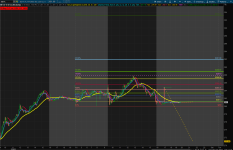

Can anyone help me change the chart bubbles to appear bars in the future?

I tried to add it like this but think I am missing something.

# plots a bubble x bars after last bar

input bars_in_future = 10;

def bif = bars_in_future;

addchartBubble(LabelsOn and F_236, F_0236,"23.6%",color.plum,bif);

here is the script.

#Automatic Fibonacci Long Levels

#based on Mobius's Fractal Pivot Strategy

#developed by Chewie76 on 8/27/2021

# User Inputs

input n = 20;

input FractalEnergyLength = 8;

input FractalEnergyThreshold = .68;

input AtrMult = .70;

input nATR = 4;

input AvgType = AverageType.HULL;

input LabelsOn = yes;

input AlertsOn = yes;

# Variables

def o = open;

def h = high;

def l = low;

def c = close;

def bar = BarNumber();

def TS = TickSize();

def nan = double.nan;

def ATR = Round((MovingAverage(AvgType, TrueRange(h, c, l), nATR)) / TS, 0) * TS;

def risk = if Between(c, 0, 1500)

then ATR

else if Between(c, 1500, 3500)

then 2

else if Between(c, 3500, 5500)

then 4

else 6;

def FE = Log(Sum((Max(h, c[1]) - Min(l, c[1])), FractalEnergyLength) /

(Highest(h, FractalEnergyLength) - Lowest(l, FractalEnergyLength)))

/ Log(FractalEnergyLength);

# Parent Aggregation Pivot High

# Pivot High Variables

def p_hh = fold i = 1 to n + 1

with p = 1

while p

do h > GetValue(h, -1);

def p_PivotH = if (bar > n and

h == Highest(h, n) and

p_hh)

then h

else NaN;

def p_PHValue = if !IsNaN(p_PivotH)

then p_PivotH

else p_PHValue[1];

def p_PHBar = if !IsNaN(p_PivotH)

then bar

else nan;

# Pivot High and Pivot High Exit Variables

# Pivot High Variables

def hh = fold ii = 1 to n + 1

with pp = 1

while pp

do h > GetValue(h, -1);

def PivotH = if (bar > n and

h == Highest(h, n) and

hh)

then h

else Double.NaN;

def PHValue = if !IsNaN(PivotH)

then PivotH

else PHValue[1];

def PHBar = if !IsNaN(PivotH)

then bar

else nan;

# Pivot High Exit Variables

def PHExit = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then l[1]

else fold r = 0 to 20

with a = NaN

while IsNaN(a)

do if GetValue(l[1], r) < l

then GetValue(l[1], r)

else NaN

else Double.NaN;

def PHExitValue = if !IsNaN(PHExit)

then PHExit

else PHExitValue[1];

def PHExitBar = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then bar - 1

else fold d = 0 to 20

with y = NaN

while IsNaN

do if GetValue(l[1], d) < l

then GetValue(bar - 1, d)

else NaN

else NaN;

# Pivot Low and Pivot Low Entry Variables

# Parent Pivot Low Variables

def p_ll = fold j = 1 to n + 1

with q = 1

while q

do l < GetValue(l, -1);

def p_PivotL = if (bar > n and

l == Lowest(l, n) and

p_ll)

then l

else NaN;

def p_PLValue = if !IsNaN(p_PivotL)

then p_PivotL

else p_PLValue[1];

def p_PLBar = if !IsNaN(p_PivotL)

then bar

else nan;

# Pivot Low Variables

def ll = fold jj = 1 to n + 1

with qq = 1

while qq

do l < GetValue(l, -1);

def PivotL = if (bar > n and

l == Lowest(l, n) and

ll)

then l

else NaN;

def PLValue = if !IsNaN(PivotL)

then PivotL

else PLValue[1];

def PLBar = if !IsNaN(PivotL)

then bar

else nan;

# Pivot Low Entry Variables

def PLEntry = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then h[1]

else fold t = 0 to 20

with w = NaN

while IsNaN(w)

do if GetValue(h[1], t) > h

then GetValue(h[1], t)

else NaN

else NaN;

def PLEntryValue = if !IsNaN(PLEntry)

then PLEntry

else PLEntryValue[1];

def PLEntryBar = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then bar - 1

else fold u = 0 to 20

with z = NaN

while IsNaN(z)

do if GetValue(h[1], u) > h

then GetValue(bar - 1, u)

else NaN

else NaN;

