https%3A//i.imgur.com/nxtRVAi.png[/img]']thanks for the help https%3A//i.imgur.com/PWL52z5.png[/img]']Here's the images. Yes, they are both set to auto.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Volume Profile Indicator & POCs For ThinkOrSwim

- Thread starter gilda

- Start date

They are both set to the same exact settings. I want to display the VAHigh and low

Try adjusting: Chart Settings --> Time Axis --> Scale (check Keep time zoom)

Yes, they are both checked.Try adjusting: Chart Settings --> Time Axis --> Scale (check Keep time zoom)

Try sharing your chart grid and we can look at how you have it set upYes, they are both checked.

chart grid? I posted both examples, it seems to look better on 5min charts for some reason, but still a big differenceTry sharing your chart grid and we can look at how you have it set up

Finally figured it out, it was in the auto expansion setting for studies is unchecked.chart grid? I posted both examples, it seems to look better on 5min charts for some reason, but still a big difference

Hey John, I stumbled across your/this posting after realizing what you mentioned during my weekend review; the think or swim VPOC indicator think script shows that the time period definitions are via aggregate value calculations (this realization started with me noticing that the weekly VPOC on a daily chart (time per profile = week, expansion = no) was different from the weekly VPOC on an intraday chart (expansion = yes, time per profile = chart). Would you happen to have a script that fixes this issue?This one has everything you asked for and more.

I have never used it with equities, only with futures. Be careful with the volume or TPO profile in TOS, it uses aggregated values, not a true tick, so it might lag the real profile, especially intraday. In addition, the values for different time frames often do not match.

