You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Hi @Ramoz,Scalper v3 is not working for me. Any suggestion?

Here is a share link to Scalper v3 https://tos.mx/spaiQtI. If that doesn't resolve the issue, I will need you to be a bit more specific as to what is happening. A screenshot would be a huge help. Let me know if the share link resolves the issue. Happy trading!

latinbori123456

Member

I have a quick question about the c3 max red and green zones.

What exactly makes the zones move up and down? I ask because I have nearly 100% win rate when shorting a stock on a green zone support break to downside and going long on a red resistance break to the upside.

When I short a red zone support break to the downside or go long on a green resistance break on the upside, I tend to get faked out a lot and have taken more losses that way.

This is on a 5 min chart on spy, qqq, /ns, /es, ie the highly liquid tickers

Today is a good example. On nq I entered a short at 832 am with after hours onnthe 5 min chart, which is a break to the green support. Rode it down all the way to 12315 area and closed out for a 700 or so point move.

The red zone never moved but the green zone kept band wrapping the entire time down

I know eventually the red zone will come back down and when it does I tend to go long on a resistance break to ride the band wrapping up. I just don’t understand how that works and what the YCOB and YCOS lines signify in relationship to the zones

Hey Latinbori, I have had the exact same issue. I started testing the Scalper_V3 again and the CC_V5. I did better with the CCV5. Can you show an example on your chart where you had your 100% win rate. I would like to analyze it.@Christopher84

I have a quick question about the c3 max red and green zones.

What exactly makes the zones move up and down? I ask because I have nearly 100% win rate when shorting a stock on a green zone support break to downside and going long on a red resistance break to the upside.

When I short a red zone support break to the downside or go long on a green resistance break on the upside, I tend to get faked out a lot and have taken more losses that way.

This is on a 5 min chart on spy, qqq, /ns, /es, ie the highly liquid tickers

Today is a good example. On nq I entered a short at 832 am with after hours onnthe 5 min chart, which is a break to the green support. Rode it down all the way to 12315 area and closed out for a 700 or so point move.

The red zone never moved but the green zone kept band wrapping the entire time down

I know eventually the red zone will come back down and when it does I tend to go long on a resistance break to ride the band wrapping up. I just don’t understand how that works and what the YCOB and YCOS lines signify in relationship to the zones

latinbori123456

Member

Hey Latinbori, I have had the exact same issue. I started testing the Scalper_V3 again and the CC_V5. I did better with the CCV5. Can you show an example on your chart where you had your 100% win rate. I would like to analyze it.

Turn on extended hours and Look at nq today from 8:30 am market time.

I got lucky and entered on the big red candle but then added a short 9:40 am est.

From there I just watched the green band wrap and bought to cover when I saw the resistance stop moving down. I also used the 5 and 21 EMA and bollinger bands to watch the trend. I closed at 10:55 am market time

latinbori123456

Member

Turn on extended hours and Look at nq today from 8:30 am market time.

I got lucky and entered on the big red candle but then added a short 9:40 am est.

From there I just watched the green band wrap and bought to cover when I saw the resistance stop moving down. I also used the 5 and 21 EMA and bollinger bands to watch the trend. I closed at 10:55 am market time

This may help

Starting at 12:10. I think it just answered my question lol

Hi @latinbori123456,@Christopher84

I have a quick question about the c3 max red and green zones.

What exactly makes the zones move up and down? I ask because I have nearly 100% win rate when shorting a stock on a green zone support break to downside and going long on a red resistance break to the upside.

When I short a red zone support break to the downside or go long on a green resistance break on the upside, I tend to get faked out a lot and have taken more losses that way.

This is on a 5 min chart on spy, qqq, /ns, /es, ie the highly liquid tickers

Today is a good example. On nq I entered a short at 832 am with after hours onnthe 5 min chart, which is a break to the green support. Rode it down all the way to 12315 area and closed out for a 700 or so point move.

