Daily Range System (DRS)

The Daily Range System (DRS) is an indicator @BenTen found on TradingView, and I ported it to thinkorswim.

See these pages for more info on how to use this indicator.

https://www.tradingview.com/script/VpEHwgys-DRS-Daily-Range-System/ and https://www.forexfactory.com/showthread.php?t=743125

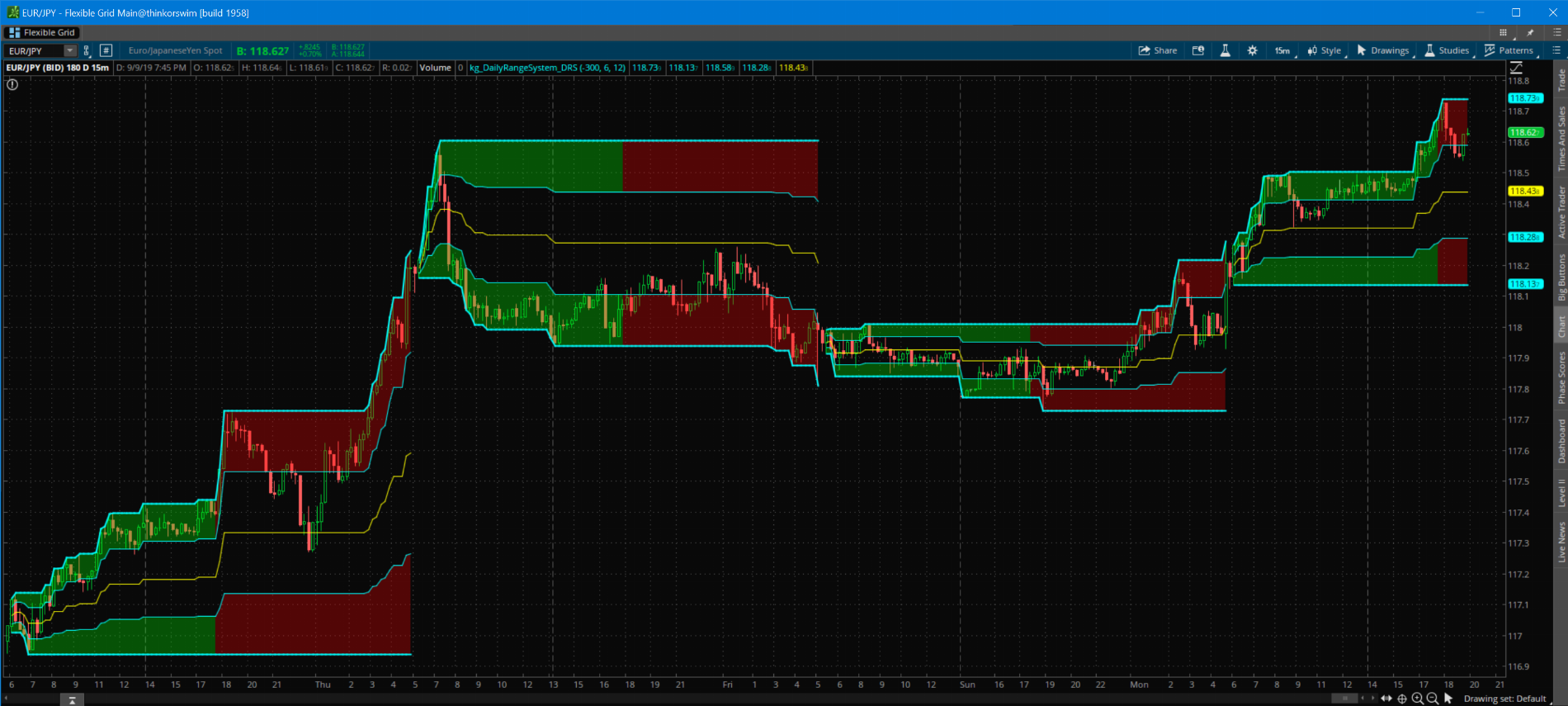

Here is what it looks like on thinkorswim

Code for DRS

Link to the study

https://tos.mx/UdEXUb

Happy Trading,

Kory Gill, @korygill

The Daily Range System (DRS) is an indicator @BenTen found on TradingView, and I ported it to thinkorswim.

See these pages for more info on how to use this indicator.

https://www.tradingview.com/script/VpEHwgys-DRS-Daily-Range-System/ and https://www.forexfactory.com/showthread.php?t=743125

Here is what it looks like on thinkorswim

Code for DRS

Code:

#

# DailyRangeSystem_DRS

#

# Author: Kory Gill, @korygill

#

# Created from idea on https://www.tradingview.com/script/VpEHwgys-DRS-Daily-Range-System/

# Original idea is from https://www.forexfactory.com/showthread.php?t=743125

#

# VERSION HISTORY (sortable date and time (your local time is fine), and your initials

# 20190909-1200-KG - Created.

# ...

# ...

input timeFromEST = -300; #hint timeFromEST: 24hr time from EST timezone

input starthr = 6; #hint start: 24hr format hour start time for DRS

input duration = 12; #hint duration: hours for 1st DRS cycle

def exhr = if starthr+duration > 24 then starthr+duration-24 else starthr+duration;

def start = starthr*100 - timeFromEST;

def nan = Double.NaN;

def bn = BarNumber();

def hi = if bn < 2 then high

else if SecondsFromTime(start) == 0

then high else if high > hi[1]

then high

else hi[1];

def lo = if bn < 2 then low

else if SecondsFromTime(start) == 0

then low else if low < lo[1]

then low

else lo[1];

def mi = (hi + lo) * 0.50;

def m75 = 0.75 * hi + 0.25 * lo;

def m25 = 0.25 * hi + 0.75 * lo;

def sft = SecondsFromTime(start);

plot p1 = if sft[-1] == 0 then nan else hi;

plot p2 = if sft[-1] == 0 then nan else lo;

plot p3 = if sft[-1] == 0 then nan else m75;

plot p4 = if sft[-1] == 0 then nan else m25;

plot p5 = if sft[-1] == 0 then nan else mi;

p1.SetDefaultColor(Color.Cyan);

p2.SetDefaultColor(Color.Cyan);

p3.SetDefaultColor(Color.Cyan);

p4.SetDefaultColor(Color.Cyan);

p5.SetDefaultColor(Color.Yellow);

p1.SetLineWeight(2);

p2.SetLineWeight(2);

def elapsed = SecondsFromTime(start);

def durationSeconds = duration*60*60;

AddCloud(

if elapsed <= durationSeconds and elapsed >= 0 then p1 else nan,

if elapsed <= durationSeconds and elapsed >= 0 then p3 else nan,

Color.GREEN, Color.GREEN);

AddCloud(

if elapsed >= durationSeconds or elapsed <= 0 then p1 else nan,

if elapsed >= durationSeconds or elapsed <= 0 then p3 else nan,

Color.RED, Color.RED);

AddCloud(

if elapsed <= durationSeconds and elapsed >= 0 then p2 else nan,

if elapsed <= durationSeconds and elapsed >= 0 then p4 else nan,

Color.GREEN, Color.GREEN);

AddCloud(

if elapsed >= durationSeconds or elapsed <= 0 then p2 else nan,

if elapsed >= durationSeconds or elapsed <= 0 then p4 else nan,

Color.RED, Color.RED);Link to the study

https://tos.mx/UdEXUb

Happy Trading,

Kory Gill, @korygill

Attachments

Last edited: