You should upgrade or use an alternative browser.

YungTrader's Ultimate Indicator

- Thread starter YungTraderFromMontana

- Start date

- Status

- Not open for further replies.

poststreet

Member

input LookbackPeriod = 3;

input TimeFrame2 = "DAY";

input TimeFrame3 = "DAY";

input price = close;

input BuyEntry2 = 10;

input SellEntry2 = 10;

#input HideSwings = no;

#input HideCurrentTF = no;

#input HideTimeFrame2 = no;

#input HideTimeFrame3 = no;

#input length1 = 8;

#input length21 = 40;

#input length31 = 4;

#assert(length1 > 0, "'length' must be positive: " + length1);

#def ROC = if price[length1] != 0 then (price / price[length1] - 1) * 100 else 0;

#assert(length21 > 0, "'length' must be positive: " + length21);

#def ROC2 = if price[length21] != 0 then (price / price[length21] - 1) * 100 else 0;

#assert(length31 > 0, "'length' must be positive: " + length31);

#def ROC3 = if price[length21] != 0 then (price / price[length31] - 1) * 100 else 0;

#def xx = roc >= roc2 or roc2 > roc3;

#def yy = roc <= roc2 or roc2 < roc3;

#input BuyEntry3 = 10;

#input SellEntry3 = 10;

#def displace2 = 0;

#def QB3 = Highest(roc, BuyEntry3);

#def QS3 = Lowest(roc, SellEntry3);

#def trueqb3 = QB3[1];

#def trueqs3 = QS3[1];

#def SMaoftruedepth= Average(trueqb3-trueqs3[-displace2], length21);

#def squeeze = (trueqb3 - trueqs3) < (smaoftruedepth/2);

#def bottom = 10;

#def top = -10;

#def goodlong = squeeze or squeeze[1] or squeeze[2];

#def goodshort = roc < trueqb3 or (roc[1] < top);

#def SwingsLagBar = 1;

#def BuyEntry = 3;

#def SellEntry = 3;

#def QB = Highest(high, BuyEntry);

#def QS = Lowest(low, SellEntry);

#def trueqb = QB[1];

#def trueqs = QS[1];

def length = 1;

def displace = 0;

def SMA = Average(price[-displace], length);

#--------------------------------------------------------------

def _highInPeriod1 = Highest(high, LookbackPeriod);

def _lowInPeriod1 = Lowest(low, LookbackPeriod);

#--------------------------------------------------------------

def marketLow1 = if _lowInPeriod1 < _lowInPeriod1[-LookbackPeriod] then _lowInPeriod1 else _lowInPeriod1[-LookbackPeriod];

def _markedLow1 = low == marketLow1;

rec _lastMarkedLow1 = CompoundValue(1, if IsNaN(_markedLow1) then _lastMarkedLow1[1] else if _markedLow1 then low else _lastMarkedLow1[1], low);

#--------------------------------------------------------------

def marketHigh1 = if _highInPeriod1 > _highInPeriod1[-LookbackPeriod] then _highInPeriod1 else _highInPeriod1[-LookbackPeriod];

def _markedHigh1 = high == marketHigh1;

rec _lastMarkedHigh1 = CompoundValue(1, if IsNaN(_markedHigh1) then _lastMarkedHigh1[1] else if _markedHigh1 then high else _lastMarkedHigh1[1], high);

#--------------------------------------------------------------

def Resistance1 = _lastMarkedHigh1;

def Support1 = _lastMarkedLow1;

#--------------------------------------------------------------

#def LowSwingForw = Lowest(low, SwingsLagBar)[-SwingsLagBar];

#def LowSwingBack = Lowest(low, LookbackPeriod)[1];

#def SwingLow = if low < LowSwingForw and low <= LowSwingBack then 1 else 0;

#def LowSwing = if SwingLow then low else Double.NaN;

#--------------------------------------------------------------

#def HighSwingForw = Highest(high, SwingsLagBar)[-SwingsLagBar];

#def HighSwingBack = Highest(high, LookbackPeriod)[1];

#def SwingHigh = if high > HighSwingForw and high >= HighSwingBack then 1 else 0;

#def HighSwing = if SwingHigh then high else Double.NaN;

#--------------------------------------------------------------

def _highInPeriod2 = Highest(high(period = TimeFrame2), LookbackPeriod);

def _lowInPeriod2 = Lowest(low(period = TimeFrame2), LookbackPeriod);

#--------------------------------------------------------------

def marketLow2 = if _lowInPeriod2 < _lowInPeriod2[-LookbackPeriod] then _lowInPeriod2 else _lowInPeriod2[-LookbackPeriod];

def _markedLow2 = low(period = TimeFrame2) == marketLow2;

rec _lastMarkedLow2 = CompoundValue(1, if IsNaN(_markedLow2) then _lastMarkedLow2[1] else if _markedLow2 then low(period = TimeFrame2) else _lastMarkedLow2[1], low(period = TimeFrame2));