The red zone never moved but the green zone kept band wrapping the entire time down

I know eventually the red zone will come back down and when it does I tend to go long on a resistance break to ride the band wrapping up. I just don’t understand how that works and what the YCOB and YCOS lines signify in relationship to the zones

There are 2 different ways that the red (OB Zone) and green (OS Zones) will form. The first works very similarly to the calculation for the coloring of the Consensus Candles. It's taking a Consensus between 7 different studies on OB/OS conditions. If more than 4 of the studies agree on OB or OS condition, then the OB/OS Zone will begin to plot. The second way the zones can be triggered is a bit more complex and it involves the STARC and Keltner Channels. This is also used to determine the YCOB and YCOS lines. These occur when price has become heavily diverged from the average.

Congratulations on your 100% win rate! Your approach will work really well on lower timeframes where the bands activate much more frequently. A lot of traders find themselves in the contrarian mindset (whether intentionally or unintentionally), but the truth is when price is trending heavily, its not uncommon to see price maintain OB or OS conditions for extended periods of time. The old adage of the market can stay OB or OS longer than a trader can stay liquid applies well here. The trend almost always favors the most recently active OB or OS band. I hope this helps!

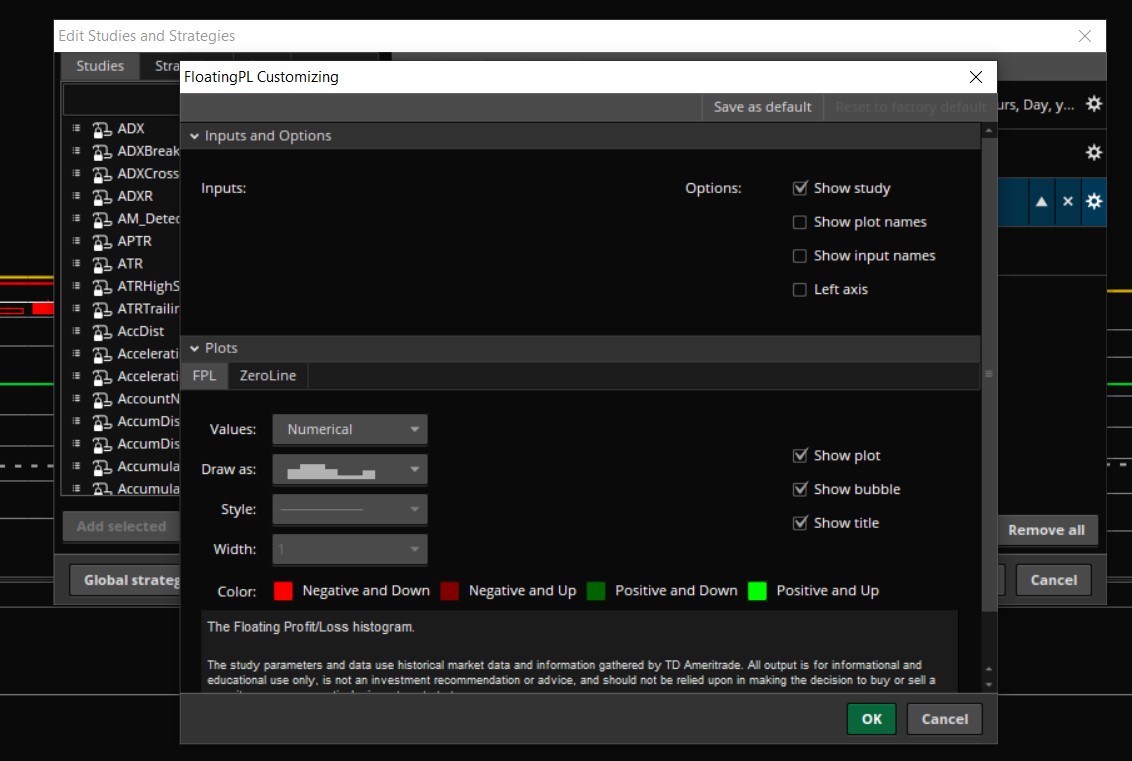

Thanks for your update. Its is working with /ES and time frame 1 min but the lower study is not working, also with higher time frame 3 mins, 15 mins or higher are not working. When i tried with other stocks and higher time frame it also did not work.Hi @Ramoz,

Here is a share link to Scalper v3 https://tos.mx/spaiQtI. If that doesn't resolve the issue, I will need you to be a bit more specific as to what is happening. A screenshot would be a huge help. Let me know if the share link resolves the issue. Happy trading!

Hi @Ramoz,Thanks for your update. Its is working with /ES and time frame 1 min but the lower study is not working, also with higher time frame 3 mins, 15 mins or higher are not working. When i tried with other stocks and higher time frame it also did not work.

Scalper v3 is a MultiTimeFrame (MTF) indicator. The default settings for Scalper v3 has agperiod1 set to 2 min. This means the indicator will not show on a timeframe higher than a 2 min chart (ie 3 min chart or higher) unless the settings are adjusted. If you want to see the Scalper on a 3 min chart try adjusting agperiod1 to 3 min and agperiod2 to 5 min. All of that being said, Scalper v3 was designed to work on lower timeframes. Also, it looks as though you have fit studies selected in your chart settings, the targets will plot better if you turn this setting off. Hope this helps!

latinbori123456

Member

Hi @latinbori123456,

There are 2 different ways that the red (OB Zone) and green (OS Zones) will form. The first works very similarly to the calculation for the coloring of the Consensus Candles. It's taking a Consensus between 7 different studies on OB/OS conditions. If more than 4 of the studies agree on OB or OS condition, then the OB/OS Zone will begin to plot. The second way the zones can be triggered is a bit more complex and it involves the STARC and Keltner Channels. This is also used to determine the YCOB and YCOS lines. These occur when price has become heavily diverged from the average.

Congratulations on your 100% win rate! Your approach will work really well on lower timeframes where the bands activate much more frequently. A lot of traders find themselves in the contrarian mindset (whether intentionally or unintentionally), but the truth is when price is trending heavily, its not uncommon to see price maintain OB or OS conditions for extended periods of time. The old adage of the market can stay OB or OS longer than a trader can stay liquid applies well here. The trend almost always favors the most recently active OB or OS band. I hope this helps!

I did notice there is built in STARC bands. Never used them before so I need to learn what the YCOB and YCOS does and how they move. But this is a good place to start. Thanks.

I also would be down for a in depth trading video.Christopher has created some fantastic indicators. Thank you so much! Doe’s anyone have a video on using some of Christopher’s combined indicators, which ones they like the most, time frames, tips and tricks… so I can verify I am analyzing my buy and sell signals correctly? Maybe a Discord to join ?

I agree. That would be very cool.I also would be down for a in depth trading video.

Christopher84 could also help me with version that is as accurate but taking as much as possible out of it and just have the buy sell signals arrows with start line, and stop line only. No targets or labels etc;

To save space an the monitor and CPU so it works faster and has less stuff on the monitor.

I could try to delete some of it but do not won't to mess it up.

Thanks

I agree. That would be very cool.

Christopher84 could also help me with version that is as accurate but taking as much as possible out of it and just have the buy sell signals arrows with start line, and stop line only. No targets or labels etc;

To save space an the monitor and CPU so it works faster and has less stuff on the monitor.

I could try to delete some of it but do not won't to mess it up.

Thanks

I know this would take up a lot of time and its asking a lot. I really do not know how YouTube works with paid patrons or some other platform such as Discord. As many people that Christopher has helped I know many people would join, including myself. The information could be extremely helpful and I bet many more people would join. Especially with how popular these indicator are and how much time Christopher has already devoted... its # 1. It's just a thought and thank you again!Christopher has created some fantastic indicators. Thank you so much! Doe’s anyone have a video on using some of Christopher’s combined indicators, which ones they like the most, time frames, tips and tricks… so I can verify I am analyzing my buy and sell signals correctly? Maybe a Discord to join ?

I use C3 Max Spark + Triple Exhaustion (colored candles off only show arrows) + PLD line and arrows (converted to study) + EMAD lower = goldChristopher has created some fantastic indicators. Thank you so much! Doe’s anyone have a video on using some of Christopher’s combined indicators, which ones they like the most, time frames, tips and tricks… so I can verify I am analyzing my buy and sell signals correctly? Maybe a Discord to join ?

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/