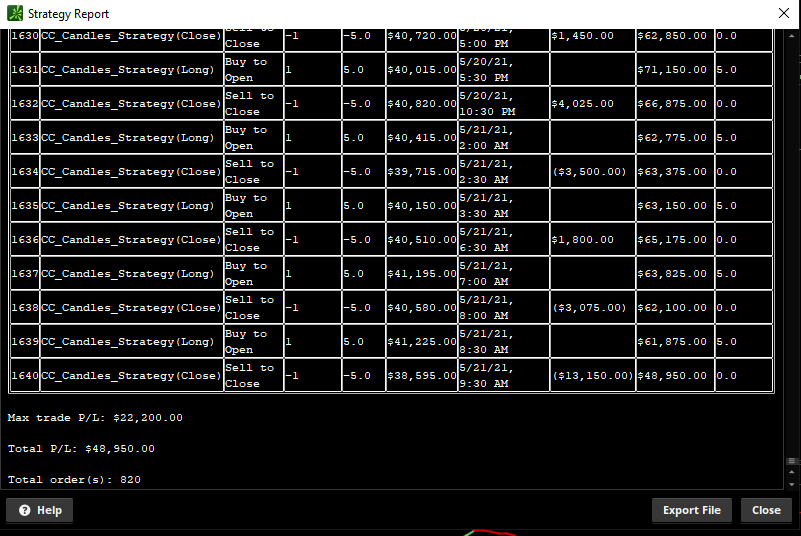

You are absolutely right! TOS's strategy analysis drives me crazy. It doesn't make it very easy to spot issues like that. Thank you for the great suggestion! I ran it on a 30min 180 day chart with no shorting using 1 coin/share. It produced much more realistic results.Thank you @Christopher84. The price entries probably needs to be the next candle's open. If the buy and sell are being triggered at the current candle, you can't realistically put an order in place for the same candle at open.

Code:AddOrder(OrderType.BUY_TO_OPEN, condition = UP, price = open[-1], 1, tickColor = GetColor(1), arrowColor = GetColor(1), name = "Long"); AddOrder(OrderType.SELL_TO_CLOSE, condition = DOWN, price = open[-1], 1, tickColor = GetColor(2), arrowColor = GetColor(2), name = "Close");

I'll try to look over it further over the weekend. There seems to be too many order entries.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

sean1970ss

New member

Chris,

I literally cannot wait till the next day to use it. Personally this is the most confident I have been trading. Total trades this week 12 1 loss and my fault. the chart told me exactly what was going to happen and I fumbled. No master here either but it makes sense to me being visual as I am. MAJOR PROPS to you for designing it. I feel so confident in a trade now where before I was like well here is a crap shoot. If i had not 2nd guessed myself I would have a perfect record this week. The more I work with it the better I see what the signals are doing are telling me. I am a day trader and only trade in the morning and maybe at 2:00pm.

I literally cannot wait till the next day to use it. Personally this is the most confident I have been trading. Total trades this week 12 1 loss and my fault. the chart told me exactly what was going to happen and I fumbled. No master here either but it makes sense to me being visual as I am. MAJOR PROPS to you for designing it. I feel so confident in a trade now where before I was like well here is a crap shoot. If i had not 2nd guessed myself I would have a perfect record this week. The more I work with it the better I see what the signals are doing are telling me. I am a day trader and only trade in the morning and maybe at 2:00pm.

Couldn't agree with your sentiment more!Chris,

I literally cannot wait till the next day to use it. Personally this is the most confident I have been trading. Total trades this week 12 1 loss and my fault. the chart told me exactly what was going to happen and I fumbled. No master here either but it makes sense to me being visual as I am. MAJOR PROPS to you for designing it. I feel so confident in a trade now where before I was like well here is a crap shoot. If i had not 2nd guessed myself I would have a perfect record this week. The more I work with it the better I see what the signals are doing are telling me. I am a day trader and only trade in the morning and maybe at 2:00pm.