Code:#v1.1 - 5/10/18 #- Able to get Implied Volatity at any specified time. Default set to 9PM est #- Modified Settlement to take closing price of the last bar of the day. Previous version used "Closing Price" at 16:15 which was usually nowhere near ending settlement #- Added option to substitute symbol used in IV/Deviation calculation for instruments with #no option chains such as /NKD #- Added customizable deviation line (hidden as default) #=========================== #Steps if you want your VA to match u/uberbotman's: #1) Set your chart to 30M, and show extended hours #2) Go to options, make sure ShowLabels is set to "Yes" (hit apply if needed) #3) Copy VAH, POC and VAL from the labels in the top left corner of your chart into Manual input locations #4) Set Value Area Area Mode to Manual declare upper; declare once_per_bar; #============================ #Inputs #============================ input SetMode = {default Auto, Manual};#Hint SetMode: Select Auto to update Settlement automatically in input manually. \n\n NOTE: ToS doesn't support Settlement so LAST closing price is used. This is usually pretty close to within a single tick, but Manually entering Settlement from CME website or UBM's nightly post is more accurate input Settlement = 2444.50;#Hint Settlement: Enter Settlement value when SetMode is set to Manual input IVMode = {default Auto, Manual};#Hint IVMode: Select Auto to update Implied Volatility at time chosen on IVSettleTime input IVSettleTime = 2100;#Hint IVSettleTime: Enter time_value of desired Implied Volatility "settlement" \n\n NOTE: If time selected is not visible on chart (i.e. 2100 on a chart not showing extended trading hours), IV will not calculate input Volatility = 11.2;#Hint Volatility: Enter Implied Volatility value when IVMode is set to Manual input IVSymbolMode = {default Auto, Manual};#Hint IVSymbolMode: Select Manual if you wish to use a different instrument's IV instead of what is on the chart input Symbol = "EWJ";#Hint Symbol: Enter symbol of Implied Volatility you wish to substitute with. For use with products with no option chains (i.e. /NKD) input ValueAreaMode = {default Auto, Manual};#Hint ValueAreaMode: Select Auto to update Value Areas automatically and is rounded to the nearest tick. Manual selection changes Value Area for today only \n\n NOTE: Value Area is typically calculated on a 30min chart, if the timeframe changes, then calculated value area may also change. To lock in the values from the 30min chart follow these steps: \n#1) Set your chart to 30M, and show extended hours \n#2) Go to options, make sure ShowLabels is set to "Yes" (hit apply if needed) \n#3) Copy VAH, POC and VAL from the labels showing in the top left corner of the chart into the Manual input locations \n#4) Set Value Area Area Mode to Manual and hit Apply input ValueAreaHigh = 2445.00;#Hint ValueAreaHigh: Enter Value Area High when ValueAreaMode is set to Manual input PointOfControl = 2442.00;#Hint PointOfControl: Enter Point of Control when ValueAreaMode is set to Manual input ValueAreaLow = 2440.00;#Hint ValueAreaLow: Enter Value Area Low when ValueAreaMode is set to Manual input ShowTodayOnly = {default "No", "Yes"};#Hint ShowTodayOnly: Show/Hide chart plots for previous days input ShowBubbles = {"No", default "Yes"};#Hint ShowBubbles: Show/Hide chart bubbles input ShowCloud = {"No", default "Yes"};#Hint ShowCloud: Show/Hide Value Area cloud input ShowLabels = {"No", default "Yes"};#Hint ShowLabels: Show/Hide Labels with Value Area data and IV used for Std Deviation calculations in Auto setting input ProfileType = {default Volume, Time};#Hint ProfileType: Switch between Volume Profile and Time Profile input valueAreaPercent = 70;#Hint valueAreaPercent: Set the size of the Value Area input ShowVWAP = {"No", default "Yes"};#Hint ShowVWAP: Show daily VWAP input CustomDev = 3.5;#Hint CustomDev: Enter custom deviation line #============================ #Std Dev Calc / Plot #============================ def CloseTime2 = SecondsTillTime(0000) >= 0; def OpenTime2 = SecondsFromTime(1700) >= 0; def MarketOpen = OpenTime2 and CloseTime2; def NewDay = IsNaN(close(period = “Day”)[-1]); def Chart = MarketOpen and NewDay; def bar = BarNumber(); def SettleTime = 1800; rec SetTimeValue = if(secondstilltime(SettleTime)== 0,close()[1],SetTimeValue[1]); def SetAtTime = if(SetTimeValue == 0, double.nan,SetTimeValue); def Set = if SetMode == SetMode."Manual" and NewDay then Settlement else SetAtTime; rec