Identifying the choicest stocks to trade is an essential part of a strategy.

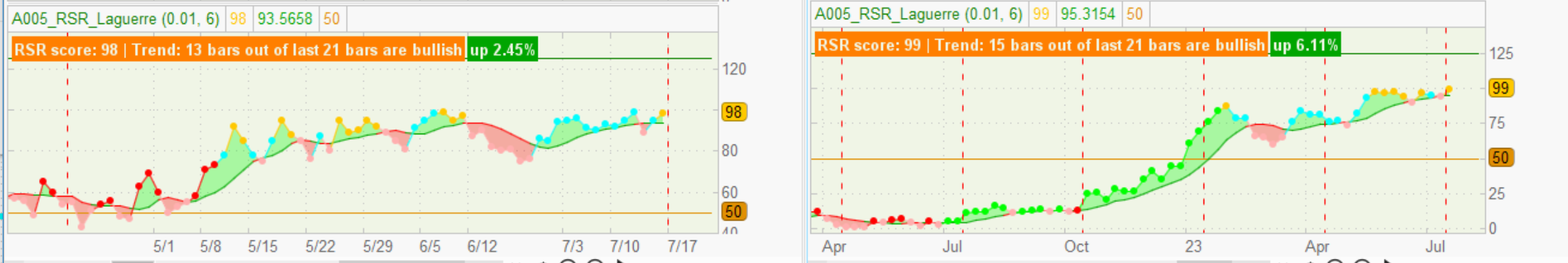

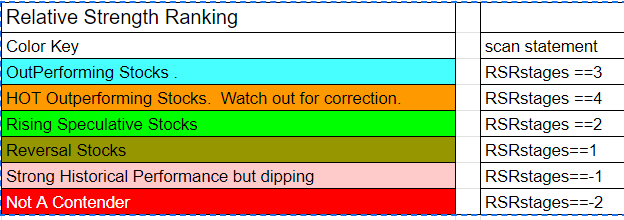

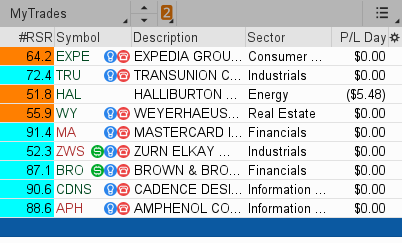

The VIP Relative Strength Ranking v2

https://usethinkscript.com/threads/relative-strength-ranking.15999/

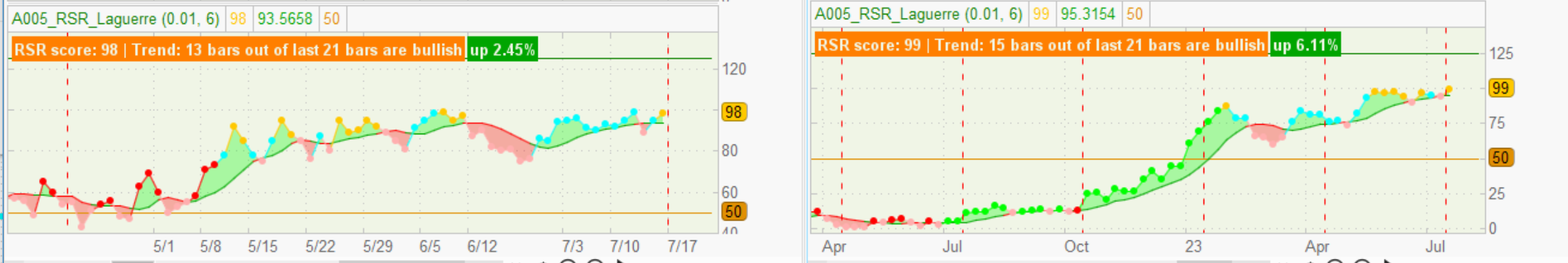

- finds the stocks which are outperforming their peers

- also pinpoints the hottest stocks in the market

- it ascertains the up-and-coming stocks that deserve a look

- and which of the strongest stocks are dipping and may represent an opportunity

- of equal importance: the RSR highlights stocks NOT to trade

Novice, risk-adverse, day and swing traders apply their strategies to

outperforming stocks.

During bull market periods, these strong stocks, have a tendency to increase in price in the absence of bad news, economic data, geopolitical events, etc.

Reduce your risk by trading these outperforming instruments.

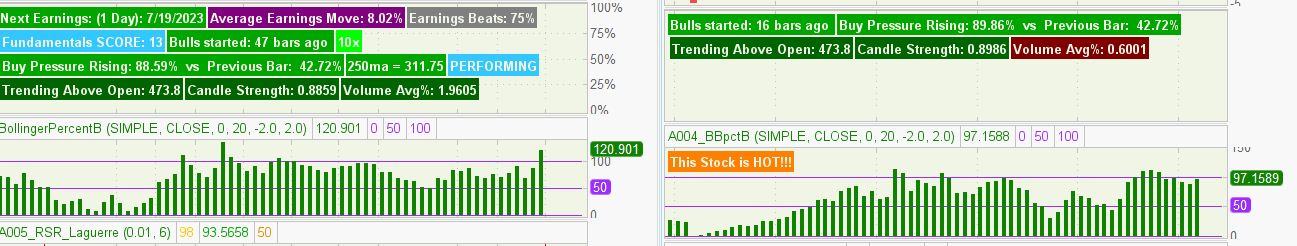

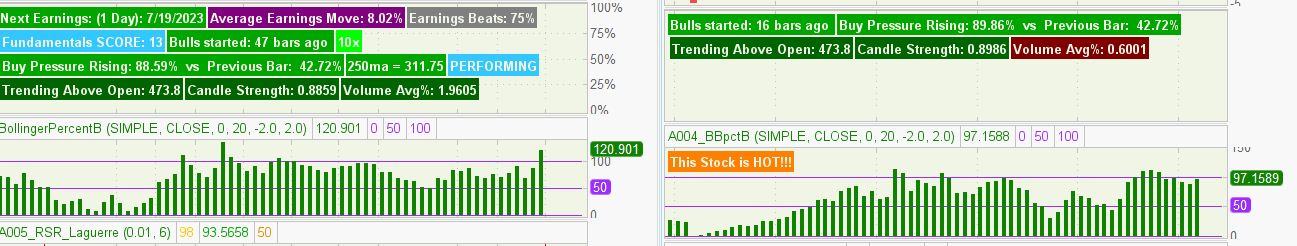

Hot Outperforming Stocks are Outperformers that are trading at the top or over the Bollinger Bands.

These stocks have the momentum to accumulate large gains.

But with great rewards comes great risk. These stocks can be subjected to sudden correction. Trend carefully.

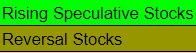

Reversion Traders, who are looking to aggressively build income, take on higher levels of risk to potentially achieve higher returns.

Many stocks were beaten down during the bear market and are now regaining strength. These underperformers have great potential.

Reversal Stocks have no trend; have no performance. Their downward movement has stopped.

Rising Speculative Stocks are underperformers, who are starting to shoot up.

Both of these groupings can experience explosive profits or losses.

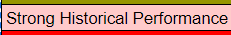

Outperformers, who are dipping.

Swing Traders love a down market day. Bargain Basement Shopping at its finest.

Swing Traders' Strategy is predicated on choosing the right stocks.

These dipped outperformers are great stocks, who are having a bad day.

These strong stocks, have a tendency to increase in price when the next rally day hits; in the absence of bad news, economic data, geopolitical events, etc.

As long as the lower timeframes are all bullish, swing traders will take entry on dipping stocks.

Swing traders don't worry as much about the exact timing of the entry. Often times, this stocks will continue dipping; leading to an initial loss. But swing traders will hold until the next new high or longer.

With these trades, it is important to monitor the news. Negative events will cause this trade to downward correct.

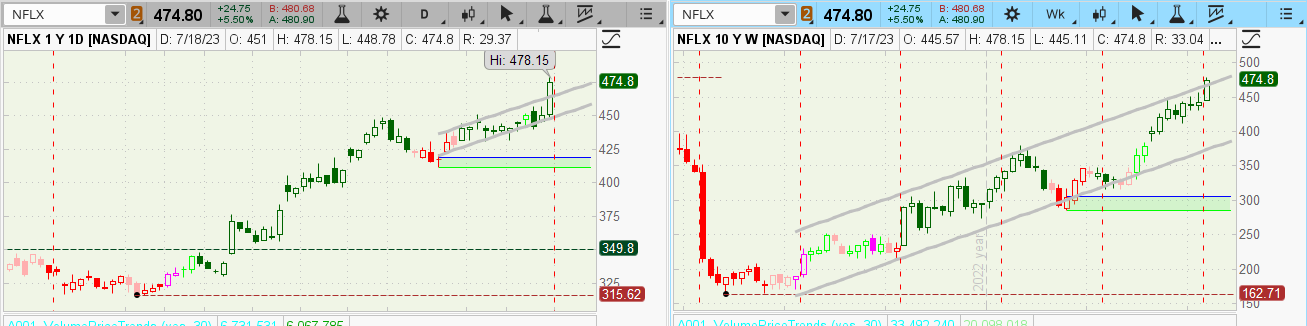

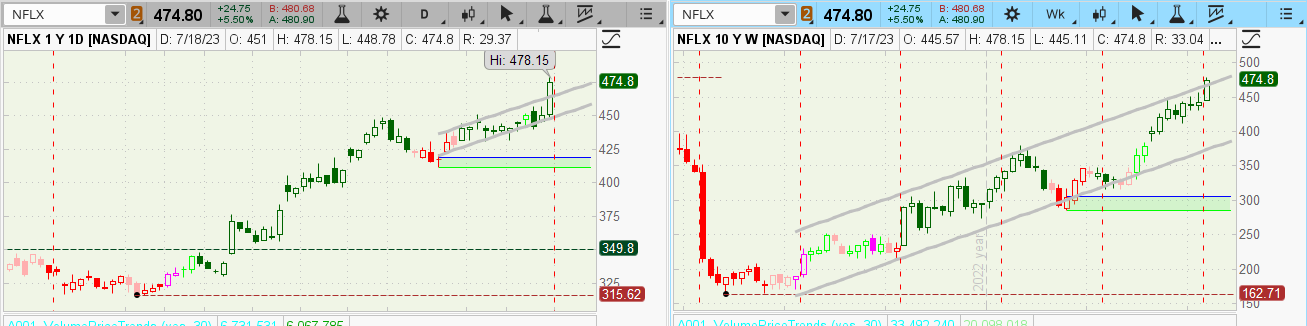

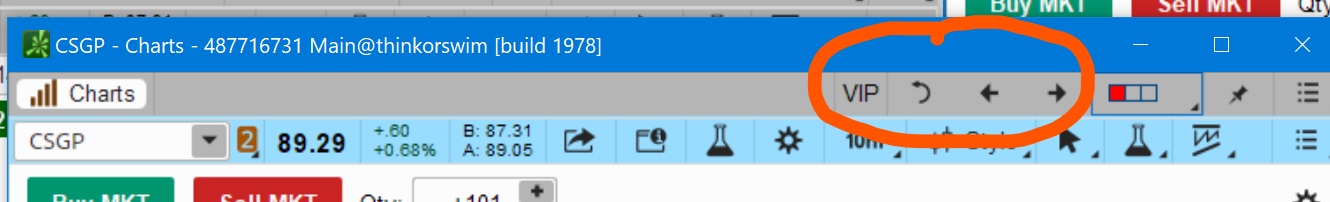

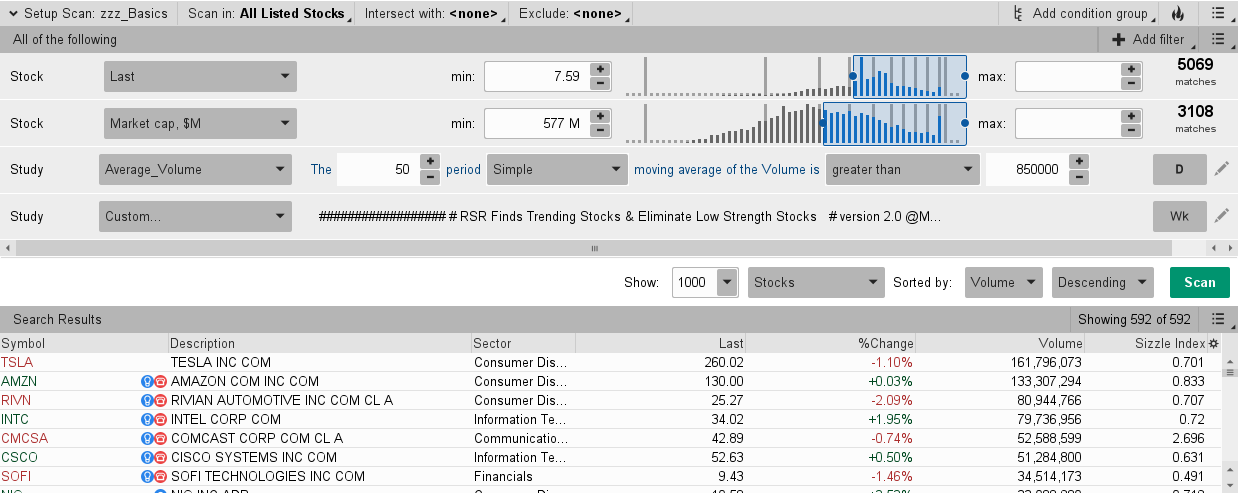

The scan results must be reviewed on the daily and weekly chart.

The stock may be so volatile as to negate any trend the computer found.

This chart allows all aspects of a stock to be verified.

Outperforming stocks will have a dMI trend.

Dipping stocks will not.

All stocks should have strong fundamentals, Decent earnings moves.

Review the stocks' sector. Is it also up trending (cyan or green)?

