@zeek

I would question everything and everybody you see on twitter with regards to trading. Most of those folks are in cahoots with each other and will promote the same penny stocks through various accounts each with their own secret strategy. For example in the image you posted for the stated traded account. There is no such thing as Volume Forecast, he is just taking simple math and renaming as if it's some new volume indicator.

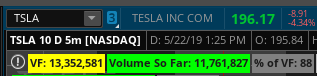

For example, in the stock in the image show, MBRX, this guy's magical indicator shows the below numbers:

VF: 19,677,066

Volume so Far: 82,891,156

% of VF: 421

Plug the above numbers in the calculator and you get:

VF / Volume so Far = % of VF

82,891,156 / 19,677,066 = 4.21

Now, he posted the chart at the end of the day at 5:15 pm after the market closed showing how his "secret" Volume Forecast indicator forecasted the end of the day volume to be at 421 percent.

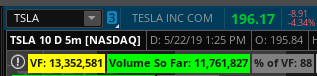

Now, let's get down and get in the weeds. All he is doing is taking a commonly shared Volume Stats indicator which is shared on this forum and various other locations, renaming the labels, removing some of the other labels and touting is as some new "Volume Forecast" indicator.

Below is one of the threads on this forum where this indicator is shared.

Volume Stats Indicator:

https://usethinkscript.com/threads/custom-thinkscript-volume-stats-for-thinkorswim.970/

How is he trying to dupe new investors?

He is posting the charts at the end of the day and showing how his indicator forecasted the volume to be to the exact percentage of volume traded for the day. Genius, right?

Let's check the labels on his indicator. So the label on his indicator VF is nothing more than the average for the last 20 or 30 days.

The Volume so Far label is nothing more than the volume traded for the day. The % of VF is nothing much more than these two numbers divided to arrive at a percentage of volume traded so far for that day.

Posting the chart at the end of the day makes him seem like a genius because he supposedly he "forecasted" the volume to be at the level and with the right chart showing a parabolic move upwards make him seem like his indicator is the next big thing.

The reality is, he didn't forecast anything. He just took the volume traded today vs the average traded for the last 30 days (or whatever other time period he has) and divided these up to arrive at the percentage.

There is no way me and you can forecast tomorrow's volume unless you're part of a dark pool or insider trader. With the indicators shared on this forum, you can create your own strategy that will blow these fake hucksters from twitter out of the water. Be cautious and don't get duped by them.