@Christopher84 thanks for all your great work and sharing of them. Can you direct me to the latest version of Confirmation Candle?I know how you feel!Hope all is well.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

tks a lot! You make my !or just enter any watchlist custom-code link, rename it 'blank' or whatever, and save it. do this as many times as you want (blank, blank 1, blank 2, etc) and that's how many new custom columns you can make. just erase the existing code and paste in the new and bingobango off to the races you go. or am i just restating the obvious?

Hi Jonas99!@Christopher84 thanks for all your great work and sharing of them. Can you direct me to the latest version of Confirmation Candle?

You are welcome and I’m glad you are liking the indicators. As I continue to make improvements to the code, I will always post the latest version on page one of this thread. Let me know if you have trouble locating it.

Hey @Christopher84, your lower MA cloud was spot-on tonight! So were the confirmation candles and near-term s/r zones. Price crossed below your cloud just as the MACD BB was heading below the zero line and price was making a 2nd close below the mobius pivot confirmation line. I didn't get as big of a move as I was hoping for because price stalled out about 2214. But I'll gladly take it for a Sunday night easy peasy no-stress trade. I can't believe I'm plotting clouds on my chart, LOL

Perfect setup! Well played!Hey @Christopher84, your lower MA cloud was spot-on tonight! So were the confirmation candles and near-term s/r zones. Price crossed below your cloud just as the MACD BB was heading below the zero line and price was making a 2nd close below the mobius pivot confirmation line. I didn't get as big of a move as I was hoping for because price stalled out about 2214. But I'll gladly take it for a Sunday night easy peasy no-stress trade. I can't believe I'm plotting clouds on my chart, LOL

YikesItsme_

New member

whats your Setup and script for this? is this good for a swing? longer time frameHey @Christopher84, your lower MA cloud was spot-on tonight! So were the confirmation candles and near-term s/r zones. Price crossed below your cloud just as the MACD BB was heading below the zero line and price was making a 2nd close below the mobius pivot confirmation line. I didn't get as big of a move as I was hoping for because price stalled out about 2214. But I'll gladly take it for a Sunday night easy peasy no-stress trade. I can't believe I'm plotting clouds on my chart, LOL

whats your Setup and script for this? is this good for a swing? longer time frame

@yikesitsme, you'd have to plot the indicators on your preferred time frame and watch them for a while to see if they work for you. I've used them on higher time frames but not as much as with 15 min or less. Everything I'm using is available on this site and can be located via a site search. This should get you started.

- B4 Lower Strategy Signals (not the arrows)

- Leavitt Slope and Acceleration (still testing; undecided if I'll keep it on my charts)

- Confirmation Candles and MTF Moving Average Lower (both available on the current thread)

- RSM MTF Labels

- MACD BB

- Mobius Trend Pivots

YikesItsme_

New member

thank you so much for the response really appreciate it. I was reading the whole thread trying to put your set up together lol this made it easier thank you@yikesitsme, you'd have to plot the indicators on your preferred time frame and watch them for a while to see if they work for you. I've used them on higher time frames but not as much as with 15 min or less. Everything I'm using is available on this site and can be located via a site search. This should get you started.

Most of these indicators can be customized to suit your preferences (colors, dots/dashes, etc). Best wishes and happy trading!

- B4 Lower Strategy Signals (not the arrows)

- Leavitt Slope and Acceleration (still testing; undecided if I'll keep it on my charts)

- Confirmation Candles and MTF Moving Average Lower (both available on the current thread)

- RSM MTF Labels

- MACD BB

- Mobius Trend Pivots

@YikesItsme_, you're welcome. Regarding higher timeframes, here's a screenshot of the 15 min, 30 min, and daily grid I traded AG from this morning. I used @Christopher84's scan to find a low-priced stock that I thought could make at least a $1 move today. I got entry signals on all 3 timeframes, and price did indeed make the move I hoped for.

Full disclosure: May just be luck. I don't trade stocks as frequently as futures.

Full disclosure: May just be luck. I don't trade stocks as frequently as futures.

G

greenalert20

Guest

So my understanding is that the clouds are the buy and sell/take profit signals? I installed the V9 Confirmation Candles from the first page and the clouds don't appear on my chart. Is it possible the code related to clouds was removed from that version? If so, what would be the buy/sell signals? The arrows are frequent and I don't see that being used as the buy/sell signal. I am interested in making this work for me so any help would be greatly appreciated. From everyone's feedback and visibility, it seems like a really solid indicator. Good job!

Good day all,

BTW Good indicator.. QQ though @Christopher84 or others

1) I like the lower indicator on Page 2... so what's the BULGECC, BULGECC2, SQUEEZCC , SQUEEZCC2 used for making an entry decision

TIA

MN

BTW Good indicator.. QQ though @Christopher84 or others

1) I like the lower indicator on Page 2... so what's the BULGECC, BULGECC2, SQUEEZCC , SQUEEZCC2 used for making an entry decision

TIA

MN

What chart are you looking at? The clouds should be showing unless showcloud is set to no. I’d also be curious to know what your confirmation level is set to? If you can share an image of your chart, I’ll take a look.So my understanding is that the clouds are the buy and sell/take profit signals? I installed the V9 Confirmation Candles from the first page and the clouds don't appear on my chart. Is it possible the code related to clouds was removed from that version? If so, what would be the buy/sell signals? The arrows are frequent and I don't see that being used as the buy/sell signal. I am interested in making this work for me so any help would be greatly appreciated. From everyone's feedback and visibility, it seems like a really solid indicator. Good job!

Hi easyman!Good day all,

BTW Good indicator.. QQ though @Christopher84 or others

1) I like the lower indicator on Page 2... so what's the BULGECC, BULGECC2, SQUEEZCC , SQUEEZCC2 used for making an entry decision

TIA

MN

I am guessing you are talking about the Super OB/OS indicator on pg.1? Anyhow, I use the bulge and squeeze lines as potential near term support/resistance. I look for the Consensus Line to pull away from the bulge/squeeze. This can indicate a change in price activity and direction especially when this occurs in an OB/OS level. I hope that helps.

Thanks Christopher,Hi easyman!

I am guessing you are talking about the Super OB/OS indicator on pg.1? Anyhow, I use the bulge and squeeze lines as potential near term support/resistance. I look for the Consensus Line to pull away from the bulge/squeeze. This can indicate a change in price activity and direction especially when this occurs in an OB/OS level. I hope that helps.

In my observation , i found that the Consensus alone is doing good but "very quick" to flip from RED/GREEN or viceversa..so have to be like SNIPER

At your convenience can u post an image on your use of Bulge/Squeeze... because i am not able to interpret ..

TIA

MN

Here is an example of how I use the Super OB/OS indicator in conjunction with the CC Candles or Confirmation Candles. Hope this helps out.Thanks Christopher,

In my observation , i found that the Consensus alone is doing good but "very quick" to flip from RED/GREEN or viceversa..so have to be like SNIPERto take the trade

At your convenience can u post an image on your use of Bulge/Squeeze... because i am not able to interpret ..

TIA

MN

tjlizwelicha

Active member

Thank you for that information. I didn't know that. So it won't erase the other code, correct?or just enter any watchlist custom-code link, rename it 'blank' or whatever, and save it. do this as many times as you want (blank, blank 1, blank 2, etc) and that's how many new custom columns you can make. just erase the existing code and paste in the new and bingobango off to the races you go. or am i just restating the obvious?

tjlizwelicha

Active member

Excellent job @Christopher84 and thanks for all your patience and knowledge. This works excellent with the BTD. Are we keeping the scan aggregation set to D?Your chart looks great! I typically use the day and week aggregation in the indicator with a chart timeframe of no less than 1 hour. I have used it on a 10 min chart but its not as easy to see (still doable). If you change the indicator to a lower aggregation period for the averages, it will not show up on a higher timeframe charts. For instance, it appears you have set your aggregation periods to 10 min and 30 min, so they will not show on charts with higher timeframes (such as a 1 hour chart). I am not sure if that is what's going on, but it could be part of the issue. Also, I personally like using the day and week aggregation periods due to the strength of those averages as support and resistance. Lower aggregation periods will still work, but it will diminish the strength of the support or resistance. One other thing I wanted to point out is that the MA Cloud was calling the breakout about two bars before the B4. If you see the red cloud with both averages going green (its telling you price action is extremely bullish and about to breakout). Very similar to the signal that the scan is setup to find just on a lower aggregation period. Very nice example!

You are welcome! Glad you are finding it to be useful.Excellent job @Christopher84 and thanks for all your patience and knowledge. This works excellent with the BTD. Are we keeping the scan aggregation set to D?

Thank you for that information. I didn't know that. So it won't erase the other code, correct?

nope, you have to do that. just open the so-called blank column up, hit ctl-a followed by delete and after that, you'll have a truly blank slate.

Hi Everyone!

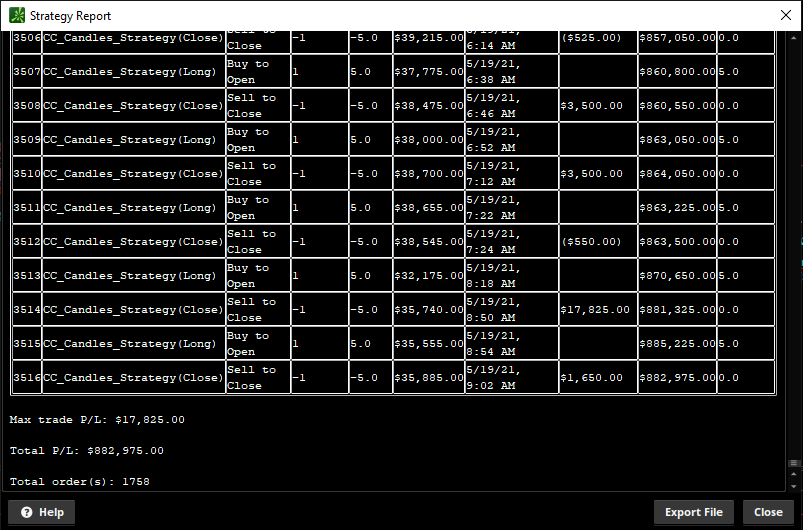

Just for fun, I ran my CC Candles strategy on the 2 min chart of /BTC over the last 30 days to see how it would perform. There is no shorting in this particular strategy, and it trades 1 share/coin at a time. The results were interesting. Gave me a good laugh this morning. Hope everyone is doing well. Happy trading on this bearish day!

Just for fun, I ran my CC Candles strategy on the 2 min chart of /BTC over the last 30 days to see how it would perform. There is no shorting in this particular strategy, and it trades 1 share/coin at a time. The results were interesting. Gave me a good laugh this morning. Hope everyone is doing well. Happy trading on this bearish day!

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

798

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.