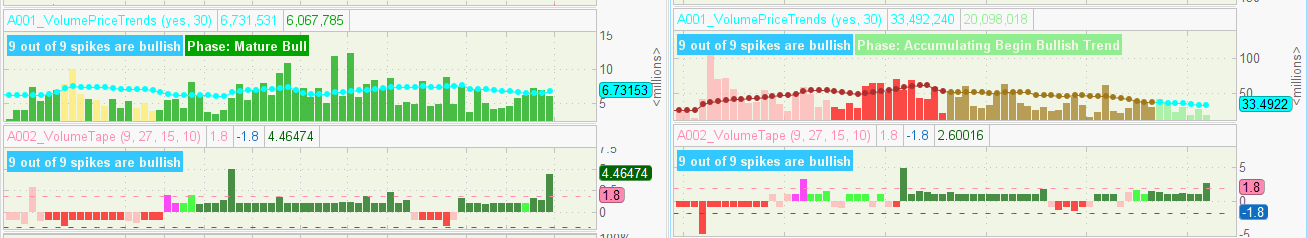

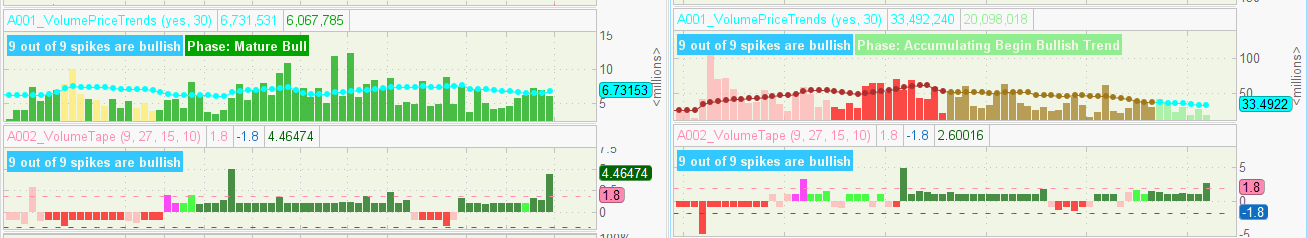

On the volume tape, more up bars than down bars is preferred.

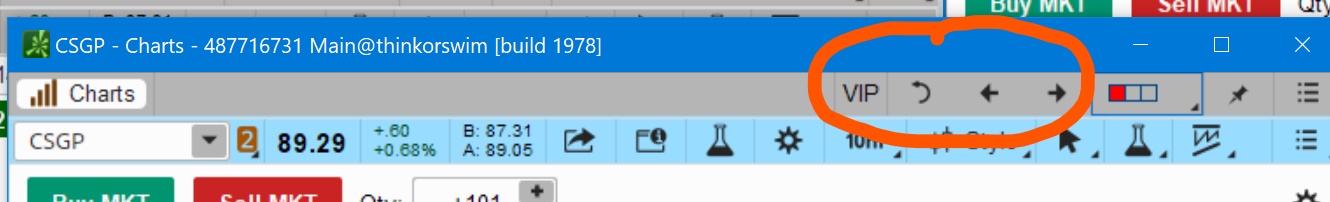

The daily and weekly charts are stacked on top of each other.

To flip through the charts, click on the arrows at the top of th screen:

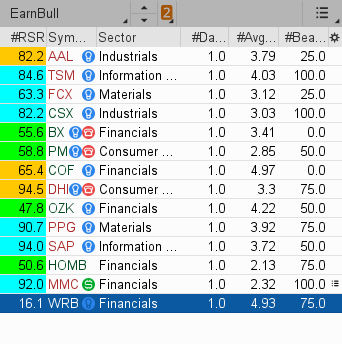

Watchlist:

Put the Relative Strength Ranking on your favorite Quotes Table.

The higher the number, the stronger the performance.

But do not discount those lower rankings that are colored cyan. They represent underperformers, who are trending.