# Plots

plot F_100 = if bar >= HighestAll(PLBar)

then HighestAll(if isNaN(c[-1])

then PLValue

else nan)

else nan;

F_100.SetDefaultColor(Color.dark_red);

F_100.SetLineWeight(2);

def F_0100 =(if isNaN(F_100[1]) then F_100 else Double.NaN);

addchartBubble(LabelsOn and F_100, F_0100,"100%",color.dark_red);

plot F_786 = if bar >= HighestAll(PLEntryBar)

then HighestAll(if isNaN(c[-1])

then PLEntryValue

else nan)

else nan;

F_786.SetDefaultColor(Color.light_red);

F_786.SetLineWeight(2);

def F_0786 =(if isNaN(F_786[1]) then F_786 else Double.NaN);

addchartBubble(LabelsOn and F_786, F_0786,"78.6%",color.light_red);

plot priceLine = HighestAll(if IsNaN(c[-1])

then c

else Double.NaN);

priceLine.SetStyle(Curve.SHORT_DASH);

priceLine.SetLineWeight(1);

priceLine.SetDefaultColor(Color.CYAN);

plot UpArrow = if c crosses above F_786 and FE > .5

then l

else Double.NaN;

UpArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

UpArrow.SetLineWeight(5);

UpArrow.SetDefaultColor(Color.GREEN);

#Fib levels

# plots a bubble x bars after last bar

input bars_in_future = 10;

def bif = bars_in_future;

plot F_0 = (F_786-F_100) * 4.673 + F_100;

F_0.setdefaultcolor(color.red);

F_0.setlineweight(2);

def F_00 =(if isNaN(F_0[1]) then F_0 else Double.NaN);

addchartBubble(LabelsOn and F_0, F_00,"0%: " + asDollars(F_00),color.red,bif);

plot F_124 = (F_0 - F_100)/1.14155+ F_100;

F_124.setdefaultcolor(color.dark_orange);

F_124.setlineweight(2);

def F_0124 =(if isNaN(F_124[1]) then F_124 else Double.NaN);

plot F_236 = (F_0 - F_100)/1.3089+ F_100;

F_236.setdefaultcolor(color.plum);

F_236.setlineweight(2);

def F_0236 = (if isNaN(F_236[1]) then F_236 else Double.NaN);

addchartBubble(LabelsOn and F_236, F_0236,"23.6%",color.plum,bif);

plot F_382 = (F_0 - F_100)/1.618+ F_100;

F_382.setdefaultcolor(color.cyan);

F_382.setlineweight(2);

def F_0382 =(if isNaN(F_382[1]) then F_382 else Double.NaN);

addchartBubble(LabelsOn and F_382, F_0382,"38.2%",color.cyan);

plot F_50 = (F_0 - F_100)/2 + F_100;

F_50.setdefaultcolor(color.green);

F_50.setlineweight(2);

def F_050 =(if isNaN(F_50[1]) then F_50 else Double.NaN);

plot F_618 = (F_0 - F_100)/2.618+ F_100;

F_618.setdefaultcolor(color.yellow);

F_618.setlineweight(2);

def F_0618 =(if isNaN(F_618[1]) then F_618 else Double.NaN);

addchartBubble(LabelsOn and F_618, F_0618,"61.8%",color.yellow);

plot F_886 = (F_786 - F_100)/1.88+ F_100;

F_886.setdefaultcolor(color.violet);

F_886.setlineweight(2);

def F_0886 =(if isNaN(F_886[1]) then F_886 else Double.NaN);

plot FE_272 = (F_0 - F_100)*1.272 + F_100;

FE_272.setdefaultcolor(color.yellow);

FE_272.SetStyle(Curve.LONG_DASH);

FE_272.setlineweight(2);

def F_0272 =(if isNaN(FE_272[1]) then FE_272 else Double.NaN);

plot FE_50 = (F_0 - F_100)*1.5 + F_100;

FE_50.setdefaultcolor(color.GREEN);

FE_50.SetStyle(Curve.LONG_DASH);

FE_50.setlineweight(2);

def FE_050 =(if isNaN(FE_50[1]) then FE_50 else Double.NaN);

# Alerts

Alert(AlertsOn and UpArrow, " ", Alert.Bar, Sound.ding);