.SetStyle(Curve.SHORT_DASH);

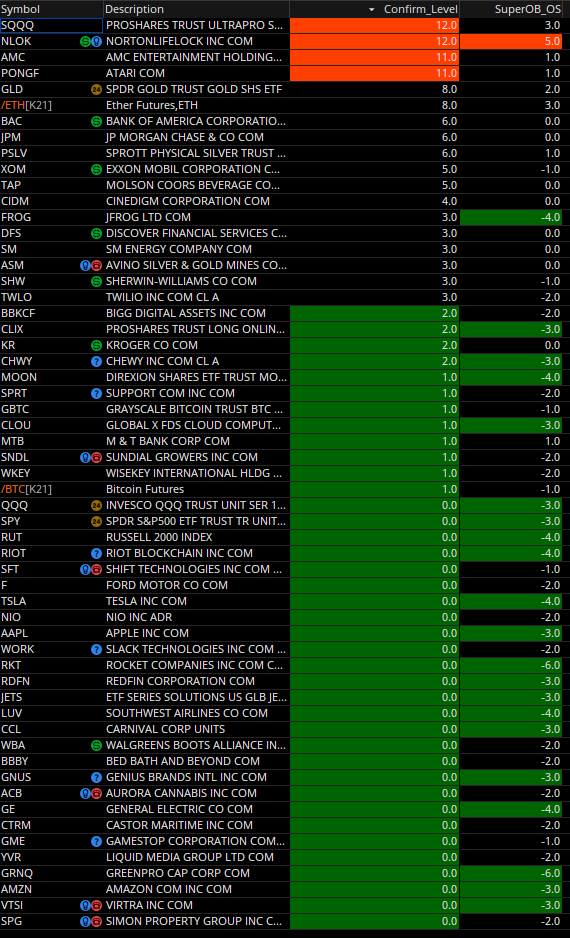

Here is a custom watchlist column for the Confirmation Candles. If you sort the column, it makes it easier to see OB/OS conditions. Especially when grouped with the Super OB/OS custom watchlist column which is also posted below.

Code:#Confirmation Level Watchlist developed 04/15/2021 by Christopher Wilson #Select the level of agreement among the 15 indicators included. #Changed 05/20/21 Included CIP. #MACD with Price declare lower; def price = close; def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength);} def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; #RSI input RSI_length = 14; input RSI_AverageType = AverageType.WILDERS; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; #MFI input MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); #Change in Price def lengthCIP = 5; def displace = 0; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def CIP_DOWN = AvgCIP < AvgCIP[1]; def condition5 = CIP_UP; #EMA_1 input EMA_length = 12; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); #EMA_2 input EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp2); #DMI Oscillator input DMI_length = 5; input averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, averageType)."DI+"; def diMinus = DMI(DMI_length, averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= ZeroLine; #Trend_Periods input TP_fastLength = 3; input TP_slowLength = 4; def Periods = sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; #Polarized Fractal Efficiency input PFE_length = 5; input smoothingLength = 2.5; def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > ZERoLine; #Bollinger Bands PercentB input BBPB_averageType = AverageType.Simple; input BBPB_length = 20; def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > 50; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition13 = (PROSC > 50); #Trend Confirmation #Confirmation_Factor range 1-13. input Confirmation_Factor = 7; #Use for testing conditions individually. #def Agreement_Level = condition1; plot Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13; def Sell_Alert = Agreement_Level >= 9; def Buy_Alert = Agreement_Level <= 2 ; def Factor_Line = Confirmation_Factor; AssignBackgroundColor(if Sell_Alert then color.LIGHT_RED else if Buy_Alert then color.dark_green else color.black);

Here is the Super OB/OS custom watchlist column.