IVTimeValue = if(secondstilltime(IVSettleTime)== 0,imp_volatility(symbol = if IVSymbolMode == IVSymbolMode."Auto" then GetSymbol() else Symbol)[1],IVTimeValue[1]); def IVSet = if(IVTimeValue==0, double.nan,IVTimeValue); def Vol = if IVMode == IVMode."Manual" and NewDay then Volatility else IVSet; def a = Vol; def b = a / Sqrt(252); def SD = b * Set; plot Settle = Round(If (MarketOpen, Set, If (ShowTodayOnly, Double.NaN, Set)) / TickSize(), 0) * TickSize(); Settle.SetDefaultColor(Color.DARK_GREEN); Settle.SetStyle(Curve.FIRM); Settle.SetLineWeight(2); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, Settle, "Set", Color.DARK_GREEN, no); plot StdDev025H = Round(If (Chart, Set + (SD * 0.25), If (ShowTodayOnly, Double.NaN, Set + (SD * 0.25))) / TickSize(), 0) * TickSize(); StdDev025H.SetDefaultColor(Color.GRAY); StdDev025H.SetStyle(Curve.SHORT_DASH); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev025H, "0.25 Std Dev ", Color.GRAY, no); plot StdDev05H = Round(If (Chart, Set + (SD * 0.5), If (ShowTodayOnly, Double.NaN, Set + (SD * 0.5))) / TickSize(), 0) * TickSize(); StdDev05H.SetDefaultColor(Color.CYAN); StdDev05H.SetStyle(Curve.SHORT_DASH); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev05H, "0.5 Std Dev ", Color.CYAN, no); plot StdDev1H = Round(If (Chart, Set + (SD * 1), If (ShowTodayOnly, Double.NaN, Set + (SD * 1))) / TickSize(), 0) * TickSize(); StdDev1H.SetDefaultColor(Color.VIOLET); StdDev1H.SetStyle(Curve.LONG_DASH); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev1H, "1 Std Dev", Color.VIOLET, no); plot StdDev1_5H = Round(If (Chart, Set + (SD * 1.5), If (ShowTodayOnly, Double.NaN, Set + (SD * 1.5))) / TickSize(), 0) * TickSize(); StdDev1_5H.SetDefaultColor(Color.PLUM); StdDev1_5H.SetStyle(Curve.LONG_DASH); #AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev1_5H, "1.5 Std Dev", Color.PLUM, no); plot StdDev2H = Round(If (Chart, Set + (SD * 2), If (ShowTodayOnly, Double.NaN, Set + (SD * 2))) / TickSize(), 0) * TickSize(); StdDev2H.SetDefaultColor(Color.PLUM); StdDev2H.SetStyle(Curve.FIRM); StdDev2H.SetLineWeight(3); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev2H, "2 Std Dev", Color.PLUM, no); plot StdDev3H = Round(If (Chart, Set + (SD * 3), If (ShowTodayOnly, Double.NaN, Set + (SD * 3))) / TickSize(), 0) * TickSize(); StdDev3H.SetDefaultColor(Color.DARK_RED); StdDev3H.SetStyle(Curve.FIRM); StdDev3H.SetLineWeight(3); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev3H, "3 Std Dev", Color.DARK_RED, no); plot StdDev025L = Round(If (Chart, Set + (SD * -0.25), If (ShowTodayOnly, Double.NaN, Set + (SD * -0.25))) / TickSize(), 0) * TickSize(); StdDev025L.SetDefaultColor(Color.GRAY); StdDev025L.SetStyle(Curve.SHORT_DASH); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev025L, "-0.25 Std Dev", Color.GRAY, no); plot StdDev05L = Round(If (Chart, Set + (SD * -0.5), If (ShowTodayOnly, Double.NaN, Set + (SD * -0.5))) / TickSize(), 0) * TickSize(); StdDev05L.SetDefaultColor(Color.CYAN); StdDev05L.SetStyle(Curve.SHORT_DASH); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev05L, "-0.5 Std Dev", Color.CYAN, no); plot StdDev1L = Round(If (Chart, Set + (SD * -1), If (ShowTodayOnly, Double.NaN, Set + (SD * -1))) / TickSize(), 0) * TickSize(); StdDev1L.SetDefaultColor(Color.VIOLET); StdDev1L.SetStyle(Curve.LONG_DASH); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev1L, "1 Std Dev", Color.VIOLET, no); plot StdDev1_5L = Round(If (Chart, Set + (SD * -1.5), If (ShowTodayOnly, Double.NaN, Set + (SD * -1.5))) / TickSize(), 0) * TickSize(); StdDev1_5L.SetDefaultColor(Color.PLUM); StdDev1_5L.SetStyle(Curve.LONG_DASH); #AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev1_5L, "-1.5 Std Dev", Color.PLUM, no); plot StdDev2L = Round(If (Chart, Set + (SD * -2), If (ShowTodayOnly, Double.NaN, Set + (SD * -2))) / TickSize(), 0) * TickSize(); StdDev2L.SetDefaultColor(Color.PLUM); StdDev2L.SetStyle(Curve.FIRM); StdDev2L.SetLineWeight(3); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev2L, "-2 Std Dev", Color.PLUM, no); plot StdDev3L = Round(If (Chart, Set + (SD * -3), If (ShowTodayOnly, Double.NaN, Set + (SD * -3))) / TickSize(), 0) * TickSize(); StdDev3L.SetDefaultColor(Color.DARK_RED); StdDev3L.SetStyle(Curve.FIRM); StdDev3L.SetLineWeight(3); AddChartBubble(bar == HighestAll(bar) and ShowBubbles, StdDev3L, "-3 Std Dev", Color.DARK_RED, no); plot CustDev = Round(If (Chart, Set + (SD * CustomDev), If (ShowTodayOnly, Double.NaN, Set + (SD * CustomDev))) / TickSize(), 