#chat261_fix_diverg

#https://usethinkscript.com/threads/chatgpt-bard-other-ai-scripts-which-cant-be-used-in-thinkorswim.13822/page-14#post-143210

#James Chen

#261

#Please fix these scripts for divergence detection. Thanks.

#declare lower;

input prd = 5;

input source = close;

input searchdiv = "Regular";

input showindis = "Full";

input showlimit = 1;

input maxpp = 10;

input maxbars = 100;

input shownum = yes;

input showlast = no;

input dontconfirm = no;

input showlines = yes;

input showpivot = no;

input calcmacd = yes;

input calcmacda = yes;

input calcrsi = yes;

input calcstoc = yes;

input calccci = yes;

input calcmom = yes;

input calcobv = yes;

input calcvwmacd = yes;

input calccmf = yes;

input calcmfi = yes;

input calcext = no;

input externalindi = close;

# Define color constants

DefineGlobalColor("PositiveRegDiv", CreateColor(255, 255, 0)); # Yellow

DefineGlobalColor("NegativeRegDiv", CreateColor(0, 0, 255)); # Blue

DefineGlobalColor("PositiveHidDiv", CreateColor(0, 255, 0)); # Green

DefineGlobalColor("NegativeHidDiv", CreateColor(255, 0, 0)); # Red

DefineGlobalColor("PosDivText", CreateColor(0, 0, 0)); # Black

DefineGlobalColor("NegDivText", CreateColor(255, 255, 255)); # White

input reg_div_l_style_ = Curve.MEDIUM_DASH;

input hid_div_l_style_ = Curve.SHORT_DASH;

input reg_div_l_width = 2;

input hid_div_l_width = 1;

input showmas = no;

# Moving Averages

#def cma1col = Color.GREEN;

#def cma2col = Color.RED;

# Moving Averages

plot ma50 = if showmas then Average(close, 50) else Double.NaN;

#ma50.SetDefaultColor(cma1col);

ma50.SetDefaultColor(Color.GREEN);

plot ma200 = if showmas then Average(close, 200) else Double.NaN;

#ma200.SetDefaultColor(cma2col);

ma200.SetDefaultColor(Color.RED);

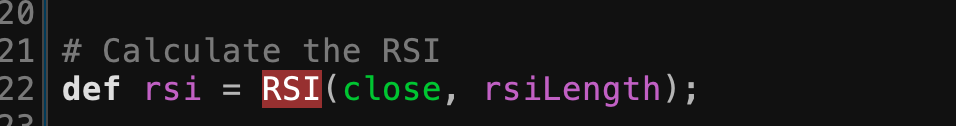

# RSI

#def rsiValue = if calcrsi then RSI(close, 14) else Double.NaN;

def rsiValue = if calcrsi then RSI(length = 14, price = close) else Double.NaN;

# MACD

#def macd = if calcmacd then MACD(close, 12, 26, 9) else Double.NaN;

def macd = if calcmacd then MACD(12, 26, 9) else Double.NaN;

def macdValue = if calcmacd then macd[1] - macd[2] else Double.NaN;

# Momentum

#def moment = if calcmom then Momentum(close, 10) else Double.NaN;

def moment = if calcmom then Momentum(10,close) else Double.NaN;

# CCI

#def cciValue = if calccci then CCI(close, 10) else Double.NaN;

def cciValue = if calccci then CCI(10,close) else Double.NaN;

# OBV

def obvValue = if calcobv then TotalSum(if close > close[1] then volume else if close < close[1] then -volume else 0) else Double.NaN;

# Stochastic

def stkValue = if calcstoc then StochasticSlow(14, 3) else Double.NaN;

# VW MACD

def vwmacd = if calcvwmacd then MovingAverage(AverageType.WILDERS, close, 12) - MovingAverage(AverageType.WILDERS, close, 26) else Double.NaN;

# Chaikin Money Flow

def cmf = if calccmf then ChaikinMoneyFlow(21) else Double.NaN;

# Money Flow Index

def mfi = if calcmfi then MoneyFlowIndex(close, 14) else Double.NaN;

# Pivot Points

def ph = if source == close then high else low;

def pl = if source == close then low else high;

def phValue = if high == Highest(high, prd) then high else Double.NaN;

def plValue = if low == Lowest(low, prd) then low else Double.NaN;

def phPosition = if !IsNaN(phValue) then BarNumber() else Double.NaN;

def plPosition = if !IsNaN(plValue) then BarNumber() else Double.NaN;

# Divergence Detection

def positiveRegular = if !IsNaN(phPosition) then

(if macdValue > Highest(macdValue[prd], prd) and low < Lowest(low[prd], prd) then 1 else 0)

else 0;

def negativeRegular = if !IsNaN(plPosition) then

(if macdValue < Lowest(macdValue[prd], prd) and high > Highest(high[prd], prd) then 1 else 0)

else 0;

def positiveHidden = if !IsNaN(phPosition) then

(if macdValue < Lowest(macdValue[prd], prd) and low > Lowest(low[prd], prd) then 1 else 0)

else 0;

def negativeHidden = if !IsNaN(plPosition) then

(if macdValue > Highest(macdValue[prd], prd) and high < Highest(high[prd], prd) then 1 else 0)

else 0;

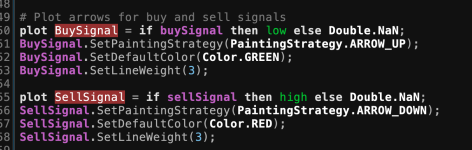

plot PositiveRegularDivergence = positiveRegular;

PositiveRegularDivergence.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

PositiveRegularDivergence.SetDefaultColor(GlobalColor("PositiveRegDiv"));

plot NegativeRegularDivergence = negativeRegular;

NegativeRegularDivergence.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

NegativeRegularDivergence.SetDefaultColor(GlobalColor("NegativeRegDiv"));

plot PositiveHiddenDivergence = positiveHidden;

PositiveHiddenDivergence.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

PositiveHiddenDivergence.SetDefaultColor(GlobalColor("PositiveHidDiv"));

plot NegativeHiddenDivergence = negativeHidden;

NegativeHiddenDivergence.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

NegativeHiddenDivergence.SetDefaultColor(GlobalColor("NegativeHidDiv"));

#