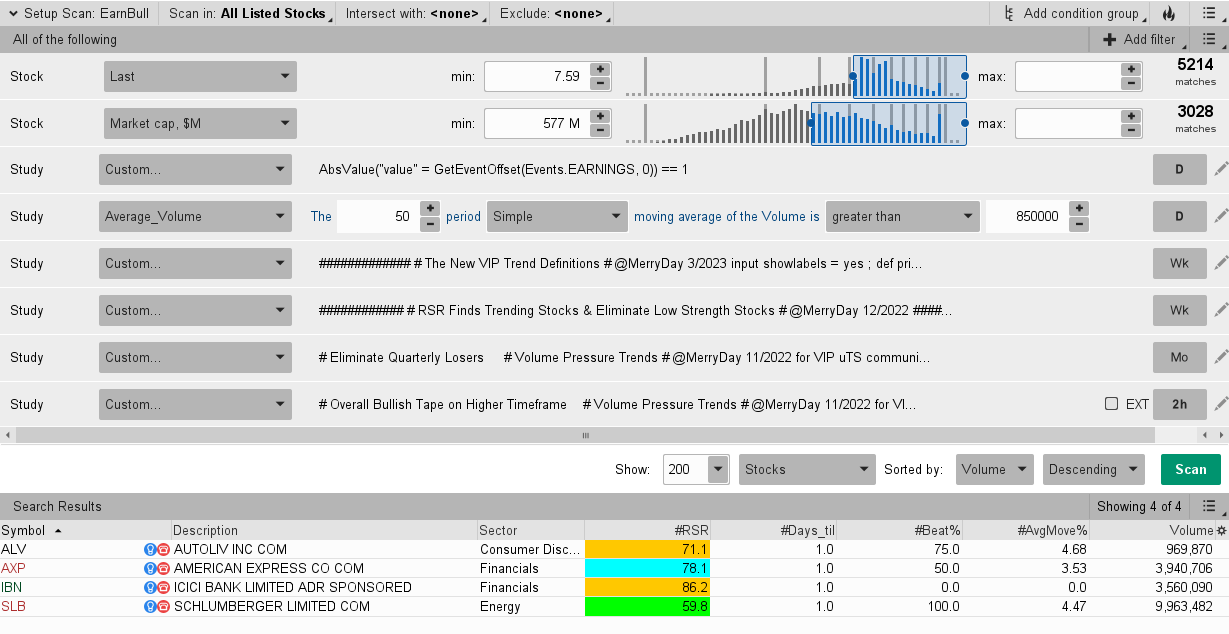

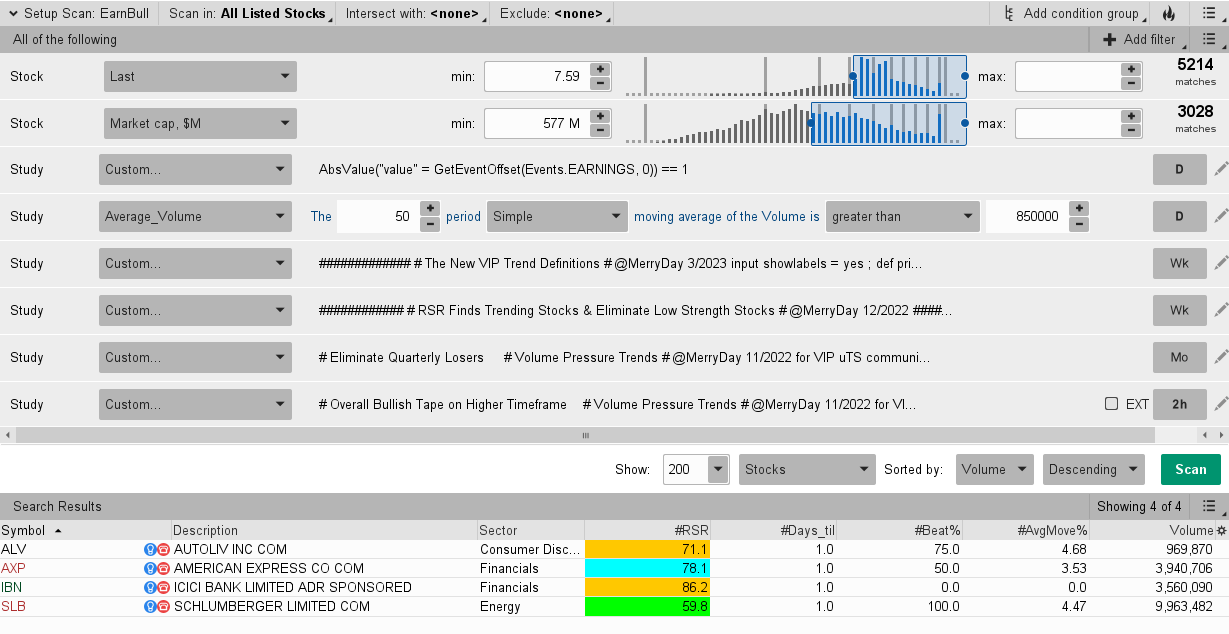

Scan Hacker:

70% of trade analysis should be taking place on charts with timeframes of 2 hours and higher.

Yet the majority of scalpers and day traders, never look at charts over 10min.

Stack the deck in your favor, by adding these higher timeframe filters to your scans.