0) * TickSize(); CustDev.Hide(); CustDev.SetDefaultColor(Color.YELLOW); CustDev.SetStyle(Curve.FIRM); CustDev.SetLineWeight(2); # ================================= # Volume Profile Definition Section # ================================= def profiles = 50; def customRowHeight = 1.0; def multiplier = 1; def onExpansion = ShowTodayOnly; def yyyymmdd = GetYYYYMMDD(); def seconds = SecondsFromTime(0); def period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1; def month = GetYear() * 12 + GetMonth(); def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd)); def dom = GetDayOfMonth(yyyymmdd); def dow = GetDayOfWeek(yyyymmdd - dom + 1); def expthismonth = (if dow > 5 then 27 else 20) - dow; def exp_opt = month + (dom > expthismonth); def height = PricePerRow.TICKSIZE; rec count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % multiplier else count[1], 0); def cond = count < count[1] + period - period[1]; #============================ # Plot POC VAH VAL Section #============================ profile tpo = if ProfileType == ProfileType.Volume then VolumeProfile("startNewProfile" = cond, "onExpansion" = onExpansion, "numberOfProfiles" = profiles, "pricePerRow" = height, "value area percent" = valueAreaPercent) else TimeProfile("startNewProfile" = cond, "onExpansion" = onExpansion, "numberOfProfiles" = profiles, "pricePerRow" = height, "value area percent" = valueAreaPercent); rec PC = if cond == 1 then tpo.GetPointOfControl()[1] else PC[1]; plot POC = Round(If(ValueAreaMode == ValueAreaMode."Auto", PC, if NewDay then PointOfControl else PC) / TickSize(), 0) * TickSize(); POC.SetDefaultColor(Color.DARK_RED); POC.SetStyle(Curve.FIRM); POC.SetLineWeight(2); rec hVA = if cond == 1 then tpo.GetHighestValueArea()[1] else hVA[1]; plot VAH = Round(If(ValueAreaMode == ValueAreaMode."Auto", hVA, if NewDay then ValueAreaHigh else hVA) / TickSize(), 0) * TickSize(); VAH.SetDefaultColor(Color.RED); VAH.SetStyle(Curve.FIRM); rec lVA = if cond == 1 then tpo.GetLowestValueArea()[1] else lVA[1]; plot VAL = Round(If(ValueAreaMode == ValueAreaMode."Auto", lVA, if NewDay then ValueAreaLow else lVA) / TickSize(), 0) * TickSize(); ; VAL.SetDefaultColor(Color.GREEN); VAL.SetStyle(Curve.FIRM); #============================ # VWAP Plot #============================ def VWAP1 = Round(vwap(period = AggregationPeriod.DAY) / TickSize(), 0) * TickSize(); plot VWAP = if ShowVWAP > 0 then VWAP1 else Double.NaN; VWAP.SetPaintingStrategy(PaintingStrategy.DASHES); VWAP.SetDefaultColor(Color.DARK_GRAY); #============================ #Value Area Cloud & Labels #============================ def VArea = Between(close, VAL, VAH); def VAreaAbove = close > VAH; def VAreaBelow = close < VAL; def Cloudhigh = if ShowCloud then VAH else Double.NaN; def Cloudlow = if ShowCloud then VAL else Double.NaN; AddCloud(CloudHigh, CloudLow, GlobalColor("cloud"), GlobalColor("cloud")); DefineGlobalColor("cloud", Color.DARK_GRAY); AddLabel(ShowLabels, Concat("VAH:", Round(VAH)), if close > VAH then Color.GREEN else Color.RED) ; AddLabel(ShowLabels, Concat("POC:", Round(POC)), if close > POC then Color.GREEN else Color.RED); AddLabel(ShowLabels, Concat("VAL:", Round(VAL)), if close > VAL then Color.GREEN else Color.RED); AddLabel(ShowLabels, Concat("VWAP: ", Round(VWAP1)), Color.LIGHT_ORANGE); AddLabel(ShowLabels, "IV: " + AsPercent(IVSet), if IsAscending(imp_volatility(period = AggregationPeriod.DAY, priceType = PriceType.LAST)[1]) then Color.RED else if IsDescending(imp_volatility(period = AggregationPeriod.DAY, priceType = PriceType.LAST)[1]) then Color.GREEN else Color.WHITE); AddLabel(ShowLabels, if VArea then "Inside Value Area" else if VAreaAbove then "Above Value Area" else "Below Value Area", if VArea then Color.ORANGE else if VAreaAbove then Color.GREEN else Color.RED); #============================ # Alerts: #============================ input alerttext = "Entry/Exit Point"; # BLOCK CODE BELOW input UseAlerts = {false, default true}; input AlertType = {default "BAR", "ONCE", "TICK"}; def at = AlertType; input AlertSound = {default "Bell", "Chimes", "Ding", "NoSound", "Ring"}; def Signal = (close crosses POC) or (close crosses VAH) or (close crosses VAL) or (close crosses StdDev05H) or (close crosses StdDev1H) or (close crosses StdDev2H) or (close crosses StdDev05L) or (close crosses StdDev1L) or (close crosses StdDev2L); Alert(UseAlerts and Signal, alerttext, if at == 1 then Alert.ONCE else if at == 2 then Alert.TICK else Alert.BAR, AlertSound);

