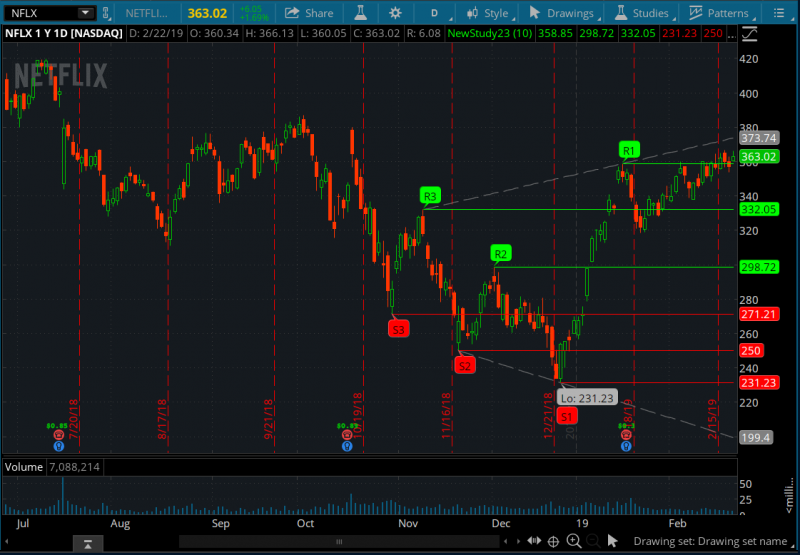

As requested, here is the Wolf Waves indicator for ThinkorSwim. It automatically plots support and resistance on your chart, as well as trend lines that you can use to catch potential breakouts or breakdown.

This indicator was created by Mobius. As mentioned by the author, this is similar to other Pivot Studies that mark different types of breakouts.

This indicator was created by Mobius. As mentioned by the author, this is similar to other Pivot Studies that mark different types of breakouts.

thinkScript Code

Rich (BB code):

# Wolf Waves

# Mobius

# V01.05.22.2018

# User Inputs

input n = 10;

# Internal Script Reference

script LinePlot {

input BarID = 0;

input Value = 0;

input BarOrigin = 0;

def ThisBar = HighestAll(BarOrigin);

def ValueLine = if BarOrigin == ThisBar

then Value

else Double.NaN;

plot P = if ThisBar - BarID <= BarOrigin

then HighestAll(ValueLine)

else Double.NaN;

}

# Variables

def o = open;

def h = high;

def l = low;

def c = close;

def x = BarNumber();

def xN = x == HighestAll(x);

# R1

def hh = fold i = 1 to n + 1

with p = 1

while p

do h > GetValue(h, -i);

def PivotH = if (x > n and

h == Highest(h, n) and

hh)

then h

else Double.NaN;

def PHValue = if !IsNaN(PivotH)

then PivotH

else PHValue[1];

def PHBarOrigin = if !IsNaN(PivotH)

then x

else PHBarOrigin[1];

def PHBarID = x - PHBarOrigin;

# R2

def R2PHValue = if PHBarOrigin != PHBarOrigin[1]

then PHValue[1]

else R2PHValue[1];

def R2PHBarOrigin = if PHBarOrigin != PHBarOrigin[1]

then PHBarOrigin[1]

else R2PHBarOrigin[1];

def R2PHBarID = x - R2PHBarOrigin;

# R3

def R3PHValue = if R2PHBarOrigin != R2PHBarOrigin[1]

then R2PHValue[1]

else R3PHValue[1];

def R3PHBarOrigin = if R2PHBarOrigin != R2PHBarOrigin[1]

then R2PHBarOrigin[1]

else R3PHBarOrigin[1];

def R3PHBarID = x - R3PHBarOrigin;

# S1

def ll = fold j = 1 to n + 1

with q = 1

while q

do l < GetValue(l, -j);

def PivotL = if (x > n and

l == Lowest(l, n) and

ll)

then l

else Double.NaN;

def PLValue = if !IsNaN(PivotL)

then PivotL

else PLValue[1];

def PLBarOrigin = if !IsNaN(PivotL)

then x

else PLBarOrigin[1];

def PLBarID = x - PLBarOrigin;

# S2

def S2PLValue = if PLBarOrigin != PLBarOrigin[1]

then PLValue[1]

else S2PLValue[1];

def S2PLBarOrigin = if PLBarOrigin != PLBarOrigin[1]

then PLBarOrigin[1]

else S2PLBarOrigin[1];

def S2PLBarID = x - S2PLBarOrigin;