Since you are a VIP member on this form, if you like, we can connect over Discord to chat about it further. You have done a great job so far. We can then come back and post findings here.You are absolutely right! TOS's strategy analysis drives me crazy. It doesn't make it very easy to spot issues like that. Thank you for the great suggestion! I ran it on a 30min 180 day chart with no shorting using 1 coin/share. It produced much more realistic results.

I haven't joined the discord group yet. I will get on there this afternoon. I'm looking forward to chatting further. Thank you for the kind words!Since you are a VIP member on this form, if you like, we can connect over Discord to chat about it further. You have done a great job so far. We can then come back and post findings here.

I'm on discord now.Since you are a VIP member on this form, if you like, we can connect over Discord to chat about it further. You have done a great job so far. We can then come back and post findings here.

tjlizwelicha

Active member

I was not able to find you on discord. Do you have a You Tube channel to explain in detail?I'm on discord now.

tjlizwelicha

Active member

Christopher84: Could you explain Confirmation: box? I have it in green Confirmation:1. I also notice Confirmation: in gray. I apologize if you have explained prior. lolI'm on discord now.

Yes, thank you! Today I adjusted the confirmation level settings higher just to watch. Very nice feature that I hadn't been using.I hope my explanation is helpful. Happy trading!

Also appreciate your share of the btc strategy. Will be watching that one closely. Happy Weekend!

No worries. I designed the label to turn green if price is in an oversold condition and red if price is in an overbought condition. I hope that helps.Christopher84: Could you explain Confirmation: box? I have it in green Confirmation:1. I also notice Confirmation: in gray. I apologize if you have explained prior. lol

The confirmation level is definitely handy to help fine tune the indicator. Just remember, as you approach the highest or lowest confirmation level it starts to behave as more of a contrarian indicator (can show potential reversals instead of entry points). I am reworking the strategy now. There were some issues in my add order code. I will have something before the start of the week. It looks very promising and realistic on the 30 min chart.Yes, thank you! Today I adjusted the confirmation level settings higher just to watch. Very nice feature that I hadn't been using.

Also appreciate your share of the btc strategy. Will be watching that one closely. Happy Weekend!

Thank you so much! That’s very encouraging!Christopher84 I continue to keep being impressed by this indicator. Thank you so much for all your hard work. It is amazing!! I have followed this from the beginning and I hope it continues to be available to everyone!

Good day @Christopher84

Just few observations ( and suggestions possibly). Again good work... thanks for sharing.

1) I like the V3 upper better than V2 (FYI - I was just using only the Lower and not the upper V2 bcoz i like that OB/OS only). Now after V3.. i got to discard the lower

2) For future updates .. I would suggest (again IMO) to just have the latest version on the top (and then V1 later) so people will always get the latest in the beginning of the thread. Now the V3 is lower.

This is a question

1) How are u using the Look to buy, sell, increasing mom, decreasing or Squeeze alert please.

I can't decode ...the purpose..

Thanks again..

MN

Just few observations ( and suggestions possibly). Again good work... thanks for sharing.

1) I like the V3 upper better than V2 (FYI - I was just using only the Lower and not the upper V2 bcoz i like that OB/OS only). Now after V3.. i got to discard the lower

2) For future updates .. I would suggest (again IMO) to just have the latest version on the top (and then V1 later) so people will always get the latest in the beginning of the thread. Now the V3 is lower.

This is a question

1) How are u using the Look to buy, sell, increasing mom, decreasing or Squeeze alert please.

I can't decode ...the purpose..

Thanks again..

MN

Hi MN,Good day @Christopher84

Just few observations ( and suggestions possibly). Again good work... thanks for sharing.

1) I like the V3 upper better than V2 (FYI - I was just using only the Lower and not the upper V2 bcoz i like that OB/OS only). Now after V3.. i got to discard the lower

2) For future updates .. I would suggest (again IMO) to just have the latest version on the top (and then V1 later) so people will always get the latest in the beginning of the thread. Now the V3 is lower.

This is a question

1) How are u using the Look to buy, sell, increasing mom, decreasing or Squeeze alert please.

I can't decode ...the purpose..

Thanks again..

MN

I’m glad to hear you liked the modifications to the labels on V3. It has definitely helped me free up some screen space. As for the most updated versions of the indicators, they start at the top of page 1 with the Confirmation Candles V.10 (I think you may have thought this was a 1?), and then the Consensus Confirmation Candles V.3. Those are the most recent versions of those indicators (kind of confusing, I know).

Look to Buy is meant to identify weakness in a strong uptrend. The red candle in a green channel scenario. When it is triggered I’m looking for signs of price reversal (triggering another up arrow) or approaching support with increasing momentum. The increasing momentum is telling the trader that the Consensus Level or Confirmation Level (depending on which indicator you are using) is going up.

Look to Sell is pretty much the opposite. It’s identifying strength in a downtrend and an opportunity to go short. If instead the trader played the mean reversion in the downtrend, they could use the green candles in the red channel as potential exit points (especially if nearing resistance).

The Sqeeze Alert is to alert the trader that price is in a squeeze condition. This lets the trader know a larger move in price is imminent and to watch for it to breakout.

My intention is for the labels to serve as reminders of the trend environment and to help improve decision making. I hope I have been able to shed some light on this for you. Thank you for the feedback MN!

Last edited:

What is your Discord user name?I'm on discord now.

Christopher84What is your Discord user name?

not sure if you will find this valuable but in your cloud watchlist column, the avg number wasn't meaning much to me, so i removed it and in its stead placed a counter for the number of periods the green or red state has been ongoing, if any. i have an exceedingly hard time seeing the clouds on the chart itself, especially when the cloud is but one or two periods old (especially one, of course), so having its age along with the color on the watchlist column is a boon, imho. anyway, i think i've got it coded right but perhaps one of my betters could confirm.

p.s. if'n you can't tell, i have an aversion to cap letters (made worse by an odd case of arthritis) hence my addition below doesn't use them, and it doesn't seem to make a diff.

p.s. if'n you can't tell, i have an aversion to cap letters (made worse by an odd case of arthritis) hence my addition below doesn't use them, and it doesn't seem to make a diff.

Code:

#Keltner_STARC_WL

#Keltner

declare weak_volume_dependency;

input displace = 0;

input factor = 3.25;

input length = 20;

input price = close;

input averageType = AverageType.SIMPLE;

input trueRangeAverageType = AverageType.SIMPLE;

def shift = factor * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), length);

def average = MovingAverage(averageType, price, length);

plot Avg = average[-displace];

def Upper_BandK = average[-displace] + shift[-displace];

def Lower_BandK = average[-displace] - shift[-displace];

#STARC

input ATR_length = 15;

input SMA_length = 6;

input multiplier_factor = 1.25;

def val = Average(price, sma_length);

def average_true_range = Average(TrueRange(high, close, low), length = atr_length);

def Upper_BandS = val[-displace] + multiplier_factor * average_true_range[-displace];

def Lower_BandS = val[-displace] - multiplier_factor * average_true_range[-displace];

def UP = Lower_BandS < Lower_BandK;

def DOWN = Upper_BandS > Upper_BandK;

AssignBackgroundColor(if DOWN then color.LIGHT_RED else if UP then color.dark_green else color.black);

def upcounter = if up then upcounter[1] + 1 else if !up then 0 else upcounter[1];

def downcounter = if down then downcounter[1] + 1 else if !down then 0 else downcounter[1];

addlabel (yes, if up then "" + upcounter else "" + downcounter);

Last edited:

@Christopher84 Is there any setting I can change because I use it on a 1 minute chart . There is way too many up down arrows . I scalp for options and would like to change setting for only good signals .Thanks in advance. BTW Im using V10, Thanks for your hard work !!

There are two options that I can think of right off.@Christopher84 Is there any setting I can change because I use it on a 1 minute chart . There is way too many up down arrows . I scalp for options and would like to change setting for only good signals .Thanks in advance. BTW Im using V10, Thanks for your hard work !!

1. Use a higher timeframe chart to reduce the noise. When I am using this indicator to scalp, I don't go below 2 min charts and prefer 10 min charts.

2. You could increase the Confirmation Level if you prefer the 1 min charts and it should help to reduce the noise. Play around with the level and see what works best for the asset you are trading.

Hopefully this will help. If not, let me know.

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1393

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.