Did anyone realize that the VPOC for stocks changes based on the time frame chosen. I noticed this while analyzing the VPOC for FUBO from 07/01/21 - 07/23/2021, expansion = yes. The VPOC for the 5 minute time frame is higher than the VPOC for the 15 minute time frame during the same time period. Which one is correct? Does anyone know why this is the case?

Hey Sleepy, do you agree that there is an issue with the Week definition in this script since it seems to be based on the past 7 days? I thought it was an issue since I incorrectly thought the weekly VPOC read was for the specific trading week and not inclusive of data from the previous week. Or am I interpreting this incorrectly?Thank you, I was referring to the RTH version. What you may be seeing with the #64 code is that did not have an option for

pricePerRowHeightMode rather than just automatic. So if you are comparing that code to a stock volume profile the previous day set at 'custom or tick' rather than automatic, you might see a difference. I have adjusted the script to allow for options for row height.

Code:#VolumeProfile_PreviousDay_displayed_NextDay #20190426 Sleepyz #20210712 Sleepyz - revised to add option for pricePerRowHeightMode rather than just automatic input pricePerRowHeightMode = {default AUTOMATIC, TICKSIZE, CUSTOM}; input customRowHeight = 1.0; def height; switch (pricePerRowHeightMode) { case AUTOMATIC: height = PricePerRow.AUTOMATIC; case TICKSIZE: height = PricePerRow.TICKSIZE; case CUSTOM: height = customRowHeight; } input timePerProfile = {CHART, MINUTE, HOUR, default DAY, WEEK, MONTH, "OPT EXP", BAR}; input multiplier = 1; input profiles = 1000; input valueAreaPercent = 70; def period; def yyyymmdd = GetYYYYMMDD(); def seconds = SecondsFromTime(0); def month = GetYear() * 12 + GetMonth(); def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd)); def dom = GetDayOfMonth(yyyymmdd); def dow = GetDayOfWeek(yyyymmdd - dom + 1); def expthismonth = (if dow > 5 then 27 else 20) - dow; def exp_opt = month + (dom > expthismonth); switch (timePerProfile) { case CHART: period = 0; case MINUTE: period = Floor(seconds / 60 + day_number * 24 * 60); case HOUR: period = Floor(seconds / 3600 + day_number * 24); case DAY: period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1; case WEEK: period = Floor(day_number / 7); case MONTH: period = Floor(month - First(month)); case "OPT EXP": period = exp_opt - First(exp_opt); case BAR: period = BarNumber() - 1; } def count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % multiplier else count[1], 0); def cond = count < count[1] + period - period[1]; profile vol = VolumeProfile("startNewProfile" = cond, "numberOfProfiles" = profiles, "pricePerRow" = height, "value area percent" = valueAreaPercent, onExpansion = no); #Prior Day High/Low ValueAreas def HVA = if IsNaN(vol.GetHighestValueArea()) then HVA[1] else vol.GetHighestValueArea(); def pHVA = CompoundValue(1, if cond then HVA[1] else pHVA[1], Double.NaN); def LVA = if IsNaN(vol.GetLowestValueArea()) then LVA[1] else vol.GetLowestValueArea(); def pLVA = CompoundValue(1, if cond then LVA[1] else pLVA[1], Double.NaN); plot PrevHVA = pHVA; plot PrevLVA = pLVA; PrevHVA.SetDefaultColor(Color.YELLOW); PrevLVA.SetDefaultColor(Color.YELLOW); PrevHVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); PrevLVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); #Prior Day POC Calculated def POC = if IsNaN(vol.GetPointOfControl()) and cond then POC[1] else vol.GetPointOfControl(); def pPOC = CompoundValue (1, if cond then POC[1] else pPOC[1], Double.NaN); plot PrevPOC = pPOC; PrevPOC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); PrevPOC.SetDefaultColor(Color.MAGENTA);

Hey Sleepy, do you agree that there is an issue with the Week definition in this script since it seems to be based on the past 7 days? I thought it was an issue since I incorrectly thought the weekly VPOC read was for the specific trading week and not inclusive of data from the previous week. Or am I interpreting this incorrectly?

The above script is set to display the previous day on the current day for how the user requested it.

See the header -- #VolumeProfile_PreviousDay_displayed_NextDay.

Just use the native TOS volumeprofile set to a week and it will displays Mon-Fri for stocks (other instruments may include more periods when traded, for example, /ES includes Sunday. The above script will plot the previous week's Mon-Fri volume profile on the current week for stocks.

Wow thanks for getting back to me so quickly SleepyZ; this is greatly appreciated.

I don't believe the native TOS volume profile set to a week displays the correct VPOC for Mon-Fri for stocks. I've come to this realization by comparing the VPOC readings under two different settings.

The first setting is

Chart time frame = 2 year, Daily

time per profile = Week

on expansion = No

The second setting is

Chart time frame = custom, dates for specific week chosen, aggregation period = any intra day period from 5 to 30 min)

Time per profile = Chart

on expansion = Yes

I believe the VPOC calculation from the second setting criteria is more accurate than the VPOC calculation from the first setting criteria due to the calculation used for the Week case in the thinkscript (which includes information being divided by 7, maybe for 7 days a week?).

But then again, when analyzing VPOC readings according to the second setting criteria while changing the aggregation period between 1, 5, 15, and 30 min and keeping the custom time period (a specific trading week) the same, I noticed that the VPOC readings are not the same.

Yeah; this confuses me - do I need to change a setting detail to fix this you think?

I don't believe the native TOS volume profile set to a week displays the correct VPOC for Mon-Fri for stocks. I've come to this realization by comparing the VPOC readings under two different settings.

The first setting is

Chart time frame = 2 year, Daily

time per profile = Week

on expansion = No

The second setting is

Chart time frame = custom, dates for specific week chosen, aggregation period = any intra day period from 5 to 30 min)

Time per profile = Chart

on expansion = Yes

I believe the VPOC calculation from the second setting criteria is more accurate than the VPOC calculation from the first setting criteria due to the calculation used for the Week case in the thinkscript (which includes information being divided by 7, maybe for 7 days a week?).

But then again, when analyzing VPOC readings according to the second setting criteria while changing the aggregation period between 1, 5, 15, and 30 min and keeping the custom time period (a specific trading week) the same, I noticed that the VPOC readings are not the same.

Yeah; this confuses me - do I need to change a setting detail to fix this you think?

I noticed the differences as you. I use the prior day levels mostly and find they are very useful even though not entirely matching other site’s exactly. I have therefore not studied it as TOS does not provide enough detail IMO to do so.Wow thanks for getting back to me so quickly SleepyZ; this is greatly appreciated.

I don't believe the native TOS volume profile set to a week displays the correct VPOC for Mon-Fri for stocks. I've come to this realization by comparing the VPOC readings under two different settings.

The first setting is

Chart time frame = 2 year, Daily

time per profile = Week

on expansion = No

The second setting is

Chart time frame = custom, dates for specific week chosen, aggregation period = any intra day period from 5 to 30 min)

Time per profile = Chart

on expansion = Yes

I believe the VPOC calculation from the second setting criteria is more accurate than the VPOC calculation from the first setting criteria due to the calculation used for the Week case in the thinkscript (which includes information being divided by 7, maybe for 7 days a week?).

But then again, when analyzing VPOC readings according to the second setting criteria while changing the aggregation period between 1, 5, 15, and 30 min and keeping the custom time period (a specific trading week) the same, I noticed that the VPOC readings are not the same.

Yeah; this confuses me - do I need to change a setting detail to fix this you think?

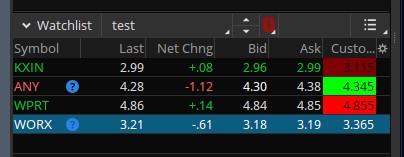

I use the Volume Profile a lot in my trading so I'm hoping someone can help me come up with a watchlist column utilizing that indicator. I haven't been able to locate anything like it, and I've been unsuccessful trying to create it on my own.

I'm thinking this should be fairly simple for someone who knows how to code.

I would like to add a watchlist column that does 2 things:

1) Display the current POC based on the timeframe I have selected

2) Color the background of the watchlist column based upon where price is at in relation to the POC, VAHigh & VALow.

I believe the code below (which I have borrowed from the ORB watchlist column and edited should work for that), but I haven't any idea how to put the rest of it together.

CODE FOR CHANGING BACKGROUND COLOR:

Appreciate any help the community can provide! This could be a useful addition for anyone who trades with the volume profile indicator.

Cheers!

I'm thinking this should be fairly simple for someone who knows how to code.

I would like to add a watchlist column that does 2 things:

1) Display the current POC based on the timeframe I have selected

2) Color the background of the watchlist column based upon where price is at in relation to the POC, VAHigh & VALow.

I believe the code below (which I have borrowed from the ORB watchlist column and edited should work for that), but I haven't any idea how to put the rest of it together.