#--------------------------------------------------------------

def marketHigh2 = if _highInPeriod2 > _highInPeriod2[-LookbackPeriod] then _highInPeriod2 else _highInPeriod2[-LookbackPeriod];

def _markedHigh2 = high(period = TimeFrame2) == marketHigh2;

rec _lastMarkedHigh2 = CompoundValue(1, if IsNaN(_markedHigh2) then _lastMarkedHigh2[1] else if _markedHigh2 then high(period = TimeFrame2) else _lastMarkedHigh2[1], high(period = TimeFrame2));

#--------------------------------------------------------------

def Resistance2 = _lastMarkedHigh2;

def Support2 = _lastMarkedLow2;

#--------------------------------------------------------------

def _highInPeriod3 = Highest(high(period = TimeFrame3), LookbackPeriod);

def _lowInPeriod3 = Lowest(low(period = TimeFrame3), LookbackPeriod);

#--------------------------------------------------------------

def marketLow3 = if _lowInPeriod3 < _lowInPeriod3[-LookbackPeriod] then _lowInPeriod3 else _lowInPeriod3[-LookbackPeriod];

def _markedLow3 = low(period = TimeFrame3) == marketLow3;

rec _lastMarkedLow3 = CompoundValue(1, if IsNaN(_markedLow3) then _lastMarkedLow3[1] else if _markedLow3 then low(period = TimeFrame3) else _lastMarkedLow3[1], low(period = TimeFrame3));

#--------------------------------------------------------------

def marketHigh3 = if _highInPeriod3 > _highInPeriod3[-LookbackPeriod] then _highInPeriod3 else _highInPeriod3[-LookbackPeriod];

def _markedHigh3 = high(period = TimeFrame3) == marketHigh3;

rec _lastMarkedHigh3 = CompoundValue(1, if IsNaN(_markedHigh3) then _lastMarkedHigh3[1] else if _markedHigh3 then high(period = TimeFrame3) else _lastMarkedHigh3[1], high(period = TimeFrame3));

def Resistance3 = _lastMarkedHigh3;

def Support3 = _lastMarkedLow3;

#--------------------------------------------------------------

def lower_close1 = (SMA crosses below Support1[1]);

def higher_close1 = (SMA crosses above Resistance1[1]);

def lower_close2 = (SMA crosses below Support2[1]);

def higher_close2 = (SMA crosses above Resistance2[1]);

def lower_close3 = (SMA crosses below Support3[1]);

def higher_close3 = (SMA crosses above Resistance3[1]);

#def x = (close > trueqb);

#def c = (close[1] < trueqb[1]);

#def v = (close[2] < trueqb[2]);

#def b = x and (c or v);

#def y = (close > trueqs);

#def w = (close[1] < trueqs[1]);

#def e = (close[2] < trueqs[2]);

#def r = y and (w or e);

def allbreakdown = (lower_close1 or lower_close2 or lower_close3);

def allbreakup = (higher_close1 or higher_close2 or higher_close3);

def QB2 = Highest(high, BuyEntry2);

def QS2 = Lowest(low, SellEntry2);

def trueqb2 = QB2[1];

def trueqs2 = QS2[1];

def ath = (((trueqb2 - trueqb2[3]) / 100) < .10);

def atl = (((trueqs2 - trueqs2[3]) / 100) >= -.10);

plot goldenbuy = (allbreakup or allbreakup[1]) and ((high) > trueqb2) and ath;theopacc13

New member

https://tos.mx/b6sKXQtJust curious is there anycode for harmonics? Like elliot wave theory? All these code are great, just curious if there one that these resistance can be pair with.

television

Member

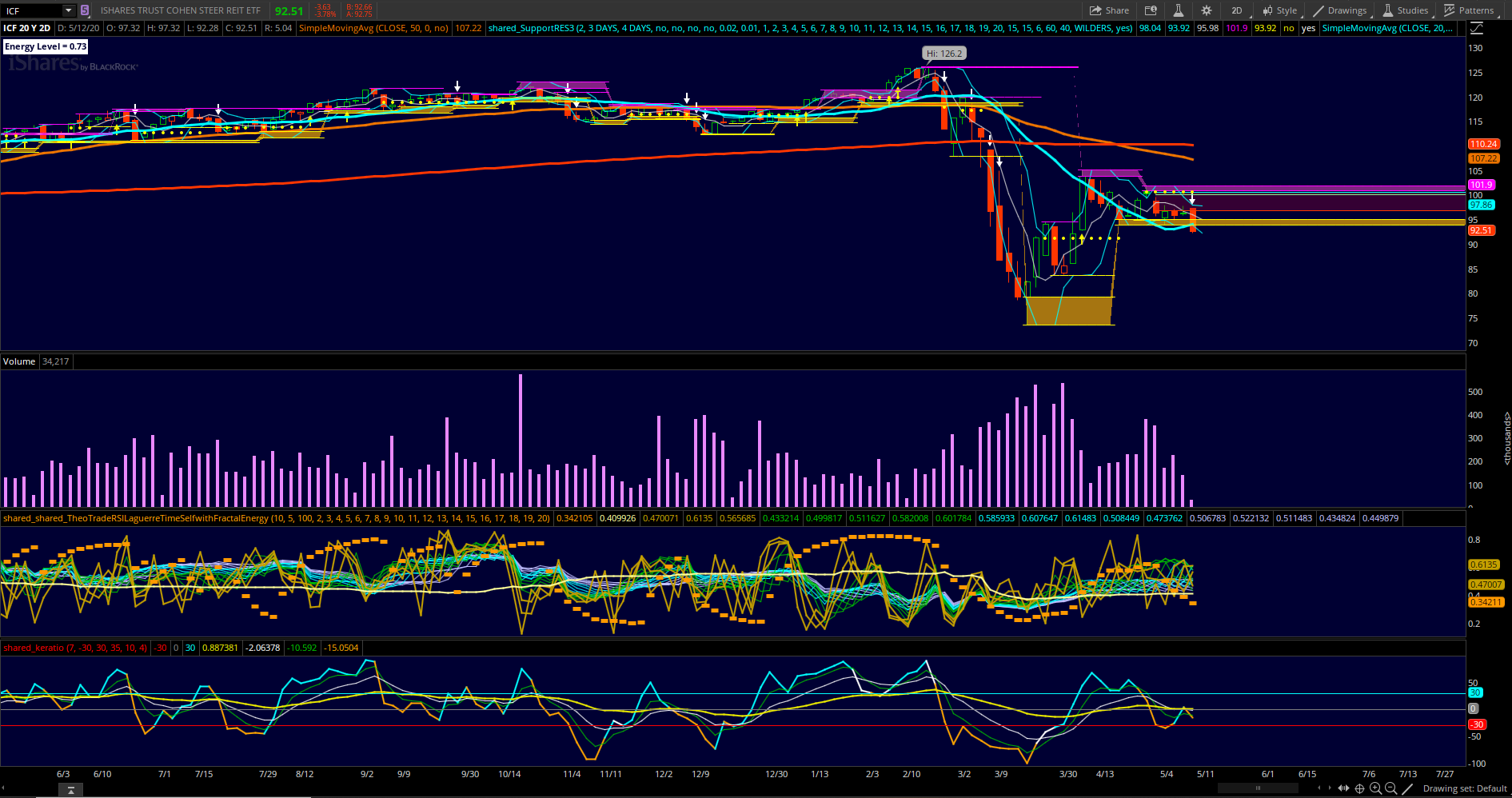

long: czr, vod, oke, ERI (beat earnings, super aptr so careful )

Realestate trust etf^

lookin weak

Thank you, yah i have use that before, i think bubble shows up late after harmonics is completed and its covering too much of the candlestick making it hard to read. If someone can add some lines to pull out those bubble that will be great. I changed the color from green to pink and down bubble to gray to make it more clearer. Thanks though.

YungTraderFromMontana

Well-known member

Atticmonkey81

New member

If you dont mind me asking, what do you base your entry on? I know the scanner is bringing these picks to the surface but when you have one on watch what is your criteria to enter the trade?Made bank in NINE

YungTraderFromMontana

Well-known member

long: OKE, CLVS

short: ZYME, SLG

(editing as I find new ones)

theopacc13

New member

Short: ZM (based off 1 hour chart, looking for a clean breakthrough 56 intraday), CTSH

YungTraderFromMontana

Well-known member

****, I don't know how I missed PDD. Amazing opportunity clear breakout. Nice find, unfortunately risk reward isn't there anymore.Long: PDD (got in this morning), BMY, CZR, TME, ABBV

Short: ZM (based off 1 hour chart, looking for a clean breakthrough 56 intraday), CTSH

Plus it has a MACD Bearish divergence.****, I don't know how I missed PDD. Amazing opportunity clear breakout. Nice find, unfortunately risk reward isn't there anymore.

television

Member

great idea TV!thoughts on making a discord server for the plays, and using this thread for working on the indicator?

television

Member

short: chk, dlr, avb, hpp**, psb <<< most shorts are real estate funds so just pick the one that you like (based on r:R and other factors)

long: czr, vod, oke, ERI (beat earnings, super aptr so careful ), ovv, MUR (oil), pflt, kod, main, aciu

Realestate trust etf^

lookin weak

replyin to the post cuz it was hidden all the way at the top

theopacc13

New member

why not today?Looking at entering short on dlr for next day or two

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

YungTrader's Relative Volume | Indicators | 17 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 | |

| P | Ultimate MACD For ThinkOrSwim | Indicators | 16 | |

|

|

Ultimate RSI [LuxAlgo] for ThinkOrSwim | Indicators | 20 | |

|

|

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading | Indicators | 26 |

Similar threads

-

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

Similar threads

-

-

-

-

-

Ultimate Bullish Cross using Price Momentum and Volume For SwingTrading

- Started by justAnotherTrader

- Replies: 26

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/