Rather than have multiple versions, my offering is a slight modification of the original, with selectable moving average type and length. http://tos.mx/kCS5Kr2

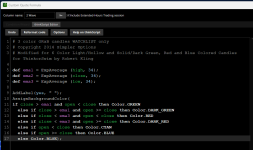

Code:

# 3 color GRaB candles for ThinkorSwim

# Copyright 2014 Simpler Options

#

# Credit: Raghee Horner

#

# V1.01 Robert Kling Modified for 6 Color Light/Hollow and Solid/Dark Green, Red and Blue Colored Candles for ThinkorSwim

#

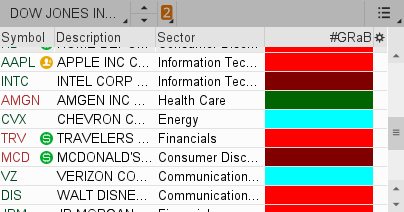

# The original EMA GRaB indicator produced a wave consists of:

# The high of 34 period exponential moving average

# The low of 34 period exponential moving average

# The close of 34 period exponential moving average

#

# The 34-EMA GRaB indicator helps to identify the following:

# Uptrend market (green)

# Downtrend market (red)

# Sideways market (blue)

#

# V1.02 [USER=8847]@VernT[/USER] modified to allow any moving average type and length. These are now inputs.

#

#

declare upper;

declare once_per_bar;

input avgType = AverageType.Exponential;

input avgLength = 34;

Plot avg1 = MovingAverage(avgType, high, avgLength);

plot avg2 = MovingAverage(avgType, close, avgLength);

plot avg3 = MovingAverage(avgType, low, avgLength);

avg1.SetDefaultColor(Color.GREEN);

avg1.SetLineWeight(2);

avg2.SetDefaultColor(Color.BLUE);

avg2.SetLineWeight(2);

avg3.SetDefaultColor(Color.RED);

avg3.SetLineWeight(2);

AssignPriceColor(if close > avg1 and open < close then Color.GREEN

else if close > avg1 and open >= close then Color.DARK_GREEN

else if close < avg3 and open < close then Color.RED

else if close < avg3 and open >= close then Color.DARK_RED

else if open < close then Color.CYAN

else if open >= close then Color.BLUE

else Color.BLUE);