CODE FOR CHANGING BACKGROUND COLOR:

Code:

AssignBackgroundColor(if Close>POC and Close<VAHigh then color.green else if Close>POC and Close>VAHigh then color.dark_green else if Close<POC and Close>VALow then color.red else if Close<POC and Close<VALow then color.dark_red else color.black);Appreciate any help the community can provide! This could be a useful addition for anyone who trades with the volume profile indicator.

Cheers!

Here is the following code in a watchlistI use the Volume Profile a lot in my trading so I'm hoping someone can help me come up with a watchlist column utilizing that indicator. I haven't been able to locate anything like it, and I've been unsuccessful trying to create it on my own.

I'm thinking this should be fairly simple for someone who knows how to code.

I would like to add a watchlist column that does 2 things:

1) Display the current POC based on the timeframe I have selected

2) Color the background of the watchlist column based upon where price is at in relation to the POC, VAHigh & VALow.

I believe the code below (which I have borrowed from the ORB watchlist column and edited should work for that), but I haven't any idea how to put the rest of it together.

CODE FOR CHANGING BACKGROUND COLOR:

Code:AssignBackgroundColor(if Close>POC and Close<VAHigh then color.green else if Close>POC and Close>VAHigh then color.dark_green else if Close<POC and Close>VALow then color.red else if Close<POC and Close<VALow then color.dark_red else color.black);

Appreciate any help the community can provide! This could be a useful addition for anyone who trades with the volume profile indicator.

Cheers!

Ruby:def poc = reference VolumeProfile("price per row height mode" = "TICKSIZE", "time per profile" = "DAY", "on expansion" = no); def vahigh = reference VolumeProfile("price per row height mode" = "TICKSIZE", "time per profile" = "DAY", "on expansion" = no).VAHigh; def valow = reference VolumeProfile("price per row height mode" = "TICKSIZE", "time per profile" = "DAY", "on expansion" = no).VALow; AddLabel(1, poc, Color.BLACK); AssignBackgroundColor(if close > poc and close < vahigh then Color.GREEN else if close > poc and close > vahigh then Color.DARK_GREEN else if close < poc and close > valow then Color.RED else if close < poc and close < valow then Color.DARK_RED else Color.BLACK);

Thanks @SleepyZ, really appreciate your quick response with providing the code! I'm noticing that the value appearing in the watchlist is not matching up with POC shown on my charts. For example, if I select the 10m time frame for the watchlist and view a 10m chart the POC values are never the same.Here is the following code in a watchlist

Could there be a small discrepancy in the code causing the watchlist to calculate a different value?

Thanks again.

Thanks @SleepyZ, really appreciate your quick response with providing the code! I'm noticing that the value appearing in the watchlist is not matching up with POC shown on my charts. For example, if I select the 10m time frame for the watchlist and view a 10m chart the POC values are never the same.

Could there be a small discrepancy in the code causing the watchlist to calculate a different value?

Thanks again.

Everything matches the same for my test.

Please make sure all settings are the same on the chart, watchlist and volume profiles contained therein. The volume profile in the watchlist is set to ticksize and Day, with the watchlist set to 10min extended hours.

Thanks, it is matching for me now. It seems that is just in PM or AH that the values are differing, but after 9:30 they are correct. It must have something to do with extended hours which I do have selected on the watchlist, but I don't typically trade premarket so not a huge deal. Appreciate the help.Everything matches the same for my test.

Please make sure all settings are the same on the chart, watchlist and volume profiles contained therein. The volume profile in the watchlist is set to ticksize and Day, with the watchlist set to 10min extended hours.

ComfyCouch

New member

@halcyonguy

Hey, I apologize for bumping an old thread and pinging you here, but I was wondering if you ever got around to figuring out OP/your own study? I too am doing something similar to OP's original query - basically wanting to plot levels of significance (high, low, POCs of day bars) dating back from two Sundays ago to current. For example, if today is Monday (8/23), then ideally, the study would be plotting levels up to the second previous Sunday (8/15) on today's chart. However, I'm not quite sure how to even approach this. I started by trying to define the Sunday as an offset to input in the look back of the variable, but quickly learned thats not how it worked. A friend of mine, though not familiar with thinkscript, told me that a fold function might work. I looked into this on ToS' TLC website and from what I can tell, if I define the days as numbers with Sunday being the start, it could loop until the 14th day? I'm not even sure if that makes sense.

If possible, any help and/or advice here is greatly appreciated. Again, sorry to ping and bump this old thread.

Couch.