# S3

def S3PLValue = if S2PLBarOrigin != S2PLBarOrigin[1]

then S2PLValue[1]

else S3PLValue[1];

def S3PLBarOrigin = if S2PLBarOrigin != S2PLBarOrigin[1]

then S2PLBarOrigin[1]

else S3PLBarOrigin[1];

def S3PLBarID = x - S3PLBarOrigin;

# S4

def S4PLValue = if S3PLBarOrigin != S3PLBarOrigin[1]

then S3PLValue[1]

else S4PLValue[1];

def S4PLBarOrigin = if S3PLBarOrigin != S3PLBarOrigin[1]

then S3PLBarOrigin[1]

else S4PLBarOrigin[1];

def S4PLBarID = x - S4PLBarOrigin;

# S5

def S5PLValue = if S4PLBarOrigin != S4PLBarOrigin[1]

then S4PLValue[1]

else S5PLValue[1];

def S5PLBarOrigin = if S4PLBarOrigin != S4PLBarOrigin[1]

then S4PLBarOrigin[1]

else S5PLBarOrigin[1];

def S5PLBarID = x - S5PLBarOrigin;

# Plots

plot R1 = LinePlot(BarID = PHBarID,

Value = PHValue,

BarOrigin = PHBarOrigin);

R1.SetDefaultColor(Color.GREEN);

AddChartBubble(x == HighestAll(PHBarOrigin), PHValue, "R1", Color.GREEN, 1);

plot R2 = LinePlot(BarID = R2PHBarID,

Value = R2PHValue,

BarOrigin = R2PHBarOrigin);

R2.SetDefaultColor(Color.GREEN);

AddChartBubble(x == HighestAll(R2PHBarOrigin), PHValue, "R2", Color.GREEN, 1);

plot R3 = LinePlot(BarID = R3PHBarID,

Value = R3PHValue,

BarOrigin = R3PHBarOrigin);

R3.SetDefaultColor(Color.GREEN);

AddChartBubble(x == HighestAll(R3PHBarOrigin), PHValue, "R3", Color.GREEN, 1);

plot S1 = LinePlot(BarID = PLBarID,

Value = PLValue,

BarOrigin = PLBarOrigin);

S1.SetDefaultColor(Color.RED);

AddChartBubble(x == HighestAll(PLBarOrigin), PLValue, "S1", Color.RED, 0);

plot S2 = LinePlot(BarID = S2PLBarID,

Value = S2PLValue,

BarOrigin = S2PLBarOrigin);

S2.SetDefaultColor(Color.RED);

AddChartBubble(x == HighestAll(S2PLBarOrigin), PLValue, "S2", Color.RED, 0);

plot S3 = LinePlot(BarID = S3PLBarID,

Value = S3PLValue,

BarOrigin = S3PLBarOrigin);

S3.SetDefaultColor(Color.RED);

AddChartBubble(x == HighestAll(S3PLBarOrigin), PLValue, "S3", Color.RED, 0);

# Trend Line

plot SupportLine2 = if x == HighestAll(S2PLBarOrigin)

then S2

else if x == HighestAll(PLBarOrigin)

then S1 #Parentlow

else Double.NaN;

SupportLine2.EnableApproximation();

SupportLine2.SetDefaultColor(Color.GRAY);

SupportLine2.SetLineWeight(1);

SupportLine2.SetStyle(Curve.LONG_DASH);

def slope2 = (S2 - S1) /

(HighestAll(S2PLBarOrigin) - PLBarOrigin);

plot ExtLine2 = if x >= S2PLBarOrigin

then (x - HighestAll(S2PLBarOrigin)) * slope2 + S2

else Double.NaN;

ExtLine2.EnableApproximation();

ExtLine2.SetDefaultColor(Color.GRAY);

ExtLine2.SetLineWeight(1);

ExtLine2.SetStyle(Curve.LONG_DASH);

plot SupportLine3 = if x == HighestAll(R3PHBarOrigin)

then R3

else if x == PHBarOrigin

then R1

else Double.NaN;

SupportLine3.EnableApproximation();

SupportLine3.SetDefaultColor(Color.GRAY);

SupportLine3.SetLineWeight(1);

SupportLine3.SetStyle(Curve.LONG_DASH);

def slope3 = (R1 - R3) /

(HighestAll(PHBarOrigin) - R3PHBarOrigin);

plot ExtLine3 = if x >= R3PHBarOrigin

then (x - HighestAll(R3PHBarOrigin)) * slope3 + R3

else Double.NaN;

ExtLine3.EnableApproximation();

ExtLine3.SetDefaultColor(Color.GRAY);

ExtLine3.SetLineWeight(1);

ExtLine3.SetStyle(Curve.LONG_DASH);Shareable Link

https://tos.mx/Wj3rEc

Last edited: