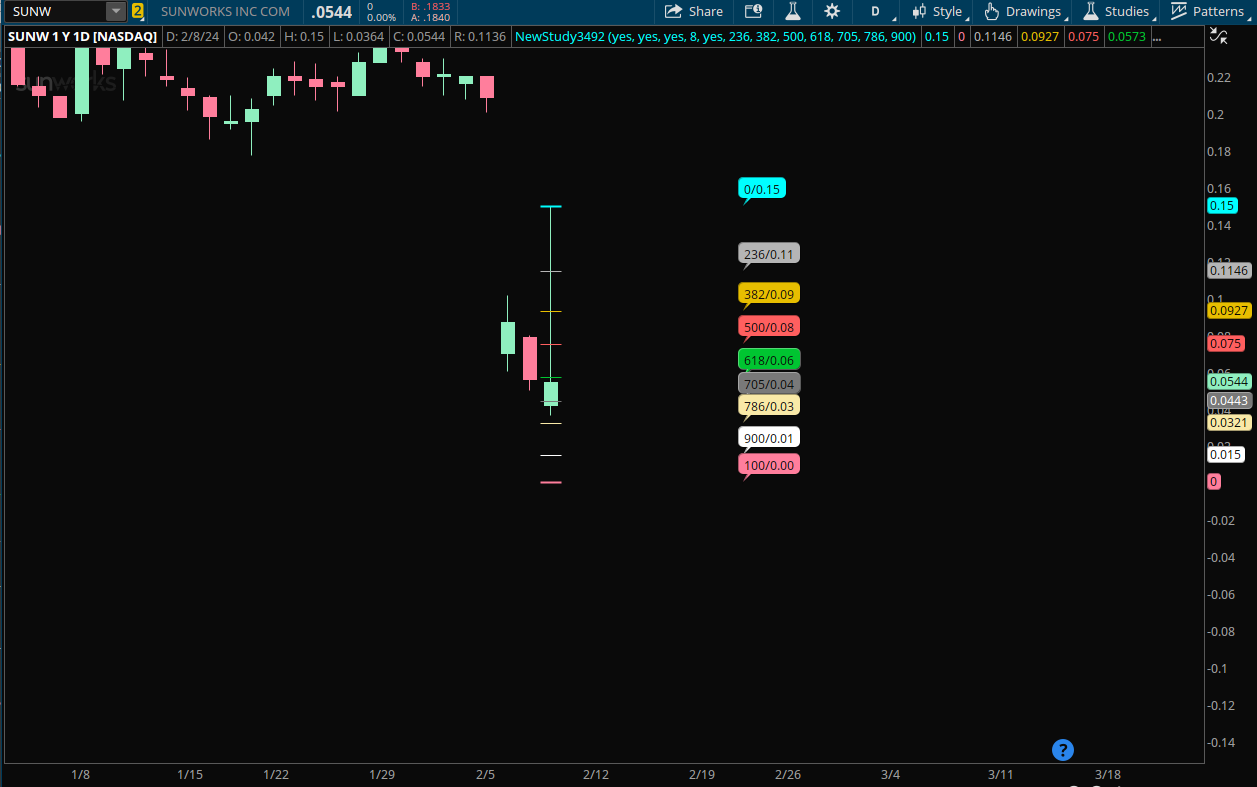

# Auto Fib V1.3

# tomsk

# 11.19.2019

# Automatically draws fibonacci retracements using the highest price and lowest price

# from the current view and timeframe.

#

# Fibonacci retracements use horizontal lines to indicate areas of support or resistance

# at the key Fibonacci levels before it continues in the original direction. These levels

# are created by drawing a trendline between two extreme points and then dividing the

# vertical distance by the key Fibonacci ratios of: 23.6%, 38.2%, 50%, 61.8%, 78.6%, and 100%.

# CHANGE LOG

#

# V1.0 - 12.18.2018 - BenTen - Initial release of Auto Fib, created by Ryan Hendricks

# V1.1 - 11.15.2019 - theelderwand - As script was difficult to read, made the following enhancements

# Expands to right

# Doesn't expand to left

# Custom colors for Fibonacci bars (0.618 is GOLD color)

# Custom line weights

# Code is modularized so you can add extra plots as needed

# V1.2 - 11.15.2019 - tomsk - Added an input selector for the colors of the label. You

# can select from any of the colors listed - red, orange,

# green, etc and bubbles for all the fib retracements will

# utilize that color.

# V1.3 - 11.19.2019 - tomsk - Modified the AddChartBubbles to be displayed on the right

# side of the chart. Please ensure that you increase the

# expansion area to that the bubbles have room to be displayed

# Chart Settings > Time Axis > Expansion Area

#hint Price: Price used in the alerts on crossing retracement lines. <b>(Default is Close)</b>

#hint coefficient_0: Retracement Line 0: Retracement from the highest high to the lowest low.<b>(Default is 0%)</b>

#hint Coefficient_1: Retracement Line 1: Retracement from the highest high to the lowest low.<b>(Default is 23.6%)</b>

#hint Coefficient_2: Retracement Line 2: Retracement from the highest high to the lowest low.<b>(Default is 38.2%)</b>

#hint Coefficient_3: Retracement Line 3: Retracement from the highest high to the lowest low.<b>(Default is 50%)</b>

#hint Coefficient_4: Retracement Line 4: Retracement from the highest high to the lowest low.<b>(Default is 61.8%)</b>

#hint Coefficient_5: Retracement Line 5: Retracement from the highest high to the lowest low.<b>(Default is 78.6%)</b>

#hint Coefficient_6: Retracement Line 6: Retracement from the highest high to the lowest low.<b>(Default is 100%)</b>

#wizard input: Price

#wizard text: Inputs: Price:

#wizard input: coefficient_0

#wizard text: coefficient_0:

#wizard input: Coefficient_1

#wizard text: Coefficient_1:

#wizard input: Coefficient_2

#wizard text: Coefficient_2:

#wizard input: Coefficient_3

#wizard text: Coefficient_3:

#wizard input: Coefficient_4

#wizard text: Coefficient_4:

#wizard input: Coefficient_5

#wizard text: Coefficient_5:

#wizard input: Coefficient_6

#wizard text: Coefficient_6:

input price = close;

input high = high;

input low = low;

input coefficient_0 = 0.000;

input coefficient_1 = .236;

input Coefficient_2 = .382;

input Coefficient_3 = .500;

input Coefficient_4 = .618;

Input Coefficient_5 = .786;

input Coefficient_6 = 1.000;

input LabelColor = {default "MAGENTA", "CYAN", "PINK", "LIGHT_GRAY", "ORANGE", "RED", "GREEN", "GRAY", "WHITE"};

input n = 3;

def n1 = n + 1;

def a = HighestAll(high);

def b = LowestAll(low);

def barnumber = barNumber();

def c = if high == a then barnumber else double.nan;

def d = if low == b then barnumber else double.nan;

rec highnumber = compoundValue(1, if IsNaN(c) then highnumber[1] else c, c);

def highnumberall = HighestAll(highnumber);

rec lownumber = compoundValue(1, if IsNaN(d) then lownumber[1] else d, d);

def lownumberall = LowestAll(lownumber);

def upward = highnumberall > lownumberall;

def downward = highnumberall < lownumberall;

def x = AbsValue(lownumberall - highnumberall );

def slope = (a - b) / x;

def slopelow = (b - a) / x;

def day = getDay();

def month = getMonth();

def year = getYear();

def lastDay = getLastDay();

def lastmonth = getLastMonth();

def lastyear = getLastYear();

def isToday = if(day == lastDay and month == lastmonth and year == lastyear, 1, 0);

def istodaybarnumber = HighestAll(if isToday then barnumber else double.nan);

def line = b + (slope * (barnumber - lownumber));

def linelow = a + (slopelow * (barnumber - highnumber));

def currentlinelow = if barnumber <= lownumberall then linelow else double.nan;

def currentline = if barnumber <= highnumberall then line else double.nan;

Plot FibFan = if downward then currentlinelow else if upward then currentline else double.nan;

FibFan.SetStyle(Curve.SHORT_DASH);

FibFan.AssignValueColor(color.red);

fibfan.hidebubble();

def range = a - b;

def value0 = range * coefficient_0;

def value1 = range * coefficient_1;

def value2 = range * coefficient_2;

def value3 = range * coefficient_3;

def value4 = range * coefficient_4;

def value5 = range * coefficient_5;

def value6 = range * coefficient_6;

def condition1 = downward and barnumber >= highnumberall;

def condition2 = upward and barnumber >= lownumberall;

Plot Retracement0 = if condition1 then highestall(b + value0) else if condition2 then highestall(a - value0) else double.nan;

Plot Retracement1 = if condition1 then highestall(b + value1) else if condition2 then highestall(a - value1) else double.nan;

Plot Retracement2 = if condition1 then highestall(b + value2) else if condition2 then highestall(a - value2) else double.nan;

Plot Retracement3 = if condition1 then highestall(b + value3) else if condition2 then highestall(a - value3) else double.nan;

Plot Retracement4 = if condition1 then highestall(b + value4) else if condition2 then highestall(a - value4) else double.nan;

Plot Retracement5 = if condition1 then highestall(b + value5) else if condition2 then highestall(a - value5) else double.nan;

Plot Retracement6 = if condition1 then highestall(b + value6) else if condition2 then highestall(a - value6) else double.nan;

Retracement0.assignvaluecolor(CreateColor(255,255,255));

Retracement0.setLineWeight(4);

retracement0.hidebubble();

AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes);

AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes);

Retracement1.assignvaluecolor(CreateColor(173,216,230));

Retracement1.setLineWeight(2);

retracement1.hidebubble();

AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement1, concat( (coefficient_1 * 100), "%"), GetColor(LabelColor), yes);

AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement1, concat( (coefficient_1 * 100), "%"), GetColor(LabelColor), yes);

Retracement2.assignvaluecolor(CreateColor(0,197,49));

Retracement2.setLineWeight(2);

retracement2.hidebubble();

AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes);

AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes);

Retracement3.assignvaluecolor(CreateColor(255,64,64));

Retracement3.setLineWeight(3);

retracement3.hidebubble();

AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement3, concat( (coefficient_3 * 100), "%"), GetColor(LabelColor), yes);

AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement3, concat( (coefficient_3 * 100), "%"), GetColor(LabelColor), yes);

Retracement4.assignvaluecolor(CreateColor(255,215,0));

Retracement4.setLineWeight(5);

retracement4.hidebubble();

AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes);

AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes);

Retracement5.assignvaluecolor(CreateColor(0,255,255));

Retracement5.setLineWeight(2);

retracement5.hidebubble();

AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement5, concat( (coefficient_5 * 100), "%"), GetColor(LabelColor), yes);

AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement5, concat( (coefficient_5 * 100), "%"), GetColor(LabelColor), yes);

Retracement6.assignvaluecolor(CreateColor(255,255,255));

Retracement6.setLineWeight(4);

Retracement6.hidebubble();

AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes);

AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes);

alert((price crosses below Retracement0) , "Price crosses below Retracement Line 0");

alert((price crosses above Retracement0) , "Price crosses above Retracement Line 0");

alert((price crosses below Retracement1) , "Price crosses below Retracement Line 1");

alert((price crosses above Retracement1) , "Price crosses above Retracement Line 1");

alert((price crosses below Retracement2) , "Price crosses below Retracement Line 2");

alert((price crosses above Retracement2) , "Price crosses above Retracement Line 2");

alert((price crosses below Retracement3) , "Price crosses below Retracement Line 3");

alert((price crosses above Retracement3) , "Price crosses above Retracement Line 3");

alert((price crosses below Retracement4) , "Price crosses below Retracement Line 4");

alert((price crosses above Retracement4) , "Price crosses above Retracement Line 4");

alert((price crosses below Retracement5) , "Price crosses below Retracement Line 5");

alert((price crosses above Retracement5) , "Price crosses above Retracement Line 5");

alert((price crosses below Retracement6) , "Price crosses below Retracement Line 6");

alert((price crosses above Retracement6) , "Price crosses above Retracement Line 6");

# End Auto Fib v1.3

Code:

Code: