K_O_Trader

Member

#Chris' Enhanced Volume V.2 /w Uptick/DowntickBuy and Sell Volume Pressure Indicator for higher TimeFrames (Weekly, Monthly etc.)

Anyone know how to modify this Indicator to view / use it on higher time frames

Code:#Total Volume for Regular Trading Day AddLabel(yes, "Total Vol: " + volume(period = AggregationPeriod.DAY), Color.white); #Volume of Current Bar AddLabel(yes, "CurrentBar Vol: " + volume, Color.LIGHT_GREEN); #Volume of the Last Bar AddLabel(yes, "LastBar Vol: " + volume[1], Color.LIGHT_ORANGE); #PreMarket Volume input startTime = 0400; input endTime = 0929; def startCounter = SecondsFromTime(startTime); def endCounter = SecondsTillTime(endTime); def targetPeriod = if startCounter >= 0 and endCounter >= 0 then 1 else 0; rec volumeTotal = if targetPeriod and !targetPeriod[1] then volume else if targetPeriod then volumeTotal[1] + volume else volumeTotal[1]; AddLabel(yes, Concat("PreMrket Vol: ", volumeTotal), Color.VIOLET); #Volume color coded by amount of volume on up-tick versus amount of volume on down-tick declare lower; def O = open; def H = high; def C = close; def L = low; def V = volume; def Buying = V * (C - L) / (H - L); def Selling = V * (H - C) / (H - L); # Selling Volume plot SV = Selling; SV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); SV.SetDefaultColor(Color.LIGHT_RED); SV.HideTitle(); SV.HideBubble(); SV.SetLineWeight(5); # Buying Volume # Plot BV = Buying; # Note that Selling + Buying Volume = Volume. plot BV = volume; BV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); BV.SetDefaultColor(Color.GREEN); BV.HideTitle(); BV.HideBubble(); BV.SetLineWeight(5); #Create an average volume line based on last 50 bars input length = 20; plot Vol = volume; plot VolAvg = Average(volume, length); Vol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

declare on_volume;

###############

#DPL CRITERIA #

###############

input agg = aggregationPeriod.fIVE_MIN;

input Audible_Alert = yes;

def Deviation_Length = 60;

def Deviate = 2;

def volumestdev = RelativeVolumeStDev(length = Deviation_Length);

def abovedev = volumestdev >= Deviate;

def belowdev = volumestdev <= Deviate;

############

# DPL BARS #

############

def increase = volume(period=agg) > volume(period=agg)[1];

def devincrease = increase and abovedev;

def decrease = volume(period=agg) < volume(period=agg)[1];

def devdecrease = decrease and abovedev;

##############################

# UPTICK / DOWNTICK CRITERIA #

##############################

def O = open(period=agg);

def H = high(period=agg);

def C = close(period=agg);

def L = low(period=agg);

def V = volume(period=agg);

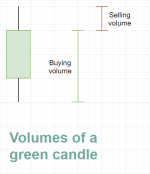

def Buying = V * (C - L) / (H - L);

def Selling = V * (H - C) / (H - L);

##################

# Selling Volume #

##################

plot SV = Selling;

SV.DefineColor("Decrease", Color.rED);

SV.DefineColor("DevDecrease", Color.pink);

SV.AssignValueColor(if devdecrease then SV.Color("DevDecrease") else SV.Color("Decrease"));

SV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

SV.HideTitle();

SV.HideBubble();

SV.SetLineWeight(5);

#################

# Buying Volume #

#################

DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ;

plot BV = Buying;

BV.DefineColor("Increase", GlobalColor("LabelGreen"));

BV.DefineColor("DevIncrease", Color.light_GREEN);

BV.AssignValueColor(if devincrease then BV.Color("DevIncrease") else BV.Color("Increase"));

BV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

BV.HideTitle();

BV.HideBubble();

BV.SetLineWeight(5);

#################

# Adding Volume Labels #

#################

input Show_Labels = yes;

AddLabel(Show_Labels, "Buy Vol = " + Round(Buying, 0),

if Buying > Selling then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Buy %: " + Round((Buying/(Buying+Selling))*100,2), If (Buying/(Buying+Selling))*100 > 60 then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Sell Vol = " + Round(Selling, 0),

if Selling > Buying then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Sell %: " + Round((Selling/(Selling+Buying))*100,2), If (Selling/(Selling+Buying))*100 > 60 then GlobalColor("LabelGreen") else color.RED);