crawford5002

Member

I tried gave me a few errors@crawford5002 You should be able to use that code for your watchlist column without any further modification.

I tried gave me a few errors@crawford5002 You should be able to use that code for your watchlist column without any further modification.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

plot scan = last5mins>percent_of_avg;plot scan = if last5mins>percent_of_avg then 1 else 0;I'm still learning thinkscript, but it doesn't seem like just posting the script that was posted on thread#1 will scan for any code. From what I've been learning so far, it seems like there has to be a single variable (either increasing or decreasing) for the scanner to work. Is my understanding correct? If so, does it mean I have to comment out one of the variables (increasing or decreasing)?

I have been looking for a scanner to scan for unusual volume that occurs within the one minute candle. It would be great to run the scanner pre-market, during market and after mark close for volume jumps of 300% or more above the previous fifteen minutes of candle volume. Does anyone know of a scanner code that can accomplish this scan?

#

# TD Ameritrade IP Company, Inc. (c) 2007-2021

# Modified VolumeAvg to paint candlesticks that are 3x the average volume.

# Make sure you put this in the Volume section of studies

declare lower;

declare zerobase;

input length = 50;

def AvgVol = Average(volume * 3);

plot Vol = volume;

plot VolAvg = Average(volume, length);

Vol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Vol.SetLineWeight(3);

Vol.DefineColor("Up", Color.UPTICK);

Vol.DefineColor("Down", Color.DOWNTICK);

Vol.AssignValueColor(if close > close[1] then Vol.color("Up") else if close < close[1] then Vol.color("Down") else GetColor(1));

VolAvg.SetDefaultColor(GetColor(8));

AssignPriceColor(if close > close[1] AND volume > AvgVol then color.DARK_GREEN else color.current);

AssignPriceColor(if close < close[1] AND volume > AvgVol then color.DARK_RED else color.current);Simple solution. I kept it easy for my eyes, I don’t like the bright neon colors for highlighting that others like. But you can change it as you see fit if you decide to use it@KCLLive After more careful inspection I can see the slightly darker candle... Between the small size and minimal color differentiation it was tough to notice...

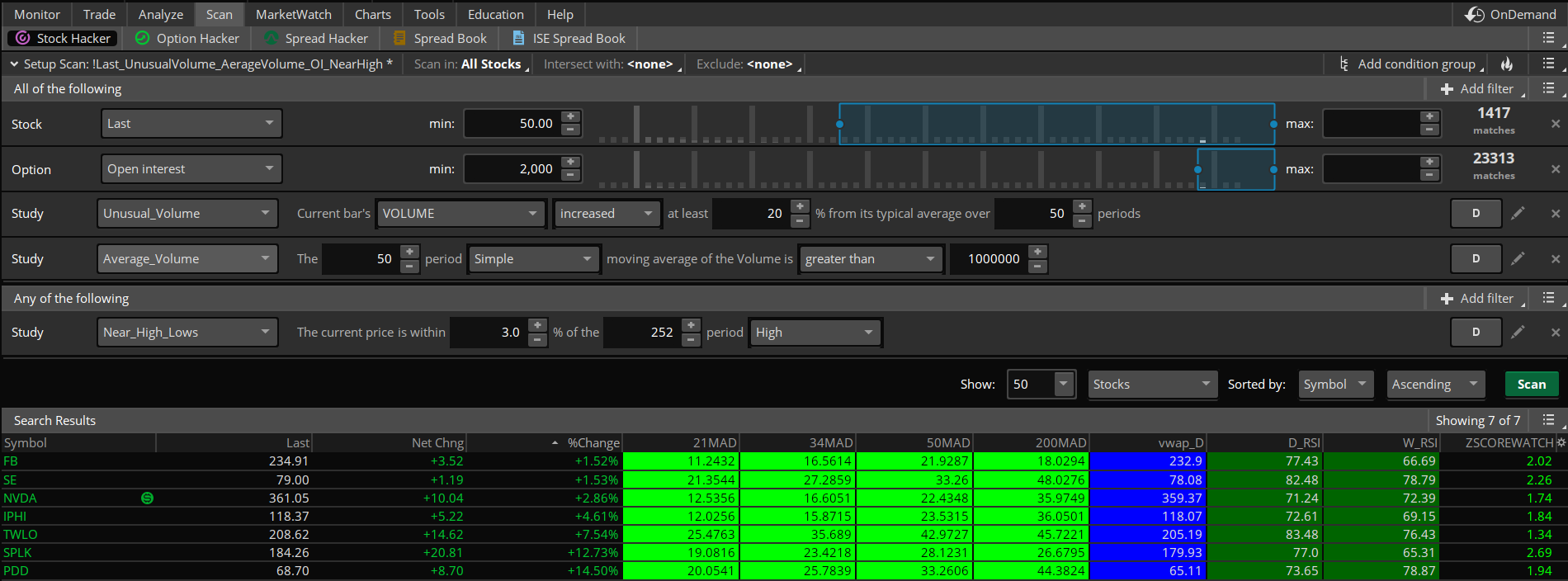

AssignPriceColor(if close < close[1] AND volume > AvgVol then color.DARK_RED else color.current);I am a new trader, how do i save your thinkorswim workspace to my chart. just cannot seem to do it. anyone can help?Unusual Volume near 52 weeks high scanner: https://tos.mx/qksBhga

1. Near 52 week high indicates strength

2. Unusual volume indicates current interest at peak

3. Sorting on Zscore or DMI oscillator --> intraday strength

4. Sustained momentum --> Daily and weekly RSI >60

5. Green on E1, E5, E15, E30, E4h --> strength

6. Chart Observations -> REGN is a good candidate at this time

7. Only possibility, it can change any time

My ThinkorSwim workspace: https://tos.mx/aIZeT6k

The basic concept of Z-Score is that it’s an oscillator denominated in standard deviations from the VWAP mean.

are you able to get his workspace properly loaded? i cant seem to get most of the studies to properly load, especially the watchlist. Appreciate the help!@Technicalyst93 Click here for --> Easiest way to load shared links

@CJ_brt This is not a workspace or a watchlist. The shared link Is a SCANNER.

Unusual Volume near 52 weeks high scanner: https://tos.mx/qksBhga Click here for --> Easiest way to load shared l

@KevinSammy , I found this nice little code on this forum that I am using. Check it out, it might be something similar to what you are asking for. It paints the candles that have 2x volume. You might find it useful.Hello,

As many of you know, we can enable volume to be displayed as an overlap in the upper part of the chart.

I like doing this because it allows me to compare volume easily while simultaneously looking at the chart/candles. I used to have volume in the lower sections, but found that I wasn't using it well because I was too focused on the chart.

The one thing, however, that I liked about having volume in the lower section was that it showed the average volume for one's desired timeframe as a horizontal line across the volume bars. This was nice because of the additional analysis it provided.

My question is whether anyone knows how to display the average volume (per one's desired tim frame) as a horizontal line on the upper, overlap volume bars?

Thank you!

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.