Hey, I apologize for bumping an old thread and pinging you here, but I was wondering if you ever got around to figuring out OP/your own study? I too am doing something similar to OP's original query - basically wanting to plot levels of significance (high, low, POCs of day bars) dating back from two Sundays ago to current. For example, if today is Monday (8/23), then ideally, the study would be plotting levels up to the second previous Sunday (8/15) on today's chart. However, I'm not quite sure how to even approach this. I started by trying to define the Sunday as an offset to input in the look back of the variable, but quickly learned thats not how it worked. A friend of mine, though not familiar with thinkscript, told me that a fold function might work. I looked into this on ToS' TLC website and from what I can tell, if I define the days as numbers with Sunday being the start, it could loop until the 14th day? I'm not even sure if that makes sense.

If possible, any help and/or advice here is greatly appreciated. Again, sorry to ping and bump this old thread.

Couch.

@halcyonguy

Hey, I apologize for bumping an old thread and pinging you here, but I was wondering if you ever got around to figuring out OP/your own study? I too am doing something similar to OP's original query - basically wanting to plot levels of significance (high, low, POCs of day bars) dating back from two Sundays ago to current. For example, if today is Monday (8/23), then ideally, the study would be plotting levels up to the second previous Sunday (8/15) on today's chart. However, I'm not quite sure how to even approach this. I started by trying to define the Sunday as an offset to input in the look back of the variable, but quickly learned thats not how it worked. A friend of mine, though not familiar with thinkscript, told me that a fold function might work. I looked into this on ToS' TLC website and from what I can tell, if I define the days as numbers with Sunday being the start, it could loop until the 14th day? I'm not even sure if that makes sense.

If possible, any help and/or advice here is greatly appreciated. Again, sorry to ping and bump this old thread.

Couch.

@ktrades sorry i haven't posted up my code yet. i tend to take on new challenges sometimes before i finish up existing ones. i've come across a couple of posts, where people say it can't be done, so i figure out how to.

i just posted a mvp study. tomorrow i will look at my to do list of a half dozen or so studies i am in the middle of, and try to finish them up. i will get back to this.

@ComfyCouch see above. it's late, i will read your post in the morning

@halcyonguy

Hey, I apologize for bumping an old thread and pinging you here, but I was wondering if you ever got around to figuring out OP/your own study? I too am doing something similar to OP's original query - basically wanting to plot levels of significance (high, low, POCs of day bars) dating back from two Sundays ago to current. For example, if today is Monday (8/23), then ideally, the study would be plotting levels up to the second previous Sunday (8/15) on today's chart. However, I'm not quite sure how to even approach this. I started by trying to define the Sunday as an offset to input in the look back of the variable, but quickly learned thats not how it worked. A friend of mine, though not familiar with thinkscript, told me that a fold function might work. I looked into this on ToS' TLC website and from what I can tell, if I define the days as numbers with Sunday being the start, it could loop until the 14th day? I'm not even sure if that makes sense.

If possible, any help and/or advice here is greatly appreciated. Again, sorry to ping and bump this old thread.

Couch.

is this what you are asking ?

do you want to look at an intra day chart,

and only on the current day,

see 28+ lines,

based from high and low levels from the days in the past 14+ days?

i'm ignoring poc for now....

...wanting to plot levels of significance (high, low, POCs of day bars)

...dating back from two Sundays ago to current.

...the study would be plotting levels up to the second previous Sunday (8/15) ,

this will need 28+ plot functions and supportive formulas.

Last edited:

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

-

-

Trade Ideas Intraday , single bar , Relative Volume RVOL For ThinkOrSwim

- Started by Svanoy

- Replies: 15

-

-

Cumulative Delta Volume Pressure - Mod by Sam4Cok for ThinkOrSwim

- Started by merryDay

- Replies: 34

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

786

Online

Similar threads

-

-

-

Trade Ideas Intraday , single bar , Relative Volume RVOL For ThinkOrSwim

- Started by Svanoy

- Replies: 15

-

-

Cumulative Delta Volume Pressure - Mod by Sam4Cok for ThinkOrSwim

- Started by merryDay

- Replies: 34

Similar threads

-

-

-

Trade Ideas Intraday , single bar , Relative Volume RVOL For ThinkOrSwim

- Started by Svanoy

- Replies: 15

-

-

Cumulative Delta Volume Pressure - Mod by Sam4Cok for ThinkOrSwim

- Started by merryDay

- Replies: 34

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.